February 2026

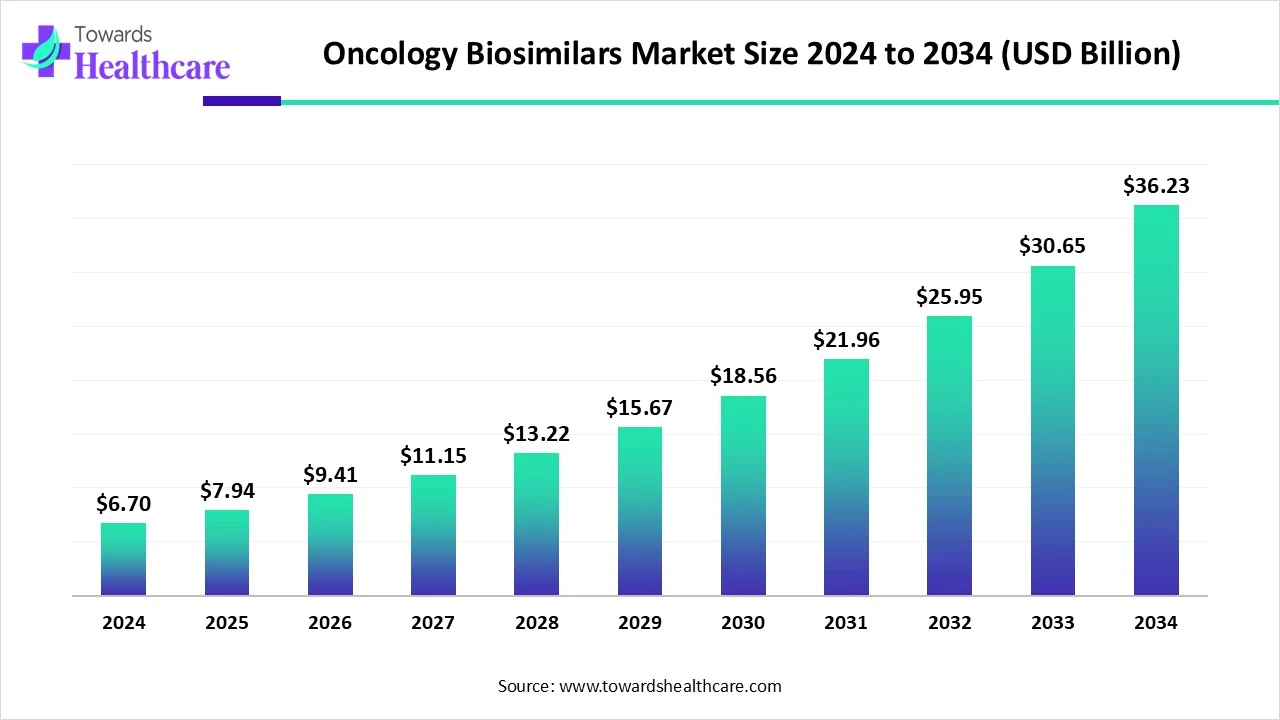

The global oncology biosimilars market size is calculated at US$ 6.7 billion in 2024, grew to US$ 7.94 billion in 2025, and is projected to reach around US$ 36.23 billion by 2034. The market is expanding at a CAGR of 18.47% between 2025 and 2034.

The oncology biosimilars market is undergoing rapid expansion as healthcare systems are increasingly seeking cost-effective alternatives to biologic therapies. Biosimilars are designed to match the safety standards, efficacy, and quality of original biologics, playing a vital role in cancer treatments. As the world develops, cancer diagnosis becomes more complex.

