January 2026

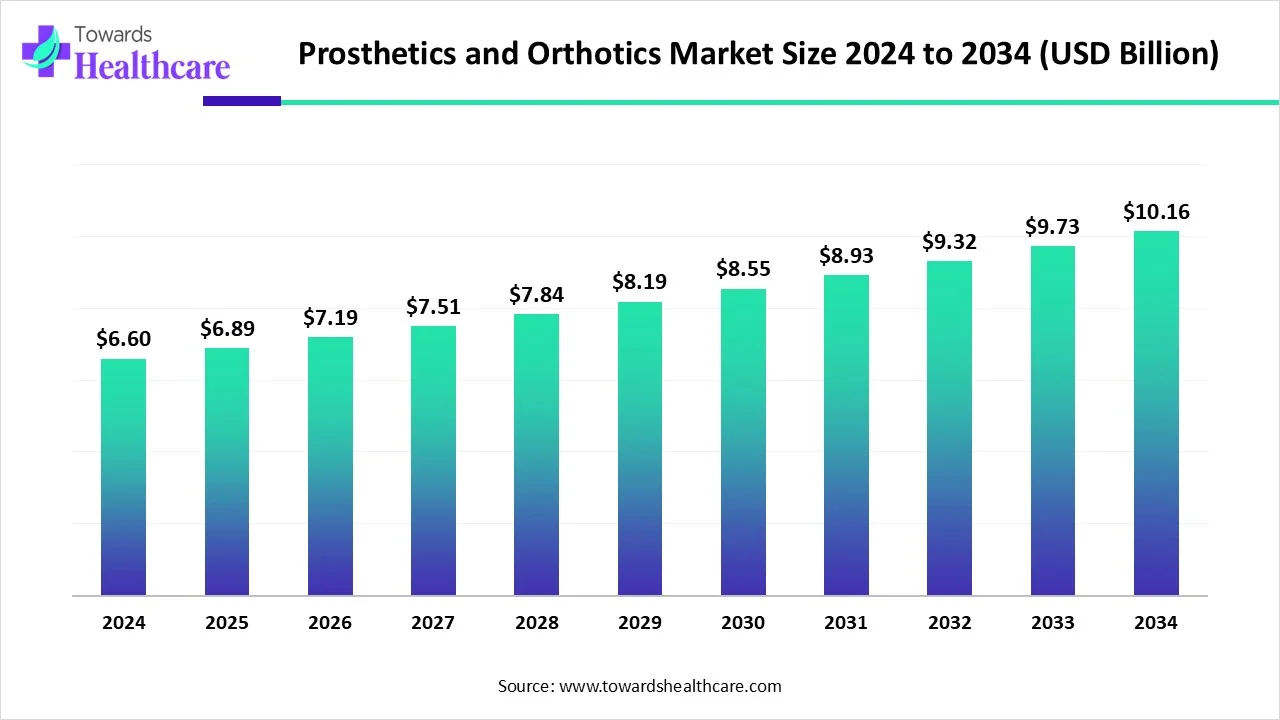

The global prosthetics and orthotics market size is calculated at US$ 6.6 in 2024, grew to US$ 6.89 billion in 2025, and is projected to reach around US$ 10.16 billion by 2034. The market is expanding at a CAGR of 4.44% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 6.89 Billion |

