December 2025

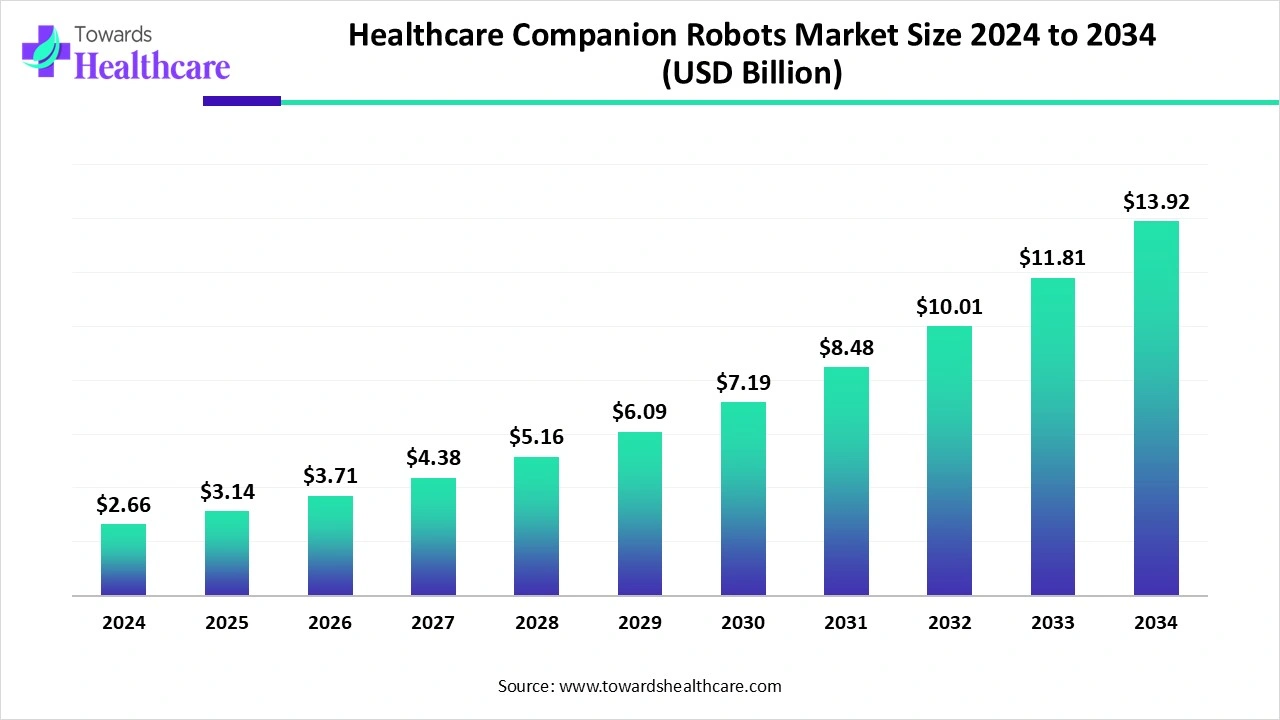

The global healthcare companion robots market size stood at US$ 2.66 billion in 2024, grew to US$ 3.14 billion in 2025, and is forecast to reach US$ 13.92 billion by 2034, expanding at a CAGR of 18.04% from 2025 to 2034.

The healthcare companion robots market is expanding rapidly, driven by the growing need for elderly care, patient monitoring, and rehabilitation support. Advances in AI, machine learning, and robotics enable personalized assistance, emotional support, and routine healthcare tasks. Increasing adoption in hospitals, nursing homes, and home care settings, along with rising healthcare costs and staff shortages, further fuel market growth, positioning companion robots as an essential solution for modern healthcare delivery.

