February 2026

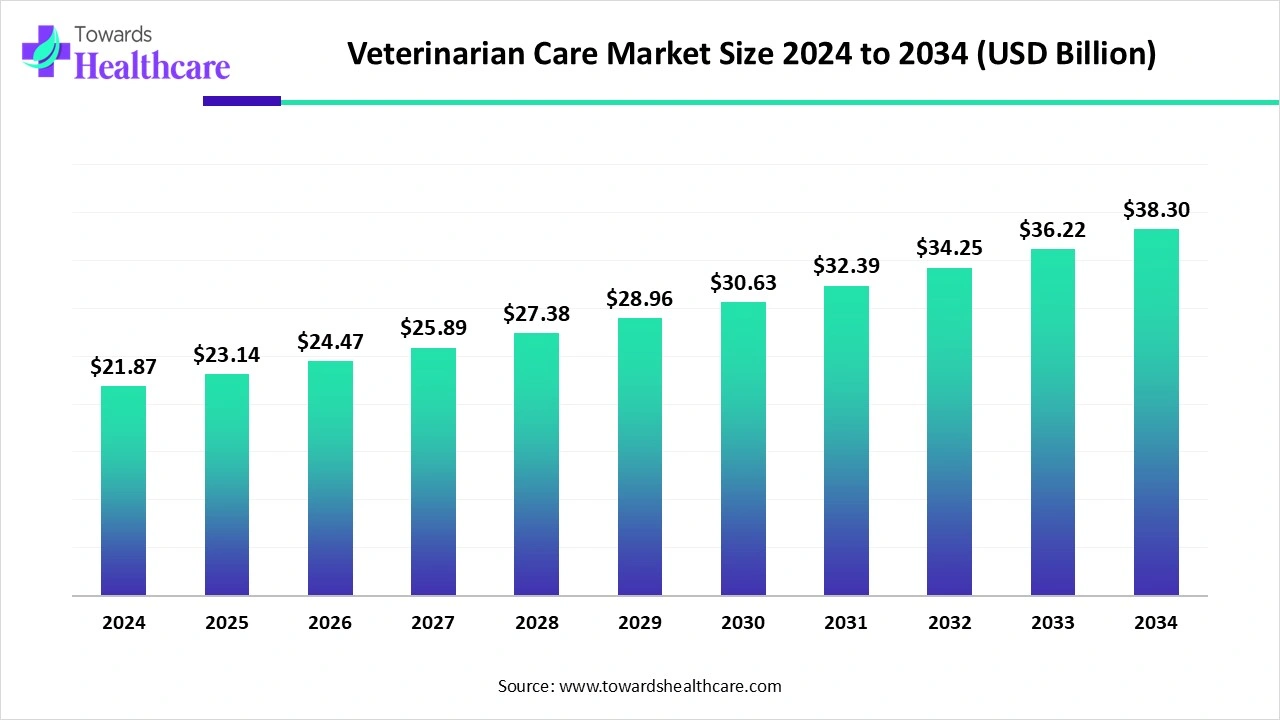

The global veterinarian care market size began at US$ 21.87 billion in 2024 and is forecast to rise to US$ 23.14 billion by 2025. By the end of 2034, it is expected to surpass US$ 38.3 billion, growing steadily at a CAGR of 5.75%.

