February 2026

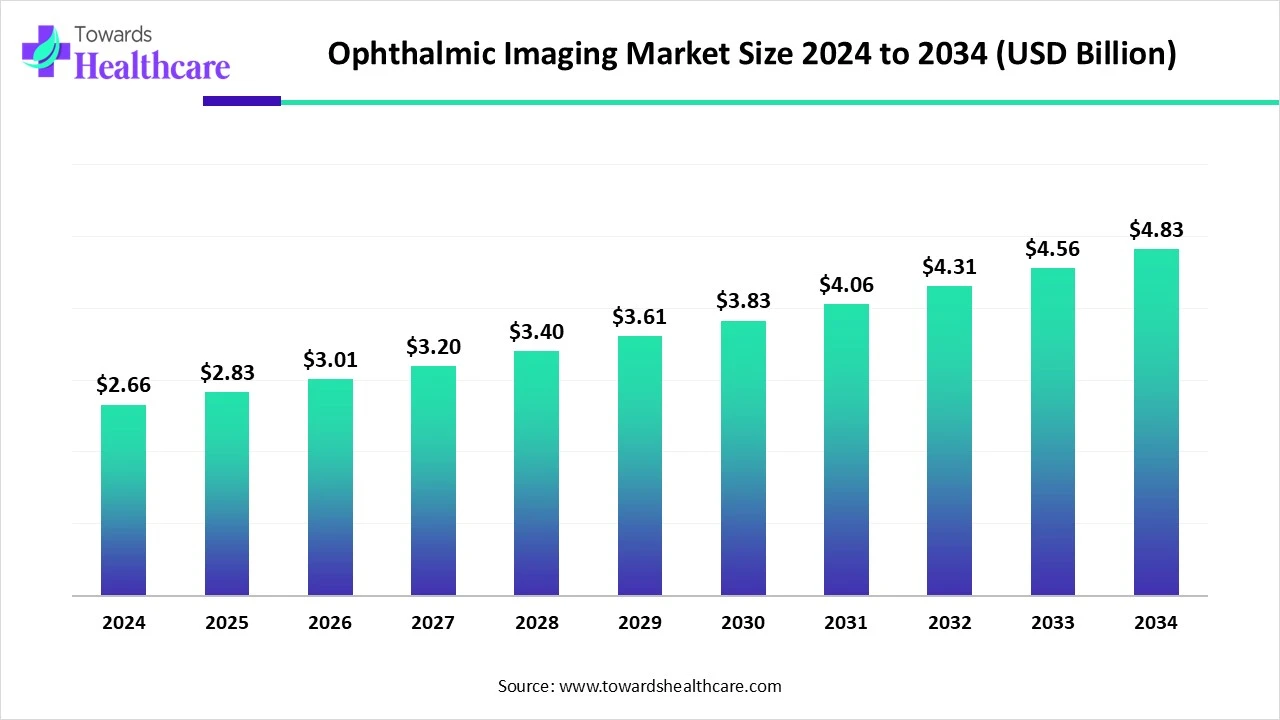

The global ophthalmic imaging market size is calculated at USD 2.66 billion in 2024, grew to USD 2.83 billion in 2025, and is projected to reach around USD 4.83 billion by 2034. The market is expanding at a CAGR of 6.27% between 2025 and 2034.

The ophthalmic imaging market is primarily driven by the rising prevalence of ocular disorders and advancements in technology. Government organizations raise awareness about the screening and early diagnosis of ocular disorders through initiatives. Prominent players collaborate to access advanced technologies and expand their geographical presence. Integrating artificial intelligence (AI) in ophthalmic imaging improves its accuracy and precision. The future looks promising, with the growing demand for portable imaging devices.

| Table | Scope |

| Market Size in 2025 | USD 2.83 Billion |

| Projected Market Size in 2034 | USD 4.83 Billion |

| CAGR (2025 - 2034) | 6.27% |

| Leading Region | North America |

| Market Segmentation | By Imaging Modality/Product Type, By Clinical Application/Use Case, By End-User/Buyer, By Sales/Distribution Channel, By Region |

| Top Key Players | Carl Zeiss Meditec AG, Topcon Corporation, Canon Inc. (Canon Medical / Canon Ophthalmic), NIDEK Co., Ltd., Heidelberg Engineering GmbH, Optos (part of Nikon/Optos), Optovue, Inc., Kowa Company, Ltd., Haag-Streit Holding AG, Konan Medical USA, Inc., iCare Finland Oy, Tomey Corporation, Clarity Medical Systems, Optomed Oyj, AEYE Health (AEYE), Imagine Eyes, Optina Diagnostics, Intalight, IRIDEX Corporation, Sonomed Escalon |

The ophthalmic imaging market refers to devices and software used to visualize, measure, and document eye anatomy and function for diagnosis, treatment planning, and monitoring of ocular disease. Core modalities include optical coherence tomography (OCT), fundus / retinal cameras (including ultra-widefield), OCT-angiography (OCT-A), slit-lamp imaging, corneal topography/tomography, ophthalmic ultrasound, and ancillary imaging (pachymetry, specular microscopy, fluorescein angiography). Systems increasingly combine hardware with software (image analysis, AI/ML diagnostic assists), cloud storage, and teleophthalmology workflows. The market spans clinics, hospitals, eye care chains, optometry practices, and screening programs.

