November 2025

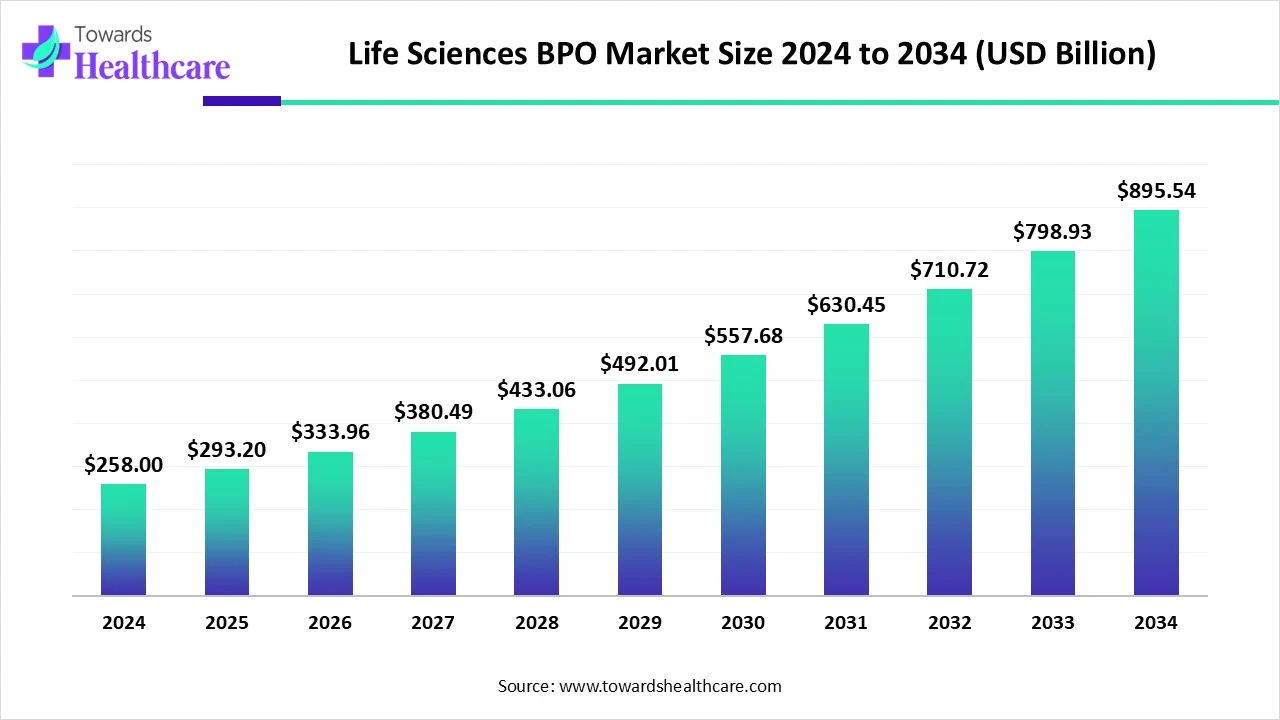

The global life sciences BPO market size is calculated at US$ 293.19 billion in 2025, grew to US$ 333.18 billion in 2026, and is projected to reach around US$ 1053.08 billion by 2035. The market is expanding at a CAGR of 13.64% between 2026 and 2035.

Various companies are increasing the demand for life science BPO. The growing innovations are leading to a rise in the reliance on life science BPO for various purposes. At the same time, new platforms are being developed and launched by integrating them with AI to enhance their applications. This, in turn, is leading to new partnerships among the companies. Moreover, the growing research, clinical trials, and strict regulations are increasing their demand in different regions. Thus, this is promoting the market growth.

| Metric | Details |

| Market Size in 2026 | USD 333.18 Billion |

| Projected Market Size in 2035 | USD 1053.08 Billion |

| CAGR (2026 - 2035) | 13.64% |

| Leading Region | North America share by 43% |

| Market Segmentation | By Service Type, By Phase, By End User, By Region |

| Top Key Players | IQVIA, Parexel International Corporation, Syneos Health, Labcorp Drug Development (formerly Covance), PPD (Thermo Fisher Scientific), Charles River Laboratories, ICON plc, Wuxi AppTec, Pharmaron, PRA Health Sciences (now part of ICON), Medpace Holdings, Inc., Catalent, Inc., Lonza Group AG, Samsung Biologics, Boehringer Ingelheim BioXcellence, PharmaLex (now part of AmerisourceBergen), Tata Consultancy Services (TCS) – Life Sciences Division, Cognizant Technology Solutions, Accenture Life Sciences, Genpact – Life Sciences Division |

The life sciences BPO market includes outsourced services provided to pharmaceutical, biotechnology, and medical device companies across non-core but critical business functions such as clinical trial management, regulatory compliance, pharmacovigilance, manufacturing, supply chain, as well as sales & marketing. At the same time, these services help companies reduce costs, accelerate drug development, improve compliance, and increase operational efficiency. The market is growing due to increasing R&D complexity, rising cost pressures, as well as the need for scalability and global expertise.

