January 2026

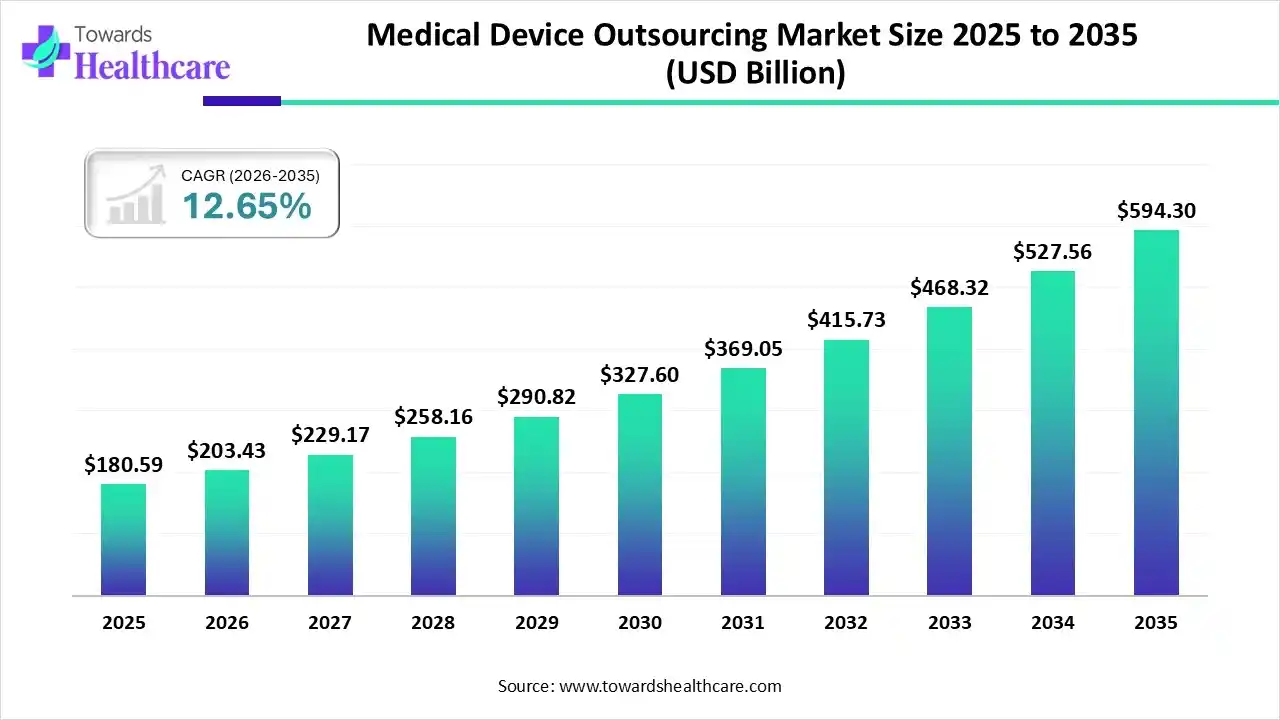

The global medical device outsourcing market size is calculated at US$ 180.59 billion in 2025, grew to US$ 203.43 billion in 2026, and is projected to reach around US$ 594.3 billion by 2035. The market is expanding at a CAGR of 12.65% between 2026 and 2035.

Outsourcing medical devices is becoming more and more common among original equipment manufacturers. The industry is growing as a result of mounting demand on manufacturers to lower administrative and operational costs without sacrificing the standard of healthcare services. Benefits include faster manufacturing schedules that guarantee an early product launch and increased market expansion brought on by the requirement to adhere to regulatory requirements.

| Metric | Details |

| Market Size in 2026 | USD 203.43 Billion |

| Projected Market Size in 2035 | USD 594.3 Billion |

| CAGR (2026 - 2035) | 12.65% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Service, By Application, By Class, By Region |

| Top Key Players | Mandala International, SGS SA, Pace Analytical Services, Inc., Laboratory Corporation of America Holdings, Eurofins Scientific, Intertek Group plc, North American Science Associates, LLC, TÜV SÜD, WuXiAppTec, Sterigenics U.S., LLC (GTCR, LLC), Charles River Laboratories, Medical Device Testing Services, RJR Consulting, Inc., Freyr, Global Regulatory Partners, PAREXEL International Corporation, Bioteknica, Accell Clinical Research, LLC, Genpact, Sanmina Corporation, Criterium, Inc., Emergo (UL LLC), West Pharmaceutical Services, Inc., Promedica International, Med pace, ICON plc., Tecomet Inc., IQVIA Inc., Integer Holdings Corporation, Jabil Inc., FLEX LTD., Phillips Medisize (Molex, LLC), Celestica Inc., Plexus Corp., Cantel Medical Corp. (STERIS plc) |

