March 2026

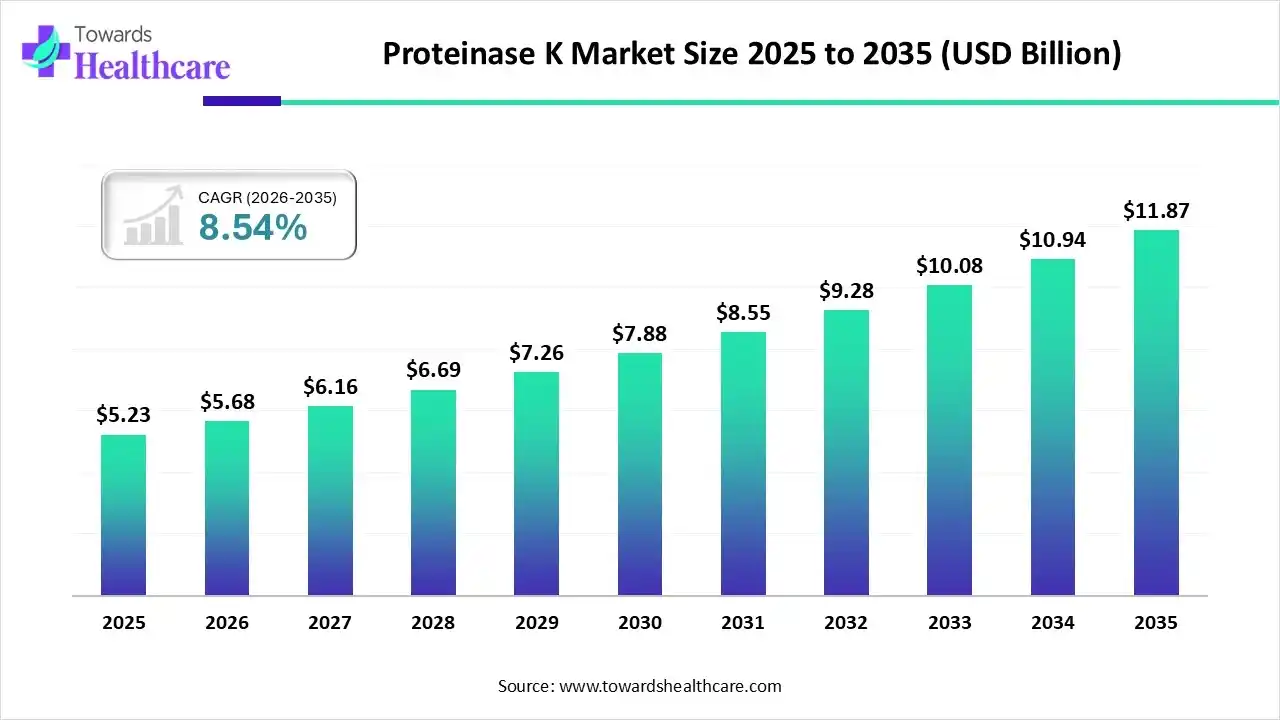

The global proteinase K market size is calculated at USD 5.23 billion in 2025, grew to USD 5.68 billion in 2026, and is projected to reach around USD 11.87 billion by 2035. The market is expanding at a CAGR of 8.54% between 2026 and 2035.

The proteinase K market is primarily driven by the increasing prevalence of chronic diseases and the demand for screening and early disease diagnosis. The growing geriatric population leads to the need for home healthcare, thereby potentiating the demand for point-of-care diagnostics. Numerous government organizations support genomic research through funding programs. The market's future looks promising, driven by technological advancements such as AI/ML and genomic technologies.