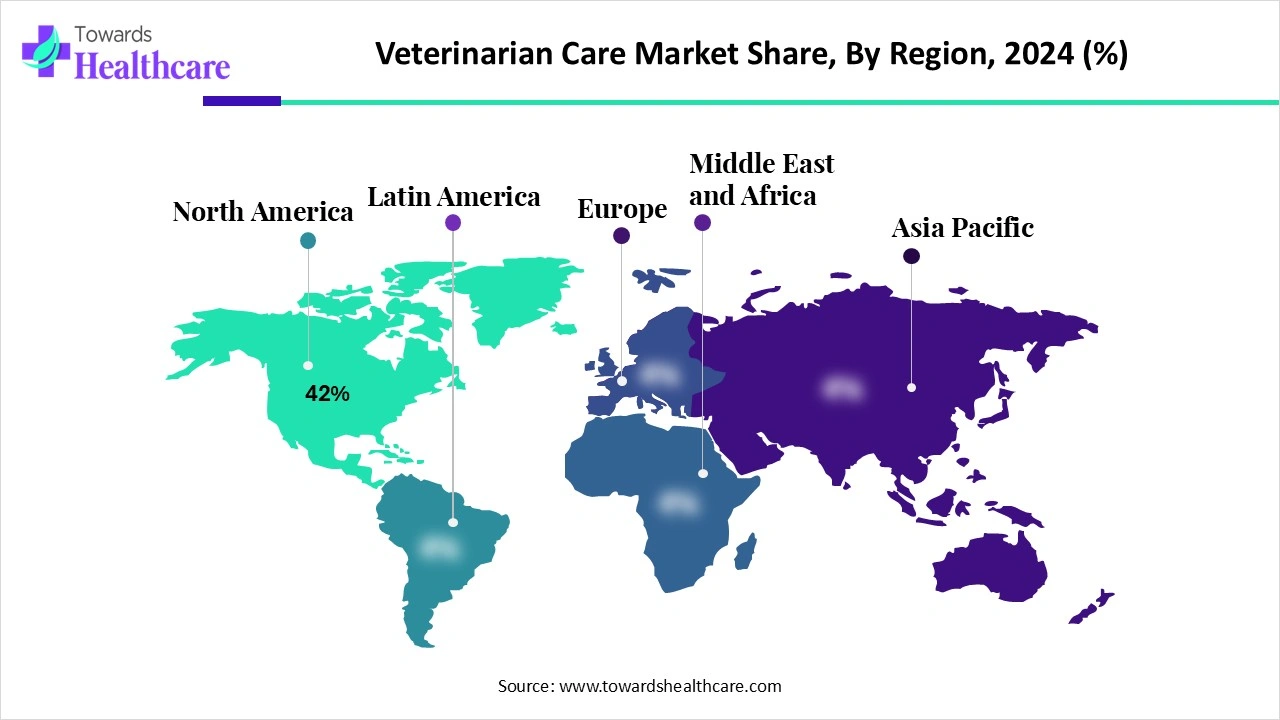

The global veterinarian care market is experiencing steady growth, driven by rising pet ownership, increasing awareness of preventive healthcare, and advancements in veterinary technologies such as diagnostics, imaging, and telemedicine. North America leads the market due to its high companion animal population, widespread adoption of pet insurance, and growing expenditure on premium pet healthcare products and services. Expansion of veterinary clinics, hospitals, and specialized care facilities further supports market growth, while the humanization of pets and lifestyle changes continue to drive demand for quality veterinary care across the region.

| Table | Scope |

| Market Size in 2025 | USD 23.14 Billion |

| Projected Market Size in 2034 | USD 38.3 Billion |

| CAGR (2025 - 2034) | 5.75% |

| Leading Region | North America 42% |

| Market Segmentation | By Service Type, By Animal Type, By End User, By Mode of Service, By Region |

| Top Key Players | Banfield Pet Hospital (Mars, Inc.), VCA Animal Hospitals (Mars, Inc.), BluePearl Specialty and Emergency Pet Hospital, National Veterinary Associates (NVA), Greencross Vets, IDEXX Laboratories (diagnostics-focused), CVS Group Plc, MedVet Associates, VetPartners (U.S. & Australia), Pathway Vet Alliance (Thrive Pet Healthcare), AniCura (Mars, Inc., Europe), Pets at Home Veterinary Group (U.K.), Mission Veterinary Partners, Petco Veterinary Services, Zoetis (veterinary services collaborations, diagnostics), Village Vet Group, VetCor, Veterinary Emergency Group (VEG), CityVet, Innovetive Petcare |

Veterinarian care refers to the comprehensive range of medical, preventive, and wellness services provided to companion, farm, and exotic animals. This includes routine checkups, vaccinations, diagnostics, surgical procedures, disease management, and emergency care, aimed at maintaining optimal animal health and longevity. In a business context, veterinary care encompasses not only clinical services but also associated products such as pharmaceuticals, pet food, supplements, and insurance solutions. Growing pet ownership, rising consumer awareness of animal welfare, and technological advancements in diagnostics and treatment are driving demand, making veterinary and care services a critical and expanding segment of the animal health industry.

AI integration is transforming the veterinarian care market by enhancing diagnostic accuracy, streamlining workflows, and improving treatment outcomes. Artificial intelligence tools analyze large volumes of clinical data, including imaging, lab results, and medical histories, enabling faster and more precise disease detection. Predictive analytics help veterinarians anticipate potential health issues, personalize treatment plans, and optimize preventive care. AI-powered telemedicine platforms facilitate remote consultations, triaging cases efficiently, and reduce clinic congestion. Additionally, AI assists in inventory management, scheduling, and record-keeping, increasing operational efficiency. Overall, AI adoption elevates the quality, accessibility, and cost-effectiveness of veterinary services, benefiting both pets and practitioners.

Expansion of Veterinary Hospitals and Clinics

The expansion of veterinary clinics and hospitals significantly contributes to the growth of the veterinarian care market by enhancing service accessibility, improving treatment capabilities, and fostering industry consolidation. In 2025, several notable developments highlight this trend.

