March 2026

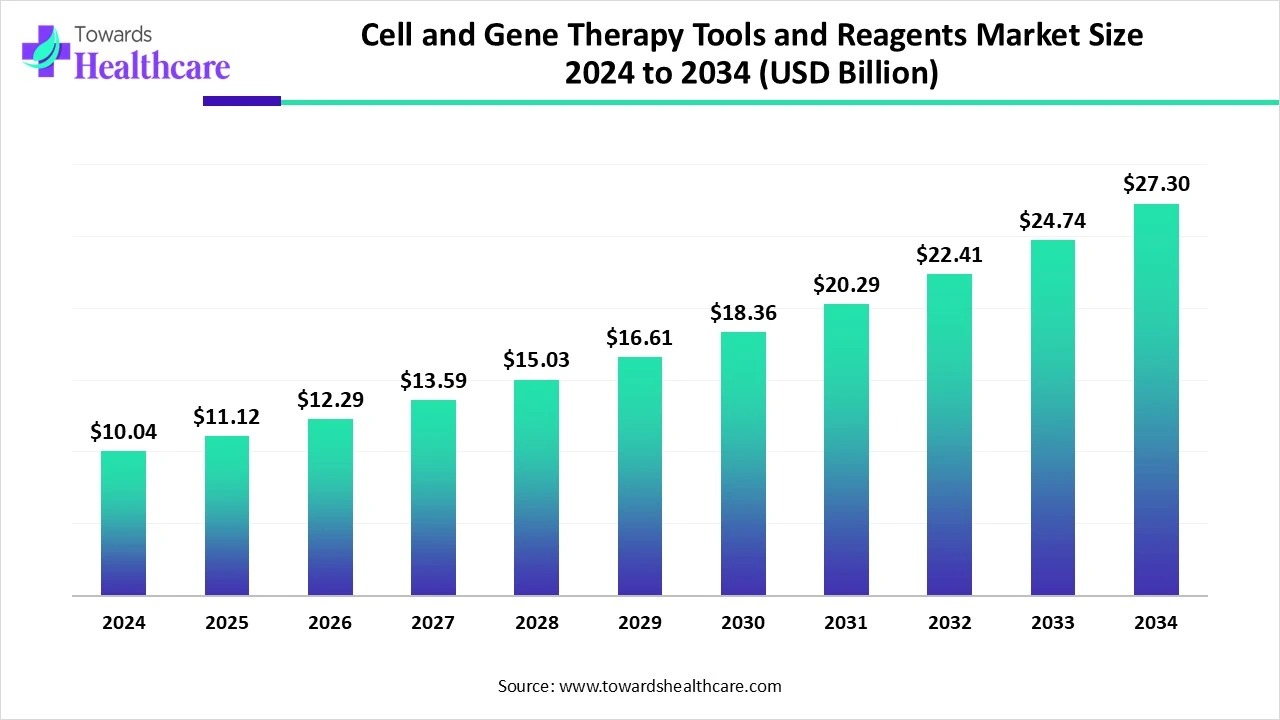

The global cell and gene therapy tools and reagents market size is calculated at US$ 10.04 billion in 2024, grew to US$ 11.12 billion in 2025, and is projected to reach around US$ 27.3 billion by 2034. The market is expanding at a CAGR of 10.76% between 2025 and 2034.

The demand for the use of cell and gene therapy tools and reagents is increasing due to the growth in the cell and gene therapy pipeline. This is increasing the collaborations and investments by the companies to enhance their development. AI is also being used for the optimization of the tools and reagents. Moreover, due to growing research and development and manufacturing, their demand in different regions is increasing. The companies are also launching new platforms and reagents to simplify the CGT development. Thus, this is promoting the market growth.

