February 2026

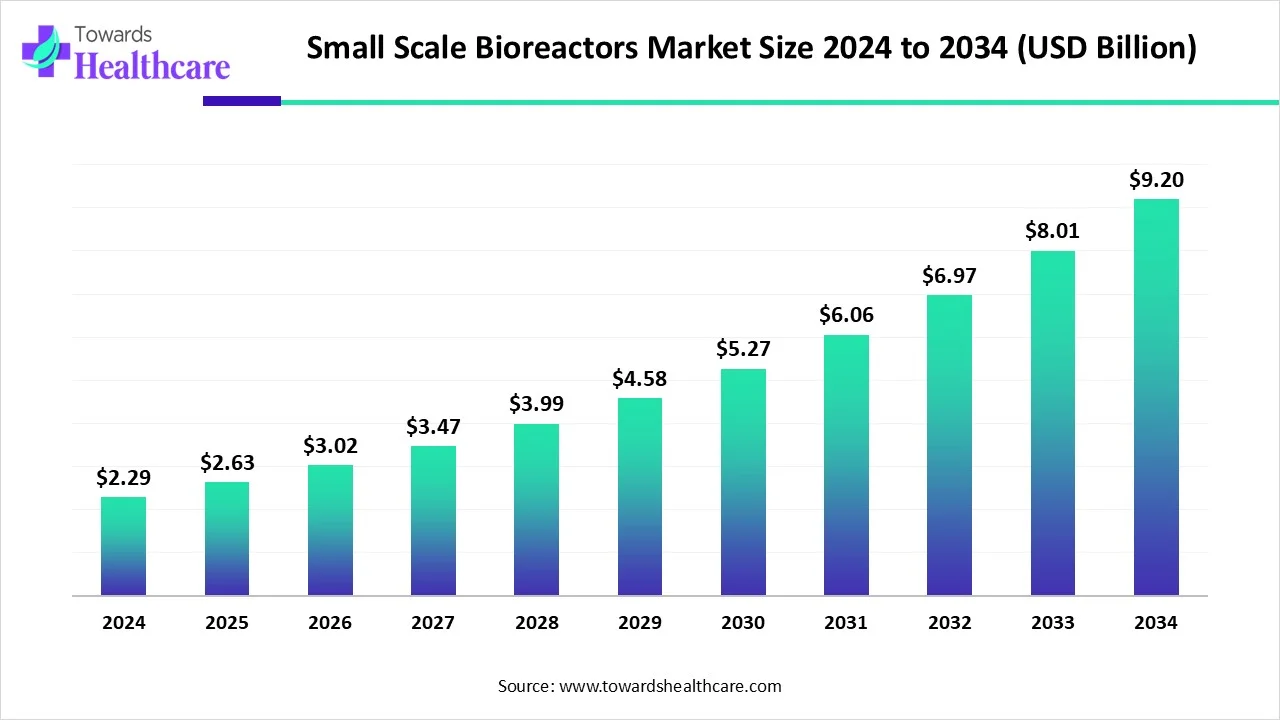

The global small-scale bioreactors market size is calculated at USD 2.63 billion in 2025, grew to USD 3.02 billion in 2026, and is projected to reach around USD 10.49 billion by 2035. The market is expanding at a CAGR of 14.84% between 2026 and 2035.

| Metric | Details |

| Market Size in 2026 | USD 3.02 Billion |

| Projected Market Size in 2035 | USD 10.49 Billion |

| CAGR (2026 - 2035) | 14.84% |

| Leading Region | North America share by 44% |

| Market Segmentation | By Product, By Capacity, By End-User, By Region |

| Top Key Players | Bionet, Cytiva GmbH, Eppendorf AG, GE Healthcare, Infors AG, Lonza Group, Merck KGaA, Miltenyi Biotec, Pall Corporation, PBS Biotech, Inc., Sartorius AG, Thermo Fisher Scientific |

Bioreactors are vessels that culture cells or microorganisms under tightly controlled conditions. They provide optimal productivity, efficiency, and product quality. The main components of bioreactors are sensors, control software, and actuators for real-time monitoring of process parameters. They are used to manufacture a wide range of biologics from small-scale to large-scale. Small-scale bioreactors have a working volume of around 100 mL and are typically used in R&D.

