January 2026

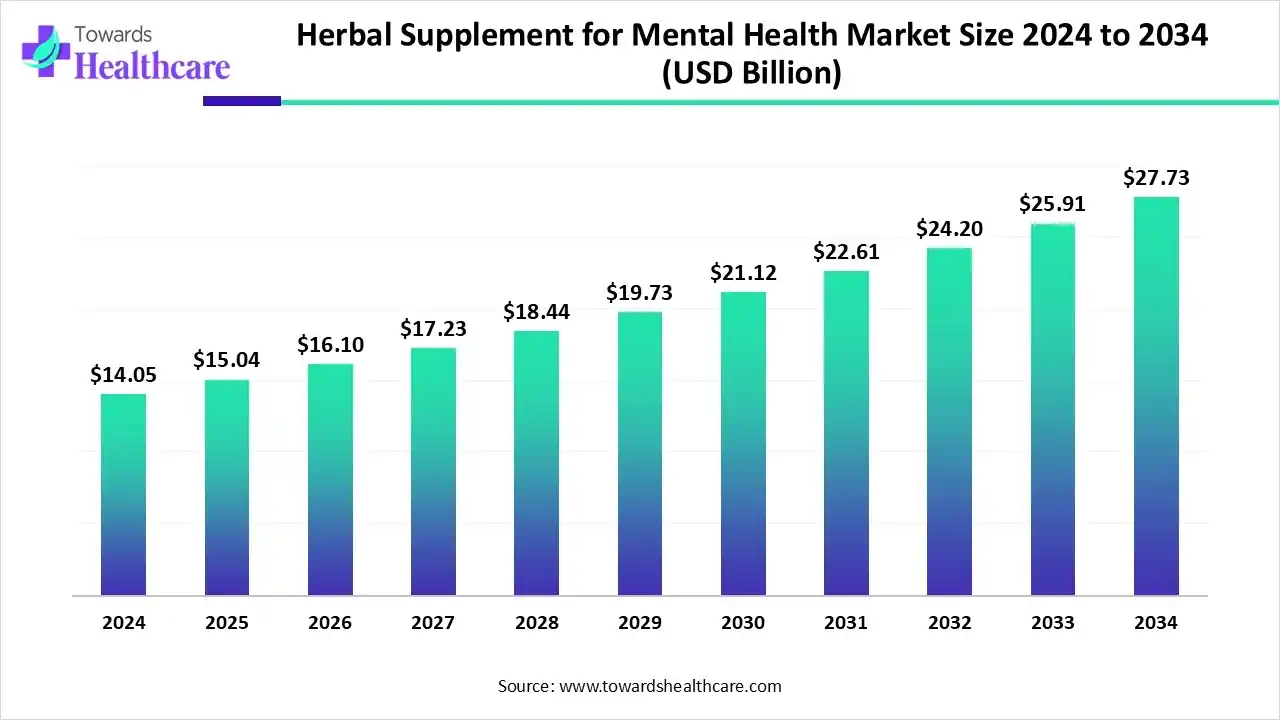

The global herbal supplement for mental health market size is calculated at USD 15.04 billion in 2025, grew to USD 16.1 billion in 2026, and is projected to reach around USD 29.7 billion by 2035. The market is expanding at a CAGR of 7.04% between 2026 and 2035.

The herbal supplement for mental health market is primarily driven by growing research and development activities and the increasing innovations in product formats (e.g., gummies and ready-to-drink beverages). Evidence-based herbal products are used either as an alternative to pharmaceuticals or as adjuvants to alleviate cognitive symptoms. Government organizations authorize the use of herbal supplements for mental health disorders. Artificial intelligence (AI) helps analyze appropriate products based on patients’ conditions.

