January 2026

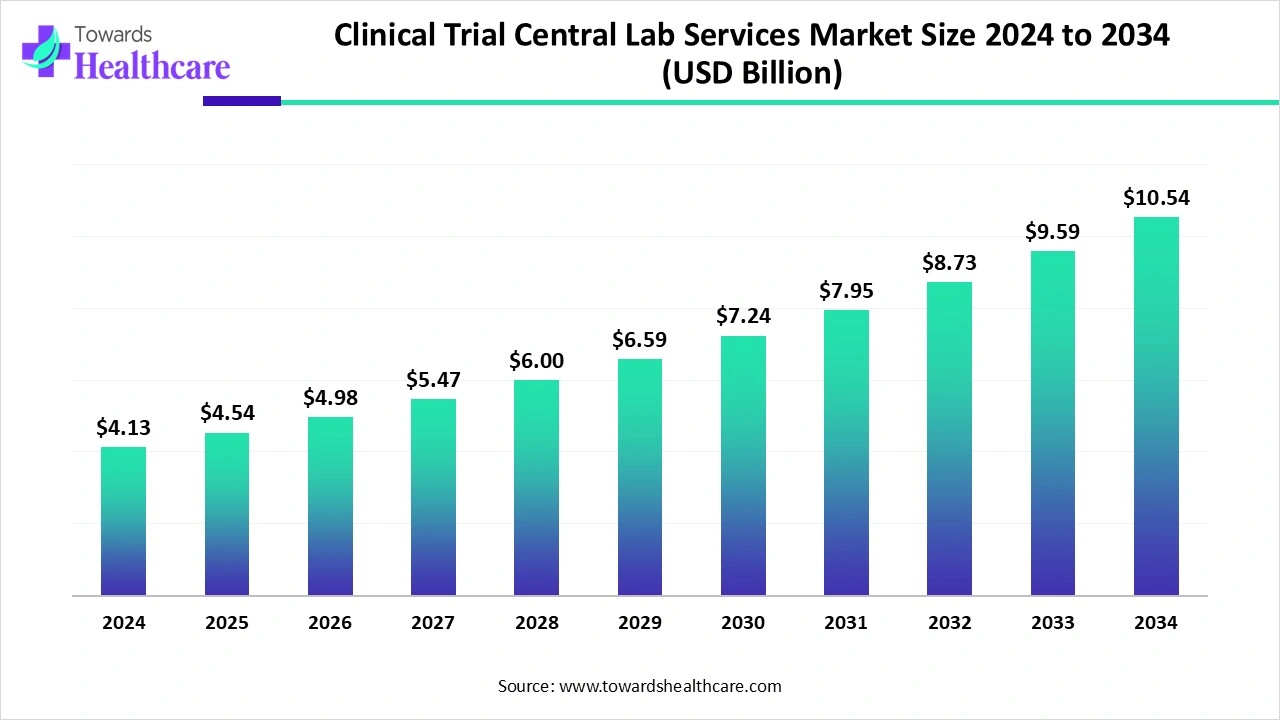

The global clinical trial central lab services market size is calculated at USD 4.13 billion in 2024, grew to USD 4.54 billion in 2025, and is projected to reach around USD 10.54 billion by 2034. The market is expanding at a CAGR of 9.84% between 2025 and 2034.

The clinical trial central lab services market is primarily driven by the need for decentralized clinical trials and the increasing collaborations among clinical trial sponsors and service providers. The stringent regulations necessitate sponsors to ensure standardized and consistent testing procedures with appropriate quality control measures, potentiating the need for central labs. Favorable government support also promotes market growth. Artificial intelligence (AI) introduces automation in testing procedures, facilitating data management and analysis. The development of integrated labs and expanding geographical presence presents future opportunities for market growth.

