February 2026

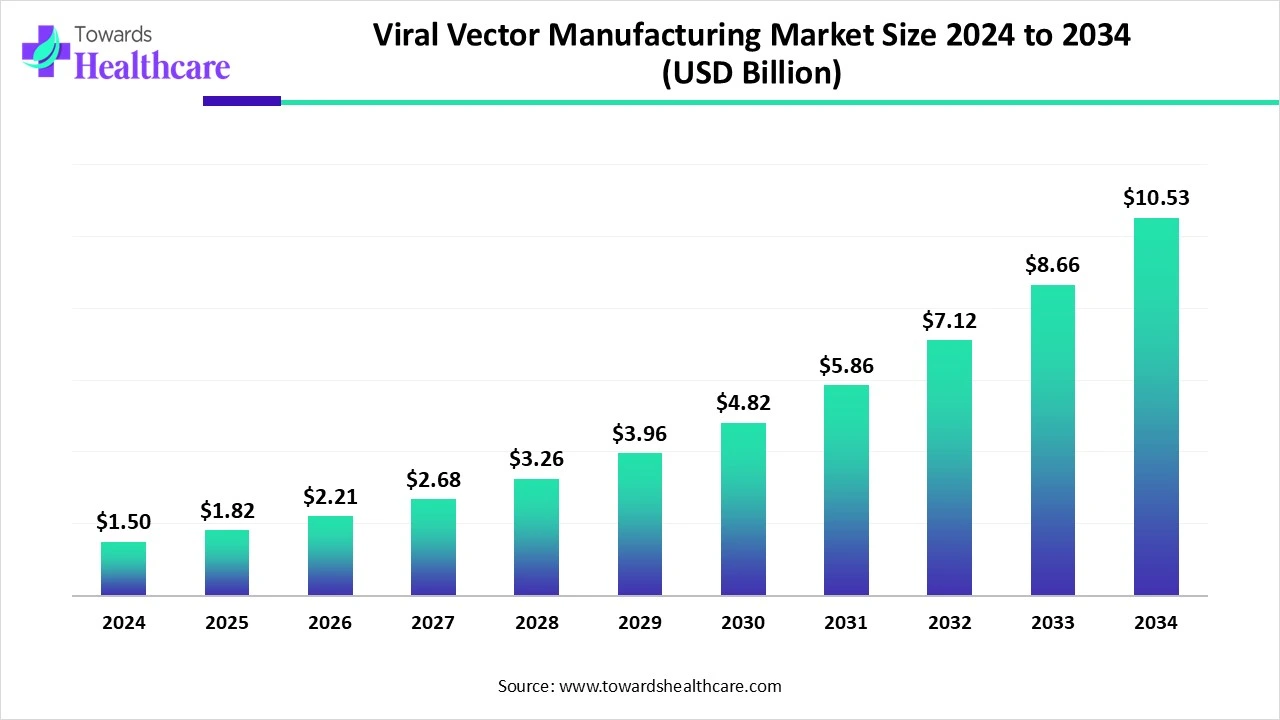

The global viral vector manufacturing market size is calculated at USD 1.82 billion in 2025, grows to USD 2.21 billion in 2026, and is projected to reach around USD 12.91 billion by 2035. The market is expanding at a CAGR of 21.64% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 1.82 Billion |

| Projected Market Size in 2035 | USD 12.91 Billion |

| CAGR (2026 - 2035) | 21.64% |

| Leading Region | North America |

| Market Segmentation | By types, By Diseases, By applications, By end-user, By Regions |

| Top Key Players | Merk GA, Lonza, BD, Fujifilm Diosynth biotechnologies USA Inc., Brammer Bio, Cell Therapy Catapult Limited, Waisman Biomanufacturing, GENEZEN LABORATORIES, Yposkesi Inc., REGENXBIO Inc. |

Viral vector manufacturing is the biotechnological process of producing replication-deficient viruses that are engineered to deliver genetic material into host cells for therapeutic or research purposes. This process involves upstream production, downstream purification, and rigorous quality control to ensure the viral vectors are safe, potent, and suitable for clinical or commercial application in gene therapy, vaccines, and cell-based treatment. The viral vector manufacturing market is growing due to the rising prevalence of genetic disorders and cancers, where gene and cell therapies offer promising treatments. Increasing regulatory approvals and advancements in vector production, purification, and scalability have encouraged pharmaceutical companies to invest in this space. As more need for high-quality, large-scale viral vector production continues to grow, supporting in vivo and ex vivo therapeutic applications.

For Instance,

AI can significantly enhance the market by optimizing production processes, improving quality control, and reducing development timelines. Through machine learning, AI can analyze complex data to predict yields, identify process deviations, and streamline vector design. It enables faster troubleshooting and better scalability, leading to more efficient and cost-effective manufacturing. Additionally, AI-driven automation can reduce human error and enhance consistency in Good Manufacturing Practice (GMP) environments. Overall, AI integration supports higher productivity and innovation, meeting the rising demand for gene therapies using viral vectors.

