January 2026

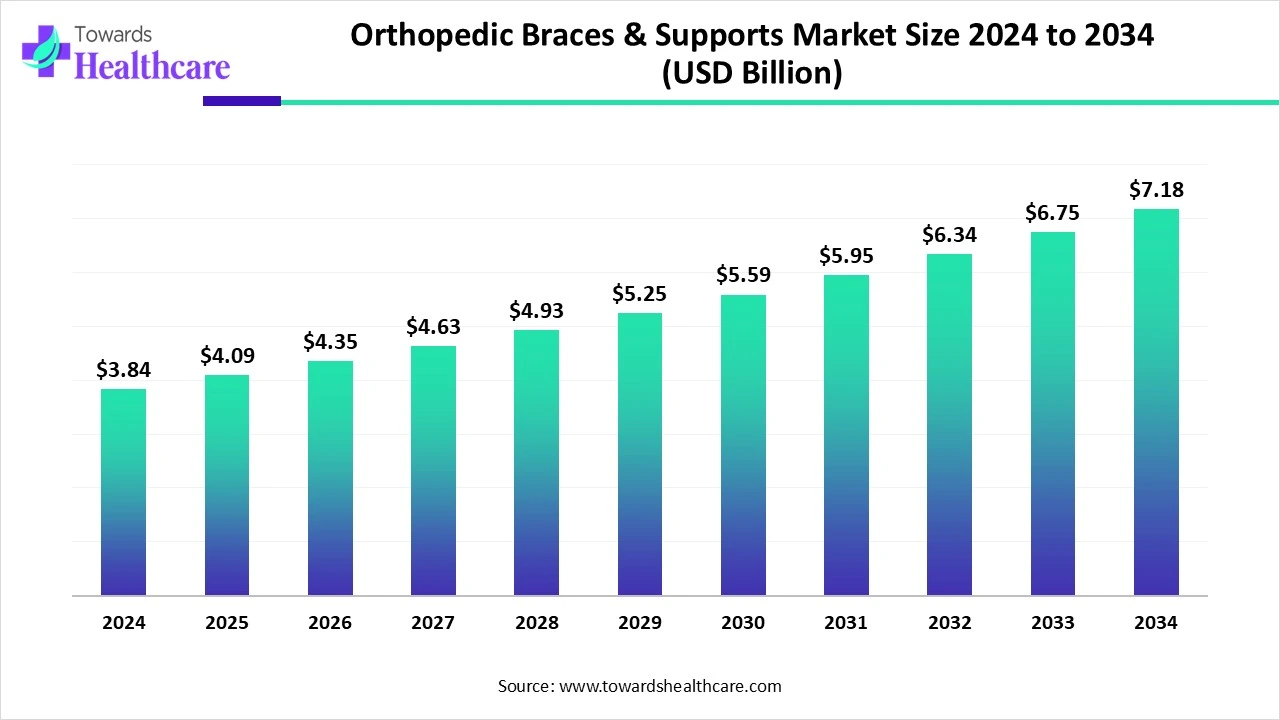

The global orthopedic braces & supports market size is estimated at US$ 4.09 billion in 2025, is projected to grow to US$ 4.35 billion in 2026, and is expected to reach around US$ 7.65 billion by 2035. The market is projected to expand at a CAGR of 6.46% between 2026 and 2035.

