February 2026

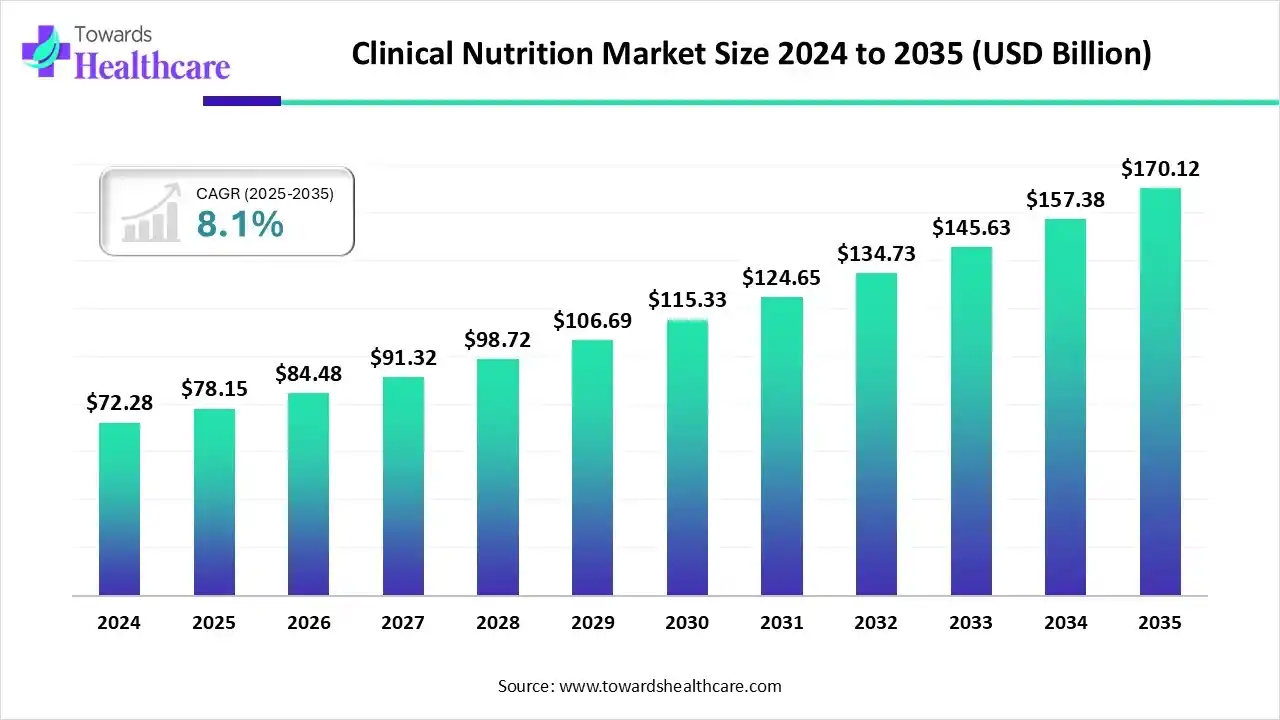

The global clinical nutrition market size is estimated at US$ 78.15 billion in 2025, increased to US$ 84.48 billion in 2026, and is expected to reach around US$ 170.12 billion by 2035. The market is growing at a CAGR of 8.1% between 2026 and 2035.

The growing public awareness of medical nutrition is being driven by trends such as accessible nutrition, healthy aging, longevity, targeted dietary interventions, weight management, and satiety, supported by evolving policy frameworks. Sustainability is emerging as a key focus, with efforts centered on nutrient-dense diets, regenerative agriculture, reducing food waste, and building resilient supply chains. Consequently, the clinical nutrition market is experiencing significant growth, fueled by initiatives to improve food availability, minimize waste, and ensure robust, sustainable food systems.

| Table | Scope |

| Market Size in 2025 | USD 78.15 Billion |

| Projected Market Size in 2035 | USD 170.12 Billion |

| CAGR (2026 - 2035) | 8.1% |

| Leading Region | North America |

| Market Segmentation | By Product, By Application, By Sales Channel, By Region |

| Top Key Players | Danone S.A. (Nutricia), Fresenius Kabi AG, Baxter International Inc., B. Braun Melsungen AG, Ajinomoto Co., Inc., Perrigo Company plc, Kate Farms Inc., Meiji Holdings Co., Ltd, Otsuka Pharmaceutical Co., Ltd., Vitaflo International Ltd., Aenova Group |

