February 2026

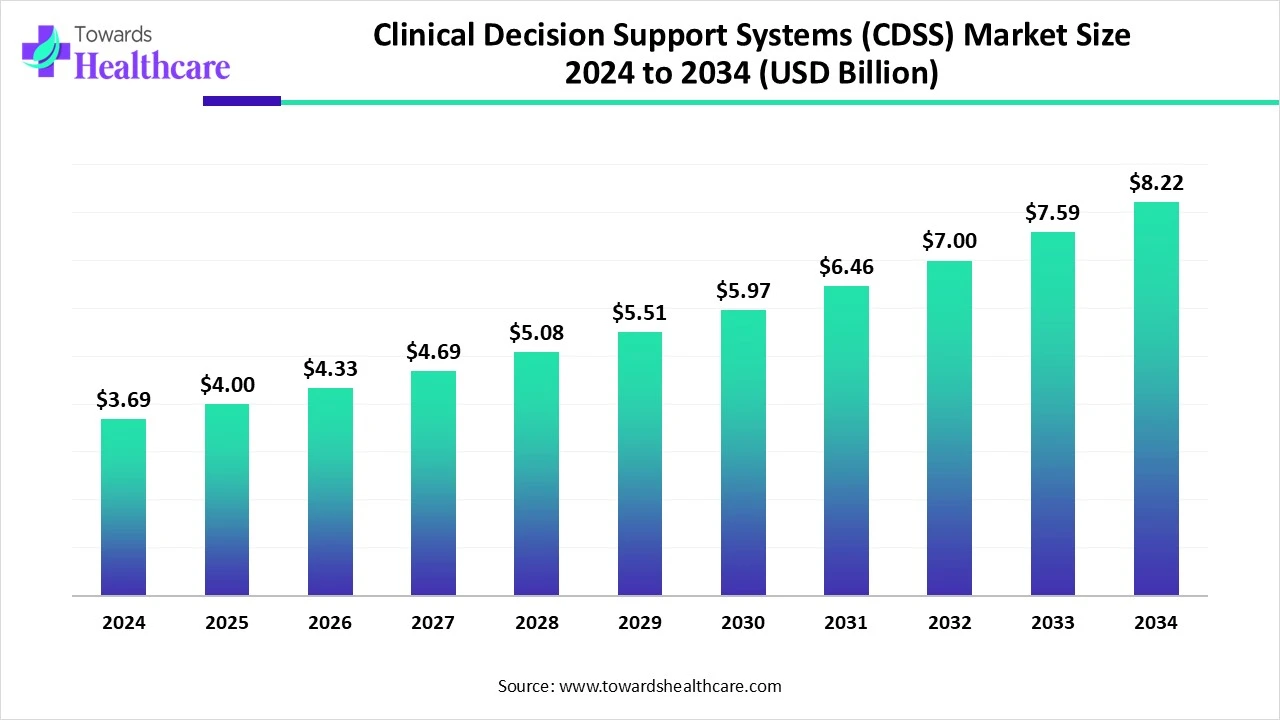

The global clinical decision support systems (CDSS) market size is calculated at US$ 3.69 billion in 2024, grew to US$ 4 billion in 2025, and is projected to reach around US$ 8.22 billion by 2034. The market is expanding at a CAGR of 8.34% between 2025 and 2034.

The use of clinical decision support systems (CDSS) is increasing to reduce clinical errors, growing health IT adoption, integrations with mHealth platforms, etc. This is increasing their development by various companies, which is resulting in new collaborations and acquisitions. They are also developing and launching AI-based CDSS. Moreover, due to the expanding healthcare sector, increasing digitalization, and innovations, their utilization in different regions is increasing. The government is also supporting their adoption by highlighting their applications and providing investments. Thus, this promotes the market growth.