| Table | Scope |

| Market Size in 2026 | USD 16.1 Billion |

| Projected Market Size in 2035 | USD 29.7 Billion |

| CAGR (2026 - 2035) | 7.04% |

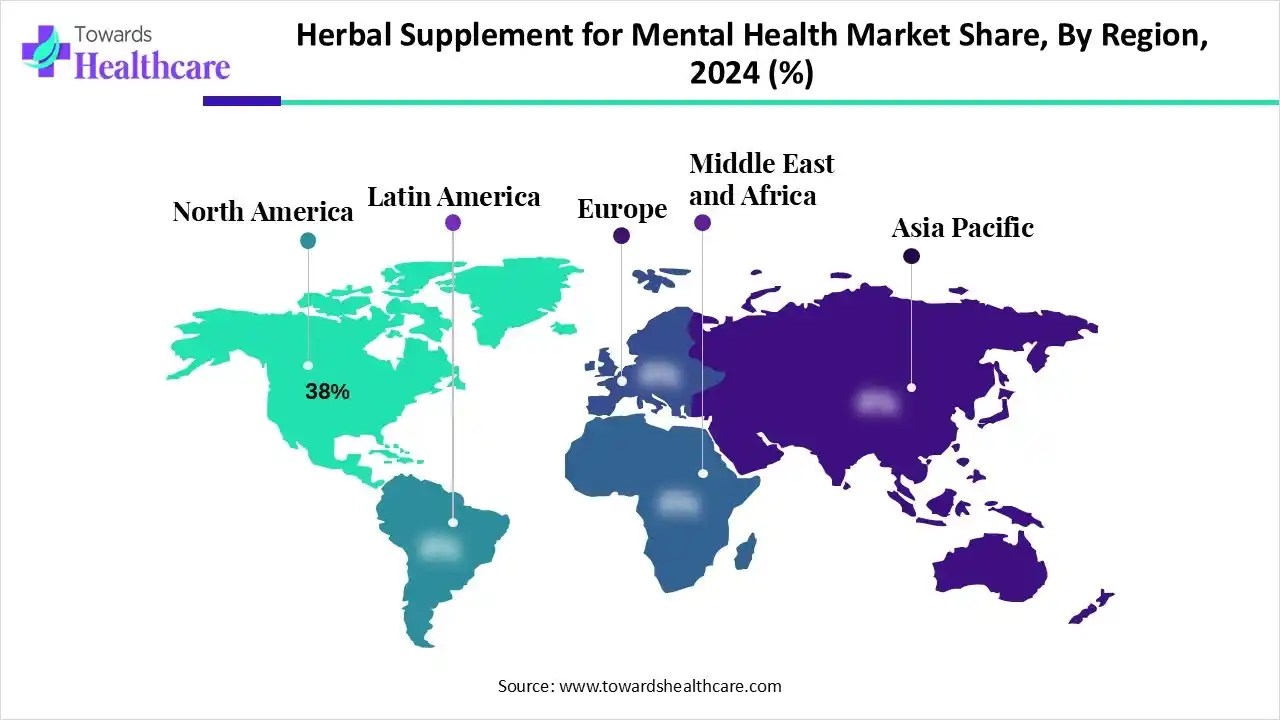

| Leading Region | North America by 38% |

| Market Segmentation | By Product/Ingredient, By Formulation/Format, By Indication/Use Case, By Distribution Channel, By End-User, By Region |

| Top Key Players | Himalaya Wellness Company, Swisse Wellness, Solgar, Jarrow Formulas, New Nordic, NutraScience, MegaFood, Pukka Herbs, Nature’s Bounty, A.Vogel, Sabinsa, Indena, Euromed |

The herbal supplement for mental health market is experiencing robust growth, driven by the increasing prevalence of mental health disorders, shifting trend towards mental health self-care, and rising consumer preference for natural products. It covers herbal and botanical dietary supplements (single-herb extracts, standardized botanical ingredients, adaptogen blends, and multi-ingredient formulas)

They are used for a variety of mental health-related problems, such as mood (mild-moderate depression), anxiety/stress management, sleep quality, cognitive clarity/focus, and emotional resilience. Products include St. John’s wort, ashwagandha, rhodiola, ginkgo, saffron, valerian, chamomile, lemon balm, and formulated adaptogen stacks sold as capsules, tablets, tinctures, teas, gummies, and ready-to-drink formats.

