December 2025

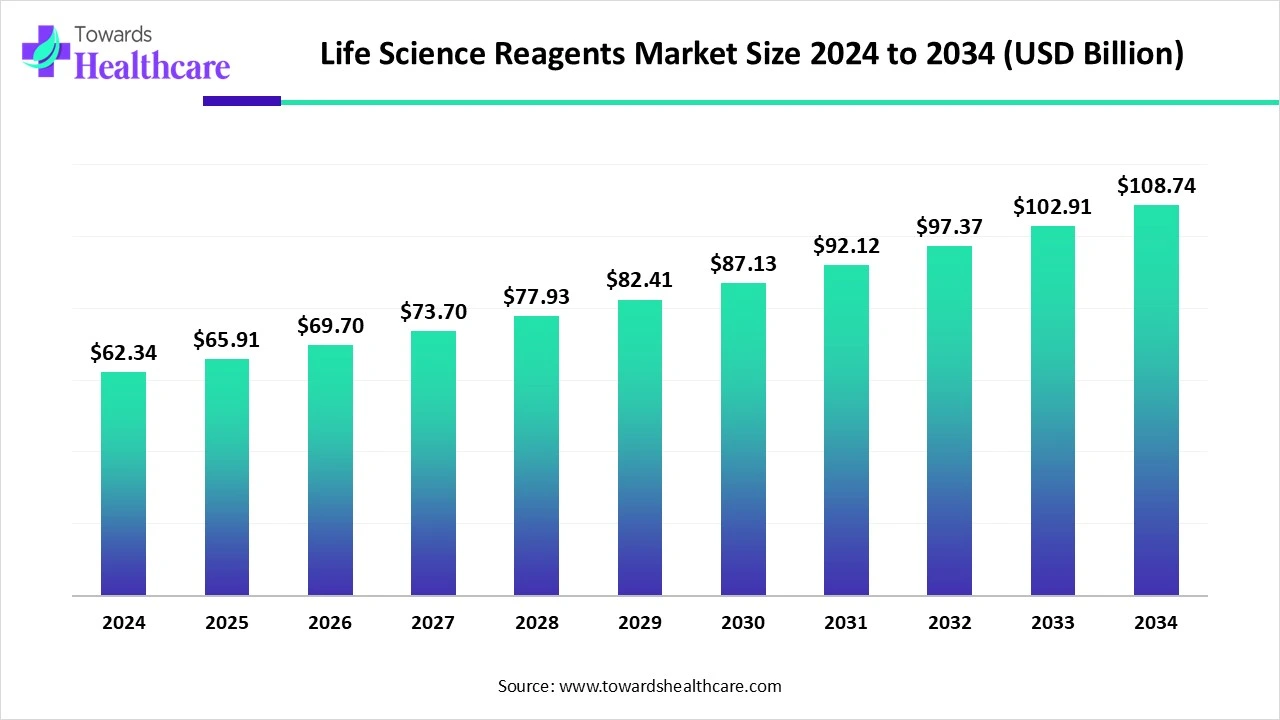

The global life science reagents market size is calculated at US$ 62.37 in 2024, grew to US$ 65.91 billion in 2025, and is projected to reach around US$ 108.74 billion by 2034. The market is expanding at a CAGR of 5.74% between 2025 and 2034.

The global life science reagents market is experiencing significant growth due to several key factors that warrant attention. One of the primary drivers is the rising prevalence of infectious diseases, which increases demand for advanced life science reagents. These diseases are easily transmitted, which emphasizes the importance of using sophisticated reagents in research and diagnostic processes. Additionally, the biotechnology sector's robust growth, marked by high R&D expenditures and continuous technological advancements in the life sciences field, is a major driver of the market's expansion.

| Metric | Details |

| Market Size in 2025 | USD 65.91 Billion |

| Projected Market Size in 2034 | USD 108.74 Billion |

| CAGR (2025 - 2034) | 5.74% |

| Leading Region | North America |

| Market Segmentation | By Product Type, By End User, By Application, By Form, By Region |

| Top Key Players | Abbott Laboratories, Merck KGaA, Becton Dickinson and Company, Thermo Fisher Scientific, Roche Holding AG, SigmaAldrich Corporation, Qiagen N.V., Bio-Rad Laboratories, Agilent Technologies, General Electric Company, Promega Corporation, Luminex Corporation, F. Hoffmann-La Roche AG, PerkinElmer, Danaher Corporation |

The market for life science reagents is essential to developments in biotechnology, diagnostics, and biological research. These chemicals are necessary for carrying out accurate reactions, identifying molecular constituents, and examining biological systems. With extensive uses in drug development, genetics, and molecular biology, this industry is still expanding as a result of scientific and technological advancements. In diagnostics, life science reagents are essential. Life science reagents are essential for investigating genetics, cell biology, and molecular biology in research.

