February 2026

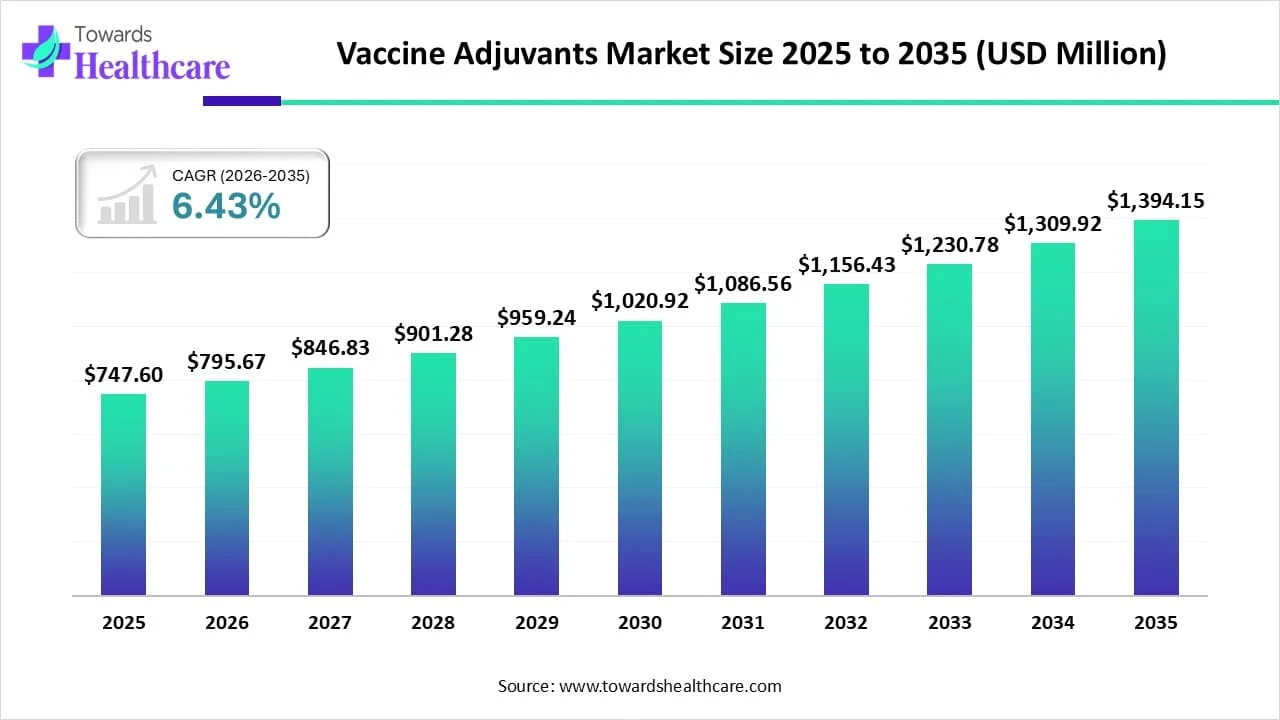

The global vaccine adjuvant market size recorded US$ 747.6 million in 2025, set to grow to US$ 795.67 million in 2026 and projected to hit nearly US$ 1394.15 million by 2035, with a CAGR of 6.43% throughout the forecast timeline.

The vaccine adjuvant market in 2025 is witnessing significant momentum driven by the nation's robust biotech manufacturing base, growing vaccination programs, and proactive government support for domestic vaccine development. The production of sophisticated adjuvants for both conventional and next-generation vaccines is being accelerated by the rise in collaborations between Indian pharmaceutical companies and international vaccine developers.