| Table | Scope |

| Market Size in 2025 | USD 11.12 Billion |

| Projected Market Size in 2034 | USD 27.3 Billion |

| CAGR (2025 - 2034) | 10.76% |

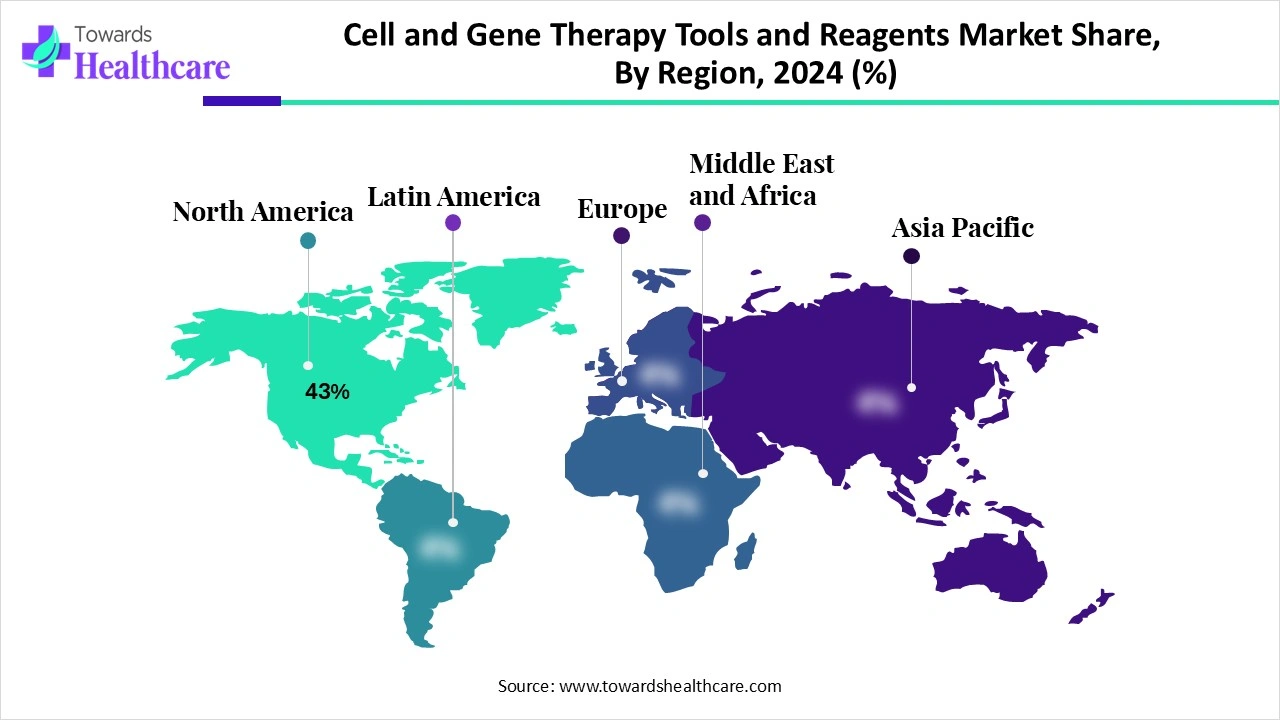

| Leading Region | North America 43% |

| Market Segmentation | By Product Type, By Technology, By Application, By End User, By Region |

| Top Key Players | Thermo Fisher Scientific Inc., Merck KGaA, Lonza Group, Miltenyi Biotec, Bio-Rad Laboratories, Takara Bio Inc., Agilent Technologies, QIAGEN N.V., Sartorius AG, Danaher Corporation, PerkinElmer Inc., GenScript Biotech, Corning Incorporated, Oxford Biomedica, Charles River Laboratories |

The Cell and Gene Therapy Tools and Reagents Market encompasses specialized products, consumables, and kits required for developing, manufacturing, and delivering cell and gene therapies (CGT). These include reagents, vectors, enzymes, culture media, PCR kits, plasmids, antibodies, and genome-editing tools essential for advanced research and clinical applications. The market is driven by increasing approvals of cell and gene therapies, growing R&D investments, and advancements in technologies like CRISPR, viral vectors, and non-viral delivery systems. With rising demand for personalized medicines and regenerative treatments, the market plays a critical role in supporting therapeutic innovation.

Growing CGT Developments: There is a rise in cell and gene therapy development, which is increasing the demand for suitable tools and reagents. Thus, new collaborations among the companies and institutes are being formed to leverage their tools and reagents. Moreover, there is a growth in investments and funding to enhance the development of reagents, tools, and therapies.

For instance,

The use of AI in the cell and gene therapy tools and reagents market is increasing for enhancing the efficiency and precision of the tools. It also helps in predicting the off-target effects, minimizing the errors. A vast amount of data can be analyzed and interpreted by using AI, which can be used while selecting appropriate reagents. It can also be used for the selection and prediction of the combination of reagents and their interactions. It is also being used in the development of new tools.

Growing Technological Advancements

To enhance the precision of cell and gene therapies, different types of tools are being developed, such as CRISPR-Cas9. Similarly, to improve the quality of the therapies, new cell engineering techniques are also being developed. Different types of systems or platforms are also being innovated for developing new delivery systems. Additionally, to ensure safety, new analytical tools are also being developed. These developments are further increasing the demand for reagents and media. Thus, this drives the cell and gene therapy tools and reagents market growth.

High Cost and Limited Availability

The reagents and tools used in the development of cell and gene therapy are costly. Moreover, they are required repeatedly, which adds up to the cost. Additionally, the reagents used must be of GMP grade for the development of the therapies. Thus, the high cost and lack of GMP-grade reagents can limit the use of cell and gene therapy reagents and tools.

Increasing Research and Development

Due to growing demand for cell and gene therapies, there is a rise in their research and development. This, in turn, is increasing the use of reagents and tools throughout their development. Additionally, to enhance the R&D, the industries and institutes are increasing the use of advanced technologies such as base editing or non-viral delivery platforms. They are also being used for preclinical studies and clinical trials for the testing and optimization of therapies. Thus, this promotes the cell and gene therapy tools and reagents market growth.

For instance,

By product type, the reagents & kits segment led the cell and gene therapy tools and reagents market with an approximate 55% share in 2024, due to their continuous use. They were crucial for every step, which increased their repeated use. Moreover, they were used to enhance their efficacy of the therapies. This contributed to the market growth.