| Table | Scope |

| Market Size in 2025 | USD 4 Billion |

| Projected Market Size in 2034 | USD 8.22 Billion |

| CAGR (2025 - 2034) | 8.34% |

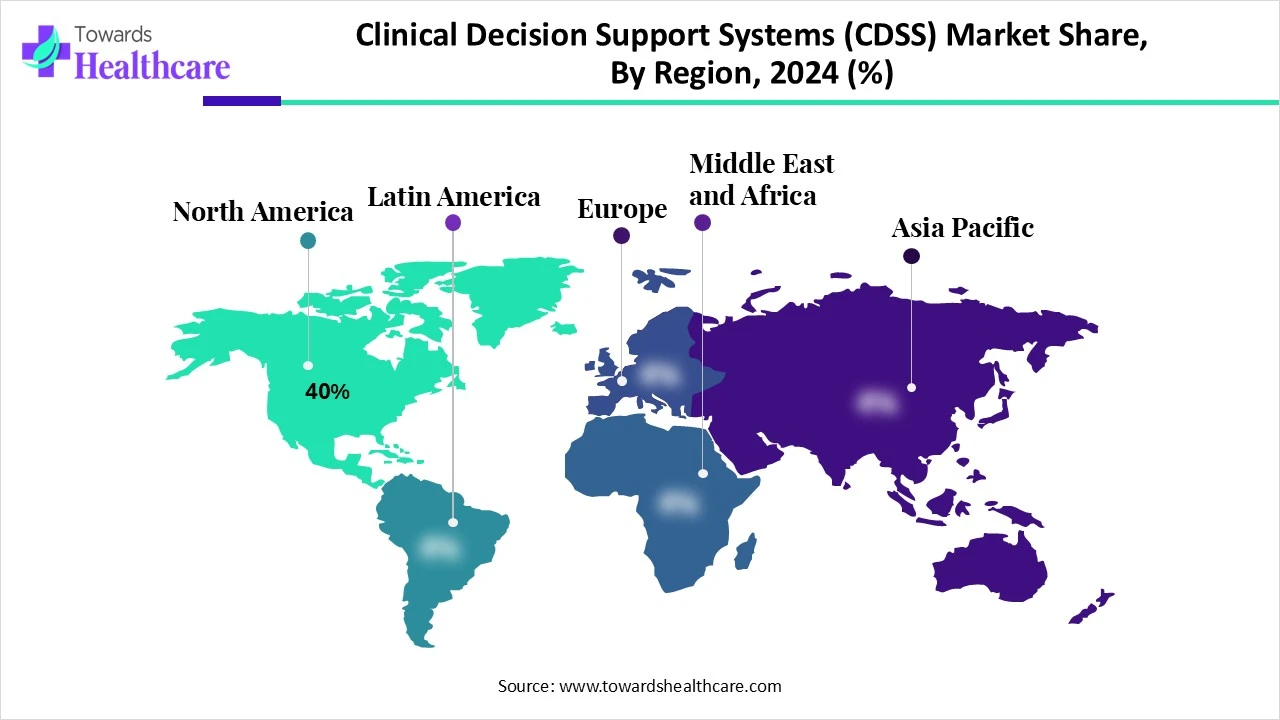

| Leading Region | North America Share 40% |

| Market Segmentation | By Type, By Component, By Delivery Mode, By Application, By End User, By Region |

| Top Key Players | Cerner Corporation (Oracle), Epic Systems Corporation, Allscripts Healthcare Solutions, Inc., IBM Watson Health, GE Healthcare, McKesson Corporation, Meditech, Wolters Kluwer, Athenahealth, SAS Institute, Elsevier (ClinicalKey), Optum (UnitedHealth Group), Agfa Healthcare, Siemens Healthineers, Zynx Health (Hearst Health), NextGen Healthcare, BioClinica, Inc., Infermedica, Mayo Clinic Platform |

The clinical decision support systems (CDSS) market includes software and tools designed to assist healthcare providers by offering evidence-based clinical knowledge and patient-specific information to improve decision-making. This helps in enhancing the safety, effectiveness, quality, and efficiency of healthcare. CDSS solutions analyze data such as medical histories, lab results, and clinical guidelines to deliver alerts, reminders, diagnostic support, and treatment suggestions. Adoption is driven by the need to reduce medical errors, improve patient outcomes, optimize workflows, and comply with regulatory mandates promoting health IT integration.

