January 2026

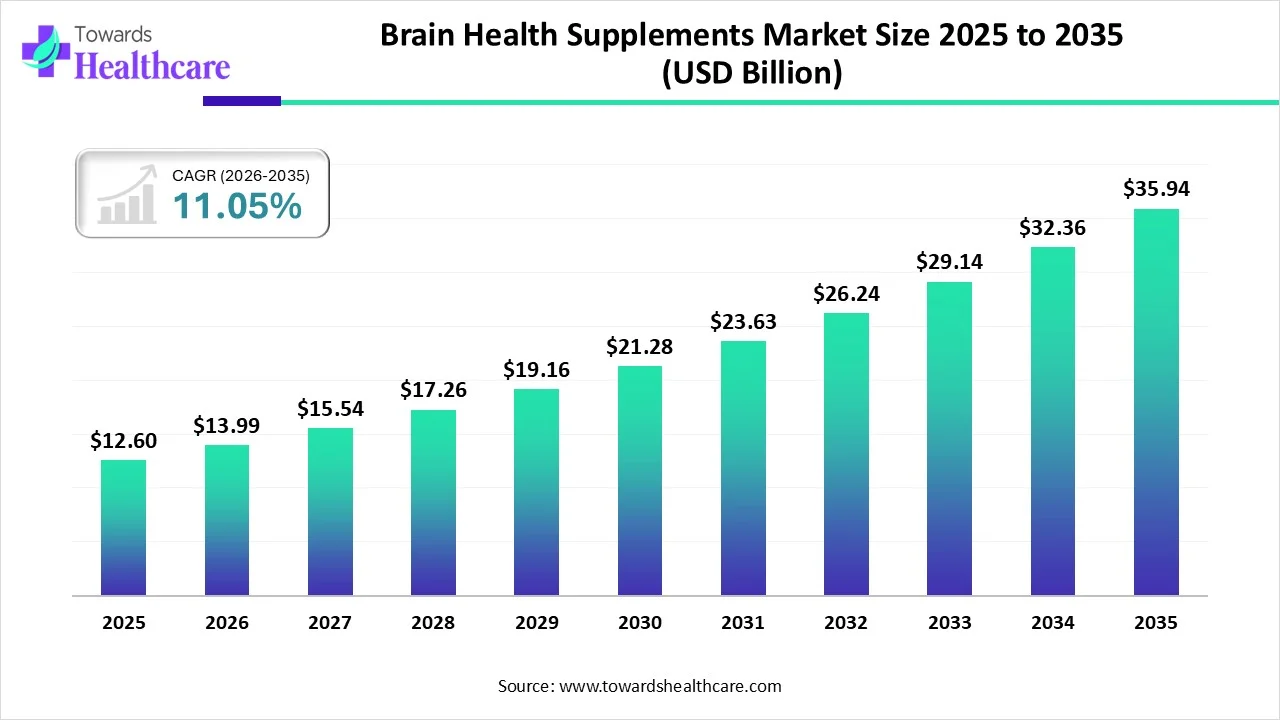

The brain health supplements market size was valued at US$ 12.6 billion in 2025 and is projected to grow to 13.99 billion in 2026. Forecasts suggest it will reach approximately US$ 35.94 billion by 2035, registering a CAGR of 11.05% during the period.

