APAC Life Science Market Size, Top Key Players and Shares with Insights

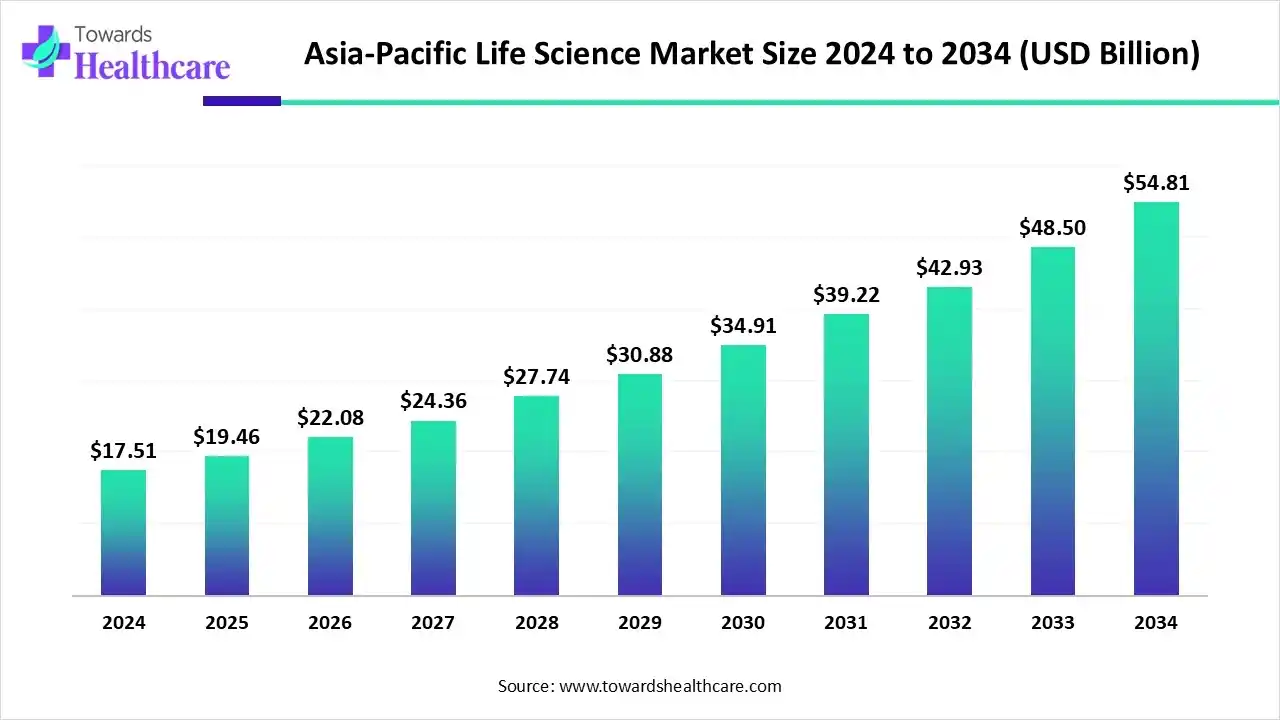

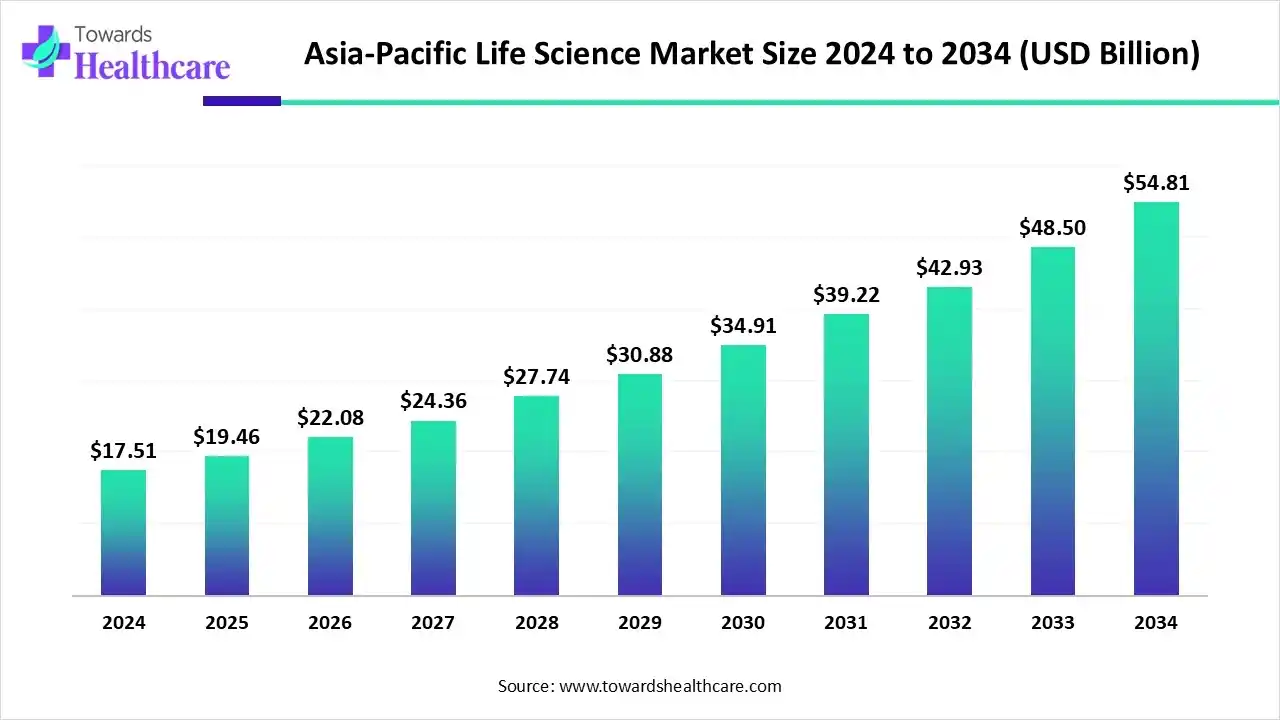

The APAC Life Science market size began at US$ 17.51 billion in 2024 and is forecast to rise to US$ 19.46 billion by 2025. By the end of 2034, it is expected to surpass US$ 54.81 billion, growing steadily at a CAGR of 12.09%.

The APAC Life Science market is witnessing strong growth due to rising investments in laboratory infrastructure, expanding clinical trials, and increasing focus on personalized medicine. Emerging technologies like NGS, AI-enabled bioinformatics, and high-throughput screening drive innovation. Countries such as China, India, and Singapore are key contributors, supported by government initiatives, biotech startups, and collaborations with global firms. The market is characterized by growing demand for instruments, reagents, and integrated research solutions across healthcare and research sectors.

Key Takeaways

- APAC Life Science industry poised to reach USD 17.51 billion by 2024.

- Forecasted to grow to USD 54.81 billion by 2034.

- Expected to maintain a CAGR of 12.09% from 2025 to 2034.

- The global life sciences market is expected to grow from USD 98.63 billion in 2025 to around USD 269.56 billion by 2034, at a CAGR of 11.82%.

- China dominated the APAC Life science market with a revenue share of approximately 35% in 2024.

- By product type, the instruments segment held the largest market share of approximately 48% in 2024.

