January 2026

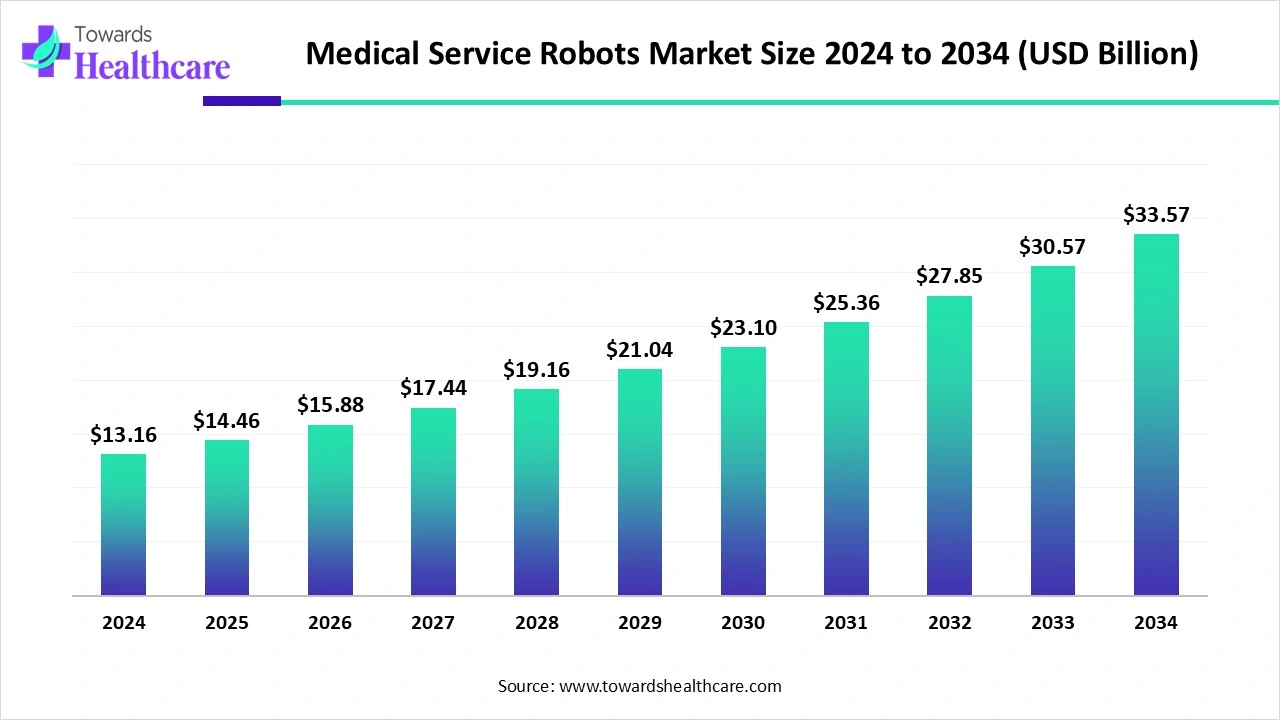

The global medical service robots market size is calculated at USD 14.46 billion in 2025, grew to USD 15.88 billion in 2026, and is projected to reach around USD 36.96 billion by 2035. The market is expanding at a CAGR of 9.84% between 2025 and 2034.

The medical service robots market is primarily driven by the increasing use of advanced technologies and the rising prevalence of chronic disorders. Robots assist patients in performing daily tasks with ease. This can benefit the geriatric population and people living alone. Government bodies provide funding for developing and deploying advanced technologies for healthcare purposes. Artificial intelligence (AI) and machine learning (ML) simplify the operations of robots, enhancing their efficiency. Telehealth presents future opportunities in the market.