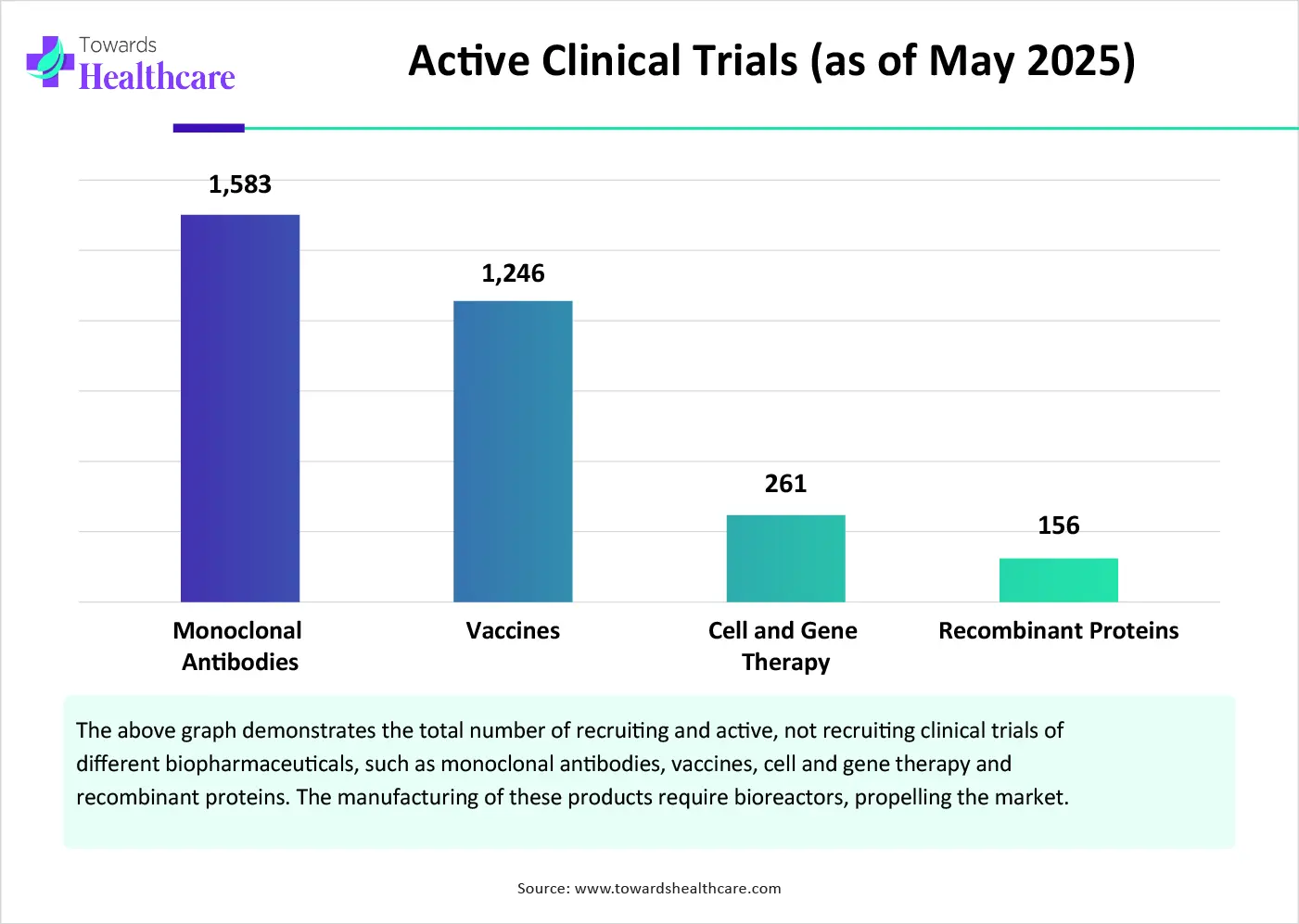

Various factors that govern market growth are the growing demand for biologics and the rising research and development activities. The increasing number of clinical trials and new product launches also encourages researchers to develop novel biologics. The increasing investments, collaborations, and mergers & acquisitions promote the use of small-scale bioreactors. Several government organizations support advanced biotech research, augmenting market growth.

