January 2026

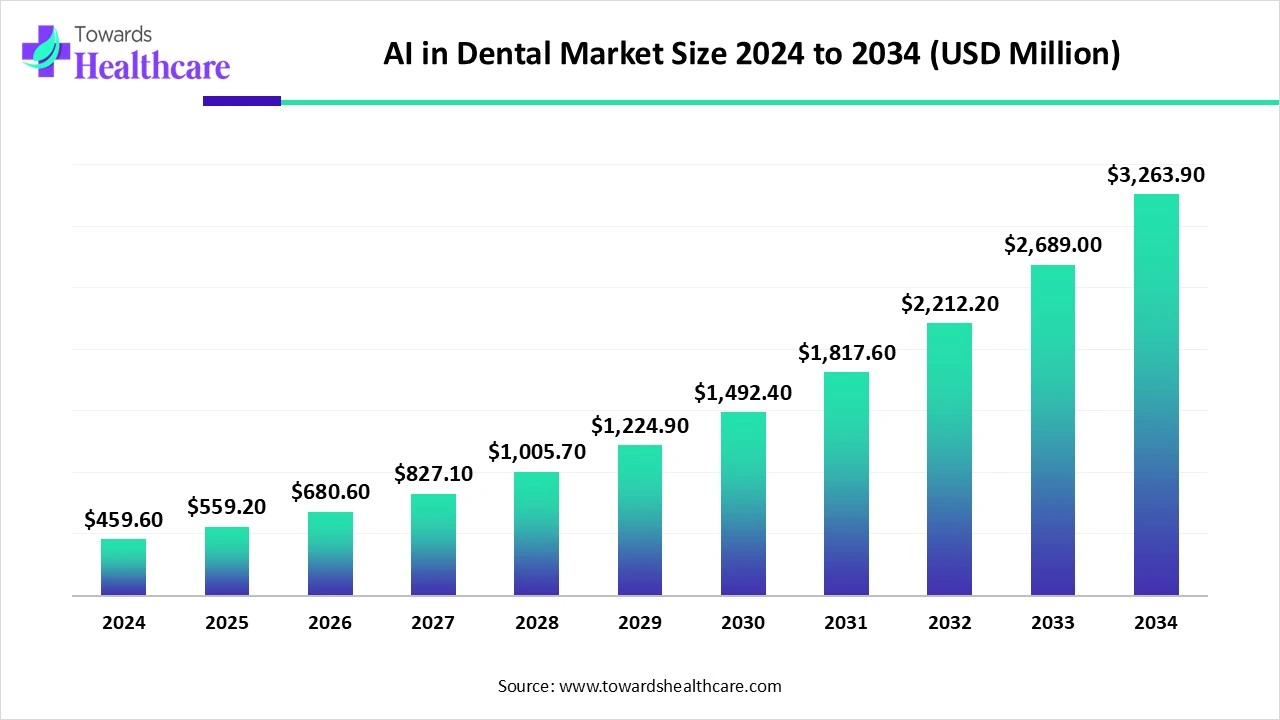

The global AI in dental market size is estimated at US$ 459.6 million in 2024, is projected to grow to US$ 559.2 million in 2025, and is expected to reach around US$ 3263.9 million by 2034. The market is projected to expand at a CAGR of 21.78% between 2025 and 2034.

The AI in dental market is expanding rapidly due to increasing advancements in diagnostics, targeted treatment and diagnostics. AI technologies improve the accuracy in detecting oral issues and improve patient outcomes. Major applications of it in virtual consultation, radiograph analysis, and predictive analytics. Many healthcare companies are spending on AI-driven healthcare solutions. North America is dominant in the market due to the growing demand for digital dentistry, while the Asia Pacific is the fastest-growing due to increasing government support.

| Table | Scope |

| Market Size in 2025 | USD 559.2 Million |

| Projected Market Size in 2034 | USD 3263.9 Million |

| CAGR (2025 - 2034) | 21.78% |

| Leading Region | North America |

| Market Segmentation | By Solution Type, By Deployment Mode, By Application, By Dental Specialty, By Distribution Channel, By Region |

| Top Key Players | Align Technology, Inc., Apteryx Imaging Inc., Carestream Dental LLC, Dentsply Sirona Inc., Diagnocat Inc., Envista Holdings Corporation, Henry Schein One, Kapanu AG (Straumann Group), Overjet Inc, Pearl AI, Planmeca Oy, ProSomnus AI, VideaHealth, 3Shape A/S, Zirkonzahn GmbH |

The AI in dental market refers to the global industry focused on integrating artificial intelligence technologies into dental care, diagnostics, treatment planning, imaging, and practice management. It encompasses AI-powered solutions such as dental imaging analysis, predictive diagnostics, treatment simulation, patient data management, appointment scheduling, and workflow automation. These technologies are designed to enhance diagnostic accuracy, improve patient experience, optimize clinic operations, and support evidence-based dentistry. Growing adoption of AI in dental practices and laboratories is driven by advancements in deep learning, cloud computing, and computer vision, alongside increasing demand for precision-driven, cost-effective dental care.

