January 2026

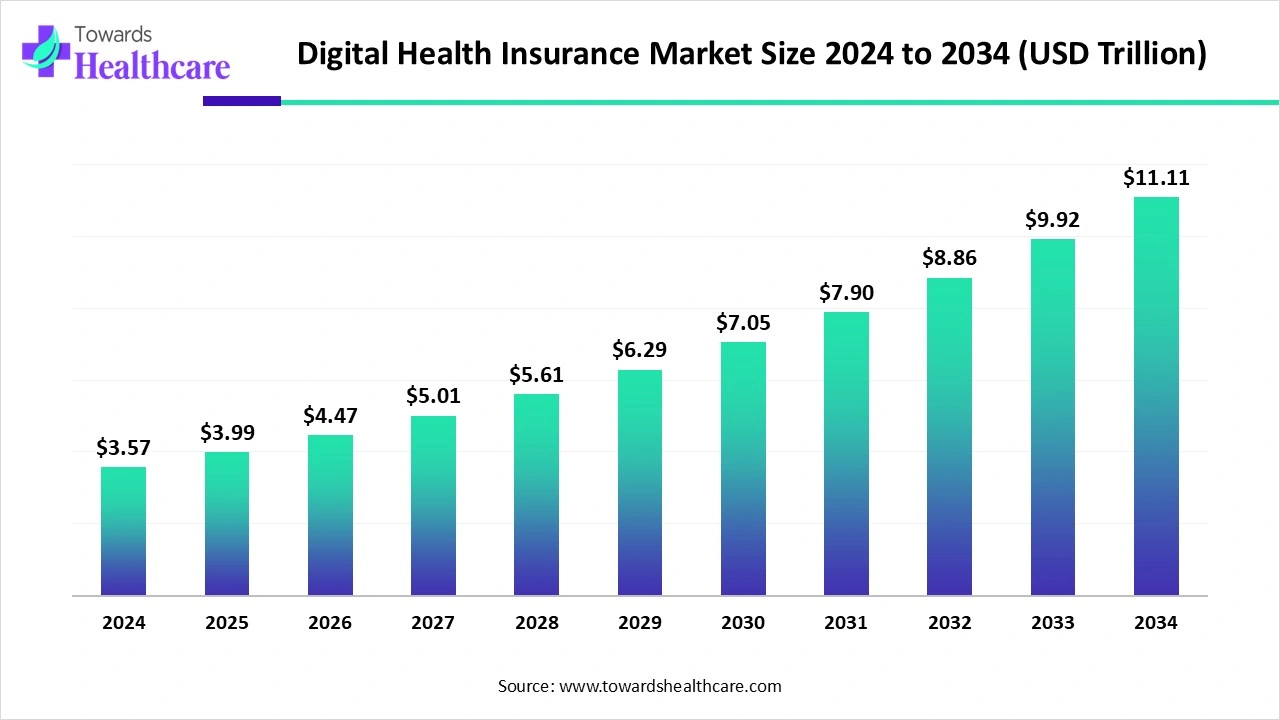

The global digital health insurance market size is calculated at US$ 3.57 trillion in 2024, grew to US$ 3.99 trillion in 2025, and is projected to reach around US$ 11.11 trillion by 2034. The market is expanding at a CAGR of 12.05% between 2025 and 2034.

The digital health insurance market is accelerating e-health by making healthcare services quickly and securely accessible to insured people. The digital identities (digital IDs) are ideal to use in an online mode to authenticate and authorize users. The digital IDs improve the safety and efficiency of healthcare services and the processing of healthcare industries. They ensure the safety and maintain the confidentiality of the sensitive medical data and health information of patients. The digitalization in the form of electronic patient records and electronic health cards revolutionized health insurance services.

| Table | Scope |

| Market Size in 2025 | USD 3.99 Trillion |

| Projected Market Size in 2034 | USD 11.11 Trillion |

| CAGR (2025 - 2034) | 12.05% |

| Leading Region | North America |

| Market Segmentation | By Product Type, By Service Offering, By Technology, By Distribution Channel, By Payment/Reimbursement Model, By Region |

| Top Key Players | UnitedHealth Group, Anthem / Elevance Health, CVS Health (Aetna), Cigna, Humana, Centene Corporation, Kaiser Permanente, Molina Healthcare, Bupa, Allianz Care, AXA, Prudential plc, MetLife, Ping An Insurance, Oscar Health, Clover Health, Bright Health, Lemonade, Babylon Health, Alan |