With a growing focus on preventive healthcare and pandemic preparedness, India is establishing itself as a center for cutting-edge adjuvant technologies in addition to being a major supplier of favorable vaccines. Major biotech clusters are making it easier to conduct research, scale up production, and concentrate on exporting adjuvant-based vaccine solutions.

| Metric | Details |

| Market Size in 2026 | USD 795.67 Million |

| Projected Market Size in 2035 | USD 1394.15 Million |

| CAGR (2026 - 2035) | 6.43% |

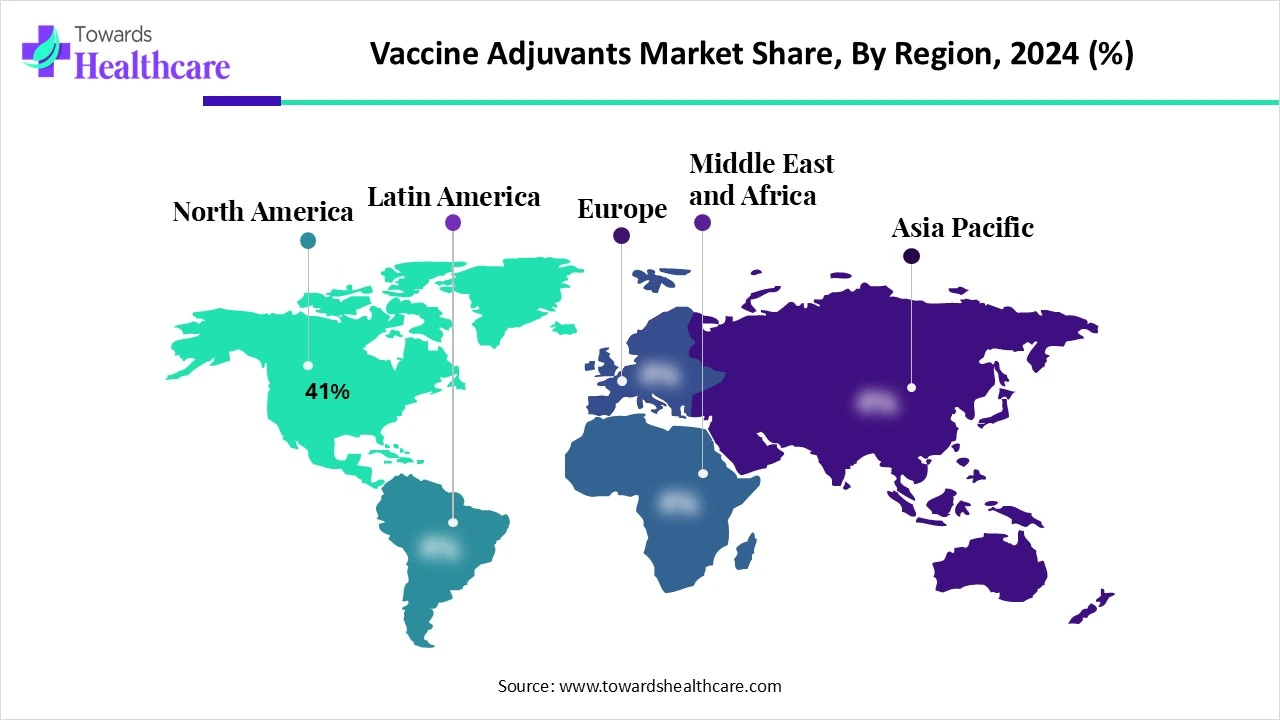

| Leading Region | North America Share 41% |

| Market Segmentation | By Product Type, By Route of Administration, By Disease Area, By Type of Vaccine, By End User, By Region |

| Top Key Players | GSK, Croda International, Dynavax Technologies, SEPPIC, InvivoGen, Novavax, Agenus Inc., Brenntag Biosector, Adjuvatis, IDRI, Prizer Inc., Sanofi, Matrivax Research and Development Corp., VaxLiant, CSL Seqirus, Biomay AG, Ozgene Ptv Ltd, Kinddeva Drug Delivery, Sigma Aldrich, Avanti Polar Lipids |

The vaccine adjuvants market encompasses the development, production, and application of adjuvant substances added to vaccines to enhance and modulate the immune response to an antigen. Adjuvants improve vaccine efficacy, reduce antigen dosage requirements, and enable stronger and longer-lasting immunity, particularly in subunit, recombinant, and inactivated vaccines. The market is driven by the growing need for next-generation vaccines (e.g., for cancer, HIV, and pandemics), increasing geriatric and immunocompromised populations, and the expansion of COVID-19 and mRNA vaccine platforms.

