January 2026

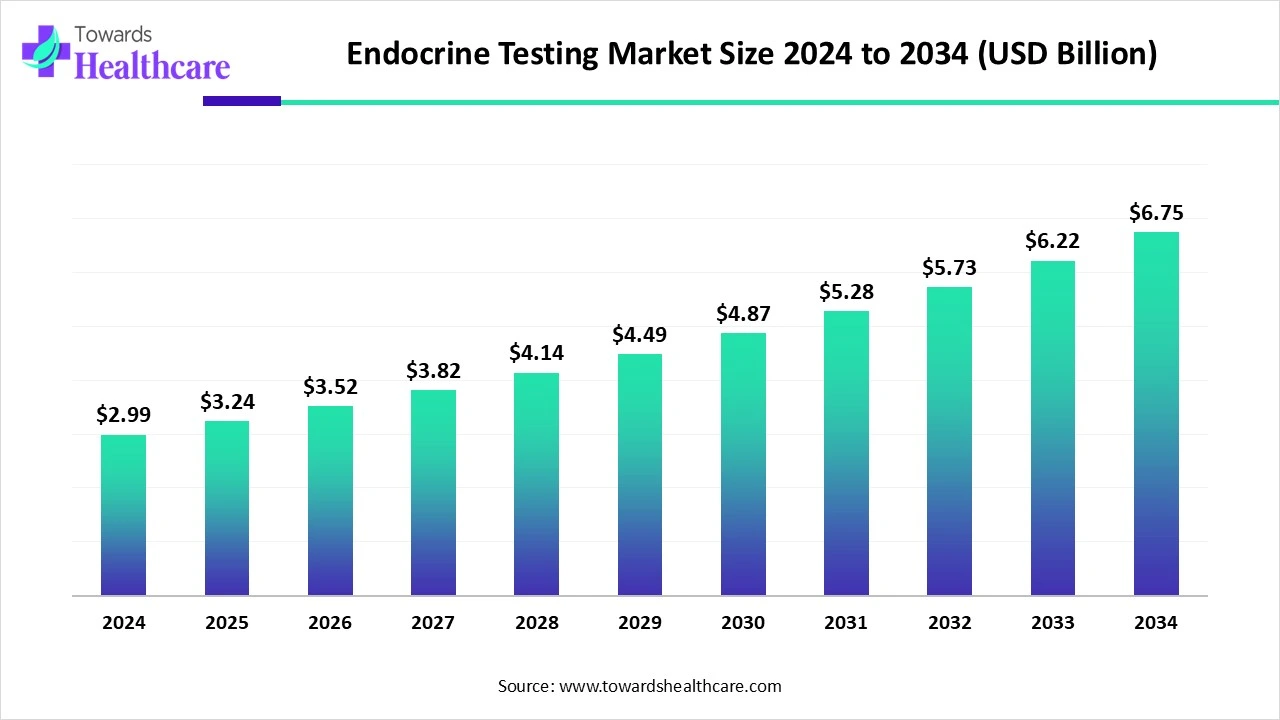

The global endocrine testing market size is calculated at USD 3.25 billion in 2025, grew to USD 3.52 billion in 2026, and is projected to reach around USD 7.36 billion by 2035. The market is expanding at a CAGR of 8.54% between 2026 and 2035.