Artificial intelligence (AI) introduces automation in bioreactors, enhancing their efficiency and reproducibility. AI and machine learning (ML) can enhance the production capacity of biopharmaceuticals, increasing the speed. AI-enabled sensors can facilitate real-time monitoring of bioprocessing systems, improving consistency. This also allows researchers to get real-time insights into process parameters, facilitating seamless data collection and analysis. AI leads to better product yields and higher speed-to-market. Automation also reduces batch-to-batch variability and maintains regulatory compliance. AI and ML can analyze vast amounts of data and provide insights into the fermentation process that are difficult to obtain through manual processes.

Increasing Number of Clinical Trials

The growing research and development activities lead to an increasing number of clinical trials. This facilitates enhanced development of biopharmaceuticals to fulfill patients’ needs. The rising demand for biopharmaceuticals potentiates the need for small-scale bioreactors. There are a total of 859 clinical trials registered on the clinicaltrials.gov website related to cell and gene therapy as an intervention as of May 2025. The website also contains 6,083 clinical trials related to monoclonal antibodies. Stringent regulatory policies necessitate clinical trials to evaluate the safety and efficacy of novel biopharmaceuticals.

High Cost

The major challenge of the small-scale bioreactors market is the high installation cost of bioreactors. Several companies in the low- and middle-income countries limit the affordability of advanced bioreactors. In the U.S., bioreactors range from $20,000 to $500,000.

Latest Advancements

The future of the market is promising, driven by the latest advancements in bioreactor technology. Continuous advancements are made in the design and materials used in bioreactor construction. Materials with improved biocompatibility and transparency are widely preferred for designing bioreactors, allowing for real-time monitoring and control of culture conditions. The demand for single-use bioreactors is increasing due to the need for environmental sustainability, cost-effectiveness, and reduced risk of contamination. Researchers are also developing miniaturized or microscale bioreactors to conduct parallel experiments with reduced resource requirements.

By product, the reusable bioreactors segment held a dominant presence in the small-scale bioreactors market in 2024. Reusable bioreactors are generally made of stainless steel or glass and need to be pre-sterilized before usage. They have been preferred for many decades as they are supported by a large amount of knowledge and experience in process control. Reusable bioreactors maximize cell productivity and yield while minimizing process scope and overall cost. The other benefits of using reusable bioreactors include lower initial capital investment and potential for multiple product runs.

By product, the single-use bioreactors segment is expected to grow at the fastest CAGR in the market during the forecast period. Single-use bioreactors are generally made of disposable plastics and are discarded after use. They eliminate the need to clean and sterilize the equipment. This eventually saves time and cost for manufacturers and researchers. The growing demand for environmental sustainability also potentiates the need for single-use bioreactors. They are lightweight and appropriate, especially for research purposes.

By capacity, the 1-3 L segment held the largest share of the small-scale bioreactors market in 2024 and is estimated to be the fastest-growing during the predicted period. 1-3 L bioreactors are commonly used for pilot-scale applications. Several lab operations are tested on a pilot scale with different reaction conditions and chemical compositions before going for large-scale production. Hence, validation of all process parameters is essential at the pilot scale. The 1-3 L bioreactor system provides a user-friendly and cost-effective alternative to bigger and complex equipment. They can be easily handled and transported from one manufacturing site to another.

By capacity, the 3-5 L segment is expected to grow significantly in the market during the studied years. 3-5 L bioreactors are also used for pilot-scale operations for cell culture and microbial fermentation applications. They are also used for research and development activities for biotechnological and biopharmaceutical processes. The integration of advanced technologies and their flexibility make them a suitable choice.

