March 2026

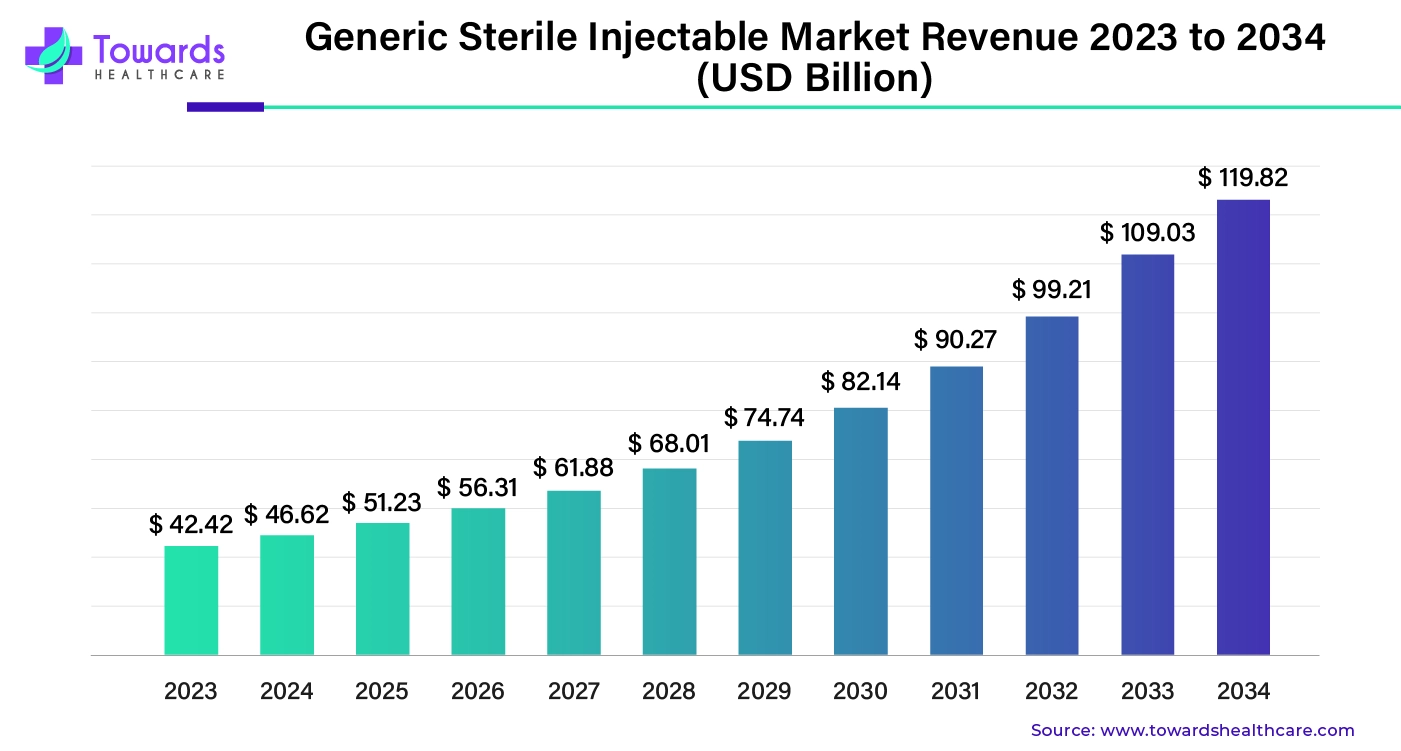

The global generic sterile injectable market was estimated at US$ 42.42 billion in 2023 and is projected to grow to US$ 119.82 billion by 2034, rising at a compound annual growth rate (CAGR) of 9.9% from 2024 to 2034.