AI has made significant breakthroughs in nutraceuticals by evaluating their novel applications, as well as quantifying and qualifying their chemical compositions. AI and machine learning (ML) algorithms can analyze vast amounts of data and predict potential pharmacological effects of certain herbal products. They can also monitor a patient and suggest appropriate therapy based on their condition. Moreover, AI and ML can enable healthcare professionals to monitor a patient and study the response of nutraceuticals continuously.

By product/ingredient, the adaptogens & stress-support segment held a dominant presence in the herbal supplement for mental health market with a share of approximately 30% in 2024, due to sedentary lifestyles and increasing stress levels among adults. Adaptogens help manage stress and restore balance after a stressful situation. Several studies have demonstrated that adaptogens play a crucial role in improving mood, balancing hormones, fighting fatigue, and boosting the immune system.

By product/ingredient, the other/emerging botanicals segment is expected to grow at the fastest CAGR in the market during the forecast period. Emerging botanicals are identified that can provide a more desired therapeutic effect against mental health disorders. For instance, cannabidiol-adjacent botanical combinations are prescribed to patients in nations where cannabis is legal. Herbal products, such as lavender, hops, maypop, lemon balm, and valerian, have consistently shown positive results in clinical trials to relieve mild forms of neurodegenerative disorders.

By formulation/format, the capsules & tablets segment held the largest revenue share of approximately 46% in the herbal supplement for mental health market in 2024, due to ease of administration and cost-effectiveness. Tablets & capsules enhance patient convenience, due to faster absorption and improved bioavailability. They are the most stable forms of formulations that can be transported and stored easily. They can be either immediate-release or sustained-release, providing desired therapeutic effects.

By formulation/format, the gummies & chewables segment is expected to grow with the highest CAGR in the market during the studied years. Gummies & chewables are preferred to mask the bitter taste of tablets & capsules. It is estimated that up to 40% American adults have reported difficulty swallowing pills, potentiating the demand for chewables & gummies. Compared to gummies, chewables have higher active ingredient content, offering significantly more potency.

By indication/use case, the stress & anxiety support segment contributed the biggest revenue share of approximately 36% in the herbal supplement for mental health market in 2024, due to the rising prevalence of mood disorders. According to the Ipsos World Mental Health Day Report 2024, 62% of people, or over 3 in 5 people, across 31 countries reported feeling stressed at least once in their lifetime. Stress & anxiety are mainly caused by major life changes, financial problems, and work-life balance. Herbal supplements provide a safe, effective, and easy-to-use alternative for mitigating mental health symptoms.

By indication/use case, the cognitive support/focus & memory segment is expected to expand rapidly in the market in the coming years. Cognitive support is required for promoting healthy aging and assisting people with disabilities. Herbal supplements can increase productivity, quality, and accessibility of patients. The rising prevalence of dementia and attention-deficit hyperactivity disorder (ADHD) boosts the segment’s growth. Approximately 6.9 million Americans aged 65 years and older are living with Alzheimer’s disease.

By distribution channel, the brick-and-mortar retail segment led the herbal supplement for mental health market with a share of approximately 44% in 2024, due to favorable infrastructure and suitable capital investments. Investments enable retail stores to adopt innovative products for expanded indications. The increasing number of health stores and pharmacies enhances patient accessibility. Health stores have skilled professionals to guide patients about herbal supplements.

By distribution channel, the direct-to-consumer/brand websites segment is expected to witness the fastest growth in the market over the forecast period. Most companies sell their proprietary products from their websites. Direct-to-consumer (DTC) delivery enables patients to purchase high-quality products directly from manufacturers at affordable costs. Patients can choose the desired products from a wide range of options. Companies offer specialized discounts and free home delivery.