| Metric | Details |

| Market Size in 2026 | USD 5.68 Billion |

| Projected Market Size in 2035 | USD 11.87 Billion |

| CAGR (2026 - 2035) | 8.54% |

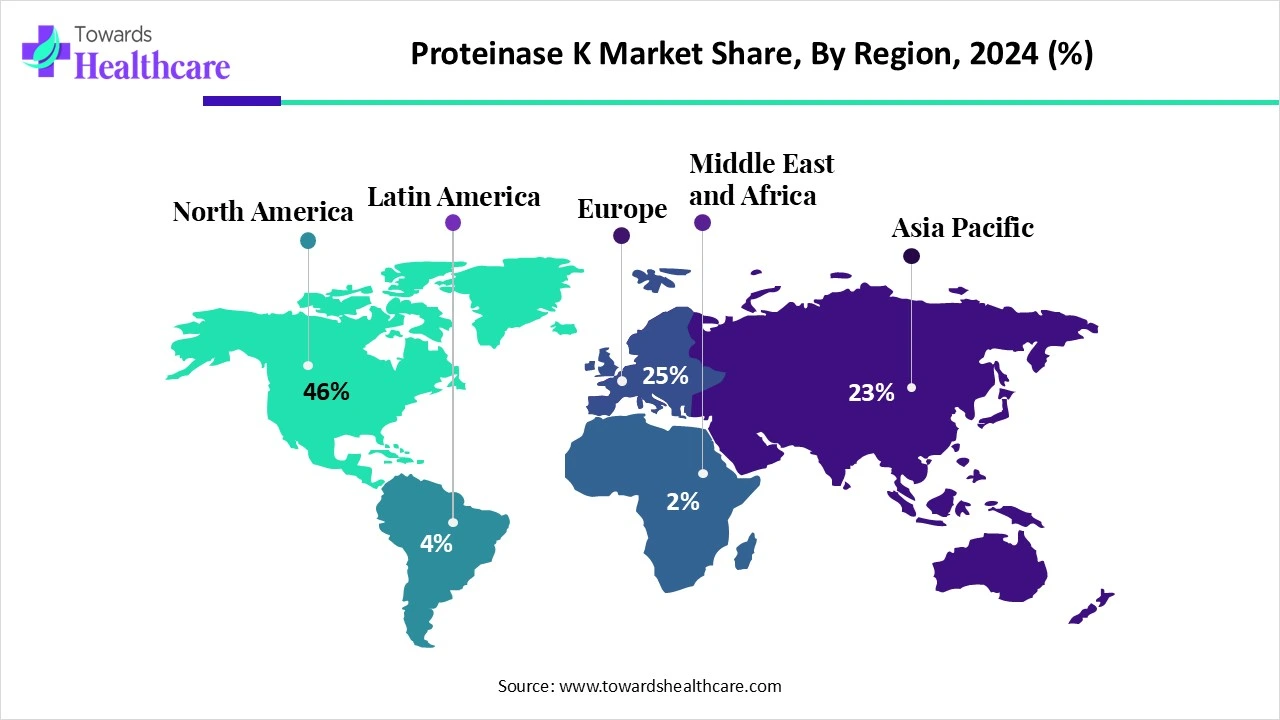

| Leading Region | North America share by 46% |

| Market Segmentation | By Form, By Therapeutic Area, By Application, By End-Use, By Region |

| Top Key Players | ACROBiosystems, Canvax Biotech, CDH Fine Chemical, ELK Biotechnology, Glentham Life Sciences, Magen Biotech, MagGenome, Meridian Bioscience, Minerva Biolabs, Inc., Sigma Aldrich, Takara Bio, TransGen Biotech Co. Ltd., Worthington Biochemical |

Proteinase K is a serine protease enzyme that is used to cleave the peptide bond in a protein. It has several applications, including the removal of nucleases that degrade DNA and RNA and the isolation of intact genomic DNA from various sources. It is also used in molecular biology and biochemistry to digest structural proteins and enzymes. It is indirectly used in the PCR technique in the DNA extraction step to improve the quality of the DNA sample.

The major growth factors of the market include the rising prevalence of genetic and infectious disorders and growing research and development activities. The growing research enables researchers to study disease progression and identify the primary structure of proteins. It also allows researchers to develop point-of-care diagnostics to detect the presence of chronic disorders. Moreover, technological advancements drive the latest innovations in genomic research.

Artificial intelligence (AI) plays a vital role in the automation of sample preparation and other genomic activities. It can be used to sequence the proteinase K enzyme to enhance its functionality. AI-driven systems can enhance efficiency, reduce errors, and optimize resource utilization in proteinase K production. AI and machine learning (ML) algorithms can analyze vast amounts of data and predict the properties of proteinase K. They can reduce the number of experimental variants in genomics, saving time and cost of experiments.

Point-of-Care Diagnostics

The major growth factor of the proteinase K market is the growing demand for point-of-care diagnostics. Point-of-care (PoC) testing refers to a clinical laboratory testing that is conducted close to the site of patient care. The growing geriatric population potentiates the demand for home healthcare, thereby increasing the use of PoC diagnostics. PoC testing leads to faster, on-site testing, facilitating quicker diagnosis and treatment decisions. Proteinase K plays a vital role in sample preparation before DNA isolation in PoC testing. It can break down protein components of the cell membrane to allow access to the genetic material and to remove nucleases that degrade DNA and RNA.

