March 2026

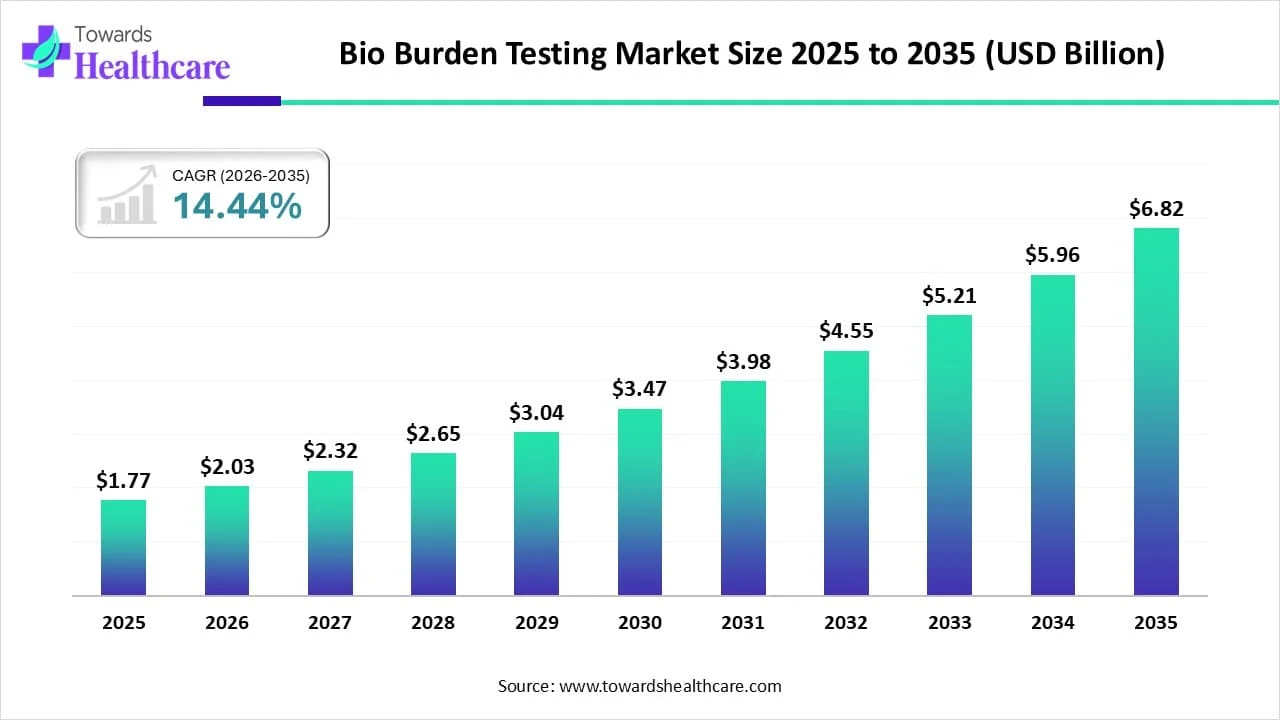

The global bio burden testing market size is calculated at US$ 1.77 in billion 2025, grew to US$ 2.03 billion in 2026, and is projected to reach around US$ 6.82 billion by 2035. The market is expanding at a CAGR of 14.44% between 2026 and 2035.

Across the globe, the bio burden testing market is experiencing significant growth in various areas, including pharmaceutical and biotechnology companies. Adoption of bioburden testing in biopharmaceutical industries enhances the confirmation of product safety, quality, and efficacy by detecting microbial contamination. Nowadays, a variety of infectious diseases are growing in the world are boosting the development of robust drug candidates and personalized medicines, resulting in a raised demand for bioburden testing services. Escalating technological advancements in testing, like PCR and other microbial testing systems, are facilitating faster and more accurate results.