Vaccine adjuvants enhance the effectiveness of immunizations by stimulating a stronger and longer-lasting immune response. They ais in the innate immune system's activation, which improves the body's ability to recognize the vaccine antigen. This results in stronger cellular immunity, better antibody production, and frequently lower dosages needed to provide protection. Moreover, certain adjuvants aid in focusing on immune pathways, increasing the effectiveness of vaccinations, particularly in older adults or groups with weakened immune systems.

AI is playing a transformative role in the vaccine adjuvants market by accelerating the discovery, design, and optimization of adjuvants. While in silico platforms mimic immune responses to minimize trial and error in early-stage development, machine learning tools such as AdjuPred aid in predicting the most effective adjuvant antigen combinations. By examining intricate immunological data to comprehend the effects of various adjuvants on the body, AI also makes immune fingerprinting possible. Moreover, lipid nanoparticle delivery systems for protein and mRNA-based vaccines are optimized using AI models. These developments not only hasten the onset of R&D but also aid in the creation of tailored vaccines that are more effective and have fewer adverse effects.

Rising Demand for Long-Lasting and Effective Immunity

Demand for adjuvants is rising because of the growing number of infectious and chronic disease cases, which is driving the need for vaccines that provide a more robust and long-lasting immune response. In many areas, aging populations, urbanization, and modern lifestyles have resulted in weakened baseline immunity. Adjuvants frequently result in fewer boosters being needed by promoting a faster and more comprehensive immune response. This is particularly important in places with limited resources and rural areas where access to vaccines varies. Adjuvanted vaccines are turning into an essential public health tool as the prevalence of illnesses like malaria, hepatitis, and HPV rises.

Public Misinformation and Vaccine Hesitancy

Misinformation regarding vaccine ingredients, especially adjuvants, is still widely disseminated online, which erodes public confidence in vaccine safety. Even though adjuvants have been used safely for decades, they are frequently mislabeled as toxic or experimental. Health organizations invest in educations invest in educational campaigns because of this reluctance, which reduces vaccine uptake. Communities that have historically viewed pharmaceutical interventions with skepticism are particularly vulnerable to mistrust.

Adjuvants Enabling dose Sparing and Rapid Scale-up in Pandemics

Adjuvants are essential during outbreaks or supply shortages because they enable vaccine manufacturers to use less antigen per dose without sacrificing efficacy. Additionally, this antigen-sparing effect enhances scalability, facilitating the manufacturer's ability to quickly serve populations around the world. Several governments are pursuing adjuvant stockpiling strategies to prepare for future pandemics.