Advancements in technology, drugs, strict regulations, and supportive government initiatives are fueling the development of this industry. Furthermore, patients and healthcare professionals have become more aware of and acceptable of new forms of treatment, particularly in chemotherapy targeted treatment plans, and supportive care. These biosimilars are emerging as a transformative force in the oncology domain, prioritizing care, safety, and accessibility.

| Table | Scope |

| Market Size in 2025 | USD 7.94 Billion |

| Projected Market Size in 2034 | USD 36.23 Billion |

| CAGR (2025 - 2034) | 18.47% |

| Leading Region | North America |

| Market Segmentation | By Indication, By Drug Class, By Region |

| Top Key Players | Samsung Bioepis Co., Celltrion, Amgen Inc, Mylan N.V., Allergan, Novartis International AG, Biocon, Pfizer, Dr. Reddy’s Laboratories, STADA Arzneimittel AG, Apotex, BIOCAD, Merck & Co. |

The oncology biosimilars market is a vast, growing network that includes everything from manufacturing, analysis, and clinical trial designs. The development of these factors requires efficient bioprocessing capabilities, detailed cell line engineering, and precise purification processes. Several pharmaceutical companies are investing in cutting-edge technologies to improve performance and scalability. The market also benefits from the development of glycosylation profiling and structural compatibility, allowing developers to make necessary modifications and meet the requirements for biosimilars. Clinical development practices are also being optimized through thorough analysis of real-world evidence, thus maturing the oncology landscape.

Pricing discounts and cost competition: The oncology biosimilars market is defining the aspect of pricing. Manufacturers are offering up to 50-80% discounts in order to gain formulary access and drive uptake. These price reductions lead to a competitive dynamic and enhance affordability. This expands its access across diverse healthcare systems. Samsung Bioepis stated that newly launched biosimilars in the U.S. are available with a wholesale acquisition cost discount of almost 80%. The FDA and European EMA are also actively considering streamlining biosimilar development in order to accelerate market entry and make development smoother.

Rising Collaborations and development: Strategic partnerships between global biotech and pharmaceutical companies are pushing the oncology biosimilars market ahead. These alliances help to speed up timelines and expand market reach. By joining forces, companies can pool their resources together, work with each other’s strengths, and bring deep expertise in biologics innovation and process development. This collaborative approach helps to mitigate risks, broaden geographic reach, and quickly introduce these drugs in the market. This increases the patient’s access to advanced cancer care, where timing is everything.

With millions of people being diagnosed with cancer every year, our traditional treatment paths are being stretched thin. Here, AI not just acts as a replacement, but a valued ally. It is revolutionizing drug discovery, detection, and the way we treat different forms of cancer. In oncology, there is a plethora of data, and machine learning tools and AI systems can now analyze these massive amounts of data, such as genomic profiles and protein structures, to predict how a patient might respond to the drug compared to its reference biologic. This allows researchers to modify molecular design, optimize cell lines, and deal with potential manufacturing challenges before setbacks arise.

Another sector where AI tools prove to be beneficial is in manufacturing. AI-driven processes and control systems maintain consistency in biologics production, detecting minute variations and adjusting parameters to keep quality consistent. This is particularly important for the oncology field, where slight changes can alter therapeutic outcomes. AI is not only helping the healthcare industry in cancer treatment, but also in their very understanding of it. Together, these AI applications can greatly improve the success rate of biosimilars, ensuring the patient gets the best chance for a healthy life.

Patent Expirations of Blockbuster Biologics

A key factor that is fueling the expansion of the oncology biosimilars market is the patent expirations for major biologic cancer drugs. Many expensive therapies, such as monoclonal antibodies used to treat breast cancer, lymphoma, and other cancers, are losing their market exclusivity, opening the door for biosimilars. For years, these medicines have set the standards for cancer treatment, which allows manufacturers and researchers to introduce new cost-effective, efficient, and reliable treatment alternatives. This helps to significantly reduce the financial burden on healthcare systems while still maintaining the quality of clinical outcomes.

Patients now have access to advanced therapy options that might have been previously unaffordable. These patent expirations make it possible for patients who come from lower-income regions to invest in broader cancer care. The companies best equipped to handle this transition are those with strong research and development lines, efficient manufacturing processes, and vast distribution channels. As patents are expiring in regions like the U.S, Europe, and Asia, the oncology biosimilars market is expected to accelerate even more.