Growth in Genetic Disorders

The rise in genetic disorders is fuelling demand for gene therapies, which rely on viral vectors to deliver therapeutic genes. As more patients seek lasting treatments, the need for a safe, efficient delivery system grows. Viral vectors, especially AAV and lentivirus, are crucial for precision targeting in gene therapy, promoting increased investment, R&D, and production capacity in the viral vector manufacturing market to meet the expanding therapeutic landscape.

Regulatory and Manufacturing Challenges

Regulatory and manufacturing challenges restrain the viral vector manufacturing market due to strict quality standards, complex production processes, and lengthy approval timelines. Ensuring consistent batch quality and meeting evolving regulatory requirements increases costs and delays. Limited manufacturing capacity and a skilled workforce further hinder scalability. These barriers slow down product development and commercialization, limiting market growth despite rising demand for gene therapies and vaccines.

Advanced Therapies

Advanced therapies such as gene and cell therapies offer a major opportunity for the market because they rely heavily on viral vectors for delivering genetic, cellular information into cells. As the demand for personalized, targeted treatments grows, especially for rare and chronic diseases, the need for safe, efficient, and scalable viral vectors increases. This drives innovation, investment, and expansion in viral vector production, fueling market growth.

By type, the adeno-associated viral vectors (AAV) segment accounted largest share in the market in 2024, due to their favorable safety profile, broad therapeutic applicability, and strong clinical demand. AAVs are non-pathogenic and capable of long-term gene expression, making them ideal for treatment, and a growing pipeline of AAV-based therapies has driven investment in specialized manufacturing infrastructure, further solidifying their dominance in the gene therapy and viral vector space.

By type, the adenoviral vector segment held a significant growth of the viral vector manufacturing market in 2024, driven by its high transduction efficiency and strong immune response stimulation. These vectors are widely used in vaccine development and gene therapy. For example is TILT-123, an oncolytic adenovirus encoding TNF-a and IL-2, which demonstrates safety and promising tumor-targeting efficiency in advanced solid cancer patients during a 2024 clinical trial. This success underscores the expanding role of adenoviral vectors in oncology and gene therapy applications.

By disease, the cancer segment was dominant in the market in 2024, due to the rising prevalence of cancer and growing adoption of gene and cell therapies, especially CAR-T and oncolytic virus-based treatments. Increased investment in oncology-focused R&D, along with recent regulatory approvals, fueled demand for viral vectors. Technological advancement in viral delivery systems further supported their use in cancer therapy, positioning oncology as the dominating application area in the viral vector manufacturing market.

For Instance,

By disease, the infectious diseases segment is expected to grow at the fastest CAGR in the market during the forecast period. The increasing demand for novel vaccines against persistent and emerging infections like HIV, malaria, and tuberculosis. Increased awareness, early diagnosis efforts, and advancements in molecular diagnostics have significantly enhanced detection and treatment rates. Additionally, urbanization, climate change, and global travel contribute to the spread of infectious agents, prompting government and healthcare providers to invest more in prevention, surveillance, and therapeutic solutions.

By application, the gene therapy segment accounted highest shares in the market in 2024, due to the growing prevalence of genetic disorders and the increasing adoption of gene-based treatments. Advancements in viral vector technologies, especially with adeno-associated viruses (AAVs), have improved the safety and efficiency of gene delivery. Additionally, rising R&D investment and favorable regulatory approvals have accelerated the development and commercialization of gene therapies, driving demand for viral vectors in this application.

By application, the vaccinology segment is projected to grow at the fastest rate in the market, due to increased demand for innovative vaccine platforms and advancements in vector production technologies. The rising focus on developing vaccines for chronic illness and emerging health threats has expanded the scope of viral vectors. Additionally, improvements in scalability and efficiency of manufacturing processes, along with strong support from government and research institutions, are further accelerating the adoption of viral vectors in vaccine development.

By end-user, the pharmaceutical and biopharmaceutical companies segment held a dominant presence in the market in 2024, because of the growing demand for gene and cell therapies, particularly in oncology and rare genetic disorders. These companies significantly increased R&D investment and expanded in-house manufacturing capabilities to support clinical and commercial production. Strategic collaborations and acquisitions further strengthened their presence while regulatory approvals of viral vector-based therapies fueled the need for scalable production solutions, solidifying their leadership in the market.

By end-user, the research institutes segment is estimated to grow at the fastest rate during the predicted timeframe due to increasing investment in R&D, rising demand for advanced technologies, and growing collaboration between academia and industry. These institutes drive innovation and are often early adopters of modern tools and methods, fueling demand for specialized products and services. Additionally, government and private fueling support further accelerates research activities, contributing to the segments’ rapid growth during the forecast period.

In 2024, North America dominated the viral vector manufacturing market due to strong biopharmaceutical infrastructure, significant investments in gene therapy research, and supportive regulatory frameworks. The region is home to major industry players and leading research institutions, which have accelerated the development and commercialization of viral vector-based therapies. High healthcare spending, a growing number of clinical trials, and favorable government initiatives further fueled market growth. Additionally, increased demand for advanced therapies for rare and genetic diseases contributed to North America’s market leadership.

