Diabetes Management Supplements Market Size, Key Players with Trends and Growth

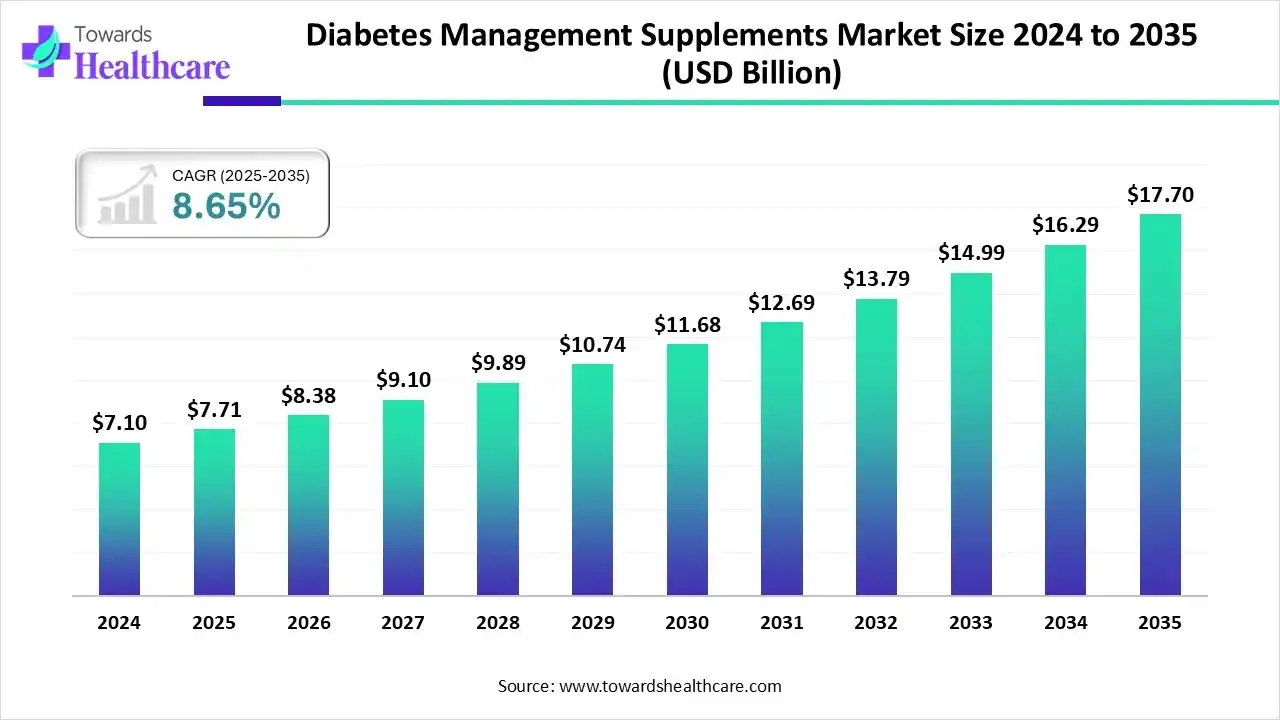

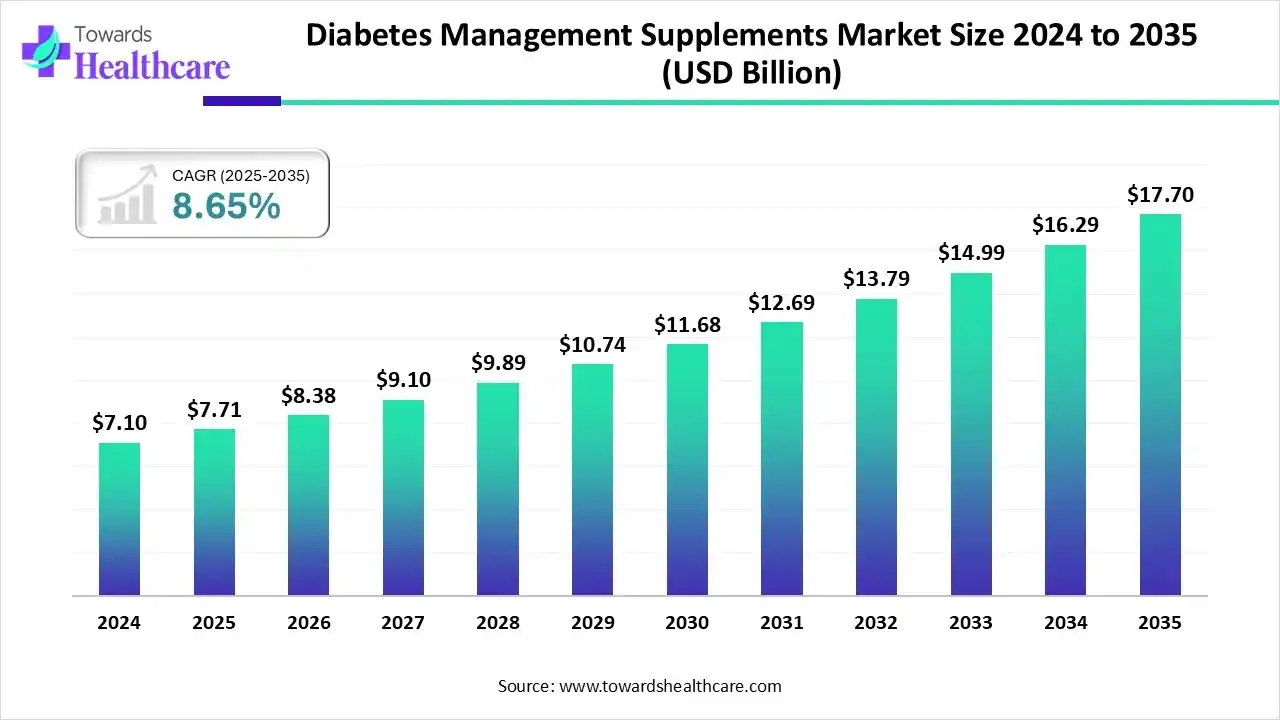

The diabetes management supplements market size stood at US$ 7.17 billion in 2025, grew to US$ 8.38 billion in 2026, and is forecast to reach US$ 17.7 billion by 2035, expanding at a CAGR of 8.65% from 2026 to 2035.