Complex Development Process

Bringing oncology biosimilars into the market is not a straightforward task. Biosimilars are not like other small-molecule drugs that can be chemically replicated; they are complex, living-molecule medicines that require precision at every stage of development. It is challenging to match them to the original biological structure, function, and performance. In order to reach this level of accuracy, labs and companies run multiple tests, molecular comparisons, and even undergo full-scale clinical trials. This requires cutting-edge facilities, advanced tools, expert teams, and efficient systems.

Expansion in Emerging Markets

Emerging markets are serving as a promising growth platform for the oncology biosimilars market. Over the years, there has been a rise in cancer cases in regions like Africa, Southeast Asia, and Latin America, and yet, access to high-quality biologics remains limited. Biosimilars can fill these gaps by providing the same treatment for a lower price, leading to easy market expansion. Governments from these regions have also started to take notice and are rolling out policies that encourage local manufacturing and research, creating a welcoming environment for the biosimilars market.

Manufacturers in countries like India, China, and South Korea are combining technical expertise with cost advantages to boost supply and exports. As awareness about biosimilars grows, trust also grows. Through clinical experiments, these emerging markets may be set to become key players and major contributors to the rest of the world. The combination of rising need, supportive regulations, and research capabilities, coupled with manufacturing developments, is a key part of this industry’s growth.

By indication, the breast cancer segment is dominating the oncology biosimilars market as of 2024. Breast cancer is one of the most common malignancies found all across the world, giving rise to the development of biosimilars such as Kanjinti, Herzuma, and Hercessi. These types of medications target the HER2 receptors and replicate the effects of the original biologic. Regulatory bodies such as the FDA and EMA already have multiple versions, leading to their broad acceptance, smoothening the path to widespread use.

By indication, the lung cancer segment is estimated to be the fastest-growing during 2025-2034. This growth is driven by new biosimilar versions of key biologics such as bevacizumab, slowly but steadily making their way into NSCLC treatments. In addition to this, targeted therapies and personalized medicines are bringing a new momentum to NSCLC as global lung cancer rates rise and an urgent demand sweeps the market.

By drug class, the Granulocyte Colony-Stimulating Factor (G-CSF) segment was the dominant segment in the oncology biosimilars market in the year 2024. This is due to their important role in effective cancer care, as they help reduce infections during chemotherapy. Medicines such as Zarxio, Zefylti, and Nivestym have become the first FDA-approved biosimilars and have attained widespread adoption due to their low cost profiles. Additionally, pegfilgrastim biosimilars have also gained popularity due to their longer half-life, which means fewer injections and more convenience. The development complexity for G-CSF biosimilars is also lower than compared of other medicines, allowing manufacturers to create a stable yet high-volume market.

By drug class, the monoclonal antibodies segment is anticipated to be the fastest-growing during the upcoming period. This is due to blockbuster biologics losing their patents. Regulatory bodies in the U.S and Europe have approved a number of biosimilars, fueling their rapid expansion. Cost savings are the most important factor as they offer relief to the overburdened healthcare systems. Their therapeutic impact is another such factor. Since mAbs have multiple indications across different types of cancer, this means that a single biosimilar drug can open up several market segments, rising consumption rates.

By route of administration, the intravenous segment was the dominant one in the oncology biosimilars market as well as the fastest growing segment. This is due to its long-standing role in cancer treatment as well as its compatibility with hospital models. Intravenous delivery ensures that the dosing is precise, consistent, and hygienic. All these are critical factors that need to be taken into consideration as oncology treatment practices are stringent, complex, and time-sensitive in nature. Hospitals are adequately equipped with IV infrastructure, making them an easy fit into pre-existing workflows. As biosimilars were originally created for IV forms, many hospitals and developers still follow the same route. It also makes it easy for healthcare personnel to monitor the patient during the transfusion process, ensuring safety and security.