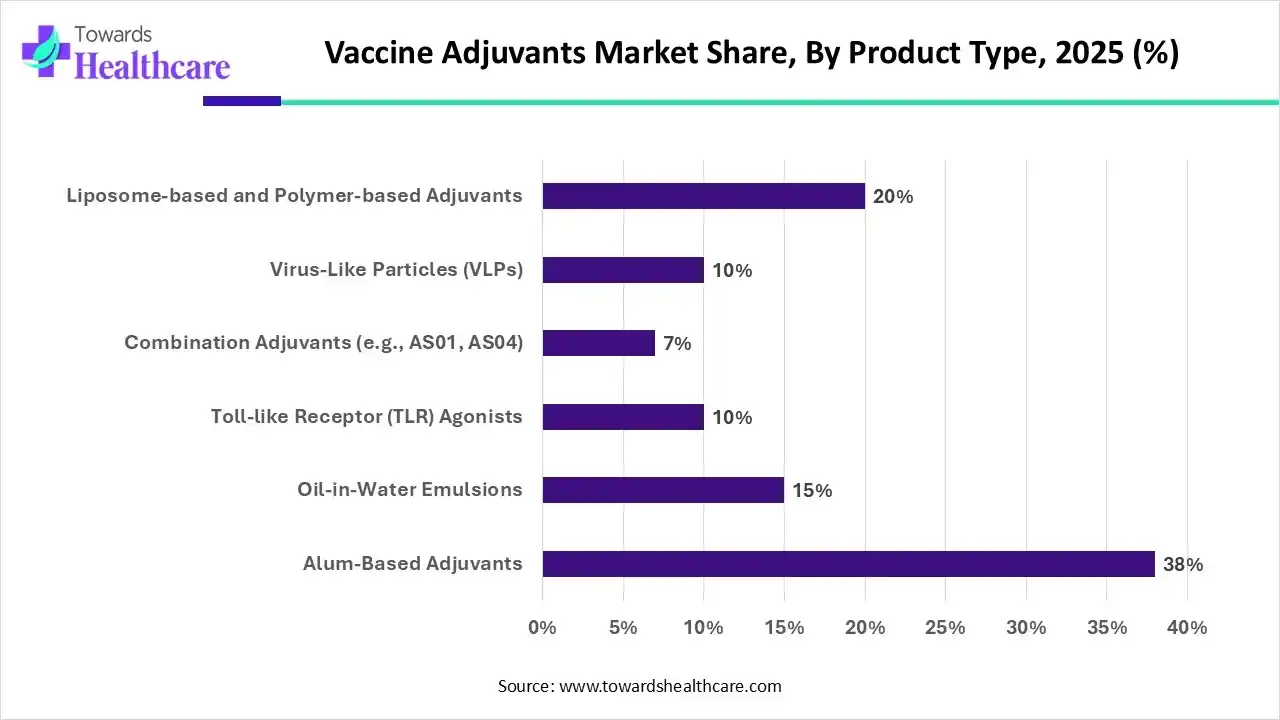

Why did the Alum-Based Adjuvants Segment Dominate the Vaccine Adjuvants Market in 2025?

The alum-based adjuvants segment dominated the market by 38% because of their established safety profile, affordability, and long history of use. Many approved vaccines, including those for tetanus, diphtheria, and hepatitis A and B, contain these adjuvants, which are frequently derived from aluminum salts. Across the world, they are the vaccine of choice for both adults and children due to their capacity to boost immune responses with few adverse effects.

The toll-like receptor agonist segment is the fastest-growing product type, due to their exceptional immunostimulatory properties and capacity to elicit both innate and adaptive immune responses. These adjuvants are perfect for the development of mRNA vaccines for infectious diseases and cancer because they mimic pathogen-associated molecular patterns (PAMPs). Rapid growth in this market is being driven by ongoing clinical trials and more funding for TLR-based vaccine platforms.

Why did the Intramuscular (IM) Segment Hold the Largest Share of the Vaccine Adjuvants Market in 2025?

The intramuscular (IM) segment dominated the market by 58%, as it offers a consistent and efficient route for delivering vaccines, ensuring optimal absorption and immune response. IM administration is preferred in most routine immunizations, supported by a strong base of clinical evidence, established dosage techniques, and broader patient acceptance.

The intranasal segment is the fastest growing route, motivated by its convenience, potential for mucosal immunity, and non-invasiveness, particularly for young patients and those who are needle averse. The demand for this route is being further fueled by the development of respiratory vaccines such as those for COVID-19 and influenza, which directly target mucosal membranes.

| Segment | Share 2025 (%) |

| Infectious Diseases | 72% |

| Cancer Vaccines | 15% |

| Allergy and Autoimmune Diseases | 5% |

| Veterinary Applications | 8% |

Why did the Infectious Diseases Segment Dominate the Vaccine Adjuvants Market in 2025?