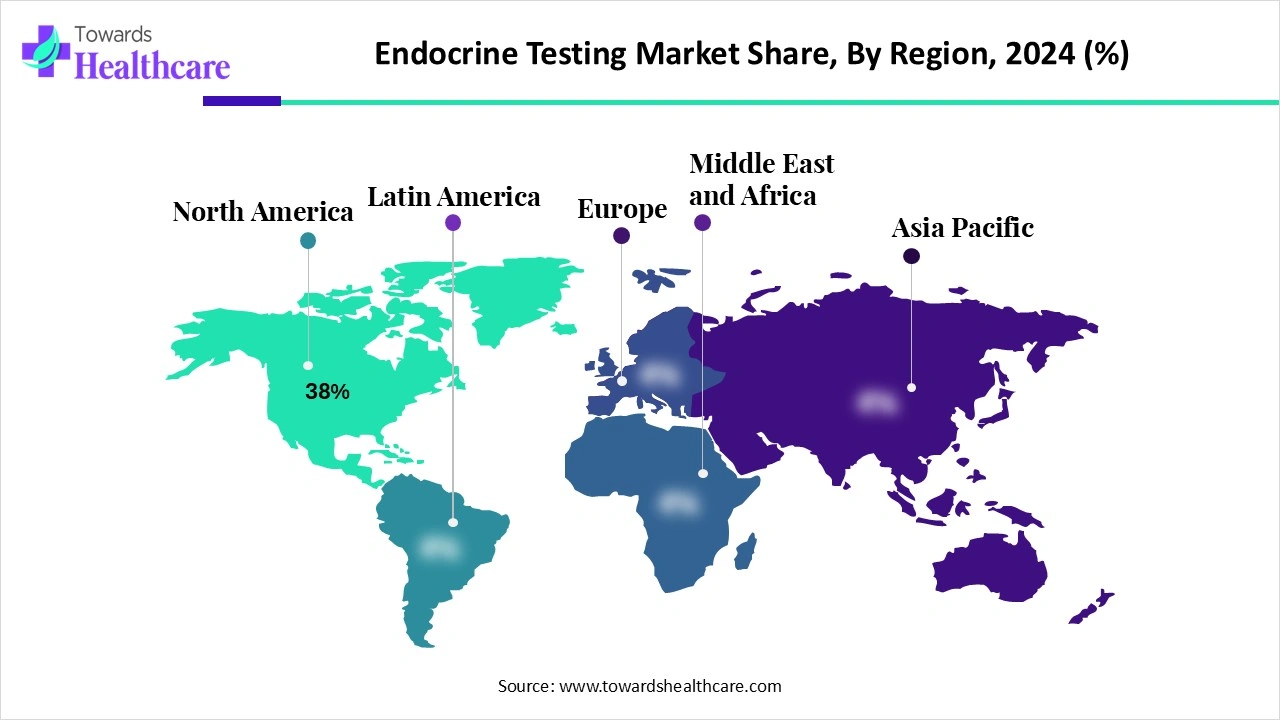

The endocrine testing market is witnessing steady growth driven by the rising prevalence of hormonal disorders, diabetes, thyroid dysfunction, and obesity. Increasing awareness of preventive healthcare and early disease detection is further boosting demand for advanced testing solutions. Technological advancements, including automated platforms and highly sensitive assays, are enhancing diagnostic accuracy and efficiency. North America leads the market, supported by a well-established healthcare infrastructure, strong adoption of innovative diagnostic technologies, and a high burden of endocrine disorders. Favorable reimbursement policies and growing investments in clinical research also contribute to the region dominance in the global endocrine testing landscape.

| Table | Scope |

| Market Size in 2026 | USD 3.52 Billion |

| Projected Market Size in 2035 | USD 7.36 Billion |

| CAGR (2026 - 2035) | 8.54% |

| Leading Region | North America by 38% |

| Market Segmentation | By Test Type, By Technology / Assay Platform, By Indication / Clinical Use, By End User / Buyer, By Revenue Stream / Business Model, By Distribution Channel, By Region |

| Top Key Players | Roche Diagnostics, Abbott Diagnostics, Siemens Healthineers, Beckman Coulter, Ortho Clinical Diagnostics, DiaSorin, Thermo Fisher Scientific, Agilent Technologies, Waters Corporation, Bio-Rad Laboratories, Tosoh Bioscience, Snibe / Mindray, Fujirebio, QuidelOrtho, LabCorp, Quest Diagnostics, ARUP Laboratories / Mayo Clinic Labs, Eurofins / Synlab, Abbott / Roche POC divisions |

Endocrine testing refers to a group of diagnostic procedures used to evaluate the function of the endocrine system, which regulates hormones responsible for growth, metabolism, reproduction, and overall homeostasis. These tests measure hormone levels in blood, urine, or saliva to detect imbalances that may indicate disorders such as diabetes, thyroid disease, adrenal dysfunction, or reproductive issues. Common tests include thyroid function tests, glucose tolerance tests, and assays for cortisol, insulin, or reproductive hormones. By identifying hormonal irregularities early, endocrine testing plays a critical role in guiding treatment plans, monitoring therapy effectiveness, and supporting preventive healthcare strategies.

In May 2025, Hormona, a women healthcare startup based in London, raised $6.7 million in a seed funding round to introduce its hormone tests. The company main offering is a hormone monitoring app that lets users record their overall health, symptoms, and menstrual cycles. The app finds trends and provides information about changes in hormone-related health using user-inputted data and algorithmic analysis.