The clinical nutrition market is increasingly centered on personalized and targeted nutrition, microbiome research, women’s health, and surgical and critical care nutrition. Alongside this, there is a growing emphasis on producing healthy and sustainable food products while making nutrition more accessible to a broader population. Initiatives such as those by the American Journal of Clinical Nutrition bring together cutting-edge research from diverse fields to foster collaboration, including studies on nutritional considerations amid emerging obesity medications. Similarly, the European Society for Clinical Nutrition and Metabolism (ESPEN) has issued scientific guidelines on clinical nutrition in surgery and focused research on areas such as nutrition and hydration in dementia, as well as nutrition care for cystic fibrosis, highlighting the sector’s breadth and depth.

AI is increasingly transforming the clinical nutrition market, impacting areas such as critical care nutrition, outpatient care, women’s health, maternity, diabetes management, home care, oncology, and autoimmune diseases. AI-powered solutions provide personalized nutritional guidance for pregnant women, optimize nutrition delivery for critically ill patients, and precisely calculate individual nutritional requirements to improve patient outcomes. Additionally, AI facilitates efficient care planning for healthcare providers by automating assessments, customizing diet plans, and integrating with digital health tools. These capabilities not only enhance patient-centric care but also open new opportunities for product innovation, remote monitoring solutions, and expansion into emerging markets.

The oral clinical nutrition segment dominated the market in 2024, driven by the increased focus on disease management, addressing malnutrition, enhancing muscle health, and supporting post-surgical recovery. Oral nutritional supplements (ONS) deliver precise nutrients for disease-specific needs, such as oncology, diabetes, and gastrointestinal disorders, while supporting adherence through palatable, ready-to-consume formulations. The introduction of personalized and targeted oral formulations, along with plant-based and clean-label solutions, promotes product innovation and solid research. Additionally, the adoption of oral formulations has been increasing due to their convenience, ease of administration, and wide applicability across diverse patient groups, including outpatients, home care recipients, and individuals with chronic or critical conditions.

The parenteral nutrition segment is expected to grow at the fastest CAGR in the upcoming period, owing to its critical role in supporting critically ill patients and those with specific medical conditions. The growing adoption of home parenteral nutrition is fueled by technological advancements such as remote monitoring systems and portable infusion pumps, which not only reduce hospital costs but also enhance patient quality of life.

The enteral feeding formulas segment is expected to grow significantly in the coming years due to faster recovery, fewer complications, nutritional support, and disease-specific management. They prevent malnutrition, and ongoing innovations focus on creating highly personalized nutritional solutions. The new formulations developed by manufacturers aim to meet individual patient metabolic needs, specific health conditions, and genetic profiles.

The cancer care segment dominated the market with the largest share in 2024 due to the high prevalence of cancer and the complex nutritional needs of oncology patients undergoing surgery, chemotherapy, or radiotherapy. Malnutrition is common among cancer patients, which makes specialized nutritional interventions critical for improving treatment outcomes, reducing complications, and enhancing quality of life. Increasing adoption of disease-specific oral and parenteral nutritional formulations, along with personalized nutrition plans guided by digital health tools, has further strengthened the segment’s market leadership.

The malabsorption/GI disorder/diarrhea segment is expected to grow at the fastest rate during the projected timeframe due to the increasing adoption of personalized and evidence-based nutritional strategies. Nutritional assessment and tailored dietary interventions are critical for managing malnutrition and supporting patients with chronic gastrointestinal conditions. Advanced approaches, including medical nutrition therapy and specialized diets, are increasingly important for improving patient outcomes and quality of life.

The diabetes segment is expected to grow significantly in the coming years due to technological integration, including continuous glucose monitoring (CGM) for a broad range of patients. The expansion of digital health tools and tele-nutrition platforms has improved access to remote monitoring and personalized medical nutrition therapy. The focus on macronutrient balance and holistic approaches, such as regular physical activity and sufficient sleep, enhances diabetes care.

The institutional sales channel segment dominated the market in 2024 due to its direct and efficient supply chain from leading manufacturers to healthcare organizations. This channel ensures a consistent and reliable supply, reduces costs, and eliminates the need for intermediaries. It has also facilitated the rapid adoption of specialized nutritional solutions, including immunonutrition formulas, plant-based options, and post-surgery recovery products.

