January 2026

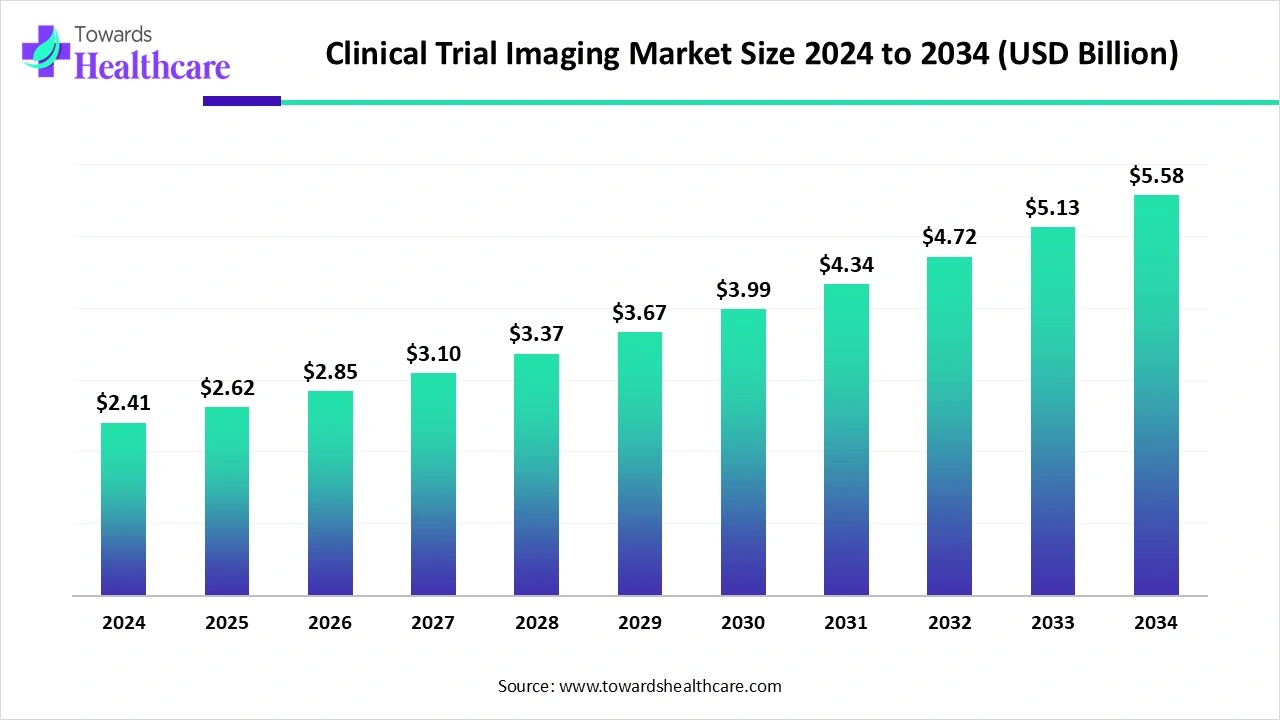

The global clinical trial imaging market size touched US$ 2.41 billion in 2024, with expectations of climbing to US$ 2.62 billion in 2025 and hitting US$ 5.58 billion by 2034, driven by a CAGR of 8.8% over the forecast period.

The clinical trial imaging market is growing as pharmaceutical and biotech companies increasingly rely on imaging to accelerate patient recruitment, assess safety, and evaluate drug efficacy. Innovations in high-resolution and functional imaging, coupled with automated image analysis, are improving accuracy and reducing trial timelines. Expansion of global clinical trials, rising investment in personalized medicine, and partnerships between imaging solution providers and contract research organizations (CROs) are further driving market growth, making imaging an integral part of modern clinical research.

