February 2026

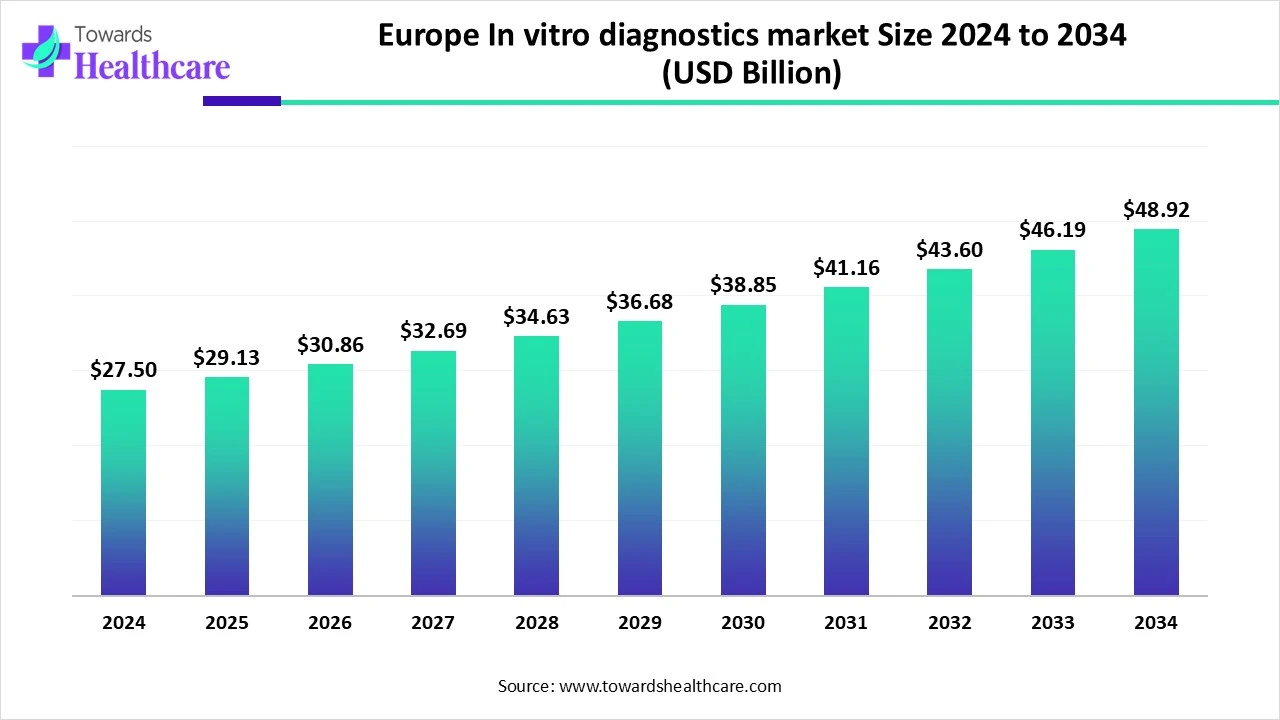

The Europe in-vitro diagnostics market size is calculated at USD 27.5 in 2024, grew to USD 29.13 billion in 2025, and is projected to reach around USD 48.92 billion by 2034. The market is expanding at a CAGR of 5.93% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 29.13 Billion |

| Projected Market Size in 2034 | USD 48.92 Billion |

| CAGR (2025 - 2034) | 5.93% |

| Market Segmentation | By Product, By Technology, By Application, By End-use, By Region |

| Top Key Players | Bio-Rad Laboratories, Inc, Abbott, Sysmex Corporation, BD, BIOMÉRIEUX, Danaher, F. Hoffmann-La Roche Ltd, Siemens, QIAGEN, Thermo Fisher Scientific Inc |

