February 2026

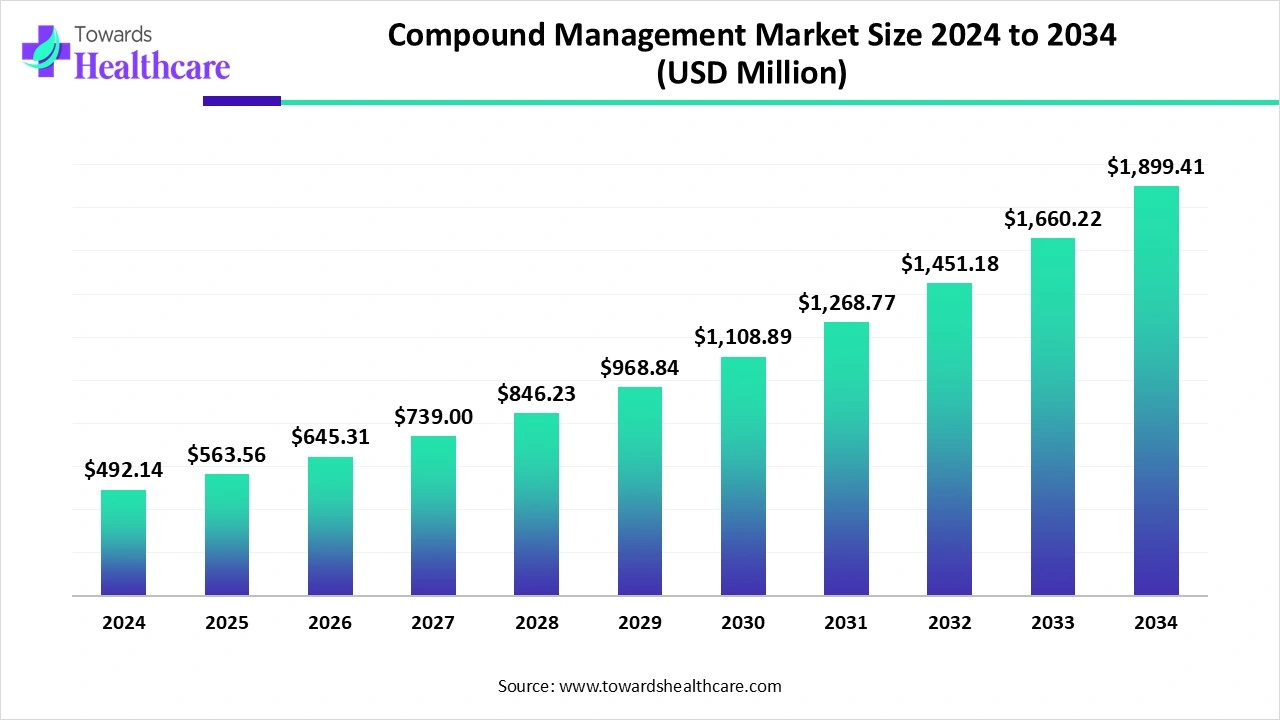

The global compound management market size is calculated at US$ 492.14 million in 2024, grew to US$ 563.56 million in 2025, and is projected to reach around US$ 1899.41 million by 2034. The market is expanding at a CAGR of 14.51% between 2025 and 2034.

The growing innovations in the healthcare sector are increasing the use of compound management systems for various purposes. Similarly, the growing demand for biologics is increasing the acquisitions and investments to enhance its facilities. AI is also being used to enhance its efficiency and scalability. At the same time, expanding industries and growing research and development across various regions are increasing the demand for these systems. Moreover, the companies are launching new compound management centers and services as well. Thus, this is promoting the market growth.

