December 2025

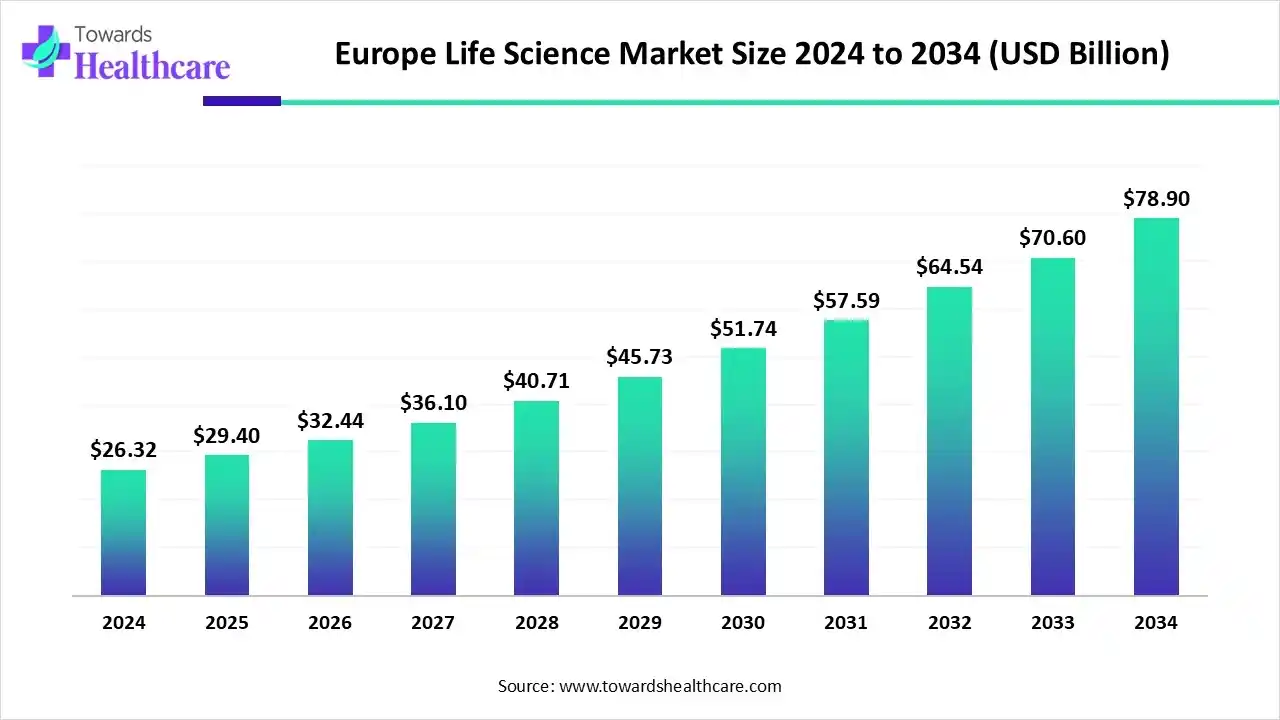

The Europe life science market size is calculated at US$ 26.32 billion in 2024, grew to US$ 29.40 billion in 2025, and is projected to reach around US$ 78.90 billion by 2034. The market is expanding at a CAGR of 11.61% between 2025 and 2034.

Europe has been a global leader in life sciences, driving the Europe life science market, supported by a strong scientific excellence, knowledge, and innovations. The European Commission has recently set a strategy to accelerate research and innovations, improve market access for life science innovations, and build public trust in novel innovations. It aims to make Europe the most attractive place in the World for biological sciences by 2030. According to the European Commission, life sciences support 29 million jobs across the EU and add nearly €1.5 trillion in value to the EU economy.

| Table | Scope |

| Market Size in 2025 | USD 25.16 Billion |

| Projected Market Size in 2034 | USD 74.02 Billion |

| CAGR (2025 - 2034) | 12.62% |

| Market Segmentation | By Product Type, By Technology, By Application, By End User, By Region |

| Top Key Players | Thermo Fisher Scientific , Danaher Corporation, Agilent Technologies, Illumina, Inc., Qiagen N.V., Sartorius AG, Merck KGaA, Bio-Rad Laboratories, Charles River Laboratories, Lonza Group, Catalent, Inc., Bruker Corporation, Shimadzu Corporation, Eppendorf AG, Roche Diagnostics, PerkinElmer, Inc.,IDT, Mettler-Toledo International, GE Healthcare Life Sciences, Samsung Biologics |