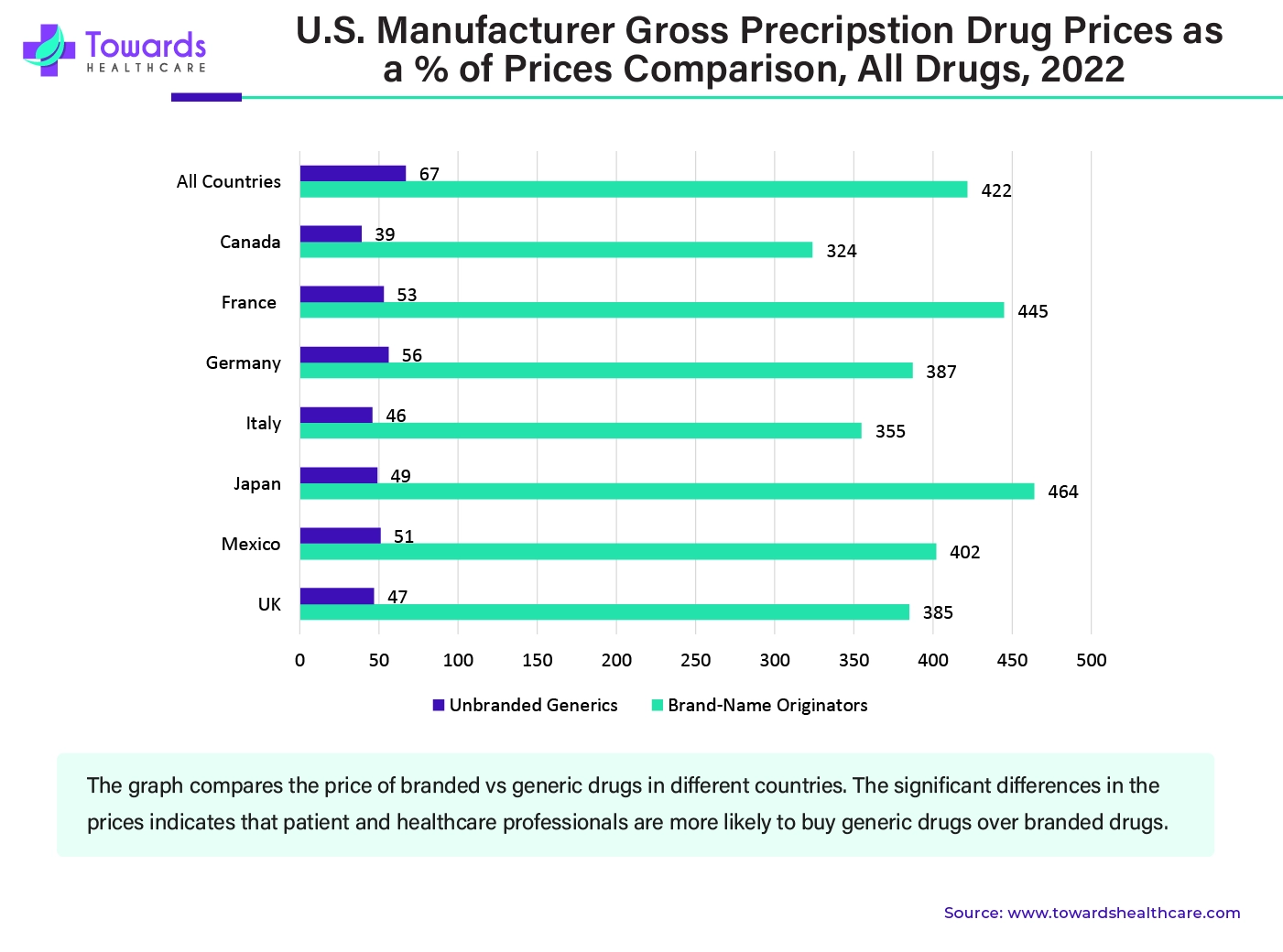

For people who belong to the poor class or in underdeveloped countries where branded medicines are very expensive, the market for generic medicines grows strongly due to their affordability.

Generic sterile injectables are the same as branded injectables when it comes to strength, dosage form, quality, route of administration, intended use, and performance characteristics. However, generic medicines have different looks and contain different non-active ingredients compared to brand-name medicines. Generic alternatives are cheaper than branded medicines because manufacturers do not invest in development and marketing. The generic sterile injectable market deals with the production of injectable medicines that come in vials, pre-filled syringes, and ampoules. Generic injectables are used to treat various conditions, including pain, inflammation, infections, and others. With the growing demand for pharmaceutical products, generic medicines might need high production in the future.

There are various aspects in the development of generic drugs in which AI can play a useful role. First of all, AI can be used for finding drug biosimilars with the help of natural language processing and predictive analysis. Predictive analysis can also be used in conducting research associated with the crystal structures of drug compounds. Machine learning can also be used in generic drug development by implementing it in salt and polymorph screening. As generic medicines have different non-active compounds, AI can be used for data analysis to find different ingredients that can be used as replacements. Apart from this, AI can also be used in supply chain management, manufacturing, transportation, inventory management, and sorting tasks that can decrease labor costs and increase efficiency and productivity.