For Instance,

AI training enhances dental patient care by early and precise diagnosis and ensuring rapid patient treatment. It improves the patient’s overall outcomes through AR and VR; therefore, an appropriate understanding of the treatment process drives the growth of the market.

For instance,

A growing AI-driven platform that will help various healthcare companies achieve economic benefits, which contributes to the growth of the market.

For Instance,

Increasing Prevalence of Dental Diseases

The global prevalence of major oral diseases continues to rise amid increasing urbanization and changing living conditions. This trend is mainly due to insufficient fluoride exposure, the availability and affordability of high-sugar foods, and limited access to oral health services in many communities. Most of these oral health issues are preventable and can be addressed effectively if caught early. The most common problems include dental caries, periodontal diseases, tooth loss, and oral cancers. Other significant oral health concerns are orofacial clefts, noma, a severe gangrenous disease mainly affecting children, starting in the mouth, and oro-dental trauma. These issues are also fueling growth in the AI dental market.

Major Challenges of AI in Dental Practice

Integrating AI into dental practices demands a substantial initial investment. Smaller clinics and dental professionals in resource-limited settings might find these technologies unaffordable, which hampers the expansion of the AI dental market.

Recent Advancements in Robotic Dentistry

Robotics has become a crucial auxiliary tool in dentistry, especially in implantology, restorative procedures, and education. Moreover, the use of AI in robotics, via humanoid robots, is further transforming the field. A fully autonomous AI-driven robot recently completed an entire procedure on a human patient, doing so about eight times faster than a dentist would when preparing teeth for crowns. This system employs a handheld 3D volumetric scanner that creates a detailed model of the mouth, including teeth, gums, and even nerves beneath the tooth surface, using optical coherence tomography (OCT). This advancement opens new opportunities for AI in dental market.

For Instance,

By solution type, the AI-powered dental imaging and diagnostics segment led the AI in dental market, as dental AI improves imaging accuracy, efficiency, and patient belief. AI algorithms enhance dental imaging technologies, like X-rays, by detecting minor irregularities that the human eye may miss. AI analyzes X-rays to notice cavities, gum disease, cancer, and early signs of oral cancer with supreme precision.

On the other hand, the AI in orthodontics and prosthodontics segment is projected to experience the fastest CAGR from 2025 to 2034, as AI-based technology has the potential to improve diagnostic accuracy in orthodontics by investigating multifaceted patterns in imaging data. Orthodontic management is lengthy, taking 18 to 24 months or more, based on the severity of the case. AI shortens this time period by confirming that each stage of the treatment is as well-organized as possible. AI-driven systems simulate the movement of teeth and enhance the forces used by orthodontic appliances to confirm that every tooth moves in the intended direction with negligible delays.

By deployment mode, the cloud-based solutions segment is dominant in the AI in dental market in 2024, as this solution gives dental practices more flexibility, reduced IT costs, increased data security, and better teamwork. They scale simply as practice grows, whether expanding staff, locations, or services. It analyses radiographs in real time, flags latent issues, and supports automated documentation and insurance procedures, all without disrupting the presenting workflow.

The on-premise solutions segment is projected to grow at a significant CAGR from 2025 to 2034, as on-premise software enables practices to work during internet outages, confirming continuity in workflows and people care. Major on-premise solutions operate on a one-time permitting model, which appeals to practices that want to evade continuing subscription fees. This software has long-standing a choice for major dental practices. It can be easily installed on local servers, and it provides a level of control that some practices find comforting.

By application, the dental imaging and diagnostics segment led the AI in dental market in 2024, as this offers a significant way for dentists to correctly diagnose and manage a variety of tooth and gum conditions. Digital dental x-rays are a substitute for the outdated processes that were before used to view details related to dental health. Through the imaging of dental radiographs alert dentists are alerted to changes in hard and soft tissues.

The restorative dentistry and prosthodontics segment is projected to experience the fastest CAGR from 2025 to 2034, as restorative dentistry provides the greatest chance at continuing oral health. The main reason for restorative dentistry is to save teeth while restoring their natural appearance, feel, and shape. This dentistry provides various options obtainable in the dental world to fix, replace, or repair damaged, fractured, and broken teeth.