The Europe life science market covers research, development, manufacturing, and commercialization of biopharmaceuticals, biotechnology products, diagnostics, laboratory instruments, reagents, consumables, software, and services across countries such as Germany, France, the United Kingdom, Italy, Spain, Switzerland, the Nordic countries, and other regional markets. The market includes instruments, lab automation, genomics and proteomics platforms, cell and gene therapies, molecular diagnostics, and AI-enabled drug discovery solutions.

Growth is driven by rising R&D expenditure, healthcare modernization programs, advanced regulatory frameworks, and expansion of CRO/CDMO services. Challenges include regulatory fragmentation across countries and infrastructure gaps in emerging markets, while opportunities exist in next-generation sequencing, laboratory automation, cell and gene therapy adoption, and digital bioinformatics solutions for precision medicine.

AI is advancing genomics, structural biology, and drug discovery. AI is helpful in biological data analysis, scientific research, cellular imaging, analysis of patterns in health records, etc. It is used to combine variable biological data related to genomics and proteomics. AI-guided microscopy and imaging enhance cellular and molecular analysis. It improves accuracy in large-scale experiments and reduces manual approaches.

The clinical research and development continue to rise by providing lifesaving treatment options and medical solutions. For instance, in October 2025, SeaBeLife, a French Biotech, raised €2 million to bring clinical trials in age-related macular degeneration (AMD) and acute hepatitis to the market.

The leading investment platforms in Europe maintain competitiveness in the life sciences sector. For instance, in October 2025, Asabys Partners integrated Aliath Bioventures life sciences investment platform in collaboration with AltamarCAM to expand from €300 million to over €400 million.

| Sr. No. | Initiatives | International Partners | Investments | Motive |

| 1 | Global Polio Eradication |

|

€500 million | To eliminate polio. |

| 2 | HERA Invest | European Commission | €100 million | To boost advanced R&D investments |

| 3 | COVID-19 Response | European Commission | €4.9 billion | To end the pandemic and build up global health security |

| 4 | WHO Collaboration | WHO | - | To combat COVID-19 and build resilient healthcare systems. |

| 5 | Vaccine Development | Coalition for Epidemic Preparedness Innovations (CEPI) | - | To boost vaccines for infectious diseases |

| 6 | EU Malaria Fund |

|

- | To support promising research projects to prevent and treat malaria. |

| 7 | Emergency Preparedness | United Nations Office for Project Services (UNOPS) | - | To help the government respond to health crises and natural disasters. |

| 8 | Innovation in Health | Israel’s National Technological Innovation Authority | - | To cooperate in the field of bioconvergence |

The instruments segment dominated the market in 2024, with a revenue share of approximately 50%, owing to their assistance in genomic and proteomic analysis, molecular diagnostics, and CRISPR gene editing. They are very useful in automated workflows and increasing laboratory automation and efficiency. They enable advanced research and logistics and help in forensic and environmental testing.

The software & services segment is expected to grow at the fastest CAGR in the market during the forecast period due to its potential use in data management, data analytics, cloud computing, and laboratory automation. They drive the Europe life science market by optimizing clinical trials and compliance through clinical trial software and software-as-a-service (SaaS). They enhance regulatory compliance and decision-making, and manage commercial and supply chain operations.

The genomics segment dominated the market in 2024, with a revenue share of approximately 46%, owing to the rising trend of precision medicine, including targeted therapies, newborn screening, genomic diagnostics, and pharmacogenomics. The integration of genomic data into healthcare systems improves disease prevention, enhances diagnostics, and advances personalized medicine. Whole-genome sequencing clearly diagnoses rare genetic disorders and is integrated into routine clinical practices, which also drives the Europe life science market.