FDA Approval: In February 2025, AI Optics announced that the U.S. Food and Drug Administration (FDA) approved its Sentinel Camera for retinal disease screening. Sentinel Camera is a handheld retinal imaging system that captures high-quality images without the need for dilation.

Increasing Collaboration: In February 2025, Optos announced a collaboration with Monaco to develop MonacoPro, a next-generation ultra-widefield scanning laser ophthalmology (SLO) and spectral domain retinal imaging solution. The solution enhances OCT image quality and improves diagnostic precision.

AI plays a vital role in ophthalmic imaging by enhancing the efficiency and accuracy of diagnosing ocular disorders. AI-assisted ophthalmic imaging analyzes vascular changes and retinal images to determine the stages of ocular disorders, enabling clinical decision-making. AI can identify minimal alterations in the eyes that are difficult for healthcare professionals. AI and machine learning (ML) algorithms can analyze vast amounts of data, facilitating the screening of a large patient population. Smartphone imaging can advance the diagnosis of anterior segment diseases, improving access to eye care and providing rapid results.

Rising Prevalence of Ocular Disorders

The major growth factor for the ophthalmic imaging market is the rising prevalence of ocular disorders. Cataract, glaucoma, age-related macular degeneration, and diabetic retinopathy are some of the common ocular disorders. In 2020, 76 million people were estimated to be affected by glaucoma globally, and it is projected that 112 million people will be affected by 2040. The major risk factors of these disorders are genetics, infectious diseases, and environmental factors. The growing geriatric population and the increasing prevalence of chronic disorders, such as diabetes, are major concerns. People are becoming aware of early diagnosis of ocular disorders, fostering market growth.

High Cost

The installation of ophthalmic imaging systems is very expensive, limiting the affordability of many healthcare organizations in low- and middle-income countries. The average cost of an ophthalmic imaging system falls in the range of $20,000 to $80,000. This significantly impacts the cost of a single scan for patients. A single scan may range from $40 to $250.

What is the Future of the Ophthalmic Imaging Market?

The market future is promising, driven by the growing demand for portable imaging systems and tele-ophthalmology. Companies develop innovative portable imaging systems to deliver enhanced care. Portable systems can be carried from one place, eliminating the need for patients to personally visit a clinic. Advancements in camera technology improve the image quality, offering enhanced magnification. Tele-ophthalmology is an emerging field that enables remote monitoring and diagnosis. Video visits and eye evaluations through computer webcams are common methods used by ophthalmologists. Ongoing efforts are made to develop accurate and reliable teleophthalmic systems with accuracy similar to or better than in-person visits.

By imaging modality/product type, the optical coherence tomography (OCT) segment held a dominant presence in the market in 2024. This is due to the growing demand for non-invasive diagnostic tests. OCT is a traditional imaging technique that uses reflected light to create images of the back of the eye. It helps to diagnose and treat a wide range of disorders, including bull’s eye maculopathy, eye cancer, glaucoma, posterior vitreous detachment, and retinal tears. OCT is widely preferred due to high-resolution images, as well as high accuracy and precision. Additionally, it is cost-effective and easily available to clinicians globally.

By imaging modality/product type, the OCT-angiography (OCT-A) segment is expected to grow at the fastest CAGR in the market during the forecast period. The demand for OCT-A is increasing due to its non-invasiveness and shorter acquisition times. OCT-A is used for imaging the microvasculature of the retina and the choroid. It is a 3D technique that provides details of every direction of the macula and peripapillary capillaries. It also provides quantitative analysis of the retinal vessels.

By clinical application/use cases, the retinal disease segment held the largest revenue share of the market in 2024. This is due to the increasing prevalence and risk of chronic disorders, such as diabetes and hypertension. The different types of retinal diseases include diabetic retinopathy, macular degeneration, retinal tear, retinal detachment, and retinitis pigmentosa. The prevalence of macular degeneration in India is 4.7% of people with 40 years and above. Retinal diseases are major causes of vision loss globally. Hence, screening and early diagnosis of retinal diseases are essential, especially for the geriatric population.

The diabetic retinopathy sub-segment is expected to expand rapidly. Diabetes is a major public health concern among people globally. The International Diabetes Federation (IDF) reported that approximately 11.1% of the adult population in the world suffers from diabetes. It is also predicted that about 853 million people will be living with diabetes by 2050. It is estimated that more than half of the people with diabetes will develop diabetic retinopathy.