- By product type, the reagents & consumables segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By technology, the genomics segment led the APAC Life Science market with the largest revenue share of approximately 43% in 2024.

- By technology, the AI-based bioinformatics platforms segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the drug discovery & development segment held the highest market share of approximately 40% in 2024.

- By application, the personalized medicine segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By end user, the pharmaceutical & biotechnology companies segment dominated the APAC Life Science market with the revenue shares of approximately 41%.

- By end user, the hospitals & clinical research laboratories segment is expected to grow at the fastest CAGR in the market during the forecast period.

Quick Facts Table

| Table |

Scope |

| Market Size in 2025 |

USD 24.53 Billion |

| Projected Market Size in 2034 |

USD 66.66 Billion |

| CAGR (2025 - 2034) |

11.51% |

| Market Segmentation |

By Product Type, By Technology, By Application, By End User, By Region

|

| Top Key Players |

Shimadzu Corporation, Eppendorf AG, Bio-Rad Laboratories, Merck KGaA (MilliporeSigma in APAC), GE Healthcare Life Sciences, Charles River Laboratories, Lonza Group, Catalent, Inc., BGI Group (China), Takara Bio Inc. (Japan), Mettler-Toledo International, Samsung Biologics, WuXi AppTec (China — CRO/CDMO), IDT (Integrated DNA Technologies — nucleic acids), Cytiva (cell culture & bioprocessing platforms)

|

What is APAC Life Science Systems?