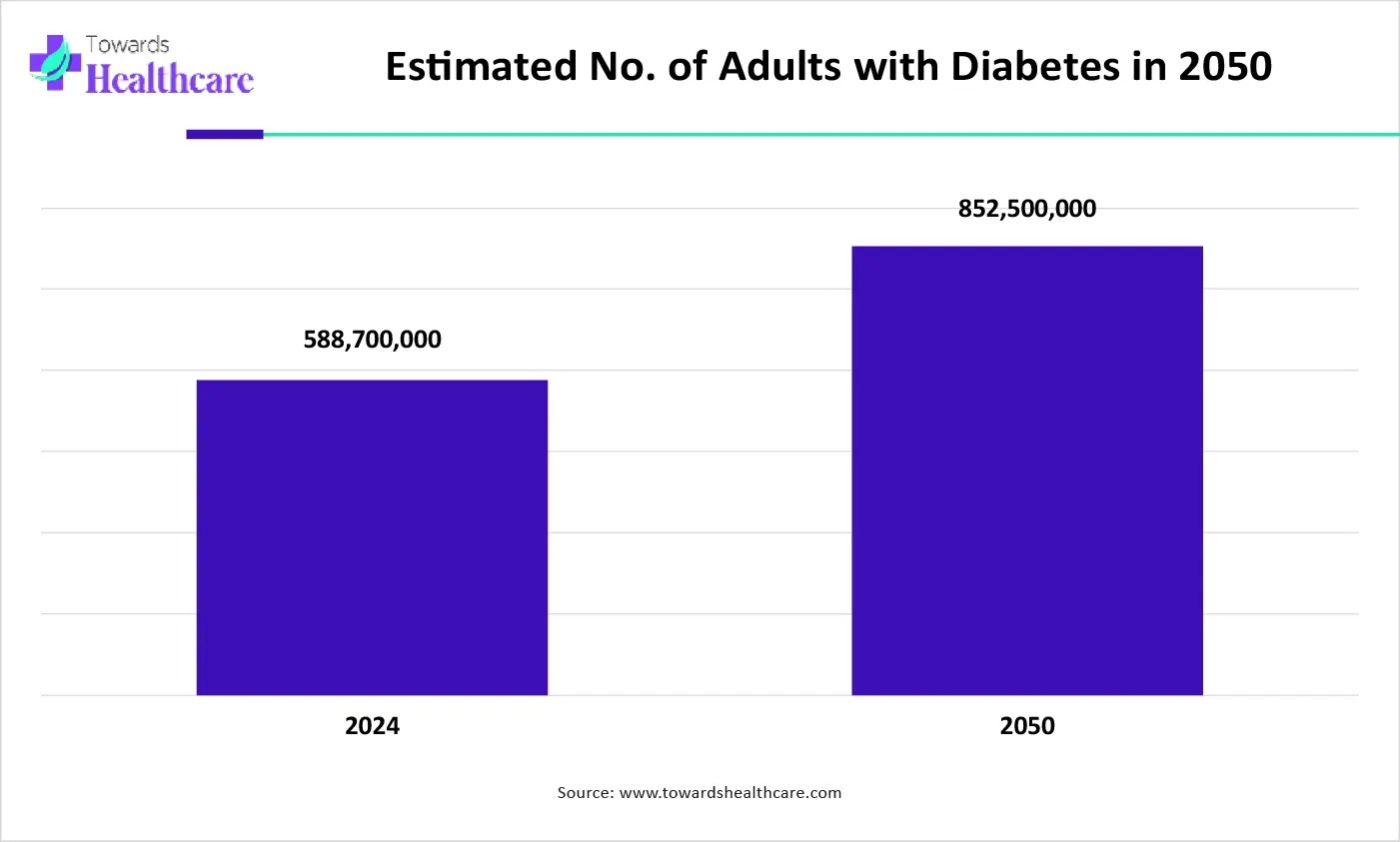

The graph represents a comparison of adults with diabetes globally in the years 2024 and 2050. It indicates that there will be a rise in cases of diabetes by 45%. Hence, it increases the demand for clinical decision support systems (CDSS) to deliver diagnostic support and treatment suggestions for effective management. Thus, this in turn will ultimately promote the market growth.