The online sales channel segment is expected to grow the fastest in the market during the upcoming period because online platforms manage long-term nutrition needs for patients and caregivers. Online platforms efficiently deliver nutritional products and medical supplies directly to patients' home care settings. They enable seamless communication between patients and healthcare providers and support real-time health monitoring.

The retail sales channel segment is expected to grow at a significant rate in the coming years, driven by an expanding range of products, including disease-specific formulas, plant-based options, and specialized nutrition for geriatric and pediatric populations. These products support immune function, bone health, and digestive wellness. Physical retail channels such as supermarkets, pharmacies, drugstores, and hypermarkets play a critical role in building consumer trust, facilitating product discovery, and enabling direct interaction with end users.

North America dominated the clinical nutrition market, accounting for the largest share in 2024, owing to a growing shift toward home-based enteral and parenteral nutrition therapy and a well-developed retail pharmacy network. Key initiatives and events, such as the Nutrition Program 2024 organized by the American Society for Nutrition, highlighted trends in precision health, obesity research, and the use of AI and ML in nutrition. The Academy of Nutrition and Dietetics in Chicago, the world’s largest organization of food and nutrition professionals, has brought together 19 health, nutrition, and business leaders to advance the field. Additionally, academic centers like UNT Health in Texas are addressing the rising demand for registered dietitian nutritionists, while governmental initiatives in the U.S. and investments in nutrition in Canada further strengthen the region’s market leadership.

In May 2025, the U.S. Food and Drug Administration (FDA) and the National Institutes of Health (NIH) announced the innovative joint nutrition regulatory science program.

The U.S. is a major leader in the market. In August 2025, the U.S. Department of Health and Human Services (HHS) and the U.S. Department of Education announced an initiative to unite medical education organizations to implement nutrition education and training. The U.S. HHS adopted food-as-medicine approaches that focus on ensuring consistent access to diet and nutrition-related resources. The U.S. government nutrition initiatives include reforms in nutrition education, dietary guidelines, FDA initiatives, NIH research, and food-as-medicine programs.

Asia Pacific is expected to experience the fastest growth in the market during the forecast period due to e-commerce expansion, increased access to products, and widespread adoption of nutrition products. The Asia Pacific Clinical Nutrition Society (APCNS) promotes education and training for dietitians and clinical nutritionists in the region, supported by the International Union of Nutritional Sciences (IUNS). South Asia has implemented essential nutrition interventions to improve preconception nutrition among women, including health and nutrition screening, access to necessary micronutrients, dietary and lifestyle counseling, infection prevention, and special care for women at risk.

Growing demand for disease-specific, plant-based, and personalized nutrition solutions, combined with a rising geriatric population, is driving market adoption. Additionally, expanding home healthcare services, telehealth platforms, and e-commerce distribution channels are improving access to clinical nutrition products across urban and rural areas. Government initiatives and investments in nutrition programs further support the region’s rapid market growth.

The increasing occurrence of chronic and lifestyle diseases, such as diabetes, heart conditions, and cancer, is boosting demand for medical nutrition therapies in India. The World Bank Group stated that Poshan Abhiyaan has transformed India’s nationwide nutrition program. India leads public health initiatives against diseases like anemia that affect millions, including women, children, and adolescents. In May 2024, the Indian Council of Medical Research (ICMR) issued updated dietary guidelines for Indians to better suit modern eating habits for 2024.

Europe is expected to expand at a notable rate in the coming period, driven by innovations in product formulations, increasing rates of metabolic and chronic diseases, and supportive reimbursement policies. In March 2025, Team Europe of the European Commission, under the European Civil Protection and Humanitarian Aid Operations, announced €6.5 billion to combat global malnutrition at the N4G Paris Summit. In October 2025, governments across Central Asia and Europe adopted a new WHO strategy to ensure every child has a healthy start in life. The European Rare Kidney Disease Reference Network (ERKNet), funded by the European Union, organized a clinical exchange program to bring together clinicians and other healthcare professionals such as technicians, specialist nurses, and dietitians. In March 2025, the Government of France hosted the 2025 Nutrition for Growth (N4G) Summit in Paris.

The market in Germany is being driven by an aging population and increasing prevalence of chronic diseases (such as diabetes, cardiovascular disease, and cancer), which are elevating demand for specialized clinical nutrition products and interventions. The German Nutrition Society is a professional scientific organization dedicated to advancing nutritional science. Germany remains a global leader in public health and a partner of the WHO, committed to strong policies, effective health strategies, expertise, and funding, contributing to market growth.