| Table | Scope |

| Market Size in 2025 | USD 563.56 Million |

| Projected Market Size in 2034 | USD 1899.41 Million |

| CAGR (2025 - 2034) | 14.51% |

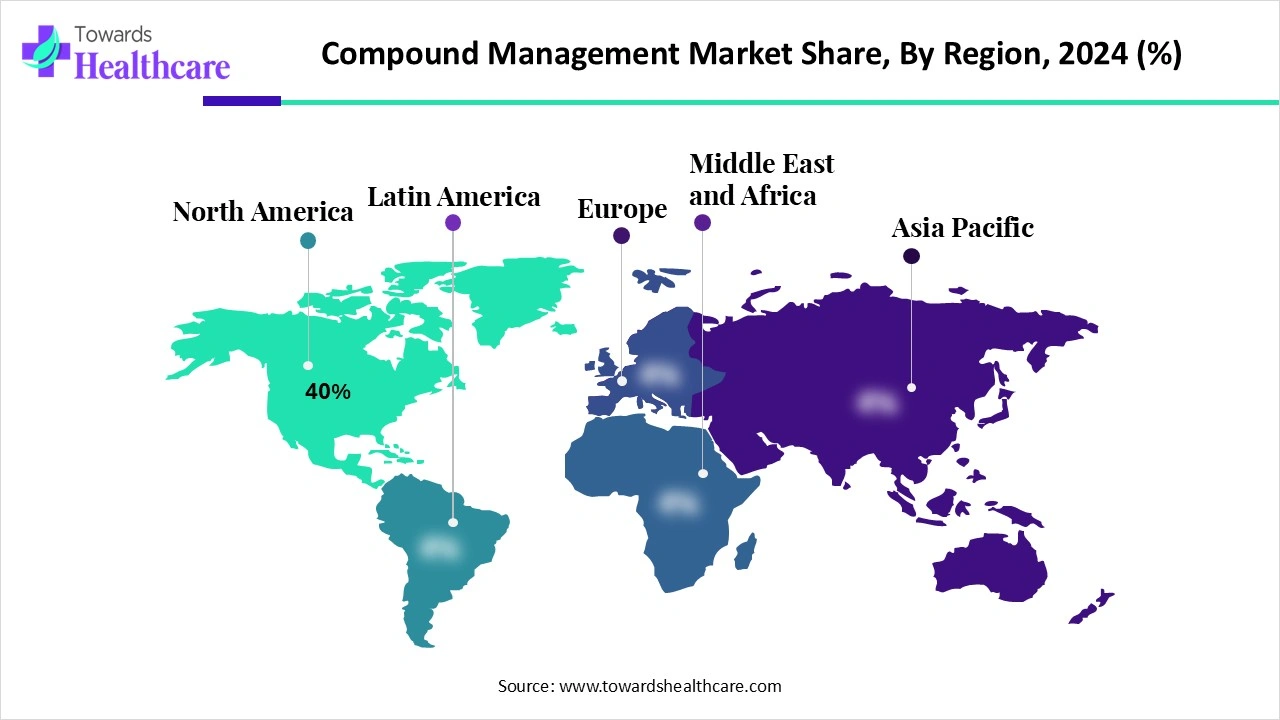

| Leading Region | North America 40% |

| Market Segmentation | By Product & Service, By Sample Type, By Application, By End User, By Region |

| Top Key Players | Brooks Life Sciences (Azenta Life Sciences), Hamilton Company, TTP Labtech (SPT Labtech), Titian Software, Evotec SE, Wuxi AppTec, Icagen, Inc., BioAscent Discovery Ltd., Labcyte (Beckman Coulter Life Sciences), Biosero Inc., ChemBridge Corporation, ChemDiv Inc., Compound Management Group (CMG), BioIVT, OpenEye Scientific Software , Arctoris Ltd., Collaborative Drug Discovery (CDD), Horizon Discovery (PerkinElmer), Enamine Ltd., GenScript Biotech |

The compound management market consists of systems, services, and technologies used to store, track, and handle large libraries of chemical and biological compounds for drug discovery, high-throughput screening, and research. It includes automated storage systems, sample preparation tools, and informatics solutions that ensure compound quality, integrity, and accessibility. Pharmaceutical companies, biotech firms, CROs, and academic research centers rely on efficient compound management to accelerate R&D, reduce costs, and minimize errors. Market growth is driven by the expansion of drug discovery pipelines, increasing use of AI/ML in chemical screening, demand for outsourced compound management services, and rising adoption of automation in laboratories.

Growing biologics development: The growing use of biologics is increasing their development. Moreover, the R&D of these biologics is also increasing. Thus, this, in turn, is increasing the use of compound management systems as well as the acquisitions for the storage, distribution, and tracking of the biologics.

For instance.

The use of AI in compound management is increasing as it helps in the analysis of a vast amount of chemical libraries. It also helps in selecting the optimized drug candidate, which accelerates the drug screening process. It also helps in inventory management and reduces the chances of understocking or overstocking. The storage of samples is also enhanced as it selects optimized storage conditions, maintaining the sample stability and providing alerts during their changes. Moreover, the use of robotics enhances tasks such as sorting, labelling, and placing the samples.

Growing Drug Discovery

There is a rise in drug discoveries due to growing chronic diseases. This is increasing the demand for compound management systems for storing, tracking, and retrieval of compounds. They are also being used for the high-throughput screening of drug candidates for their biological activities. It also helps in maintaining the drug integrity and quality, as well as minimizing the risk of contamination. At the same time, they are also being used during the development of personalized medications for storing customized compounds and inventories. Thus, this is driving the compound management market growth.

Complex Handling

Products such as biologics require specific storage conditions, which may increase the complexities and costs. The improper handling, storage, or automation can lead to their degradation. Moreover, due to the difference in the sample storage, tracking, and labelling protocols of the compound management, their handling procedures can be affected. Thus, improper handling can minimize the use of compound management.

