November 2025

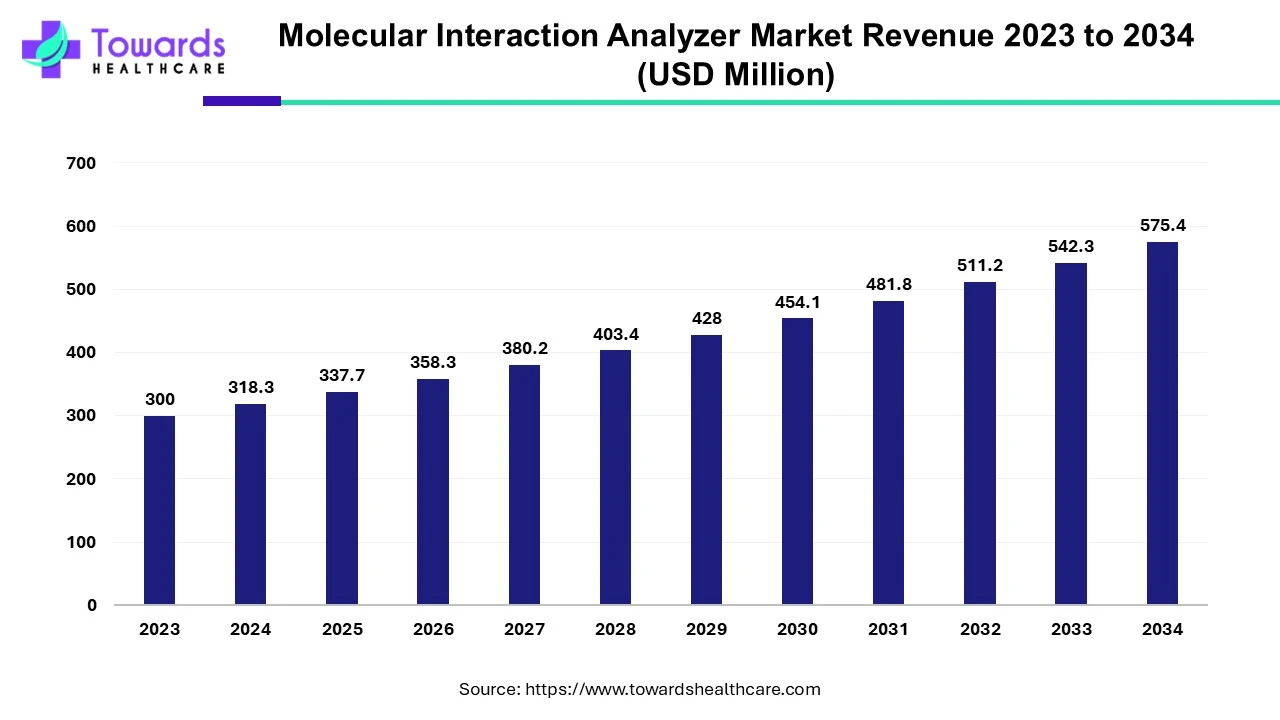

The molecular interaction analyzer market was estimated at US$ 300 million in 2023 and is projected to grow to US$ 575.4 million by 2034, rising at a compound annual growth rate (CAGR) of 6.1% from 2024 to 2034. The growing research & development activities, increasing investments, and latest innovations drive the market.

Molecular or biomolecular interaction analysis refers to a process of identifying several interactions between biomolecules and the result of those interactions. Molecular interaction analyzer is an equipment that studies these interactions. Molecular interactions are intrinsic to all areas of cellular processes, such as the regulation of metabolic pathways, cellular motion, signal transduction, and environment sensing. The tools used for molecular interaction analysis are based on different principles such as surface plasmon resonance (SPR), isothermal titration calorimetry, biolayer interferometry (BLI), molecular affinity screening system (MASS), and flow cytometry.