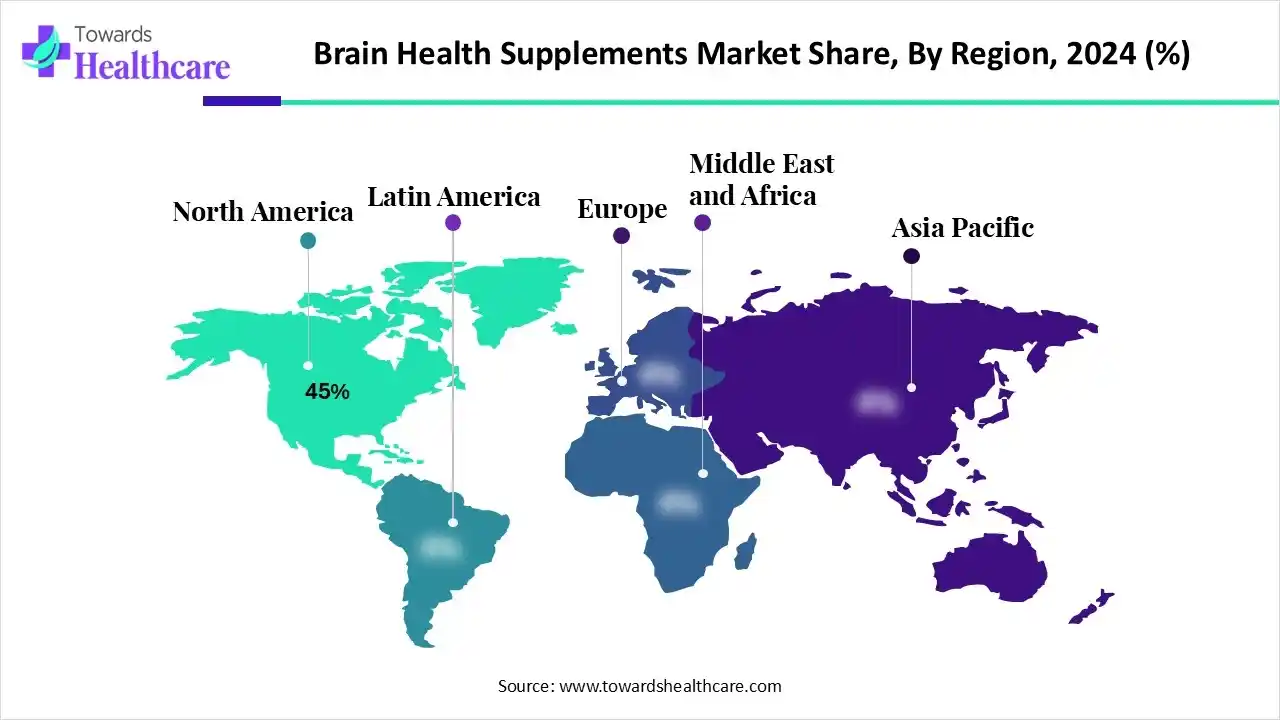

The brain health supplements market is expanding rapidly, driven by increasing cases of cognitive decline, growing awareness of mental wellness, and demand for natural nootropics. Rising aging populations and lifestyle stress further boost consumption, with North America leading the market, followed by the Asia Pacific, showing significant growth potential.

| Table | Scope |

| Market Size in 2025 | USD 12.6 Billion |

| Projected Market Size in 2035 | USD 35.94 Billion |

| CAGR (2026-2035) | 11.05% |

| Leading Region | North America by 45% |

| Market Segmentation | By Product Type, By Mechanism / Function, By Form / Dosage Form, By Distribution Channel, By End-User, By Type of Manufacturer, By Region |

| Top Key Players | Herbalife Nutrition Ltd., Nature’s Bounty Co., NOW Foods, Abbott Laboratories, Jamieson Wellness Inc., Swisse Wellness Pty Ltd., NutraScience Labs, DSM Nutritional Products, Lonza Group AG, Blackmores Limited, Himalaya Global Holdings Ltd., Solgar Inc., Life Extension, GNC Holdings, Inc., Pharmavite LLC |

The brain health supplements market is growing due to rising awareness of cognitive wellness and increasing demand for products that enhance memory, focus, and mental performance. The Market encompasses nutraceuticals, vitamins, minerals, herbal extracts, and other dietary formulations designed to support cognitive function, memory, focus, neuroprotection, and mental well-being. These supplements target a broad range of neurological needs, including age-related cognitive decline, stress and anxiety management, and neurodegenerative disorders such as Alzheimer’s and Parkinson’s disease.

AI is transforming the brain health supplements market by enabling personalized nutrition plans, analyzing consumer health data, and predicting cognitive needs based on genetics and lifestyle. It enhances product formulation, improves clinical research efficiency, and supports data-driven marketing strategies, leading to more effective, targeted, and scientifically backed cognitive wellness solutions for consumers.

In 2024, the nootropic supplements segment held the largest share of 50% of the brain health supplements market, driven by increasing consumer focus on cognitive enhancements, memory, support, and mental performance. The rising prevalence of cognitive disorders and growing awareness of preventive brain health contributed to the strong demand. Nootropics generated s significant portion of market revenue, with the U.S. accounting for an opportunity $2.8 billion, reflecting widespread adoption among adults seeking memory, focus, and concentration improvement.