The combination of machine learning and artificial intelligence (AI) technologies has revolutionized the reagent development scene in recent years. To forecast the behavior and effectiveness of possible reagents, machine learning algorithms may examine enormous databases of genetic sequences, biochemical characteristics, and past experimental outcomes. Automated HTS of reagent candidates is made possible by integration with robots and AI-powered picture analysis. AI systems are capable of real-time manufacturing process monitoring, utilizing sensor data to identify irregularities that impact the quality of reagents.

Rising Disease Diagnostics

Converging causes continue to drive the demand for diagnostic testing. Nearly 60% of US individuals have at least one chronic illness, demonstrating the prevalence of noncommunicable illnesses. At the same time, there is an opportunity for all parties involved in the diagnostics sector, from pathologists and medical practitioners to device manufacturers, to collaborate in addressing the rising demand for life science reagents. As the number of patients increases and healthcare systems continue to be at capacity, there will probably be a greater demand for diagnostic testing.

Strict Regulatory Frameworks

The life science reagents market is challenged globally by stringent rules enforced by regulatory bodies. Complicated approval procedures, strict quality standards, and compliance requirements might impede market expansion and raise product development costs and duration.

How will Personalized Medicine Promote the Market's Growth?

One of the key factors propelling the market for life science reagents is the shift to customized treatment. Accurate and trustworthy diagnostic tests are necessary for personalized medicine, which adjusts therapies according to a patient's genetic composition. These applications depend heavily on the reagents used in drug testing, genomic sequencing, and immunoassays. The need for sophisticated reagents will further increase as more biopharmaceutical companies concentrate on precision medicine, especially in clinical and research settings.

By product type, the diagnostic reagents segment held the largest share of the life science reagents market in 2024. Materials that start a chemical reaction are called reagents. There are many uses for them. For instance, they are added to samples in the medical profession to perform diagnostic tests or find out whether particular compounds are present in mixes. Reagents come in a wide variety of forms and kinds, although the majority are either liquid or solid.

By product type, the biological reagents segment is estimated to grow at the highest CAGR during the upcoming period. Biological reagents are compounds that are especially employed in medical diagnostics and biological research. These may consist of biomolecules that interact with biological systems, such as enzymes and antibodies. For instance, a biological reagent called glucose oxidase is employed in assays to determine the amount of glucose present in blood samples.

By end-user, the clinical laboratories segment led the life science reagents market in 2024. Using a variety of reagents is essential in laboratory settings to carry out chemical reactions, conduct tests, and provide precise findings. In order to bind antibodies, speed up analytical procedures, and help create desirable molecules, reagents are essential. There are several classes of reagents available, each having special qualities and applications based on their particular usage.

By end-user, the pharmaceutical companies segment is expected to grow at the fastest CAGR during the forecast period. Precision and accuracy are critical in the complex and heavily regulated realm of pharmaceutical development. For pharmaceutical goods to be safe, effective, and of high quality, analytical reagents are essential. In the course of developing new drugs, from research to manufacturing, these reagents are necessary for a variety of tests, analyses, and studies.

By application, the clinical diagnostics segment dominated the life science reagents market in 2024. In a variety of medical examinations, diagnostic reagents are chemicals that are used to identify or measure particular biological markers in patient samples. These chemicals are essential for tracking medical conditions, identifying illnesses, and directing therapy choices. As healthcare continues to change, technological improvements, the growing need for individualized medication, and the need for quick, precise, and affordable diagnostics all present exciting opportunities for the future of diagnostic reagents.

By application, the drug discovery segment is expected to grow at the fastest CAGR during the forecast period. The process of finding new drugs is lengthy and intricate. Drug discovery test kits can increase productivity, lower expenses, and minimize cycle times. Drug research in the quickly evolving pharmaceutical sector needs a greater degree of expert technical assistance from life science service providers.

By form, the ready-to-use segment dominated the life science reagents market in 2024. The two main benefits of ready-to-use reagents are time savings and a decreased chance of human error. Reconstitution, which may be laborious and error-prone, is not necessary with these chemicals. Along with increased use and portability, they frequently have better stability and storage convenience.

By form, the liquid segment is expected to grow at the fastest CAGR during the forecast period. The benefits of liquid biological reagents are unique. Exact volumetric measurements are made possible by liquid reagents, guaranteeing the precision of experimental procedures. Experimental procedures can be streamlined by using liquid reagents since they are convenient and instantly usable. Since liquid reagents dissolve and produce their chemical impact on water samples the quickest, they are without a doubt the fastest detection agents.