In August 2025, Merck, a leading science and technology company, welcomed new expert guidelines that will standardize the tests used in Australia and New Zealand to diagnose and treat endocrine disorders in children.

In July 2025, The Norman Parathyroid Center at the Hospital for Endocrine Surgery is pleased to announce a nationwide partnership with Any Lab Test Now in observance of Parathyroid Awareness Month. This partnership will expand access to diagnostic testing for hyperparathyroidism, a prevalent but underdiagnosed endocrine disorder that primarily affects women over 50.

AI integration can significantly improve endocrine testing by enhancing diagnostic accuracy, efficiency, and personalized care. Artificial intelligence algorithms can analyze large datasets of patient hormone profiles, imaging results, and medical histories to identify subtle patterns and correlations that may be overlooked by conventional testing methods. This enables earlier detection of endocrine disorders such as diabetes, thyroid dysfunction, and adrenal or pituitary abnormalities. AI-powered decision-support tools can help clinicians interpret complex test results, reduce diagnostic errors, and optimize treatment strategies.

Additionally, AI can streamline laboratory workflows by automating data analysis, thereby minimizing turnaround time and enhancing cost-effectiveness. Predictive analytics, supported by AI, can forecast disease progression and therapy outcomes, enabling more precise and proactive interventions. Furthermore, integration with wearable devices and remote monitoring systems enables continuous hormone tracking, providing real-time insights into patient health. Overall, AI enhances the precision, accessibility, and effectiveness of endocrine testing and management.

Government Screening Programs Drive the Market

Government screening programs and initiatives play a pivotal role in driving the growth of the endocrine testing market by enhancing early detection, improving public health outcomes, and fostering widespread adoption of diagnostic services. These programs increase the demand for endocrine tests such as thyroid, diabetes, and reproductive hormone assays, thereby expanding market opportunities for diagnostic providers.

Shortage of Skilled Laboratory Operators & Regulatory Hurdles

The key players operating in the market are facing challenges due to regulatory hurdles and a shortage of skilled laboratory operators, which is expected to restrict the market growth over the forecast period. Limited reimbursement policies in several countries restrict patient access to affordable care. A shortage of skilled laboratory professionals and inadequate healthcare infrastructure hinders the widespread adoption. Regulatory hurdles and lengthy approval processes delay the introduction of new assays and technologies.

Rising Prevalence of Hormonal Disorders

The rising prevalence of hormonal disorders significantly supports the growth of the endocrine testing market by increasing the demand for diagnostic services. Conditions such as thyroid disorders, diabetes, and reproductive hormone imbalances are becoming more common globally, prompting healthcare systems to implement widespread screening and monitoring programs.

For instance,

The thyroid function tests segment dominates the market due to the high global prevalence of thyroid disorders such as hypothyroidism, hyperthyroidism, and autoimmune thyroid diseases. These conditions are increasingly diagnosed across diverse age groups, driving consistent demand for thyroid screening. Thyroid hormones play a vital role in regulating metabolism, growth, and energy balance, making an accurate assessment essential for patient care. Rising awareness, routine health check-ups, and government-led screening programs further support segment growth. Additionally, advancements in diagnostic technologies, such as highly sensitive immunoassays and automated platforms, enhance accuracy and efficiency, solidifying thyroid function tests as the leading test type.

The reproductive/sex hormone tests segment is estimated to be the fastest-growing in the endocrine testing market, driven by rising cases of infertility, polycystic ovary syndrome (PCOS), and other reproductive health disorders. Increasing awareness of hormonal imbalances affecting fertility and overall well-being has led to greater demand for these tests among both men and women. Growing adoption of assisted reproductive technologies (ART) and fertility treatments further fuels the need for accurate hormone testing. Moreover, lifestyle changes, delayed parenthood trends, and rising prevalence of conditions like hypogonadism contribute to segment growth. Advancements in diagnostic technologies and personalized treatment approaches also accelerate market expansion.

The automated immunoassays segment holds dominance in the market due to its high accuracy, efficiency, and ability to process large volumes of samples with minimal manual intervention. These systems offer faster turnaround times, standardized results, and reduced chances of human error, making them highly reliable for detecting complex hormonal imbalances. Growing demand for precise and reproducible testing in conditions such as thyroid, diabetes, and reproductive disorders has further boosted their adoption. Additionally, continuous technological advancements, integration with laboratory automation, and compatibility with advanced analyzers strengthen their market position, making automated immunoassays the preferred choice in endocrine diagnostics.

