January 2026

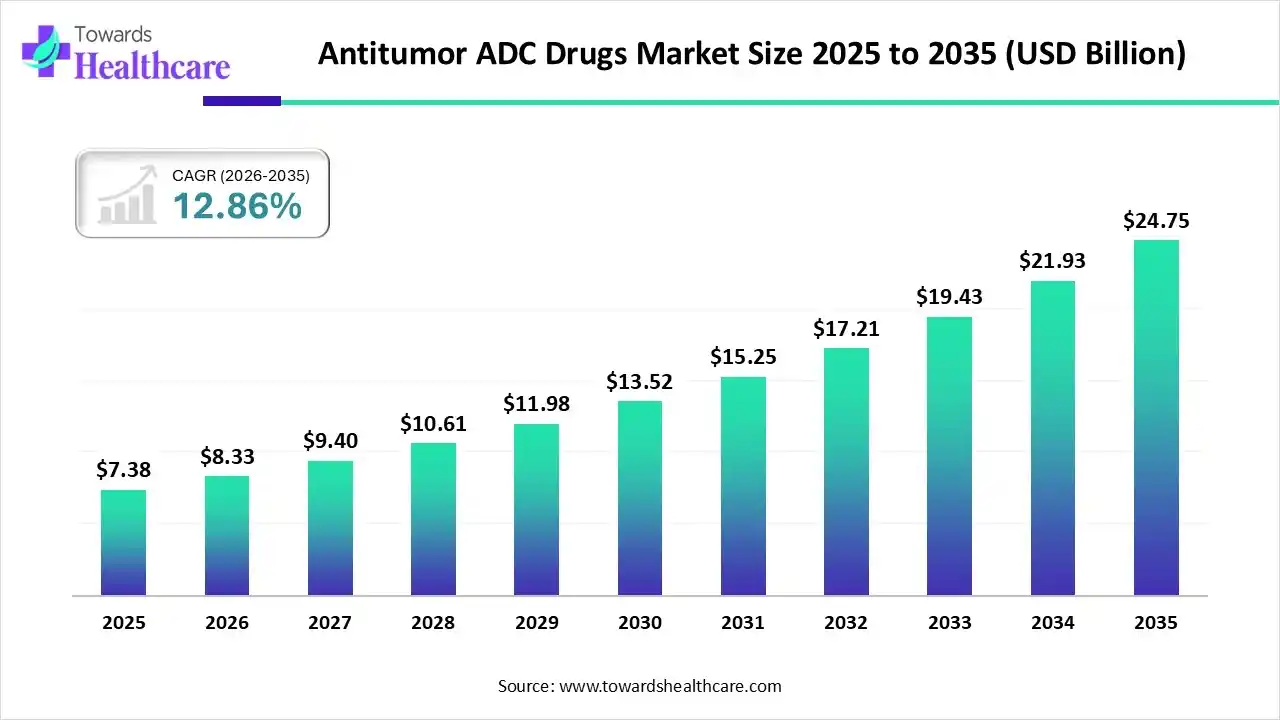

The antitumor ADC drugs market size stood at US$ 7.38 billion in 2025, grew to US$ 8.33 billion in 2026, and is forecast to reach US$ 24.75 billion by 2035, expanding at a CAGR of 12.86% from 2026 to 2035.

