January 2026

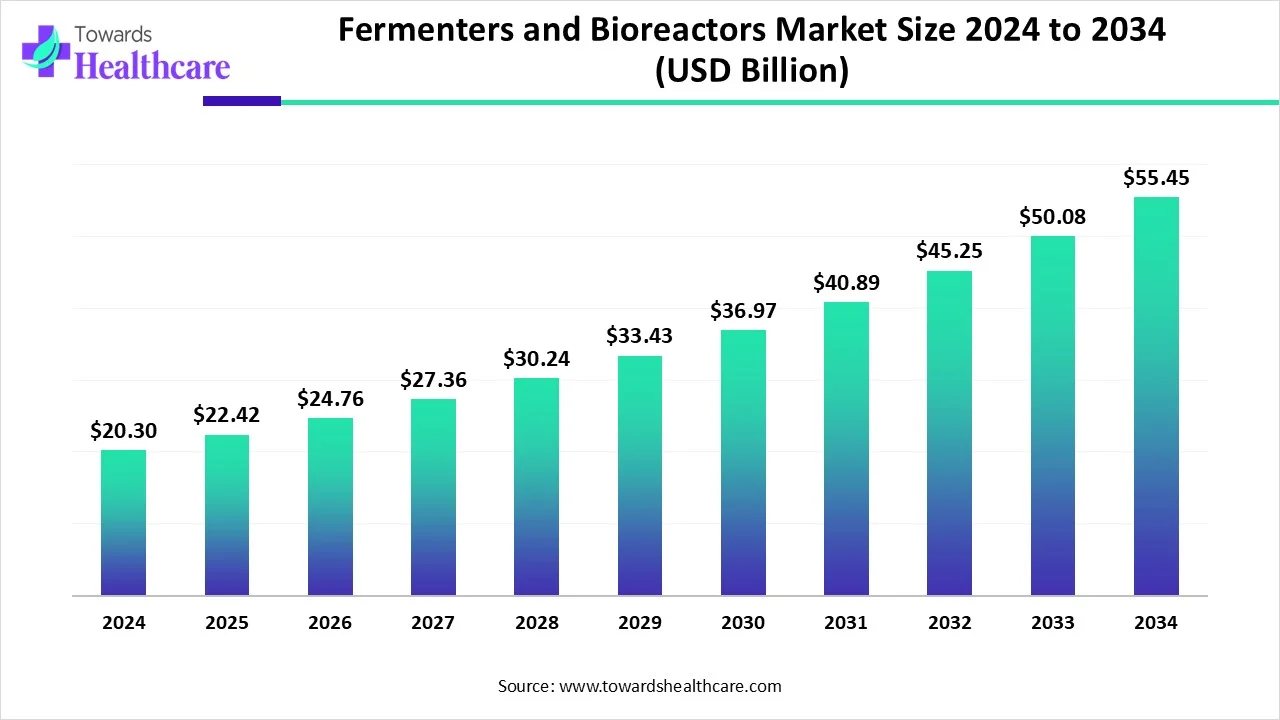

The global fermenters and bioreactors market size is calculated at USD 22.42 billion in 2025, grew to USD 24.76 billion in 2026, and is projected to reach around USD 60.52 billion by 2035. The market is expanding at a CAGR of 10.44% between 2026 and 2035.

| Metric | Details |

| Market Size in 2026 | USD 24.76 Billion |

| Projected Market Size in 2035 | USD 60.52 Billion |

| CAGR (2026 - 2035) | 10.44% |

| Leading Region | North America |

| Market Segmentation | By Product, By Fabrication Material, By Bioprocess Type, By Biologic Type, By End-User, By Region |

| Top Key Players | Applikon Biotechnology B.V., Bbi-Biotech GmbH, Biosphere, Eppendorf AG, Merck Millipore, PBS Biotech, Inc., Sartorius AG, SM Biosystems, Solaris Biotechnology BRL, Sysbiotech GmbH, VFL Sciences |

Fermenters are equipment designed to carry out fermentation processes, where microorganisms convert organic substances into alcohols, organic acids, and gases. Bioreactors are more versatile than fermenters used for the production of biopharmaceuticals, such as proteins, vaccines, monoclonal antibodies, and stem cells. Fermenters provide precise control of factors, such as temperature, pH, and oxygen, which are essential for fermentation. Bioreactors range from small volumes in laboratories to large volumes in industrial production.