The subcutaneous segment is also significantly growing in the oncology biosimilars market during 2025-2034. It allows for shorter administration times and enables home-based care, making it a patient-friendly alternative and reducing the burden on healthcare facilities. This route particularly gained traction after the COVID-19 pandemic, when home-based treatment gained popularity. They also improve the patient’s comfort and mental well-being, minimizing hospital exposure.

By distribution channel, the hospital pharmacy segment held the largest share of the oncology biosimilars market in 2024. This is because all types of cancer treatments are primarily managed in hospital settings. These pharmacies ensure drug quality, proper storage facilities, and seamlessly integrate inpatient and outpatient oncology protocols. They also benefit from bulk purchasing, supporting cost efficiency and reliable supply. Moreover, hospital pharmacies are trusted more by patients as they allow for immediate administration of medicine without the risk of shortage.

By distribution channel, the online pharmacy segment is estimated be grow at the highest CAGR during the predicted timeframe. While still limited, this segment is witnessing growth due to an increase in patients demanding convenience, expanding e-health infrastructure, rising home care practices, and rapid digitization. Self-administered biosimilars are increasingly becoming popular, further fueling this trend. Online platforms often offer competitive pricing, additional discounts, home delivery, and easy access to refills, making it a good option for long-term treatments and therapy management.

By end user, the hospitals segment was dominant in the oncology biosimilars market as of 2024. This is because cancer treatment usually requires controlled environments, specialized equipment, close patient monitoring, and skilled staff. This setup helps to reduce the risk of adverse effects, especially during initial treatment cycles. In addition to this, hospitals often negotiate large volume purchases, securing cost benefits that can further incentivize biosimilars.

By end user, the home care segment is anticipated to be the fastest-growing segment during the predicted time frame. This is due to rising popularity in subcutaneous formulations, portable technologies, and remote patient monitoring systems. This offers a more convenient way of treatment, making the process easy for patients who face long travel times, crowded facilities, and high servicing costs. The patient can receive treatment from the comfort of his/her own home, greatly improving quality of life.

North America is currently dominating the oncology biosimilars market. This is due to a drive in advanced oncology infrastructure, development in healthcare practices, advanced technological integrations, and scientific advancements in a world with high cancer prevalence. This region has strong government frameworks and structured approval pathways that help balance safety, efficacy, and market accessibility. Robust policies and incentives further aim at reducing healthcare expenditures, creating a strong platform for the biosimilars market. Moreover, the established presence of pharmaceutical companies paired with well-funded oncology research programs further strengthens North America’s standing in the global market. The region’s competitive landscape drives manufacturers to act quickly in order to secure a market share, leading to high-quality production processes.

The U.S leads North America’s oncology biosimilars market and continues to make its mark on this sector on a global level. Its high healthcare spending capacity and robust infrastructure give it a lead across clinical, commercial, and regulatory fronts. The Biologics Price Competition Act of 2009 was a turning point for the country as it laid the foundation for biosimilars. This act enabled emerging products to gain approval based on a comprehensive comparison with originally established biologics. Furthermore, new FDA guidelines that simplify glycan profiles and enable healthcare companies to propose new indications independently help reduce costs and facilitate a broader market penetration. In 2024, the FDA broke its own record by approving over 19 biosimilars across eight molecules, a sharp jump from 5 in 2023, highlighting acceleration in the industry’s momentum.

Canada is steadily making its mark in the oncology biosimilars section, supported by vast provincial strategies for the implementation of biosimilar switching. Several policies are being adopted by the country that help transition patients from expensive biologics to affordable biosimilars. Health Canada has recently approved over 56 various biosimilars and covering 18 different reference products. On a similar note, Ontario’s biosimilar switching policy resulted in enhanced uptake and drove cost containment. This highlights the progress made up till now and the opportunities that lie ahead.

Asia Pacific is estimated to be the fastest-growing region in the oncology biosimilars market during the forecast period. This is due to a large aging population, rising cancer cases, and assertive industrial policies that push the biosimilar uptake forward. Governments have tightened their incentives while regional players such as India, South Korea, China, and Japan are also boosting their high-scale manufacturing practices in order to pursue multi-market opportunities. Since national healthcare budgets are unable to keep up with the costs of branded biologics, biosimilars have become a strategic move. More approvals lead to sharper price competition, leading to broader access. AI integrations and regional trade agreements are further aiding cross-border market access, helping APAC establish itself as a strong biosimilar player.

