February 2026

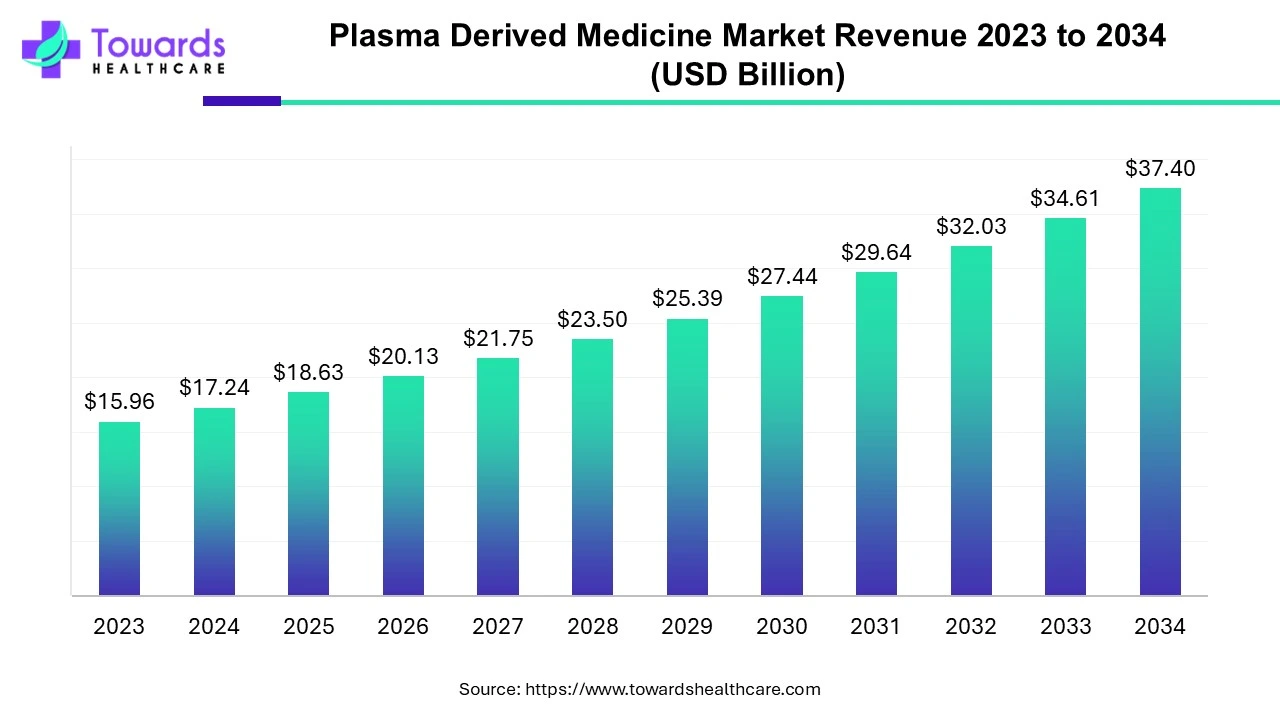

The global plasma derived medicine market size was estimated at US$ 15.96 billion in 2023 and is projected to grow to US$ 37.4 billion by 2034, rising at a compound annual growth rate (CAGR) of 8.05% from 2024 to 2034. Plasma-derived medicines are in high demand due to their use in various plasma protein dysfunctions and deficiencies.

The plasma derived medicine market encompasses the production of plasma-derived products or medicines that are further used during the treatment of health issues that require specific plasma-based products. Plasma-derived medicines include coagulation factors, albumin, and immunoglobin. The demand for these products is increasing because they are used as therapeutics in many chronic and acute life-threatening diseases.

In the near future, PDMPS is expected to worsen because of the aging population and better healthcare, which leads to better diagnosis and treatment. Discovering novel therapeutic indications and diseases that PDMPs can cure will be essential. There doesn't seem to be a replacement for IVIG. Thus, its therapeutic use will be expanded by potential new indications in neurological conditions such as neuropathic pain, chronic fatigue syndrome, post-polio syndrome, and others. Researchers are also looking at other uses for albumin, such as sepsis, cirrhosis, stroke, Alzheimer's disease, and malaria.

Medicines made from plasma are the result of costly methods that use human plasma, a complicated raw material. These items are expensive due to their numerous safety precautions, pricey raw materials, and sophisticated technology.

