March 2026

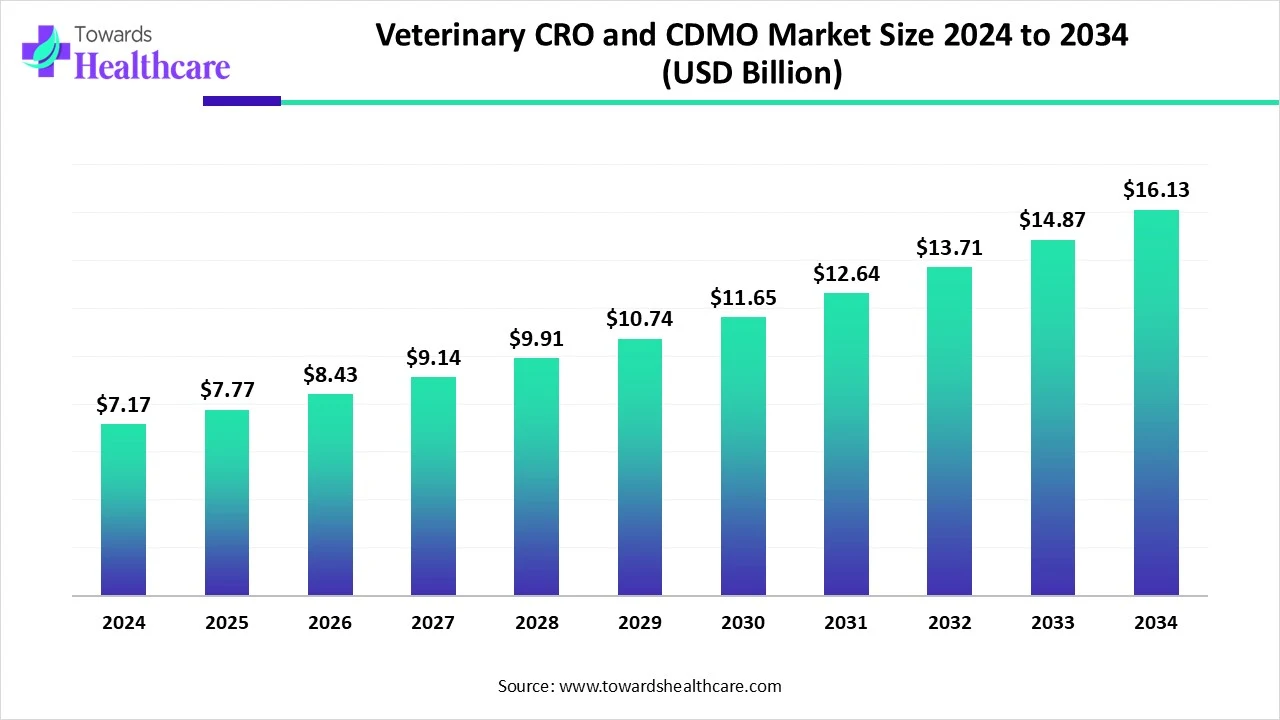

The global veterinary CRO and CDMO market size is calculated at USD 7.17 billion in 2024, grows to USD 7.77 billion in 2025, and is projected to reach around USD 16.13 billion by 2034.The market is expanding at a CAGR of 8.43% between 2025 and 2034.

The veterinary CRO and CDMO market is witnessing steady growth driven by increased pet ownership, rising demand for animal healthcare, and growing concerns over zoonotic diseases. Pharmaceutical companies are outsourcing research and manufacturing to specialized providers to enhance efficiency, reduce costs, and meet regulatory requirements. Technological advancements and the expansion of veterinary clinical trials are further boosting the market, making it a vital part of the animal health industry.

| Metric | Details |

| Market Size in 2025 | USD 7.77 Billion |

| Projected Market Size in 2034 | USD 16.13 Billion |

| CAGR (2025 - 2034) | 8.43% |

| Leading Region | North America |

| Market Segmentation | By Service Type, By Product Type, By Animal Type, By Development Stage, By End Use, By Region |

| Top Key Players | Argenta, Aurigon Life Science, Avacta Animal Health, Biovet, Charles River Laboratories, Dopharma, Elanco Contract Manufacturing, Evonik (Vetmed Division), Huvepharma, LGC Group, Lonza (Veterinary Biologics CDMO Division), MBV VET Research, Norbrook Laboratories, Pharmgate, Phibro Animal Health CDMO Services, Ridley Veterinary Services, Selvita, SGS Animal Health, Vaxxinova, Zoetis Contract Services |