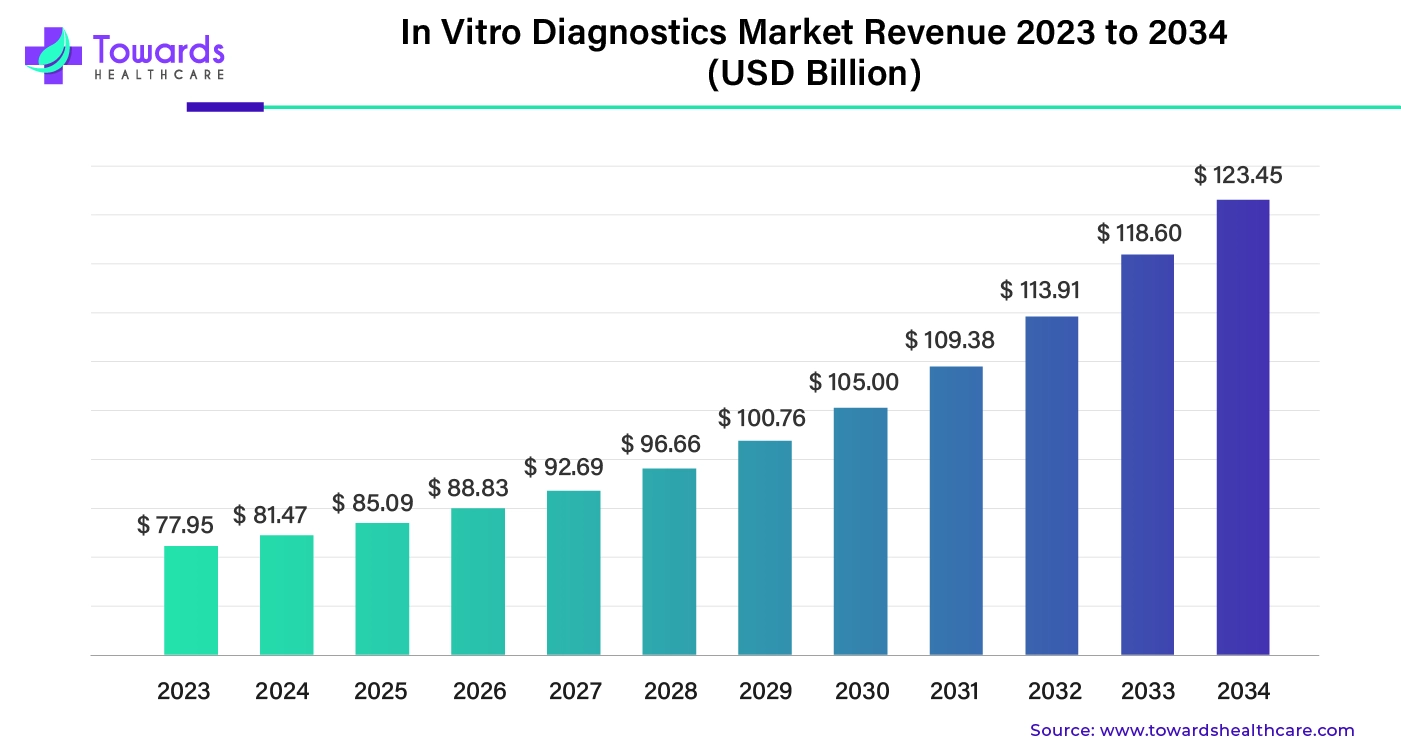

The global in vitro diagnostics market size was worth about $77.95 billion in 2023. It's expected to grow consistently over the next decade and reach nearly $123.45 billion by 2034, with an average yearly growth rate of 4.45%.

Tests known as in vitro diagnostics (IVDs) are used to identify illnesses, ailments, and infections. The tests themselves may be conducted using a range of equipment, from simple portable testing to sophisticated lab equipment. They make it possible for medical professionals to properly diagnose patients and treat them. The impact of diagnosis on patients, the economy, and the health system is significant, and it is a key factor in facilitating universal health care. As more sophisticated and affordable technologies become accessible, the industry is anticipated to expand quickly.

IVD technologies are revolutionized by AI and machine learning, which enhance healthcare outcomes and change the way tests are performed. AI and machine learning algorithms can handle large amounts of data, such as test results, pictures, and patient records, very fast and precisely. This makes it possible for IVD systems to spot patterns and anomalies that human eyes might miss, resulting in more accurate diagnoses. Early disease identification for diseases like cancer, sepsis, or genetic disorders can be achieved by more effective biomarker analysis employing AI-driven IVD systems.

Rising Need for Point-of-Care Testing

Compared to laboratory testing, POCT offers a quicker turnaround time for test findings, perhaps producing a result soon enough to administer the right therapy and enhance clinical or economic outcomes. POCT has undergone a revolution thanks to technological advancements, including enhanced instrumentation and electronics downsizing, which have made it possible to create devices that are more precise and smaller. One of the main factors propelling the point-of-care diagnostics market is the rising incidence of chronic illnesses, including diabetes, heart disease, and respiratory conditions.

High Cost of Diagnostics

The Europe in-vitro diagnostics market is hampered by the high cost of maintenance and equipment. High-end molecular diagnostic systems typically cost between $100,000 and $500,000. Usually, yearly maintenance expenses account for 10–15% of the original equipment purchase price.

Molecular Diagnostics

The importance of molecular diagnostics for individuals and populations has been highlighted more than in a few other decades. The field of infectious disease molecular diagnostics, specifically nucleic acid-based methods, is the one in clinical laboratory diagnostics that is growing the fastest. Because of recent developments, in-depth research on microorganisms, and the development of innovative nucleic acid-based procedures, the use of molecular tests in clinical laboratories has grown. Many commercial tests are now available.

By product, the reagents segment held the largest share of the Europe in-vitro diagnostics market in 2024. The segmental growth is attributed to the growing demand for remote in vitro diagnostics and the need for refilling reagent requirements. Medical devices that are used for in vitro testing of human samples for the purposes of disease prediction, prevention, diagnosis, treatment monitoring, prognosis observation, and health status evaluation include reagents, kits, calibrators, quality control products, and other items. It is possible to employ IVD reagents alone or in conjunction with other tools, devices, machinery, or systems.