High Cost

The major challenge of proteinase K is the high cost of the enzyme. Researchers face prohibitive costs for enzyme purification. This limits the affordability of many academic institutions in low- and middle-income countries.

What is the Future of the Proteinase K Market?

The future of the market is promising, driven by the growing genomics research. Proteinase K is essential for downstream analysis in clinical and diagnostic labs, molecular biology research, and pharmaceutical and biotech industries. The downstream analysis experiments include PCR, NGS, and gene expression analysis. It is widely used in cell lysis buffers and reagents, nucleic acid extraction kits, and purification chromatography columns in sample preparation workflows. Advancements in genomic technologies also present future growth opportunities in the market. The increasing investments in R&D and biotech startups enable researchers to perform complex genomic experiments. The venture capital investment in the biotech sector was $21.4 billion in 2024, compared to $16.1 billion in 2023.

Which Form Segment Dominated the Proteinase K Market?

By form, the powder segment held a dominant presence in the market in 2024. Proteinase K powder is a lyophilized, white powder used for the digestion of proteins. Powders are widely preferred due to their high stability over diverse temperature conditions and cost-effectiveness. They can be easily transported as they are lightweight. Proteinase K is a lyophilized powder and can be used by dissolving it in water or other solvents. Powders do not require specific storage conditions due to their stability.

By form, the liquid segment is expected to grow at the fastest CAGR in the market during the forecast period. Proteinase K solution is a clear, colorless liquid with long-term stability when stored at room temperature. Proteinase K liquids are more convenient and easier to use. Researchers eliminate the need to measure specific quantities of solvent and dissolve the powder in the solvent, saving time for researchers.

Why Did the Infectious Diseases Segment Dominate the Proteinase K Market?

By therapeutic area, the infectious diseases segment led the global market in 2024. This segment dominated due to the rising prevalence of infectious diseases and the demand for early diagnosis of infectious diseases. Dengue, monkey pox, cholera, and measles are some of the most common infectious diseases. According to a statistical analysis study, Brazil reported the highest number of monkeypox cases in 2024, accounting for 25,179 cases. Proteinase K is used for diagnosing these diseases by digesting proteins, enabling the extraction and analysis of DNA and RNA.

By therapeutic area, the neurology segment is expected to grow with the highest CAGR in the market during the studied years. The rising prevalence of neurodegenerative disorders and their complexity promote the use of proteinase K. The exact mechanism of neurodegenerative diseases is still under investigation. However, several proteins have been found to play a role in impairing neurological conditions. Proteinase K can help in identifying the primary structure of novel proteins, studying the role of known proteins, and diagnosing neurodegenerative diseases at an early stage.

Which Application Segment Dominated the Proteinase K Market?

By application, the isolation & purification of genomic DNA & RNA segment held the largest revenue share of the market in 2024. Proteinase K is widely used for purifying DNA/RNA by inactivating nucleases that degrade these nucleic acids. Hence, it can obtain contamination-free DNA and RNA for various molecular biology and genomic applications. The increasing demand for PCR, NGS, and other downstream genomic workflows augments the segment’s growth.

By application, the in situ hybridization segment is expected to expand rapidly in the market in the coming years. In situ hybridization (ISH) is a technique to localize a sequence of DNA and RNA in a biological sample. Proteinase K is crucial for ISH for the digestion of proteins. Insufficient digestion may lead to diminished hybridization signal, and over-hybridization may destroy tissue morphology. Thus, researchers use specific amounts of proteinase K depending on their tissue type, length of fixation, and size of tissue core.

How the Biotech Companies Segment Dominated the Proteinase K Market?

By end-use, the biotech companies segment contributed the biggest revenue share of the market in 2024. The segmental growth is attributed to the increasing number of biotech startups and favorable infrastructure. The rising venture capital investments enable companies to adopt cutting-edge technologies for research activities. The growing number of CDMOs/CMOs also increases the demand for proteinase K.

By end-use, the academic institutions segment is expected to witness the fastest growth in the market over the forecast period. The growing research and development activities and the presence of skilled professionals propel the segment’s growth. Numerous government and private organizations provide funding for advanced research activities related to genomics and proteomics. The increasing collaboration among academic researchers fosters the segment’s growth.