| Table | Scope |

| Market Size in 2025 | USD 4.54 Billion |

| Projected Market Size in 2034 | USD 10.54 Billion |

| CAGR (2025 - 2034) | 9.84% |

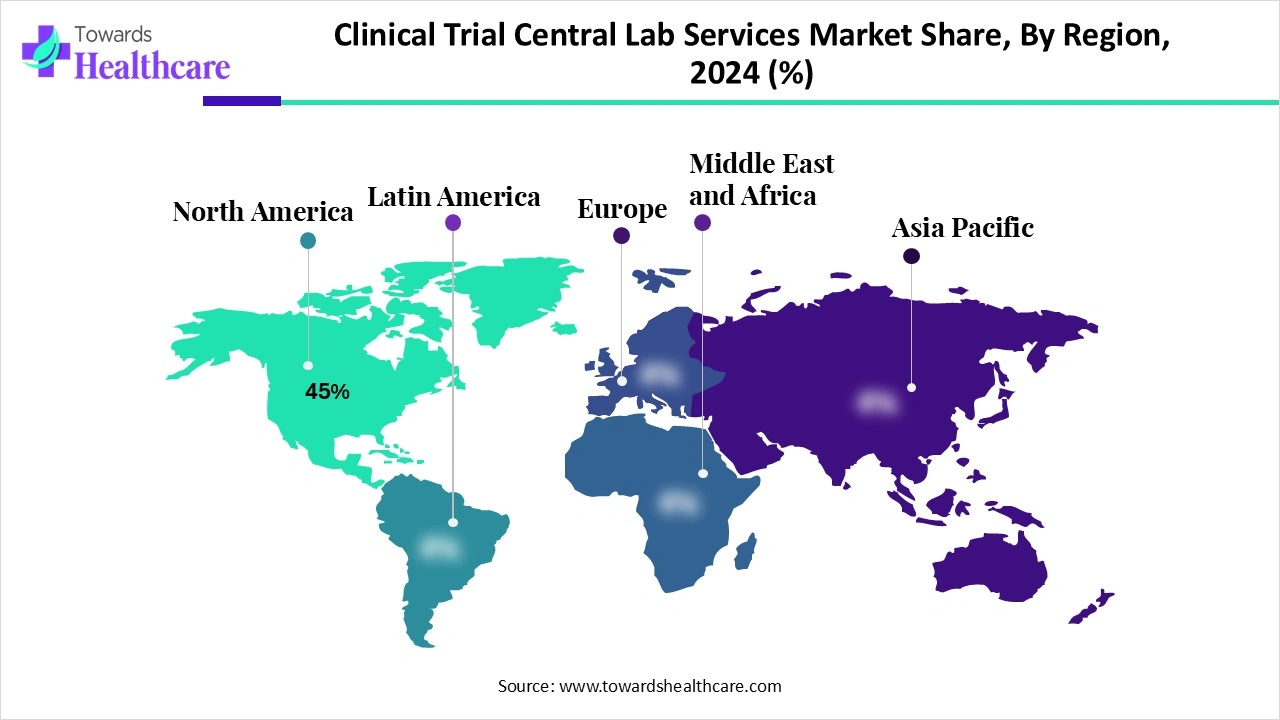

| Leading Region | North America 45% |

| Market Segmentation | By Service Type, By Offering, By Therapeutic Area, By Specimen Type, By Technology, By Region |

| Top Key Players | Labcorp Drug Development (Covance), IQVIA, Eurofins Scientific, ICON Central Laboratories, Syneos Health, Medpace, Charles River Laboratories, Q² Solutions (IQVIA + Quest Diagnostics JV), PPD (part of Thermo Fisher Scientific), Parexel International, SGS Life Sciences, Frontage Laboratories, Intertek Group, BioAgilytix Labs, ACM Global Laboratories, CMIC Holdings, WuXi AppTec, Synexa Life Sciences, Altasciences, Veeda Clinical Research |

The clinical trial central lab services market refers to specialized laboratory solutions that support drug development by providing centralized testing, analysis, and data management for clinical studies. Unlike local or site-based labs, central labs standardize processes and ensure uniform quality across global trial sites. Services typically include safety testing, biomarker analysis, genomic testing, microbiology, and specimen logistics, enabling consistent and regulatory-compliant results.

With the increasing complexity of clinical trials, demand for advanced assays, biostatistics support, and real-time data integration has surged. Growth is further driven by rising oncology and rare disease studies, decentralization of trials, and adoption of digital platforms for sample tracking and electronic data capture. Central labs thus serve as a critical backbone of modern clinical research.

Increasing Collaboration: Companies collaborate to access advanced technologies for a large client base, propelling the clinical trial central lab services market.

Geographical Expansion: Major companies expand their services in diverse geographical locations, attracting global researchers and entrepreneurs.

AI can revolutionize the clinical trial central lab services market by introducing automation in laboratory procedures, enhancing efficiency and accuracy. It can also automate data management and improve operational efficiency. AI and machine learning (ML) algorithms can analyze vast amounts of data and help researchers in data analysis. They delegate data handling tasks to reduce staff burden. They also monitor inventory and suggest to laboratory assistants about the shortage of products. By leveraging AI, central labs can increase their capacity to manage complex multi-site trials while reducing turnaround times.