| Table | Scope |

| Market Size in 2025 | USD 2.62 Billion |

| Projected Market Size in 2034 | USD 5.58 Billion |

| CAGR (2025 - 2034) | 8.8% |

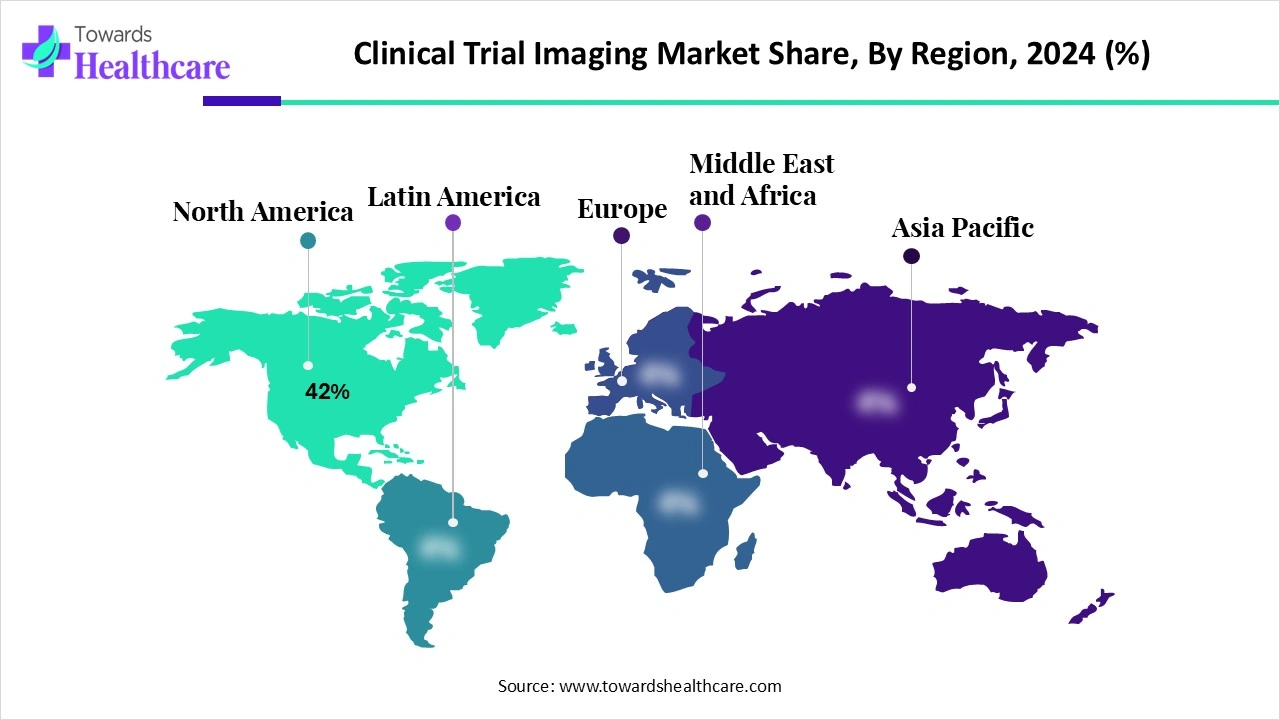

| Leading Region | North America 42% |

| Market Segmentation | By Service Type, By Therapeutic Area, By End User, By Region |

| Top Key Players | ICON plc, Parexel International, BioTel Research (Philips), Median Technologies, Navitas Life Sciences, Bioclinica (Clario), Resonance Health Ltd., Cardiovascular Imaging Technologies, IXICO plc, Intrinsic Imaging LLC, Radiant Sage LLC, VirtualScopics Inc., WorldCare Clinical, Calyx (formerly Perceptive Informatics), Imaging Endpoints, Prism Clinical Imaging, Synarc Imaging (merged into Clario), Invicro (Konica Minolta), RadMD, ERT (merged into Clario) |

The clinical trial imaging market covers the use of medical imaging technologies and associated services in clinical research to evaluate the efficacy and safety of new drugs, biologics, and medical devices. Imaging plays a critical role in endpoint measurement, patient recruitment, and biomarker analysis, ensuring regulatory compliance and objective assessment in trials. Modalities such as MRI, CT, PET, ultrasound, and X-ray are used alongside advanced image analysis software, cloud platforms, and centralized imaging services.