By end-user/buyer, the ophthalmology clinics & hospitals segment led the global market in 2024. The segmental growth is attributed to the presence of skilled professionals and specialized equipment. Ophthalmic clinics and hospitals have experts from different disciplines, providing multidisciplinary expertise. The increasing number of ophthalmic clinics and hospitals and favorable reimbursement policies boost the segment’s growth.

By end-user/buyer, the optometry practices & vision centers segment is expected to expand rapidly in the market in the coming years. The increasing incidence of myopia and vision impairment necessitates people to visit optometry & vision centers. According to the World Health Organization (WHO), 2.2 billion people have near or distant vision impairment.Refractive errors and cataracts are leading causes of vision impairment globally. The WHO and government agencies take several measures to encourage people to have regular eye check-ups.

By sales/distribution channel, the direct OEM sales segment contributed the highest revenue share of the market in 2024. Hospitals and clinics sign a contract with original equipment manufacturers (OEMs) for the delivery and maintenance of ophthalmic imaging devices. This helps them to receive affordable devices and after-sales services. OEMs can also provide customized solutions to hospitals based on the user experience, thereby resolving common issues.

By sales/distribution channel, the SaaS billing & subscription models segment is expected to witness the fastest growth in the market over the forecast period. The increasing use of cloud-based software solutions for ophthalmic imaging potentiates the need for subscription models. Healthcare professionals prefer using Picture Archiving & Communication Systems (PACS) for accessing patient data from remote locations. These technologies demand annual subscriptions.

North America dominated the global market in 2024. The presence of key players, new product launches, and a robust healthcare infrastructure are the major growth factors of the market in North America. The rising prevalence of ocular disorders and the growing geriatric population promote the demand for ophthalmic imaging. The increasing investments and collaborations among key players also contribute to market growth. Favorable government and regulatory support encourage researchers to develop and deploy innovative imaging systems.

Key players, such as AEYE Health and Optovue, Inc., are major contributors to the market in the U.S. In February 2024, the Advanced Research Projects Agency for Health (ARPA-H) announced the development of Photonic Chips-based Optical Coherence Tomography (PIC-OCT), a device for faster and more affordable eye scanning. The project includes a budget of up to $20 million over 5 years.

It is estimated that approximately 8 million Canadians have one of the four major eye diseases. INOVAIT and the Government of Canada have announced an investment of $10.7 million to support commercialization-focused R&D projects, including the advancement of image-guided therapy through AI, big data, and ML.

Asia-Pacific is expected to grow at the fastest CAGR in the ophthalmic imaging market during the forecast period. The burgeoning healthcare sector and the rising adoption of advanced technologies bolster market growth. Government and private organizations conduct seminars, conferences, and workshops to raise awareness about the screening and early diagnosis of ocular disorders. The Asia-Pacific Ocular Imaging Society provides a professional and educational platform for ophthalmologists and advances knowledge in ocular imaging.

The Congress of Ophthalmology and Optometry China (COOC) 2025 was held at the Shanghai Convention & Exhibition Center of International Sourcing in April 2025 to showcase advanced ophthalmic products, eye care, lenses, and pharmaceuticals. Moreover, the National Medical Products Administration (NMPA) approved ZEISS CLARUS 700 with fluorescein angiography, developed by Zeiss Medical Technology, in June 2025.

In June 2025, Hong Kong conducted a first-of-its-kind new brain health service that utilized retinal imaging AI to predict Alzheimer’s disease risk. I-Cognito’s AI validated 13,000 fundus images from 648 Alzheimer’s patients and over 3,000 patients with normal cognition. Zhaoke Ophthalmology Pharmaceutical Ltd., a Hong Kong-based company, generated a revenue of RMB 69.32 million in 2024.

Researchers focus on developing innovative ophthalmic imaging devices by leveraging AI, ML, and large language models (LLMs) for real-time analysis of ophthalmic conditions to enhance the accuracy and precision, resulting in rapid outcomes.

Key Players: Syneos Health, Sectra Medical, and Topcon Corporation

Companies distribute their novel and innovative ophthalmic imaging devices to hospitals and clinics, enabling healthcare professionals to provide advanced patient care.

Key Players: Heidelberg Engineering, Remidio, Appasamy Associates, and Forus Health

Patient support & services in ophthalmic imaging include the use of portable and non-invasive ophthalmic devices for determining ocular disorders at affordable rates. It also refers to patient education and a smooth experience during the diagnostic process.

Key Players: Voiant Clinical, Clario, Carl Zeiss, and DAS Health

Ram Liebenthal, General Manager US at Heidelberg Engineering, commented that the FDA clearance of SPECTRALIS Flex Module fulfills the company’s vision of bringing Heidelberg image quality to all patients, regardless of their age or physical abilities. He also said that the module ensures patients have access to best-in-class imaging, offering peace of mind to parents, guardians, and caretakers.

By Imaging Modality/Product Type

By Clinical Application/Use Case

By End-User/Buyer

By Sales/Distribution Channel

By Region

February 2026

February 2026

February 2026

February 2026