January 2026

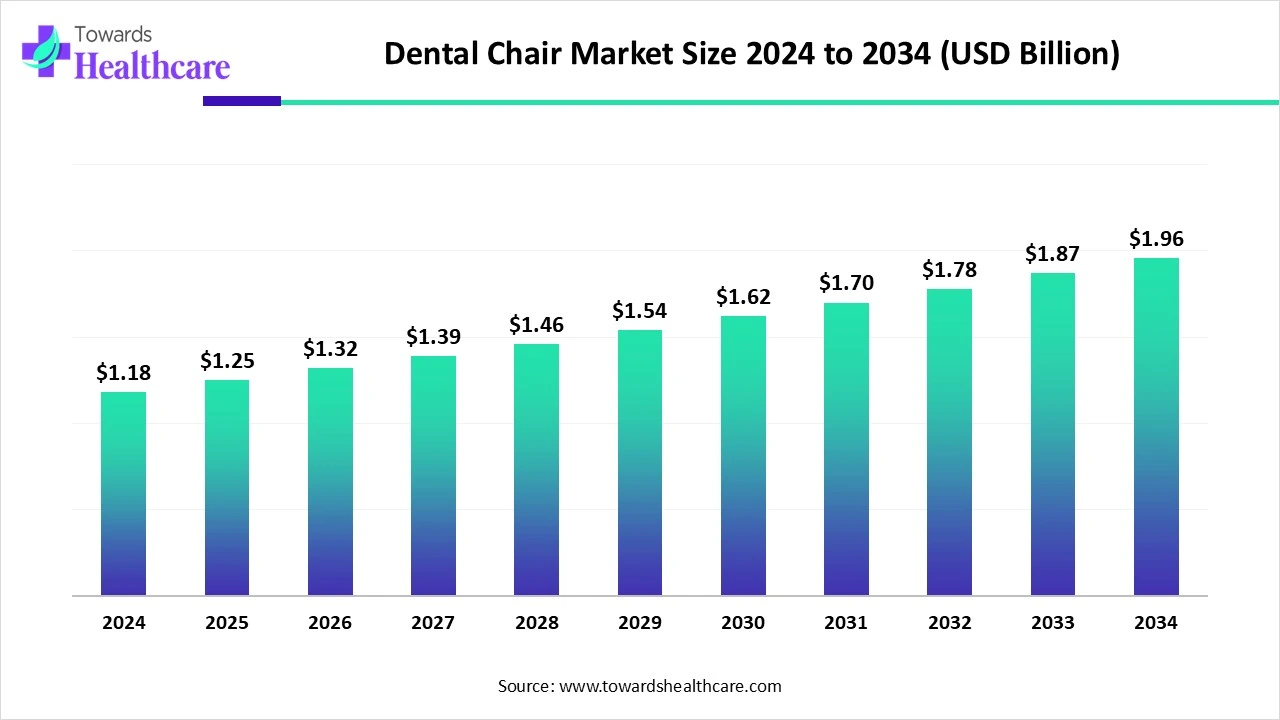

The global dental chair market size is calculated at US$ 1.18 billion in 2024, grew to US$ 1.25 billion in 2025, and is projected to reach around US$ 1.96 billion by 2034. The market is expanding at a CAGR of 5.75% between 2025 and 2034.

The increasing focus on patient comfort and ongoing technical improvements are major factors driving the growth of the dental chair market. Patients' expectations have changed in recent years, with a greater emphasis now being placed on total dental experience and comfort. At the same time, the modern dental workspace is changing due to technological improvements in dental chairs. In keeping with international hygiene requirements, infection prevention features like hands-free operation and antimicrobial upholstery are also becoming more and more popular.

| Table | Scope |

| Market Size in 2025 | USD 1.25 Billion |

| Projected Market Size in 2034 | USD 1.96 Billion |

| CAGR (2025 - 2034) | 5.75% |

| Leading Region | North America |

| Market Segmentation | By Product Form/Configuration, By Delivery System Style, By Drive & Adjustment Mechanism, By Price Tier/Market Segment, By Distribution & Sales Channel, By Region |

| Top Key Players | A-dec, Dentsply Sirona, Midmark, KaVo / Kerr (KaVo brand), Takara Belmont, Planmeca, Stern Weber (Fimet Group), Anthos (Cefla), DentalEZ (Dentalez), Pelton & Crane, J. Morita (Morita Corporation), Gnatus (Brazilian OEM), Castellini (Italy), Osada (Japanese dental equipment maker), W&H (dental units and accessories) |

Seated operator dental delivery systems that provide patient chair support, integrated delivery systems (handpieces, water/suction), operatory lights, ergonomic positioning, and ancillary accessories for dental procedures across general dentistry and specialty clinics, offered as standalone chairs, fully integrated treatment centers, portable/compact units, and modular upgradeable systems; sold via distributors, OEM dealers, and direct channels with service, maintenance, and training.