By Dental Specialty, the orthodontics segment led the AI in dental market in 2024, as orthodontics helps to prevent and correct misaligned teeth in the jaws and the appropriate positioning of the jaws in the expression. Orthodontics is the dental field that is concerned with treating malocclusion, which is characterized by the presence of misaligned teeth and maxilla and mandible inconsistencies. Orthodontic treatment helps improve oral health by correcting any challenges with overcrowding and bent teeth.

On the other hand, the prosthodontics segment is projected to experience the fastest CAGR from 2025 to 2034, as prosthetic devices allow people to regain the capacity to speak, bite, and chew properly, enhance inclusive dental function, and nutritional intake. Prosthodontic services predominantly enhance the appearance of the smile, enhancing self-confidence and self-esteem. Patients enjoy a natural-looking smile that seamlessly blends with their present teeth.

By distribution channel, the direct sales segment led the AI in dental market in 2024, as it provides dental products with cost-effective, enhanced quality control, improved support and service, amplified inventory management, and supported relationships. Direct sales provide dental professionals with several advantages, such as growing profitability through a direct relationship with the consumer.

On the other hand, the online platforms segment is projected to experience the fastest CAGR from 2025 to 2034, as this platform provides significantly greater variety and convenience than traditional retail, with increasing access to sonic toothbrushes, natural toothpaste, and water flosser options, which may not be accessible in local pharmacies. These platforms provide comprehensive product data, demo videos, consumer reviews, and instructive content that support consumers in making well-versed decisions related to complex dental devices.

North America is dominant in the market in 2024, due to tooth decay being the most chronic disease in children in North America, which increases the demand for AI services in dental care. The growing prevalence of healthcare comorbidities increases the significance of medical-dental incorporation to efficiently manage patient care requirements. North America holds a well-developed healthcare infrastructure because of increasing investments in healthcare research and technology, vigorous government support, and economic incentives for digital health solutions, which contribute to the growth of the market.

For Instance,

In the U.S., tooth decay is the greatest common chronic disease in children and adults. Almost 60 million U.S. people live in a region designated as a shortage of dental health specialists, which is increasing the demand for AI in dental care.

For Instance,

The increasing rates of dental care as an increasing fraction of Canadians have higher incomes and are better educated, which drives the growth of the market. Rising access to cost-effective dental care is significant for Canadians to allow better health results, lower barriers to care, and lessen pressure on the medical care system, contributing to the growth of the market.

Asia Pacific is the fastest-growing region in the AI in dental market in the forecast period, due to the increasing prevalence of dental caries of permanent teeth and periodontal ailments. A high presence of an ageing population so dental issues are likely to grow in the upcoming years, which raises the demand for AI-driven solutions in dental care. Increasing financial growth and healthcare spending drive the growth of the market.

In China, increasing government initiative encourages advanced quality dental care to enhance the total health of the population. The investigators recommend treating dental health throughout treatment for other chronic diseases. Dental caries and periodontal disease are major diseases that affect the dental health of Chinese people. They are the main reasons for missing teeth in the middle-aged and aging populations, which drives the growth of the market.

In India, appearances significant challenges in dental health because of the low awareness, inadequate infrastructure, and financial barriers, which increase the demand for AI services to treat dental issues. In India, the most common oral health challenges are dental caries, toothache, loose teeth, gingival bleeding, and gingival sensitivity. This increases the need for advanced treatment to manage this condition, which contributes to the growth of the market.

Europe is expected to grow significantly in the market during the forecast period, as this region has the second-highest share of cases of tooth loss (25.2%), with about 88 million people aged 20 years or over. This interprets to a prevalence of 12.4%, the highest among the regions and almost double the worldwide prevalence of 6.8%. Increasing Government programmes and insurance schemes offer partial coverage for dental health care, which drives the growth of the market.

In Germany, the low prevalence of decayed, missing, or filled teeth in the 12-year-olds showcases the effectiveness of its oral health strategies. The country faces the huge expenses for dental implants and crowns, which increase the financial implications of post-disease involvements, increasing the demand for cost-effective AI-driven dentistry solutions. Rising awareness of healthcare and innovations in the technology of dental treatments drive the growth of the market.

In March 2025, Simon Beard, Align Technology executive vice president and managing director, stated, “Align X-ray Insights represents a significant advancement in our digital restorative dentistry solutions with broader patient applicability.”

By Solution Type

By Deployment Mode

By Application

By Dental Specialty

By Distribution Channel

By Region

January 2026

January 2026

January 2026

January 2026