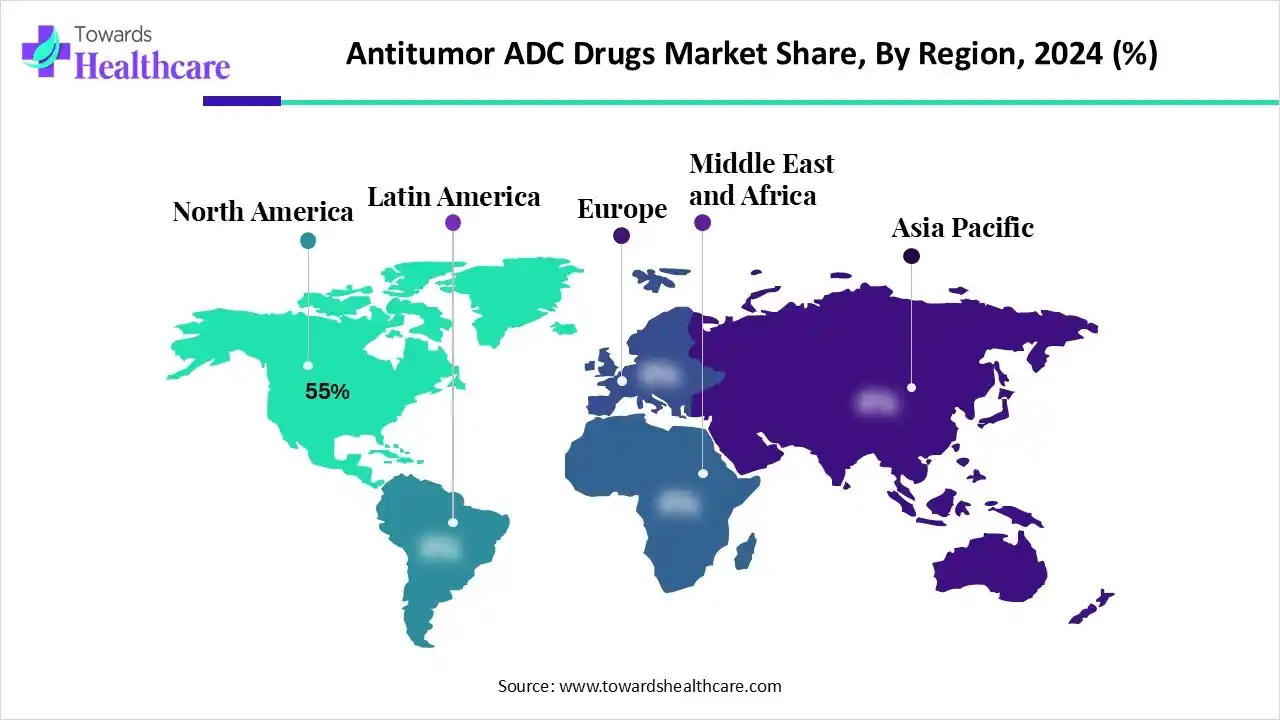

The antitumor ADC drugs market is experiencing rapid growth due to rising cancer prevalence and the increasing demand for targeted therapies with minimal side effects. North America dominates the market, driven by advanced research infrastructure, strong pharmaceutical innovation, and favorable regulatory frameworks supporting rapid drug approvals. Continuous technological advancements in linker and payload chemistry, coupled with strategic collaborations among major biopharmaceutical companies, are enhancing treatment efficacy. Growing investments in oncology R&D further strengthen the region’s leadership in the global ADC drugs market.

| Key Elements | Scope |

| Market Size in 2026 | USD 8.33 Billion |

| Projected Market Size in 2035 | USD 24.75 Billion |

| CAGR (2025 - 2035) | 12.86% |

| Leading Region | North America by 55% |

| Market Segmentation | By Drug Type, By Payload Type, By Linker Technology, By Target Antigen / Therapeutic Area, By Route of Administration, By Distribution Channel, By Type of Manufacturer, By Region |

| Top Key Players | Seattle Genetics, Inc. (Seagen), Roche Holding AG, ImmunoGen, Inc., Daiichi Sankyo Company, Limited, Pfizer Inc., Amgen Inc., AstraZeneca plc, AbbVie Inc., Bristol-Myers Squibb Company, Gilead Sciences, Inc., Genmab A/S, Takeda Pharmaceutical Company Limited, Emergent BioSolutions Inc., Synaffix B.V.,Sorrento Therapeutics, Inc., Zymeworks Inc., Allogene Therapeutics, Inc., Astellas Pharma Inc., Curis, Inc., BioNTech SE |

The antitumor ADC drugs market is driven by the rising global incidence of cancer, growing demand for targeted therapies, and continuous advancements in biopharmaceutical research. Increasing investments in oncology drug development and favorable regulatory support further accelerate market expansion. Anti-tumor ADC (Antibody-Drug Conjugate) drugs are an innovative class of targeted cancer therapies that combine monoclonal antibodies with potent cytotoxic agents through chemical linkers. These drugs precisely deliver toxic payloads to cancer cells while minimizing damage to healthy tissues. ADCs enhance treatment specificity, reduce side effects, and improve survival outcomes, making them one of the most promising advancements in modern oncology treatment.

Recent advancements in injectable anti-tumor ADCs have pushed the field forward markedly. At AACR 2025, Chinese biotech firms presented dual-payload bispecific ADCs (e.g., targeting EGFR + HER3) to improve targeting and overcome resistance. Datopotamab deruxtecan gained expanded indications, including EGFR-mutated NSCLC, broadening its injectable usage. Raludotatug deruxtecan received FDA Breakthrough Therapy Designation for CDH6-expressing platinum-resistant ovarian and related cancers. Other improvements include enhanced linker chemistry, site-specific conjugation, and novel payloads to reduce off-target toxicity and increase therapeutic window.

The branded ADC drugs segment dominates the market with a share of 75% due to strong brand recognition, established clinical efficacy, and regulatory approvals. Leading pharmaceutical companies heavily promote these products, ensuring wide physician adoption and patient trust. Additionally, proprietary technologies, targeted payloads, and exclusive distribution networks give branded ADCs a competitive advantage over generic alternatives, maintaining market leadership.