The APAC life science systems are growing as governments boost funding, local biotech startups expand, and demand for innovative therapies and laboratory solutions rises in the region. The APAC Life Science Market covers research, development, manufacturing, and commercialization of biopharmaceuticals, biotechnology products, diagnostics, laboratory instruments, reagents, consumables, software, and services across countries such as China, Japan, India, South Korea, Australia & New Zealand, ASEAN nations, and other regional markets.

The APAC Life Science market includes instruments, lab automation, genomic and proteomic platforms, cell and gene therapy, molecular diagnostics, and AI-enabled drug discovery tools. Growth is driven by increasing R&D expenditure, government initiatives to strengthen healthcare infrastructure, rising adoption of precision medicine, and expansion of CRO/CDMO services. Challenges include regulatory diversity, limited infrastructure in emerging economies, and pricing pressures, but opportunities exist in next-generation sequencing, cell and gene therapies, laboratory automation, and digital bioinformatics solutions.

APAC Life Science Market Outlook

- Industry Growth Overview- The APAC life science system market comprises biotechnology, pharmaceuticals, and research institutions, driven by increasing R&D investments, advanced laboratory technologies, government support, and growing demand for innovative diagnostics and therapeutic solutions.

- Sustainability Trends- Sustainability trends in the APAC Life Science System market focus on renewable energy integration, carbon footprint reduction, circular economy practices, digitalization to reduce resource use, and the development of biodegradable lab consumables and eco-friendly equipment.

- Major Investors- Key investors in the APAC Life Science System market comprise regional healthcare conglomerates, research-focused foundations, angel investors, technology incubators, and international funding agencies, all promoting biotech innovation, advanced diagnostics, and laboratory infrastructure development.

How Can AI Affect the Market?

AI can transform the APAC life science market by enabling smart laboratory management, real-time monitoring, and advanced quality control. It supports predictive maintenance of equipment, optimizes workflows, and enhances data-driven decision-making. Furthermore, AI facilitates virtual simulations, accelerates clinical research, and enhances regulatory compliance, enabling organizations to reduce operational costs and increase efficiency. These capabilities encourage faster adoption of life science technologies across research institutions and biotech companies in the region.

What are the Government Initiatives for the APAC Life Science Market in 2024?

- In July 2025, APAC governments, including Singapore, are supporting early-stage R&D with capital and infrastructure incentives. Singapore’s political stability, strong IP protection, regulatory transparency, and focus on innovation attract pharmaceutical companies, top scientific talent, and biotech firms seeking diversified and resilient investment opportunities in the region.

- In June 2025, Ontario’s government allocated $6.5 million via the Life Sciences Innovation Fund (LSIF) to support 13 local businesses in developing and launching medical technologies, creating quality jobs, and strengthening the province’s global leadership in life sciences.

Segmental Insights

How does the Instruments Segment dominate the APAC Life Science Market in 2024?

The instruments segment dominated the market with the revenue shares of approximately 48% due to rising investment in modern laboratories, growing biotechnology and pharmaceutical research, and the need for high-throughput, accurate analytical tools. Increasing adoption of innovative diagnostic and experimental instruments, coupled with expanding research infrastructure in countries like China, India, and Japan, has fueled demand.

The reagents & consumables segment is projected to grow rapidly due to the expansion of molecular biology, genomics, and proteomics research in APAC. Increasing laboratory activities, rising clinical diagnostics, and growing demand for specialized kits and chemicals for experiments drive sales.

Why Did the Genomics Segment Dominate the APAC Life Science Market in 2024?

The genomics segment dominated in 2024, with the revenue shares of approximately 43% because of its expanding applications in early disease detection, drug development, and agricultural biotechnology. Rising demand for genetic profiling, biomarker discovery, and population-scale sequencing studies in APAC has driven adoption.

The AI-based bioinformatics platforms segment is projected to grow rapidly as researchers increasingly rely on advanced computational tools to manage and interpret large-scale biological data. Demand is rising for automated data analysis, virtual simulations, and predictive analytics in drug development and molecular research.

How does the Drug Discovery & Development Segment Dominate the APAC Life Science Market?

The drug discovery & development segment held the highest market share of approximately 40% in 2024 due to the growing demand for new and effective therapeutics across various disease areas. Increasing investment in pharmaceutical R&D, rising prevalence of chronic and complex diseases, and the need for faster, more efficient drug development processes drove the adoption of life science systems.

