December 2025

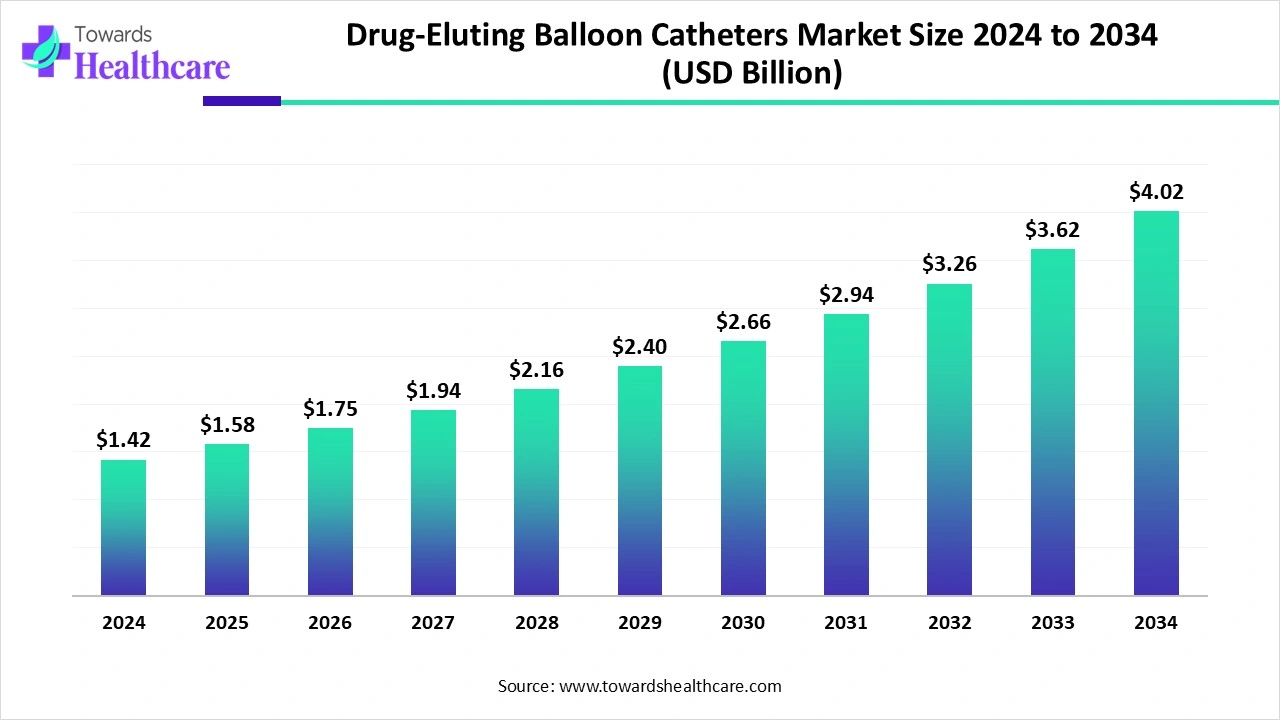

The global drug-eluting balloon catheters market size is calculated at US$ 1.42 billion in 2024, grew to US$ 1.58 billion in 2025, and is projected to reach around US$ 4.02 billion by 2034. The market is expanding at a CAGR of 11.1% between 2025 and 2034.

Day by day, the world is focusing on the development of minimally invasive procedures that are widely used in the treatment of diverse cardiovascular concerns, arterial diseases, and PAD. Whereas, the global drug-eluting balloon catheters market is transforming various solutions, including the widespread adoption of paclitaxel-coated balloons and sirolimus/limus-family coated balloons. Additionally, the accelerating focus on the phenomenal advances in drug delivery systems, which comprises nano-drug balloons and micro-needle drug balloons.

| Table | Scope |

| Market Size in 2025 | USD 158 Billion |

| Projected Market Size in 2034 | USD 4.02 Billion |

| CAGR (2025 - 2034) | 11.1% |

| Leading Region | North America |

| Market Segmentation | By Indication/Clinical Application, By Drug/Pharmacology, By Balloon Design/Catheter Format, By Mode of Use/Procedure Strategy, By Clinical Setting/End-User, By Distribution & Commercial Channel, By Region |

| Top Key Players | Abbott, B. Braun Melsungen AG, Bard/BD Interventional, BIOTRONIK, Boston Scientific, Concept Medical, Cook Medical, Edward Lifesciences, Gore & Associates, Lépine, MedAlliance, Medtronic, Philips, Terumo Corporation, W. L. Gore & Associates |