By product, the services segment is estimated to be the fastest-growing in the Europe in-vitro diagnostics market during the forecast period. In actuality, a range of services may help physicians and patients get a diagnosis and select the best clinical care approach. Therefore, in the realm of medical diagnostics, patient safety and service accuracy are essential. It is therefore not surprising that strict regulations are in place to help companies provide patients with the best care possible. The European Union (EU) has established two primary regulations that regulate the creation and utilization of IVD services.

By technology, the immunoassay segment led the Europe in-vitro diagnostics market in 2024. The demand for immunoassays is increasing because they are extremely accurate and economical method of identifying chemicals that cannot be found using conventional methods. In recent years, a number of sophisticated and highly automated new immunoassay equipment have been introduced into the clinical testing area as a result of the cross-fertilization of laboratory medicine and biological high technology. The accuracy and efficiency of the test have been dramatically improved, and the sensitivity and specificity of the analysis index have been greatly boosted by these new immunological analysis instruments.

By technology, the microbiology segment is expected to grow at the fastest CAGR in the Europe in-vitro diagnostics market during the forecast period. For the detection and identification of pathogens, the study of microorganisms, or microbiology, mostly depends on IVD test reagents and kits. In order to guarantee the precision and dependability of test findings, control materials and culture medium are also crucial elements in microbiological testing. Controls are used in microbiological testing to guarantee the precision and dependability of test findings.

By application, the infectious diseases segment was dominant in the Europe in-vitro diagnostics market in 2024. The need for IVD testing has increased continuously and significantly in areas where the prevalence is high throughout the decades due to the growing occurrence of infectious illnesses. Developments in laboratory equipment have had a significant impact on the expansion of the IVD infectious diseases industry. In recent years, there has been a surge in demand for IVD infectious illnesses due to the overwhelming number of tests conducted for COVID-19 infections.

By application, the oncology segment is anticipated to witness the fastest growth in the Europe in-vitro diagnostics market during 2025-2034. If oncology prevention and treatment don't make major strides, 13.2 million people might die from cancer each year by 2030. The ability to get IVDs is essential for cancer early diagnosis. It is possible to avoid between 30% and 50% of human malignancies, and IVD tests can be used to screen for some of them. Significant technological and immunochemical developments have produced reliable and reasonably priced IVD tests, such as self-testing and point-of-care (POC) testing.

By end-use, the hospitals segment dominated the Europe in-vitro diagnostics market in 2024. Multispecialty hospitals' diagnostic services are set up to give all kinds of institutions access to cutting-edge medical equipment, systems, and technology, and individuals receive the quickest results in the healthcare sector every day. Multispecialty hospitals offer emergency care, diagnostic services, and a wide range of medical treatments.

By end-use, the homecare segment is expected to achieve the highest CAGR in the Europe in-vitro diagnostics market during the predicted timeframe. Use at home. The general population can utilize IVD medical equipment. Therefore, in comparison to professional/laboratory IVD medical devices that perform comparable duties, these devices are intended to have comparatively straightforward and uncomplicated operation procedures and test result interpretation. High-quality, trustworthy health examinations and testing are now available in the convenience of your own home with the Diagnostics at Home service. Home diagnostics eliminates the need to go or wait by enabling planned testing at a selected time and place, providing the utmost in convenience.

A number of important reasons are contributing to the continuous expansion of the in-vitro diagnostics industry in Europe. The region's need for in vitro diagnostics is being driven by consumer aspirations for precise and non-invasive diagnostic procedures as well as the rising incidence of chronic illnesses. Local unique conditions are also influencing the market's growth, such as government programs that encourage early disease identification and the existence of a strong healthcare infrastructure. In Europe, consumers are favoring non-invasive diagnostic procedures that yield precise and trustworthy findings.

In 2021, 29% of Germans were over 60; by 2035, that number is expected to increase to almost 33%. In the European Union, Germany has one of the highest rates of key modifiable risk factors for non-communicable illnesses. An analytical summary of the evolution, organizations, and players in German public health is what Health Policy seeks to present. More precisely, it aims to identify the causes of Germany's poor health metrics and offer solutions.

In 2024, the UK government planned to release a Major Conditions Strategy. It was published to address mental health in addition to other illnesses like cancer and heart disease. The majority of healthcare spending in the UK is funded by the government, which spent £258 billion in 2024—a 2.5% real increase from 2023. In 2024, healthcare spending as a percentage of GDP was 11.1%, which was comparable to 2023 levels. (Source - Office for National Statistics)

In March 2025, following a successful commercial roll-out in the UK, we are thrilled to be introducing SalistickTM, the first saliva pregnancy test, in Germany and other European countries, said Chris Yates, CEO of Abingdon Health plc. Pregnancy testing may now be done anywhere, at any time, thanks to this innovative technology. It gives us great pleasure to expand our collaborations with Salignostics and NeutraPharma, and we look forward to working with them to introduce more cutting-edge self-test solutions to the market. (Source - LONDON STOCK EXCHANGE)

By Product

By Technology

By Application

By End-use

By Region

February 2026

February 2026

January 2026

December 2025