The medical device sector, which is renowned for its high standards and ongoing innovation, has been using outsourced production more and more in recent years to meet the need for medical innovations worldwide. It is essential to the healthcare ecosystem because it makes essential medical devices from basic diagnostic instruments to sophisticated therapeutic and surgical instruments more readily available when needed. The quality, scalability, and affordability of healthcare solutions are improved by OEMs using this approach, which enables them to make use of the specialized skills, cutting-edge technologies, and cost-effectiveness of skilled manufacturers. The choice to use outsourced production by medical device businesses stems from a strategic assessment of their competitive, operational, and financial environments.

Artificial intelligence (AI) has transformed health care, particularly in the creation of medical equipment. The use of AI technology facilitates the development of innovative devices that enhance diagnosis, increase manufacturing efficiency, and ultimately lead to improved patient outcomes. Medical equipment accuracy is increased by artificial intelligence through the use of machine learning algorithms on datasets. Automated devices with AI capabilities might save time and money by streamlining industrial operations.

Reduction of Overall Medical Costs

Outsourcing operations can result in cost savings for both medical device makers and healthcare providers. Contracting with specialized manufacturers or service providers is less expensive than maintaining operations internally. They are now able to produce medical equipment at a lower cost due to the development of production facilities, economies of scale, and simplified processes by outside partners. Additionally, medical device companies can deploy resources as effectively as possible by outsourcing non-core services like manufacture and shipping.

IP Protection Issue

When private information and proprietary designs are disclosed to outside parties, there are risks related to intellectual property security. A company's competitive advantage must be safeguarded by robust confidentiality agreements and intellectual property protection protocols.

What is the Growth Opportunity for the Medical Device Outsourcing Market?

Increasing use of Interventional Medical Devices (IMDs) presents a potential market expansion opportunity. Furthermore, it is projected that the market will expand due to rising healthcare prices and technology advancements. Moreover, the market is expected to develop over the forecast period due to the increasing complexity of medical devices and the rising internationalization of both big and small manufacturers of medical instruments.

By service, the contract manufacturing segment dominated the market in 2024. In the medical device sector, contract medical manufacturers are crucial to the creation and manufacturing of innovative goods. These businesses frequently collaborate with original equipment manufacturers (OEMs) to create new goods, and they specialize in the design and production of medical devices. Contract manufacturing offers several advantages, such as cost savings, quality assurance knowledge, and access to state-of-the-art manufacturing technologies.

By service, the quality assurance segment is expected to grow at the fastest CAGR during the forecast period. Managing adherence to a constantly evolving set of medical device rules across several nations can be challenging in the rapidly evolving and more complicated regulatory landscape of today. To manage compliance in these global marketplaces, many medical device firms are opting to outsource part of their quality assurance and regulatory affairs responsibilities.

By application, the cardiology segment captured the largest revenue of the market in 2024. Heart disease affects people of all genders and races without distinction. The disease affects millions of people worldwide each year, and in 2024, it is expected to claim hundreds of thousands of lives. Its exponential growth and existence point to the necessity of continuous public health campaigns and education, enlightening the public about proactive strategies and preventative measures.

By application, the general and plastic surgery segment is expected to grow at the fastest CAGR during the forecast period. Patients worldwide are increasingly opting for cosmetic and reconstructive operations to enhance their appearance or address physical flaws. This trend is being driven by the need to maintain societal beauty standards and increase self-esteem. These days, patients want less invasive procedures that are safer and need less time to recuperate. This has led to the development of advanced technology such as radiofrequency devices, laser equipment, and non-surgical injectables.

By class, the class II segment dominated the market in 2024 and is expected to grow at the fastest CAGR during the forecast period. Class 2 medical devices are those that pose a moderate to high risk. Class 2 goods make up the majority of the medical equipment in the account. Because of these crucial factors, class 2 medical devices are growing in the class sector of the global medical device outsourcing market.