Balloon catheter systems whose surfaces are coated with an active pharmaceutical agent (e.g., paclitaxel, sirolimus, or analogues) and delivery excipients to transfer the drug to the vessel wall during balloon inflation are used to reduce restenosis and target-site neointimal hyperplasia in coronary and peripheral arteries, arteriovenous access, and other vascular/urovascular indications. Market scope includes DEB catheters (multiple diameters/lengths), coating chemistries & excipients, delivery systems (introducer sheaths, guidewires compatibility), procedure consumables, regulatory/clinical services, CDMO coating & sterile-fill, and commercial/after-sales support sold to hospitals, cath labs, vascular clinics, and ambulatory surgery centres.

Numerous leaders are leveraging their position in the global market to invest in the development of novel therapies and the latest solutions for severe conditions.

The widespread emergence of AI is bolstering its benefits in the market by coupling with computational fluid dynamics (CFD), finite element analysis (FEA), and fluid-structure interaction (FSI). This further assists in developing high-fidelity 3D simulations for estimating long-term outcomes and informing next-generation DEB design. Alongside the deep learning solutions, such as Faster R-CNN, are powering ultrasound imaging to enhance diagnostic accuracy in the study of DEB efficiency for arterial occlusions, representing robust agreement with traditional methods, including Digital Subtraction Angiography (DSA).

Rising Developments in the Treatments

2025 is an era where an expanding geriatric population is highly prone to cardiovascular diseases and peripheral artery disease (PAD), which are further boosting several developments in the treatment. The global drug-eluting balloon catheters market is widely demanding minimally invasive procedures, where DEBs are offering the delivery of drugs directly to the lesion without necessitating a permanent implant, reducing complications linked with stents. Besides this, the market is supporting ongoing technological advances in DEB design and drug coating, ensuring more efficacious and localized drug delivery, accelerating treatment outcomes, and lowering the risk of restenosis.

Challenges in Mortality

Certain clinical studies have demonstrated a risk of mortality connected with paclitaxel-coated balloon treatments for femoropopliteal lesions; along with this, companies have registered warnings about escalated late mortality with their products.

Stepping into De Novo Lesions Application

Day by day, the use of advanced DEB, like polymer-free drug coatings, is fostering the reduction of late adverse events associated with DEB procedures. The global drug-eluting balloon catheters market is further promising the DEBs application in the treatment of de novo lesions to provide a stent-free alternative for specific complex anatomies, such as small vessels and bifurcations. Researchers are working on innovations in novel materials and technologies like nano-drug balloons and micro-needle drug balloons, which are supporting the improvements in drug delivery and therapeutic outcomes.

In 2024, the peripheral arterial disease (PAD) segment accounted for a major share of the drug-eluting balloon catheters market. Accelerating cases of diabetes, hypertension, obesity, and smoking are significant risk factors for the evolving PAD. Currently, the market is putting efforts into transforming balloons with biodegradable polymeric microreservoirs that are being created to facilitate prolonged and sustained drug release, mimicking the effect of drug-eluting stents (DES). Additionally, the emergence of wing-seal technology for the Protégé balloon is boosting drug protection during insertion, minimizing drug loss, and ensuring more drug reaches the target lesion.

The arteriovenous (AV) access maintenance segment is estimated to witness rapid expansion. The growing instances of stenosis and dysfunction in AV fistulas, the restricted long-term patency of plain balloon angioplasty, and the leading to the requirement for fewer reinterventions with DCBs are fueling the segmental expansion. Recent studies like IN. PACT AV Access Trial and studies from China are leveraging DEBs to majorly enhance target lesion primary patency and lower the need for reintervention compared to plain angioplasty. Also, the increasing clinical evidence, such as results from randomized controlled trials and regulatory approvals in different regions, is assisting in the accelerated use of DCBs for AV access maintenance.