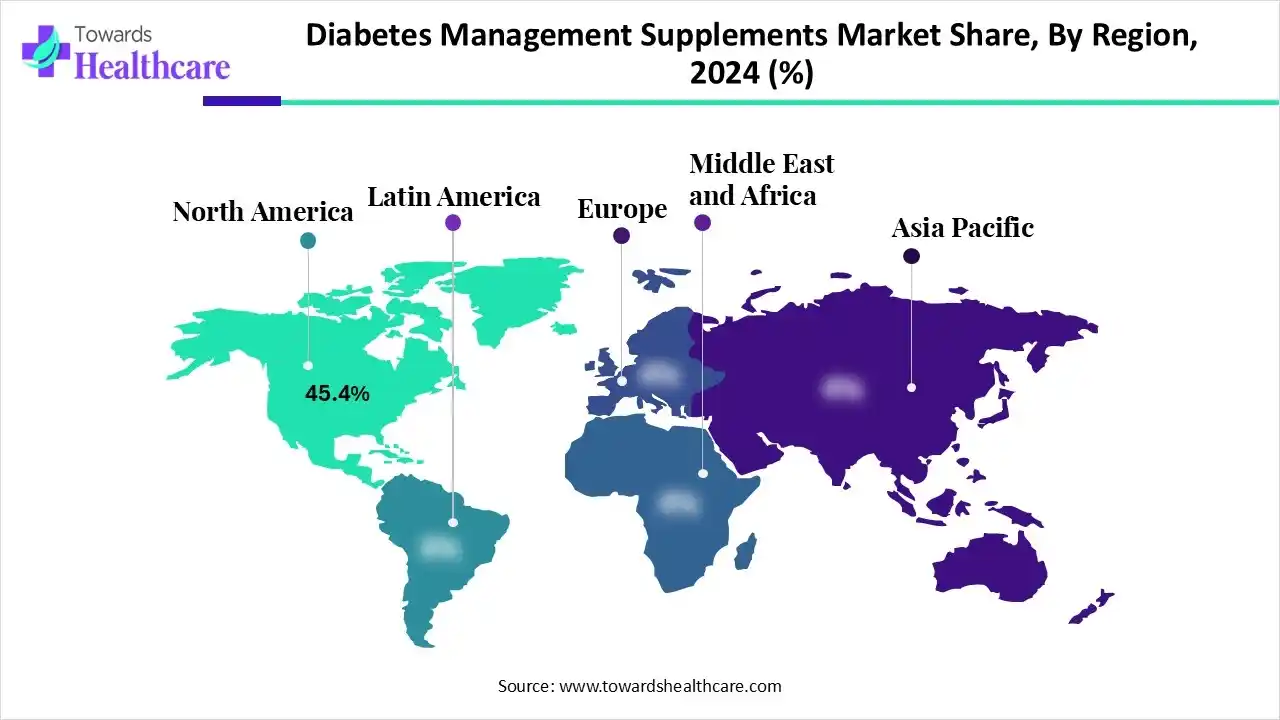

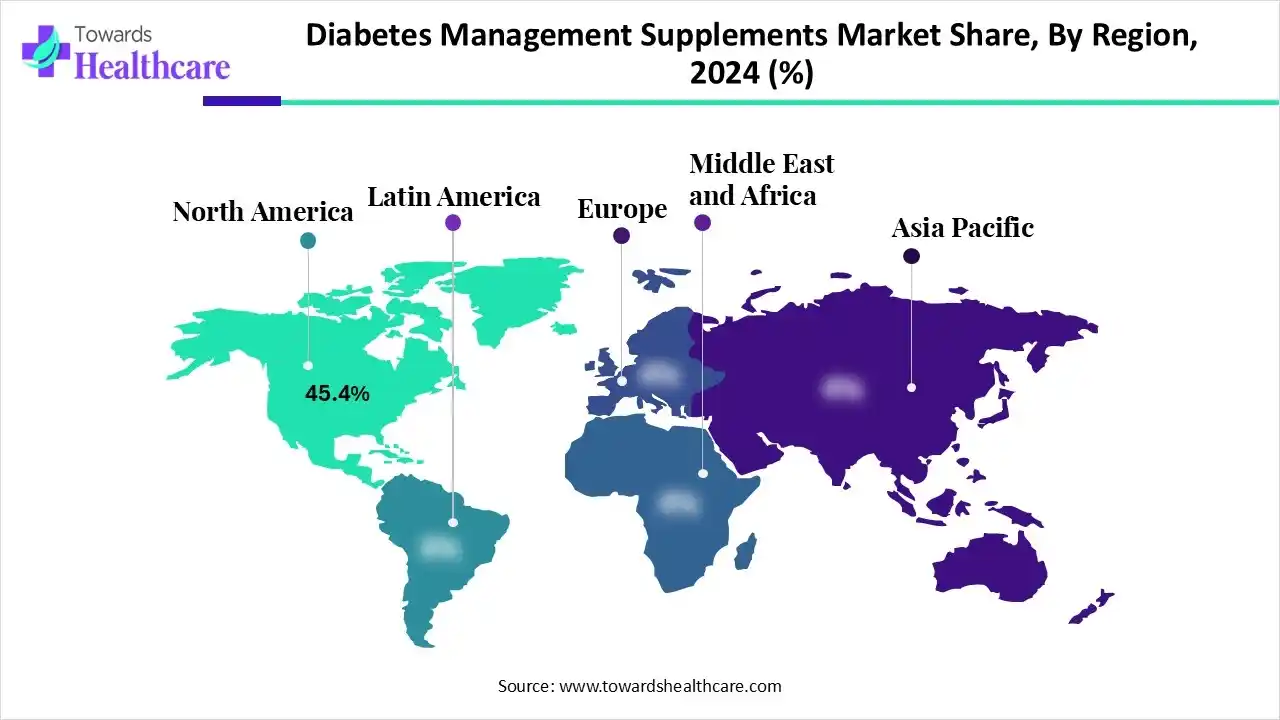

The global diabetes management supplements market is witnessing steady growth driven by the increasing prevalence of diabetes, rising health awareness, and growing adoption of herbal and nutritional supplements for blood sugar control. North America leads the market due to advanced healthcare infrastructure and high consumer awareness, while Asia-Pacific is emerging as a lucrative region with rising diabetic populations.

Key Takeaways

- The diabetes management supplements market will likely exceed USD 7.17 billion by 2025.

- Valuation is projected to hit USD 17.7 billion by 2035.

- Estimated to grow at a CAGR of 8.65% starting from 2026 to 2035.

- North America dominated the diabetes management supplements market with a revenue share of 45.4% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR of 9.4% in the market during the forecast Period.

- By product type, the herbal supplements segment held the largest market share of 37.8% in 2024.

- By product type, the probiotics segment is expected to grow at the fastest CAGR of 8.8% in the market during the forecast Period.

- By ingredient source, the plant-based segment dominated the market with a revenue share of 47.8% in 2024 and is expected to grow at the fastest CAGR of 8.5% in the market during the forecast period.

- By form, the tablets & capsules segment led the market with the largest revenue share of 48.4% in 2024.

- By form, the gummies segment is expected to grow at the fastest CAGR of 8.4% in the market during the forecast period.

- By distribution channel, the pharmacies & drug stores segment held the highest diabetes management supplements market share of 56.4% in 2024.

- By distribution channel, the online channels segment is expected to grow at the fastest CAGR of 8.2% in the market during the forecast period.

- By end user, the adults segment dominated the market with a revenue share of 56.8% in 2024.

- By end user, the geriatric population segment is expected to grow at the fastest CAGR of 8.4% in the market during the forecast period.