The clinical trial imaging market growth is driven by the increasing complexity of clinical trials, adoption of imaging biomarkers, rise in oncology and neurology trials, and demand for outsourcing imaging operations to specialized service providers. The market is evolving with the adoption of portable and hybrid imaging systems, allowing more flexible and decentralized trial design. Enhanced software for quantitative analysis and real-time data sharing is streamlining decision-making. Furthermore, collaborations between imaging technology providers and CROs are expanding access to specialized imaging services, supporting faster, more cost-effective trials across diverse therapeutic areas.

Advancements in Imaging Technologies – Innovations like PET/MRI, high-resolution CT, and molecular imaging improve accuracy, reduce invasive procedures, and provide real-time insights

Collaborations Between Pharma and Imaging Providers – Partnerships with CROs and imaging solution companies provide access to expertise, infrastructure, and efficient trial workflows.

AI is reshaping the market by facilitating advanced image reconstruction, enhancing image quality, and enabling automated quality control. It allows integration of multi-modal imaging data, supports adaptive trial designs, and improves remote monitoring in decentralized trials. Additionally, AI-driven analytics help identify subtle patterns and early disease markers, boosting the reliability of endpoints. These capabilities reduce operational complexity, accelerate data interpretation, and expand the scope of imaging applications, driving broader adoption in clinical research.

Advancements in Imaging Technologies

Advancements in imaging technologies propel the clinical trial imaging market by expanding the scope and efficiency of data collection. Cutting-edge tools such as hybrid imaging systems, functional imaging, and throughput scanners enable faster acquisition, improved image clarity, and multi-parameter assessments. These innovations support complex disease modelling, longitudinal studies, and decentralized trials, reducing operational challenges by enabling trial accuracy and enabling more. Comprehensive insight, these technological improvements encourage wider adoption of imaging solutions in pharmaceutical and biotech research programs.

High Cost of Imaging Equipment

The high cost of imaging equipment limits the clinical trial imaging market by creating a financial barrier for many organizations, particularly in emerging markets. Beyond the initial purchase, expenses for specialized infrastructure, training, and routine upkeep make these technologies less accessible. This can lead to underutilization of advanced imaging modalities and slower adoption of innovative techniques in trials. Consequently, companies may rely on older, less precise imaging systems, which can impact the quality and efficiency of clinical trial outcomes.

Cloud-based Imaging Platforms

Cloud-based imaging platforms present a major future opportunity in the clinical trial imaging market as they enable seamless storage, sharing, and real-time access to imaging data across global research sites. These platforms reduce infrastructure costs, improve collaboration between stakeholders, and support remote or decentralized trials. Additionally, cloud systems enhance data security, scalability, and integration with AI-driven analytics. This flexibility allows faster decision-making, streamlines trial workflows, and expands trial participation, particularly for multi-center and international studies.

For Instance,

The imaging core lab services segment dominated the clinical trial imaging market in 2024 because it provides end-to-end solutions that reduce the operational burden on trial sponsors. These services manage everything from site training to image quality control, helping minimize errors and delays. Their role in harmonizing data across diverse geographies also improves trial efficiency. Moreover, core labs' ability to adapt workflows for decentralized and hybrid trials has increased their relevance, making them a preferred choice for global pharmaceutical and biotech studies.

The cloud-based imaging platforms & AI-enabled solutions segment is projected to grow fastest because they allow integration of device imaging modalities into unified systems, improving data consistency and interoperability. These solutions also support real-time collaboration among global stakeholders, enabling faster communication and adaptive trial designs. Their capability to handle large imaging datasets while ensuring compliance with evolving regulatory standards makes them highly valuable. As trials become more complex, such technologies offer flexibility and scalability that traditional systems cannot match.

The computed tomography (CT) segment dominated the clinical trial imaging market in 2024 as it offers reliable qualification of structural changes, making it essential for tracking biomarkers in large-scale trials. Its versatility in assessing multiple organ systems within a single scan provides comprehensive insights that other modalities may not deliver. Moreover, continuous innovations, such as low-dose radiation techniques and multi-slice CT systems, improved safety and image quality, encouraging broader adoption across complex clinical studies and reinforcing CT's leading role in trial imaging.