Growing advancements: There is a rise in the development of cloud-based or AI-powered CDSS. This is increasing their utilization, funding, and collaboration among the companies to detect various diseases and to provide effective treatment solutions. Moreover, to promote their use, the number of acquisitions is also increasing.

For instance,

The capabilities of CDSS are being transformed by using AI technologies. They help in enhancing the accuracy and speed of CDDS. The vast amount of healthcare data can be interpreted and processed rapidly with AI. The use of machine learning algorithms can provide insights into complex datasets, distinguish patterns, and recognize correlations, empowering CDSS. Furthermore, the patient outcomes and clinical decision-making can be improved by using ML with CDSS, as it can provide personalized recommendations that are customized depending on individual patient needs.

Growing Electronic Health Records (EHRs) Adoption

Electronic health records (EHR) are responsible for the collection and storage of the patient’s data. This data is being used by CDSS to provide accurate analysis and decision support. Insights such as patient history, drug allergy reaction, dose adjustments, etc, can be provided by CDSS by using EHR data. This, in turn, helps in the development of personalized treatment approaches. Hence, merging EHR with the CDSS can enhance the clinical workflow and improve patient outcomes. Thus, this drives the clinical decision support systems (CDSS) market growth.

Data Privacy Concerns

The health information of the patient is used by CDSS to offer its application. The unauthorized access can lead to data breaches. Additionally, it relies on multiple sources to provide or transfer the data, which can affect the security of the system. Thus, this increases the risk of cyberattacks. Hence, this decreases its use by the healthcare systems.

Why is Increasing Demand for Quality Care an Opportunity in the Market?

The use of CDSS is increasing in healthcare systems to minimize the risk of medical errors. With the help of CDSS, the chances of misdiagnosis are being reduced. It also provided real-time alerts, preventing medical errors. Moreover, to ensure quality care, the CDSS supports the professionals to meet the clinical standards. At the same time, to deal with growing volumes of patients, the CDSS is offering diagnostic suggestions and treatment solutions, improving the quality of care. Furthermore, it is also being used to provide personalized treatment. Thus, this is promoting the clinical decision support systems (CDSS) market growth.

For instance,

By type, the knowledge-based CDSS segment held the largest share of approximately 60% in the clinical decision support systems (CDSS) market in 2024, as it utilized clinical guidelines. Moreover, the data provided was supported by clear explanations. Hence was used to develop evidence-based medicines. This contributed to the market growth.

By type, the non-knowledge-based CDSS segment is expected to show the fastest growth rate at a notable CAGR, with approximately 40% share during the predicted time. It is providing real-world evidence by using a larger dataset. It is also being used in complex decision-making. It is also supporting the development of personalized medicines.

By component type, the software segment led the clinical decision support systems (CDSS) market with approximately a 75% share in 2024, due to its enhanced analysis and decision support. They were also used with EHR to improve the CDSS workflow. Moreover, it also provided enhanced accessibility.

By component type, the services segment is expected to show the fastest growth rate during the upcoming years. To deal with the continuous optimization and updates, their use is increasing. They are also being used for monitoring and troubleshooting. Additionally, the growing demand for training is also increasing its adoption.

By delivery mode type, the cloud-based segment held the dominating share of approximately 65% in the clinical decision support systems (CDSS) market in 2024 and is expected to show the highest growth during the predicted time, due to its improved flexibility and scalability. They are also integrated with telehealth, which is promoting its accessibility. Furthermore, the regular updates are maintaining their security. Thus, this enhanced the market growth.