Quick Facts Table

| Table |

Scope |

| Market Size in 2025 |

USD 7.17 Billion |

| Projected Market Size in 2035 |

USD 17.7 Billion |

| CAGR (2026 - 2035) |

8.65% |

| Leading Region |

North America by 45.4% |

| Market Segmentation |

By Product Type, By Ingredient Source, By Form, By Distribution Channel, By End User, By Region |

| Top Key Players |

Abbott Laboratories, Bayer AG, Nestlé Health Science, Herbalife Nutrition Ltd., Amway Corp., Glanbia plc, Nature’s Bounty Co., NOW Foods, Himalaya Wellness Company, GNC Holdings LLC, Swisse Wellness Pty Ltd., MegaFood, Pure Encapsulations, Inc., NutraScience Labs, Pharmavite LLC |

What are Diabetes Management Supplements?

The diabetes management supplements market is growing due to the rising prevalence of diabetes and increasing awareness of natural blood sugar control solutions. The market includes nutritional products designed to help regulate blood glucose levels, enhance insulin sensitivity, and support overall metabolic health. These supplements typically contain vitamins, minerals, herbal extracts, amino acids, and antioxidants.

The diabetes management supplements market growth is driven by the rising global prevalence of diabetes, increasing consumer awareness of preventive healthcare, and demand for natural and plant-based formulations. The expansion of e-commerce and the growing use of nutraceuticals as adjunct therapy further boost market adoption.

For Instance,

- According to the International Diabetes Federation, around 589 million adults aged 20–79 were living with diabetes globally in 2024, and the disease accounted for nearly 7 million deaths in 2021.

Diabetes Management Supplements Market Outlook

- Sustainability Trends: Sustainability trends in the market focus on eco-friendly packaging, ethically sourced natural ingredients, and reduced carbon footprints in production. Companies are adopting plant-based formulations, minimizing waste, and ensuring transparent supply chains to meet consumer demand for environmentally responsible and health-conscious products, driving long-term market growth and trust.