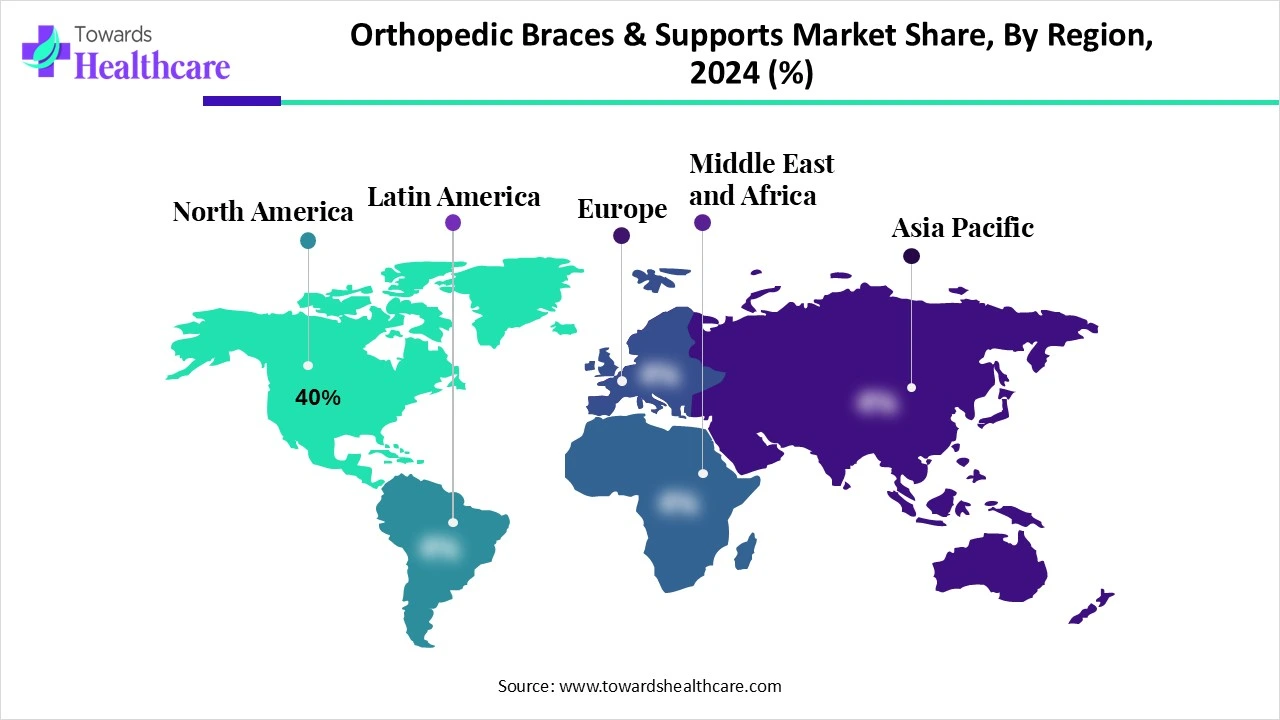

The orthopedic braces & supports market is expanding due to the growing incidence of musculoskeletal disorders, the increasing aging population, and sports injuries. This device offers stability, enhanced mobility for the situation of ligament injuries, arthritis, and post-operative recovery. North America is dominated by early adoption of advanced technology and increasing healthcare spending. Asia Pacific is the fastest growing as enhancements in healthcare infrastructure and increasing government support.

| Table | Scope |

| Market Size in 2026 | USD 4.35 Billion |

| Projected Market Size in 2035 | USD 7.65 Billion |

| CAGR (2026 - 2035) | 6.46% |

| Leading Region | North America Share 40% |

| Market Segmentation | By Product Type, By Mobility Type, By Application, By Distribution Channel, By End User, By Region |

| Top Key Players | DJO Global, Inc., Össur hf., Breg, Inc., Bauerfeind AG, 3M Company, Zimmer Biomet Holdings, Inc., DeRoyal Industries, Inc., Thuasne Group, medi GmbH & Co. KG, Bird & Cronin Inc., BSN Medical GmbH (Essity), Reh4Mat, Tynor Orthotics Pvt. Ltd., Ottobock SE & Co. KGaA, Aspen Medical Products, United Ortho, Vision Meditech Pvt. Ltd., Mueller Sports Medicine, Inc., Neo G Ltd., Orthomerica Products, Inc. |

The orthopedic braces & supports market includes non-invasive devices used to support, align, prevent, or correct musculoskeletal deformities or injuries. These products provide joint stabilization, pain relief, and improved mobility, and are widely used in post-operative recovery, sports injuries, chronic conditions (like osteoarthritis), and preventive care. Demand is driven by an aging population, a rise in orthopedic disorders, sports injuries, and increasing awareness of non-surgical management of musculoskeletal issues.

Recently government started various healthcare initiatives to promote the growth of the orthopaedic implants and medical devices sector, which drives the growth of the market.

For instance,

Novel developments in orthopedic surgery have significantly enhanced the management of musculoskeletal injuries and disorders, which drives the growth of the market.

For Instance,

Integration of AI in orthopaedic braces and supports drives the growth of the market as AI is transforming the sector of orthopaedics and orthodontics by providing physicians greater accuracy and effectiveness in the diagnosis and treatment. AI algorithms are applied to analyze challenging healthcare datasets, like three-dimensional (3D) scans, radiographs, and patient records, enabling the appreciation of insights in every patient’s specific requirement. AI-driven technology continues to evolve, and robotic technologies mature; their functional abilities and scope of application in surgical planning have grown significantly. AI is developing the creative design and fitting of orthodontic braces by creating a process more efficient, personalized, and patient-friendly, which drives the growth of the orthopedic braces & supports market.