By application type, the drug dose support/drug interaction checks segment led the clinical decision support systems (CDSS) market with approximately a 30% share in 2024, as it minimized the risk of medication errors. This, in turn, enhances the safety and compliance with the treatment by the patient. It also helped in minimizing the risk of drug adverse effects.

By application type, the image recognition & radiology support segment is expected to show the fastest growth rate during the forthcoming years. It helps in offering accurate and rapid analysis of the vast amount of data. The anomalies are also detected easily. Thus, this helps in reducing the workload.

By end user, the hospitals & healthcare providers segment held the largest share of approximately 60% share in the global clinical decision support systems (CDSS) market in 2024, as they used CDSS to provide decision support to the patients. The use of EHR has increased its adoption. Moreover, it was also used to provide diagnostic support. Thus, this promoted the market growth.

By end user, the ambulatory care centers segment is expected to show the highest growth during the upcoming years. The use of CDSS is increasing to deal with the growing number of outpatients. They are being integrated with telehealth to provide diagnostic services. Moreover, advanced CDSS, which are cloud-based, are also being used at affordable prices.

North America dominated the clinical decision support systems (CDSS) market share by 40% in 2024. North America consists of an advanced healthcare infrastructure, along with the presence of advanced technologies. This, in turn, has increased the adoption of CDSS to improve patient outcomes. Thus, this contributed to the market growth.

The growing incidence of chronic diseases is increasing the adoption of CDSS to enhance their diagnosis as well as treatment approaches. This, in turn, is increasing their innovations as well. Moreover, the growing investments from private and government are promoting their innovations.

The growing research and development in Canada are focusing on enhancing the workflow and application of CDSS. This, in turn, is increasing the number of collaborations among the companies. Additionally, the growing government initiatives are promoting the use of such systems.

Asia Pacific is expected to host the fastest-growing clinical decision support systems (CDSS) market during the forecast period. The Asia Pacific is experiencing an expansion in the healthcare sector. Therefore, along with the growing digitalization, the demand for CDDS in the healthcare sector is increasing. Thus, this is enhancing the market growth.

The healthcare sector of China is increasingly adopting various digital technologies. Thus, this is increasing the reliance on the CDSS for various healthcare procedures. At the same time, AI-powered CDSS are also being developed. Furthermore, the growing government initiatives are also promoting their adoption.

The growing digitalization in India is increasing the use of CDSS in the healthcare sector. These are being used for the management of growing diseases. The growing medical tourism is also increasing its utilization along with other advanced technologies. These developments are supported by government initiatives and investments.

Europe is expected to grow significantly in the clinical decision support systems (CDSS) market during the forecast period. The adoption of CDDS for enhancing patient safety is increasing in Europe. They are also being used to deliver appropriate treatment approaches and decisions. Thus, this is promoting the market growth.

The healthcare sector in Germany is widely using EHR, which in turn is increasing the use of CDSS to provide clinical support. They are also being used to provide personalized and precision medications to the patients depending on their disease condition. Additionally, the government sectors are investing in digital health, which is increasing its use.

The industries present in the UK are developing AI or cloud-based CDSS. This, in turn, is increasing the collaboration between the private and government sectors, driving their innovation, which complies with the regulatory standards. Moreover, these developments are supported by investments from various sources.

In February 2025, after receiving the 10th FDA clearance, the CEO of Etiometry, Shane Cooke, stated that their leadership in clinical decision support and regulatory compliance will be strengthened, and their dedication to cybersecurity will be supported by this clearance. With increasing cybercrimes, the hospitals are demanding technologies with the FDA’s latest security standards and are adopting solutions that are not scrutinized, exposing them to unnecessary vulnerabilities. Thus, a solution that can enhance patient outcomes and protect their data and hospital systems will be provided by the company as per its mission.

By Type

By Component

By Delivery Mode

By Application

By End User

By Region

February 2026

February 2026

February 2026

February 2026