| Key Elements | Scope |

| Market Size in 2025 | USD 14.46 Billion |

| Projected Market Size in 2035 | USD 14.46 Billion |

| CAGR (2026 - 2035) | 9.84% |

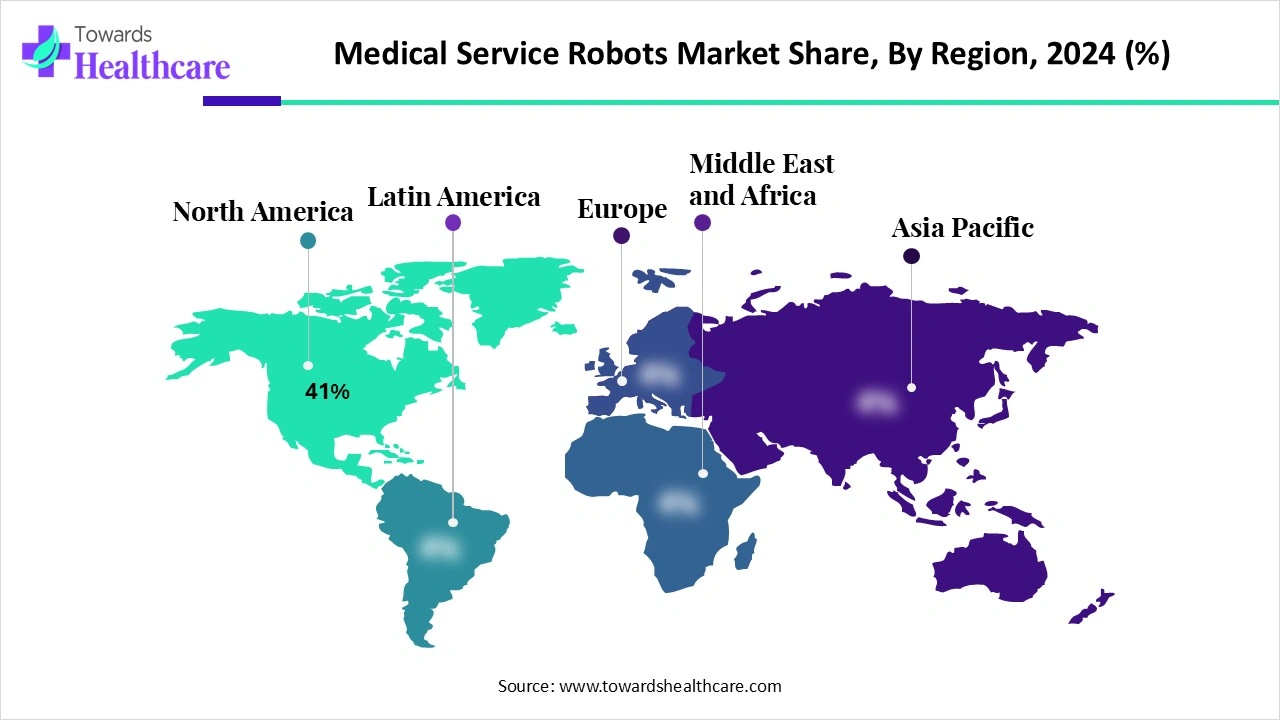

| Leading Region | North America 41% |

| Market Segmentation | By Product Type, By Application, By Mobility, By Region |

| Top Key Players | Intuitive Surgical, Omnicell Inc., Xenex Disinfection Services, Ekso Bionics, Hocoma AG, Cyberdyne Inc., ReWalk Robotics, Panasonic Healthcare Robotics, ABB Robotics, Aethon Inc., Toyota Robotics Healthcare, PAL Robotics, OhmniLabs, Diligent Robotics, F&P Robotics, SoftBank Robotics, Savioke, Kinova Robotics, Sevic Systems SE, Medtronic |

The medical service robots market encompasses robotic systems designed to support healthcare providers and patients across hospitals, clinics, laboratories, and home-care environments. These robots assist in non-surgical healthcare tasks such as patient monitoring, rehabilitation, disinfection, logistics, telepresence, and elderly care. Unlike surgical robots, service robots focus on enhancing efficiency, safety, and patient outcomes in routine and repetitive medical functions. Market growth is driven by rising healthcare automation, aging populations, labor shortages in hospitals, infection control demands, and technological advancements in AI, ML, and mobility.

