December 2025

The Latin America life science market size began at US$ 4.49 billion in 2024 and is forecast to rise to US$ 4.90 billion by 2025. By the end of 2034, it is expected to surpass US$ 12.05 billion, growing steadily at a CAGR of 10.38%.

The Latin America life science market is experiencing steady growth, fueled by increasing government investments, rising R&D activities, and expanding biotechnology and pharmaceutical sectors. Brazil and Mexico lead the region with advanced research infrastructure and supportive regulatory frameworks. Demand for diagnostics, personalized medicine, and biopharmaceuticals is growing, while collaborations with global life sciences companies and adoption of advanced technologies like AI and genomics are further driving market expansion across the region.

| Table | Scope |

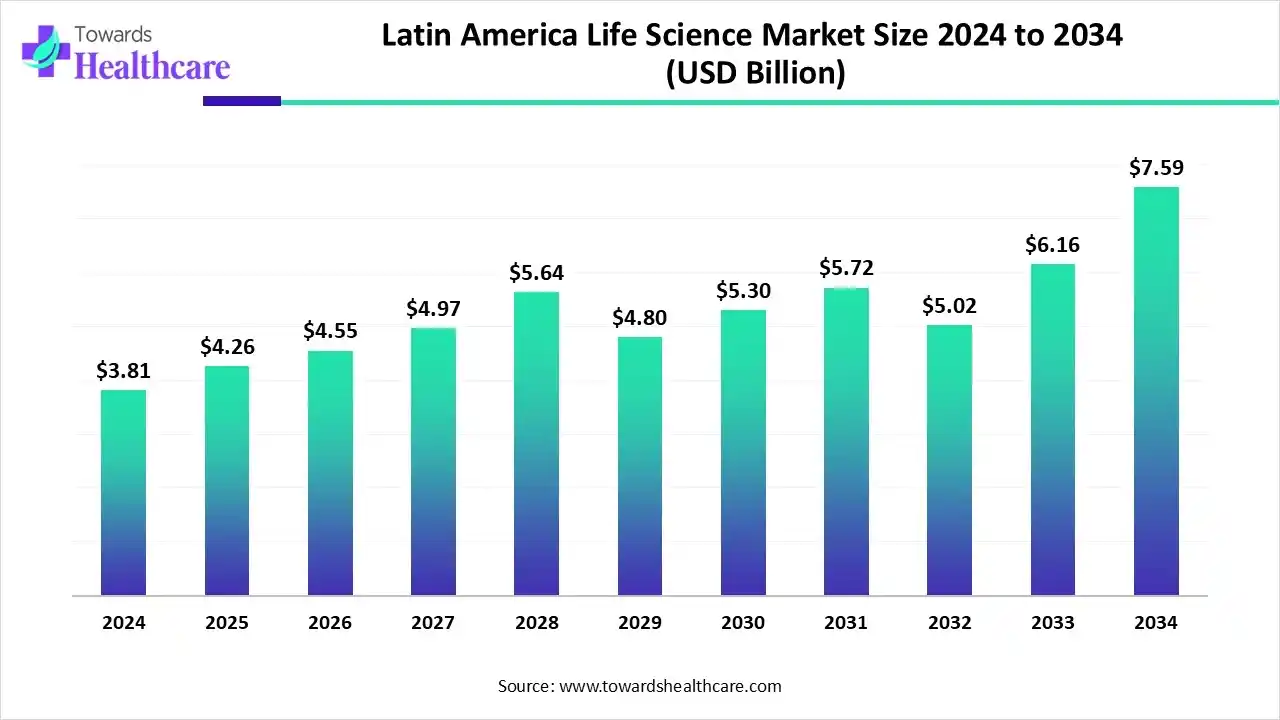

| Market Size in 2025 | USD 4.26 Billion |

| Projected Market Size in 2034 | USD 7.59 Billion |

| CAGR (2025 - 2034) | 7.14% |

| Market Segmentation | By Component, By Technology, By Application, By Product Type, By End-User, By Therapeutic Area, By Clinical Development Stage, By Region |

| Top Key Players | Biomérieux Latin America, Fiocruz – Oswaldo Cruz Foundation, Cristália, Laboratorios Liomont, Laboratorios Silanes, Grupo Insud, Medix |

The market is growing due to rising healthcare investment and expanding biotechnology and pharmaceutical sectors. This market encompasses the biotechnology, pharmaceuticals, medical devices, diagnostics, contract research/manufacturing, and research tools sectors across Latin American countries. It includes drug discovery, development, and manufacturing; medical technology innovation; academic and industrial research; and supporting infrastructure such as CROs, CDMOs, and research institutes.