The government initiatives for the life sciences BPO market include:

The use of AI in the life sciences BPO is increasing for enhancing clinical trial activities. It can be used for the selection of patients for the trials, as well as can predict the chances of trial failure. It can quickly and accurately interpret the data obtained. At the same time, its use in medical writing is also increasing, which is improving the speed, accuracy, clarity, and regulatory compliance. Moreover, it also provides deep insights as well as helps in monitoring and detecting patient outcomes.

Growing Clinical Trials

Various pharmaceutical and biotech companies are advancing in their innovative development, which in turn increases the number of clinical trials conducted. This, in turn, increases the trial complexities. Thus, the demand for life science BPO increases. Hence, to reduce the complexities, the outsourcing and specialized services are provided by the BPO. Moreover, the outsourcing also helps in minimizing the chances of delays. At the same time, it also minimizes the regulatory hurdles and is affordable. Thus, this drives the life sciences BPO market growth.

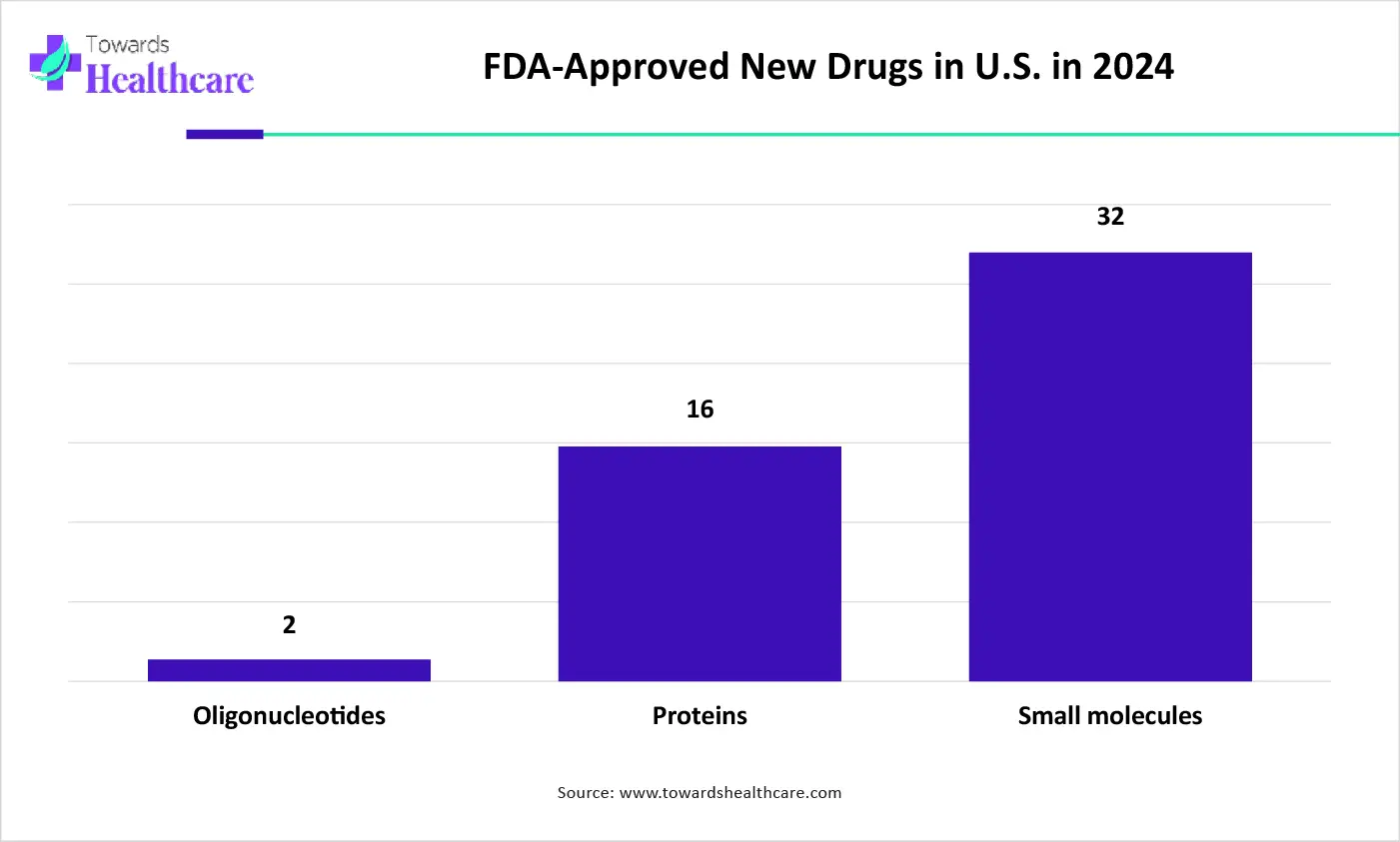

The graph represents the total number of FDA-approved drugs in the U.S. in year of 2024. It indicates that there will be a rise in drug development and clinical trials. Hence, it increases the demand for life sciences BPO for the management of clinical trials. Thus, this in turn will ultimately promote the market growth.

Privacy and Security Concerns

The data that is outsourced by the life sciences BPO can be hacked or leaked. At the same time, data breaches, due to the use of digital tools, can also be observed. Thus, this can damage the reputation of the companies, leading to financial or ethical loss. Hence, this limits the use of life sciences BPO.

Advancements in Medical Writing

The growing drug development increases the documentation process, which in turn, increases the medical writing. At the same time, various companies may lack the presence of a medical writer or tools, which increases their reliance on life sciences BPO services. Thus, various advanced platforms are being provided, as well as developed by these BPOs, for accelerating the accuracy and speed of medical writing. Moreover, they are also enhancing their accessibility and affordability. Thus, this promotes the life sciences BPO market growth.

