January 2026

The global dietary supplements for weight loss market size is calculated at US$ 139.42 billion in 2024, grew to US$ 145.65 billion in 2025, and is projected to reach around US$ 215.6 billion by 2034. The market is expanding at a CAGR of 4.47% between 2025 and 2034.

The growing obesity and overweight population globally is increasing the use of dietary supplements for weight loss. AI is also being used to develop personalized formulations and for their optimization, where, along with these advancements, the growing health consciousness, natural products, and fitness trends are increasing their use across various regions. The companies are also launching new products, driving the market growth.

| Table | Scope |

| Market Size in 2025 | USD 145.65 Billion |

| Projected Market Size in 2034 | USD 215.6 Billion |

| CAGR (2025-2034) | 4.47% |

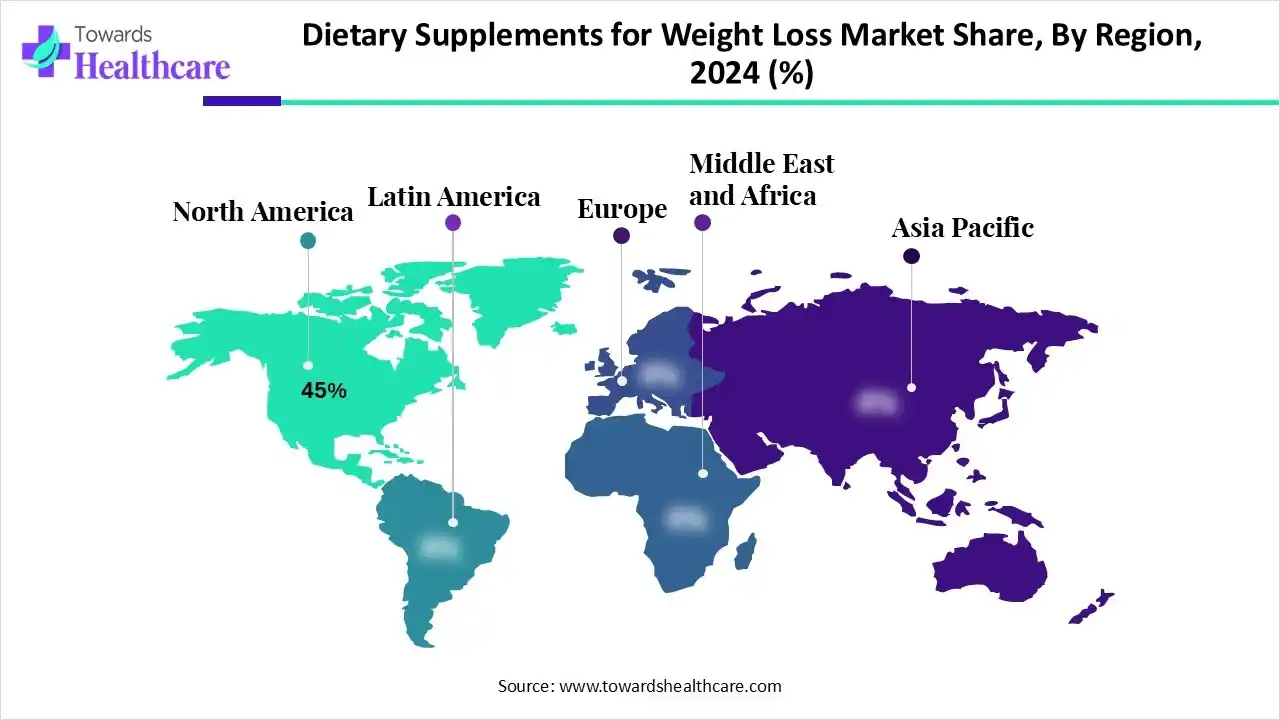

| Leading Region | North America by 45% |

| Market Segmentation | By Product Type, By Mechanism of Action, By Form/Dosage Form, By Route of Administration, By Distribution Channel, By Region |

| Top Key Players | Abbott Laboratories, Glanbia Plc , NOW Foods, USANA Health Sciences, Inc., The Himalaya Drug Company, Swisse Wellness Pty Ltd., BioTechUSA, Shaklee Corporation, NutraScience Labs, Pharmavite LLC, Lonza Group AG, Life Extension, Inc., MuscleTech/Iovate Health Sciences, Bayer AG, Nestlé Health Science |

The dietary supplements for weight loss market is driven by increasing preference for natural and organic ingredients, growing global obesity rates, and rising consumer health consciousness. The dietary supplements for weight loss encompass products formulated to aid in weight management, fat reduction, appetite control, metabolism enhancement, or overall body composition improvement. These supplements include herbal extracts, protein powders, amino acids, fiber-based products, vitamins, minerals, thermogenic agents, and other nutraceuticals designed to support weight reduction or maintenance when combined with diet and exercise.

The use of AI in the dietary supplements for weight loss market is increasing for treatment planning. At the same time, they are able to analyze vast amounts of data such as medical history, lifestyle factors, and genetic information, which help in developing personalized health interventions like nutraceuticals. Moreover, AI can help in the optimization of dietary supplements, which enhances their effectiveness and reduces side effects, as it can predict their interaction within the unique biology.

In October 2025, a collaboration between Tonum Health and MyNetDiary, which is a leading AI-powered nutrition and wellness tracker, was announced. This collaboration will combine evidence-based supplements of Tonum with advanced digital tracking and coaching tools of MyNetDiary to provide Tonum Health's customers with a personalized and smarter approach to their health.