The paclitaxel-coated balloons segment registered dominance in the drug-eluting balloon catheters market in 2024. The localized delivery of paclitaxel to the vessel wall supports the effective prevention of restenosis after angioplasty or stent placement. The exploration of this type of balloon for vulnerable lipid-rich plaques, which are a major cause of heart attacks. Innovative PCBs are using shellac and vitamin E, which are highly involved in optimizing drug retention, which further provides more targeted therapy and possible plaque stabilisation. Other solutions, like SirPlux Duo, are demonstrating the application of paclitaxel with another drug, like sirolimus.

Although the sirolimus/limus-family coated balloons segment will expand rapidly. Involvement of certain SCBs by employing techniques, especially phospholipid nanocarriers, has promising effects in the reduction of downstream vascular injury and myocyte necrosis as compared to paclitaxel-coated balloons (pDCBs). This type of drug offers a metal-free alternative that omits the chronic inflammation and vasomotion risks associated with metal DES. Recently developed MagicTouch™ and Selution SLR™ are securing FDA advanced designations for peripheral use, whereas novel technologies, like the Virtue™ balloon, are boosting liquid formulations delivered through micropores.

The semi-compliant standard DEBs segment held the biggest share of the drug-eluting balloon catheters market in 2024. The segment is mainly driven by a rise in the improvements in the flexibility and conformability of semi-compliant balloons that enable better navigation and deployment in complex or tortuous lesions. Currently, the market is leveraging the application of new limus-eluting balloons for sustained drug release, expanding their utilization from the restenosis to de novo lesions and small vessel disease. Alongside, the continuous randomized trials comparing them to drug-eluting stents (DES) are being conducted to develop optimal treatment plans.

Moreover, the low-profile distal access DEBs segment is predicted to expand fastest in the coming era. This segment explores its wider contribution to access and treat complex anatomies comprising small vessels and bifurcation lesions, which are complex to treat with standard stents. The era is establishing ultra-low tip profiles and bi-segment inner shafts that further optimize flexibility and minimize tip catch, enabling feasible navigation and crossing of complex and distal lesions. This approach further uses sirolimus and everolimus for their anti-inflammatory properties, focusing on enhancing long-term outcomes, particularly in limiting patient and lesion types.

The DEB following vessel preparation segment was dominant in the drug-eluting balloon catheters market in 2024. The segment is propelled by the requirement of compressed plaque to foster the contact time and surface area between the balloon and the vessel wall, which is vital for the effective transfer of the antirestenotic drug. Ongoing developments encompass specialized balloons, such as intravascular lithotripsy (IVL) for cracking calcified plaques, and other devices, including scoring balloons or specialty balloons (e.g., Chocolate™) for controlled dilation, stress minimization, and mitigation of recoil and dissection.

During 2025-2034, the hybrid DEB + provisional stenting/covered stent placement segment is anticipated to register the fastest growth. A rise in cases of complex percutaneous coronary interventions (PCIs), especially chronic total occlusions (CTOs), bifurcation lesions, and long diffuse lesions, where an integrated approach facilitates advantages beyond single-modality treatments. Latest studies, including the PROVISION-DEB trial, are compared to a provisional 1-stent plus DEB strategy to a strategized 2-stent approach for bifurcation lesions, with DEBs also having promising application in the treatment of small vessel disease and lesions where dual antiplatelet therapy is an issue.

The hospital catheterization labs segment captured a dominant share of the drug-eluting balloon catheters market in 2024. The wider application of DEBs in severe concerns acts as a minimally invasive procedure, resulting in shorter recovery times and lowered risks, which is increasingly appealing to both patients and healthcare providers. Ongoing developments in balloon technology, like wing seals, emphasize improving deliverability, mainly in restricting anatomies, and preventing drug loss during delivery is also supporting these hospital catheterization labs.

The outpatient endovascular centres & ASCs segment is anticipated to expand rapidly. Primarily, patients prefer the convenient and comfortable outpatient settings, as well as faster recovery, which ASCs can offer. Outpatient endovascular centers are assisting in the management of in-stent restenosis (ISR) and selected de novo lesions, especially in the peripheral arteries and small coronary vessels, which transfer antiproliferative drugs to mitigate neointimal hyperplasia without leaving a permanent stent implant. Consistent breakthroughs in ASC-suitable DEBs focusing on the reduction of long-term difficulties, such as restenosis and thrombosis, by skipping permanent implants.