The positron emission tomography (PET) segment is projected to grow at the fastest CAGR in the clinical trial imaging market because of its expanding role in personalized medicine and targeted therapy trials. Unlike conventional imaging, PET can utilize novel radiotracers tailored to specific biomarkers, allowing researchers to evaluate drug mechanisms and patient-specific responses more effectively. Increased collaboration for developing new PET tracers and the rising demand for non-invasive molecular imaging in immunotherapy and rare disease trials are further boosting its adoption, driving accelerated growth during the forecast period.

The oncology segment led the clinical trial imaging market in 2024 because imaging is indispensable for patient stratification and endpoint validation in cancer trials. Sophisticated imaging techniques enable differentiation between active disease and treatment-related changes, which is critical in evaluating novel therapies. Furthermore, regulatory bodies increasingly require imaging-based evidence to support oncology drug approvals. With a strong pipeline of cancer therapies and rising investment in biomarker-driven studies, oncology maintained its dominance as the therapeutic area most dependent on imaging technologies.

The neurology segment is projected to record the fastest CAGR in the clinical trial imaging market as clinical trials in this area increasingly require sophisticated imaging to capture subtle structural and functional brain changes. Emerging approaches, such as diffusion tensor imaging and hybrid PET-MRI, are providing deeper insights into neuronal connectivity and disease mechanisms. Coupled with a surge in innovative disorders, these imaging advances are driving greater reliance on neuroimaging, making neurology the fastest-growing therapeutic area in trial imaging.

The pharmaceutical & biotechnology companies segment captured the largest revenue share in 2024 because of their extensive global trial networks that depend on standardized imaging for consistency across diverse sites. Imaging also support their need to demonstrate safety and efficacy data to regulators and investors, making it safety and efficacy data to regulators and investors, making it a strategic tool beyond research. Additionally, these forms increasingly outsource imaging services to specialized providers, boosting spending in this segment and reinforcing their leading position within the clinical trial imaging market.

The contract research organizations (CROs) segment is projected to grow at the fastest CAGR, providing flexible, scalable imaging services that allow sponsors to manage increasing trial complexity without heavy capital investment. They offer expertise in regulatory compliance, standardized image analysis, and multi-site coordination, enabling faster study execution. Additionally, the rising trend of decentralized and hybrid trials increases the use of CROs for remote imaging management and centralized data handling, making them a key growth driver in the market during the forecast period.

North America led the market share 42% in 2024 because of its mature clinical research ecosystem and high concentration of specialized imaging centers. The region’s emphasis on precision medicine and complex therapeutic trials, coupled with strong collaborations between pharma, biotech, and academic institutions, drives extensive use of advanced imaging. Additionally, favorable regulatory frameworks, access to skilled professionals, and early adoption of innovative technologies like AI-enabled and cloud-based imaging solutions have reinforced North America’s dominance in market revenue.

