January 2026

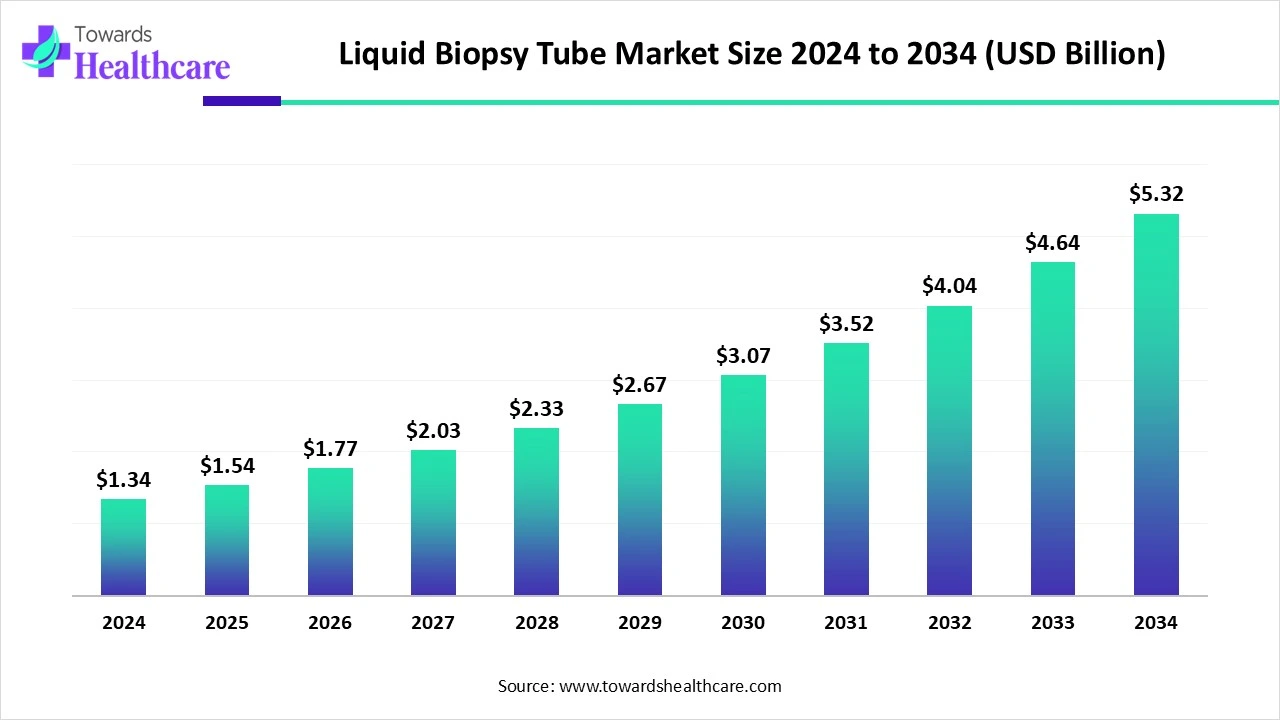

The global liquid biopsy tube market size stood at US$ 1.34 billion in 2024, grew to US$ 1.54 billion in 2025, and is forecast to reach US$ 5.32 billion by 2034, expanding at a CAGR of 14.85% from 2025 to 2034.

In 2025, the market is experiencing steady growth driven by the increasing adoption of minimally invasive diagnostics techniques. Rising cancer prevalence globally is one of the key contributors to the market expansion. Advancements in precision oncology and personalized medicine are further fueling the demand for liquid biopsy solutions. Liquid biopsy tubes are becoming critical in research and clinical applications due to their ability to stabilize blood samples over extended periods. The growing focus on early cancer detection and treatment monitoring is pushing laboratories and hospitals to invest in these tubes. Regulatory support and increasing research funding are expected to drive further market acceleration.