Increasing Investments: Healthcare startups raise funding to develop robots for medical services and launch their products globally.

Growing Need: Government organizations support the launch of healthcare centers leveraged with robots for medical services, increasing the accessibility of advanced care.

AI plays a crucial role in medical service robots in introducing automation, enabling remote operations, and redefining patient care. It provides personalized care to patients based on their conditions. ML and AI enable healthcare professionals to continuously monitor a patient and suggest potential treatment solutions. They analyze vast amounts of patient data and can help identify risk factors and intervene before diseases occur. Moreover, AI-enabled robots can facilitate contactless delivery of medication and food to patients, minimizing infection risks.

Geriatric Population

The major growth factor for the medical service robots market is the increasing geriatric population globally. The World Health Organization (WHO) reported that by 2030, 1 in 6 people will be aged 60 years or above, accounting for approximately 1.4 billion. By 2050, it is estimated that 2.1 billion people will be above 60 years old. Thus, it becomes difficult for healthcare professionals to provide personalized care to every patient. This potentiates the demand for medical service robots to assist patients in non-surgical activities.

Employment Challenges

The healthcare sector is becoming reliant on robots for day-to-day operations. Hence, healthcare professionals fear the replacement of their jobs with robots. This limits many organizations from adopting robots for medical services.

What is the Future of the Medical Service Robots Market?

The market future is promising, driven by the growing demand for telehealth. Telepresence and remote care robots enhance the efficiency of medical services and ensure continuity of care during emergencies. Remote consultations eliminate the need to visit healthcare organizations, saving a lot of time and traveling costs. Robots can send real-time data to healthcare professionals, enabling them to make proactive decisions. Thus, doctors provide timely and informed care from any location. According to a recent survey by KeyCare, 63% of respondents preferred telehealth for preventive, specialty, and chronic care.

By product type, the patient care robots segment held a dominant presence in the market in 2024. This is due to the rising prevalence of chronic disorders and the growing need for rehabilitation. It is estimated that over 2.4 billion people in the world are living with a health condition that may benefit from rehabilitation. Shortages of healthcare professionals encourage the use of medical service robots. Telepresence robots provide remote caregiving while disinfectant robots reduce hospital-acquired infections.

By product type, the companion & elderly care robots segment is expected to grow at the fastest CAGR in the medical service robots market during the forecast period. The shifting trend of elderly people to living alone potentiates the need for medical service robots. In the U.S., approximately 30% of older adults lived alone as of 2023; among women aged 75 years or above, around 40% live alone. Robots help the elderly to physically support them by assisting in sitting and standing. They also prevent people from falling as they move around their homes.

By application, the hospital & clinical care segment led the global market in 2024. This segment dominated because medical service robots are increasingly adopted in hospitals and clinical settings to streamline clinical workflows. Robots simplify administrative tasks, supply delivery, and disinfection, allowing healthcare professionals to focus on patient care. Robots can clean and prep patient rooms independently and reduce the time it takes to identify, match, and distribute medicine. Apart from this, robots can help improve patients’ well-being, as well as automate laboratory tasks.

By application, the home healthcare segment is expected to expand rapidly in the medical service robots market in the coming years. The increasing geriatric population and the need for telehealth augment the segment’s growth. Home healthcare enables patients to receive personalized care from expert professionals irrespective of their geographical location. It increases the accessibility of advanced medical care to patients living in remote areas. Robots assist patients in daily tasks, including medication management and bedside care. They enhance the sense of security and quality of life of the elderly.