| Metric | Details |

| Market Size in 2026 | USD 2.03 Billion |

| Projected Market Size in 2035 | USD 6.82 Billion |

| CAGR (2025 - 2034) | 14.44% |

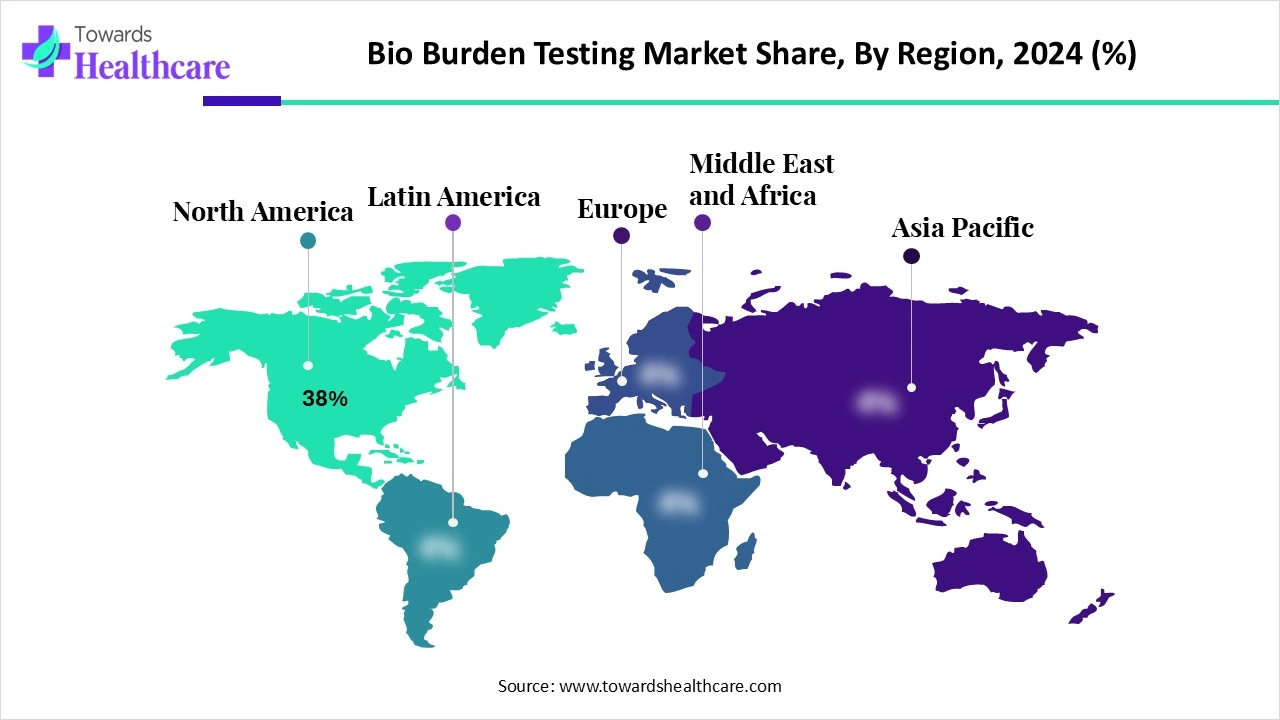

| Leading Region | North America share by 38% |

| Market Segmentation | By Product Type, By Test Type, By Technology, By Application, By End-Use Industry, By Region |

| Top Key Players | Charles River Laboratories, Merck KGaA (MilliporeSigma), Thermo Fisher Scientific Inc., SGS S.A., BD (Becton, Dickinson and Company), bioMérieux SA, Eurofins Scientific, Nelson Laboratories (Sotera Health), WuXi AppTec, Pace Analytical Services, Sigma-Aldrich (subsidiary of Merck), North American Science Associates, Inc. (NAMSA), Steris PLC, Rapid Micro Biosystems, Laboratory Corporation of America Holdings (Labcorp), Lonza Group AG, ICON plc, Bioburden Testing Inc., Cleanroom Technology Limited, Accugen Labs, Inc. |

Bio burden testing refers to the process of measuring the number of viable microorganisms (bacteria, fungi, spores, etc.) present on a medical device, pharmaceutical product, or raw material before sterilization. It is essential for quality control, regulatory compliance, and risk assessment in industries like pharmaceuticals, biotechnology, medical devices, and food & beverage. In 2025, the market encompasses developments such as advancements in faster microbial detection approaches, automation with integration of AI and machine learning, and also broad emphasis on sustainability and the development of eco-friendly testing procedures.

Currently, in the world, the rising adoption of automation and AI-powered solutions in different areas including biologics and personalized medicines, which need highly sophisticated biomonitoring and bioburden testing technologies. In these sectors, AI enables the product sterility, safety with enhanced accuracy, efficiency, rapid, and more precise approaches.