Asia Pacific dominated the medical device outsourcing market in 2024. The Asia Pacific region has expanded as a result of the presence of several significant market players in countries such as China, South Korea, and Japan. Because of the high population density in the Asia Pacific area, there are more individuals suffering from a range of chronic ailments. This has led to a rise in the region's requirement for medical devices. Government spending on healthcare has increased in several Asia-Pacific countries. This has helped the growth of the local medical device outsourcing industry.

The Chinese government is actively promoting the establishment of industrial facilities in China by international manufacturers. By simplifying and expediting the application procedure, the National Medical Products Administration (NMPA) has announced incentives for manufacturers establishing facilities in China in conjunction with the new Foreign Investment Law.

Numerous initiatives have been launched by the Indian government to assist the medical device sector. With the help of the PLI initiative, the Medical Devices Sector, for example, is expected to grow from its present value of US$11 billion to US$50 billion by 2030. With a maximum assistance of Rs. 100 crore (US$ 12.24 million) per Medical Device Park and a total financial commitment of Rs. 400 crore (US$ 48.97 million) for FY21–25, the Department of Pharmaceuticals authorized the "Promotion of Medical Device Parks" initiative in August 2022.

North America is estimated to host the fastest-growing medical device outsourcing market during the forecast period. As the emphasis on innovation and better patient outcomes grows, North American businesses are making significant investments in R&D to produce innovative medical devices. Companies frequently contract out a variety of tasks, including production and regulatory compliance, to seasoned partners due to the requirement for specific manufacturing capabilities to develop this cutting-edge technology. The North American market also benefits from a strong healthcare system and a strong demand for cutting-edge medical equipment, including wearable health monitors, telemedicine, and robotic surgical systems.

The U.S. is among the world's biggest markets for biopharmaceuticals and medical devices. According to the U.S. Census Bureau, both industries account for hundreds of thousands of jobs and have a significant influence on the American economy. The production of medical and surgical instruments had the largest income, sales, and shipping values among the medical devices industry's subsectors.

Health Canada's Medical Devices Regulations serve as some of the most stringent licensing requirements for medical devices worldwide. According to the Regulations, the best methods for assessing the safety and effectiveness of medical devices include pre-market inspection, post-market surveillance, and compliance and enforcement initiatives. With this approach, the requirement to provide the healthcare system with timely access to state-of-the-art technology is balanced with the appropriate level of oversight and time required to assess its safety and effectiveness.

Europe is expected to grow significantly in the medical device outsourcing market during the forecast period. Having reputable healthcare systems and significant contributions from nations like as France and Germany. The area is a major contributor to the global medical device outsourcing sector because it places a strong emphasis on high standards and teamwork in research and development.

Germany's medical equipment business is quite robust and well-established. Companies such as Siemens, Carl Zeiss, and Drägerwerk, which were founded at the end of the 19th century, speak to the long history of producing high-quality medical equipment, with an emphasis on optical technologies, diagnostic imaging, and precision dentistry and medical instruments. By enacting several laws that call for improvement, the German government has altered the regulatory environment and is dedicated to modernizing the nation's healthcare system.

In the UK, the medical technology sector generates over $33 billion annually. It has a strong foundation of mostly small to medium-sized firms dispersed throughout the country, with concentrations of activity in areas like the Midlands and the Southeast of England. Many global companies, including some of the leading manufacturers of medical equipment in the US, have offices or production facilities in the UK.

The Middle East & Africa are expected to grow at a notable rate in the foreseeable future. The burgeoning medical device sector, rising investments by government and private organizations, and favorable regulatory support augment the market. Government organizations launch initiatives to support the development of innovative medical devices. The region is focusing on services like contract manufacturing and quality assurance.

Abu Dhabi Medical Devices, Pennine Healthcare, and Al Naghi Medical are leading providers of medical devices in the UAE. In July 2024, the UAE sent 337 tonnes of medical supplies, including devices, medicines, and essential supplies for the Ministry of Health of Khan Younis, operating in the Gaza Strip. This results in increased manufacturing in the region.

Latin America is expected to grow at a considerable CAGR in the upcoming period. The rising prevalence of chronic disorders, growing research activity, and increasing adoption of advanced technologies are propelling market growth. Government bodies and regulatory agencies constantly make efforts to establish a suitable regulatory landscape, supporting innovation in medical devices.