By end-user, the CROs & CMOs segment led the global small-scale bioreactors market in 2024 and is anticipated to grow at the highest CAGR during the forecast period. The increasing number of biotech startups and the rising venture capital investments promote the demand for CROs and CMOs. CROs and CMOs conduct research and manufacturing for small- and large-scale companies, providing favorable infrastructure and relevant expertise. Numerous large-scale pharma and biotech companies also prefer to outsource their research activities, focusing on product marketing and sales.

By end-user, the academic & research institutes segment is expected to witness significant growth in the market over the forecast period. The growing research and development activities in academic & research institutes increase the demand for small-scale bioreactors. Favorable government support through initiatives and funding encourages research activities in research institutions. The presence of skilled professionals and suitable infrastructure augments the segment’s growth.

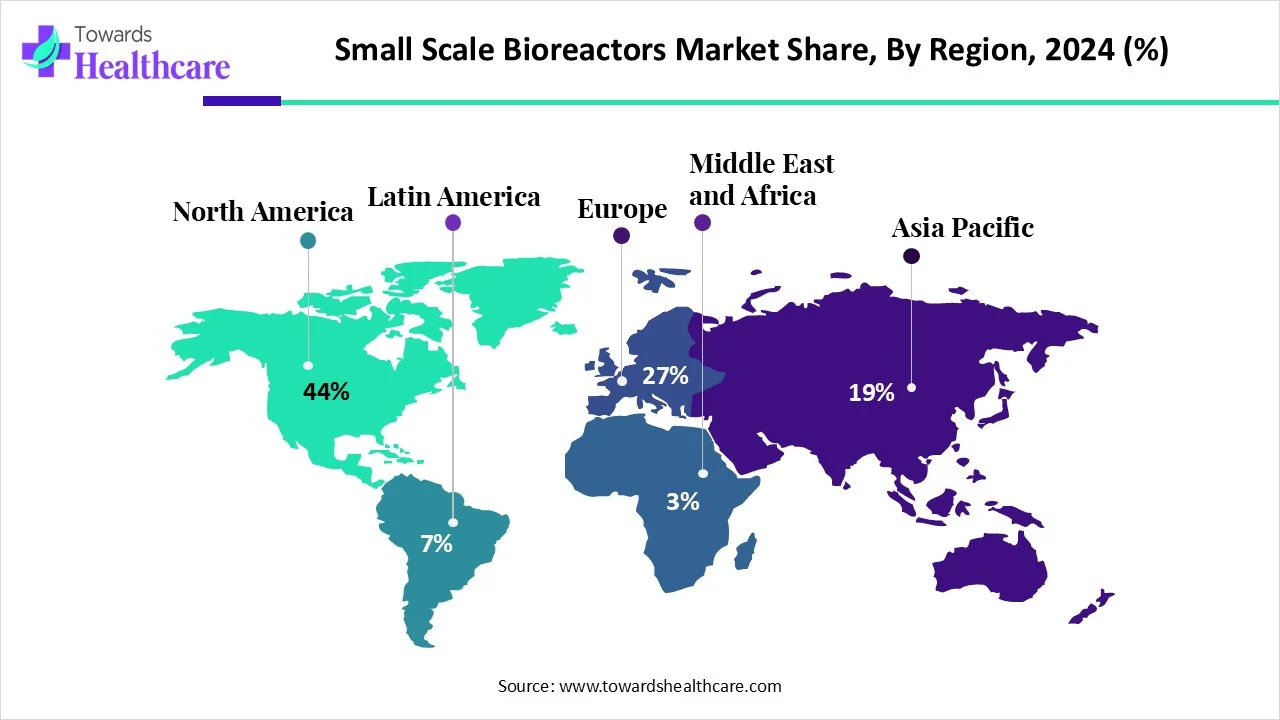

North America dominated the global small-scale bioreactors market share by 44% in 2024. Favorable government policies and regulatory frameworks are the major growth factors of the market in North America. The increasing number of pharma and biotech companies potentiates the demand for small-scale bioreactors. State-of-the-art research and development facilities in companies and research institutions facilitate the use of innovative small-scale bioreactors. The rising prevalence of chronic, genetic, and congenital diseases also favors the development of biologics.