The herbal/plant-based supplements segment is expected to grow at the fastest CAGR in the brain health supplements market due to rising consumer preference for natural and minimally processed products. Increasing health consciousness, concern over synthetic additives, and the perception of herbal supplements as safe and effective are driving demand. Government-backed studies highlight growing interest in plant-based remedies for cognitive support, emphasizing preventive brain health and overall wellness, which is accelerating the adoption of herbal brain supplements globally.

In 2024, the cognitive enhancers segment dominated the market with a revenue of 45% due to increasing consumer demand for products targeting memory, focus, and mental performance. A 2024 study published by the U.S. National Institutes of Health indicates that memory enhancement supplements comprised the highest global revenue share in 2021. In the U.S. alone, dietary supplement sales reached approximately USD 18 billion in 2018. This growth reflects strong consumer interest in cognitive enhancement products.

The mood & stress management segment is projected to experience rapid growth in the brain health supplements market during the forecast period. A 2024 report by the U.S. Department of Health and Human Services indicates that mental health and substance use disorders are among the most prevalent and costly health conditions in the United States, with an estimated economic burden of over $300 billion annually. This underscores the increasing demand for supplements aimed at improving mood and reducing stress.

In 2024, the capsules/tablets segment led the market, with a revenue of 60% driven by convenience, precise dosing, and long shelf life. Government data from the U.S. National Institutes of Health highlights that tablets and capsules are the most widely used dosage form for dietary supplements, preferred for their ease, widespread, and consistent delivery of active ingredients. This widespread adoption among consumers seeking cognitive support and memory enhancement contributed to the segment's largest revenue share in the market.

The liquids/syrups segment is expected to grow at the fastest CAGR in the brain health supplements market during the forecast period due to increasing demand for easy-to-consume formats. These forms are particularly preferred by children and elderly populations for their ease of swallowing and adjustable dosing. According to a 2024 U.S. FDA report, liquid supplements account for a growing proportion of dietary supplement usage, reflecting their convenience and rising consumer adoption globally.

In 2024, the retail pharmacies segment led the market with the highest share of 40%, driven by widespread accessibility and consumer trust. According to a 2024 report by the U.S. FDA, retail pharmacies are the most common point of purchase for dietary supplements in the United States, accounting for approximately 60% of supplement sales. This dominance is attributed to their extensive distribution networks, knowledgeable staff, and established customer base, making them a preferred channel for consumers seeking cognitive support products.

The online/e-commerce platforms segment is projected to grow at the fastest CAGR in the brain health supplements market during the forecast period. This growth is supported by increasing consumer preference for convenient shopping and home delivery. According to a 2024 report by the U.S. Census Bureau, retail e-commerce sales in the second quarter of 2024 increased by 5.3% compared to the same period in 2023, while total retail sales increased by 3.9% in the same period. E-commerce sales accounted for 16.1% of total retail sales in the second quarter of 2024, up from 15.3% in the same period in 2023. This trend reflects the growing adoption of online shopping for health and wellness products.

In 2024, the adults (18–50 years) segment led the market 2024 with a revenue of 50%, driven by increasing awareness of cognitive health and proactive wellness. According to the National Health and Nutrition Examination Survey (NHANES), 57.6% of adults aged 20 and over reported using any dietary supplement in the past 30 days, with usage increasing with age. This demographic's growing interest in mental clarity, focus, and stress management contributed to their dominant market share in cognitive support products.

The seniors (50+ years) segment is expected to grow at the fastest rate in the brain health supplements market, driven by increasing concerns over age-related cognitive decline and memory support. According to NHANES data, 80.2% of adults aged 60 and over reported using dietary supplements, compared to 57.6% of adults aged 20 and above. This high adoption reflects a strong demand for supplements that enhance brain function, focus, and overall mental wellness in the aging population.

In 2024, the in-house manufacturing segment dominated the market with a revenue of 70%, driven by stringent quality control and regulatory compliance. The U.S. Food and Drug Administration (FDA) enforces Good Manufacturing Practices (GMPs) under 21 CFR Part 111, requiring dietary supplement manufacturers to establish quality control procedures and maintain records. This regulatory framework ensures product consistency and safety, fostering consumer trust and contributing to the segment's significant market share.