By end-user/buyer type, the general consumers segment accounted for the highest revenue share of approximately 62% in the herbal supplement for mental health market in 2024, due to the growing awareness of self-care for mental health and the online availability of herbal supplements. The increasing demand for natural products due to their cost-effectiveness and fewer side effects augments the segment’s growth. Herbal supplements offer perceived advantages over conventional medicine.

By end-user/buyer type, the clinically-referred/integrative medicine patients segment is expected to show the fastest growth over the forecast period. Numerous healthcare professionals refer patients to herbal supplements. Integrative medicine is emerging as a vital component of patient care, reducing hospital costs. The increasing trust of patients in healthcare professionals propels the segment’s growth.

North America dominated the global herbal supplement for mental health market with a share of approximately 38% in 2024. The availability of state-of-the-art research and development facilities, the presence of key players, and the growing awareness of nutraceuticals are the major growth factors of the market in North America. The rising prevalence of mental health disorders due to the growing geriatric population and sedentary lifestyles promotes market growth. The presence of a robust healthcare infrastructure and favorable government support contributes to market growth.

Key players, such as Gaia Herbs, Thorne Research, and NaturesPlus, are the major contributors to the market in the U.S. The Mental Health America organization reported that approximately 23.4% of Americans experienced mental illness in 2024, accounting for 60 million people. Americans are aware of natural remedies and their benefits. In the last decade, the use of high-dose vitamins has increased by 130%, and the use of herbal supplements has surged by 380%.

Asia-Pacific is expected to grow at the fastest CAGR in the herbal supplement for mental health market during the forecast period. Asia-Pacific countries, such as China and India, are at the forefront in promoting herbal products and their benefits to the world. The Traditional Chinese Medicine (TCM) and Ayurveda (India) are centuries-old traditions that local people follow. Government organizations also support and encourage the use of indigenously-grown herbal medicines for numerous chronic disorders. Healthcare professionals aim to fulfill the unmet needs of people due to the increasing population in the region.

According to a recent all-India survey, at least 1 member in 85% of rural households and 86% of urban households is aware of medicinal plants, home remedies, local health traditions, or folk medicine. According to the Indian Ministry of AYUSH, over 25% of India’s Ayurvedic or herbal products exports were made to the U.S. in 2023. Organic India, Vedi Herbals, and Kerala Ayurveda Ltd. are major companies that offer herbal supplements for mental health in India.

Europe is expected to grow at a considerable CAGR in the herbal supplement for mental health market in the upcoming period. The burgeoning healthcare sector and the increasing awareness of herbal supplements among the general public augment the market. Europe is an attractive market for natural ingredients due to its large import volumes of medicinal and aromatic plants. Countries like the UK, Germany, France, and Spain produce the highest amount of medicinal supplements for mental health disorders. The Committee on Herbal Medicinal Products (HMPC) issues scientific opinions on herbal substances and preparations.

The UK government invested £15 million in a new National Alternative Protein Innovation Centre (NAPIC) to accelerate the commercialization of plant-based, cultivated, and fermentation-based foods. About 487,432 patients were diagnosed with dementia in the UK as of June 2024. Of these, 65% of patients aged 65 years and above were diagnosed with dementia.

Researchers focus on evaluating the role of herbal supplements on mental health disorders and developing novel formulations.

Clinical trials are conducted to assess the role and efficacy of certain herbal supplements on humans and identify their potential adverse effects and drug-drug interactions.

Key Players: ICBio CRO, Atlanta Clinical Trials, and Vipragen.

Herbal supplements are distributed to hospitals and pharmacies through distributors and wholesalers. They are also directly sold to patients through e-commerce platforms.

Healthcare professionals and pharmacists guide patients about the indication and dose of herbal supplements. They also support the patient in managing side effects caused by drug interactions.

By Product/Ingredient

By Formulation/Format

By Indication/Use Case

By Distribution Channel

By End-User

By Region

January 2026

January 2026

January 2026

January 2026