For instance,

Branded products are high in cost due to patents, intense research, investment while approval by the FDA, marketing, and other factors. Due to this, brand-name injectables become unaffordable for people who belong to the poor class. In many cases, even middle-class people are unable to afford injectables. For people who live in countries like the U.S., affording healthcare becomes very expensive without insurance. Therefore, due to the lower cost of generic injectables, they are in high demand, especially in underdeveloped countries. Not only are they cheaper, but they also have the same medicinal effect as the brand-name injectables. Due to their cost-effectiveness, generic injectables become an attractive alternative for healthcare providers and patients.

The generic sterile injectable market is facing a shortage of drugs, which is a leading issue impacting the market’s growth. According to the Drug Shortage Report published by USP in 2024, there was a 91% shortage of generic sterile injectables in 2023, out of which 58% were injectable drugs that newly went into shortage in 2023. This shortage usually occurs due to supply chain disruptions. It is highly essential for the generic medicine industry to bolster its supply chain resilience. Apart from this, sterile injectable drugs have high manufacturing complexity, which leads to shortages. There have been quality concerns related to generic drugs, which have caused manufacturers to recall the products back to inventory, causing a shortage of generic sterile injectables in the market.

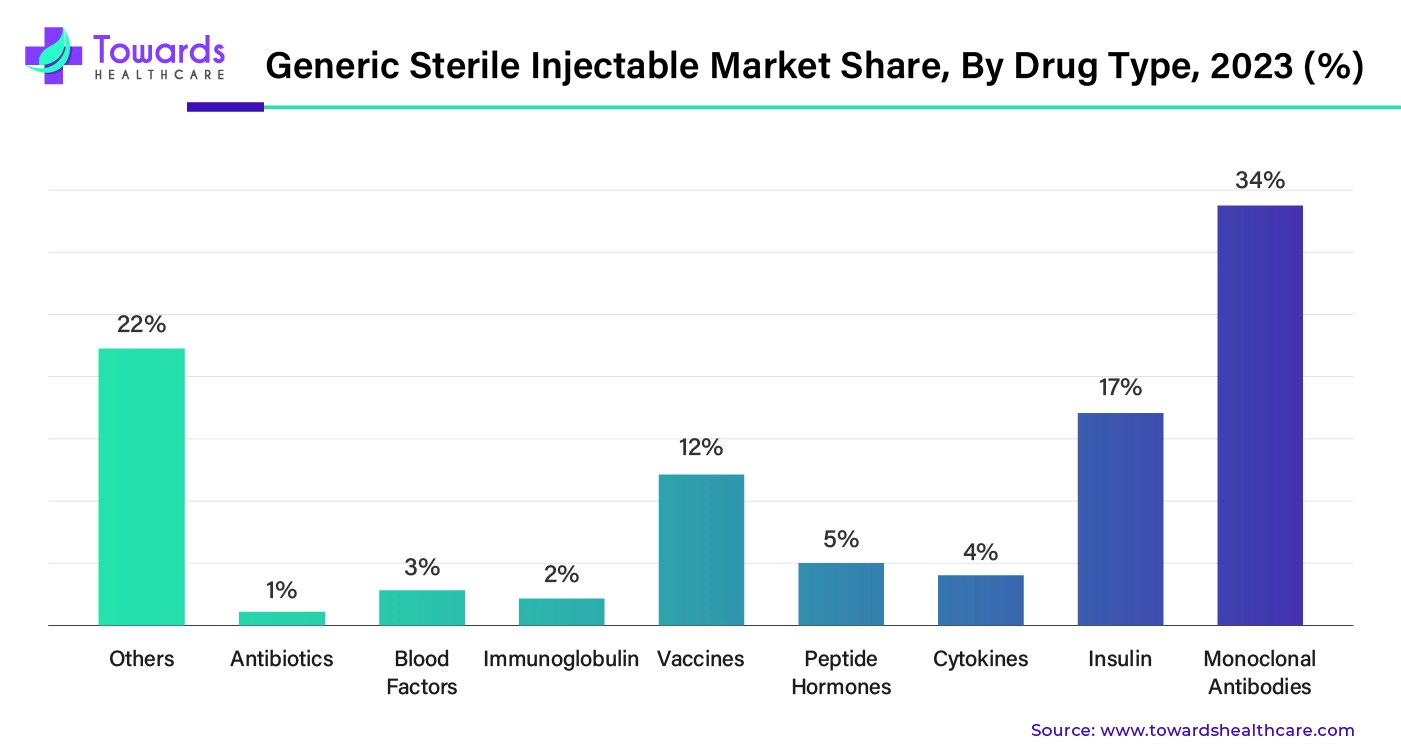

With growing research and development in biosimilars, the generic sterile injectable market can get a boost in the future. The market for generic sterile injectables is seeing an increase in the use of biosimilars, which are generic copies of monoclonal antibodies. When it comes to safety and efficacy, biosimilars are a more cost-effective option than branded monoclonal antibodies. The market for generic sterile injectables containing monoclonal antibodies is predicted to continue growing as a result of the increasing development and approval of biosimilars for these drugs, which include rituximab, trastuzumab, and adalimumab.

For instance,

By drug type, the monoclonal antibodies segment poised its dominance over the market share by 34%. When it comes to therapeutics, monoclonal antibodies dominate in treating different diseases or conditions. Monoclonal antibodies are used in diagnostics, infectious disease treatment, radio immunodetection, radioimmunotherapy, cancer treatment, cardiovascular disease treatment, autoimmune disease therapy, viral disease treatment, pathogen identification, cell & their function tracing, and so on. Though monoclonal antibodies hold great therapeutic potential, the high cost reduces usage, which is why developing biosimilar or generic monoclonal antibodies becomes a crucial step for developing cost-effective monoclonal therapeutics.

For instance,

By drug type, the vaccines segment is expected to grow at the fastest rate in the market during the forecast period. The rising prevalence of infectious disorders and the growing need for preventing diseases boost the segment’s growth. Generic vaccines offer a cost-effective alternative to costly injections, making them suitable for low- and middle-income groups. Government organizations and the WHO mandate immunization for newborns and children, potentiating the demand for vaccines.