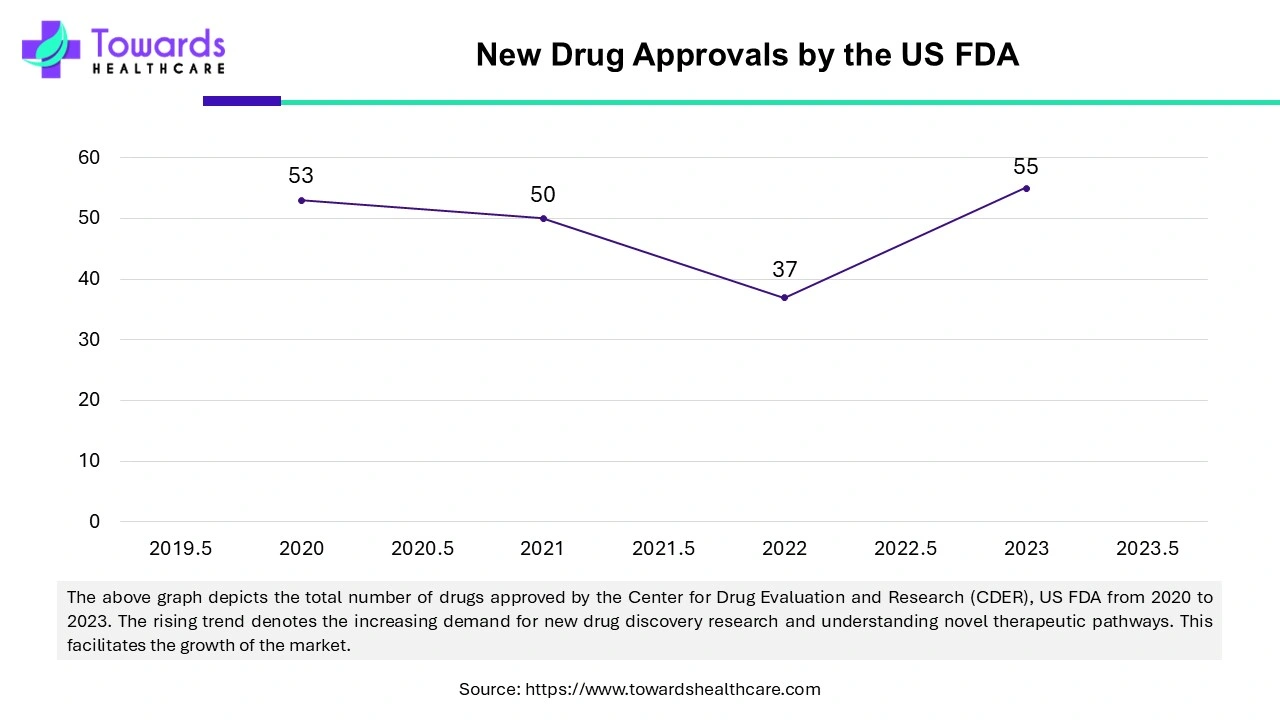

The rising demand for proteomics research and new drug development research in pharmaceutical and molecular biology drives the market. The protein function and nature can be identified which can boost drug discovery & development research. Additionally, increasing investments, the advent of novel equipment and technology, and favorable government policies augment the market growth.

The major growth factor of the market is increasing proteomics research. Researchers are interested in understanding the different proteins involved in disease progression and studying their structure. Apart from protein structure, disease progression results from protein-protein interactions and interactions with other biomarkers. Advances in proteomics technology, such as the increasing use of bioinformatics, simplify the tasks of researchers. Several government organizations support proteomics research through funding.

For instance,

Personalized medicines are molecules that are designed based on a person’s characteristics, such as unique genetic, proteomic, and metabolic profiles, to guide decisions made concerning the prevention, diagnosis, and treatment of a disease. Molecular interaction analysis gives a deeper understanding of the various pathways involved in the disease. These pathways can foster the discovery of novel therapeutic targets. This can further lead to new drug discovery based on the functions of protein-protein and protein-ligand interactions. Molecular interaction analyzers are the tools that favor the identification of biomarkers and the development of targeted therapies. The personalized medicine approach can revolutionize the field of medicine and improve patient outcomes. Additionally, the rising population and technological advancements like artificial intelligence promote the demand and development for personalized medicines, thereby potentiating the molecular interaction analyzer market.