- Global Expansion: The global expansion of the market is driven by increasing awareness of diabetes prevention, rising demand for natural health products, and growing adoption in emerging economies. Companies are expanding distribution networks and launching region-specific formulations to cater to diverse consumer needs across North America, Europe, and Asia-Pacific.

- Startup Ecosystems: The startup ecosystem in the diabetes management supplements market is rapidly evolving, with new players focusing on personalized nutrition, AI-driven health tracking, and plant-based formulations. These startups are leveraging digital platforms and partnerships with healthcare providers to deliver innovative, science-backed supplements that support effective diabetes prevention and management.

How Can AI Affect the Market?

AI is transforming the diabetes management supplements market by enabling personalized nutrition plans, predictive health monitoring, and data-driven product development. It helps identify individual supplement needs, optimize formulations, and enhance customer engagement through smart apps, ultimately improving diabetes control and promoting preventive healthcare solutions.

Segmental Insights

Product Type Insights

| Sub-Segment |

Market Share (%) |

| Herbal Supplements |

37.8 |

| Vitamins & Minerals |

25.4 |

| Antioxidants |

14.6 |

| Omega-3 Fatty Acids |

10.3 |

| Probiotics |

8.7 |

Explanation:

- Herbal supplements (37.8%) hold the top share due to rising preference for natural glucose-regulating botanicals.

- Vitamins & minerals (25.4%) remain vital for insulin sensitivity support and nutritional balance.

- Antioxidants (14.6%) gain traction for their role in reducing oxidative stress in diabetics.

- Omega-3 fatty acids (10.3%) are used widely for cardiovascular protection among diabetic patients.

- Probiotics (8.7%) are expanding quickly (CAGR 8.8%) due to their potential to modulate gut microbiota and improve metabolic health.

- Others (3.2%) include niche supplements catering to specialized diabetic needs.

How Does the Herbal Supplements Segment Dominate the Market in 2024?

The herbal supplements segment dominated the diabetes management supplements market with revenue shares of 37.8% in 2024, owing to the increasing shift towards natural and plant-based solutions for diabetes management. Consumers are favoring herbal ingredients such as fenugreek, cinnamon, and bitter melon for their proven blood sugar control benefits and minimal side effects. Additionally, the growing demand for clean-label, chemical-free, and preventive healthcare products has further strengthened the popularity of herbal supplements.

Probiotics

The probiotics segment is expected to witness the fastest CAGR of 8.8% during the forecast period, driven by increasing of the increasing link between gut health and diabetes management. Probiotics help improve insulin sensitivity, regulate glucose metabolism, and reduce inflammation, making them highly preferred among consumers. Additionally, the rising adoption of functional foods and supplements promoting digestive and metabolic health further supports the segment's rapid expansion.

Vitamins & Minerals

The vitamins & minerals segment is projected to grow at a lucrative rate in the diabetes management supplements market during the forecast period due to increasing recognition of micronutrients' role in managing diabetes and improving overall metabolic health. Supplements containing vitamin D, B-complex, magnesium, and chromium help enhance insulin function and glucose control. Rising health awareness and preference for preventive nutrition are further boosting demand for these essential nutrient-based supplements.

Ingredient Source Insights

| Sub-Segment |

Market Share (%) |

| Plant-Based |

47.8 |

| Animal-Based |

28.6 |

| Synthetic |

23.6 |

Explanation:

- Plant-based (47.8%) leads due to consumer preference for natural and clean-label products, also projected to grow fastest (CAGR 8.5%).

- Animal-based (28.6%) contributes to nutrient-specific formulations such as omega-3s from fish oils.

- Synthetic (23.6%) remains steady for standardized nutrient supplementation and affordability.

What Made the Plant-Based Segment Dominant in the Market in 2024?

The plant-based segment dominated the market with a major revenue share of 47.8% in 2024 and is expected to grow at the fastest CAGR of 8.5% during the forecast period, driven by increasing consumers' inclination toward natural, chemical-free, and sustainable products. Growing awareness of the therapeutic benefits of plant-derived ingredients in regulating blood-sugar levels, along with the rising adoption of vegan and clean-label supplements, has significantly boosted demand, making plant-based formulations a key driver in the diabetes management supplements market.

Animal-Based

The animal-based segment is expected to grow at a significant rate in the market during the forecast period due to the high bioavailability and efficacy of animal-derived ingredients such as omega-3 fatty acids and collagen. These components support insulin sensitivity, cardiovascular health, and metabolic balance. Increasing consumers' awareness of their clinical benefits and expanding product innovation, driving market growth.

Form Insights

| Sub-Segment |

Market Share (%) |

| Tablets & Capsules |

48.4 |

| Powders |

21.7 |

| Liquids |

16.8 |

| Gummies |

13.1 |

Explanation:

- Tablets & capsules (48.4%) dominate owing to precise dosing and wide consumer familiarity.

- Powders (21.7%) appeal to health-conscious users mixing supplements into beverages.

- Liquids (16.8%) are preferred for faster absorption and ease of intake.

- Gummies (13.1%) show rapid growth (CAGR 8.4%) due to better taste and compliance among younger adults.

How the Tablets & Capsules Dominated the Market in 2024?