The U.S. market is expanding due to rising demand for gene and cell therapies targeting genetic disorders and cancers. Strong government funding, a robust biotech ecosystem, and a growing number of clinical trials are driving growth. The presence of advanced CDMOs and technological innovations in large-scale production has improved manufacturing capabilities. These factors, combined with a surge in gene therapy approvals, are solidifying the U.S. as a global leader in viral vector manufacturing.

The market in Canada is rapidly expanding due to strong government support, including funding through the Strategic Innovation Fund and initiatives like the Medical Countermeasures program. Advances in biomanufacturing technologies, such as single-use systems and automated processing, are boosting production efficiency. Additionally, the establishment of specialized training centers like CATTI and strategic partnerships between academia and industry are enhancing expertise and capacity. These combined efforts position Canada as a growing leader in the global biotechnology landscape.

Asia-Pacific is anticipated to experience the fastest growth in the market during the forecast period, due to increasing investments in biotechnology and pharmaceutical research, rising demand for gene therapies, and expanding healthcare infrastructure. Governments in countries like China, India, and South Korea are supporting biopharmaceutical innovation through favorable policies and funding. Additionally, the availability of a skilled workforce and cost-effective manufacturing capabilities make the region attractive for outsourcing production. These factors collectively drive rapid market expansion across the Asia-Pacific during the forecast period.

The market in China is growing rapidly due to strong government support, increased investments in biotechnology, and favorable regulatory reforms. Initiatives like “Made in China 2025” and substantial funding for R&D have boosted innovation in gene therapies. Additionally, leading companies are investing in large-scale manufacturing facilities, enhancing production capabilities. China's cost-effective manufacturing environment and expanding healthcare sector further contribute to its emergence as a key player in the global viral vector market.

India's market is growing due to rising demand for gene and cell therapies, strong government support through initiatives like “Make in India,” and increasing biotech investments. The country’s cost-effective production, skilled talent pool, and expanding pharmaceutical infrastructure attract global partnerships. As a major vaccine producer, India is leveraging its existing capabilities to scale viral vector manufacturing, positioning itself as a competitive player in the global biotech and life sciences landscape.

Europe is expected to see significant growth in the viral vector manufacturing market during the forecast period, due to rising investments in gene therapy research, a strong presence of biopharmaceutical companies, and supportive regulatory frameworks. Additionally, the increasing prevalence of genetic disorders and cancer is driving demand for advanced therapies. Collaborations between academic institutions and industry players, along with government funding, further boost innovation and capacity expansion. These factors collectively position Europe as a key hub for viral vector production during the forecast period.

Horizon Europe, the EU’s flagship program for research and innovation, has allocated EUR 11.5 billion (USD 12.6 billion) to support progress in biotechnology and pharmaceutical R&D. Additionally, InvestEU plans to contribute over EUR 1 billion (USD 1.1 billion) toward biotech and medicine-focused projects. These substantial investments are expected to drive innovation and growth in viral vector production across Europe, reinforcing the region’s role in advancing next-generation therapies.

The UK market is expanding rapidly due to strong government support, increased investment in biotech infrastructure, and rising demand for gene therapies. Key players are enhancing production capabilities, while initiatives like the RNA Centre of Excellence drive innovation. Additionally, the UK’s active role in clinical research and trials further supports market growth, making it a leading hub for viral vector development in Europe.

Germany's market is expanding due to strategic investments in biomanufacturing infrastructure, a robust pharmaceutical sector, and supportive regulatory frameworks. Leading companies like Merck KGaA have enhanced their production capabilities, obtaining approvals from both the U.S. FDA and EMA for viral vector manufacturing. The country's focus on gene and cell therapies, bolstered by government funding and a strong clinical research environment, positions Germany as a key player in Europe's viral vector industry.

The Middle East & Africa are considered to be a significantly growing area, due to rapidly expanding manufacturing infrastructure and the growing demand for biologics. The rising prevalence of infectious and other chronic diseases potentiates the need for advanced biologics. Several government organizations also support the adoption of cutting-edge technologies for manufacturing viral vectors. The entire African continent represents 25% of the total global vaccine usage. Additionally, there are 11 viral vector manufacturers in Africa, out of which 10 have operational formulation/fill/finish capacities. (Source: Science Direct)

South Africa is at the forefront of advancing cellular and gene therapies, driving research, innovation, and equitable access. Numerous government and private institutions conduct seminars and conferences to increase awareness of biologics. The International Society for Cell & Gene Therapy and the ISCT ANZ LRA organized a webinar on the “Progress in Advanced Cellular & Gene Therapies in South Africa” in June 2025. (Source: ISCT Global)

In September 2024, Rentschler Biopharma announced the expansion of services at its Stevenage, UK site, introducing a new lentiviral vector (LVV) manufacturing toolbox for advanced therapy medicinal products (ATMPs). This addition complements its existing adeno-associated virus (AAV) services. “We made a strategic investment in the cell and gene therapy sector... to support innovators in this fast-developing space,” said Christiane Bardroff, COO of Rentschler Biopharma. (Source - Rentschler)

By types

By Diseases

By applications

By end-user

By Regions

February 2026

February 2026

January 2026

January 2026