| Table | Scope |

| Market Size in 2025 | USD 3.14 Billion |

| Projected Market Size in 2034 | USD 13.92 Billion |

| CAGR (2025 - 2034) | 18.04% |

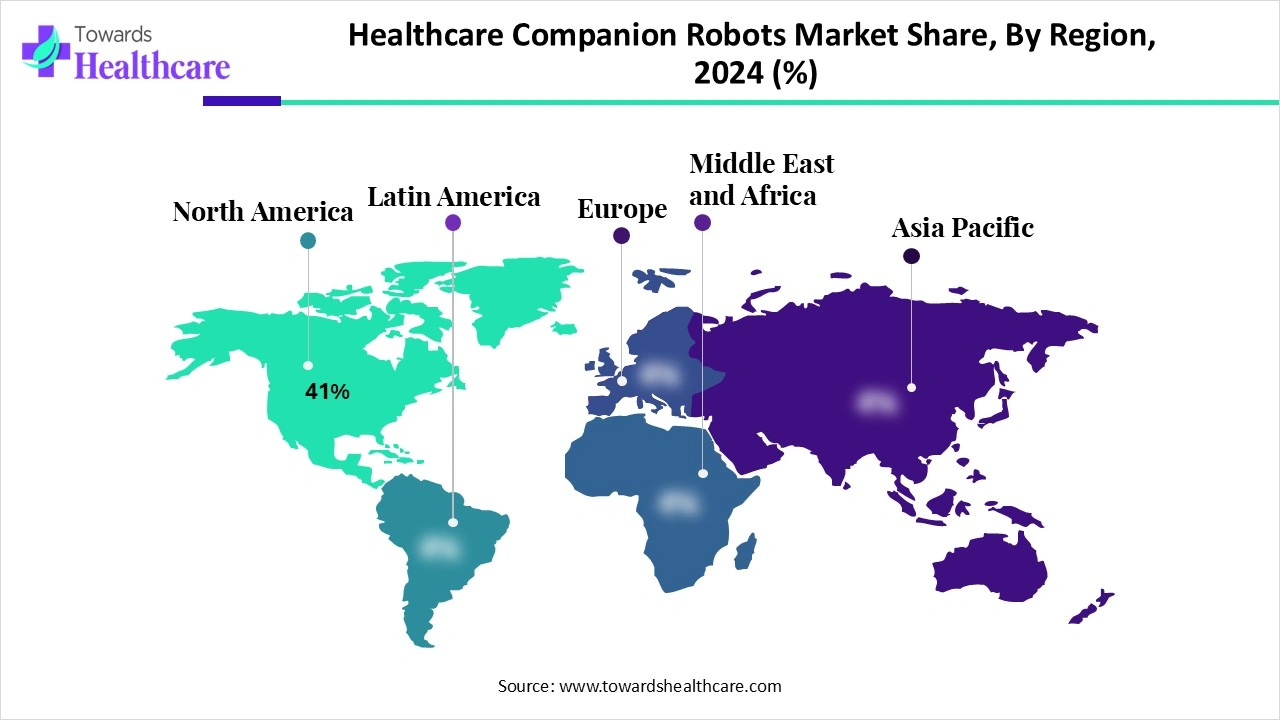

| Leading Region | North America 41% |

| Market Segmentation | By Product Type, By Application, By Technology, By End User, By Region |

| Top Key Players | SoftBank Robotics (Pepper, NAO), Intuition Robotics (ElliQ), PARO Robots U.S., Inc. (PARO Therapeutic Robot), Diligent Robotics (Moxi), Blue Frog Robotics (Buddy), Robot Care Systems (LEA Care Robot), UBTECH Robotics, Hanson Robotics (Sophia, Grace), Toyota Robotics, Jibo, Inc., GiraffPlus (telepresence robots), PAL Robotics (Ari, TIAGo), Furhat Robotics, AIST – National Institute of Advanced Industrial Science and Technology (Japan), Fraunhofer IPA (Care-O-bot), Boston Dynamics (healthcare pilot use cases), iRobot (Roomba adapted for healthcare assistance), Kinova Robotics, Robosoft Technologies, Future Robotics Ltd. |

The Healthcare Companion Robots Market refers to robotic systems designed to provide emotional support, assistance, and companionship to patients, elderly individuals, and people with disabilities or chronic illnesses. These robots combine artificial intelligence, natural language processing, sensors, and mobility features to interact with patients, remind them about medications, monitor vital signs, and reduce feelings of loneliness. They are increasingly adopted in hospitals, nursing homes, rehabilitation centers, and home care settings to complement caregivers and improve patient engagement.