| Metric | Details |

| Market Size in 2025 | USD 1.54 Billion |

| Projected Market Size in 2034 | USD 5.32 Billion |

| CAGR (2025 - 2034) | 14.85% |

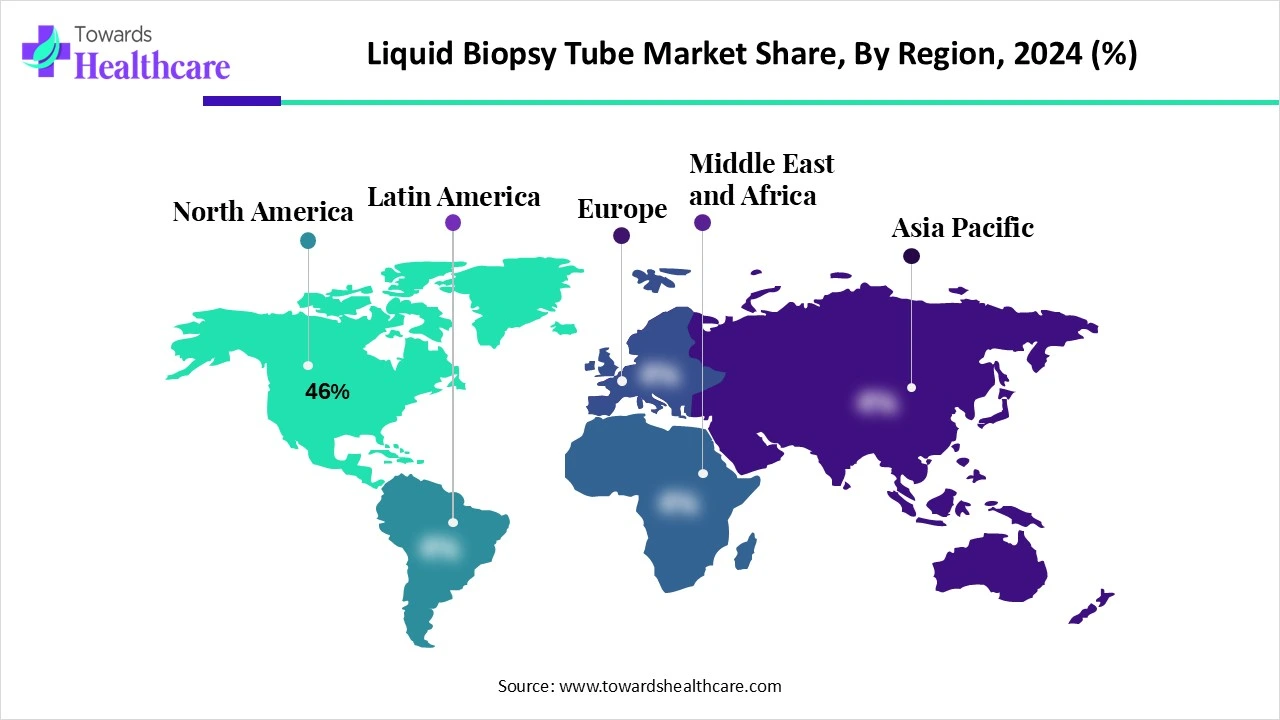

| Leading Region | North America Share 46% |

| Market Segmentation | By Tube Type, By Additive/Preservation Chemistry, By Material, By Application, By End User, By Region |

| Top Key Players | Streck, Inc., PreAnalytiX, Roche Diagnostics, Bio-Rad Laboratories, Inc., Norgen Biotek Corp., Thermo Fisher Scientific, Inc., Exact Sciences Corporation, Greiner Bio-One GmbH, Macrogen Inc., Sarstedt AG & Co. KG, Biomatrica, Agena Bioscience, Transgenomic Inc., ZenBio, Inc., Genolution Inc., Yourgene Health, BD (Becton, Dickinson and Company), Tecan Group Ltd., Dxome Co., Ltd., Alifax S.r.l |