The major growth factor for the plasma derived medicine market is the increasing blood and plasma donations. Government and private organizations conduct campaigns to encourage healthy individuals to donate blood. The World Health Organization (WHO) reported that around 118.5 million blood donations are collected globally. This increases access to blood and blood products for the development of plasma-derived medicines. Moreover, the increasing awareness of blood donations among the general public also leads to the creation of plasma-derived medicines.

North America dominated the market for many reasons. First of all, the region has advanced healthcare infrastructure, which ensures that the people in the region get proper and high-quality care. Secondly, the key market players in the region continuously conduct R&D, innovate, and collaborate with other organizations to develop better products. Apart from this, various government and non-government organizations invest time, resources, and money to support clinical trials, research, awareness programs, and healthcare programs to improve the healthcare system.

The citizens in the region are also aware of their healthcare rights and facilities, which ensures that they utilize the resources properly. A lot of people make sure to take proper health services due to health insurance. Moreover, a lot of campaigns conducted by the organization about blood donation and awareness about the importance of blood donation encourage people to participate in blood donation programs. The blood plasma derived medicine market is growing in the region mainly due to contributions from the U.S. and Canada.

For instance,

The region's plasma derived medicine market is growing due to growing awareness of blood donations. Government and non-government organizations are conducting many campaigns and awareness programs to increase blood donation. Apart from this, the number of blood banks is also increasing in the region, which ensures that people can get blood products like plasma-derived medicines on time. Along with this, many key market players are actively expanding the production of plasma-derived products in the region due to the growing prevalence of diseases. China, India, Japan, and South Korea are the major countries contributing to the growth of the plasma derived medicine market.

For instance,

Europe is considered to be a significantly growing area in the plasma-derived medicines market. Government organizations launch initiatives to encourage blood and plasma donations. They also provide funding for the development of plasma-derived medicines and increase access to such medicines. The European Medicines Agency (EMA) regulates the approval of plasma-derived medicines in Europe. In July 2025, the EMA and the Heads of Medicines Agencies (HMA) issued recommendations to address vulnerabilities in the supply chain of anti-D immunoglobulins, the only source for manufacturing plasma-derived drugs.

For instance,

By product, the immunoglobin segment held the largest share of the plasma derived medicine market in 2023. This segment dominated because Intravenous (IVIG) and subcutaneous (ScIG) immunoglobulin therapy is constantly growing and is currently recommended as a treatment for a number of immunodeficiencies and immune-mediated illnesses. Both newly recognized indications and a number of rising off-label indications contribute to the growing global use.

The coagulation factors segment is anticipated to grow significantly during the forecast period. Coagulation factors are mainly used in bleeding disorders like hemophilia, where patients lack enough clotting factors to prevent bleeding.

By application, the bleeding disorders segment held the largest share of the plasma derived medicine market in 2023. High coagulation factor concentrate expenses are linked to treating individuals with hemophilia A. Boys are more likely than girls to be born with hemophilia A and B, which are estimated to affect 1 in 5000 and 1 in 30,000 babies worldwide, respectively. As a result, it is reasonable to assume that there are about 1.1 million hemophiliacs worldwide, of whom approximately 400,000 are likely to experience severe hemophilia. Even in wealthy nations like the United States, Germany, Japan, and others, the annual cost of blood clotting factors for treating a single patient with hemophilia B can run up to $450,000, and the total cost of therapy can potentially approach $20 million or more.

By distribution channel, the hospital pharmacies segment led the plasma derived medicine market in 2023. Patients with bleeding disorders or other health issues that require plasma medicine need proper medical attention, so they are admitted to hospitals. Pharmacies associated with hospitals become major suppliers of medicines. Therapeutics are easily accessible and given under the guidance of professionals.

The online pharmacies segment is estimated to grow rapidly in the plasma-derived medicine market during the forecast period. Online pharmacies are gaining popularity due to their ease of accessibility. People who need plasma-derived medicines can easily get their medicines delivered to their doorsteps.

Anita Brikman, President & CEO of Plasma Protein Therapeutics Association, commented that the urgent need for plasma donations and plasma-derived medicines continues to grow as more people are diagnosed with rare and chronic conditions. She further added that AB 725 is an opportunity for California to support the entire plasma ecosystem, from donors to patients, who rely on these life-saving therapies.

By Product

By Application

By Distribution Channel

By Region

February 2026

December 2025

January 2026

December 2025