| Projected Market Size in 2034 | USD 10.16 Billion |

| CAGR (2025 - 2034) | 4.44% |

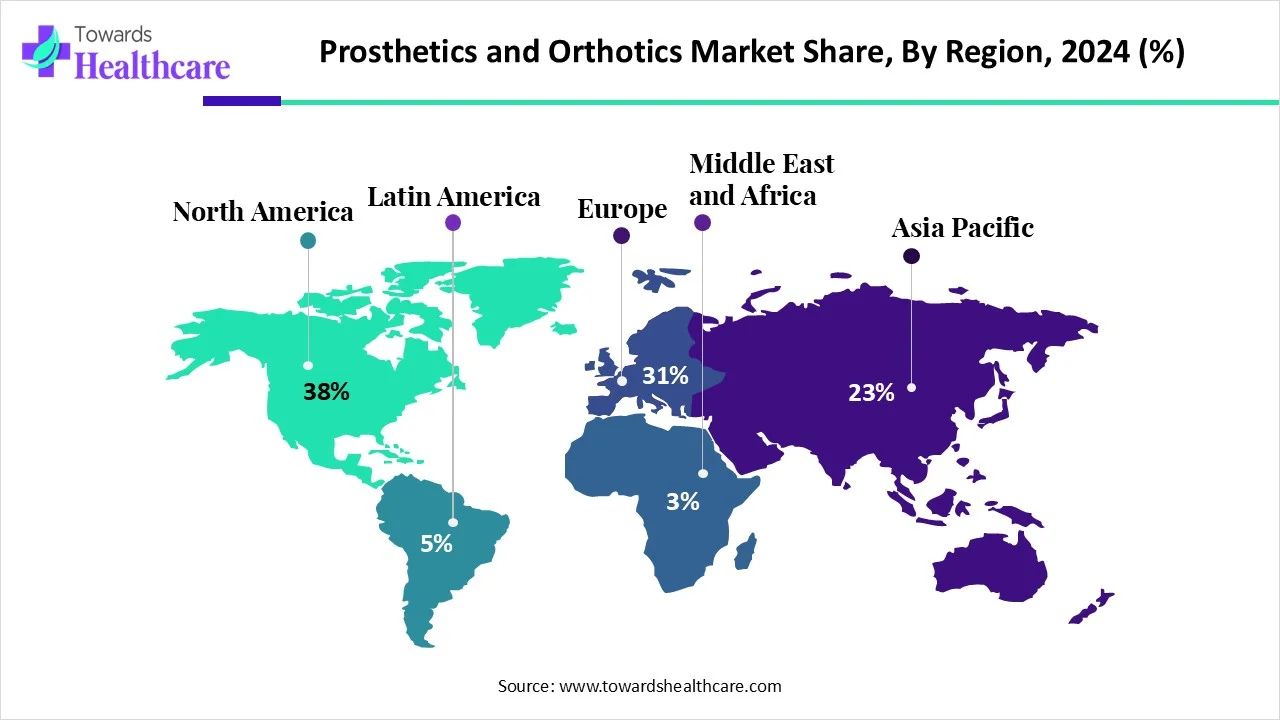

| Leading Region | North America |

| Market Segmentation | By Product, By Region |

| Top Key Players | Ossur, Blatchford Limited, Fillauer LLC, Ottobock, WillowWood Global LLC., Ultraflex Systems Inc., Steeper Group, Bauerfeind, Aether Biomedical, Mobius Bionics |

The market is growing rapidly the with rapid advances in technology and medical care, the roles of the orthotist and prosthetist have expanded from a scientific focus to a more inclusive focus in the rehabilitation team. Prosthetics and orthotics services support specialised health care that combines an exclusive blend of technical and clinical capabilities to offer assistive products for people with physical disabilities. The use of prostheses or orthoses reduces the requirement for formal health care, long-term care, support services, and caregivers. They also support amputees to recover their independence and participate in daily activities, as well as advance their mental and physical health.