The AI-based bioinformatics platforms segment is estimated to grow at the fastest rate in the market during the predicted timeframe due to accelerated drug discovery and development, and advanced diagnostics and omics research. They help in molecular screening, toxicity prediction, and optimizing clinical trials. They are also useful in genomic analysis, biomarker discovery, and tailoring treatment.

The drug discovery & development segment dominated the market in 2024, with a revenue share of approximately 44%, owing to the increased research efforts in the Europe life science market for drug design and screening, target identification and validation, and clinical trial optimization. The significant investments in biotechnology, biologics, and clinical research support the development and launch of advanced therapies and advanced therapy products. The gene, cell, and tissue-engineered therapies are introduced into the market through novel R&D efforts.

The personalized medicine segment is anticipated to grow at a notable rate in the market during the upcoming period due to its potential in enhancing disease prevention and treatment. The standardized methods and digital health integration are transforming healthcare systems. The personalized medicine approach introduces massive growth in the Europe life science market through targeted therapies and enables optimal drug selection and dosage with improved diagnostic accuracy.

The pharmaceutical & biotechnology companies segment dominated the market in 2024, with a revenue share of approximately 42%, owing to the advanced manufacturing, improved public health, and advanced therapy and drug innovations. The robust R&D efforts, multiple collaborations, and strategic solutions offered by biopharmaceutical firms are lifesaving for the European and global population. They focus on building relationships, trust, and compliance with laws and regulations.

The hospitals & clinical research laboratories segment is predicted to grow at a rapid rate in the Europe life science market during the studied period due to the importance of clinical trials for drug development and advancing personalized medicine. The advanced laboratory services and real-world evidence support drug discovery and development. They act as life saviors for the entire population, especially for people dealing with severe health conditions.

Europe dominated the market in 2024, owing to several government initiatives, strategic investments, and financial resilience. The European Investment Bank (EIB) prioritized research and development, infrastructure, and global partnerships. The Health Impact Investment Platform (HIIP) also supports the growth of the Europe life science market, which unites the WHO, several development banks, and countries to organize funding for resilient primary healthcare. The EIB supports many health projects that are eligible for financing, which encompass hospitals and infrastructure investments, medical research, education, training, health informatics, and innovation. It also provides services that expand universal access to affordable and safe care.

Germany dominated the Europe life science market in 2024, with a revenue share of approximately 25%. In April 2024, Merck announced the investment of more than € 300 million in a new research center in Germany.

In September 2025, the European Research Council (ERC) awarded €761 million to the next generation of scientists in Europe, through which the successful candidates planned to conduct their projects at research centers and universities across 25 countries, including Germany, the Netherlands, the UK, and France.

In May 2025, the President of the French Republic and the European Commission President launched the “Choose Europe for Science” initiative, which aims to encourage public and private researchers and entrepreneurs from across the globe to choose France and Europe as their place of work. https://www.welcometofrance.com/en/france-attracts-foreign-researchers

The President of the French Republic also announced an additional funding of €100 million, supported by the France 2030 program, to invite foreign researchers.

The President of the French Republic reported the European funding plan worth €500 million for the period 2025-2027.

The global life sciences market was valued at US$ 88.2 billion in 2024 and is expected to grow to US$ 98.63 billion in 2025. It is projected to reach approximately US$ 269.56 billion by 2034, expanding at a CAGR of 11.82% between 2025 and 2034.

The R&D process in the life sciences sector involves discovery and preclinical research, clinical research, regulatory review and market access, and manufacturing and post-market surveillance.

Key Players: Novo Nordisk, Roche, AstraZeneca, Sanofi, Bayer AG, Owkin, Evotec, BioNTech.

They revolve around advanced therapy medicinal products, pharmaceutical legislation reform, and real-world data, and the EU Clinical Trials Regulation (EU CTR).

Key Players: 858 Therapeutics, Inc., IQVIA, ICON Plc, Parexel, Syneos Health, Medpace, Charles River Laboratories.

These include digital transformation, AI integration, regulatory changes, complex disease support, business model, and delivery innovations.

Key Players: Novartis, AstraZeneca, IQVIA, Bayer AG, Sanofi, Roche, Royal Philips.

By Product Type

By Technology

By Application

By End User

By Region

December 2025

November 2025

November 2025

November 2025