The tablets & capsules segment captured the largest revenue share of 48.4% in 2024 due to their convenience, precise dosage, and longer shelf life compared to other supplement forms. Their easy consumption and portability make them the preferred choice among diabetic patients. Additionally, widespread product availability, improved formulation technologies, and consumer trust in traditional supplement formats have further strengthened this segment's dominance in the diabetes management supplements market.

Gummies

The gummies segment is expected to grow at a faster CAGR of 8.4% during the forecast period due to rising consumer preference for convenient, tasty, and easy-to-consume supplement formats. Gummies appeal particularly to younger and older populations who face difficulty swallowing pills. Additionally, the availability of sugar-free, nutrient-rich formulations tailored for diabetic health is driving their popularity, boosting the segment's rapid expansion in the diabetes management supplements market.

Liquids

The liquids segment is expected to grow at a notable rate during the forecast period due to a higher absorption rate, faster action, and ease of consumption compared to solid supplement forms. Liquids are especially preferred by elderly and pediatric diabetic patients. Additionally, the introduction of flavored, ready-to-drink, and fortified formulations tailored for blood sugar management is further boosting the demand for liquid diabetes management supplements.

Distribution Channel Insights

| Sub-Segment |

Market Share (%) |

| Pharmacies & Drug Stores |

56.4 |

| Supermarkets/Hypermarkets |

20.7 |

| Online Channels |

15.6 |

| Specialty Stores |

7.3 |

Explanation:

- Pharmacies & drug stores (56.4%) dominate as trusted sources for diabetes-specific formulations.

- Supermarkets (20.7%) benefit from easy accessibility and bulk purchase options.

- Online channels (15.6%) are growing rapidly (CAGR 8.2%) due to digital health awareness and subscription models.

- Specialty stores (7.3%) cater to premium and niche supplement buyers.

How Did the Pharmacies & Drug Stores Dominate the Market?

The pharmacies & drug stores segment held the highest revenue share of 56.4% in the diabetes management supplements market in 2024 due to their widespread availability, consumer trust, and easy access to a wide range of diabetes management supplements. Pharmacies often guide patients in product selection through professional consultation, and the convenience of one-stop purchasing for medications and supplements further strengthened this segment's market dominance.

Online Channels

The online channels segment is expected to grow at the fastest rate of 8.2% due to the rising popularity of e-commerce platforms, the convenience of home delivery, and the availability of a wide product range at competitive prices. Increasing digital literacy, easy payment options, and personalized recommendations are also driving online supplement purchases, making it the fastest-growing distribution channel in the diabetes management supplements market.

Specialty Stores

The specialty stores segment is expected to grow at a lucrative rate during the forecast period due to its focus on personalized customer service, expert guidance, and the availability of premium, niche diabetes management supplements. These stores offer high-quality, certified, and customized products catering to specific dietary needs. Growing consumer preference for trusted health-focused products further supports the segment's expansion in the diabetes management supplements market.

End User Insights

| Sub-Segment |

Market Share (%) |

| Adults |

56.8 |

| Geriatric Population |

31.6 |

| Adolescents |

11.6 |

Explanation:

- Adults (56.8%) dominate as the largest diabetic demographic group managing long-term blood sugar control.

- Geriatric population (31.6%) shows increasing uptake (CAGR 8.4%) due to age-related metabolic issues and comorbidities.

- Adolescents (11.6%) reflect a smaller share but a rising trend due to early-onset diabetes and preventive awareness.

How did the Adults dominate the Market?

The adults segment dominated the market with the largest revenue shares of 56.8% in 2024 due to the high prevalence of diabetes and prediabetes among the adult population. Rising health consciousness, sedentary lifestyles, and unhealthy dietary habits have increased supplement demand for blood sugar control. Additionally, growing awareness about preventive healthcare and the benefits of nutritional supplements further contributed to the segment's strong market presence.

Geriatric Population

The geriatric population segment is expected to grow at the fastest CAGR of 8.4% in the diabetes management supplements market during the forecast period due to the increasing incidence of diabetes and related metabolic disorders among older adults. Aging leads to reduced insulin sensitivity and slows metabolism, driving the need for effective supplements. Additionally, rising awareness of preventive healthcare and growing demand for easily consumable, nutrient-rich formulations are fueling the rapid growth in the market.

Adolescents

The adolescent segment is expected to grow at a significant rate during the forecast period due to the rising prevalence of childhood and adolescent obesity, which increases the risk of early-onset diabetes. Growing awareness of maintaining healthy blood sugar levels, coupled with the availability of appealing supplement formats like gummies and fortified beverages, is driving demand. Additionally, parental focus on preventive nutrition further supports the market growth.

Regional Insights

| Region |

Market Share (%) |

| North America |

45.4 |

| Europe |

27.3 |

| Asia-Pacific |

18.2 |

| Latin America |

5.4 |

| Middle East & Africa |

3.7 |

Explanation:

- North America (45.4%) dominates with strong supplement adoption and healthcare spending.

- Europe (27.3%) benefits from preventive health initiatives and high supplement penetration.

- Asia-Pacific (18.2%) is the fastest-growing region (CAGR 9.4%) due to increasing diabetes incidence and nutraceutical awareness.

- Latin America (5.4%) shows moderate growth from emerging healthcare retail networks.

- Middle East & Africa (3.7%) lags due to limited awareness and accessibility challenges.