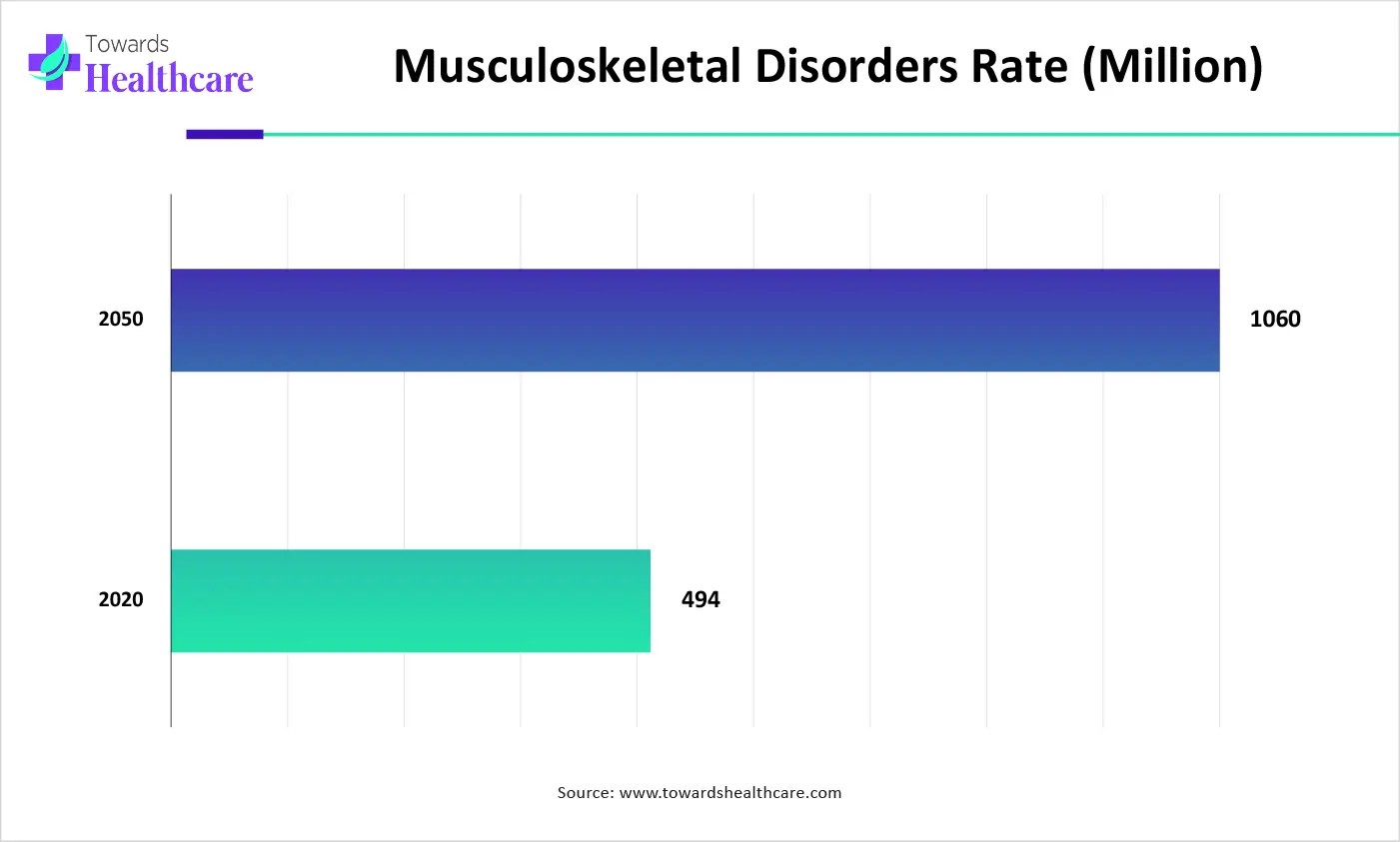

The above infographic indicates that increasing cases of musculoskeletal disorders directly increase the requirement for prosthetic and orthotic services to manage pain, enhance mobility function, and improve the quality of musculoskeletal disorder patients.

Integration of AI in the prosthetics and orthotics services is driving the growth of the market through the application of AI-based 3D scanning technologies, like the BodyScan and Luma Scanner, physicians capture extremely precise digital impressions of patients’ anatomy. These tools ensure accurate and personalized fittings for prosthetic and orthotic devices, lessening discomfort and improving functionality. AI plays a significant role in walking biomechanics and analysis. Artificial intelligence algorithms process large volumes of patient movement information, detecting subtle abnormalities and recommending curative measures. AI has streamlined the design and fabrication processes for prosthetics and orthotics. AI has significant potential to democratize access to advanced orthotic and prosthetic care by lowering production expenses and improving efficiency, which contributes to the growth of the market.

Rising Demand for Military-Grade Prosthetics and Orthotics Solutions

Increasing demand for military-grade prosthetics and orthotics due to higher incidence of conflicts and accidents in military services, which is a major growth driver for the prosthetics and orthotics market. They are designed for rapid response, strength, agility, and endurance. These devices are custom-made to every person’s lifestyle, future goals, and work. In military services, the adoption of smart limbs in real time, to rugged, field-tested components, these modern devices are reshaping the way injured veterans return to life after trauma. This device is engineered to handle pressure, work in erratic environments, and perform under physical stress.

Challenges of Prosthetics and Orthotics Services

One of the major challenges in developing next-generation orthopedic prostheses is enhancing their biocompatibility with the human body. This improvement is vital for the long-term success of the prosthesis and for reducing the risks of complications like inflammation and rejection, which limit the growth of the prosthetics and orthotics market.

Recent Advancements in Prosthetics and Orthotics Services

Recent progress in body-powered prosthesis technology, surgical advancements, and improved rehabilitation offers hope for patients with limb loss aiming to regain their pre-injury functionality. Body-powered prostheses rely on cables or harnesses that utilize the movement of proximal joints to operate the device. These prostheses effectively restore abilities like grasping and handling objects, while also aiding the user’s sound hand. Individuals involved in manual labor or demanding activities at work or home may prefer body-powered prostheses due to their durability and functionality, as they are designed to endure challenging conditions with exposure to dirt, moisture, heavy loads, and vibrations. This situation presents an opportunity for the prosthetics and orthotics market.