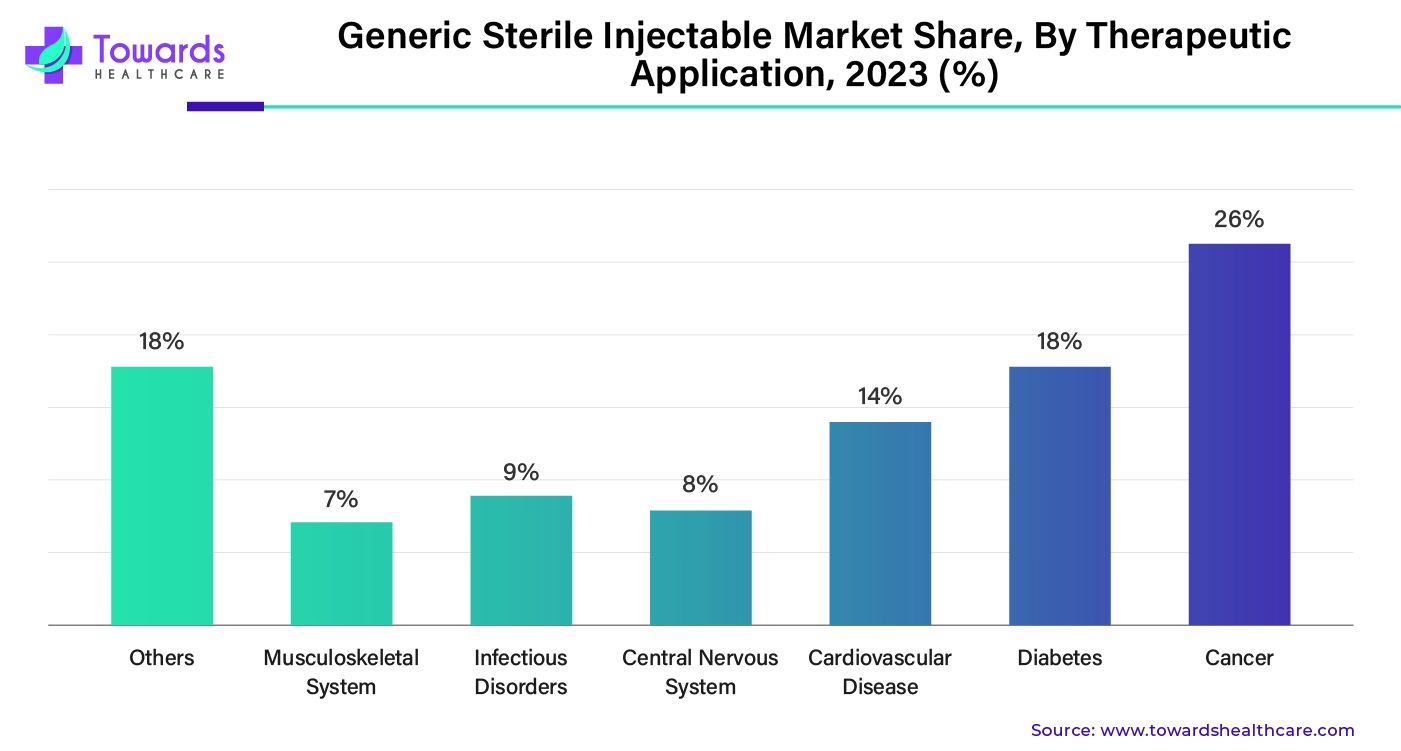

By therapeutic application, the cancer segment held the largest market share by 26%. The cases of cancer are growing exponentially, and cancer is becoming a leading cause of death globally. There were 20 million new cases of cancer, and it is estimated that there will be 30 million new cases by 2040, according to the WHO. A large population is not able to afford cancer treatment due to the cost of therapies and drugs. The development of generic sterile injectables can significantly reduce the overall cost of cancer treatment. With growing R&D in cancer, researchers have been working on developing biosimilars, biosimilar monoclonal antibodies, and other injectable drugs.

For instance,

By therapeutic application, the diabetes segment is expected to show lucrative growth in the market in the upcoming years. The rising prevalence of diabetes and the increasing economic burden drive the segment’s growth. According to the International Diabetes Federation, 11.1%, or 1 in 9 adult population, are living with diabetes globally. Approximately $1,760 is spent per person with diabetes. In addition, diabetes accounted for $1.015 trillion in global health expenditure in 2024. (Source: International Diabetes Federation). This necessitates people to prefer generic drugs and injections.