For instance,

Strict Regulatory Landscape and Technological Advancements

The global bio burden testing market is majorly driven by stringent regulatory frameworks in the pharmaceutical and medical devices areas, with rising awareness about the importance of microbial contamination control to ensure improved product safety and compliance with these considerations. However, another contributing factor is growing advancements in testing techniques such as PCR and automated microbial detection systems, which are allowing quick and more reliable bioburden testing, resulting in their raised adoption and overall market growth.

Lack of Trained & Skilled Professionals and High Expenses

Emerging challenges in the bio burden testing market include an increasingly greater need for trained personnel to handle complex testing methods, especially with advanced techniques like PCR, flow cytometry, and high-content screening, which is developing a shortage of these skilled professionals and ultimately hinders market expansion. Whereas, the execution of these advanced testing technologies with automation and faster microbial detection approaches is highly expensive.

Enhancement of Biopharmaceutical Companies and Accelerating Healthcare Spending

In the coming era, the respective market will have diverse opportunities in many areas, including major expansion in biopharmaceutical companies, and rising research and development activities in these industries will significantly demand bioburden testing services. Furthermore, various sectors’ players will actively collaborate and align to boost their capabilities and market position by coupling with these advanced testing methods. On the other hand, expanding population is widely investing in healthcare to raise high-quality, contamination-free products will also accelerate the emergence of new opportunities in the market.

The consumables segment led the market with the highest share in 2024, due to consisting factors like growing demand for culture media, reagents, and test kits, particularly with the increase in customized medicine and the requirement for often testing facilities in biopharmaceutical and medical device production companies. Along with this, major investments in life science research are boosting the segment's growth.

The instruments segment will show rapid growth, with their development of automation in testing methods, the expansion of the pharmaceutical and medical device industries, and the need for accurate and effective microbial contamination detection. This segment mainly comprises more reliable, rapid, and less error-prone testing instruments like PCR instruments and others incorporated in the microbial detection process.

By test type, the aerobic count testing segment dominated the bio burden testing market, due to the involvement of many aerobic microorganisms in a sample, are assists in ensuring the product safety and quality across different industries. These tests are increasingly adopted in the numerous pharmaceutical, medical device, and food industries to control hygiene, detect contamination, and validate sterilization processes.

However, the fungi/mold count testing segment will expand rapidly, with increasing awareness about the possible risks connected with fungal and mold contamination, especially in industries like food and beverage and pharmaceuticals, where these microorganisms lead to spoilage, product recalls, and even health concerns. As well as regulatory agencies, including the FDA and EMA, need these testing methods at several stages for the assessment of product safety and efficacy.

The culture-based testing segment led the market, due to the widespread need for accurate microbial contamination testing across many industries. Besides this, the rising requirement of precise and standardized procedures for the examination of microbial contamination in raw materials, finished products, and manufacturing processes is also fueling the adoption of culture-based testing approaches.

The advanced rapid testing segment is predicted to expand fastest during 2025-2034. Primarily influencing factors like these rapid testing offer less time consumption as compared to conventional approaches, with faster approval of products, resulting in rapid time-to-market for pharmaceuticals and medical devices manufacturing processes.

In the advanced rapid testing methods, the PCR (Polymerase Chain Reaction) test is estimated to grow at the fastest CAGR in the bio burden testing market during the forecast period. Because of its numerous advantages, such as accelerating developments in miniaturized and portable PCR instruments, automation, and integration with robotics, have improved speed, accuracy, and convenience, with a crucial role in the diagnosis of infectious diseases (derived from viruses, bacteria, and fungi), and significant use in gene expression analysis, genotyping, cloning, and other molecular biology applications.

The final product testing segment held a major share of the market in 2024. The segment is fueled by the expansion of pharmaceutical and biotechnology companies with a major need for bio burden testing to confirm the final product’s safety and quality. As well as, oftentimes, product recalls due to microbial contamination, escalating research and development investments in life sciences are also driving the overall segment and market development.

On the other hand, the environmental monitoring segment will register the fastest growth, because of the quick and more precise results are occur with rapid microbiological methods (RMMs), which is enhancing the adoption of bio burden testing in this segment. Besides this, increasing demand for biologics, such as cell and gene therapies are highly prone to contamination, propels the need for comprehensive environmental monitoring.

By end-use industry, the pharmaceuticals segment held a major revenue share of the bio burden testing market. Raised focus on manufacturing product safety, quality, and efficacy, as well as rising public and private investments in pharmaceutical research and development, mainly in biologics and personalized medicine areas, are impelling the segment growth with enhanced adoption of advanced testing methods.