By product type, the herbal/plant-based supplements segment held the dominating share of 40% in the dietary supplements for weight loss market in 2024, due to a growth in consumer awareness. They were preferred due to traditional use, which increased their production rates. At the same time, the growth in their accessibility increased their use.

By product type, the fiber-based supplements segment is expected to show the highest growth during the predicted time. Their use is increasing due to their appetite-controlling actions, which are reducing calorie intake. Moreover, it also enhances digestive health along with weight loss.

By mechanism of action type, the appetite suppressants segment led the dietary supplements for weight loss market with a 35% share in 2024, as they minimized calorie intake. This, in turn, increased their use by the consumer, avoiding exercise. Moreover, the fast effects and natural ingredients also increased their use.

By mechanism of action type, the carb/fat blockers segment is expected to show the fastest growth rate during the predicted time. As they do not affect the diet of the individual, their use is increasing. Additionally, they also help in reducing blood sugar and cholesterol levels, which is attracting the population.

By form/dosage form type, the tablets/capsules segment held the largest share of 55% in the dietary supplements for weight loss market in 2024, driven by their convenience and accurate dosing. At the same time, they showed enhanced stability compared to other dosage forms and helped in masking the unwanted tastes. Additionally, they showed enhanced scalability, which contributed to their increased use.

By form/dosage form type, the liquids/syrups segment is expected to show the highest growth during the upcoming years. The consumers are able to adjust the dose with these dosage forms, which enhances their convenience. Moreover, they are easy to swallow and provide faster absorption rates.

By route of administration type, the oral segment led the dietary supplements for weight loss market in 2024, due to its non-invasive approach. They showed increased consumer acceptance rates due to their easy use, portability, and convenience. Moreover, their affordability and better stability also contributed to their growth.

Why Did the Retail Pharmacies Segment Dominate in the Market in 2024?

By distribution channel type, the retail pharmacies segment held the largest share of 35% in the global dietary supplements for weight loss market in 2024, driven by their wide availability. This increased access to the dietary supplements. Moreover, they also provided guidance that increased consumer trust.

By distribution channel type, the online retail/e-commerce segment is expected to show the highest growth during the upcoming years. These platforms offer a wide range of products and are accessible 24/7. Additionally, the home deliveries and discounts are grabbing the attention of the consumers.

North America dominated the dietary supplements for weight loss market with 45% in 2024, due to growing incidences of obesity. At the same time, the growth in health awareness has also increased the use of dietary supplements for weight loss, where their purchase through online platforms is increasing. Moreover, a rise in their innovations also contributed to the market growth.

The high obesity rates in the U.S. are driving the dietary supplements for weight loss market. This, in turn, is increasing the demand for various dietary supplements, where consumers are increasing the use of branded or natural ingredient-based products. Moreover, growing investments are also raising their production rates.

For instance,

Asia Pacific is expected to host the fastest-growing dietary supplements for weight loss market during the forecast period, due to growing health awareness, which is increasing the use of these supplements. The growing sedentary lifestyle is also increasing the obesity rates, which is driving the use of herbal products backed by healthcare investments. Moreover, growing beauty standards are also promoting the market growth.

The growing urbanization and sedentary lifestyles are increasing obesity in India, which is propelling the dietary supplements for weight loss market. Moreover, to deal with the growing obesity complications and increasing fitness awareness are also increasing the use of dietary supplements. This is also growing the development of natural and herbal products, which are supported by investments from various sources.

For instance,

India faces a future with a significant rise in obesity, with projections estimating over 440 million people could be overweight or obese by 2050.

Europe is expected to grow significantly in the dietary supplements for weight loss market during the forecast period, as it consists of strong healthcare systems focusing on preventive health and wellness, promoting the use of these supplements. The growing obesity rates, health consciousness, and fitness trends are also increasing their use. Moreover, the stringent regulations are ensuring safe and enhanced quality product development, promoting their use, and enhancing the market growth.

The presence of a health-conscious population in Germany amplifies the dietary supplements for weight loss market. Moreover, preventive healthcare offers various dietary supplements with different types of mechanisms of action. Additionally, the companies are developing various herbal, non-GMO, and organic products, with minimal artificial ingredients.

For instance,

The R&D of dietary supplements for weight loss focuses on the development of effective science-backed formulations with natural ingredients to promote metabolic health, positive gut microbiome changes, and satiety.

Key Players: Nestlé Health Science, Abbott Laboratories, Amway Corporation, Herbalife Nutrition Ltd., GNC Holdings, Inc.

The clinical trial and regulatory approval of the dietary supplements for weight loss are not rigorous; the clinical trials evaluate the substantiating specific health claim for products, and regulatory approval evaluates their safety, effectiveness, and compliance with good manufacturing practices (GLP).

Key Players: Nestlé Health Science, Abbott Laboratories, Amway Corporation, Herbalife Nutrition Ltd., GNC Holdings, Inc., Glanbia Plc.

The patient support and services of the dietary supplements for weight loss include personalized choices and the use of digital tools to improve consumer adherence and engagement with the use of mobile apps for tracking, community features, and nutritional guidance.

Key Players: Nestlé Health Science, Abbott Laboratories, Amway Corporation, Herbalife Nutrition Ltd., GNC Holdings, Inc., Glanbia Plc.

By Product Type

By Mechanism of Action

By Form/Dosage Form

By Route of Administration

By Distribution Channel

By Region

January 2026

January 2026

January 2026

January 2026