The major challenge of the market is the high cost of the analyzer. The analyzers are based on several advanced technologies, which eventually increase the price of the equipment. Thus, several small and medium enterprises and low-budget academic research institutions cannot afford the system. The average cost of a molecular interaction analyzer ranges from $150,000 to $300,000. Additionally, the lack of trained professionals to operate such advanced systems hinders the market growth.

North America dominated the molecular interaction analyzer market in 2023. The state-of-the-art research and development facilities, increasing investments & collaborations, increasing awareness, and favorable government policies drive the market. Countries like the US and Canada are at the forefront of driving the market growth. Several US government organizations, like the National Institute of Science and Technology and the National Cancer Institute, support research related to personalized medicines, proteomics, and new drug discovery through funding. This demonstrates the use of molecular interaction analyzers. Furthermore, several organizations and research institutions frequently conduct national and international conferences to increase awareness and share the latest knowledge about molecular interactions.

Asia-Pacific is anticipated to grow at the fastest rate in the molecular interaction analyzer market during the forecast period. The rising population, increasing incidences of chronic disorders, increasing investments & collaborations, and growing research & development drive the market. In 2022, China reported approximately 4.8 million new cancer cases, whereas India reported 1.4 million new cancer cases. This rise in cancer incidences increases the demand for studying molecular interactions and pathways involved in the disease and novel drug discovery. The Indian Government invested around $1 billion in biotech R&D in 2022. The market is also driven by the presence of several pharmaceutical and biotechnology companies in the region. Additionally, the increasing number of publications and patents from China, India, and Japan boost the market growth.

Europe is considered to be a significantly growing area, due to the rising adoption of advanced technologies and growing proteomics research. Government organizations provide funding and launch initiatives for screening and early disease diagnosis. The increasing collaborations and mergers & acquisitions enable key players to access innovative analyzers and develop novel analyzers using cutting-edge technologies. The growing research and development activities and increasing demand for personalized medicines boost the market.

Key players, such as Dynamic Biosensors, Creative Diagnostics, and Biaffin GmbH & Co KG, offer advanced molecular interaction analyzers to research labs, institutions, and life science companies in Europe. The UK government recently announced an investment of £20 million ($27.2 million) to support the UK Biobank Pharma Proteomics Project (UKB-PPP) by the UK Biobank. (Source: Genome Web) Moreover, researchers from Denmark and Sweden have formed the Danish Proteomics Society and the Swedish Proteomics Society, respectively, to promote proteomics research, education, and training, as well as develop cutting-edge technology.

By type, the surface plasmon resonance (SPR) segment held a dominant presence in the market. This segment dominated because SPR is the most widely used technology for analyzing molecular interactions. It is a sensitive, optical-based, label-free detection technology that measures affinity, kinetics, and thermodynamics of two or more protein interactions. The latest technology aids in monitoring protein-protein, protein-DNA, and protein-ligand interactions. It does not require additional reagents, sample preparation, or assays and has high precision for classifying protein-protein interactions.

By application, the universities & research institutions segment accounted for a considerable share of the market. The increasing funding, advanced research and development facilities, and the increasing number of publications & patents by universities & research institutions boost the segment growth. The institutions focus on multidisciplinary research, including proteomics, disease prognosis, and novel drug discovery.

Nilshad Salim, Product Manager of Octet Systems at Sartorius, commented that Octet R8e is the company’s most advanced BLI system that was designed to future-proof research by enhancing the role of BLI in discovery and development. The system delivers the performance and reliability to address new targets, emerging modalities, and increasingly complex programs. (Source: Medical Net News)

By Type

By Application

By Region

November 2025

February 2026

November 2025

November 2025