The laboratory mass spectrometry (LC-MS/MS) segment is anticipated to be the fastest-growing in the endocrine testing market due to its exceptional sensitivity, specificity, and ability to accurately measure multiple hormones simultaneously. It is particularly valuable for detecting low-concentration or structurally similar hormones that traditional immunoassays may misidentify. Increasing demand for precise diagnostics in complex endocrine disorders, such as adrenal, steroid, and reproductive hormone imbalances, is driving adoption. Technological advancements, including high-throughput instruments and automated sample preparation, enhance efficiency and reduce analysis time. Additionally, growing applications in clinical research, personalized medicine, and biomarker discovery further accelerate the growth of laboratory mass spectrometry in endocrine testing.

The diagnostic & monitoring of thyroid & diabetes segment dominates the market due to the high prevalence of these disorders globally. Thyroid dysfunction and diabetes affect a significant portion of the population across all age groups, creating consistent demand for routine testing and long-term monitoring. Early diagnosis and continuous monitoring are critical to managing complications and ensuring effective treatment, which drives regular utilization of endocrine tests in this segment. Additionally, government-led screening programs, growing awareness of metabolic and hormonal health, and advancements in accurate, automated testing technologies further strengthen the dominance of thyroid and diabetes diagnostic and monitoring services in the market.

The infertility/reproductive endocrinology segment is estimated to be the fastest-growing in the endocrine testing market due to the rising prevalence of infertility, polycystic ovary syndrome (PCOS), and other reproductive disorders worldwide. Increasing awareness about hormonal imbalances affecting fertility and delayed parenthood trends among couples is driving demand for precise reproductive hormone testing. The growing adoption of assisted reproductive technologies (ART) and fertility treatments further fuels the need for accurate monitoring of hormone levels. Additionally, advancements in sensitive diagnostic assays, personalized fertility management, and increasing investments in reproductive healthcare research contribute to rapid growth in this segment of the market.

The clinical & hospital laboratories segment dominates the market due to its wide accessibility, well-established infrastructure, and ability to provide comprehensive diagnostic services. Hospitals and large clinical laboratories handle high patient volumes, enabling routine testing for thyroid, diabetes, and reproductive disorders. The presence of skilled personnel, advanced equipment, and integrated laboratory information systems ensures accurate and timely results, which are critical for effective disease management. Additionally, hospitals often serve as primary points of care for both outpatient and inpatient services, driving consistent demand. Strong collaborations with healthcare providers and government screening programs further reinforce the dominance of Clinical and Hospital Laboratories in endocrine testing.

The reference & specialty laboratories segment is anticipated to be the fastest-growing in the endocrine testing market due to its ability to offer highly specialized and advanced diagnostic services that are not typically available in routine clinical or hospital laboratories. These laboratories provide accurate testing for complex hormonal disorders, rare endocrine conditions, and research-driven assays, attracting referrals from clinics and hospitals. Rising demand for personalized medicine, specialized fertility assessments, and comprehensive metabolic profiling further fuels growth. Additionally, technological advancements, high-throughput testing capabilities, and collaborations with pharmaceutical and biotech companies enhance their service offerings. The increasing need for precise, specialized endocrine diagnostics is rapidly expanding this segment rapidly expand in the market.

The instruments & reagents segment dominates the market due to the essential role these components play in performing accurate and reliable hormonal assays. High demand for advanced diagnostic instruments, such as automated immunoassay analyzers and laboratory mass spectrometers, drives consistent market growth. Reagents, including antibodies, substrates, and calibrators, are critical for test sensitivity and precision, ensuring dependable results across thyroid, diabetes, and reproductive hormone tests. Additionally, continuous technological innovations, increasing laboratory automation, and the expansion of clinical and hospital laboratories globally further strengthen the segment dominance. Regular consumption of reagents for routine testing also contributes to sustained market demand.

The contract testing/reference lab services segment is anticipated to be the fastest-growing in the endocrine testing market due to the increasing outsourcing of specialized and complex hormonal assays by hospitals, clinics, and smaller laboratories. These services provide access to advanced testing technologies, highly skilled personnel, and accurate, high-throughput diagnostics without the need for heavy infrastructure investment. Rising demand for cost-effective solutions, faster turnaround times, and high-quality results drives adoption. Additionally, the growth of personalized medicine, fertility treatments, and research studies requiring precise endocrine profiling further fuels the segment. Collaborations with pharmaceutical companies and the expansion of centralized testing networks also accelerate market growth in this segment.