The healthcare companion robots market growth is driven by rising aging populations, a shortage of healthcare professionals, and advancements in AI-driven robotics. The market is driven by rising demand for elderly care and patient monitoring, coupled with the increasing prevalence of chronic diseases. Technological advancements in AI, robotics, and machine learning enable personalized assistance, emotional support, and rehabilitation. Additionally, healthcare staff shortage and the growing adoption of robots in hospitals and home care settings further propel market growth.

Collaborations Between Robotics Companies and Healthcare Providers: Partnerships with hospitals, clinics, and nursing homes enable robots to be tested, customized, and deployed in real-world care settings, increasing adoption and market reach.

Advancements in AI and Robotics: Integration of AI, machine learning, NLP, and emotional recognition enables robots to provide personalized care, understand emotions, and interact effectively with patients, enhancing adoption.

AI can transform the market by enabling adaptive learning, allowing robots to adjust care routines based on individual patient behaviors and preferences. It improves remote monitoring capabilities, integrating with wearable devices and electronic health records for better decision-making. AI also facilitates advanced social interaction, providing companionship and cognitive engagement for patients with mental health or neurological conditions. By enhancing efficiency, safety, and patient satisfaction, AI expands the practical applications and adoption of companion robots in healthcare settings.

Rising Prevalence of Chronic and Neurological Disease

The increasing prevalence of chronic and neurological diseases is a major driver for the healthcare companion robots market because it creates demand for advanced rehabilitation and continuous assistance technologies. These robots support patients by tracking health progress, facilitating exercise routines, and reducing hospital readmission through home-based care. For neurological disorders, they aid in cognitive training and speech support, enhancing recovery outcomes. As the number of patients grows globally, the reliance on robotic companions to deliver cost-effective, consistent care strengthens market growth.

For Instance,

High Cost of Development, Deployment, and Maintenance

High development and maintenance costs limit the healthcare companion robots market because they create long payback periods and uncertain return on investment for healthcare providers. Frequent need for skilled technicians, specialized spare parts, and system upgrades adds to operational challenges. Moreover, budget constraints in public hospitals and resource-limited care facilities discourage adoption. This financial strain makes scaling difficult, restricting companion robots from becoming a widely accessible solution across diverse healthcare settings, thereby slowing overall market expansion.

Telehealth and Remote Care Platforms

Telehealth and remote care platforms open new opportunities for the healthcare companion robots market by allowing robots to act as interactive mediators between patients and clinicians. Beyond monitoring, they can guide patients through therapy exercises, support medication adherence, and provide language translation in virtual consultations. This adds functionally enhanced patient engagement, reduces isolation, and personalizes care experiences. As healthcare increasingly shifts towards hybrid models, the demand for companion robots integrated with remote platforms is expected to rise sharply.

The socially assistive robots segment led the healthcare companion robots market in 2024 as healthcare providers increasingly adopted them for interactive training, patient motivation, and behavior management. Their role extended beyond companionship to facilitating rehabilitation exercises, reminding patients about lifestyle habits, and supporting individuals with developmental or psychological conditions. Enhanced AI-driven communication and adaptability also made them suitable for diverse age groups, from children to the elderly, driving broader acceptance and securing the largest revenue shares in the market.

The AI-enabled mobile robots segment is projected to expand at the fastest rate in the healthcare companion robots market as healthcare systems increasingly require flexible solutions that move beyond static assistance. These robots can integrate with smart hospital infrastructure, connect to IoT devices, and support dynamic workflows such as remote and diagnostic services and emergency responses. This scalability for different care environments, from large hospitals to home care, along with continuous AI upgrade that enhances efficiency and reduces human error, positions them for strong growth ahead.

The elderly care & assisted living segment dominated the healthcare companion robots market in 2024 due to the growing emphasis on preventive care and elderly detection of health issues among aging populations. Companion robots equipped with advanced sensors and AI-driven analytics provide real-time health tracking, medication adherence reminders, and fall detection, reducing hospitalization risks. This proactive approach to elderly care attracted significant investment from healthcare providers and families, ensuring higher adoption rates and stronger revenue generation.

The chronic disease management segment is set to expand at the fastest rate as healthcare companion robots evolve to deliver cognitive-behavioral support, stress reduction techniques, and personalized patient engagement. Beyond physical health monitoring, these robots aid in improving treatment adherence by fostering emotional well-being and motivation, which are often overlooked in chronic care. Growing recognition of mental health’s role in managing long-term diseases, combined with AI-driven adaptive learning for individualized care, positions this segment for strong growth in the forecast period.