North America dominated the global market share by 46% in 2024. The availability of state-of-the-art research and development facilities and the rising adoption of advanced technologies are the major growth factors of the market in North America. Government organizations launch initiatives to promote screening and early diagnosis of chronic disorders. They also provide funding for genomics and proteomics research.

U.S. Market Trends

The presence of key players, such as Thermo Fisher Scientific and Sigma Aldrich, majorly contributes to market growth. The U.S. government’s National Institute of Health granted $50.3 million for the “Multi-Omics for Health and Disease Consortium” to advance the generation and analysis of multi-omic data for human health research.

Canada Market Trends

There are over 12,000 biotech companies that employ more than 200,000 people. Out of 12,000 biotech companies, 54% of companies are related to bio-health. It is estimated that 65,000 new jobs will be created within the industry by 2029. From 2000 to 2024, Genome Canada invested approximately $1.6 billion in applied and translational genomics research.

Asia-Pacific is expected to host the fastest-growing proteinase K market in the coming years. The burgeoning biotech and pharma sectors and increasing investments boost the market. Favorable government support and increasing collaboration among key players contribute to market growth. The rising prevalence of chronic and infectious diseases and advancements in biotechnology also foster market growth.

Japan Market Trends

Japan hosted the “3rd International Conference on Infectious Diseases” in October 2024 to address the dynamic landscape of infectious diseases, foster collaboration, and advance global health. In December 2024, the Tohoku Medical Megabank Organization (ToMMo) achieved a milestone of sequencing 100,000 people. It aims to sequence 150,000 people.

India Market Trends

The Department of Biotechnology recently completed its whole genome sequencing database of over 10,000 individuals as part of the “GenomeIndia” project. The project aims to foster sustainable development through democratizing and disseminating national genetic resource knowledge.

Europe is expected to grow at a considerable CAGR in the proteinase K market in the upcoming period. The growing research and development facilities and the increasing use of advanced technologies propel the market. The rapidly expanding molecular biology sector and the increasing number of biotech startups augment market growth. The presence of key players and increasing collaborations govern the market. Key players, such as Bioron GmbH and Dutscher, held a major growth factor market in Europe.

Germany Market Trends

The German biotech startups raised EUR 1.92 billion in funding in 2024, an increase of 78%. Several government organizations dealing with infectious diseases will receive EUR 50 million in funding from 2023 to 2028 to advance the R&D for developing new tools to fight HIV/AIDs, malaria, TB, and other neglected tropical diseases (NTDs).

UK Market Trends

A recent report by the Bioindustry Association stated that UK biotech companies raised £924 million in venture capital investments from January-March 2025.The UK holds the first position in Europe with the largest amount of investment in the biotech sector. The UK hosts around 7,067 biotech companies as of Q1 2025.

South America is expected to grow significantly in the proteinase K market during the forecast period, due to growing R&D investments. At the same time, the expanding industries and diagnostic centres are also increasing their demand for the development of PCR techniques. Additionally, increasing government initiatives are also enhancing the market growth.

Brazil Proteinase K Market Trends

The growth in the R&D activities in Brazil is increasing the demand for proteinase K for various diagnostic applications. The expanding biotechnology and pharma industries are also increasing their use in the development of molecular diagnostic platforms, which are further supported by government investments.

MEA is expected to grow significantly in the proteinase K market during the forecast period, due to expanding healthcare infrastructure. The growing government initiatives are also increasing their demand, where the increasing interest in molecular diagnostic are also growing their use, promoting the market growth.

Saudi Arabia Proteinase K Market Trends

The growing government initiatives and increasing interest in molecular diagnostics are increasing the use of proteinase K in Saudi Arabia. At the same time, the expanding healthcare infrastructure, increasing shift toward personalized treatment options, and growing interest in genomics are also increasing their demand.

R&D

Clinical Trials and Regulatory Approvals

Formulation and Final Dosage Preparation

Packaging and Serialization

Patient Support and Services

Matthew Lawrence, CEO of Virscio, commented that the launch of their molecular biology platform represents a major milestone in the company’s objective of fully integrated translational R&D capabilities to support precision medicine companies in developing next-generation therapeutics. The company can deliver more comprehensive scientific and biological insights to improve study interpretation and accelerate program decision-making.

By Form

By Therapeutic Area

By Application

By End-Use

By Region

March 2026

March 2026

March 2026

March 2026