Why North America Dominated the Diabetes Management Supplements Market in 2024?

North America dominated the market with the largest revenue share of 45.4% in 2024 due to the high prevalence of diabetes, strong consumer awareness of preventive healthcare, and widespread adoption of dietary supplements. The region benefits from advanced healthcare infrastructure, strong product availability, and active participation of key market players. Additionally, increasing preference for natural and clinically tested formulations, along with supportive regulatory frameworks, further strengthened North America’s leading position in the market.

Rising Health Awareness and Preventive Care Fuel the Growth of the U.S.

The U.S. diabetes management supplements market is growing due to the rising prevalence of diabetes and prediabetes, coupled with increasing health awareness among consumers. A strong focus on preventive healthcare, high spending on nutritional supplements, and availability of advanced, clinically tested products are driving market expansion. Additionally, growing demand for natural, plant-based, and personalized formulations further supports the steady growth of the market in the U.S.

Asia Pacific: Rising Prevalence of Diabetes

Asia-Pacific is expected to grow at the fastest CAGR in the diabetes management supplements market during the forecast period due to the rapidly increasing diabetic population, changing lifestyles, and growing awareness of preventive healthcare. Rising disposable incomes, expanding healthcare infrastructure, and greater accessibility to nutritional supplements are fueling market growth. Additionally, the growing adoption of herbal and traditional ingredients in diabetes management further supports the region’s strong expansion potential.

Rising Diabetes Cases and Ayurvedic Innovation Drive Growth of India’s Market

The India diabetes management supplements market is expanding due to the growing diabetic population, rising health awareness, and increasing preference for natural and Ayurvedic formulations. Urbanization, sedentary lifestyles, and changing dietary habits are fueling diabetes prevalence, boosting supplement demand. Additionally, government health initiatives, expanding e-commerce channels, and the availability of affordable, locally manufactured supplements are further driving market growth and strengthening India’s position in the global diabetes management supplement industry.

Europe: Increasing Health Consciousness and Demand for Natural Solutions

The European diabetes management supplements market is growing significantly during the forecast period due to the rising prevalence of diabetes, increasing aging population, and growing emphasis on preventive healthcare. Strong consumer preference for natural and clinically proven supplements, coupled with supportive government health initiatives, is driving demand. Additionally, the presence of leading nutraceutical companies and advancements in formulation technologies are further fueling the market’s steady growth across the region.

UK: Increasing Diabetic Population and Shift Towards Healthier Lifestyles

The U.K. diabetes management supplements market is growing due to the rising prevalence of diabetes and growing consumer awareness about preventive healthcare. Increasing adoption of nutritional supplements for blood sugar control, coupled with strong demand for natural and clinically validated ingredients, is driving market growth. Additionally, government initiatives promoting diabetes awareness and the expanding availability of supplements through pharmacies and online platforms further support the market’s expansion in the country.

South America Surge: A Continent Turning to Natural Balance

Rising urbanization, sedentary habits, and dietary changes are driving diabetes prevalence, prompting greater use of herbal and micronutrient-based supplements supporting blood sugar control across Argentina, Chile, and neighboring countries.

Brazil’s Health Drive: Fighting Diabetes with Smarter Nutrition

With around 16.6 million adults living with diabetes in 2024, Brazil’s public health campaigns and doctor-recommended nutraceuticals are increasing consumer trust in clinically tested diabetes management supplements.

MEA Wellness Shift: Supplements Meet Public Health Goals

Governments across the Middle East and Africa are prioritizing metabolic health programs, encouraging consumers to adopt safe, evidence-based supplements that complement conventional diabetes therapies and lifestyle interventions.

GCC Preventive Push: Turning Awareness into Action

Facing one of the world’s highest diabetes rates, around 12% of adults, GCC nations are promoting supplement-based glucose regulation through awareness campaigns, hospital collaborations, and smart health retail platforms.

Diabetes Management Supplements Market Value Chain Analysis

R&D

- The R&D process for diabetes management supplements includes identifying effective and natural ingredients.

- Scientific research is conducted to ensure the safety and efficacy of these ingredients.

- Products are then formulated to meet specific health and nutritional needs.

- Finally, companies work through regulatory approvals to ensure compliance and product quality before market launch.

Distribution to Hospitals, Pharmacies

- Manufacturers and distributors use multiple channels to supply diabetes management supplements to hospitals and pharmacies.

- These channels include wholesalers, direct sales representatives, and online distribution networks.

- The choice of distribution method depends on product regulations, marketing goals, and target customer segments.

Patient Support and Services

- Patient support for diabetes supplements involves educational programs, online tools, and community-based initiatives.

- As supplements are less regulated than medicines, patients should consult healthcare professionals before use.

- Expert guidance helps prevent adverse interactions and ensures safe, effective supplement use for diabetes management.

Company Landscape

Herbalife Nutrition Ltd.

Company Overview

- Herbalife Nutrition is a premier global nutrition company that sells dietary supplements and personal care products through a network of independent distributors. The company focuses on weight management, targeted nutrition, energy, fitness, and outer nutrition.

Corporate Information

- Headquarters: Los Angeles, California, USA | Year Founded: 1980 | Ownership Type: Public (NYSE: HLF)

History and Background

- History and Background: Founded by Mark Hughes, the company started by selling a single weight-loss product. It rapidly expanded globally, pioneering the direct-selling model for nutrition products. Despite regulatory challenges and controversies over its business model, it has become a major global player in the nutrition and wellness industry.