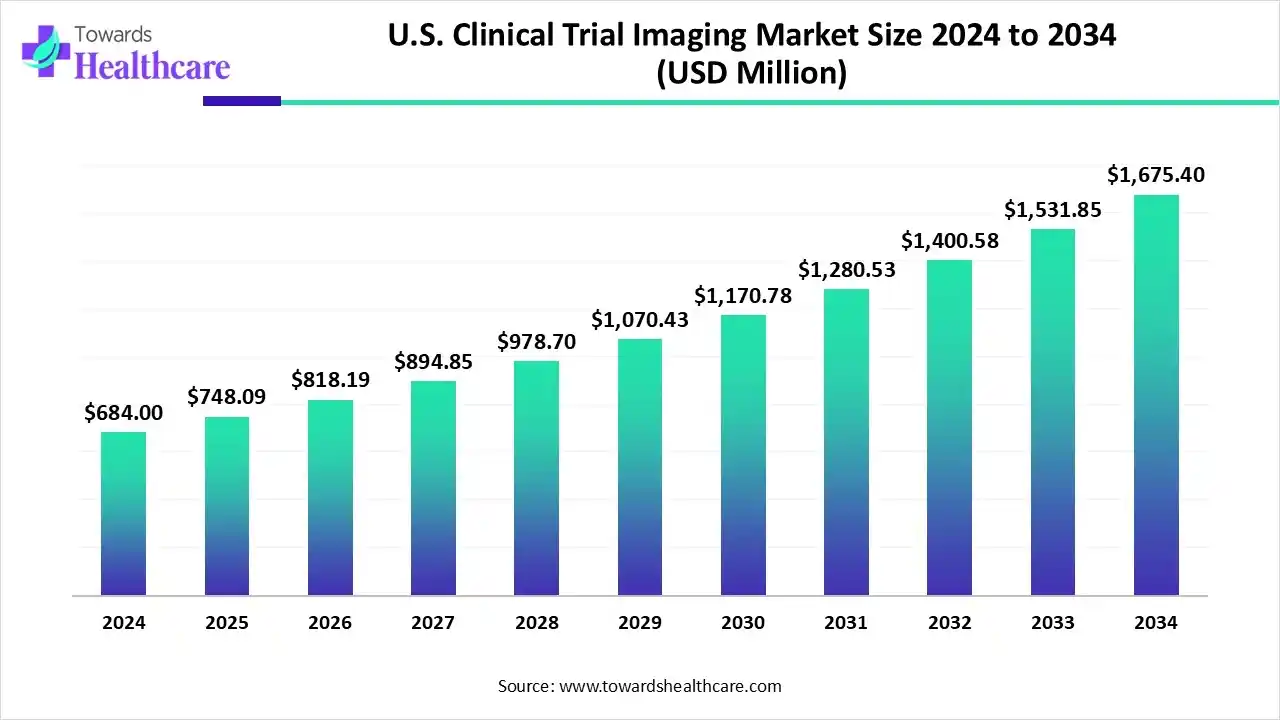

The U.S. market is expanding as sponsors focus on accelerating drug development and improving trial outcomes. Growing use of hybrid imaging systems, molecular imaging, and AI-assisted tools enables precise monitoring of treatment effects. Additionally, the rise in rare disease and personalized medicine trials, combined with collaborations between imaging solution providers and contract research organizations, is increasing adoption. These factors collectively contribute to steady market growth in the United States.

The U.S. clinical trial imaging market was valued at US$ 684 million in 2024 and is projected to grow steadily, reaching US$ 748.09 million in 2025 and US$ 1,675.4 million by 2034, registering a CAGR of 9.37%.

The market is growing as the country becomes a preferred hub for cost-effective and high-quality clinical research. Increasing collaborations between domestic research institutions and global pharmaceutical companies are boosting trial volumes. Adoption of innovative imaging technologies, including AI-assisted analysis and cloud-based platforms, allows faster and more accurate data collection. Furthermore, the focus on rare diseases and specialized therapeutic areas is expanding the need for advanced imaging in Canadian clinical trials.

The Asia-Pacific market is projected to grow rapidly due to the emergence of new imaging centers and increased availability of skilled professionals. Rising focus on complex therapeutic areas, such as oncology and neurology, is driving demand for advanced imaging solutions. Additionally, government incentives for clinical research, growing partnerships between local and global pharmaceutical companies, and expanding adoption of hybrid and AI-enabled imaging technologies are contributing to faster market penetration and robust CAGR during the forecast period.

In May 2025, Bayer launched its Imaging Core Lab, Centafore™, providing specialized imaging solutions for clinical trials and SaMD development. Leveraging 25+ years of experience and a network of board-certified radiologists across 50+ countries, Centafore™ offers image management, processing, interpretation, and advanced analyses. Nelson Ambrogio, Bayer’s President of Radiology, stated, “Centafore™ represents a significant leap forward in enhancing clinical trial imaging and advancing new medicines."

By Service Type

By Therapeutic Area

By End User

By Region

January 2026

January 2026

December 2025

December 2025