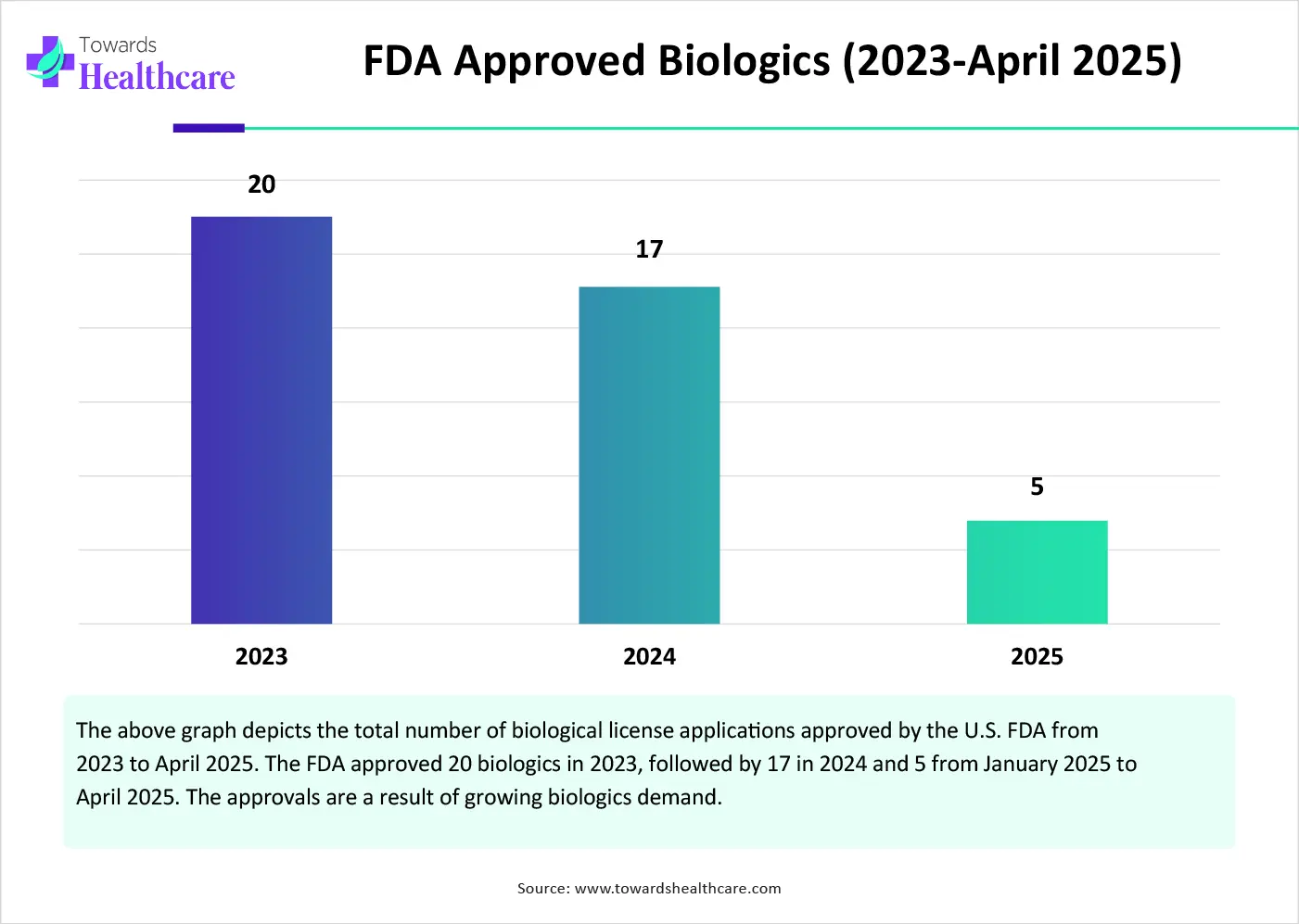

The increasing demand for biologics and their manufacturing boosts the market. The growing research and development activities lead to the development of novel biologics. The rising prevalence of chronic disorders and the increasing geriatric population potentiate the demand for biopharmaceuticals to treat these disorders. Favorable government policies and regulatory frameworks augment the market.