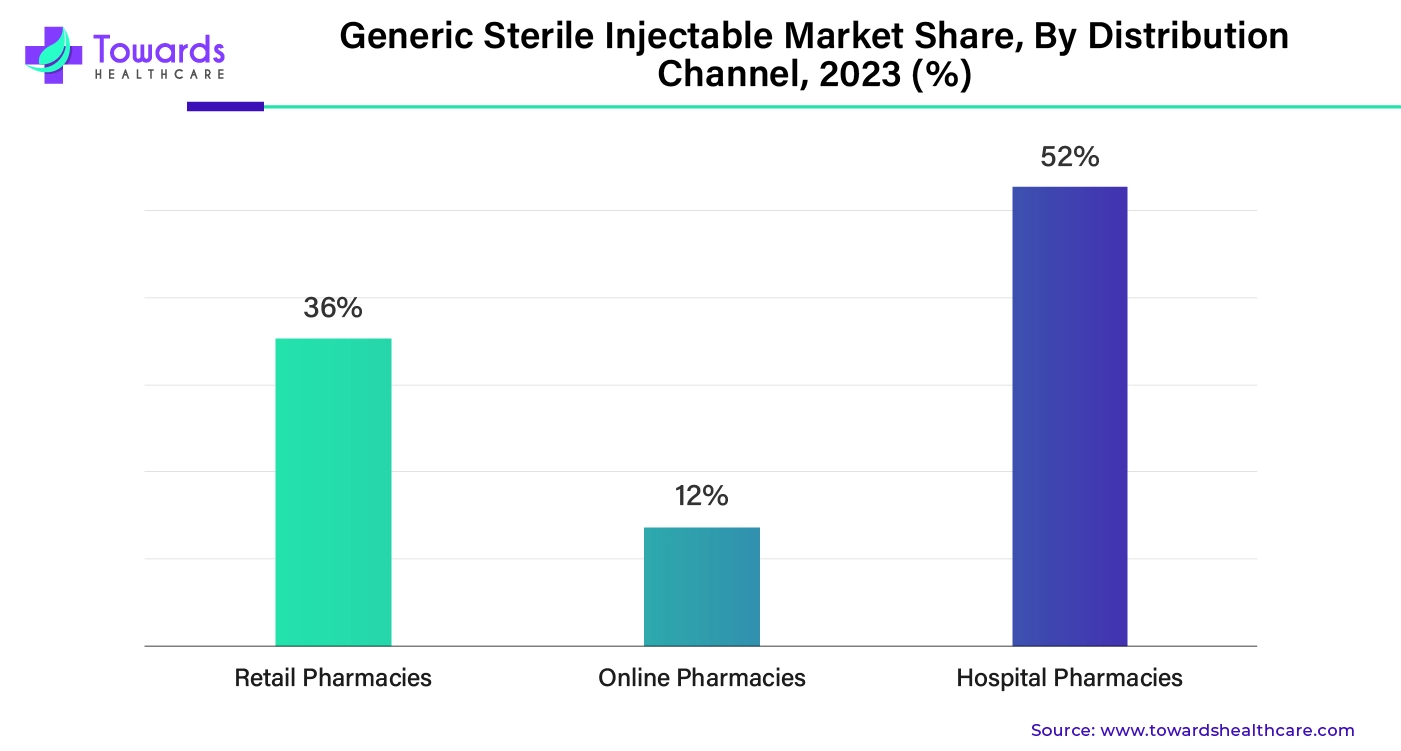

By distribution channel, the hospital pharmacies segment held the dominant share of the market share by 52%. Hospital pharmacies are attached to hospitals, and most patients purchase medicines from hospital pharmacies, which is why this segment holds the dominant share. Apart from this, hospital pharmacies have access to a wide range of generic medicines. Hospital pharmacies are also involved in testing, procurement, compounding, dispensing, packaging, storage, manufacturing, distribution, and research of drugs, which gives hospital pharmacies more opportunities for growth and development. With a growing number of communicable and non-communicable diseases, the number of hospital admissions has increased and is going to increase even further in the future, which will increase the demand for hospital pharmacies.

By distribution channel, the retail pharmacies segment is expected to witness significant growth in the market over the studied period. The segmental growth is attributed to favorable infrastructure and the presence of skilled professionals. Retail pharmacies have suitable infrastructure to store sterile injectables and maintain their sterility. Retail pharmacies offer generic drugs and injectables at affordable rates. They offer numerous services, including free home delivery and special discounts. The increasing number of retail pharmacies enhances the accessibility of patients. It becomes more convenient for patients to purchase generic injectables from retail pharmacies near their homes.

Brian Guy, President and Chief Commercial Officer of Breckenridge Pharmaceutical, commented that the approval and launch of Dehydrated Alcohol Injection USP is a significant achievement, positioning Breckenridge as one of the first companies in the U.S. market to offer a generic alternative to Ablysinol. He also said that the milestone reflects the company’s continued dedication to providing affordable treatment options that meet real patient needs and reinforces the company’s commitment to serving the institutional channel. (Source: PR Newswirel)