For instance,

By service type, the contract research services (CROs) segment dominated the market with a 41% share in 2024. The demand for CROs rose due to a growth in the outsourcing by the industries to reduce the drug development and manufacturing costs. Moreover, it was also used to reduce the time and complexity of the trials. This contributed to the market growth.

By service type, the contract manufacturing services (CMOs/CDMOs) segment is expected to show the fastest growth rate at a notable CAGR during the predicted time. The growing advances in the development of next-generation therapies or drugs are increasing the use of these services. Additionally, to support the development and production and to reduce its cost, they are being preferred.

By phase type, the preclinical & clinical phase services segment held the largest share of 53% in the market in 2024. The preclinical & clinical phase services were used to reduce the complications associated with the clinical trials. The presence of regulatory expertise and advanced platforms also enhanced their use.

By phase type, the commercial phase services segment is expected to show the highest growth during the upcoming years. The use of commercial phase services is increasing due to growing drug developments and approvals. At the same time, to monitor the pharmacovigilance and safety profile of the products, their use is increasing.

Similarly, to monitor the safety profile of the products, the use of post-marketing surveillance services sub-segment is increasing. Moreover, their use is also increasing due to growing outsourcing demands. Furthermore, they are also used during a product recall or withdrawal from the market.

By end user, the pharmaceutical companies segment led the market with a 46% share in 2024. The pharmaceutical companies required the BPO services for regulatory expertise and outsourcing. Moreover, they were also used in the manufacturing and clinical trials to reduce their complications and the regulatory barriers. This enhanced the market growth.

By end user, the biotechnology companies segment is expected to show the fastest growth rate during the forthcoming years. The demand for BPO services in biotechnology companies is growing due to their limited internal capacity. Moreover, growing innovations in gene and cell therapies are also contributing to the same.