The digital health insurance market involves the provision and management of health insurance through digital platforms, technologies, and insurtech solutions. It includes digital distribution of insurance plans, integration of telehealth and remote monitoring services, AI-driven underwriting, automated claims, and consumer-centric mobile applications. Products cover individual, group, and government-backed health plans, with growing adoption of embedded benefits and value-based care models. Technology enablers include AI/ML, cloud platforms, wearable data integration, and digital marketplaces. This market is driven by consumer demand for convenience, personalized coverage, lower costs, and faster claims, alongside regulatory pushes for transparency and value-based models. Expanding insurtech startups and payer–provider digital collaborations further accelerate adoption globally.

Artificial intelligence plays a significant role in enhancing the quality of human lives. AI makes healthcare services more efficient, safer, and easier. AI contributes to healthcare insurance by detecting fraud, resolving medical information asymmetries, improving underwriting accuracy, and increasing transparency. AI algorithms are essential in telematics, customer engagement, claim processes, virtual agents, chatbots, and underwriting.

What are the Major Drifts in the Digital Health Insurance Market?

The increased priorities of several companies to enhance customer experiences through improved products and services and omnichannel interactions drive the huge adoption of healthcare insurance services. The wide use of technologies helps to streamline business processes, reduce operational costs, and increase agility. The utilization of AI and modern solutions provides end-to-end digital experiences. These major driving forces transform the entire insurance system.

What are the Potential Challenges in the Digital Health Insurance Market?

The challenges for the digital transformation of health insurance are inefficient change management, dependency on legacy systems, talent shortages, and training concerns. The other challenges are associated with regulatory compliance, claims processing, fraud, risk assessment, and underwriting.

What is the Future of the Digital Health Insurance Market?

There are numerous opportunities to adopt insurance technologies. Insurance technology expenditure is expected to grow in the U.S. and UK by 2026. The future growth is expected to be achieved by providing contextual onboarding and training and enabling end-users with immediate support. It is now possible to keep end-users updated on changes and analyze the behavior of end-users for continuous improvements. Digital technologies also enable the collection of feedback by end-users with in-app surveys and the management of software subscriptions and licenses efficiently.

The group/employer-sponsored plans segment dominated the market in 2024, owing to the benefits for employees and employers in terms of convenience, accessibility, faster and simpler claims process, and wellness and preventive care. These plans provide cost-effectiveness, enable simplified HR administration, enhanced compliance, and transparency. They became proactive tools to enhance the well-being of employees.

The embedded health benefits segment is expected to grow at the fastest CAGR in the market during the forecast period due to seamless and convenient experience, proactive and personalized care, and enhanced access to healthcare. These services enable deeper customer engagement, improved risk assessment, and operational efficiency. They contribute to the healthcare system through informed decision-making, innovation, and resource optimization.

The telehealth coverage segment dominated the market in 2024, owing to improved access to specialists, better preventive care, and continuous care management. These services offer cost control, better risk management, and increased customer satisfaction. They also bring operational efficiency, better customer engagement, and enhanced mental health support.

The digital therapeutics (DTx) coverage segment is expected to grow at the fastest CAGR in the market during the forecast period due to enhanced medication adherence, data-driven underwriting, and risk assessment. It supports value-based care, empowers self-management, and enables enhanced access to care. It delivers advanced analytics and predictive capabilities along with real-time patient insights.

The member portals & mobile apps segment dominated the market in 2024, owing to 24/7 access and convenience, self-service options, and enhanced communication. These services are beneficial for administration efficiency, which enables reduced paperwork and efficient data management. They introduce operational cost reduction and streamlined claims processing.

The AI/ML underwriting & risk scoring segment is expected to grow at the fastest CAGR in the market during the forecast period due to enhanced accuracy and efficiency for insurers. These services and solutions enable faster risk assessment, smarter underwriting decisions, and reduced human error. They present fairer and more profitable pricing, improved fraud detection, and cost reduction.

The brokers/agents segment dominated the market in 2024, owing to the customized recommendations, ongoing relationships, and advocacy during claims. They allow streamlined processes and reduced paperwork during claims and administrative support. They are combining human touch with digital tools and enabling efficient administration.

The direct-to-consumer (D2C) segment is expected to grow at the fastest CAGR in the market during the forecast period due to lower premiums and clearer pricing for consumers. The D2C platforms offer tailored policies and integrated wellness programs. They enable streamlined processes and 24/7 access to healthcare.