The generic/biosimilar ADC drugs segment is estimated to be the fastest-growing in the market due to several key factors. These include the expiration of patents for original branded ADCs, leading to increased competition and reduced treatment costs. Biosimilars typically enter the market at a list price 15% to 35% lower than their reference products, making cancer therapies more accessible to a broader patient population.

The cytotoxic payloads segment is the dominant segment in the market, with a share of 70% due to its exceptional potency and ability to selectively kill cancer cells when linked to targeted antibodies. Advances in payload design, including novel DNA-damaging agents and microtubule inhibitors, enhance efficacy while minimizing off-target toxicity. Additionally, ongoing research into next-generation payloads, combination therapies, and site-specific conjugation techniques has accelerated adoption. Regulatory approvals of innovative cytotoxic ADCs and growing investments in R&D further drive the rapid growth of this segment in oncology therapeutics.

The novel payloads segment is anticipated to be the fastest-growing in the market, due to the development of next-generation cytotoxic agents with higher specificity and reduced off-target toxicity. Innovations such as DNA-alkylating agents, topoisomerase inhibitors, and dual-action payloads improve therapeutic efficacy. Combined with advanced linker technologies and targeted antibodies, these novel payloads enhance treatment outcomes, driving rapid adoption in oncology therapeutics.

The cleavable linkers segment dominates the market with a share of 60% due to its ability to release cytotoxic payloads efficiently within targeted cancer cells. These linkers respond to specific intracellular conditions, such as pH changes or enzymatic activity, ensuring precise drug delivery and minimizing damage to healthy tissues. Their versatility with various antibodies and payloads, along with demonstrated clinical efficacy, makes cleavable linkers the preferred choice for designing effective and safe ADC therapies in oncology.

The site-specific/novel linkers segment is estimated to be the fastest-growing in the market, due to its ability to improve stability, reduce off-target toxicity, and enable precise payload delivery. Advanced conjugation techniques ensure uniform drug-to-antibody ratios, enhancing therapeutic efficacy. Coupled with innovative payloads and targeted antibodies, these linkers support next-generation ADC development, driving rapid adoption in oncology therapeutics.

The hematologic cancers segment dominates the market share of 35% due to the high prevalence of blood cancers such as leukemia, lymphoma, and multiple myeloma. ADCs effectively target specific antigens expressed on malignant blood cells, offering precise therapy with reduced systemic toxicity. Early clinical successes and regulatory approvals for hematologic indications further reinforce adoption, making this segment the leading application area in the ADC market.

The solid tumor segment is estimated to be the fastest-growing segment in the market with a share of 50% due to the increasing incidence of cancers such as breast, lung, and gastric tumors. Advances in identifying tumor-specific antigens, improved linker and payload technologies, and successful clinical trials are driving the adoption of ADCs for targeted treatment of solid tumors.

The Intravenous (IV) segment dominates the market with a share of 90% due to its ability to deliver precise doses directly into the bloodstream, ensuring effective distribution of the cytotoxic payload to targeted cancer cells. Intravenous administration allows controlled infusion rates, compatibility with various ADC formulations, and established clinical protocols, making it the preferred route for oncology treatments and supporting widespread adoption in hospitals and cancer care centers.

The subcutaneous/intramuscular segment is the fastest-growing in the anti-tumor ADC drugs market, due to patient convenience, reduced hospital visits, and easier administration. These routes enhance treatment adherence and support outpatient therapy adoption, driving rapid growth across oncology settings.

The hospital pharmacies/oncology centers segment dominates the market with a share of 70% due to their advanced infrastructure, access to specialized oncology expertise, and ability to administer complex intravenous therapies. These settings ensure proper patient monitoring, adherence to treatment protocols, and safe handling of cytotoxic agents, making them the preferred channels for delivering ADC therapies effectively and reliably.

The online pharmacies/direct-to-patient segment is anticipated to be the fastest-growing in the market, due to increasing patient preference for convenient access, home delivery, and reduced hospital visits. Integration with telemedicine, digital prescriptions, and specialized logistics for handling cytotoxic therapies enhances treatment adherence and expands market reach, particularly in remote or underserved regions.

The In-house/integrated biopharma segment dominates the market with a share of 65% due to its ability to control the entire development and manufacturing process. This integration ensures high-quality standards, streamlined R&D, faster clinical trial execution, and efficient production, giving companies a competitive advantage in bringing innovative ADC therapies to market.