The Veterinary CRO and CDMO Market refers to the specialized outsourcing sector that provides contract research and contract manufacturing services for animal health products. This includes services supporting the development, clinical testing, regulatory filing, and manufacturing of veterinary pharmaceuticals, biologics, feed additives, vaccines, and diagnostics for both companion and livestock animals. Veterinary Contract Research Organizations (CROs) offer preclinical studies, clinical trials, safety and efficacy testing, and regulatory consulting. Veterinary Contract Development and Manufacturing Organizations (CDMOs) provide formulation development, scale-up, GMP manufacturing, and packaging services. The market has seen increasing demand due to rising R&D costs, growth in companion animal care, stricter regulatory frameworks, and innovation in biologics and parasiticides.

The veterinary CRO and CDMO market is evolving through increased outsourcing adoption of advanced technologies, and growing demand for specialized animal health solutions. Companies are focusing on faster, cost-effective development and regulatory compliance to meet rising global veterinary needs.

For Instance,

AI is significantly impacting the market by streamlining research, enhancing data analysis, and improving trial accuracy. It enables faster identification of drug candidates, predictive modeling of animal responses, and automation of routine processes, reducing time and costs. AI-driven insights also support regulatory compliance and optimize manufacturing workflows. As a result, companies can accelerate development timelines, improve treatment outcomes, and deliver more precise animal health solutions, driving efficiency and innovation across the sector.

Rising Demand for Outsourced R&D and Manufacturing Services

The growing reliance on outsourced R&D and manufacturing is driving the veterinary CRO and CDMO market, as it enables animal health companies to focus on innovation while leveraging external expertise. These service providers offer cost-effective solutions, technical specialization, and regulatory support, helping streamline product development and manufacturing processes. This approach not only reduces infrastructure investment but also improves scalability and flexibility, making it easier for companies to respond to evolving market needs and bring veterinary products to market faster.

For Instance,

High cost and Complexity of Regulatory Compliance

Regulatory compliance in the veterinary CRO and CDMO market poses a challenge due to varying global standards, detailed approval processes, and high associated costs. Companies must invest heavily in regulatory infrastructure to meet country-specific guidelines, which can delay project timelines and inflate budgets. This complexity often discourages smaller players and slows down innovation, making it harder for service providers to efficiently bring new veterinary products to market across multiple regions.

Development of Biologics and Advanced Therapies for Animal

The growing focus on biologics and advanced therapies in animal health opens new doors for veterinary CRO and CDMOs. These therapies offer more precise and long-lasting treatment options for complex and chronic conditions in animals. As the limitations of conventional drugs become more evident, pharmaceutical companies are turning to specialized services providers for support in developing and manufacturing these innovative products, creating long-term growth potential and expanding the scope of veterinary research and development.

For Instance,

In 2024, the contract manufacturing services segment led the market, as animal health companies increasingly outsourced production to reduce costs, enhance scalability, and access specialized manufacturing capabilities. This shift allowed firms to focus on research and development while ensuring efficient, high-quality, and compliant manufacturing of veterinary pharmaceutical products.

In the contract manufacturing services segment, the oral dosage form subsegment dominated the market in 2024, due to its ease of administration, higher patient compliance, and cost-effective production. These forms are widely preferred in veterinary medicine for treating various conditions, especially in companion animals. Their stability, longer shelf life, and availability further contribute to market expansion.

The biologics manufacturing segment is projected to grow rapidly in the veterinary CRO and CDMO market as animal health companies shift towards more innovative, targeted therapies. With the rising prevalence of chronic and infectious diseases in animals, biologics offer promising results in prevention and treatment. The complexity of biologics production encourages firms to outsource to experienced CDMOs, enabling faster development, regulatory support, and cost-effective scaling, boosting the market growth.