Rising Awareness: Dental or oral health is still not considered very essential in underdeveloped countries and rural areas. These regions require awareness programs for promoting the importance of dental health. Various organizations, companies, and governments have taken initiatives to increase dental awareness. Due to this, a lot of people are visiting dental clinics to improve their oral health.

For instance,

Advanced AI algorithms are included into the 2025 generation of dental chairs, which analyse patient body parameters in real time. All diagnostic data and electronic patient records may be automatically synchronised by the AI system in dental chairs. AI-enabled chairs now keep track of each patient's unique comfort profile. Between visits, there is no need for manual modifications because the AI system retains user preferences and settings.

Technological Advancements Drive the Dental Chair market

High-tech elements included in contemporary dental chairs improve patient care by making the dental procedure more comfortable and convenient. These cutting-edge technology meet the demands of the patients, making them more comfortable during procedures and improving the practice's reputation. The dentist may make rapid, accurate changes without disrupting the appointment's flow thanks to automated modifications, such memory settings for chair placement, which subtly improve patient comfort. Practices may provide a memorable patient experience, foster trust, and entice patients to return for more sessions by investing in high-tech dental chairs.

High Cost of Dental Chairs

The high price of sophisticated chairs is one of the main factors limiting the worldwide dental chair industry. These chairs frequently include high-end features that raise their cost considerably. The initial investment and continuing maintenance expenses might be expensive for small clinics or practices in emerging nations.

What is the Future of the Dental Chair Market

Future dental chairs will include built-in sensors to track stress levels and vital indicators, enabling real-time treatment plan modifications. Cutting-edge sterilisation technology will provide a safer environment for patients and staff, while sophisticated 3D vision systems and AI capability will improve procedural accuracy and help clinical decision-making. Furthermore, the combination of IoT connection and augmented reality (AR) is a revolutionary development.

The integrated treatment centers segment held the major revenue of the dental chair market in 2024. A smart dental chair is a cutting-edge, technologically integrated dental device made to provide patients with exceptional comfort and optimise dentists' efficiency. A comprehensive and efficient dental care solution is created within a single unit by these integrated systems, which link to intraoral scanners, imaging systems, and software. They also include touch-screen controls, patient chair adjustments, and integrated infection prevention systems.

The portable/mobile chairs & compact units segment is estimated to be the fastest-growing during 2025-2034. The dynamic portable dental chair is made to be convenient and adaptable in a variety of dental environments. These portable dental chairs, which are strong and lightweight, are the perfect answer for dental offices that need to be mobile without sacrificing patient comfort or safety.

The rear-delivery segment held the major revenue of the dental chair market in 2024. For experts, rear-delivery is seen to be a preferable design since it enables them to have all of their instruments and handpieces combined into a single, effective workstation. Since the patient can go in and out of the dentist chair with ease and won't have to stare at or bump the delivery unit while seated, it can also have a positive psychological impact on them.

The over-the-patient/front delivery segment is estimated to be the fastest-growing during 2025-2034. Because the device is positioned above the patient's chest, the assistant and dentist can easily access handpieces and other equipment. This method is quite unsuitable for pedo clinics since it is readily bumped due to its near closeness to the patient and obvious visibility.

The hydraulic actuation segment held the major revenue of the dental chair market in 2024. Function and design are closely related. Regardless of the patient's weight, hydraulic drives consistently move them into the position required for therapy. It has a long operating life and requires almost no maintenance because it is a closed-circuit system. The seat's individual settings are infinitely adjustable and may be achieved without jerking.

The electric/motorized adjustment segment is estimated to be the fastest-growing during 2025-2034. Because the power system allows electronic devices to accurately control the motor's speed and torque, the electric dental chair operates more smoothly. It is also possible to pre-program electric dental chairs to quickly convert between different chair positions.