In 2024, the direct OEM sales & GPO contracts segment held the largest share of the drug-eluting balloon catheters market. GPOs are collecting demand from numerous hospitals and healthcare providers to negotiate favorable costs and contract terms for DEB catheters from OEMs. GPOs are further emphasizing fueling down expenditures for their members, which makes advanced treatments like DEB catheters more accessible and cost-effective for healthcare systems. The emerging alliances, like Cordis' purchase of MedAlliance, are allowing leading leader to strengthen their portfolios and reach a huge global patient base.

The catheter rental/procedure-kitting services segment will expand rapidly during 2025-2034. These services support hospitals in avoiding the crucial upfront investments of purchasing expensive drug-eluting balloons and associated surgical instruments by renting them on a per-procedure basis. Whereas kitting services are enabling the management of the complex inventory of devices and consumables required for DEB procedures, which further prevents waste and ensures that the right components are available when necessary. These services are fostering the availability of essential surgical supplies through pre-packaged kits and boosting patient safety by offering standardized, sterile components, thereby fueling the adoption of sophisticated DEB technology for treating vascular diseases.

North America’s drug-eluting balloon catheters market captured the biggest share in 2024. The regional expansion is mainly propelled by a rise in cardiovascular diseases (CVDs), particularly coronary artery disease and peripheral artery disease (PAD), and the growing demand for minimally invasive procedures. Along with this, North America is stepping into the progress of ambulatory surgical centers (ASCs), and outpatient procedures are further demanding advanced balloon catheters.

For instance,

In April 2025, Orchestra BioMed Holdings, Inc., a biomedical company, received FDA approval of an IDE to start the U.S. coronary pivotal trial randomizing the first-in-class sirolimus-angioinfusion balloon, Virtue Sab, head-to-head with a paclitaxel-coated balloon.

In January 2024, Cook Medical’s Slip-Cath Beacon Tip Hydrophilic Selective Catheter was made available for application in the U.S. and Canada. Slip-Cath is a hydrophilic angiographic catheter used in vascular and non-vascular procedures.

During 2025-2034, the Asia Pacific is estimated to witness the fastest expansion in the drug-eluting balloon catheters market. This region is mainly bolstering the advanced DEBs solutions for patients, possessing specific anatomical characteristics like smaller coronary arteries and longer lesions, which are common in Asia-Pacific patients and often associated with a greater incidence of diabetes. The broader emphasis on the prevention of restenosis by emerging technology for the treatment of in-stent restenosis and the mitigation of smooth muscle cell proliferation, offering a non-stent alternative with optimized healing.

Ongoing clinical trials in China are supporting the assessment of the real-world safety and efficacy of paclitaxel-eluting balloons for coronary de novo lesions, as seen in the study NCT03466749. China’s drug-eluting balloon catheters market is further expanding with NMPA market approval in February 2025 for Firelimus® Rapamycin Drug-Eluting Balloon Catheter from MicroPort, used in coronary bifurcation lesions.

Recently, Becton Dickinson (BD) in India developed the Lutonix Drug Coated Balloon PTA Catheter that transfers Paclitaxel for peripheral arterial disease. Along with this, Translumina offered the Protégé, which comes in both semi-compliant and non-compliant versions for complex lesions and in-stent restenosis (ISR).

Europe is experiencing a notable growth in the drug-eluting balloon catheters market. European players are exploring innovations in balloon designs, such as those by iVascular and Concept Medical Inc., that provide optimized features like rapid deflation times, accelerated pushability through optimized transition lumen structure, and better visibility with radiopaque markers. Additionally, continuous advancements in nanoparticle technology for better drug encapsulation, controlled release mechanisms (like microcapsule and polymer-free coatings), and bioadhesive or multilayer coatings to lower drug loss and enhance target delivery are also impacting the European market expansion.

In April 2025, Cordis, a leading player in interventional cardiovascular and endovascular technologies, announced new data from two important peripheral studies that are assessing the SELUTION SLR™ Drug-Eluting Balloon (DEB). Dr. Michael Lichtenberg, Chief of Interventional Angiology, said that this approach will deliver unequivocal clinical advantages in complex patient cohorts.

By Indication/Clinical Application

By Drug/Pharmacology

By Balloon Design/Catheter Format

By Mode of Use/Procedure Strategy

By Clinical Setting/End-User

By Distribution & Commercial Channel

By Region

December 2025