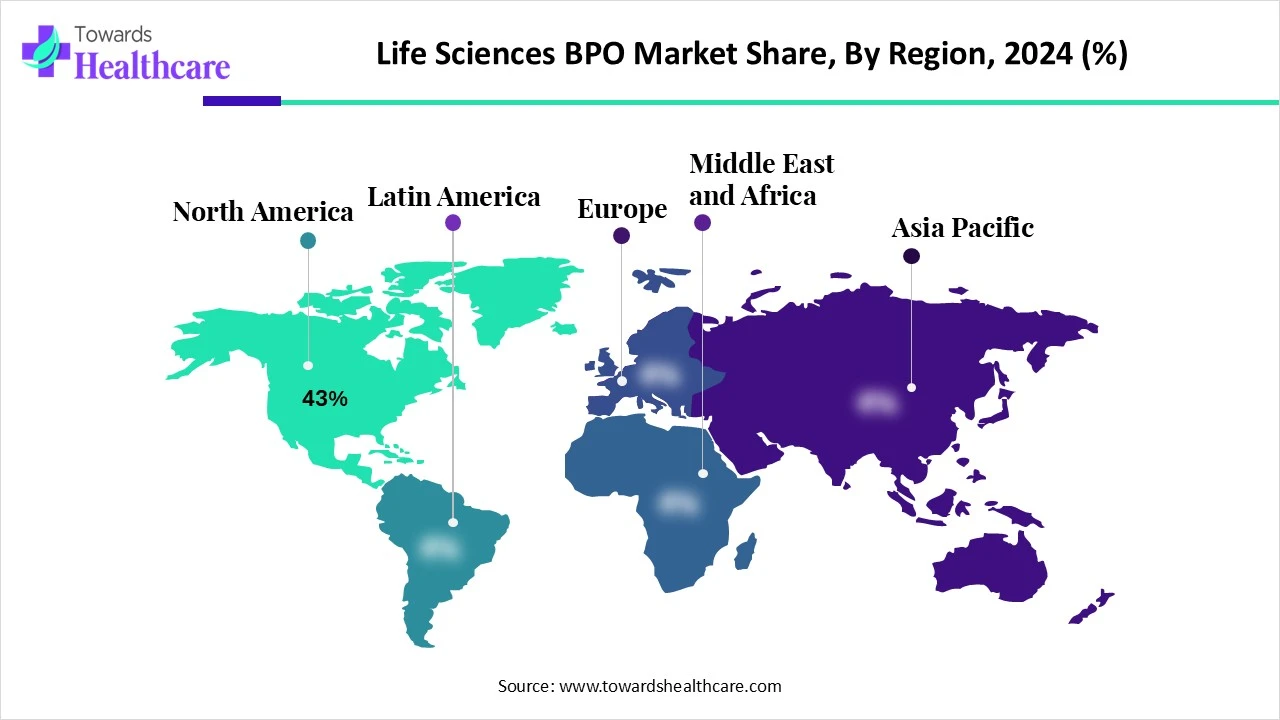

North America dominated the life sciences BPO market share by 43% in 2024. The pharmaceutical and biotech companies present in North America are well-developed. At the same time, due to their high concentration, they relied on CROs & CMOs for various purposes. This, in turn, contributed to the market growth.

The companies present in the U.S. are focusing on the development of various diagnostic and treatment innovations. This, in turn, is increasing the collaboration between the companies and the life sciences BPO. These services help in accelerating their development, pharmacovigilance, clinical trials, as well as approval by being in compliance with the regulatory guidelines.

The growing research and development in Canada are increasing the demand for life science BPO services. At the same time, the advanced technologies and various platforms are being developed and launched to enhance various operational functions. Moreover, to manage the cost and outsourcing their reliance is increasing.

Asia Pacific is expected to host the fastest-growing life sciences BPO market during the forecast period. There is a rise in the clinical trials conducted in Asia Pacific, which in turn is increasing the demand for life sciences BPO. Moreover, the lower labour costs are also enhancing its use. Thus, this promotes the market growth.

The growing incidence of diseases in China is increasing the development of various diagnostic and treatment approaches. Hence, the clinical trials conducted are increasing, leading to the demand for the use of BPO services. Thus, the advanced facilities and platforms are promoting their use.

The clinical trial outsourcing in India is increasing the adoption of life science BPO services. At the same time, the lower labour costs along with a skilled workforce are also attracting various companies. Additionally, to support this development, various investments, as well as policies, are being introduced by the government.

Europe is expected to grow significantly in the life sciences BPO market during the forecast period. The products in clinical trials and ones that are being launched have to be in compliance with the stringent rules and regulations laid by the regulatory bodies of Europe. This increases the reliance on the life science BPO. Thus, this enhances the market growth.

The companies present in Germany are advanced, which majorly contribute to various research and development. Thus, to reduce their operational cost of these research studies, manufacturing, and clinical trials, the use of BOP services is increasing. Moreover, their use for regulatory expertise is also increasing.

The UK is experiencing a rise in clinical trial activities, which in turn, is increasing the collaborations of companies with life science BPO. At the same time, the growing development of personalized treatment approaches is increasing the use of outsourced services, digital tools, as well as various advanced platforms.

The global life science market size is calculated at US$ 88.2 billion in 2024, grew to US$ 98.63 billion in 2025, and is projected to reach around US$ 269.56 billion by 2034. The market is expanding at a CAGR of 11.82% between 2025 and 2034.

By Service Type

By Phase

By End User

By Region

November 2025

October 2025

October 2025

October 2025