South America is experiencing an opportunistic rise in the market due to the increasing prevalence of chronic diseases, malnutrition, and age-related health conditions, which are driving demand for disease-specific and personalized nutritional solutions. Expanding healthcare infrastructure, growing awareness of preventive nutrition, and rising adoption of home-based and outpatient care models are further fueling market growth. E-commerce platforms and telehealth services are improving access to clinical nutrition products, particularly in urban and semi-urban areas. Additionally, supportive government initiatives and investments in public health programs present significant growth opportunities for both multinational and local players in the region.

Brazil is the major contributor to the South American clinical nutrition market, driven by its large population, rising prevalence of chronic diseases, and increasing healthcare expenditure. The country has witnessed growing adoption of disease-specific, personalized, and home-based nutritional solutions, supported by both private healthcare providers and government initiatives. Additionally, expanding e-commerce platforms and urban healthcare infrastructure have further strengthened Brazil’s position as the dominant market in the region.

The growth of the Middle East and Africa clinical nutrition market is driven by the rising prevalence of chronic diseases, malnutrition, and age-related health conditions, which are increasing the demand for specialized and disease-specific nutritional solutions. Expanding healthcare infrastructure, government initiatives to improve nutrition awareness, and rising adoption of home-based and outpatient care are further supporting market growth. Additionally, increasing urbanization, higher disposable incomes, and the expansion of e-commerce and telehealth channels are enhancing accessibility to clinical nutrition products across the region. These factors collectively create significant opportunities for both local and international market players.

Saudi Arabia is the major contributor to the Middle East and Africa clinical nutrition market, driven by its well-developed healthcare infrastructure and rising prevalence of chronic diseases such as diabetes, cardiovascular conditions, and cancer. Government initiatives to improve nutrition awareness, coupled with increasing adoption of home-based and outpatient care, are further supporting market growth. Additionally, growing investments in healthcare technology, telehealth, and specialized nutritional products have strengthened Saudi Arabia’s leading position in the regional market.

The R&D process in clinical nutrition involves multi-stage approaches such as idea generation, market research, concept development, formulation, prototyping, testing, regulatory review, business analysis, scale-up, and commercialization.

Key Players: Nestlé Health Science, Abbott Laboratories, Danone Nutricia, Fresenius Kabi, B. Braun Melsungen AG, Otsuka Pharmaceutical Factory, Baxter International.

The primary distribution channels, such as hospitals and pharmacies, are expanding due to the shift toward home-based care, automation, digital transformation, emphasis on cold chain logistics, and the rapid rise of e-commerce.

Key Players: Nestlé Health Science, Abbott Laboratories, Danone Nutricia, Fresenius Kabi.

Key services such as personalized nutrition, weight management, and others are primarily powered by AI, big data, telehealth, remote monitoring, digital tools for professionals, and food tech innovations.

Key Players: Ajinomoto Co., Inc., Medtrition Inc., Kate Farms, Nestlé Health Science, Abbott Laboratories, Danone Nutricia.

Corporate Information: Headquarters: Abbott Park, Illinois, U.S. | Year Founded: 1888

Business Overview

Abbott Laboratories is a diversified global healthcare company engaged in the discovery, development, manufacture, and sale of nutritional products, diagnostics, medical devices, and branded generic pharmaceuticals. Within the nutrition category, Abbott Nutrition offers science-based nutritional solutions spanning pediatric, adult, and therapeutic/disease-specific segments.

Business Segments / Divisions

Key reportable segments include:

Geographic Presence

Abbott operates in over 160 countries globally, reaching a very broad market footprint across the Americas, Europe, AsiaPacific, the Middle East & Africa, and Latin America. Its nutrition business targets both developed and emerging markets, with tailored products for local needs and investments in manufacturing and the supply chain to support global reach.

Key Offerings (Pertaining to Clinical Nutrition)

SWOT Analysis

Corporate Information: Headquarters: Epalinges (near Lausanne), Switzerland. | Year Founded: 2011.

Business Overview

Nestlé Health Science is a globally-managed unit within the Nestlé S.A. Group, dedicated to advancing the therapeutic role of nutrition. It offers science-based solutions for both medical/clinical nutrition and consumer-oriented nutritional health, aiming to support patients across their health journey, from disease-specific interventions to active lifestyle support.