The outsourced/CDM partners segment is anticipated to be the fastest-growing in the market, due to increasing demand for specialized manufacturing, cost efficiency, and accelerated drug development timelines. Partnerships with contract development and manufacturing organizations allow biopharma companies to access advanced technologies, scale production quickly, and focus on R&D, driving rapid adoption of outsourced solutions in ADC therapy development.

North America dominates the anti-tumor ADC drugs market share by 55% due to advanced biopharmaceutical infrastructure, high R&D investment, and strong regulatory support, facilitating rapid drug approvals. The region also benefits from a high prevalence of cancer, well-established clinical trial networks, and strategic collaborations between biotech firms and pharmaceutical companies, driving innovation and market adoption.

In 2025, the U.S. is projected to experience a significant number of new cancer cases, underscoring the urgent need for advanced treatment options. The American Cancer Society estimates approximately 316,950 new cases of invasive breast cancer in women, with an additional 59,080 cases of ductal carcinoma in situ (DCIS). Bladder cancer is also notable, with an estimated 84,870 new cases expected. These statistics highlight the increasing cancer burden, particularly among women and older adults, emphasizing the necessity for effective therapies.

The Asia-Pacific region is the fastest-growing market for anti-tumor ADC drugs due to rising cancer prevalence, expanding healthcare infrastructure, and increasing adoption of advanced therapies. Strong government support, growing investments in R&D, and the presence of emerging biotech firms in countries like China, Japan, and India are accelerating clinical development and commercial availability of ADCs, driving rapid regional market growth.

In China, the increasing prevalence of brain tumors and overall cancer cases is significantly driving the growth of the anti-tumor antibody-drug conjugate (ADC) market. According to the World Health Organization's Global Cancer Observatory, China is projected to have approximately 5.12 million new cancer cases in 2025, up from 4.82 million in 2022. This rising cancer burden, particularly brain tumors, underscores the urgent need for effective therapies like ADCs. ADCs, which deliver cytotoxic agents directly to cancer cells, offer a promising treatment option, leading to increased demand and market growth in China.

The European anti-tumor antibody-drug conjugate (ADC) market is experiencing notable growth due to several key factors. The increasing incidence of cancer across European nations, alongside the expanding role of targeted therapies in oncology, is a key driver accelerating the demand for ADCs. Additionally, the rising prevalence of breast cancer, coupled with increased approvals for ADCs for breast cancer treatment, is contributing to the market's expansion. The presence of major pharmaceutical companies and research institutions in countries like Germany, the UK, and Switzerland further supports the development and adoption of ADC therapies in the region.

In 2025, the increasing prevalence of cancer in the UK is significantly driving the growth of the anti-tumor antibody-drug conjugate (ADC) market. According to the World Health Organization (WHO), cancer is a leading cause of death in the UK, with lung, colorectal, and breast cancers being the most common types. The rising incidence of these cancers underscores the urgent need for effective treatment options. ADCs, which deliver cytotoxic agents directly to cancer cells, offer a promising solution by minimizing damage to healthy tissues.

Research begins with identifying suitable tumor antigens, designing monoclonal antibodies, selecting cytotoxic payloads, and optimizing linker technologies. Preclinical studies test efficacy, stability, and safety before progressing to human trials. Iterative refinements ensure high specificity and minimized toxicity.

Organizations: Roche, Seagen (Pfizer), Daiichi Sankyo, AstraZeneca, Gilead Sciences, ImmunoGen, Takeda.

ADC candidates undergo Phase I, II, and III clinical trials to assess safety, dosage, efficacy, and adverse effects. Regulatory submissions are prepared for authorities like FDA, EMA, and PMDA. Successful approval allows commercial manufacturing and distribution.

Organizations: FDA (USA), EMA (Europe), PMDA (Japan), national regulatory bodies, and clinical research organizations (CROs) such as IQVIA and Parexel.

Post-launch, programs include patient education, adherence monitoring, financial support, and infusion guidance. Specialized oncology centers, hospitals, and homecare services ensure safe administration. Patient assistance programs improve treatment continuity and accessibility, enhancing overall outcomes.

Organizations: Hospital pharmacies, oncology centers, specialty pharmacies, non-profits, and pharma patient support divisions (e.g., Roche Patient Assistance, Pfizer Oncology Services).

Seagen (Acquired by Pfizer)

Roche / Genentech

AstraZeneca / Daiichi Sankyo

Gilead Sciences (Acquired Immunomedics)

ADC Therapeutics

ImmunoGen

BioNTech

Byondis

By Drug Type

By Payload Type

By Linker Technology

By Target Antigen / Therapeutic Area

By Route of Administration

By Distribution Channel

By Type of Manufacturer

By Region

January 2026

January 2026

January 2026

January 2026