The pharmaceuticals segment dominated the veterinary Cro and CDMO market due to the consistent need for therapeutic drugs across both companies and farm animals. Rising awareness of animal health, increased veterinary visits, and demand for tailored medications have contributed to this growth. Moreover, the outsourcing of drug development processes from early research to commercial manufacturing has further strengthened the market role as a key revenue contributor within the veterinary services industry.

The biologics segment is expected to witness the fastest growth in the veterinary CRO and CDMO market as animal healthcare shifts towards innovative treatment approaches. Biologics offer improved efficacy for conditions where traditional drugs may fall short. Growing investment in veterinary biotechnology and the increasing use of biologically based vaccines and therapies are fueling this demand. Due to the complexity of development, companies are relying on specialized CROs and CDMOs, further accelerating the expansion of the market.

In 2024, the companion animal segment led the market due to rising pet ownership, increased spending on pet healthcare, and growing awareness of preventive treatments. Demand for advanced diagnostics, tailored therapies, and regular veterinary care also supported the market's dominant position.

For Instance,

The dogs subsegment held the highest revenue share in the veterinary CRO and CDMO market due to the large global dog population and rising adoption rates. Increased spending on canine healthcare, including vaccinations, chronic disease management, and prevention treatments, has driven demand. Additionally, the strong emotional bond between owners and dogs boosts investment in advanced veterinary care and pharmaceuticals.

The livestock segment is expected to grow at the fastest rate due to rising global demand for meat, dairy, and other animal-derived products. This has led to increased focus on disease prevention, productivity enhancement, and food safety. As a result, there’s growing investment in veterinary drugs, vaccines, and outsourcing services to support large-scale livestock health management.

For Instance,

The aquaculture subsegment is projected to grow rapidly due to the growing importance of sustainable fish farming and the need to ensure healthy aquatic stock. As aquaculture operations expand, there is a rising focus on disease control, driving demand for specialized veterinary biologics and therapeutics. This has increased outsourcing to CROs and CDMOs for tailored aquatic health solutions.

The clinical segment dominated the veterinary CRO and CDMO market as animal health companies prioritize testing to ensure product safety and effectiveness. This stage involves a detailed evaluation of the target species, which is essential for regulatory approval. The increasing complexity of therapies has further driven the outsourcing of clinical research to specialized veterinary service providers.

The Phase III subsegment led the veterinary CRO and CDMO market in 2024 due to the comprehensive nature of this stage, which involves a broad animal population and final efficacy assessments. It demands significant clinical infrastructure, regulatory coordination, and data collection, resulting in higher service utilization and costs, making it the most financial impactful phase in veterinary drug development.

The commercial manufacturing segment is expected to witness the fastest growth as veterinary drug approvals increase and companies shift towards external partners for efficient, large-scale production. CDMO offers advanced technologies, compliance expertise, and flexible capacity, enabling faster market entry. Growing demand for high-quality, cost-effective animal health products globally further fuels the reliance on outsourced commercial manufacturing during the forecast period.

The animal health companies segment led the market in 2024 as these organizations increasingly relied on external partners to manage rising development workloads and regulatory complexities. With a growing focus on innovation and global expansion, they turned to CRO and CDMOs for access to advanced technologies, flexible manufacturing capabilities, and faster development timelines, helping them bring veterinary products to market more efficiently and cost-effectively.

The veterinary biotech startups segment is projected to grow at the fastest rate as they bring cutting-edge innovations to animal health, but often lack the internal resources for full-scale development and production. These companies increasingly depend on CRO and CDMO partners for technical expertise, regulatory guidance, and scalable manufacturing. Their agility focuses on niche therapies, and reliance on outsourcing to advance products efficiently positions them as a key contributor to market expansion during the forecast period.

North America dominated the market due to its well-established animal healthcare infrastructure, high pet ownership rates, and strong presence of major pharmaceutical and biotech companies. The region benefits from advanced R&D capabilities, favorable regulatory frameworks, and increased investment in innovative animal health solutions. Additionally, the growing demand for premium veterinary products and services, along with rising awareness of pet health, has further fueled the need for outsourcing research and manufacturing in the region.

The U.S. market is expanding due to increasing demand for advanced animal health solutions, driven by high pet ownership and rising livestock needs. The presence of major pharmaceutical and biotech firms, coupled with significant investments in R&D, supports this growth. Additionally, the adoption of cutting-edge technologies and favorable regulatory frameworks enhances the efficiency and innovation in veterinary research and manufacturing services.