For Instance,

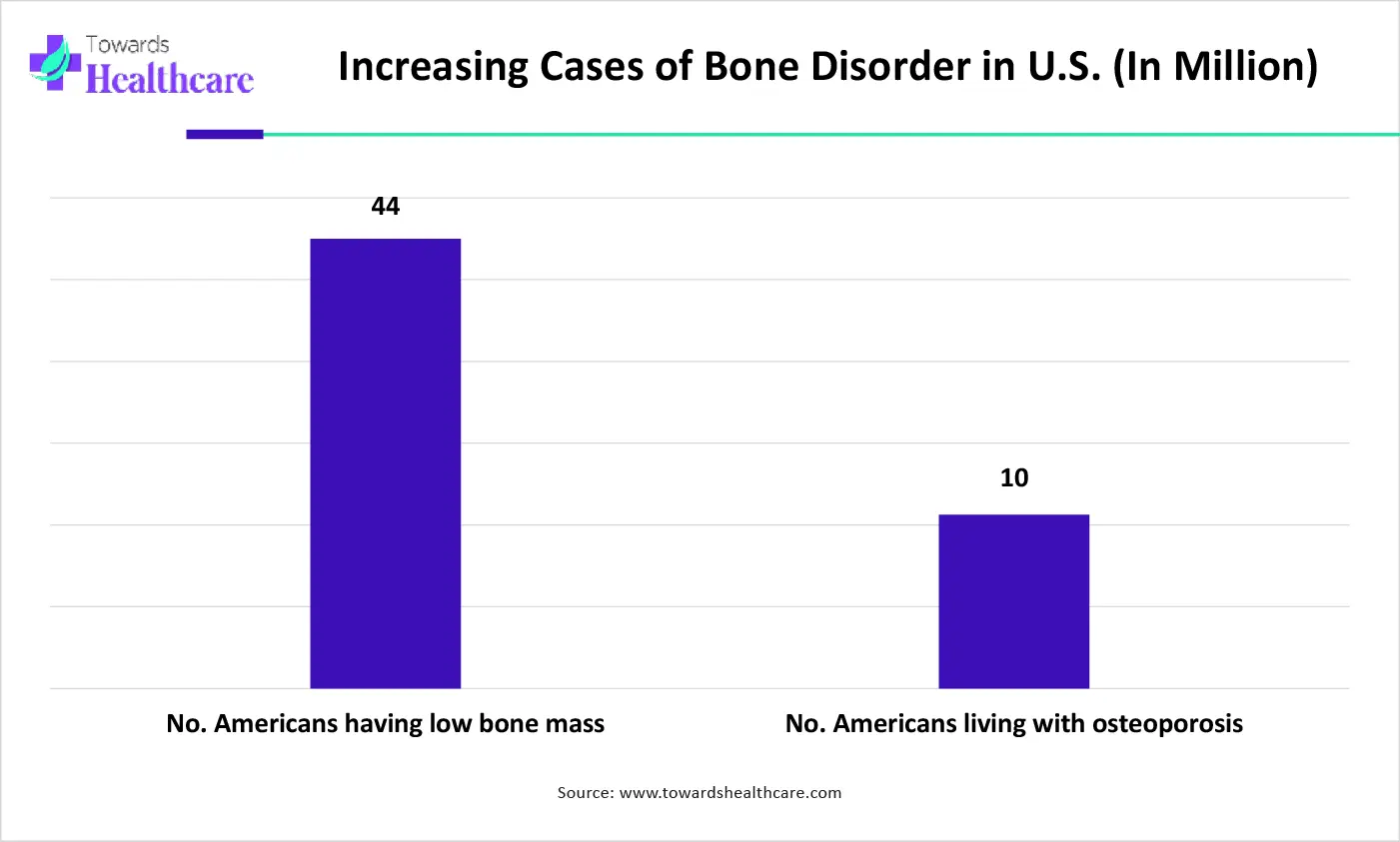

Increasing Prevalence of Musculoskeletal Disorders

The increasing prevalence of musculoskeletal disorders due to population growth and aging is leading to a rapid rise in the number of individuals affected, with approximately 1.71 billion people worldwide having such conditions. These disorders are the top cause of disability globally, with low back pain ranking as the leading cause of disability in 160 countries. They considerably impair mobility and dexterity, resulting in early retirement, decreased well-being, and reduced social participation. Consequently, this growth is fueling the expansion of the orthopedic braces & supports market.