The liquid biopsy tube market refers to the specialized segment of the diagnostics and sample collection industry that produces blood collection tubes specifically designed for liquid biopsy applications. These tubes are critical for preserving the integrity of biomarkers, such as circulating tumor DNA (ctDNA), circulating tumor cells (CTCs), exosomes, and RNA during storage and transport. Unlike standard blood collection tubes, liquid biopsy tubes contain stabilizing agents that prevent cell lysis and minimize genomic contamination. The market is expanding rapidly due to the growing adoption of liquid biopsies in cancer diagnostics, minimal residual disease (MRD) monitoring, and non-invasive prenatal testing (NIPT).

The liquid biopsy tube market is poised for robust growth as the demand for non-invasive diagnostic tools continues to rise. The technology’s compatibility with advanced molecular testing methods has accelerated its adoption in cancer diagnostics. Market players are innovating with stabilizing agents and tube materials that preserve analytes longer and with higher integrity. The integration of liquid biopsy tubes in clinical workflows is increasing due to their role in real-time monitoring and recurrence detection. Alongside oncology new applications in parental testing and infectious disease detection are also expanding. The evolution is driving diversification and technological advancement across the market landscape.

Artificial intelligence is bringing a paradigm shift to the liquid biopsy tube market by enhancing the precision and efficiency of diagnostics. AI algorithms are now capable of analyzing ctDNA and exosome content with unprecedented accuracy, reducing interpretation errors. These technologies can process vast genomic datasets quickly, enabling faster detection of early-stage cancers. AI also assists in predicting disease progression and treatment responses, offering actionable insights to clinicians. By integrating an AI-powered analysis platform with liquid biopsy sampling, the time between sample collection and decision-making is significantly shortened. This synergy is setting new benchmarks for personalized medicine and driving the adoption of liquid biopsy tubes across research and clinical labs.

Fueling Diagnostics: What’s Driving the Market?

A surge in cancer cases globally is a primary driver pushing the demand for liquid biopsy tubes. The tubes play a crucial role in enabling early diagnosis, which significantly improves survival rates. Their minimally invasive nature appeals to both patients and physicians, reducing the risks and costs associated with traditional biopsies. Governments and institutions are investing in early cancer screening programs, further promoting the use of liquid biopsy tubes. Growing awareness about the clinical benefits of liquid biopsies is increasing adoption in developed and emerging regions alike. As research expands, testing and neurological diseases, the demand for reliable tube technology continues to climb.

Holding Back Progress: Market Restraints to Watch

Despite promising growth, the market faces several restraints. High costs associated with premium liquid biopsy tubes may deter adoption in low-income settings. Lack of standardization in sample handling and analyte preservation can lead to inconsistent results. Limited awareness and accessibility in rural and underdeveloped areas also hinder market penetration. The regulatory landscape for liquid biopsy products remains complex and varies by region, posing challenges for global players. Technical limitations in detecting low-frequency mutations or rare biomarkers can affect diagnostic reliability. Furthermore, the need for skilled personnel to handle and interpret results from liquid biopsy samples creates a gap in widespread clinical use.

Window of Opportunity: Expanding Frontiers of Use

The versatility of liquid biopsy tubes opens doors to a multitude of opportunities in healthcare diagnostics. Beyond oncology, these tubes are gaining traction in prenatal screening, organ transplant monitoring, and infectious disease diagnostics. Pharmaceutical companies are increasingly using liquid biopsies for biomarker discovery and drug development, fueling demand for high-integrity preservation tubes. The rising popularity of at-home diagnostics kits and decentralized testing is another potential growth avenue. Emerging markets offer untapped potential due to improving healthcare infrastructure and rising awareness. With continuous innovation in tube design and analyte stabilization, the market is ripe for expansion into non-traditional applications.