The personalized medicine segment is projected to grow rapidly as healthcare shifts toward more targeted, patient-specific treatments. Rising adoption of molecular diagnostics, companion diagnostics, and AI-driven predictive tools enables clinicians to customize therapies. Additionally, the growing prevalence of chronic and genetic disorders, along with increased funding for precision healthcare and supportive regulatory frameworks in APAC, is accelerating the development and use of personalized therapies, making this segment the fastest-growing application in the life science systems market during the forecast period.

What made the Pharmaceutical & Biotechnology Companies Segment Dominant in the APAC Life Science Market in 2024?

The pharmaceutical & biotechnology companies segment leads the market with the revenue shares of approximately 41% because these organizations require sophisticated life science systems for regulatory-compliant production, quality control, and process optimization. Their focus on developing novel therapeutics, biologics, and vaccines drives consistent demand for advanced instruments and consumables.

The hospitals & clinical research laboratories segment is projected to grow rapidly as healthcare facilities and academic institutions increasingly adopt automated and high-throughput life science systems. Rising focus on translational research, clinical trials, and advanced diagnostics, along with expanding laboratory networks and collaborations with biotech firms, is driving demand.

Regional Insights

How is China contributing to the Expansion of the APAC Life Science Market?

China held the largest revenue share of approximately 35% in the market in 2024 due to rising adoption of AI-driven healthcare technologies, strong local manufacturing capabilities, and an expanding network of research parks and biotech hubs. Supportive regulatory reforms encouraged faster product approvals, while cross-border collaborations with international firms accelerated technology transfer. Combined with increasing investment from venture capital and private equity, these factors positioned China as the dominant market player within the APAC life science sector.

India Market Trends

India’s APAC life science market is expanding as digital health adoption, AI-driven research, and genomics-based projects gain momentum. The rise of biotech startups, academic–industry collaborations, and increased venture capital inflows are accelerating innovation. Additionally, improved regulatory frameworks and expanding laboratory infrastructure are fostering rapid growth, making India an emerging hub in the regional life science landscape.

Japan Market Trends

Japan’s APAC life science market is growing as it strengthens its biotechnology innovation ecosystem, supported by rising investments in AI-driven drug discovery and data-driven healthcare. Expanding partnerships between academia and industry, along with initiatives to attract global research talent, are fueling advancements. Additionally, Japan’s strong intellectual property protections and emphasis on international collaborations make it a strategic hub for life science development in the region.

Global Life Science Market Growth

The global life sciences market was valued at USD 88.2 billion in 2024 and is estimated to grow to USD 98.63 billion in 2025. It is projected to reach approximately USD 269.56 billion by 2034, expanding at a CAGR of 11.82% between 2025 and 2034.

APAC Life Science Market Value Chain Analysis

Clinical Trials

- The APAC region is witnessing rapid growth in clinical trials due to its vast patient base, cost efficiency, and supportive regulatory landscape.

- Sponsors increasingly prefer APAC as a hub for conducting diverse and large-scale studies.

- Oracle supports this growth by offering Life Sciences solutions such as Clinical Trial Management Systems (CTMS), Clinical One for data management, and recruitment tools.

- These solutions streamline operations, enhance trial efficiency, and improve patient engagement in APAC.

Regulatory Approvals

- Regulatory approvals in APAC life science systems remain challenging due to diverse, country-specific requirements instead of a unified framework.

- Nations like Japan and Australia follow mature, globally recognized regulatory standards.

- Other countries in the region are still developing and refining their approval processes.

- This variation creates complexity for companies seeking regional market entry and compliance.

Patient Support and Services

- Life science firms in APAC deliver patient support via tailored Patient Support Programs (PSPs).

- Digital tools and technology-enabled platforms are increasingly used to enhance care access and engagement.

- Partnerships with healthcare providers and stakeholders strengthen service delivery.

- These efforts help tackle issues such as treatment affordability, adherence challenges, and limited care accessibility.

- The ultimate goal is to improve patient experience and health outcomes across the region.

Top Vendors and their Offerings

- Danaher Corporation- Danaher Corporation provides the APAC life science market with integrated lab solutions, including imaging systems, bioprocessing equipment, molecular diagnostics tools, and workflow optimization technologies, enhancing research efficiency, clinical testing, and pharmaceutical development.