High Cost Challenges

In some orthopaedic braces use better materials are used to move the injured part of the body, and custom fitting, cutting-edge technology, and stringent regulatory guideline requirements. All these factors contribute to excessive manufacturing costs, which are then reflected in the price for consumers, and this limits the growth of the market.

Advancement in Posterior Cruciate Ligament (PCL) Braces

The most notable advancement in functional knee bracing is the development of dynamic posterior cruciate ligament (PCL) knee braces. These braces counteract posterior tibial translation by applying an anterior force on the posterior proximal tibia, which helps reduce undue stress on the PCL and minimizes the final posterior lag. Dynamic PCL braces represent a significant new adjunctive treatment for the conservative management of PCL injuries. Regarding ACL rehabilitation, both conservative and surgical options are considered. Conservative treatment for ACL injuries may be the optimal choice for sedentary patients, opening new opportunities for market growth.

By product type, the knee braces and supports segment led the orthopedic braces & supports market, due to they are a rapid, simple way to support the knee joint and relieve symptoms such as pain and stiffness. They help to heal safely and prevent future injuries. Braces are generally easy to put on and adjust. This is specifically supportive if patients experience swelling right after an injury. These braces come in lots of various sizes and shapes.

On the other hand, the pediatric braces segment is projected to experience the fastest CAGR from 2025 to 2034, as pediatric bracing devices provide significant support for children through developmental delays, neuromuscular conditions, musculoskeletal disorders, injury, or trauma. It helps to align the joints of their bodies, predominantly the spine, hips, knees, feet, and ankles. These devices are prescribed after diagnosis and generally custom-made to fit the child’s requirements. The applications of bracing are typically suggested by a pediatric orthopedic physician, pediatric neurologist, or physical therapist, resulting in an assessment and evaluation of the child’s condition and requirements.

By mobility type, the soft & elastic braces segment is dominant in the orthopedic braces & supports market in 2024, as it appears to stimulate the nervous system and improve the proprioception and control of the intricate joints. The soft brace does not provide mechanical strength by buttressing an aspect of the joint, which would restrict excess mobility, but it does appear that the brace can stimulate the dynamic support of the joint by exciting and growing the muscle action surrounding it. The application of a soft brace in a joint that is injured or weakened by pain and swelling might advantages from wearing a soft brace for some time during the acute and sub-acute phase of rehabilitation.

The hinged braces segment is projected to grow at the fastest CAGR from 2025 to 2034, as this type of brace offers a maximum level of support to the knee. Hinged braces are standard for day-to-day activities and all sports for those patients who are suffering from mild to moderate ligament wounds or instabilities, meniscus injuries, sprains, or osteoarthritis. It offers outstanding support and stability, helping to lessen pain and improve mobility. These hinges provide lateral support, preventing unwanted side-to-side activities, although allowing for normal flexion and extension of the knee joint.

By application, the ligament injury rehabilitation segment led the orthopedic braces & supports market in 2024, as it is braces are significant healthcare devices that maintain proper alignment in ligaments and prevent unwanted activities. Braces are worn inside shoes or boots, on the wrist, or over the knee to keep it stable. Functional knee braces are broadly applied to protect injured or reconstructed anterior cruciate ligaments.

The post-operative recovery segment is projected to experience the fastest CAGR from 2025 to 2034, as orthopedic braces and supports used to support fractures body’s joints, offer the external strength required to recover from an injury or stay active after joint issues develop. Braces ease joint pain; the targeted fit of a custom brace enables it to perform an advanced function than a brace that doesn’t quite fit the joint or injury. Bracing is a game-changer for patients suffering from the pain of an injury or chronic disease.

By distribution channel, the orthopedic clinics & hospitals segment led the orthopedic braces & supports market in 2024, as these clinics and hospitals specialize in the care of disorders of the muscles, bones, ligaments, and tendons. They are trained to address joint issues with both operative and non-operative processes. Orthopedic clinics play a significant role in maintaining mobility, improving functionality, and enhancing overall musculoskeletal health. These hospitals boast specialized surgical suites equipped with advanced technology and devices used in orthopaedic procedures.

On the other hand, the e-commerce platforms segment is projected to experience the fastest CAGR from 2025 to 2034, as e-commerce platforms for orthopaedics care have safely increased their operations. It is used in postoperative follow-up of designated cases, fracture follow-up, and also in pediatric cases. Remote diagnosis of fractures is done efficiently on an outpatient basis in various countries. Digital orthopedics services provide remote monitoring and rehabilitation, providing benefits such as better patient engagement, rapid recovery, and enhanced quality of life for those patients undergoing orthopedic treatment or managing long-lasting conditions.