By mobility, the stationary robots segment held the largest revenue share of the market in 2024. Stationary robots are widely preferred due to their ability to perform multiple functions. Patient-assist systems and rehabilitation units are some of the stationary robots used for patient care. They enable remote monitoring and send real-time data to healthcare professionals. Integrating natural language processing (NLP) in stationary robots allows patients to diagnose their conditions with the help of their native language.

By mobility, the mobile robots segment is expected to grow with the highest CAGR in the medical service robots market during the studied years. Mobile robots are used in numerous health facilities to distribute medical supplies, collect patient data, and serve food and water to patients. They eliminate the need for appropriate infrastructure to install stationary robots. Disinfection robots are also a type of mobile robot that automatically disinfects the air and the surface of hospital environments.

North America dominated the global market share 41% in 2024. The availability of a robust healthcare infrastructure, the presence of key players, and favorable government support are the major growth factors of the market in North America. Healthcare organizations in North America are increasingly adopting medical robots for rehabilitation and logistics. The increasing healthcare expenditure and favorable government support contribute to market growth. Government organizations are concerned about the shortage of healthcare labor.

Key players, such as Intuitive Surgical, Inc., Omnicell, Inc., and Diligent Robotics, provide advanced medical service robots in the U.S. The Centers for Medicare & Medicaid Services (CMS) estimated that the national health spending rose to 8.2% in 2024, and is estimated to rise by 7.1% in 2025.The American Hospital Association (AHA) projects a shortage of about 10,000 critical healthcare workers by 2028.

According to the Canadian Institute for Health Information, the total health expenditure in Canada was approximately $352 billion in 2023, representing an increase of 4.5%. The shortage of healthcare professionals is recorded due to the rising aging population and escalating physician burnout. More than 6 million Canadians are estimated to lack access to a proper primary care provider.

Asia-Pacific is expected to grow at the fastest CAGR in the medical service robots market during the forecast period. Countries like Japan, China, and South Korea are aware of medical service robots for patient care. The growing funding by government and private agencies facilitates the adoption of medical robots. People are becoming aware of digital tools to assist in medical operations. The increasing population leads to shortages of healthcare professionals, limiting personalized care for patients. Government and private organizations conduct seminars, workshops, and conferences to train individuals about medical robots and increase awareness.

In July 2025, China’s National Medical Products Administration (NMPA) launched the “Announcement on Optimizing Whole-Life-Cycle Regulation to Support Innovative Development of High-End Medical Devices” to accelerate the development and approval of domestically produced and internationally competitive medical technologies, including medical robots.

Japan has the highest geriatric population in the world, with approximately one-third of the total population. The Japanese government has generated a platform to facilitate the design, showcase, and implement medical robots in nursing care facilities. It also allocates funds for the development of elder care robots.

Europe is expected to grow at a considerable CAGR in the medical service robots market in the upcoming period. The rising adoption of advanced technologies and favorable government support bolster market growth. The growing geriatric population and the increasing number of elderly people living alone potentiate the demand for medical service robots. The rising collaboration among key players facilitates the development of novel robots. European nations have favorable regulations for installing robots in the healthcare sector.

The nation’s Federal Statistics Office reported that around 20.6% of the total population lives alone in their homes. Approximately 34% of people aged 65 years and above, and over 56% aged 85 years and above, live alone. Germany is home to 83 robotic companies, ranking third in the world. Of these, 12% offer medical robots.

Age UK reported that more than 2 million people in England aged over 75 years live alone. The UK government actively supports the development of medical robots through funding for improving the quality of life of individuals. Providers like Aethon, DSR Technologies, and KUKA AG deliver high-quality medical robots in the UK.

Matt Casella, President of Richtech Robotics, commented that the company is passionate about pioneering solutions to mitigate workplace inefficiencies and build systems that address industry concerns. The adaptation of the company’s products enhances the conditions for the healthcare workforce and infrastructure, with a success record across the hospitality and service sectors.

By Product Type

By Application

By Mobility

By Region

January 2026

January 2026

January 2026

January 2026