Key Milestones/Timeline

- 1980: Founded by Mark Hughes.

- 1996: Achieved $1 billion in annual sales.

- 2004: Became a public company (NYSE: HLF).

- 2016: Settled a case with the U.S. FTC, requiring fundamental changes to its business model in the U.S.

- Recent (2024/2025): Continued focus on digital transformation, Herbalife One platform rollout, and expanding scientific validation for products.

Business Overview

- Business Model: Multi-level marketing (MLM)/Direct Sales model, where independent distributors purchase products at a discount and sell them to customers, also earning from the sales of distributors they recruit.

- Revenue (Latest Statistics): Net sales of approximately $5.1 billion for the full year 2023.

Business Segments/Divisions

- Core Segments: Nutrition (Weight Management, Targeted Nutrition, Energy & Fitness) and Outer Nutrition.

- Targeted Nutrition: Includes supplements relevant to diabetes management (e.g., fiber, vitamins/minerals, chromium-containing products).

Geographic Presence

- Global Reach: Operates in over 90 countries worldwide.

- Key Markets: North America, Asia Pacific (China, India), Europe, Middle East & Africa (EMEA), and Latin America.

Key Offerings

- Product Focus: Meal replacements (Formula 1 shakes), vitamins, minerals, herbal supplements, protein products, and specific products marketed for general wellness and metabolic support.

- Diabetes Relevance: Supplements containing chromium, alpha-lipoic acid, and specialized vitamin/mineral blends.

End-Use Industries Served

- Primary Industry: Direct-to-Consumer Wellness and Nutrition.

- Key Developments and Strategic Initiatives

- Mergers & Acquisitions: Not a primary growth strategy; generally relies on internal product development.

Partnerships & Collaborations:

- Sponsorships of major athletes, sports teams, and fitness events to enhance brand credibility.

- Ongoing collaborations with scientific and medical advisory boards.

- Product Launches/Innovations: Continuous introduction of new flavors and formulations across its core categories, with a strategic focus on clean-label and plant-based options.

- Capacity Expansions/Investments: Ongoing investment in its Herbalife24 (sports nutrition) manufacturing and quality control facilities.

- Regulatory Approvals: Focuses on compliance with dietary supplement regulations in all operating countries (e.g., FDA, EFSA).

Distribution channel strategy

- Primary Channel: Direct selling through independent distributors (MLM structure).

- Secondary Channel: Company-operated distribution centers and increasingly leveraging digital tools for distributor sales (Herbalife One platform).

Technological Capabilities/R&D Focus

- Core Technologies/Patents: Focus on proprietary formulations and bioavailability enhancements.

- Research & Development Infrastructure: Owns and operates Innovation and Manufacturing (HIM) facilities globally.

- Innovation Focus Areas: Metabolic health, personalized nutrition, and evidence-based herbal and botanical ingredients.

Competitive Positioning

Strengths & Differentiators:

- Massive, established global distribution network.

- Strong brand recognition in the nutrition space.

- High consumer engagement through a network of local distributors.

- Market presence & ecosystem role: A dominant force in the global direct-selling nutrition market, driving consumer adoption of daily supplements.

SWOT Analysis

- Strengths: Strong global brand, extensive direct sales force, high customer retention via personalized coaching.

- Weaknesses: Dependence on MLM model, susceptible to regulatory scrutiny, competitive pressure from mass-market brands.

- Opportunities: Expansion into personalized nutrition technology, increased global awareness of metabolic health.

- Threats: Stricter government regulation of the MLM model, increased competition from e-commerce supplement brands, negative publicity.

Recent News and Updates

- Press Releases (2024): Announced strategic partnership expansions and digital platform updates to empower distributors globally.

- Industry Recognitions/Awards: Frequently recognized for its Formula 1 product as a leading meal replacement shake globally.

Amway (Nutrilite)

Company Overview

- Description: Amway is an American multi-level marketing company that sells health, beauty, and home care products. Its nutrition brand, Nutrilite, is a global leader in vitamins, minerals, and dietary supplements, holding a significant share in the general supplement market, which includes products applicable to diabetes management.

Corporate Information

- Headquarters: Ada, Michigan, USA | Year Founded: 1959 (Amway); 1934 (Nutrilite brand acquisition/roots) | Ownership Type: Private

History and Background

- History and Background: Amway was founded by Jay Van Andel and Richard DeVos. The Nutrilite brand, which dates back to 1934 (founded by Carl F. Rehnborg), was acquired by Amway in 1972 and is one of the world's best-selling vitamin and dietary supplement brands. Nutrilite emphasizes plant-based, farm-to-supplement traceability.

Key Milestones/Timeline

- 1934: Carl Rehnborg develops the Nutrilite brand.

- 1959: Amway Corporation founded.

- 1972: Amway acquires a controlling interest in the Nutrilite company.

- 2003: Launched the Nutrilite Health Institute.

- Recent (2024/2025): Continued investment in organic farming and sustainability initiatives across its certified farms globally.

Business Overview

- Business Model: Direct selling (MLM) through independent business owners (IBOs).

- Revenue (Latest Statistics): Amway's global sales for 2023 were approximately $7.7 billion, with Nutrilite being a major contributor.