The AI & natural language processing segment dominated the healthcare companion robots market in 2024 because these technologies enhance robots' ability to perform complex tasks such as interpreting patient commands, translating languages, and assisting in remote consultations. They enable real-time decision-making, learning from patient behavior, and providing tailored guidance for therapy or rehabilitation. This versatility across hospitals, home care, and assisted living facilities makes AI & NLP-enabled robots more valuable and widely adopted, securing the highest market share.

The machine learning & emotional recognition segment is poised for the fastest growth because it enables robots to continuously learn from patient interactions, adapting care strategies over time. These robots can detect stress, anxiety, or mood changes and provide tailored interventions, enhancing therapy outcomes and patient satisfaction. Growing interest in mental health support, cognitive training, and personalized engagement in hospitals and home care settings drives demand. This advanced adaptability positions the segment for the fastest CAGR in the healthcare companion robots market.

The hospitals & clinics segment led the market in 2024 because these facilities prioritized advanced technologies to improve patient outcomes and operational efficiency. Companion robots were increasingly used for patient triaging, delivering medical supplies, and assisting in infection control protocols. Their integration into smart hospital systems enhanced workflow automation and real-time patient monitoring. High patient volumes, combined with the need for consistent care and staff support, drove significant adoption, securing the largest revenue share for this end-user segment.

The home care settings segment is projected to grow at the fastest rate in the healthcare companion robots market because of the shift toward decentralized healthcare and personalized care models. Companion robots provide scalable support for patients living independently, offering safety monitoring, rehabilitation guidance, and cognitive engagement. Increasing healthcare costs and limited availability of in-person caregivers encourage families to adopt robotic assistance. Furthermore, integration with telehealth platforms allows continuous remote supervision, making home care an attractive and fast-growing end-use segment in the market.

North America led the market share 41% in 2024 owing to widespread awareness and acceptance of robotic healthcare solutions among providers and patients. The region benefits from well-established private and public healthcare systems, high per capita healthcare spending, and early adoption of innovative AI-driven technologies. Additionally, strategic collaborations between technology developers and healthcare institutions, coupled with supportive regulatory frameworks for medical robotics, accelerated deployment in hospitals, clinics, and home care, securing North America’s dominant revenue share.

The U.S. market is expanding due to a growing elderly population, increasing prevalence of chronic and neurological diseases, and rising demand for personalized, home-based care. Advanced AI and robotics technologies enable improved patient monitoring, rehabilitation, and emotional support. Additionally, healthcare providers are adopting robots to address staff shortages, reduce operational costs, and enhance care quality, driving rapid market growth across hospitals, clinics, and home care settings.

The Canadian market is growing in May 2024 as hospitals and home care providers adopt robotic solutions to improve operational efficiency and patient safety. Increasing investments in digital health technologies and pilot programs for AI-driven companion robots support remote monitoring and therapeutic assistance. Additionally, rising demand for socially interactive robots to address isolation among seniors and the expansion of healthcare infrastructure contribute to the market’s steady growth in Canada.

The Asia-Pacific market is projected to grow fastest during the forecast period as the region experiences rapid urbanization, rising disposable incomes, and increasing awareness of advanced healthcare technologies. Growing demand for remote patient monitoring and home-based elderly care, coupled with expanding R&D in robotics and AI, is encouraging adoption. Additionally, supportive policies and collaborations between local startups and international companies are accelerating innovation, making the Asia-Pacific a key growth hub in the market.

In August 2025, Chinese robotics firm Fourier introduced GR-3, its first full-sized humanoid care robot, designed to combine functionality with emotional engagement. Fourier emphasized that GR-3 aims for genuine human acceptance, featuring a lifelike, soft design and an emotional processing system that integrates vision, audio, and touch. The robot can recognize faces, maintain eye contact, and respond to touch with micro-expressions. GR-3 supports social companionship and assistive care, with potential future roles in mobility support, health monitoring, and rehabilitation. Fourier stated, love above all functionality guides its design, bridging mechanical utility and emotional connection.

By Product Type

By Application

By Technology

By End User

By Region

December 2025

December 2025

December 2025

December 2025