For instance, in May 2025, Oklahoma State University received a historic US$250 million investment to construct a new 255,000-square-foot veterinary teaching and research hospital. This facility aims to replace the existing one, addressing infrastructure needs and expanding educational and clinical services. Similarly, in 2025, in North Carolina, a US$2.5 million veterinary clinic is planned to serve both shelter animals and pets, reflecting a commitment to comprehensive animal care. Additionally, in August 2025, in Mumbai, the Brihan Mumbai Municipal Corporation announced plans to establish a 100-bed veterinary hospital, incorporating advanced diagnostic equipment and specialized treatment areas, expected to become operational within two years.

Regulatory Challenges & Economic Fluctuations

The key players operating in the market are facing issues due to economic fluctuations and regulatory challenges, which are estimated to restrict the market growth. Strict licensing, animal welfare regulations, and compliance requirements can increase operational complexity and costs for veterinary clinics. During economic downturns, discretionary spending on pets may decline, affecting demand for non-essential veterinary services.

Expansion into Untapped Markets

Expansion into untapped markets drives growth in the veterinary and care sector by increasing access to professional animal healthcare in regions with limited services. Rural areas, emerging economies, and underserved urban locations often lack sufficient veterinary clinics, creating unmet demand for preventive care, diagnostics, and treatment services. Establishing new clinics, mobile veterinary units, or telemedicine platforms in these regions enables providers to capture a broader customer base while improving animal health outcomes.

The preventive & wellness care segment dominates the market due to rising pet ownership and increasing awareness of animal health. Pet parents are proactively seeking vaccinations, regular check-ups, and preventive treatments to avoid costly illnesses. Growing disposable incomes and lifestyle changes have also encouraged preventive spending on pets. Additionally, veterinarians and clinics are emphasizing wellness programs, early disease detection, and nutrition counseling, driving consistent demand. These combined factors make preventive and wellness services the cornerstone of the veterinary care industry’s growth.

The specialty services segment is estimated to be the fastest-growing in the veterinarian care market due to increasing demand for advanced, round-the-clock medical care for pets. Rising incidences of pet illnesses and accidents, coupled with growing awareness of specialized treatments, are driving growth. Pet owners are willing to invest in critical care, surgical interventions, and advanced diagnostics. Moreover, the expansion of multi-specialty veterinary hospitals and technological advancements in treatment options further accelerate adoption, making PE specialty services the fastest-growing segment in the market.

The companion animals segment dominates the market due to the rising adoption of pets, particularly dogs and cats, as family members. Increased awareness of pet health, preventive care, and nutrition drives consistent veterinary visits. Higher disposable incomes and urban lifestyles encourage spending on pet wellness, treatments, and insurance. Additionally, advancements in veterinary services and the availability of specialized care for companion animals further strengthen this segment. These factors collectively establish companion animals as the primary revenue driver in the veterinary care market.

The equine segment is anticipated to be the fastest-growing in the veterinary care market due to increasing investment in horse breeding, racing, and recreational riding. Rising awareness of equine health, preventive care, and advanced treatments drives demand for specialized veterinary services. Additionally, the growth of equestrian sports and luxury horse ownership encourages spending on diagnostics, nutrition, and wellness programs. Technological advancements in equine healthcare, such as imaging and surgical procedures, further boost adoption, making the equine segment the fastest-growing in the veterinary care market.

The private veterinary clinics segment dominates the market due to its widespread accessibility, personalized services, and strong client relationships. Pet owners prefer clinics for routine check-ups, preventive care, and minor treatments because of convenience and trust in familiar veterinarians. These clinics often offer flexible hours, tailored wellness programs, and affordable care compared to larger hospitals. Additionally, private clinics can quickly adopt new technologies and treatment methods, enhancing service quality. Combined, these factors make private veterinary clinics the primary choice, sustaining their dominance in the market.

The mobile veterinary services segment is estimated to be the fastest-growing segment in the veterinarian care market due to increasing demand for convenient, at-home pet care. Busy pet owners prefer doorstep services for vaccinations, wellness check-ups, and minor treatments, eliminating the need to travel to clinics. Rising awareness of preventive care and pet health monitoring, combined with urbanization and busy lifestyles, drives adoption. Mobile units equipped with modern diagnostic and treatment tools enhance service quality. Flexibility, personalized attention, and time-saving benefits position mobile veterinary services as the fastest-growing segment in the market.

The in-clinic care segment dominates the market due to its comprehensive range of services, trusted expertise, and reliable medical infrastructure. Pet owners prefer in-clinic visits for diagnostics, surgeries, emergency care, and specialized treatments that require advanced equipment and professional supervision. Clinics provide a controlled environment with trained staff, ensuring accurate assessments and effective treatments. The ability to offer preventive care, vaccinations, and follow-up consultations under one roof further strengthens their appeal. These factors collectively make in-clinic care the dominant segment in the veterinary care market.