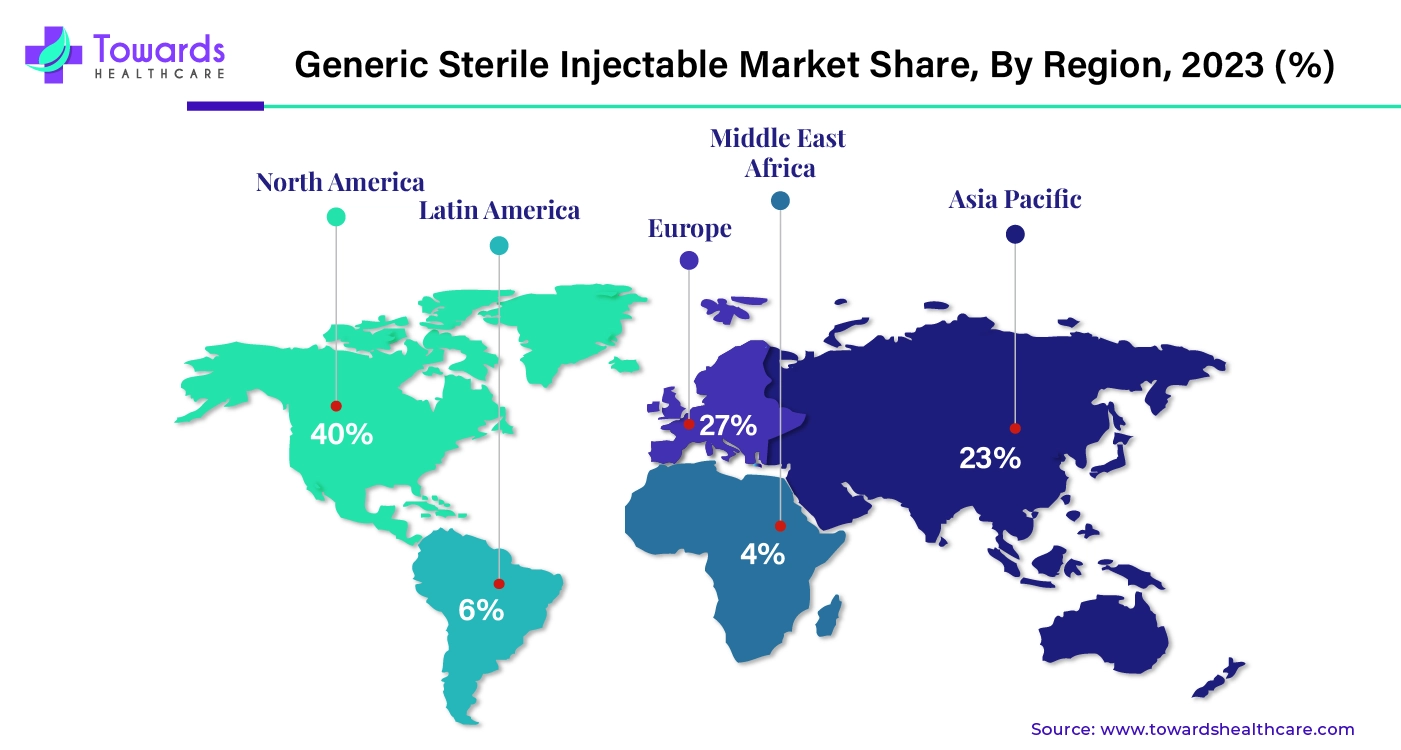

By region, North America dominated the generic sterile injectable market share by 40% in 2023 due to the strong presence of key market players, government investments, government initiatives, technological advancements, advanced healthcare infrastructure, growing R&D in therapeutics, and the strong presence of pharma and biotech companies. Apart from this, the growing prevalence of chronic conditions and cancer is increasing the production of generic medicines in the region. The U.S. and Canada majorly contribute to the growth of the market.