ANVISA, a Brazilian regulatory agency, has recently permitted manufacturers to leverage registrations from the Equivalent Foreign Regulatory Authority (AREE). The rising patient population and increasing healthcare expenditure potentiate the demand for medical devices. The medical device demand in Brazil is mainly fulfilled from imports. However, major companies are looking forward to encourage indigenous medical device production.

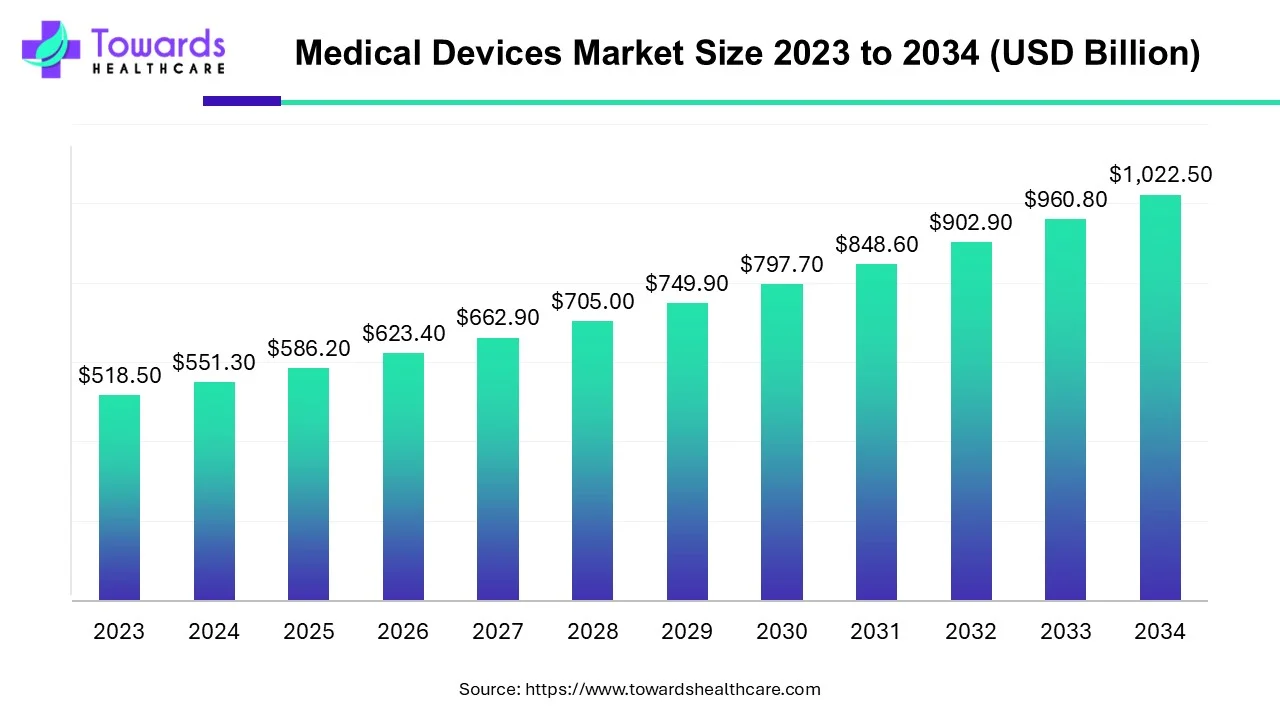

The global medical devices market size is calculated at USD 586.20 billion in 2025, grew to USD 623.37 billion in 2026, and is projected to reach around USD 1083.96 billion by 2035. The market is expanding at a CAGR of 6.34% between 2026 and 2035. Technological advancements and favorable government policies drive the market.

In November 2024, the Indian government presented a new plan worth Rs 500 crore for the medical equipment sector. Both new and established businesses will profit from our extensive program, which is ideally positioned to capitalize on regional and worldwide trends. I wholeheartedly concur that the medical devices plan will give healthcare sovereignty in a way that makes our ability to be self-sufficient in healthcare crucial. Pawan Chaudhary, the chairman of the Medical Technology Association of India (MTaI), told IANS that throughout COVID, we felt its absence. (Source - Economic Times)

By Service

By Application

By Class

By Region

January 2026

January 2026

January 2026

January 2026