The direct OEM sales to large labs & hospitals segment dominate the endocrine testing market due to the strong demand for reliable, high-volume diagnostic instruments and reagents from established healthcare providers. Large laboratories and hospitals prefer direct procurement from original equipment manufacturers (OEMs) to ensure product quality, technical support, and maintenance services. This approach also enables customized solutions, bulk pricing, and long-term service agreements, which are critical for managing high patient volumes and complex testing workflows. Additionally, the presence of well-established laboratory infrastructure, skilled personnel, and continuous demand for routine endocrine testing solidifies the dominance of direct OEM sales in the market.

The Lab-as-a-Service/Send-out to reference labs segment is estimated to be the fastest-growing in the endocrine testing market due to increasing demand for cost-effective, flexible, and specialized testing solutions. Hospitals, clinics, and smaller laboratories often lack the infrastructure or expertise to perform complex hormonal assays, making send-out services an attractive option. This model provides access to advanced diagnostic technologies, highly skilled personnel, and rapid turnaround times without significant capital investment. Rising adoption of personalized medicine, fertility treatments, and rare endocrine disorder testing further drives growth. Additionally, centralized testing networks, streamlined logistics, and collaborations with pharmaceutical and research organizations accelerate the expansion of this segment.

North America dominates the market share 38%, due to a combination of advanced healthcare infrastructure, high awareness of hormonal disorders, and widespread adoption of innovative diagnostic technologies. The region has a significant prevalence of diabetes, thyroid dysfunction, and reproductive hormone disorders, driving consistent demand for endocrine testing. Well-established clinical and hospital laboratories, coupled with strong government initiatives and reimbursement policies, support routine screening and monitoring. Additionally, continuous investments in research and development, integration of automated immunoassay systems and laboratory mass spectrometry, and the adoption of AI-driven diagnostics further strengthen North America market leadership in endocrine testing.

The U.S. dominates the North American endocrine testing market, driven by a high prevalence of endocrine disorders such as diabetes and thyroid disease, with the CDC reporting 37.3 million Americans living with diabetes and over 20 million affected by thyroid disorders. Strong healthcare infrastructure, a vast network of hospitals and clinical laboratories, and widespread adoption of advanced diagnostic technologies, including automated immunoassays, laboratory mass spectrometry, and AI-driven solutions, support market growth. Government initiatives like the National Diabetes Prevention Program (NDPP) and Medicare coverage for endocrine screenings further boost testing demand. Continuous R&D and routine screening programs reinforce the country market leadership.

Canada endocrine testing market is expanding rapidly due to the rising prevalence of hormonal disorders, such as PCOS, affecting approximately 5% of women of reproductive age. Technological integration, including point-of-care testing and digital health tools, enhances accessibility and patient monitoring. Provincial and national health programs promote routine endocrine screening and preventive care. Additionally, ongoing research and collaborations in hormonal health and endocrine disruptor studies support the adoption of advanced diagnostic solutions. These factors collectively drive the growth of Canada endocrine testing market.

The Asia-Pacific region is the fastest-growing region in the market due to several key factors. The rapidly increasing prevalence of diabetes, thyroid disorders, and reproductive hormone imbalances is driving demand for diagnostic services. Expanding healthcare infrastructure, rising disposable incomes, and greater access to advanced laboratory technologies support market growth in emerging economies such as India, China, and Southeast Asia. Growing awareness of preventive healthcare, routine health screenings, and government-led initiatives further promotes endocrine testing adoption. Additionally, the region benefits from increasing investments in research, collaborations with international diagnostic companies, and the rising use of automated immunoassays and AI-driven testing solutions, accelerating market expansion.

In January 2025, the U.S. Food and Drug Administration announced that EUROIMMUN (part of Revvity) achieved both FDA 510(k) clearance and CE marking for a chemiluminescence-based immunoassay that measures free testosterone, delivering results in under 48 minutes.

By Test Type

By Technology / Assay Platform

By Indication / Clinical Use

By End User / Buyer

By Revenue Stream / Business Model

By Distribution Channel

By Region

January 2026

January 2026

January 2026

January 2026