By product type, the vectors & plasmids segment is expected to show the fastest growth rate with an approximate 14.5% CAGR during the upcoming years. They are an important component for the development of cell and gene therapies. Thus, the growing development of cell and gene therapies is increasing their use. They help in enhancing the quality of the products developed.

By technology type, the viral vector technology segment held the dominating share of approximately 52% in the cell and gene therapy tools and reagents market in 2024, as they show enhanced delivery efficiency. They also provided target-specific action. This increased their use in the development of ex vivo and in vivo gene therapies.

By technology type, the non-viral vector technology segment is expected to show the highest growth with an approximate 15.2% CAGR during the upcoming years. This technology helps in minimizing the risk of side effects. They are being used in in vivo gene editing and for multi-gene therapies. Furthermore, their easy and affordable development is enhancing their use.

By application type, the gene therapy development segment dominated the cell and gene therapy tools and reagents market with approximately a 49% share in 2024, driven by their growing innovations. This, in turn, increased the use of different technologies to enhance their applications. Moreover, the reagents were also repeatedly used for their development.

By application type, the cell therapy development segment is expected to show the fastest growth rate with an approximate 14.8% CAGR during the predicted time. For their development, different types of reagents and tools are being used due to their multiple-step procedure. The growing R&D and clinical trials are also enhancing their use. Additionally, the investments are supporting these developments.

By end user, the pharmaceutical & biotechnology companies segment held the largest share of approximately 53% in the global cell and gene therapy tools and reagents market in 2024, because of their enhanced production. They were also used due to the growth in their manufacturing and clinical trials. The government and regulatory bodies also supported these developments. Thus, this enhanced the market growth.

By end user, the academic & research institutes segment is expected to show the highest growth with an approximate 13.9% CAGR during the predicted time. The demand for the CGT tools and reagents is increasing due to their rising research and development. Additionally, the growing collaborations are accelerating their innovations. Moreover, the government funding is encouraging these developments.

North America dominated the cell and gene therapy tools and reagents market share 43% in 2024. North America consisted of robust pharmaceutical and biotechnological industries, which increased the use of CGT tools and reagents for their development process. The presence of advanced infrastructures also enhanced their R&D, which contributed to the same. Thus, this enhanced the market growth.

Due to the growing production of cell and gene therapies in the U.S., the industry has increased the demand for its reagents and tools. They also contributed to the development of advanced tools and reagents. The growing research and development have also increased their demand. Moreover, these developments were supported by the NIH funding, which promoted the use of advanced tools and reagents.

There is a rise in the R&D hubs in Canada, which is driving the cell and gene therapy development. At the same time, due to their growing applications, their manufacturing and clinical trials are also increasing. This, in turn, is increasing the demand for advanced reagents and tools. This is increasing the collaborations among companies and government investments.

Asia Pacific is expected to host the fastest-growing cell and gene therapy tools and reagents market during the forecast period. Asia Pacific is experiencing a growth in manufacturing capacity, which is increasing the development of cell and gene therapies. The industries and institutes are focusing on discovering new applications of these therapies. Moreover, their growing production and outsourcing are also increasing. Thus, this is increasing the recurring use of the CGT tools and reagents. Thus, this is promoting the market growth.

The R&D of cell and gene therapy tools and reagents includes enhancing and developing materials, technologies, and processes to improve the scalability, safety, and efficacy of the therapies.

Key Players: Thermo Fisher Scientific, Sartorius AG, Danaher Corporation, Merck KGaA, Charles River, Lonza Group, WuXi AppTec.

The packaging and serialization of cell and gene therapy tools and reagents focus on developing containers with maintained ultralow temperature, contamination protection, and unique tracking identifiers to ensure regulatory compliance, secure chain of custody, and product integrity.

Key Players: Marken, Cryoport, DHL Supply Chain and FedEx, World Courier

The distribution to hospitals and pharmacies of cell and gene therapy tools and reagents involves the use of cold chain logistics or direct manufacturer-to-hospitals shipments with a secure chain of identity and ultra-low temperature deliveries to the designated healthcare centres.

Key Players: Marken, Cryoport, DHL Supply Chain and FedEx, World Courier

Comprehensive assistance, such as emotional support, financial navigation, logistic coordination, and educational resources, will be provided to the patients in the patient support and services of the cell and gene therapy tools and reagents.

Key Players: Bluebird Bio, Novartis Gene Therapies, Vertex Pharmaceuticals

In January 2025, after announcing the collaboration between CTMC and Syenex, the CEO of CTMC, Jason Bock, said that, to amplify the supply of transformative cell therapies to patients is their mission. Their fast access to the increasing suite of validated technologies is being expanded by introducing advanced systems of Syenex in the lentiviral and retroviral vector manufacturing platforms of CTMC. Thus, to address the critical challenges in efficiency and scalability, comprehensive technical solutions will be provided by this integration to their biotech partners.

By Product Type

By Technology

By Application

By End User

By Region

March 2026

March 2026

March 2026

March 2026