The market is driven by rising healthcare demand, expanding biotech clusters, government support, and growing clinical research activity in countries like Brazil, Mexico, Argentina, and Chile. The Latin America life science market is expanding as rising private sector investments and foreign collaborations accelerate biotechnology and pharmaceutical research. Growing awareness of preventive healthcare, expanding clinical trial activities, and adoption of digital health and laboratory automation solutions are further driving market growth, positioning the region as an emerging hub for innovative life sciences research and healthcare advancements.

AI is reshaping the Latin America life science market by enhancing patient engagement, optimizing supply chains, and supporting remote diagnostics. It enables faster identification of research gaps, improves regulatory compliance, and aids precision agriculture and biotech applications. Furthermore, AI-driven predictive modeling and virtual trials reduce costs and accelerate innovation, while digital platforms facilitate collaboration between regional and global research organizations, driving growth, efficiency, and competitive advantage in the life sciences sector across Latin America.

The biopharmaceutical segment dominated the market as companies increasingly focus on large-molecule drugs and next-generation biologics. Expanding biomanufacturing capacities, growing partnerships for therapeutic protein development, and rising demand for advanced drug delivery systems also supported its lead. Furthermore, regulatory support for biologic innovations and the strong clinical success rates of biopharmaceutical products have reinforced the segment’s substantial market share and long-term growth prospects.

The healthcare IT & digital solutions segment is anticipated to witness the fastest growth owing to breakthroughs in precision medicine, enhanced use of bioinformatics, and a stronger focus on patient-centric healthcare. The integration of digital platforms with advanced cellular research enables efficient clinical workflows, remote monitoring, and real-time data sharing. Moreover, growing investments in genomic research, digital transformation in hospitals, and partnerships between tech firms and healthcare providers further boost this segment’s expansion.

The biotechnology segment dominated the market as it underpins innovations in therapeutic development, biosimilars, and disease modeling. Its strong integration with genomics, proteomics, and cellular engineering has accelerated breakthroughs in precision and regenerative medicine. Expanding biomanufacturing capacity, collaborations between academia and industry, and increased funding for advanced biologics have reinforced its leadership. Moreover, biotechnology’s adaptability across pharmaceuticals, diagnostics, and bioinformatics continues to drive its market prominence and long-term growth potential.

The digital health & AI integration segment is projected to expand rapidly as healthcare systems increasingly adopt advanced computational tools and bioengineering techniques. The convergence of digital platforms with biological design enables faster drug development, remote patient monitoring, and improved disease modeling. Moreover, growing interest in lab automation, digital twins, and bioinformatics-driven research, along with supportive innovation policies, is enhancing efficiency and accelerating the commercialization of next-generation health and life science solutions.

The drug discovery & development segment dominated the market as it plays a pivotal role in accelerating treatment innovation and improving patient outcomes. Expanding collaborations between research institutes and pharma companies, coupled with advancements in computational biology and molecular imaging, have enhanced discovery efficiency. Rising healthcare spending, greater focus on companion diagnostics, and demand for faster, cost-effective solutions for complex diseases have further solidified this segment’s strong position within the life science industry.

The personalized & precision medicine segment is projected to grow rapidly as healthcare providers increasingly focus on tailored therapies and curative approaches. Innovations in cellular therapies, biomaterials, and genome editing are expanding treatment possibilities. Rising collaboration between biotech firms, research institutions, and healthcare organizations, along with growing patient awareness and demand for advanced treatment options, is driving adoption.

The small molecules segment leads the market as these compounds remain integral to traditional and combination therapies, offering high stability, ease of formulation, and rapid clinical development. Growing demand for targeted treatments in oncology, cardiovascular, and metabolic disorders, coupled with extensive regulatory familiarity and established manufacturing capabilities, reinforces its dominance. Additionally, small molecules’ adaptability for global distribution and inclusion in novel drug delivery systems ensures strong revenue performance and continued preference among pharmaceutical companies.

The biologics segment is projected to register the fastest growth as rising focus on innovative biologics, next-generation vaccines, and cell-based therapies expands treatment options. Increasing collaborations between biotech firms and research institutions, growing government support for immunization campaigns, and rising global demand for safe and effective vaccines contribute to this trend. Additionally, technological advancements in protein engineering, viral vector platforms, and personalized biologics are accelerating adoption, driving rapid market expansion during the forecast period.