The home/on-site veterinary care segment is estimated to be the fastest-growing segment in the veterinary care market due to rising demand for convenience, personalized attention, and stress-free pet treatment. Busy pet owners increasingly prefer at-home services for vaccinations, routine check-ups, and minor treatments, avoiding travel and clinic wait times. Urbanization, higher disposable incomes, and growing awareness of preventive care further drive adoption. Additionally, mobile units equipped with modern diagnostic tools ensure quality care, making home and on-site veterinary services a rapidly expanding and highly attractive segment in the market.

The North American region leads the global veterinary care market share 42%, driven by factors such as advanced infrastructure, high pet ownership, and significant investment in animal health services.

In March 2025 is the opening of Chewy Vet Care in Austin, Texas. This clinic offers comprehensive services, including wellness checkups, urgent care, and surgeries, integrating advanced technology with customer service to provide a convenient experience for pets and their owners. This expansion reflects the growing demand for accessible, transparent, and high-quality pet healthcare in the region.

The United States dominates the veterinarian care market due to high pet ownership, advanced healthcare infrastructure, and widespread awareness of preventive and specialized pet care. A strong network of veterinary clinics and hospitals, combined with technological adoption such as telemedicine and AI-driven diagnostics, ensures high-quality services. Pet insurance penetration also encourages regular veterinary visits. In 2025, the launch of Chewy Vet Care in Austin, Texas, offering integrated wellness, urgent care, and surgical services, exemplifies the U.S.’s focus on accessible and advanced veterinary solutions, further driving market growth and strengthening its leadership in North America.

Canada’s veterinary care market is supported by increasing pet adoption, government-backed animal welfare programs, and a growing emphasis on preventive care. Urbanization and higher disposable incomes encourage spending on pet health services, while veterinary telemedicine platforms enhance accessibility in remote areas. In addition, educational institutions like the Ontario Veterinary College continually advance veterinary research and clinical training, ensuring a skilled workforce. These factors collectively strengthen service delivery and expand care offerings. Rising awareness of pet wellness and premium healthcare in 2025 has reinforced Canada’s position as a growing market for advanced veterinary care services

The Asia-Pacific region is witnessing the fastest growth in the veterinarian care market due to rising pet adoption, increasing disposable incomes, and growing awareness of animal health and welfare. Rapid urbanization and changing lifestyles are driving demand for preventive care, vaccinations, and advanced veterinary treatments. Expansion of veterinary clinics, hospitals, and mobile services, along with telemedicine adoption, enhances accessibility in both urban and rural areas. Additionally, investments in veterinary education and the availability of pet insurance are encouraging more frequent and comprehensive care. These combined factors position Asia-Pacific as a rapidly expanding market with significant growth potential.

Steps:

Organizations: Zoetis, Elanco, Boehringer Ingelheim, Merck Animal Health, University veterinary research centers (e.g., Cornell, University of California-Davis Veterinary Medicine)

Steps:

Organizations:

Regulatory authorities: U.S. FDA’s Center for Veterinary Medicine (CVM), European Medicines Agency (EMA), Health Canada Veterinary Drugs Directorate, Contract research organizations (CROs) specializing in veterinary trials

Steps:

Organizations:

Private veterinary clinics and hospitals, Mobile veterinary service providers (e.g., VetPronto, Vetted, Petriage), Veterinary hospitals and chains (e.g., Banfield Pet Hospital, VCA Animal Hospitals)

In August 2025, VerticalVet's president, Mark Wainscott, stated that the goal at VerticalVet is to enable independent practices to provide the best care possible. The company is able to provide members with state-of-the-art technologies through its partnership with Zomedica Solutions that genuinely improve clinical results and operational effectiveness. Through the integration of Zomedica's cutting-edge veterinary platforms into the VerticalVet company’s network, the company is providing clinics with the resources they require to pioneer best-in-class medicine and push the limits of patient care. The VerticalVet company is dedicated to enhancing veterinary care and promoting the well-being of all community members, as exemplified by this partnership.

In February 2025, Elanco Animal Health Incorporated declared the release of Pet Protect, a range of supplements for cats and dogs created by veterinarians. Pet Protect is a modern, scientifically supported supplement line created especially to meet the various health needs of pets in light of the pet supplement market's explosive growth and growing significance.

In September 2025, FoW Partners is a financial firm dedicated to creating successful businesses through announced that it has teamed up with an experienced veterinary services executive in order to implement workforce-centric strategies and technological innovation. Elevated Veterinary Solutions ("EVS") for Torie Madore. A platform being developed by EVS to increase access to veterinary care through the growth of veterinary clinics that are employee-focused and powered by technology.

By Service Type

By Animal Type

By End User

By Mode of Service

By Region

February 2026

February 2026

February 2026

February 2026