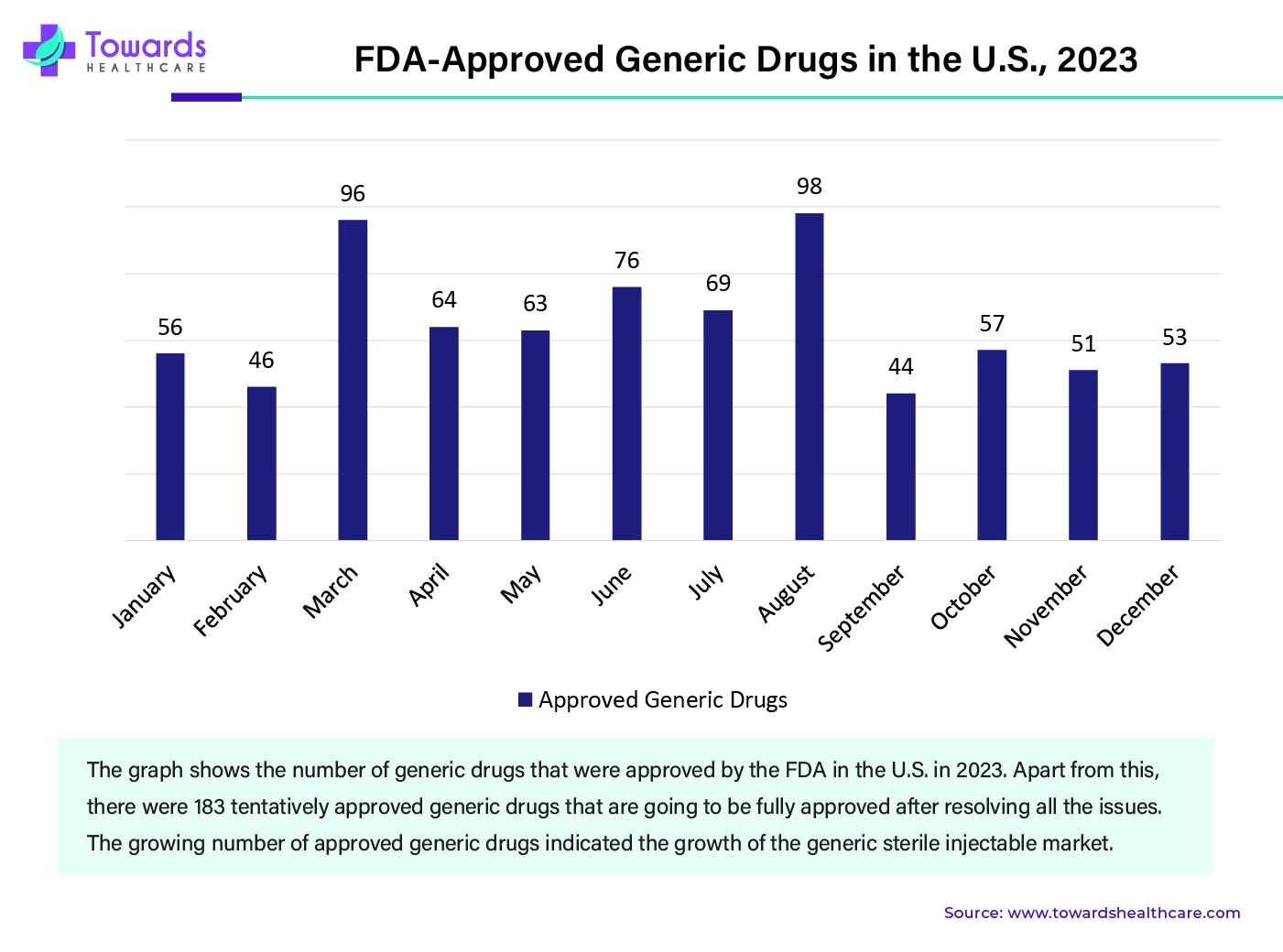

The generic sterile injectable market has grown significantly in the U.S. According to the annual report 2023 of the Office of Generic Drugs, 956 generic drugs were approved, more than 21,000 stakeholders across the world participated in workshops and webinars, and US$ 20 million was invested in generic drug science and research projects.

Canada also significantly contributes to the growth of the generic sterile injectable market. According to CGPA, 2.2 million prescriptions are dispensed using generic medicines on an everyday basis. Out of the total perceptions, 75% of prescriptions are for generic medicines. Some of the companies that provide generic drugs in Canada are Apotex, Auropharma, Baxter, Fresenius Kabi, Juno Pharmaceuticals Canada, Mantra Pharma, Marcan Pharmaceuticals Inc., Mint Pharmaceuticals Inc., Pharma Science, Sandoz, Sterimax Inc, Taro, Teva, and Viatris.

By region, Asia Pacific is expected to grow at the fastest rate during the forecast period. The growing number of health issues and the high cost of medicines are driving the generic sterile injectable market in the Asia Pacific. The major contributors to the market’s growth include India, China, Japan, and South Korea.

By region, Asia Pacific is expected to grow at the fastest rate during the forecast period. The growing number of health issues and the high cost of medicines are driving the generic sterile injectable market in the Asia Pacific. The major contributors to the market’s growth include India, China, Japan, and South Korea.