Increasing Number of Clinical Trials

The major growth factor of the clinical trial central lab services market is the increasing number of clinical trials. Clinical trials are conducted to assess the safety and efficacy of novel drugs or existing drugs on novel applications. The expanding clinical research and stringent regulatory policies necessitate researchers/companies to conduct clinical trials. Several developing countries are strengthening their clinical trial infrastructure to better serve patients. Clinical trials can help improve public health, reduce healthcare costs, and lead to new discoveries. As of 5th September 2025, 551,765 studies have been registered on the clinicaltrials.gov website.

Supply Chain Disruption

The supply of products for clinical trials is crucial, especially across different nations and geographical locations, due to the evolving regulatory landscape. This limits the timely delivery of products, impacting cost-effectiveness and environmental sustainability. This may also lead to product wastage and a decrease in revenue.

Increasing Investments

The future of the clinical trial central lab services market is promising, driven by the development of integrated labs. Integrated labs offer numerous services in a single facility, including pathology, toxicology, clinical chemistry, and molecular biology. This enables labs to provide faster and more comprehensive diagnostic services to patients and providers. Integrated labs invest heavily in digital tools, such as automated equipment, laboratory information management systems (LIMS), and robotic systems. Laboratory professionals aim to build their logistics infrastructure in new countries to expand their services.

By service type, the safety testing segment held a dominant presence in the clinical trial central lab services market in 2024. This is due to the increasing need to identify potential risks of a pharmaceutical product. Central labs possess advanced technologies to conduct routine hematology and biochemistry tests on patients. This enables investigators to monitor a patient and make proactive decisions. Central labs diagnose patients for signs of anemia, cardiovascular disorders, oncology, and bleeding disorders while undergoing novel treatment.

By service type, the biomarker services segment is expected to grow at the fastest CAGR in the market during the forecast period. Biomarker analysis is crucial for screening or diagnosing a specific disease. It enables patient stratification and improves the prediction of drug efficacy and safety. Central labs provide customized services for developing and analyzing biomarkers using advanced technologies. The increasing development of precision medicines potentiates the need for biomarker testing.

By offering, the testing & analytical services segment held the largest revenue share of the clinical trial central lab services market in 2024. This segment dominated because testing & analysis are the most crucial parts of clinical trials. Sponsors and investigators prefer high-quality testing & analysis services from central labs. Central labs possess state-of-the-art instruments for analytical purposes, providing precise and reproducible results, along with relevant expertise. This eliminates the need for sponsors to purchase complex and expensive equipment.

By offering, the data management & reporting segment is expected to grow with the highest CAGR in the market during the studied years. The increasing decentralized trials lead to a large amount of complex trial data. Data management ensures the integrity, quality, and accuracy of clinical data, leading to the success and reliability of clinical trials. Regulatory agencies mandate the maintenance of complete and accurate clinical trial data. Appropriate data reporting avoids bias and misinformation in data.

By therapeutic area, the oncology segment contributed the biggest revenue share of the clinical trial central lab services market in 2024. This is due to the increasing research activities for preventing, diagnosing, and treating cancers. The oncology segment accounts for the highest number of clinical trials globally. As of September 5, 2025, out of 551,765 studies, approximately 113,773 clinical trials were related to cancer, accounting for 20.62% of all clinical trials. This is attributed to the rising prevalence of cancer, which is estimated to rise to 32 million new cancer cases annually by 2050.

By therapeutic area, the neurology segment is expected to expand rapidly in the market in the coming years. The rising prevalence of neurological disorders and increasing awareness of early disease diagnosis boost the segment’s growth. Researchers conduct and support clinical trials to learn more about the brain, nervous system, and neurological disorders. A total of 3,899 clinical trials were registered related to Alzheimer’s disease, while 4,566 were related to Parkinson’s disease.

By specimen type, the blood & serum segment accounted for the highest revenue share of the clinical trial central lab services market in 2024. Blood & serum are widely preferred as specimen types due to easy sample collection and minimal storage requirements. They are circulated throughout the body, containing a wide range of biomarkers. Researchers can assess various disorders from blood samples. A blood test is more convenient and cost-effective, making it a suitable choice for trial participants.