The mid-tier clinical treatment centers segment held the major revenue of the dental chair market in 2024. A dental office that provides a good variety of treatments and contemporary technology at a mid-range cost is known as a mid-tier dental clinical treatment centre. It usually offers better patient care and a more comfortable experience than a basic or inexpensive clinic, without going as far as the luxury costs of upscale cosmetic procedures.

The premium/high-end ergonomic integrated systems segment is estimated to be the fastest-growing during 2025-2034. In dentistry, where dentists spend a lot of time performing complex treatments, ergonomics is essential for enhancing patient care, maximising workflow efficiency, and supporting practitioner well-being. The topic of dental ergonomics is always changing, and there are a number of promising future developments that might improve dental office ergonomics even further.

The dental distributors & authorized dealers segment held the major revenue of the dental chair market in 2024. Dental distributors are helpful because they give dental offices a single, trustworthy source for a variety of necessary supplies and equipment. They also offer advantages like easy ordering, access to high-quality brands and products, competitive pricing through bulk purchases and discounts, professional guidance, and dependable technical support and service.

The leasing & equipment-as-a-service (EaaS) programs via the financiers segment is estimated to be the fastest-growing during 2025-2034. EaaS, which differs from typical leasing, combines the use of equipment with continuing support, maintenance, and updates. It frequently makes use of IoT technologies to track consumption and provide predictable payments. These programmes meet changing expectations for servitization and sustainable practices while providing flexibility and scalable usage.

North America dominated the dental chair market in 2024. The region is anticipated to have the largest market share due to significant investments in R&D, technological breakthroughs by major companies, and highly developed healthcare infrastructure in nations like the U.S. and Canada. The government's encouraging efforts to control the rising number of cases of oral illness are driving market expansion. North America dominates the world market for dental chairs in part because of the region's high level of disposable income and inclination for higher-quality dental care.

In the U.S., there are more over 200,000 dentists, a figure that has steadily grown for almost 20 years until levelling off recently. There is a growing diversity in the dental workforce. The proportion of female dentists has grown and is predicted to reach 50% of the workforce by 2040. Since 2015, the percentage of American dentists who are DSO-affiliated has more than doubled, and as of 2024, it stands at 16.1%.

Building a stronger Canada requires investing in the health of its citizens. Access to reasonably priced dental treatment has greatly increased in the first year of the Canadian Dental treatment Plan (CDCP). Over 3.4 million Canadians were authorised to participate in the programme, and 1.7 million of them have already had treatment.

Asia Pacific is estimated to host the fastest-growing dental chair market during the forecast period. A constantly growing population, increased disposable income, growing awareness of oral health, and the opening of contemporary dentistry clinics are all factors contributing to the market's expansion throughout the area. The need for chairs in the area is also being fueled by the growing number of dentists and government initiatives.

R&D for dental chairs includes identifying user needs, designing the chair with ergonomics and features in mind, choosing materials and engineering for durability and functionality, testing and prototyping for performance and safety, and then fine-tuning the design and manufacturing procedures to maximise output and quality.

Top Companies Include: Dentsply Sirona, Planmeca, KaVo Kerr, and Straumann Group

Due to variables including higher population density, increasing demand for specialised treatments, and a greater willingness to pay for care, the distribution of dental chairs is concentrated in metropolitan regions with adequate resources.

Top Companies Include: Confident Dental Equipments Pvt Ltd, Unicorn Denmart, Phoenix Dental and Medical P. LTD., and AJK DENTAL TRADERS

Preparing the chair, helping the patient sit and position themselves comfortably for the treatment, educating the patient, and making sure they are comfortable and safe for the whole session are all examples of patient support and services during the dental chair.

In September 2024, any problem with a dental chair unit can seriously interrupt clinic operations, therefore I looked for a solution that is both reliable and easy to use, according to Dr. Ghassan Radi, a dental clinic director in the UK. In addition to being simple to maintain, the Osstem Implant K3 allows for total control over all operations through the console and its linked display, which is quite practical. Durability and product design are important since clinic administrators bear the weight of maintenance expenses.

By Product Form/Configuration

By Delivery System Style

By Drive & Adjustment Mechanism

By Price Tier/Market Segment

By Distribution & Sales Channel

By Region

January 2026

January 2026

January 2026

January 2026