India contributes significantly to the generic sterile injectable market due to the strong presence of the generic medicine market. India hosts the third largest pharmaceutical sector globally and is known for generic medicines and low-cost vaccines. In the financial year 2021-22, the pharma sector’s revenue was INR 3,44,125 Crore. India produces the largest amount of generic medicines and 60,000 different generic brands in 60 therapeutic categories, which is equivalent to 20% of the global generic medicine supply. The Indian Government also launched ‘Janaushadhi Pariyojana’ with the objective to develop generic medicines that are more affordable. As of 2024, there are 12,616 facilities under this program across the country, and there are 2047 drugs.

| Company Name | Teva Pharmaceuticals |

| Headquarters | Israel, Middle East |

| Recent Development | The company is a leading provider of generic medicines in the U.S., and its market is approximately 500 generic prescription products. The company’s pre-approved global pipeline consists of 1,100 generic products. In 2023, the company’s revenue in generic medicine was US$ 8,734 million, of which North America’s share was US$ 3,475 million, Europe’s share was US$ 3,664 million, and others’ share was US$ 1,594 million. As of 2024, the global generic market share of Teva is US$ 43 billion. |

| Company Name | Hikma Pharmaceuticals |

| Headquarters | London, UK, Europe |

| Recent Development |

In May 2024, announced the founding of HIKMA ESPAÑA, S.L.U. (Hikma Spain), Hikma Pharmaceuticals PLC (Hikma) is an international pharmaceutical firm. Spain has a generic injectable market worth around $860 million, and this is Hikma's formal debut in that country. 25 goods have been introduced by Hikma in Spain so far this year, and the company has approved 36 products. |

By Drug Type

By Therapeutic Application

By Distribution Channel

By Region

March 2026

December 2025

November 2025

November 2025