North America dominated the life science reagents market in 2024. In biotechnology, as well as the existence of top biotechnology and pharmaceutical firms. Numerous universities, healthcare facilities, and research institutes in the U.S. support the advancement of life science ideas and technology. The industry has been supported by the growing demand for healthcare services, particularly in areas such as diabetes, cardiovascular disease, and cancer. Additionally, North America's growth is being driven by the increasing demand for gene therapies, cell-based medicines, and personalized medicine.

This year, artificial intelligence may accelerate groundbreaking developments in the biological sciences in the U.S. With FDA approvals of new pharmaceuticals in 2023 approaching the second-highest annual total in the past 25 years, U.S. clinical trials of medications are expected to continue at historic levels. The U.S. biotech sector remains unmatched globally in its capacity to attract talent, investment, and innovation. Biopharmaceutical professionals are working to maintain the US's leadership position in the life sciences worldwide, from the East Coast's R&D laboratories to the West's biotech leaders and forward to expanding production centers around the nation.

Growing clinical research is supporting the growth of the market in Canada. For instance, in July 2025, the Government of Canada declared more than $1.3 billion in grants to help more than 9,700 scholars and research initiatives in Canada. The Canadian government is dedicated to creating a future that is more inventive, inclusive, and resilient.

Asia Pacific is estimated to host the fastest-growing life science reagents market during the forecast period. It is noteworthy that the region is home to several sizable CMOs (Contract Manufacturing Organizations) and CROs (Contract Research Organizations). The substantial growth of biotechnology companies and the increasing number of diagnostic labs are predicted to worsen the region's already elevated demand for life science supplies. Additionally, government initiatives to attract foreign direct investments (FDIs) encourage pharmaceutical companies to expand their production facilities in the Asia Pacific region. This planned expansion is expected to propel the market throughout the next forecast period.

In December 2024, the State Council of China released Circular No. 53, which included a number of policy incentives aimed at promoting the transformation of the nation's life sciences sector. Drug items that are approved as imported may be produced by foreign marketing authorization holders using their own manufacturing facilities in China or by contracting with Chinese corporations to handle manufacture. Commercial batches that have received preapproval will be allowed to be imported for sale in China.

India boasts the youngest population of any country, yet it is aging rapidly. By 2050, the 153 million people aged 60 years or older is expected to increase to an astounding 347 million. The growing population is a key factor driving the expansion of the life sciences industry. Several initiatives and programs have been launched by the Indian government to promote the growth of the life sciences industry. While policies like "Make in India," "Pharma Vision," and "National Biotechnology Development Strategy" have fostered an environment that has allowed the industry to flourish, more recent initiatives like the Vigyan Dhara scheme and the BioE3 (Biotechnology for Economy, Environment, and Employment) Policy are in line with the nation's larger goal of becoming a developed nation by 2047.

Europe is expected to grow significantly in the life science reagents market during the forecast period. Rising government initiatives are driving the market in Europe. For instance, in July 2025 by 2030, the European Commission wants to make Europe the most desirable location in the world for life sciences. They support 29 million jobs throughout the Union and contribute around €1.5 trillion to the EU economy by fostering innovation in sustainable production, food, and medicine. The strategy lays out a coordinated approach throughout the whole life sciences value chain and is supported by more than €10 billion a year from the present EU budget.

A capital grants initiative called the Life Sciences Innovative Manufacturing initiative (LSIMF) seeks to leverage the UK's world-class research and development capabilities while enhancing preparedness for future health catastrophes. To support the government's efforts to spur economic development and create a future-ready NHS, the government has allocated up to £520 million for life sciences production.

The global life science market size is calculated at US$ 88.2 billion in 2024, grew to US$ 98.63 billion in 2025, and is projected to reach around US$ 269.56 billion by 2034. The market is expanding at a CAGR of 11.82% between 2025 and 2034.

In June 2025, we are thrilled to announce the establishment of Draig Therapeutics and are dedicated to helping the company achieve its long-term growth objectives to bring the next innovative MDD medication to market, stated Dr. Allan Marchington, Head of ICG Life Sciences. A key component of our ICG Life Sciences strategy is the establishment of new life sciences businesses, such as Draig, which reflects our goal of developing industry-leading clinical-stage businesses that address unmet medical needs worldwide. (Source - ICG)

By Product Type

By End User

By Application

By Form

By Region

December 2025

November 2025

October 2025

October 2025