CFDNA stabilization tubes dominate the market, due to their robust ability to preserve the integrity of cell-free DNA during sample transportation and processing. These tubes are widely adopted in oncology and prenatal testing, where high sample quality is crucial. Their compatibility with various downstream molecular applications adds to their demand. Laboratories and diagnostic centers trust these tubes for accurate liquid biopsy results. Additionally, increased clinical validation supports their widespread adoption. Continuous innovations in tube formulations further enhance their appeal in clinical and research settings.

Their dominance is also bolstered by rising awareness of non-invasive cancer diagnostics. The growing preference for precision medicine is pushing laboratories to rely on cfDNA tubes for reliable genomic profiling. These tubes offer a longer stabilization time, reducing pre-analytical variability. As testing volumes increase globally, labs are moving toward standardized solutions, such as cfDNA stabilization tubes. Healthcare providers also prefer them due to reduced sample rejection rates. All these factors cumulatively position them as the go-to option in the liquid biopsy landscape.

Meanwhile, RNA stabilisation tubes are becoming the fastest-growing segment, driven by the surge in transcriptomic studies and personalized medicine. These tubes are essential for preserving RNA integrity in samples used for gene expression profiling and early cancer detection. Their role in studies involving circulating tumor RNA (ctRNA) is gaining attention. Researchers prefer these tubes to avoid RNA degradation, especially during long transit or storage. Enhanced demand in academic and pharmaceutical research is boosting their market growth. Moreover, ongoing developments in RNA-based biomarkers are further fueling adoption.

As RNA-based liquid biopsies gain clinical traction, the need for reliable RNA preservation solutions is rising. These tubes are becoming critical for multi-omic applications in oncology. Pharmaceutical companies are increasingly using RNA tubes in biomarker discovery and therapy monitoring trials. Also, government-funded genomic projects are incorporating RNA-based sample analysis. The shift toward non-coding RNA studies further amplifies the importance of these stabilisation tubes. With increasing trust in RNA signatures for early diagnosis, their usage is set to accelerate globally.

Cell stabilisation agents continue to dominate the preservation chemistry landscape, playing a pivotal role in maintaining cellular morphology and genomic content. Their inclusion in liquid biopsy tubes ensures minimal cell lysis and DNA contamination during transit. These agents provide a stabilized environment that enhances downstream analysis reliability. Their application spans multiple diagnostic areas, especially in cancer genomics. The consistency they offer improves the overall analytical performance of liquid biopsies. Their proven efficacy makes them a preferred choice across clinical labs.

This dominance is also attributed to their critical role in minimizing pre-analytical errors. They help preserve rare cells such as CTCs (circulating tumor cells), which are valuable in oncology diagnostics. The stabilization process facilitated by these agents extends sample viability and usability. As global focus intensifies on liquid biopsies, labs are leaning toward agents that provide the highest preservation accuracy. Pharmaceutical companies trust these agents in their early-phase trials. Overall, their compatibility and reliability continue to reinforce their leading position.

On the other hand, DNA/RNA stabilisers are emerging as the fastest-growing segment due to their ability to preserve nucleic acid quality for molecular assays. With the increasing use of genomic sequencing, stabilizers that can retain DNA and RNA integrity are in high demand. These agents are vital in preventing nucleic acid degradation in high-throughput testing workflows. Their compatibility with both cfDNA and ctRNA enhances their versatility. Research institutions and biotech companies are rapidly adopting them for cutting-edge molecular diagnostics. Additionally, their use in personalized therapy development is expanding.

The growth of DNA/RNA stabilisers is linked to the rise in liquid biopsy-based diagnostics in cancer and infectious diseases. Their ability to minimize sample-to-sample variability makes them indispensable in clinical research. These stabilisers are tailored for next-generation sequencing and PCR applications. Global biopharma companies are incorporating them into companion diagnostic studies. As precision diagnostics continue to evolve, so does the need for efficient preservation solutions. This makes DNA/RNA stabilisers a cornerstone of future-ready diagnostic pipelines.