The fee-for-service segment dominated the market in 2024, owing to transparency and patient choices provided by fee-for-service models. They support quality, outcomes, and value-based care. These models encourage the adoption of new digital health technologies and services like telemedicine platforms and remote monitoring.

The value-based care/risk-sharing segment is expected to grow at the fastest CAGR in the market during the forecast period due to reduced costs and fewer financial risks through preventive care approaches. These contracts enable enhanced collaborations between healthcare providers. They improve healthcare efficiency and efficiently manage population health.

North America dominated the market in 2024, led by virtual care platforms, a focus on wellness and preventive care, and a shift to value-based care. The Centers for Medicare and Medicaid Services (CMS) focuses on providing continued access to lower costs, improving consumer choice, and offering continuous support to customers when needed. HealthCare.gov was introduced to help users sign up for health insurance plans that are created under the legislation.

The U.S. Department of Health and Human Services (HHS) has set a strategic plan for the use of AI in health, human services, and public health. The Federal Communications Commission (FCC) introduced the rural health care program that offers funding to eligible healthcare providers for broadband services and telecommunications needed for the provision of healthcare. The U.S. government and Medicare, the health insurance program, make efforts to detect and prevent Medicare fraud, help patients take care of their health, and provide easy access to Medicare information.

In May 2024, the Department of Finance Canada and the Government of Canada introduced Budget 2024 for a stronger public healthcare system to boost every generation.

In May 2025, the Terry Fox Research Institute of Canada launched the $25 million digital health innovation fund to accelerate Canadian public and private sector breakthroughs.

These innovations have focused on precision medicine for neuroscience and cancer, and other health conditions through big data, AI, and machine learning approaches and solutions.

Asia Pacific is expected to grow at the fastest rate in the market during the forecast period. This regional growth is attributed to the adoption of mHealth and telemedicine, an expanding corporate sector, and Insurtech partnerships. The Asia House reported on digital health innovations of Asia, and it works with governments and companies in Asia, the Middle East, and Europe. The Asia eHealth Information Network (AeHIN) is a regional organization involving experts from Southeast Asia and South Asia to promote health information technology and improve health outcomes in this region. AeHIN introduced a framework for health data sharing that provides guidelines for data security and data privacy.

In October 2024, the Ayushman Bharat Digital Mission marked a transformative three-year journey towards enabling digital health.

The government of India is implementing the Ayushman Bharat Digital Mission to overcome challenges associated with the healthcare systems of India and enable health data interoperability. It links tech systems across private and public healthcare systems as well as in rural and urban areas. India recently launched the Digital Personal Data Protection Act, which is more accessible for cross-border sharing.

The government of China holds a more proactive regulatory approach that fuels market-based digital health innovation. Technology companies and local startups are enabled to scale up their innovation in the local market within a shorter time. Digital health startups in China have become more attractive for global investors.

Europe is expected to grow at a notable rate in the market in 2024 owing to the expansion of insurtech companies, integration of AI and big data, and reforms in insurance policy. In July 2025, PEP Health, situated in London, UK, announced that 2025 is the year of embracing digital care platforms for health insurers. There is an incorporation of more digital offerings into the coverage models by insurers across Europe that keeps them aligned with emerging standards. The governments and regulators strongly support digital health solutions, which encourage insurers across the region.

In October 2024, the United Nations launched the joint digital health program, which is a new EU-funded project funded by the UN Joint Sustainable Development Goals Fund to strengthen digital health in Kyrgyzstan.

The Digital Healthcare (DiGA) Act of Germany established a regulatory framework for doctors to prescribe approved digital health applications for diabetes management, anxiety therapy, and other health conditions. This act ensures the reimbursement of costs through lawful health insurers. Germany holds the most progressive digital health policy in Europe.

France leads as the first European country to reimburse medical telemonitoring solutions that provide clinical benefits or improve the organization of care. France has incorporated telemonitoring into common law and provided the early financial coverage for digital medical devices. The French Healthcare organization provides a platform to unite insurers, health insurance providers, and businesses to offer various services to their members. About 58% of the French population is covered by insurers and mutual insurance partners.

By Product Type

By Service Offering

By Technology

By Distribution Channel

By Payment/Reimbursement Model

By Region

January 2026

January 2026

January 2026

January 2026