By product, the orthotics segment dominated the prosthetics and orthotics market in 2024, as their goal is to improve various ankle and foot conditions, providing relief and enhanced mobility to the affected area. Offers protection and support for joints or various parts of the body. Which can optimally align a joint into an improved functional position, therefore it maintains a functional position with the joint, and uses an orthosis, whether statically or dynamically, to achieve this functional position. Orthotics prevent or treat abnormal motion and rolling of the disabled part of the body.

By product, the prosthetics segment is expected to register the fastest growth in the market in 2024 as it offers excellent movement, greater adaptability, and intuitive control, making daily tasks easier and improving independence. Prosthetics have major advantages, including being comfortable, durable, lightweight, low maintenance, aesthetically pleasing, and offering a suitable degree of mechanical function, which makes it simple for the disabled person to handle.

North America dominated the prosthetics and orthotics market share by 38% in 2024 as increasing investment in healthcare research and pharmaceutical expansion has led to revolutionary discoveries and enhanced treatment options in various fields, which facilitates access to prosthetic and orthotic services. Older Americans use more healthcare services than their younger counterparts and are more likely to have chronic diseases, like diabetes, that need both orthotic and prosthetic care, which contributes to the growth of the market.

In the United States, recent advancements in robotic systems are revolutionizing the sector of orthopaedic surgery by allowing novel approaches to spine procedures and joint reconstruction, along with the modern technologies in other sub-specialties continuing to arise, which drives the growth of the market. The American Orthotics and Prosthetics Association also serves to facilitate the growth and advancement of research and quality improvement. Growing fundamental research, development, or evaluation in prosthetics and orthotics services drives the growth of the market.

In Canada, increasing government support to the disabled person through funding such as the Canada Disability Benefit and a substantial improvement and expansion to the scope of the coverage for healthcare devices, particularly artificial limbs. Strong presence of major prosthetics and orthotics services key players drives the growth of the market, such as DJO Global, Ossur, Otto Bock, Orthotics Prosthetics Canada (OPC), and many others. These organizations offer an extensive range of products and support for Prosthetics and Orthotics professionals, which causes the growth of the market.

For Instance,

The Asia Pacific region is projected to experience the fastest growth in the market during the forecast period. This growth is driven by the rising elderly population, approximately 128 million in China and 104 million in India, which is expected to put pressure on the healthcare systems in these countries. From an orthopedic perspective, a significant rise in knee osteoarthritis prevalence is anticipated in Asia-Pacific nations. Furthermore, the rapid progress in prosthetic and orthotic (P&O) technology, alongside advancements in medical products like drugs, devices, and health technology assessments (HTA), supports the market's expansion.

The growing incidence of diabetes with the increasing prevalence of obesity in China is therefore increasing demand for prosthetic services in this region. Diabetic patients in China with advanced needs may require orthotic solutions. Custom-made prosthetics and orthotic devices are designed to make walking safer and easier. China's advanced technology, such as orthopedic AI and the surgical robotics industry, has now reached an international leading level. The novelty of modern concepts, novel instruments, and surgical skills for precise diagnostic and treatment methods in orthotics and prosthetic services drives the growth of the market.

In India estimated of more than 9 million persons 2 with musculoskeletal disabilities require prosthetic and orthotic services, which drives the growth of the market. Prosthetics play a significant role in restoring mobility and independence for persons who have experienced limb loss. Increasing Indian innovations to improve quality of life, like bionic prostheses, show the most important successes in the sector of health care, it changed the lives of the physically challenged. Indian companies and researchers have come up with bionic devices, which contribute to the growth of the market. (Source: Ispoint Org)

Europe is expected to grow significantly in the prosthetics and orthotics market during the forecast period because growing advancements in technology, industry competition, and the pursuit of better patient results drive invention, while challenges in ensuring better prosthetics and orthotics health care exist. With an increasing aging population and wealth, governments assign more resources to health systems in Europe, which drives the growth of the market.

For Instance,

Increasing funding for leading-edge medical equipment and research enhances the quality of care in Germany, which contributes to the growth of the prosthetics and orthotics market. Continuing healthcare research is being conducted to progress the treatment of injuries, which contributes to the high level of German healthcare. Many hospitals offer orthopedic or traumatology services, where patients can undergo surgery and postoperative recovery, which drives the growth of the market.

In February 2025, Edouard Archambeaud, CEO of PROTEOR, stated, "By acquiring Filament Innovations, PROTEOR can offer the highest quality 3D printers in the industry while further elevating and streamlining the overall digital experience for our consumer." Source: (PR Newswire)

By Product

By Region

January 2026

January 2026

January 2026

January 2026