Business Segments / Divisions

NHSc operates substantially in two broad divisions:

Geographic Presence

NHSc has a presence in over 140 countries. It maintains globally-managed operations whilst benefiting from the Nestlé Group’s broad infrastructure and applies region-specific solutions through its Product Technology Centers in Europe, China, and the U.S.

Key Offerings (Pertaining to Clinical/Medical Nutrition)

SWOT Analysis

Recent News

On November 3, 2025, Nestlé partnered with leading universities to accelerate open innovation in nutrition and health, focusing on women’s health, healthy longevity, and weight management. The initiative reinforced Nestlé’s commitment to advancing nutritional solutions aligned with its emerging growth platforms.

| Company | Key Offerings |

| Danone S.A. (Nutricia) | Clinical nutrition solutions such as Fortisip, Nutrison, and other enteral feeding formulas for adult and pediatric applications. |

| Fresenius Kabi AG | Enteral and parenteral nutrition products for hospitals and home care, including advanced formulations for oncology and intensive care patients. |

| Baxter International Inc. | Specialized parenteral nutrition therapies via amino acid and lipid solutions for critically ill and surgical/long-term care patients. |

| B. Braun Melsungen AG | Range of clinical nutrition products and infusion therapies for hospital and home-care use in enteral and parenteral feeding. |

| Ajinomoto Co., Inc. | Amino-acid-based nutrition molecules and precision nutrient blends for medical nutrition, especially in metabolic and critical-care segments. |

| Perrigo Company plc |

Contract-manufactured and specialty clinical nutrition products including B2B formulations and shelf-stable feeds. |

| Kate Farms Inc. | Plant-based, organic clinical nutrition formulations for adults and tube-fed patients, supporting clean-label and alternative nutrition trends. |

| Meiji Holdings Co., Ltd. | Geriatric and pediatric enteral nutrition products in Asia, supporting regional growth in clinical nutrition. |

| Otsuka Pharmaceutical Co., Ltd. | Enteral and medical nutrition products for chronic disease management and specialized adult nutrition markets in Asia. |

| Vitaflo International Ltd. | Clinical nutrition solutions for metabolic disorders such as PKU and MSUD, for both adult and pediatric patients. |

| Medtrition Inc. | Disease-specific medical nutrition products for adults, primarily for hospital and home-care applications in North America. |

| Aenova Group | Contract manufacturing of clinical nutrition and medical-food formulations for global nutrition brands. |

| Archer-Daniels-Midland Company (ADM) | Specialty ingredients, nutrient-rich blends, and bioactive compounds supporting formulation and manufacturing of clinical nutrition products. |

The global clinical nutrition market is undergoing a paradigm shift, underpinned by the escalating incidence of chronic and metabolic diseases, an aging population base, and the increasing recognition of nutrition as a therapeutic adjunct in clinical care pathways. The industry is progressively aligning with precision medicine principles, emphasizing patient-specific formulations, microbiome modulation, and targeted nutritional interventions that enhance clinical outcomes. These developments, coupled with technological integration, such as AI-assisted nutrition planning and remote monitoring, are redefining the boundaries of traditional nutritional therapy and establishing new standards for personalized medical care.

Market expansion is being further catalyzed by macroeconomic and policy drivers, including the proliferation of home healthcare services, regulatory endorsement for specialized nutritional products, and the emergence of digital health ecosystems. Multinational corporations are actively pursuing mergers, acquisitions, and R&D collaborations to strengthen their therapeutic portfolios across oncology, critical care, pediatrics, and metabolic health. The incorporation of plant-based, clean-label, and sustainable ingredients has not only broadened consumer acceptance but also provided new revenue streams, particularly in high-growth regions such as Asia-Pacific and Latin America, where healthcare modernization and middle-class expansion are converging.

From an investment perspective, the clinical nutrition domain represents a high-margin, defensible growth segment within the broader healthcare continuum. Increasing penetration of advanced enteral and parenteral nutrition, supported by innovations in bioavailability, formulation science, and digital adherence tracking, creates opportunities for both incumbents and emerging players. As payers and providers shift toward value-based care and preventive health models, the market’s potential lies in its capacity to integrate nutritional science with data-driven clinical decision-making, positioning clinical nutrition as a cornerstone of future precision healthcare systems.

By Product

By Application

By Sales Channel

By Region

February 2026

February 2026

February 2026

February 2026