Artificial intelligence (AI) can transform the future of fermenters and bioreactors by introducing automation. Integrating AI in fermenters and bioreactors enhances the efficiency and effectiveness of biological processes. AI provides real-time monitoring of conditions and factors, allowing manufacturers to observe from anywhere and at any time. AI and machine learning (ML) algorithms can automate the mixing and process optimization in large-scale manufacturing, reducing human intervention and manual errors. AI-enabled predictive analytics can enable manufacturers to detect potential errors on a prior basis, allowing them to make proactive decisions.

Growing Demand for Biologics

The rising prevalence of chronic disorders necessitates researchers to develop novel biologics. Biologics are used to treat a wide range of chronic disorders, such as autoimmune diseases, cancer, and genetic diseases. They offer numerous advantages over small-molecule drugs through targeted action. They result in reduced systemic side effects and better therapeutic action. The availability of a generic alternative to biologics, i.e., biosimilars, increases the affordability and accessibility of advanced therapeutics among patients. The DrugBank data consists of 4,285 biotech drugs. These biologics and biosimilars require specialized manufacturing equipment, such as fermenters and bioreactors, for their manufacturing.

High Initial Investment Cost

The major challenge of the fermenters and bioreactors market is the high initial investment cost of equipment. The average cost of a bioreactor ranges from $20,000 to $200,000, depending on size and configuration. This limits the affordability of several companies from low- and middle-income countries.

Environmental Sustainability

The future of the market is promising, driven by the growing demand for environmental sustainability. Numerous government organizations emphasize the need for maintaining a sustainable environment by reducing waste and lowering carbon emissions. It is estimated that the pharmaceutical industry generates over 300 million tons of plastic waste annually. Hence, this creates awareness among manufacturers, leading to the integration of renewable energy sources to power bioreactors and fermenters. This offers a promising path towards sustainable energy production and waste management. The renewable energy utilizes biological processes to convert waste streams into valuable resources like biofuels and biogas.

How did the Bioreactors Segment Dominate in 2024?

By product, the bioreactors segment held a dominant presence in the fermenters and bioreactors market in 2024. Bioreactors are widely preferred, both for small- and large-scale production, due to their versatility in producing a wide range of biopharmaceuticals. They offer greater flexibility in terms of the types of organisms and processes they can support. Additionally, they are equipped with advanced control and monitoring technologies, allowing for accurate, real-time management of culture conditions.

Fermenters Segment

By product, the fermenters segment is predicted to witness significant growth in the market over the forecast period. Fermenters are used for the preparation of antibiotics and other biotechnological products by microbial fermentation. They can handle both aerobic and anaerobic processes. Hence, fermenters are widely preferred during specific fermentation processes of certain microorganisms.

What made the Stainless Steel Segment hold the Largest Share?

By fabrication material, the stainless steel segment held the largest share of the market in 2024. Stainless steel provides excellent thermal properties, including high thermal conductivity. It offers better temperature control during fermentation. It can also withstand corrosion and can be easily sterilized and cleaned. Moreover, stainless steel bioreactors are used to sustain the pressures of high-performance and continuous usage. It is also easier to scale up the stainless steel bioreactors and fermenters.

Single-Use Segment

By fabrication material, the single-use segment is expected to grow at the fastest rate in the fermenters and bioreactors market during the forecast period. The demand for single-use fermenters and bioreactors is increasing owing to greater flexibility and cost-effectiveness. The growing demand for environmental sustainability and the need for a completely sterile process boost the segment’s growth. Single-use systems reduce the risk of cross-contamination and eliminate the need for cleaning. This saves water wastage and time for manufacturers. They are usually made of disposable plastics.