And, the biotechnology segment in the upcoming years is expected to grow rapidly as these industries are highly experiencing expansion in drug production, including biologics like vaccines and antibodies, which need robust bioburden testing throughout the production process. However, increasing outsourcing of bioburden testing to specialized contract testing laboratories is also boosting the segment expansion.

North America led the bio burden testing market share by 38% in 2024, due to possession of advanced healthcare infrastructure with well-developed testing facilities and technologies, with growing awareness about infectious diseases and the need for efficient infection control solutions are fueling demand for these testing procedures. Furthermore, this region is widely involved in investments in research and development activities, especially in the life sciences domains, which are majorly contributing to the adoption of the bio burden testing in the research process.

The US has experienced major growth in North America’s market, with emerging stringent regulatory guidelines by the FDA related to bioburden testing throughout the manufacturing process of pharmaceuticals and medical devices increasingly imposing demand for these kinds of services. Along with this, the US encompasses a robust and expanded pharmaceutical and biotechnology sector that is enormously focused on the need for quality control and assurance in drug development and production.

For this market,

Whereas Canada is targeting the expansion of the biopharmaceutical areas, including biologics and personalized medicine, which is raising the need for testing compliance. These growing needs, along with heavy reliance of medical device industries on bio burden testing for confirming product sterility and safety, are majorly contributing to the market growth.

For instance,

During 2025-2034, Asia Pacific will register rapid expansion, due to the major growth of their pharmaceutical companies in countries like China, India, and South Korea. Also, these emerging areas may comprise rising production of generic drugs, and the presence of contract manufacturing organizations (CMOs) with enhanced requirements of product safety and quality will boost the demand for bioburden testing. Besides this, ASAP is greatly incorporating consumables such as culture media, reagents, and other materials used in bioburden testing, and is estimated to hold a crucial market share.

India is a huge pool of the pharmaceutical and biotechnology sector, encompassing the development of many novel drug candidates with vital inclusion of vaccines, biologics like antibody production, which are widely in demand for the adoption of advanced rapid testing methods such as PCR and others.

For this market,

China is broadly focusing on the emergence of automated and rapid bioburden testing methods to boost efficiency and reduce testing time. Moreover, China’s companies are creating planned partnerships and collaborations to accelerate their market reach and increase their service-providing activities.

For this market,

Europe is leveraging significant market growth, due to the enforcement of stringent rules by the European Medicines Agency (EMA) and other regulatory bodies for bioburden testing, especially in pharmaceutical and medical device manufacturing, to achieve required product sterility and patient safety. Besides this, rising consumer awareness of product safety and the potential risks linked with microbial contamination are accelerating demand for advanced testing services with a focus on quality assurance to maintain product integrity.

Widely impacting factors on Germany’s market are its robust healthcare infrastructure, with a raised focus on R&D activities are highly generating a favorable environment for bioburden testing adoption. Along with this, enhanced development of precision medicine, which is dependent on diagnostic reagents and kits, is driving the demand for bioburden testing. Also, a geriatric population is putting demand for advanced medical devices and pharmaceuticals, coupled with bioburden testing services.

UK, with a strict regulatory background, including the MHRA (Medicines and Healthcare products Regulatory Agency), is playing a crucial role in managing and putting rules for microbial contamination, particularly in pharmaceuticals, medical devices, and food products are primarily impacting the market growth. The UK is stepping in to accelerate awareness of healthcare-associated infections (HAIs), and the importance of preventing contamination in healthcare settings is fueling the demand for bioburden testing.

Latin America is expected to be a significantly growing area in the bio burden testing market, due to growing research and development activities and advancements in medical technologies. Stringent regulatory policies necessitate researchers to conduct bioburden tests to check for the presence of microbiology. The burgeoning pharmaceutical sector and the increasing R&D investments contribute to market growth. Government bodies aim to develop a suitable infrastructure for the research and manufacturing of pharmaceutical products.

The increasing development of medical devices and their export propel the market in Brazil. In 2024, Brazilian exports of medical devices generated a revenue of $1.17 billion, a 24.6% increase from 2023. Most of the exports were made to the U.S., Argentina, Mexico, Chile, and Colombia among 131 countries. The Brazilian National Health Surveillance Agency (ANVISA) releases guidelines about bioburden testing.

By Product Type

By Test Type

By Technology

By Application

By End-Use Industry

By Region

March 2026

February 2026

February 2026

February 2026