The infectious diseases segment dominated the vaccine adjuvant market by 72%, as global immunization programs for diseases like hepatitis, HPV, influenza, and COVID-19 rely heavily on adjuvanted vaccines to improve efficacy. Widespread government initiatives, public health mandates, and global vaccine access programs continue to reinforce this segment’s stronghold.

The cancer segment is the fastest-growing disease area, as developments in immuno-oncology and therapeutic vaccines have brought attention to adjuvants' function in enhancing antigen-specific T-cell responses. Advanced adjuvants are being used more often in personalized cancer vaccines to increase their effectiveness, particularly in those that target neoantigens and tumor-specific antigens.

Why did the Subunit Vaccines Segment Dominate the Vaccine Adjuvants Market in 2025?

The subunit vaccines segment dominates the market by 30%, as they use purified antigenic proteins, making them safer and more stable than whole-pathogen vaccines. These vaccines depend on adjuvants to enhance immunogenicity and are widely used in licensed vaccines for diseases like hepatitis B and HPV, supported by strong regulatory approval and scalable production.

The DNA and mRNA vaccines segment is the fastest-growing vaccine type, driven by the COVID-19 pandemic and their capacity for quick development and modification. These vaccines are a focus of innovation and investment because they need strong adjuvants or delivery systems to increase humoral and cellular immune responses.

Which End User Segment Leads and Which Grows Fastest in the Vaccine Adjuvants Market?

The human vaccines segment dominates the vaccine adjuvants market by 82% given the enormous global demand for routine immunization, pandemic preparedness, and travel-related vaccinations. Government vaccination drives, WHO immunization programs, and adult booster requirements further sustain this dominance.

The veterinary vaccines segment is the fastest-growing end-user, motivated by the need to stop disease outbreaks in livestock and companion animals, growing awareness of zoonotic diseases, and investments in animal health. Adjuvants for veterinary vaccines are growing quickly, due in part to the agricultural sector's emphasis on herd immunity and productivity.

North America dominated the market share by 41% in 2024, because of its strong biotechnology infrastructure, early adoption of innovative adjuvant platforms, and large vaccine research expenditures. The area boasts high vaccination rates and substantial government support for public health initiatives. The creation of sophisticated adjuvants is also aided by partnerships between academic institutions and pharmaceutical companies. The region's dominance is also a result of ongoing clinical trials and strategic acquisitions.

The U.S. vaccine adjuvants market is witnessing significant growth, driven by a rise in emerging infectious diseases, robust and targeted vaccination demand, and growing R&D investments. Major biotechnology and pharmaceutical companies are still drawn to invest in cutting-edge adjuvant technologies by the country's robust pharmaceutical infrastructure, supportive regulatory frameworks, and strategic government initiatives. Public-private partnerships are also speeding up the development of vaccines, particularly those for cancer and mRAN. In addition, the U.A. market is strengthening its dominant position globally by taking advantage of an increasing emphasis on precision immunology and next-generation adjuvants designed for populations and diseases.

Asia Pacific is the fastest-growing region in the vaccine adjuvant market due to increased vaccine production capacity investments, growing immunization awareness, and encouraging government programs to improve pandemic preparedness and combat regional endemic diseases. Nations in the region are speeding up the development of adjuvanted vaccines. Furthermore, more clinical trials and more affordable manufacturing capabilities are drawing international business to the area to form alliances and set up production facilities.

India’s vaccine adjuvant market is surging, fueled by robust investments in domestic R&D, government-sponsored immunization programs, and expanding local pharmaceutical capacity. Businesses like Serum Institute of India and Bharat Biotech are growing their domestic adjuvant platforms such as Matrix-M and Algel-IMDG to support high-volume volume reasonably priced vaccination programs. India's growing leadership in regional and international adjuvant-enabled vaccine development is cemented by this ecosystem of innovation and technology transfer, which makes it possible to produce next-generation adjuvanted vaccines in a scalable and economical manner.

By Product Type

By Route of Administration

By Disease Area

By Type of Vaccine

By End User

By Region

February 2026

February 2026

February 2026

February 2026