Growing Clinical Trials

Due to growing innovation, there is a rise in clinical trials. This, in turn, increases the number of compounds and samples that require proper storage and retrieval systems. This increases the demand for compound management systems. They are also being used to maintain the sample integrity and for tracking them. The demand for biobanking for storing biological samples or products is also increasing due to growing trials of precision medicines. Therefore, the systems are used for managing the complex protocols, samples, their tracking, etc, and to reduce the trial failures. Thus, this is promoting the compound management market growth.

For instance,

By product & service type, the automated storage & retrieval systems segment led the market with approximately 38% share in 2024, due to its decreased errors. This enhanced the accuracy in the storage and retrieval of the products. It also helped in storing a vast amount of compound libraries. It also provided rapid access and helped in maintaining the compound stability.

By product & service type, the compound management services segment is expected to show the highest growth during the predicted time. The growing outsourcing trends are increasing the use of these services. They also offer expertise for storing and managing the products. Additionally, the growing collaborations and startups are increasing their use.

By sample type, the chemical compounds segment held the dominating share of approximately 46% in the market in 2024, as they were essential for research and development. They were used in a variety of innovations. Moreover, the growing drug discovery and development has also increased their use.

By sample type, the biological samples segment is expected to show the fastest growth rate during the predicted time. There is a rise in the development of biologics, which is increasing the demand for their samples. They are also being used for developing personalized therapies. Moreover, the growing use of cell and gene therapies is also driving the demand.

By application type, the drug discovery & development segment held the largest share of approximately 52% in the market in 2024, as compound management was crucial for storing, handling, and retrieving the drugs. It also enhanced the tracking and screening of the drug candidates, which accelerated the development process. Additionally, the growing R&D also contributed to the same.

By application type, the biobanking segment is expected to show the highest growth during the upcoming years. The growing use of biologics is increasing the demand for biobanking. They are being used to store these samples along with other personalized or targeted therapies. Furthermore, the growing clinical trials and innovations are using the stored biological samples.

By end user, the pharmaceutical companies segment dominated the global market with approximately 43% share in 2024, driven by growing R&D. This, in turn, increased the use of various chemicals and samples. Thus, the compound management systems help in their storage, handling, and retrieval, which helps in minimizing the R&D timeline.

By end user, the biotechnology companies segment is expected to show the fastest growth rate during the upcoming years. The growing development of advanced therapeutics is increasing the use of compound management systems. The growing interest in synthetic biology is also contributing to the same. Thus, this is enhancing the market growth.

North America dominated the compound management market share 40% in 2024. North America consisted of large pharma R&D hubs, which increased the use of compound management systems. At the same time, the growing utilization of advanced technologies such as AI or robotics has increased the flexibility, scalability, and efficiency of these systems. Moreover, the growing R&D investments increased their use. Thus, this contributed to the market growth.

The presence of well-known pharmaceutical and biotechnology companies in the U.S. has increased the use of compound management systems for their drug discovery and development. They were used for automated and high-throughput screening of the drugs. Moreover, they are also developing automated and cloud-based systems to enhance their efficiency. Additionally, the growing clinical trials is also increasing their use.

There is a rise in the startups and the expansion of the pharma and biotech industries. This is driving the R&D, increasing the use of compound management systems. They are also being used for managing the biological samples for the cancer genetic diseases clinical trials. Moreover, the CROs are increasing their use due to growing outsourcing. The government funding is supporting the innovation, increasing its use.

Asia Pacific is expected to host the fastest-growing compound management market during the forecast period. The biotech ecosystem in the Asia Pacific is expanding, which is increasing the adoption of compound management systems. The growing drug discovery and development is increasing their use for screening, storage, and outsourcing. Moreover, the automated storage and retrieval systems are also being utilized to enhance the R&D as well as clinical trials. Additionally, the growing investments are promoting their adoption. Thus, this is enhancing the market growth.

The optimization of storage, tracking, and distribution of the biological compounds or the chemicals to provide support to the drug discovery and development is the focus of the R&D of compound management.

Key Players: Azenta Life Sciences, Titian Software, Hamilton Company, SPT Labtech, Tecan.

The packing of compound management focuses on automated handling of the chemicals and products to maintain their integrity and inventory tracking during their R&D, while serialization focuses on providing trackable and unique codes to the final products.

Key Players: OPTEL Group, Korber AG, Syntegon

The patient support and services of compound management involve providing the patients with educational and financial assistance regarding the medications.

Key Players: Takeda Pharmaceutical, Novartis, GSK, Roche, Sanofi, Cipla, Pfizer

In October 2024, after announcing the launch of a new compound management centre, the CEO of BioDuro-Sundia, Dr. Armin Spura, stated that their commitment to provide outstanding drug discovery services will be supported by this new compound management centre. The launching of new drug candidates in the market will be supported by merging the compound management system with their drug discovery platform, which helps provide the clients with more reliable and rapid solutions.

By Product & Service

By Sample Type

By Application

By End User

By Region

February 2026

February 2026

February 2026

February 2026