Driven by a huge patient base, national pricing policies, and rapidly expanding regulatory capacity, China has strategically positioned itself as the single largest oncology biosimilars market in the Asia-Pacific region. Procedures such as the National Medical Products Administration (NMPA) and National Reimbursement Drugs List (NRDL) have boosted the biosimilars uptake, helping clear dozens of drugs. Additionally, its Volume-Based Procurement (VBP) program has slashed biosimilar prices by almost 70%. Local firms are also moving quickly with the aim of winning approvals from high-value agents and adding more therapeutic options for the industry.

South Korea has established itself as a strong global exporter of oncology biosimilars. It combines world-class developers, export orientation, and a strong regulatory body to accelerate its research and development surrounding the field. The country’s ecosystem advocates for quality manufacturing and global marketability, which expands its export practices, especially with the help of multiple FDA and EMA filings. On a domestic level, Korean companies are turning their approvals into a method for gaining commercial momentum with the help of competitive launches and partnerships. This speed, coupled with top-quality standards, is helping the country expand its business.

Europe is expected to grow significantly in the oncology biosimilars market due to a mature and policy-focused approach. The EMA has established its scientific pathway for biosimilars approval and has also recently amped up its activity. Additionally, coordinated payer and procurement approaches such as national tenders, regional tenders, and value-based commissions create an aggressive pricing competition, leading to an expand in accessibility and easy market entry. There are supposedly billions of cumulative savings across European healthcare systems, and public bodies, as well as companies, are rushing to claim these savings with the help of policies and frameworks.

Germany has a well-established framework for the oncology biosimilars market. The country has established itself with a robust healthcare system and regulatory approvals, which support its stance on widespread use across various therapeutic areas like oncology, immunology, and rheumatology. The German Bundestag passed the Act for Greater Safety in the Supply of Medicines (GSAV) enables automatic substitution of biotechnologically produced medicines in pharmacies. Germany’s strong pharmaceutical base and manufacturing front make it an important production hub.

The UK has always been vocal about pushing biosimilar uptake with the help of NHS commissioning and various optimization programs. Their focus is clear: when a clinically tested biosimilar enters the market, care boards should automatically move patients to the best value biological medicine. This NHS policy is the very backbone of the country, where clinical teams are expected to prioritize value wherever deemed appropriate.

Key R&D steps includ extensive analytical characterization, non-clinical studies, and clinical trials, all culminating in a "totality of evidence" supporting biosimilarity.

Key players include: Sandoz, Celltrion, Amgen, Pfizer, and Samsung Bioepis.

Key steps include establishing biosimilarity through extensive analytical comparisons, non-clinical studies (including in vitro and in vivo assessments), and clinical trials that demonstrate comparable efficacy and safety to the reference biologic.

Key players include: Sandoz, Celltrion, Amgen, Pfizer, and Samsung Bioepis.

These services often mirror those offered for reference biologics, including reimbursement support, educational resources, and adherence programs, but may also include specific initiatives to address concerns about biosimilarity. Key areas of focus include reimbursement assistance, education about biosimilarity, and copay support programs.

Key players include: Sandoz, Celltrion, Pfizer, Amgen, Samsung Bioepis, Biogen, Merck & Co., and Coherus Biosciences

In April 2025, Kevin Ali, Organon’s Chief Executive Officer, announced that their company had acquired regulatory and commercial rights in the U.S. for Tofidence, a biosimilar to Actemra for intravenous infusion. Organon has acquired the regulatory and commercial rights to Tofidence in the U.S, and it will be available in three vial sizes: 80 mg/4 mL, 200 mg/10 mL, and 400 mg/20 mL.

By Indication

By Drug Class

By End-Users

By Region

February 2026

February 2026

February 2026

February 2026