Plastic tubes dominate the liquid biopsy tube market due to their durability, ease of manufacturing, and cost-efficiency. Their lightweight nature makes them ideal for sample transport and storage. Most manufacturers prefer plastics because of their versatility with additives and compatibility with automation. These tubes can be easily sterilized and offer sufficient mechanical strength. They also allow for high-volume production, supporting growing global testing demands. As a result, plastic remains the material of choice in both clinical and research settings.

Plastic tubes also offer reduced breakage risk compared to glass, making them safer and more convenient. Their adaptability allows for integration with newer preservation chemistries and stabilizers. The customization options available with plastic molds make them suitable for specialized applications.

The glass segment of the Liquid Biopsy Tube Market is projected to grow rapidly over the forecast period from 2025 to 2034. This surge can be attributed to the increasing demand for high-quality sample collection and preservation methods. Glass tubes offer superior stability and reduce the risk of contamination, making them ideal for sensitive biomarker analysis.

As more research emphasizes the need for accurate diagnostics, the preference for glass tubes is expected to rise. Additionally, advancements in glass manufacturing technology are enhancing product performance, further driving market growth. Consequently, glass tubes are becoming an essential choice among clinical laboratories and research institutions.

Cancer diagnostics and mutation analysis remain the most dominant applications in the liquid biopsy tube market. The growing prevalence of cancer and demand for early detection methods are key factors driving this dominance. These tubes are critical for capturing high-quality nucleic acids for accurate mutation profiling. Their usage is standard across hospitals, diagnostic labs, and clinical research organizations. Advanced liquid biopsy platforms rely on these tubes to detect mutations from ctDNA. This application supports real-time monitoring and tailored cancer treatments.

Additionally, mutation analysis through liquid biopsies reduces the need for invasive procedures, making it widely preferred. Oncologists use these tools for both initial diagnosis and recurrence tracking. Their application is expanding beyond solid tumors into hematological malignancies. The accuracy and non-invasiveness of this approach are encouraging more healthcare facilities to adopt it. Public and private investment in cancer diagnostics is further bolstering demand. As a result, this application area continues to hold a substantial share in the global market.

Minimal residual disease (MRD) monitoring is rapidly emerging as the fastest-growing application in the liquid biopsy tube market. With increased focus on post-treatment surveillance in cancer patients, MRD monitoring is gaining clinical relevance. Liquid biopsy tubes enable non-invasive and periodic testing to detect trace levels of residual disease. This application is crucial in preventing relapse through early intervention. Hematologic malignancies and solid tumors both benefit from MRD-based strategies. Clinical trials increasingly incorporate MRD endpoints for treatment efficacy assessments.

As treatment becomes more targeted, MRD monitoring serves as a sensitive metric for therapy effectiveness. It allows oncologists to tailor treatment plans post-therapy and reduce unnecessary toxicity. Biopharma firms are investing in MRD detection assays, which rely heavily on quality-preserved samples. Health systems are now integrating MRD testing into routine care pathways. Patient demand for minimally invasive follow-ups is also accelerating this shift. Consequently, this segment is poised to witness exponential growth.

Clinical reference laboratories dominate the end-use landscape in the liquid biopsy tube market due to their role as central hubs for high-volume testing. These labs require highly standardized and scalable solutions, which liquid biopsy tubes fulfill. Their demand is fueled by diagnostic testing for oncology, NIPT, and infectious diseases. As outsourcing of diagnostics becomes more common, reference labs are expanding their service portfolios. Their infrastructure is well-suited for adopting new technologies like cfDNA/RNA-based tests. These labs act as crucial enablers for national and global health initiatives.

Their dominance is supported by their capacity to handle complex assays and multi-sample workflows. Reference labs benefit from economies of scale, which allow them to process samples faster and more cost-effectively. They also have dedicated teams for molecular diagnostics, driving higher accuracy and reliability. With growing partnerships between hospitals and third-party labs, demand continues to rise. The requirement for consistent results in clinical trials also places these labs in a strategic position. Overall, they form the operational backbone of the market.