The outsourced/contract manufacturing segment is expected to grow at the fastest CAGR in the brain health supplements market during the forecast period. This growth is driven by the increasing demand for cost-effective production, access to specialized expertise, and scalability. According to a 2024 report by the U.S. Department of Commerce, the U.S. contract manufacturing industry has seen consistent growth, with a 5.2% increase in revenue from 2022 to 2023, reflecting the rising trend of outsourcing production to specialized firms. This trend is expected to continue as companies seek to optimize operations and meet the growing consumer demand for dietary supplements.

In 2024, North America dominated the market, accounting for 45% of the global market share, with U.S. consumers spending more than $95 billion on nutritional supplements. This significant share reflects the region's high consumer awareness, robust healthcare infrastructure, and increasing demand for cognitive health products. The U.S. dietary supplement market was estimated at $63.63 billion in 2023, marking a 3.9% growth from the previous year. These factors contribute to North America's leading position in the global market.

In 2024, the U.S. market experienced significant expansion, driven by increasing consumer awareness and demand for cognitive health products. Approximately 75% of Americans reported using dietary supplements, with a notable rise in products targeting brain health, such as memory enhancers and mood stabilizers. The market's growth is further supported by the U.S. Food and Drug Administration's regulation of over 100,000 dietary supplement products, ensuring product safety and quality.

In 2024, the Canadian market expanded due to increased consumer awareness and demand for cognitive health products. Approximately 57.6% of Canadian adults aged 20 and over used dietary supplements, and the usage increased with age. Among adults aged 60 and over, 80.2% reported using dietary supplements, indicating a strong and growing market segment. This trend reflects a rising interest in maintaining cognitive function and overall mental wellness.

Asia-Pacific is expected to grow fastest in the market during the forecast period due to increasing health awareness, rising elderly population, and expanding urban middle-class consumers. Government data from the World Health Organization indicates that by 2024, over 9% of the population in countries like Japan, China, and India will be aged 65 or older, highlighting a growing need for cognitive health support and supplements targeting memory, focus, and mental wellness.

In 2024, India’s market is expanding due to growing awareness of cognitive wellness, increasing lifestyle-related stress, and a rising aging population. Government data from the Ministry of Health and Family Welfare indicates that over 10% of the Indian population is aged 60 and above, driving demand for memory and focus support. Additionally, urban consumers are increasingly adopting preventive health measures, including dietary supplements, boosting the market for brain health products across the country.

In 2024, Japan's market expanded due to a growing aging population and increasing consumer awareness of cognitive wellness. Approximately 31.7% of Japan’s population was aged 65 and above, contributing to higher demand for supplements targeting memory, focus, and mental clarity. The Ministry of Health, Labor, and Welfare's nutrition policies emphasize promoting healthy lifestyles and enhancing public health, which has led to greater public interest in dietary supplements.

In 2024, Europe advanced brain health through several key initiatives. The European Commission's EU4Health 2024 Work Program allocated €752.4 million to enhance mental well-being, prevention, and support services across the EU. Additionally, Horizon Europe-funded research on cognitive health aims to improve brain function and reduce disease burden. The European Food Safety Authority (EFSA) established guidelines for safe nutrient intake levels, ensuring supplement safety and efficacy.

In 2024, the UK market is expanding due to increasing consumer awareness of cognitive wellness and preventive healthcare. According to the National Diet and Nutrition Survey, over 50% of UK adults regularly use dietary supplements, with a rising proportion opting for products targeting memory, focus, and mood support. Government initiatives promoting healthy aging and mental well-being, along with growing lifestyle-related stress, are driving demand for brain health supplements, making them an increasingly important part of preventive healthcare in the UK.

In 2024, Germany's market expanded due to increasing consumer awareness and demand for cognitive health products. The country's aging population, with over 22% aged 65 and above, contributed to a higher prevalence of age-related cognitive decline, driving demand for supplements targeting memory, focus, and mental clarity. Additionally, the German government has been promoting healthy lifestyles and preventive healthcare, further supporting the growth of the market.

By Product Type

By Mechanism / Function

By Form / Dosage Form

By Distribution Channel

By End-User

By Type of Manufacturer

By Region

January 2026

January 2026

January 2026

January 2026