Canada’s market is expanding due to rising pet ownership, increased demand for advanced veterinary care, and strong growth in the companion animal segment. The country’s robust livestock sector also contributes significantly. Additionally, growing R&D investments and the presence of key service providers like IDEXX BioAnalytics support the development of specialized animal health solutions, driving further market growth across both companion and livestock categories.

Asia-Pacific is expected to witness the fastest CAGR in the market due to rising demand for animal healthcare across emerging economies like China, India, and Australia. Rapid growth in livestock farming, increasing pet ownership, and heightened awareness about animal diseases are fueling the need for veterinary drugs and vaccines. Additionally, cost-effective outsourcing, expanding biotech capabilities, and rising investments in animal health R&D make the region highly attractive for CRO and CDMO service expansion.

China’s market is growing steadily due to increasing demand for animal health solutions driven by rising pet ownership and the expansion of the livestock industry. The country’s cost-efficient labor, improving R&D infrastructure, and alignment with global regulatory practices make it an attractive outsourcing destination. Additionally, growing government support for biotech innovation is encouraging local and international collaborations, further accelerating market development in the animal health sector.

India’s market is expanding due to its large livestock population, growing pet ownership, and increasing demand for quality animal healthcare. The country offers cost-effective research and manufacturing services, supported by a skilled scientific workforce and improving infrastructure. Government initiatives promoting pharmaceutical innovation and exports further enhance India’s appeal as a hub for outsourcing veterinary drug development and production, driving sustained growth in the sector.

In 2024, Europe is advancing its market through a multifaceted approach. The region emphasizes stringent regulatory compliance and animal welfare, driving demand for high-quality veterinary pharmaceuticals. Collaborations between European pharmaceutical companies and CRO/CDMO service providers are fostering innovation. Additionally, the integration of digital technologies, such as electronic health records and telemedicine, is enhancing research and development processes. These factors collectively contribute to Europe's robust growth in the veterinary CRO and CDMO sector.

The UK's market is experiencing significant growth, driven by increasing pet ownership and a strong livestock sector. The country’s emphasis on high-quality animal healthcare, supported by advanced research infrastructure and skilled professionals, makes it an attractive hub for outsourcing veterinary research and manufacturing services. Additionally, the UK's robust regulatory framework and commitment to animal welfare further bolster its position in the global veterinary CRO and CDMO landscape.

Germany's market is expanding due to its advanced healthcare infrastructure and strong regulatory environment. The country's robust pharmaceutical and biotechnology sectors, coupled with significant investments in veterinary research and development, are driving growth. Additionally, Germany's emphasis on animal welfare and its strategic location within Europe make it an attractive hub for outsourcing veterinary research and manufacturing services, further propelling the market's expansion.

The Middle East & Africa are expected to grow at a notable CAGR in the veterinary CRO and CDMO market in the foreseeable future. The growing research activities and the need for developing innovative veterinary products augment the market. The increasing adoption of pets among the general public promotes the demand for veterinary products. Government bodies expand their infrastructure for outsourcing research and manufacturing activities through initiatives and funding.

Companies like MAI CDMO, Argenta Global, and the Kymos Group offer veterinary CRO and CDMO services in the UAE. Several studies have estimated that pet ownership in the UAE has surged 30% since the pandemic. In 2024, the pet population in the UAE was about 938,000. In addition, an average pet owner spends between Dh500 to Dh2,000 on their pets.

In February 2025, Fortrea, a global contract research organization, announced its sponsorship of the SCRS Collaborate Forward working group, aiming to reduce administrative burdens in clinical research. Fortrea’s SVP, Mike Clay, emphasized that “this initiative will develop tangible solutions that clinical study sponsors, CROs, vendors, sites, and patient advocacy groups can rally behind.” SCRS SVP Sean Soth added that the effort highlights “the value of cross-industry collaboration” to build a more efficient clinical trial ecosystem. (Source - Bernamabiz)

By Service Type

By Product Type

By Animal Type

By Development Stage

By End Use

By Region

March 2026

March 2026

March 2026

March 2026