- Business Segments/Divisions

- Core Segments: Nutrition (Nutrilite), Beauty (Artistry), and Home.

- Nutrilite Focus: Multi-vitamins/multi-minerals, protein powder, and targeted supplements for immune, digestive, and metabolic health.

Geographic Presence

- Global Reach: Operates in more than 100 countries and territories.

- Key Markets: Asia (China, South Korea, Japan, India) is a powerhouse, followed by the Americas and Europe.

Key Offerings

- Product Focus: Broad portfolio under the Nutrilite brand, including vitamins, minerals, phytonutrients, and specialty supplements.

- Diabetes Relevance: Targeted supplements (e.g., fiber, botanical extracts like cinnamon or bitter melon, chromium-containing formulas) for metabolic and blood sugar support.

End-Use Industries Served

- Primary Industry: Direct-to-Consumer Wellness and Nutrition.

- Key Developments and Strategic Initiatives

- Mergers & Acquisitions: Focused on organic growth and strategic vertical integration (owning its organic farms).

Partnerships & Collaborations:

- Collaboration with the Nutrilite Health Institute and global research institutions.

- Strategic alliances to promote health and wellness, particularly in Asia.

- Product Launches/Innovations: Regular introduction of new Nutrilite products leveraging cutting-edge science and its proprietary organic plant concentrates.

- Capacity Expansions/Investments: Ongoing investment in its four certified organic farms (USA, Mexico, Brazil, China) to ensure seed-to-supplement traceability.

- Regulatory Approvals: Adherence to GMP (Good Manufacturing Practices) and global regulatory standards for dietary supplements.

Distribution channel strategy

- Primary Channel: Direct selling through Independent Business Owners (IBOs).

- Secondary Channel: Strong digital platform for IBOs and customers, increasingly using e-commerce tools.

Technological Capabilities/R&D Focus

- Core Technologies/Patents: Proprietary plant concentrates and extraction processes; extensive R&D in phytonutrients and plant science.

- Research & Development Infrastructure: Nutrilite Health Institute (NHI) and Nutrilite-owned organic farms act as key R&D and supply chain assets.

- Innovation Focus Areas: Personalized nutrition, microbiome science, and leveraging traceability to validate product purity and potency.

Competitive Positioning

Strengths & Differentiators:

- Nutrilite's "Seed to Supplement" control through organic farms.

- Strong global brand equity and trust in the supplement category.

- Massive, long-established direct sales network.

- Market presence & ecosystem role: A benchmark company in the direct-selling model for high-quality, traceable nutrition products.

SWOT Analysis

- Strengths: Complete control over supply chain (farm to table), robust R&D, powerful global sales network.

- Weaknesses: Negative perception associated with MLM model, premium pricing compared to mass-market brands.

- Opportunities: Growth in key Asian markets, increasing consumer demand for organic and traceable ingredients, personalized nutrition technology.

- Threats: Intense competition from pharmaceutical and large consumer health companies, shifts in regulatory landscape impacting direct selling.

Recent News and Updates

- Press Releases (2024/2025): Focused on sustainability reporting and launches of new Nutrilite products aligned with wellness trends like gut health and immunity, which support overall metabolic health.

- Industry Recognitions/Awards: Continues to be recognized as a world-leading brand in the vitamins and dietary supplements category by various industry reports.

Company and Its Offerings

- Abbott Laboratories: Offers Glucerna and Ensure Diabetes Care, formulated with low-glycemic ingredients to help manage blood sugar levels.

- Nestlé Health Science: Provides Nutren Diabetic Plus and Boost Glucose Control, designed to support glucose management and metabolic health.

- Amway Corporation: Through its Nutrilite range, it offers herbal and plant-based supplements like Madhunashini and Glucose Health for blood sugar balance.

- Herbal One Nutritional Ltd: Develops natural, herbal-based supplements supporting glucose control and overall metabolic wellness.

Top Companies in the Diabetes Management Supplements Market

- Abbott Laboratories

- Bayer AG

- Nestlé Health Science

- Herbalife Nutrition Ltd.

- Amway Corp.

- Glanbia plc

- Nature’s Bounty Co.

- NOW Foods

- Himalaya Wellness Company

- GNC Holdings LLC

- Swisse Wellness Pty Ltd.

- MegaFood

- Pure Encapsulations, Inc.

- NutraScience Labs

- Pharmavite LLC

Recent Developments in the Diabetes Management Supplements Market

- In April 2025, HealthyCell launched Glucose Support MicroGel™, an advanced gel-based supplement aimed at promoting healthy blood sugar levels and improving overall metabolic health.

- In March 2025, SIGRID introduced a subscription-based service in the U.S. for its main product, Glucose Stabiliser, providing customers with a 22% discount on regular monthly deliveries.

Segments Covered in the Report

By Product Type

- Vitamins & Minerals

- Herbal Supplements

- Antioxidants

- Omega-3 Fatty Acids

- Probiotics

- Others

By Ingredient Source

- Plant-Based

- Animal-Based

- Synthetic

By Form

- Tablets & Capsules

- Powders

- Liquids

- Gummies

By Distribution Channel

- Pharmacies & Drug Stores

- Supermarkets/Hypermarkets

- Online Channels

- Specialty Stores

By End User

- Adults

- Geriatric Population

- Adolescents

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA