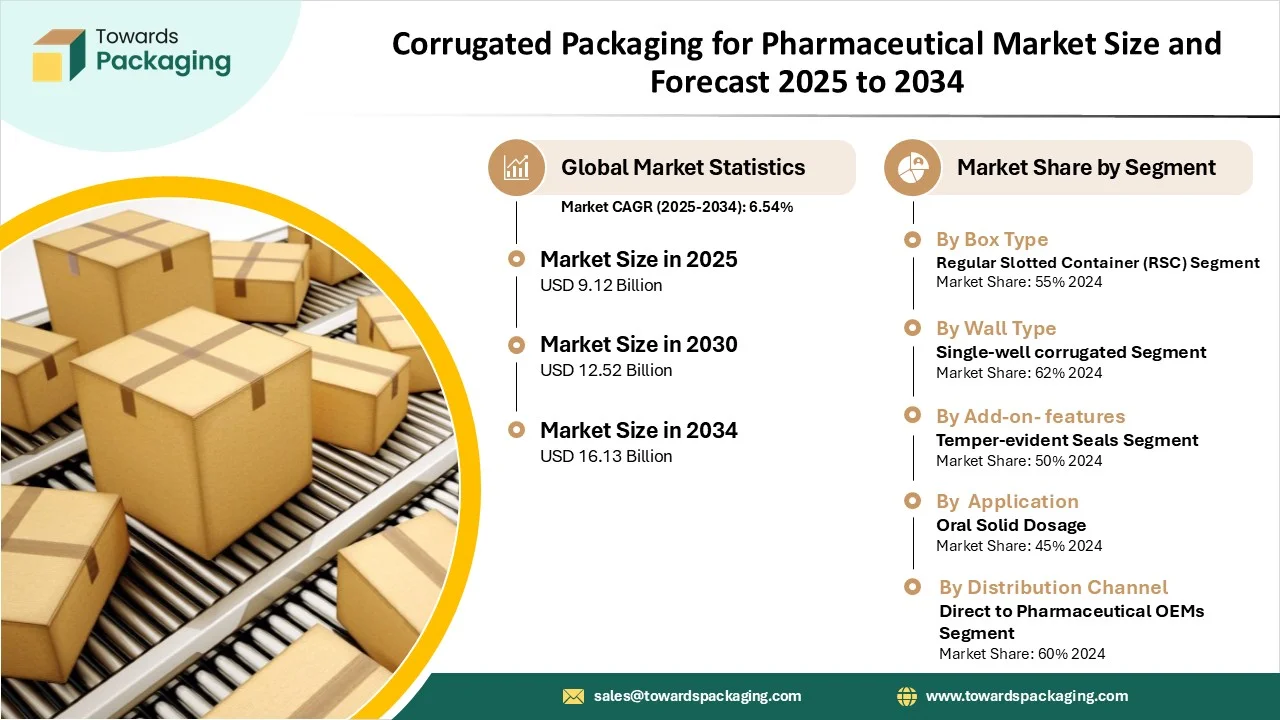

The global corrugated packaging for pharmaceutical market size was estimated at USD 8.56 billion in 2024 and is anticipated to reach around USD 16.13 billion by 2034, growing at a CAGR of 6.54% from 2025 to 2034. The wide options of customization, cost-effectiveness, security, and product protection enhance the importance of corrugated packaging in the pharmaceutical industry.

The pharmaceutical industries prefer corrugated packaging for complex medicines to maintain their integrity and safety. It improves supply chain efficiency through the integration of different technologies. The increased focus on sustainability and the rise of e-pharmacies are driving the solid growth of the corrugated packaging for pharmaceutical market. The strict regulations and the rising demand for sustainable materials are also notable driving forces for the market’s growth.

The pharmaceutical industry is shifting from single-use plastics to fully recyclable and biodegradable corrugated materials that are composed of renewable resources. There is an increased adoption of water-based inks and eco-friendly carton boxes. Advancements are made in sustainable coatings, water-based, and nano-coatings to maintain recyclability.

The expansion of cold chain markets, e-commerce, and direct-to-consumer sales is driving the continued rise of corrugated packaging for pharmaceutical market.

The increased demand for vaccines, injectable drugs, insulated corrugated boxes, and temperature-sensitive biologics is accelerating the expansion of cold chain markets.

The corrugated materials have poor barrier properties, which include poor resistance to moisture, temperature fluctuations, and gas. They are sensitive to exposure to high humidity and moisture, where they lose their structural integrity. The supply chain and operational issues are related to cost volatility, high customization costs, and integration with automation.

The regular slotted container segment dominated the corrugated packaging for pharmaceutical market in 2024, owing to its role in improving logistics efficiency and introducing cost-effectiveness. The integration of smart technologies for the security of products raises the adoption of this container. The rising preference for eco-friendly materials and reduced material use displays the efficiency of these products.

The die-cut/sleeve-style boxes segment is expected to grow at the fastest CAGR in the market during the forecast period due to their customized fit, superior integrity, and unique design. The improved branding and patient communication boost customization options for boxes with product information, regulatory compliance data, and dosage instructions. The massive growth of the corrugated packaging for pharmaceutical market is also driven by the reduced material use and cost, and the ease of assembly, enhancing operational efficiency and sustainability.

The single-wall corrugated segment dominated the market in 2024, owing to its primary role in sustainable, cost-effective, and customizable secondary and tertiary packaging. The growth of direct-to-consumer (DTC) delivery and online pharmacies expanded e-commerce and robust shipping. The novel innovations of vaccines, biologics, and specialized therapies increased the need for specialized insulated corrugated packaging.

The double-wall for the high-value/fragile goods segment is estimated to grow at the fastest rate in the corrugated packaging for pharmaceutical market during the predicted timeframe due to its enhanced strength and durability, providing superior protection and bulk shipments. The double-wall boxes hold security features that ensure product integrity and safety. The eco-friendly packaging and focus on recyclability introduce efficient double-wall boxes for enhanced product safety.

The tamper-evident seals segment dominated the market in 2024, owing to the stringent regulations and the rising demand for supply chain transparency. The integration of digital technologies and advanced security features expands the role of these seals beyond simple protection. The corrugated packaging for pharmaceutical market is driven by the emphasis of industries on ensuring regulatory compliance and addressing emerging global regulations, which expands the use of tamper-evident seals for packaging.

The barrier-coated boards segment is anticipated to grow at a notable rate in the market during the upcoming period due to their superior potential in providing moisture protection, acting as an oxygen barrier, and enabling contaminant resistance. The sustainable innovations revolving around recyclability, biodegradability, reduced carbon footprint, and regulatory compliance drive the adoption of these materials. These boards have integral use in the cold chain for insulation, biologics, and reusable systems.

The oral solid dosage segment dominated the market in 2024, owing to the regulatory changes and the expansion of e-commerce. The oral solid dosages are crucial in the pharmaceutical industry for secondary and tertiary packaging. It can meet the evolving demands for security, sustainability, and supply chain efficiency.

The injectables & biologics segment is predicted to grow at a rapid rate in the market during the studied period due to the advantages of corrugated packaging for cold chain logistics, including insulated solutions, multi-wall corrugation, and thermal protection. The corrugated packaging for pharmaceutical market is accelerated by certain types of packaging that provide structural integrity and automated packing compatibility for biologics and injectables in the pharmaceutical industry. These packaged products enhance supply chain efficiency and enhance patient engagement.

The direct-to-pharmaceutical OEMs segment dominated the market in 2024, owing to adherence to regulations and improved traceability. They provide cold chain support, optimize e-commerce, and introduce automated production compatibility. The material innovation, responsible sourcing, and eco-friendly materials drive the expansion of direct to pharmaceutical OEMs.

The contract packaging & CMOs segment is expected to grow at the fastest CAGR in the corrugated packaging for pharmaceutical market during the forecast period due to scalability, expertise, and access to advanced technologies. They facilitate regulatory compliance by the pharmaceutical industries while ensuring sustainability and meeting supply chain demands. They support circular supply chains and offer eco-friendly solutions.

How does North America Dominate the Market in 2024?

North America dominated the market in 2024, owing to research initiatives, government regulations, and emerging market trends. Several government-led activities and the corrugated packaging program are some of the potential driving forces for the expansion of the North American corrugated packaging for pharmaceutical market. The U.S. FDA provides guidance for packaging, and government-backed research funding supports R&D in packaging materials. The regulation on sustainable packaging, mergers and acquisitions, and technological integration boost the manufacturing of sustainable and innovative materials. The regulatory pressure boosts North American pharmaceutical companies to adopt corrugated packaging due to its low environmental impact and recyclability.

U.S. Market Trends

The new government programs launched in the U.S. for regulating corrugated pharmaceutical packaging. The U.S. FDA and the sustainability policies of the government support the regulatory changes in the U.S. The federal sustainability initiatives driving the growth of the corrugated packaging for pharmaceutical market in the U.S. include sustainable procurement policy and recommendations by the Environmental Protection Agency (EPA).

What is the Potential of the Market in the Asia Pacific?

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period due to several activities led by Asian Pacific governments. The government activities focused on increasing domestic production, raising manufacturing standards, and introducing sustainability measures. The specific programs, like quality upgrades, new regulations, and limitations on excessive packaging, help to reduce plastic waste and improve traceability. The new plastic waste regulations and eco-friendly packaging initiatives advance the corrugated packaging for pharmaceutical market in the Asia Pacific. The updates to good manufacturing practices (GMP) for packaging also boost regional markets’ expansion.

India Market Trends

The relevant Indian government schemes benefit and advance the pharmaceutical industrial packaging. These schemes assist industries with common facilities such as testing laboratories and manufacturing hubs. The Indian pharmaceutical industries focus on quality, compliance, and safety standards through the expertise of pharmaceutical manufacturers.

By Box Type

By Wall Type

By Application

By Add-On Features

By Distribution Channel

By Region

Source: https://www.towardspackaging.com/insights/corrugated-packaging-for-pharmaceutical-market-sizing