The pharmaceutical & biotechnology companies segment dominated the market as these organizations lead in adopting cutting-edge technologies, developing novel therapies, and expanding global market reach. Growing focus on precision medicine, vaccine development, and biologics, combined with strategic investments in R&D and clinical trials, strengthens their market position. Additionally, partnerships with academic institutions, contract research organizations, and diagnostic firms enhance innovation pipelines, making pharma and biotech companies the primary drivers of growth in the life sciences sector.

The academic & research Institutes segment is projected to grow rapidly as rising demand for specialized research services, high-throughput screening, and preclinical testing drives collaboration. Expanding government and private funding, increasing clinical trial activities, and the adoption of advanced lab technologies enhance their role in life sciences innovation. Additionally, these institutions provide flexible, cost-effective solutions for emerging biotech and pharmaceutical companies, supporting faster product development and regulatory compliance, which contributes to the segment’s accelerated growth during the forecast period.

The oncology segment led the market as these therapeutic areas remain top priorities for healthcare systems due to high morbidity and mortality rates. Increasing focus on early detection, novel drug development, and combination therapies drives growth. Additionally, rising collaborations between biotech firms, hospitals, and research institutions, along with expanding access to advanced diagnostics and treatment options, have strengthened the segment’s market position, making it a key driver of revenue and innovation in the life sciences industry.

The rare diseases & orphan drugs segment is projected to grow rapidly as rising demand for innovative, life-changing therapies drives research and commercialization. Increasing collaboration between biotech startups, academic institutions, and healthcare providers accelerates the development of advanced cell and gene therapies. Government incentives, expanded clinical trial initiatives, and growing patient advocacy for orphan diseases further boost adoption. Additionally, advancements in bioengineering, regenerative technologies, and precision medicine enable scalable, effective treatments, positioning this segment for the fastest growth in the life sciences market.

Why was the Phase II Segment Dominant in the Latin America Life Science Market in 2024?

The Phase II segment led the market as these stages generate pivotal data required for regulatory approval and commercialization. Increasing late-stage trials for innovative therapies, rising prevalence of chronic and rare diseases, and higher patient enrollment drive growth. Moreover, outsourcing to specialized CROs, adoption of advanced clinical trial technologies, and strategic partnerships between pharma companies and research institutions enhance efficiency and reduce timelines, reinforcing the segment’s dominance in revenue generation within the life sciences market.

The preclinical segment is projected to grow rapidly as rising demand for novel therapeutics and exploratory research drives early innovation. Adoption of advanced lab automation, AI-driven modeling, and bioinformatics accelerates candidate selection and development. Increased support from venture capital, public funding, and partnerships between research institutions and biotech firms enhances capabilities. Furthermore, the focus on rare diseases, personalized medicine, and next-generation biologics is expanding early-stage pipelines, making this segment the fastest-growing in the life sciences market.

The Latin America life science market is expanding as governments and the private sector increase funding for research and innovation. Growing focus on biopharmaceuticals, digital health adoption, and laboratory infrastructure improvements drives development. Additionally, rising awareness of preventive care, expanding clinical trials, and partnerships with global life sciences companies are accelerating technological adoption and market growth across the region.

Brazil led the market in 2024 owing to its robust pharmaceutical manufacturing base, increasing adoption of innovative therapies, and expanding biotechnology sector. Strategic partnerships with global life sciences firms, rising private sector investments, and supportive national health programs enhanced research capabilities. Additionally, growing demand for advanced diagnostics, vaccines, and personalized medicine, along with a large patient population, contributed to Brazil securing the highest revenue share in the region.

Mexico and Chile are projected to experience the fastest CAGR as emerging biotech startups, increasing foreign direct investment, and expanding laboratory infrastructure drive market growth. Rising demand for innovative treatments, vaccines, and diagnostic services, coupled with government initiatives to modernize healthcare and promote research, supports rapid development. Additionally, growing collaborations between academic institutions and private companies, along with the adoption of digital health technologies, are accelerating life sciences innovation and commercial opportunities in both countries.

The global life sciences market was valued at USD 88.2 billion in 2024 and increased to USD 98.63 billion in 2025. It is projected to reach approximately USD 269.56 billion by 2034, growing at a compound annual growth rate (CAGR) of 11.82% between 2025 and 2034.

By Component

By Technology

By Application

By Product Type

By End-User

By Therapeutic Area

By Clinical Development Stage

By Region

December 2025

November 2025

October 2025

November 2025