By end user, the adult segment led the orthopedic braces & supports market in 2024 due to orthopaedics devices playing a significant role in continuing mobility, enhancing functionality, and enhancing overall musculoskeletal health in adult patients. An orthopedic specialist diagnoses and manages conditions affecting the bones, joints, tissues, and spine. Orthopedic care supports in managing joint diseases by providing early diagnosis, targeted treatment plans, pain management approaches, and medical interventions.

On the other hand, the geriatric segment is projected to experience the fastest CAGR from 2025 to 2034, as geriatric patients often take more time to heal fractures, to recover medically completely, and often require more assistance than younger adults in the post-fracture period. Increasing geriatric care programmes, such as the International Geriatric Fracture Society (IGFS), are developing a program that autonomously verifies and certifies accomplishments of fracture care programs for geriatric people. Musculoskeletal fluctuations and age-related sensory losses that characterize older adults yield a patient who needs a unique orthopaedic strategy.

North America is dominant in the market share by 40% in 2024, as constant demand for orthopedic surgeons further illustrates how patient aging is driving the requirement for medical specialties, as well as orthopedic devices. With an increasing population of older adults living longer lives, the demand for orthopedic services and other dedicated healthcare facilities continues to remain high. Technological advances, like 3D printing, robotic-assisted surgeries, and enhanced biomaterials, are improving treatment results, which drives the growth of the market.

For Instance,

Growing medical care services for orthopedic conditions total $350 billion to $400 billion, or roughly 10 % of total US healthcare spending. It is growing rapidly in the forecast years as the US population ages. Increasing early adoption of orthopedic braces and supportive devices also drives the growth of the market.

In Canada, growing musculoskeletal (MSK) conditions, such as mobility restrictions, pain, and flexibility impairments, are the most commonly reported disabilities among older adults, which drives the growth of the market. Orthopaedic care is significant to maintaining quality of life, individuality, and flexibility for millions of Canadians.

Asia Pacific is the fastest-growing region in the orthopedic braces & supports market in the forecast period, as growing healthcare awareness leading to amplified health demand has, indirectly, pressurized the reigning governments in the region to increase spending in the medical care sector. The APAC MedTech segment is renovating healthcare with AI, big data, and regulatory guideline evolution. An increasing trend in mobility disorders research and development drives the growth of the market.

China has enhanced health delivery services and achieved significant success in medical care outcomes. The Chinese government and the World Health Organization recommend that the country shift away from its present hospital-centric model. Chinese orthopaedic investigators have made advanced progress, and the level of medical treatment has improved, which increases the market growth.

India has experienced an increase in orthopaedic challenges as a logical outcome of greater life expectancy, more sedentary lifestyles, and increasing obesity rates. The rising prevalence of MSDs in Indian adults ranges between 7% to 77% as per the research evidence, and as the Indian population grows, it is expected that the prevalence of MSDs will drive the growth of the market.

Europe is notably growing in the orthopedic braces & supports market, as the increasing number of fractures and an aging population above 50 are more susceptible to vertebral fractures. For instance, annually, 3,555,016 fractures, 1.7% of the population aged 50. Increasing government initiative and support, such as The European Action Towards Better Musculoskeletal Health, has developed policies to prevent musculoskeletal challenges and conditions where possible, and to ensure that those patients with musculoskeletal conditions enjoy a life with better quality as self-sufficiently as possible, which contributes to the growth of the market.

Two-thirds of high-risk osteoporosis patients in Germany persist untreated, more than 831,000 patients experience fragility fractures annually in Germany, corresponding to 95 broken bones per hour, which increases demand for orthopaedic braces and supports. Increasing growth of orthopaedic devices manufacturers providing affordable support products.

In the UK, Spinal injuries are frequent sports injuries, bear the worst health results. Poor musculoskeletal (MSK) health affects around 19 million people in the UK, leading to pain, disability, fatigue, and often anxiety, depression, or social isolation, which increases demand for orthopaedic braces and support.

In January 2025, Jim Cloar, Aspen's Chief Executive Officer, stated, “As Aspen continues to prioritize innovation, the acquisition of Advanced Orthopaedics gives us an additional platform to deliver success-driven solutions to our customers and partners. We will soon bring the same innovative approach to the global bracing and supports market that we have successfully implemented in spine for decades.”

By Product Type

By Mobility Type

By Application

By Distribution Channel

By End User

By Region

January 2026

January 2026

December 2025

December 2025