Biopharma companies and CDMOs are the fastest-growing end-users, leveraging liquid biopsy tubes for research, clinical trials, and companion diagnostics. Their increasing focus on precision medicine and biomarker development is driving demand. These entities require standardized, reproducible, and scalable sampling solutions, making liquid biopsy tubes essential. The role of CDMOs in outsourced R&D is rising, expanding their utilization of these tubes. Biopharma players use them across various stages of drug development, especially in oncology. Regulatory support for biomarker-driven approvals is also stimulating market growth.

This growth is further accelerated by strategic collaborations between diagnostic developers and pharmaceutical firms. CDMOs are investing in advanced infrastructure to support high-quality liquid biopsy processing. The need for consistent sample integrity in global trials makes these tubes indispensable. With the expansion of decentralized clinical trials, these tubes are being used in at-home sample collection. Additionally, partnerships with CROs amplify their usage in large-scale studies. Thus, biopharma and CDMOs are fast becoming critical market drivers.

North America continues to dominate the liquid biopsy tube market share 46% in 2024, thanks to strong healthcare infrastructure and widespread investment in molecular diagnostics. Prestigious clinical reference labs and major oncology centers widely adopt cfDNA and RNA tubes for precision testing. Robust regulatory frameworks and reimbursement policies support rapid clinical implementation and innovation. Collaboration between diagnostic developers, cancer centers, and biopharmaceutical firms accelerates product adoption. North American labs also benefit from domestic R&D and early adoption of next-generation biomarker technologies.

Many companies have established a strategic presence across multiple U.S. states, supplying cfDNA stabilization tubes to several leading laboratories. We recently announced an expansion of our manufacturing capacity to meet rising demand in oncology testing. Some of the key players, include Myriad Genetics, Inc. and Illumina, Inc., are highly supporting of liquid biopsy for early cancer detection tools.

In Canada, numerous companies have collaborated with provincial health networks to provide tubes for national cancer screening studies, strengthening our presence in the region. For example, Health Canada is significantly contributing to liquid biopsy initiatives by partnering with various companies across the country. Some reports indicate that the Government of Canada is also playing a crucial role in managing this project.

Asia-Pacific is emerging as the fastest-growing market for liquid biopsy tubes, driven by expanding cancer diagnostics infrastructure and rising healthcare investment. Countries such as India and China are scaling up molecular testing capabilities, including next-gen sequencing and liquid biopsy platforms. Awareness campaigns and government programs are encouraging early cancer screening and personalized diagnostics. Local manufacturers are entering the space, boosting the affordability and accessibility of preservation tubes. Innovation collaborations in the region are advancing tube chemistry to suit diverse sample conditions and climates.

Healthcare sectors have expanded distribution to key diagnostic networks across major Indian metro regions. Earlier this year, they launched a training workshop for lab technicians on using RNA stabilization tubes in clinical workflows. A diagnosis report points out the Major contribution of the Indian healthcare sector in liquid biopsy.

Dr. M. D. Ray, a Professor in the Department of Surgical Oncology at the Dr. B. R. Ambedkar Institute Rotary Cancer Hospital, AIIMS, emphasizes the significant challenges patients face due to the high expenses associated with conventional robotic surgeries, which usually cost between Rs 2 to 3 lakh. With a large number of patients to serve, he recognizes the urgent need for affordable technology that can truly impact their lives.

In July 2025, BioNexus Gene Lab Corp. and Fidelion Diagnostics Pte Ltd, a company based in Singapore, announced the signing of a term sheet for a strategic cross-equity partnership that the stakeholders are referring to as a DeepSeek-class advancement for liquid biopsy cancer monitoring and AI-driven biotechnology. This initiative aligns with BGLC's goal of becoming a global leader in liquid biopsy technology and tumor-naïve oncology solutions.

By Tube Type

By Additive/Preservation Chemistry

By Material

By Application

By End User

By Region

January 2026

January 2026

December 2025

October 2025