- Thermo Fisher Scientific- Thermo Fisher Scientific supports the APAC life science market with advanced instruments, reagents, sequencing platforms, analytics tools, and digital solutions, enabling precision research, clinical applications, and biotechnology innovation across the region.

- Agilent Technologies- Agilent Technologies provides APAC life science systems with cutting-edge diagnostic instruments, chromatography and mass spectrometry tools, lab consumables, and data management solutions, enabling accurate research, quality control, and innovative applications in biotechnology and pharmaceuticals.

- Illumina, Inc.- Illumina Inc. provides APAC life science systems with next-generation sequencing instruments, library preparation kits, and data interpretation software, supporting genomic research, clinical diagnostics, and personalized medicine initiatives across biotechnology and healthcare sectors.

- Qiagen N.V.- Qiagen N.V. provides APAC life science systems with nucleic acid extraction instruments, PCR kits, sequencing solutions, and laboratory automation tools, enabling efficient molecular testing, research applications, and diagnostic workflows across biotech and healthcare sectors.

Top Companies in the APAC Life Science Market

- Shimadzu Corporation

- Eppendorf AG

- Bio-Rad Laboratories

- Merck KGaA (MilliporeSigma in APAC)

- GE Healthcare Life Sciences

- Charles River Laboratories

- Lonza Group

- Catalent, Inc.

- BGI Group (China)

- Takara Bio Inc. (Japan)

- Mettler-Toledo International

- Samsung Biologics

- WuXi AppTec (China — CRO/CDMO)

- IDT (Integrated DNA Technologies — nucleic acids)

- Cytiva (cell culture & bioprocessing platforms)

Recent Developments in the APAC Life Science Systems Mark

- In September 2025, South Korea’s Health Minister Jeong Eun-kyeong highlighted the Asia-Pacific region’s emerging health challenges, including aging populations, chronic diseases, and post-pandemic social and economic pressures. She stressed the need for innovative technologies to enhance healthcare effectiveness, address mental health concerns, and develop sustainable solutions for healthcare disparities and future demographic shifts.

- In December 2024, the APAC ADC market grew rapidly, driven by major biopharma deals and collaborations. Roche licensed YL211 from China’s MediLink, AstraZeneca expanded its Singapore facility, and Chinese firms led development. Key partnerships included Bristol Myers Squibb with SystImmune, GSK acquiring Hansoh Pharma’s HS-20089, Eisai collaborating with Bliss Biopharmaceutical, and AstraZeneca acquiring LaNova Medicines for multiple myeloma therapies.

Segments Covered in the Report

By Product Type

- Instruments

- Chromatography Instruments

- Spectroscopy Instruments

- Microscopy Instruments

- PCR & qPCR Instruments

- Sequencers & Genomic Analysis Instruments

- Lab Automation & Robotics

- Microplate Readers

- Incubators & Ovens

- Centrifuges

- Other Instruments

- Reagents & Consumables

- Assay Kits

- Enzymes & Buffers

- Culture Media & Supplements

- Plasticware & Glassware

- Antibodies & Proteins

- Nucleic Acids & Oligonucleotides

- Other Consumables

- Software & Services

- Laboratory Information Management Systems (LIMS)

- Data Analytics & Bioinformatics Software

- Consulting Services

- Training & Support Services

By Technology

- Genomics

- Next-Generation Sequencing (NGS)

- Sanger Sequencing

- PCR & qPCR

- Microarrays

- Proteomics

- Mass Spectrometry

- Protein Microarrays

- 2D Gel Electrophoresis

- Cell & Molecular Biology

- Flow Cytometry

- CRISPR & Gene Editing

- Cell Culture & Assays

- Immunoassays

- Drug Discovery & Development

- High-Throughput Screening

- Combinatorial Chemistry

- Bioassays & Target Validation

- Laboratory Automation & Robotics

- Liquid Handling Systems

- Automated Plate Readers

- Robotic Sample Management

- AI-Powered Bioinformatics Platforms

By Application

- Drug Discovery & Development

- Diagnostics & Clinical Testing

- Genomics & Proteomics Research

- Molecular & Cell Biology Research

- Personalized Medicine

- Agriculture & Food Testing

- Environmental & Forensic Testing

By End User

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations (CROs)

- Academic & Research Institutes

- Hospitals & Clinical Research Laboratories

- Government & Regulatory Organizations

- Diagnostic Laboratories

By Region

- Asia Pacific

- Japan

- China

- India

- South Korea

- Australia

- Thailand