How Batch & Fed Batch Segment Led the Market in 2024?

By bioprocess type, the batch & fed batch segment led the global market in 2024. Batch & fed batch process offers complete control over temperature, pH, and other conditions of the bioprocess. It enables manufacturers to produce small quantities of biopharmaceuticals. A fed batch process provides numerous benefits, including enhanced productivity, better yields with controlled sequential additions of nutrients, higher cell densities, and prolonged product synthesis.

Continuous Segment

By bioprocess type, the continuous segment is anticipated to show lucrative growth in the fermenters and bioreactors market over the studied years. Continuous bioprocess involves feeding the system continuously with nutrient medium. The volume of the culture broth is constant due to constant feed-in and feed-out rates. The internal environment of the system remains constant in a continuous process. This results in higher turnover rates and more control over the microbial growth and the desired product.

Why the Antibodies Segment Dominated in 2024?

By biologic type, the antibodies segment held a major share of the market in 2024. Antibodies are proteins produced by the immune system and protect the body from any foreign substance. Antibody therapies are developed to help the body fight cancer, infection, or other diseases. The increasing number of antibody therapies approvals and growing research and development activities augment the segment’s growth. The Umabs-DB database contains comprehensive information on 11,335 antibodies and 1,708 targets.

Vaccines Segment

By biologic type, the vaccines segment is anticipated to grow with the highest CAGR in the fermenters and bioreactors market during the studied years. The rising prevalence of infectious diseases and the increasing vaccine shortage potentiate the manufacturing of vaccines globally. As of February 2025, the U.S. Food and Drug Administration (FDA) listed a few CBER-regulated products with current shortages, including BCG vaccines. The increasing vaccine trade globally also fosters the segment’s growth.'

What made the Biopharmaceutical Companies Segment Dominate in 2024?

By end-user, the biopharmaceutical companies segment registered its dominance over the global market in 2024. The presence of a favorable manufacturing infrastructure and suitable capital investments favors the segment’s growth. New product launches and the growing consumer demands enable biopharmaceutical companies to fulfill patients’ needs. The increasing number of biopharmaceutical companies and favorable regulatory policies also contribute to the segment’s growth.

CROs Segment

By end-user, the CROs segment is projected to expand rapidly in the fermenters and bioreactors market in the coming years. The increasing number of biotech startups and the rising venture capital investments encourage biopharmaceutical companies to outsource their services due to a lack of manufacturing infrastructure. CROs offer tailored expertise and access to a suitable infrastructure to both small- and large-scale biopharma companies. They enable large-scale biopharma companies to focus on product sales and marketing. According to a JP Morgan report, the venture investment in 2024 accounted for $26 billion in therapeutics and drug discovery platforms across 416 rounds.

North America dominated the global market in 2024. Technological advancements in manufacturing and favorable regulatory policies are the major growth factors of the market in North America. The growing demand for biologics and new product launches boosts the market. The presence of key players increases the need for high-quality fermenters and bioreactors embedded with cutting-edge technologies. Several government organizations also launch initiatives and provide funding to develop novel biologics and support research and manufacturing.

U.S. Market Trends

In November 2024, the White House published a report on “Building a Vibrant Domestic Biomanufacturing Ecosystem” to provide strategic direction on expanding domestic biomanufacturing capacity for products in various sectors, including health, with a focus on advancing equity, improving biomanufacturing processes, and connecting relevant infrastructure.

Canada Market Trends

The increasing number of biologic and biosimilar approvals by Health Canada promotes the use of fermenters and bioreactors. As of March 2025, Health Canada approved a total of 67 biosimilars, including human growth hormone, insulin, monoclonal antibodies, and tumor necrosis factor inhibitors. The Canadian government invested over $2.3 billion in 41 projects in the biomanufacturing, vaccine, and therapeutics ecosystem from March 2020 to March 2025.