By specimen type, the tissue samples segment is expected to witness the fastest growth in the market over the forecast period. Some specific biomarkers are assessed through tissue samples. Tissue samples may help researchers understand diseases and find ways to prevent and treat them. They are collected from skin, hair, nails, blood, urine, or tumors. Professionals conduct a biopsy to isolate tumor tissues. Tissue samples can also be stored for research purposes.

By technology, the PCR-based testing segment led the clinical trial central lab services market in 2024. This segment dominated because polymerase chain reaction (PCR) tests are conducted to evaluate the genetic material in a sample to diagnose several genetic and rare disorders. They identify genetic changes that can cause a disease. PCR-based tests are more precise, as they can detect even minute quantities of cancer cells, which are missed in other tests. The advent of qPCR and RT-PCR leads to faster and more accurate results.

By technology, the high-throughput sequencing segment is expected to show the fastest growth over the forecast period. The demand for high-throughput sequencing is increasing due to its ability to test thousands to millions of drug samples for biological activity rapidly. It is an advanced and automated technique, and is cost-effective.

North America dominated the clinical trial central lab services market share 45% in 2024. The availability of a favorable clinical trial infrastructure, the presence of key players, and favorable regulatory support are the major growth factors of the market in North America. Government organizations provide funding for research and clinical trials, encouraging researchers to develop more innovative pharmaceutical products.

The U.S. conducts the highest number of clinical trials globally, accounting for 185,079 trials as of September 2025. Key players, such as Thermo Fisher Scientific, Charles River Laboratories, IQVIA, and Medpace, hold a major share of the market by providing central lab services globally. The U.S. biopharmaceutical industry spent over $30 billion on clinical trial sites in 2023.

Canada contributes around 4% of the global clinical trials. There are about 30,819 clinical trials registered in Canada. The Government of Canada announced an investment of more than $43 million to support 14 clinical trials, focusing on the preparation of future health emergencies and advancing the life science sector.

Asia-Pacific is expected to grow at the fastest CAGR in the clinical trial central lab services market during the forecast period. The rising prevalence of chronic disorders and the burgeoning pharma & biotech sector potentiate clinical trials. Countries like China, India, and Japan are emerging as global leaders in clinical trials. The availability of affordable and skilled professionals, as well as state-of-the-art technology, encourages researchers to conduct clinical trials in Asia-Pacific countries.

It is reported that more than 180 million people in China are affected by at least one chronic disorder, of which 75% are suffering from 2 or more chronic disorders. The increasing activity from Chinese sponsors and overseas corporations and the evolving regulatory landscape promote clinical trial activities. China witnessed more than 50 major cross-border deals, recording nearly $50 billion in the first half of 2025.

India is home to 3,000 drug companies and 10,500 manufacturing units. The Indian government also supports foreign direct investment (FDI) in the pharmaceutical and biotech sectors. From April 2024 to December 2024, India attracted an investment of Rs 11,888 crore. India is poised to become the next hub for biopharma R&D and clinical trials.

Europe is expected to grow at a notable CAGR in the clinical trial central lab services market in the foreseeable future. The increasing investments and collaborations among key players augment the market. Government and private organizations support researchers to conduct clinical trials and develop innovative products. The rising adoption of advanced technologies and the presence of a suitable biotech landscape foster the market. Cost-cutting in clinical trials by the U.S. government encourages researchers to conduct their clinical trials in Europe.

The German government launched the “Medical Research Act” to govern drug and medical device trials in Germany. The act ensures that companies conducting a relevant part of their clinical trials in Germany, along with enrolling at least 5% of global trial participants, will benefit from more flexible drug pricing rules. This encourages more companies to prioritize Germany as a trial site.

In August 2025, the Medicines and Healthcare products Regulatory Agency (MHRA) announced the launch of a pilot program from 1st October 2025 to 31st March 2026 to streamline the approval process for certain changes to clinical trials. The UK government announced £100 million in funding to set up 20 new clinical research hubs.

Dan Tyner, Interim CIO at LabConnect, commented that the collaboration with Sapio Sciences represents a critical step in transforming the digital laboratory infrastructure of the company. By leveraging the science-aware platform by Sapio Sciences, they will dramatically enhance data management capabilities, ensuring faster, more accurate clinical research support.

By Service Type

By Offering

By Therapeutic Area

By Specimen Type

By Technology

By Region

January 2026

December 2025

December 2025

December 2025