It is estimated that more than 129 million people in the U.S. live with more than 1 major chronic disorder, out of which 42% have 2 or more, and 12% have at least 5. In 2024, the U.S. Food and Drug Administration (FDA) approved 18 biological entities. The Pharmaceutical Research & Manufacturers Association (PhRMA) reported that biopharmaceutical firms spent about $96 billion in the U.S. on R&D in 2023. (Source - Select USA)

It is estimated that around only 5 in 10 Canadians reported their health as very good or excellent (52.2%) in 2023. About 45.1% of Canadians live with at least 1 major chronic disorder in 2024. Health Canada has approved 67 biosimilars as of March 2025, including human growth hormone, insulin, monoclonal antibodies, and tumor necrosis factor (TNF) inhibitors. (Source - GaBI)

Asia-Pacific is expected to host the fastest-growing small-scale bioreactors market in the coming years. The burgeoning biotech sector, along with growing research and development activities, propels the market. The increasing number of startups and the rising adoption of advanced technologies drive the market. The availability of suitable manufacturing infrastructure and favorable government support contribute to market growth.

China conducts the most biotech research in the world. The increasing number of patents and publications demonstrates the growing research and development activities in China. In 2023, China accounted for the most cited papers in synthetic biology (61% of the global share), genomic sequencing and analysis (42%), novel antibiotics and antivirals (30%), and biological manufacturing (29%). (Source - MERICS)

Japan is the third-largest pharmaceutical market in the world, and biopharmaceuticals are expected to be the driving force of the market. Keidanren, a Japanese business federation, launched a “biotransformation strategy” in 2023 to support and promote bio-medicine in Japan. Moreover, the Japanese government has also launched the “Strengthening Drug Discovery Venture Ecosystem Project” with an investment of 300 billion yen from 2022. All these collectively contribute to the demand for small-scale bioreactors.

Europe is expected to grow at a considerable CAGR in the market in the upcoming period. Several government organizations provide funding to advance their pharmaceutical and biotech research activities in Europe. They also introduce initiatives to support biopharmaceuticals’ development and promote biotech research. The growing demand for biopharmaceuticals also encourages researchers to develop novel biopharmaceuticals. The increasing investments, collaborations, and mergers & acquisitions boost the market.

In April 2024, Merck KGaA announced the construction of a research center at its global headquarters in Darmstadt, Germany. The 18,000 sq m research center will focus on developing solutions for manufacturing biopharmaceuticals, such as antibodies, recombinant proteins, and viral vectors. The advanced center provides the relevant facilities and space to support the growth of research activities. (Source - Bioprocess)

In May 2025, BioNTech announced an investment of up to 1 billion pounds sterling ($1.3 billion) over the next decade to strengthen its R&D base in the UK. The investment will be used to build two new biopharmaceutical research centers in the UK. The UK government also awarded 129 million pounds ($172 million) in grant money over 10 years. (Source - FIERCE BIOTECH)

Latin America is expected to grow at a notable CAGR in the small-scale bioreactors market in the foreseeable future. The market is driven by the burgeoning biotech sector and the rapidly expanding manufacturing infrastructure. The growing demand for personalized medicines potentiates the development of biologics as therapeutics. Latin American countries promote the indigenous manufacturing of vaccines through government initiatives and funding. The increasing collaboration and mergers & acquisitions contribute to market growth.

In July 2025, Pfizer announced plans to use its Mexico facility for vaccine awareness and become a key supplier in the Latin American region. The company invests around $12 million to $15 million in its Toluca plant annually and has an annual manufacturing capacity of 194 million units.

In May 2025, the Brazilian government and Gavi announced that they reaffirm and strengthen their long-standing partnership focused on equitable access to vaccines and resilient health systems. This marks significant advancements in local vaccine manufacturing, climate adaptation through immunization, and South-South cooperation.

Stefan Egli, Head of the Mammalian Business Unit, Lonza Group, commented that the company completed its first GMP product batch from the next-generation mammalian manufacturing facility in Portsmouth, NH. He also said that this highlights the company’s efforts to support customers’ needs across their product lifecycle and meet growing market demand for the launch scale.

By Product

By Capacity

By End-User

By Region

February 2026

February 2026

February 2026

February 2026