Asia-Pacific is anticipated to grow at the fastest rate in the market during the forecast period. The availability of a suitable manufacturing infrastructure encourages foreign investors to set up their manufacturing facilities in the Asia-Pacific countries. The increasing number of biopharmaceutical startups and the burgeoning biopharma sector drive the market. The growing investments, collaborations, and mergers & acquisitions also contribute to market growth.

China Market Trends

The Chinese Ministry of Industry and Information Technology recently announced that approximately $4.17 billion was invested in the biotechnology sector in 2024. China also announced that biomanufacturing is an emerging field in the nation, poised to accelerate development in 2025. The federal government’s initiatives, such as “Made in China 2025” and “14th Five-Year Plan (2021-2025)”, help China become a global leader in the biotech sector.

India Market Trends

India is home to over 3,500 biotechnology companies. The biotech sector contributes about 4.25% to the national GDP and has demonstrated a robust CAGR of 17.9% over the past four years. The Indian government aims to make India a global bio-manufacturing hub driven by innovation, sustainability, and inclusive development. Several initiatives that support India’s mission include the BioE3 policy (Biotechnology for Economy, Environment, and Employment) and the National Biopharma Mission.

Europe is estimated to grow at a considerable rate in the fermenters and bioreactors market in the upcoming period. Several government organizations support the development of innovative technologies in the biotech sector, and favorable regulatory policies are a major growth factor for the market in Europe. The increasing venture capital investments and the growing research and development activities augment the market. The growing demand for biologics due to the rising prevalence of chronic disorders also contributes to market growth. The European Medicines Agency (EMA) approved 28 biosimilars in 2024.

France Market Trends

France is a hub of biomanufacturing in Europe. The French government launched the “France 2030” plan to make France a European leader in biomanufacturing by 2030. The main objectives of this plan include increasing national production capacity, supporting innovation in bioproduction technologies, training professionals, and promoting investment.

UK Market Trends

The UK attracts the most venture capital investments in the biotech sector in Europe. According to the Bioindustry Association report, the UK biotech sector raised £3.5 billion in investment, an increase of 94% compared to 2023. Out of these, the venture capital funding was £2.06 billion across 111 deals, and the remaining £1.5 billion was raised through follow-on financings.

South America is expected to grow significantly in the fermenters and bioreactors market during the forecast period, due to the growing use of vaccines and biologics. This, in turn, is increasing the demand for fermenters and bioreactors, where the growing government investments are increasing their innovations and enhancing the market growth.

Brazil Fermenters and Bioreactors Market Trends

The presence of advanced biopharma hubs in Brazil is increasing the use of fermenters and bioreactors to develop various biologics and vaccines. The growing adoption of advanced technologies is also enhancing their features, where the increasing R&D activities are also increasing their use.

MEA is expected to grow significantly in the fermenters and bioreactors market during the forecast period, due to growing investments and usage. This is encouraging the use of fermenters and bioreactors to enhance the production of vaccines, advanced therapies, and biologics. Additionally, increasing innovations and immunization campaigns are also increasing their demand, promoting the market growth.

Saudi Arabia Fermenters and Bioreactors Market Trends

The expanding biotech hubs and growing government initiatives are increasing the use of various biologics and advanced therapies along with vaccines, which is ultimately increasing the use of fermenters and bioreactors in Saudi Arabia. The industries are also utilizing advanced technologies to enhance their efficiency and flexibility.

R&D

Clinical Trials and Regulatory Approvals

Packaging and Serialization

Distribution to Hospitals, Pharmacies

Patient Support and Services

Brian Heligman, Co-founder & CEO of Biosphere, commented on the launch of UV Bioreactor, saying that its bioreactor is a first-principles reimagining of biomanufacturing systems. The company is replacing 80-year-old technology with a cost-effective, scalable platform designed for the future. He also said that the UV Bioreactor will be the foundation of biomanufacturing in the 21st Century.

By Product

By Fabrication Material

By Bioprocess Type

By Biologic Type

By End-User

By Region

January 2026

January 2026

January 2026

January 2026