February 2026

The global branded generics market size is calculated at US$ 383.1 billion in 2025, grew to US$ 415.54 billion in 2026, and is projected to reach around US$ 867.21 billion by 2035. The market is expanding at a CAGR of 8.47% between 2026 and 2035.

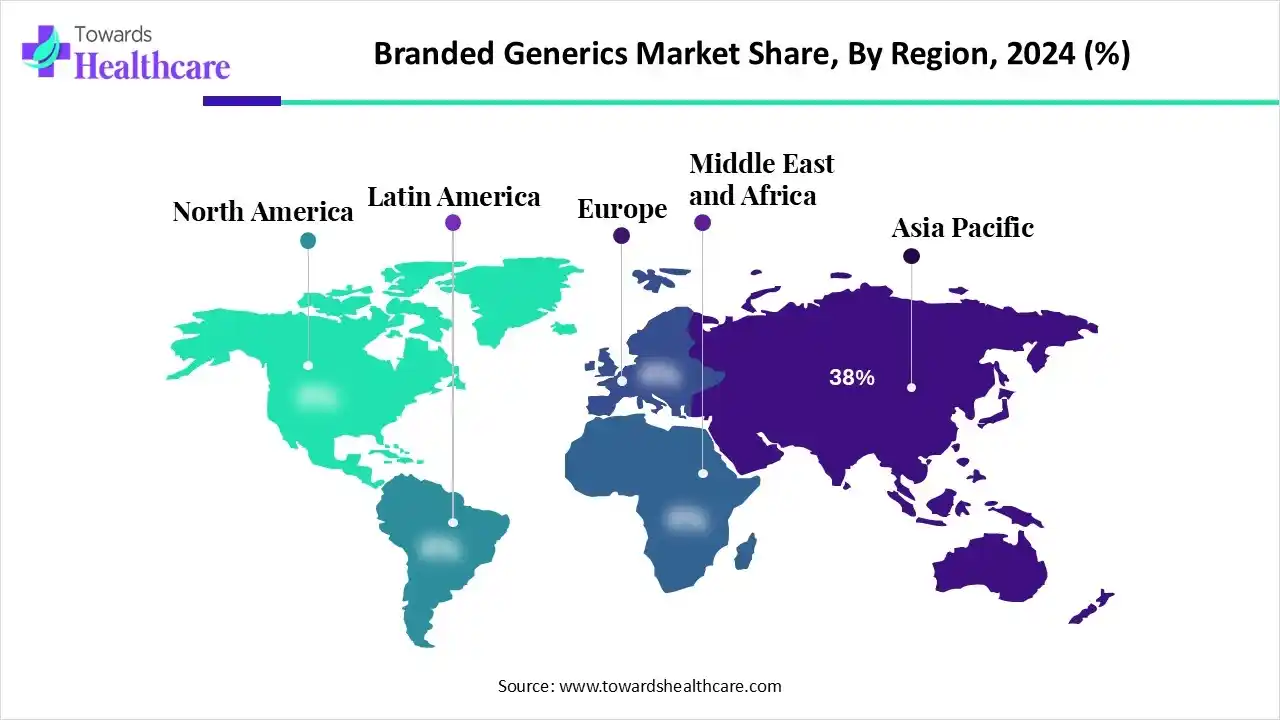

The branded generics market is expanding due to increasing medical care expenses, the expiration of patents on blockbuster drugs, and patient and physician preferences for the perceived reliability of branded products over unbranded generics. North America is dominant in the market due to a growing aging population and cases of chronic diseases, while the Asia Pacific is the fastest-growing due to branded generics offering a more affordable substitute to expensive patented medication.

| Table | Scope |

| Market Size in 2025 | USD 383.1 Billion |

| Projected Market Size in 2035 | USD 867.21 Billion |

| CAGR (2026 - 2035) | 8.47% |

| Leading Region | Asia Pacific by 38% |

| Market Segmentation | By Product Type, By Dosage Form, By Therapeutic Area, By Distribution Channel, By End-User Industry / Customer, By Region |

| Top Key Players | Sun Pharmaceutical Industries Ltd., Sandoz (Novartis), Teva Pharmaceutical Industries Ltd., Viatris (Mylan/Upjohn), Cipla Ltd., Dr. Reddy’s Laboratories Ltd., Lupin Ltd., Aurobindo Pharma Ltd., Zydus Cadila (Cadila Healthcare Ltd.), Glenmark Pharmaceuticals Ltd., Torrent Pharmaceuticals Ltd., Mankind Pharma Pvt. Ltd., Abbott Laboratories, Pfizer Inc., Hikma Pharmaceuticals plc, Jubilant Life Sciences / Jubilant Pharma, Alembic Pharmaceuticals Ltd., Emcure Pharmaceuticals Ltd., Natco Pharma Ltd., Aspen Pharmacare Holdings Ltd. |

The branded generics market covers instruments, consumables, software, and services used to detect, quantify, and characterize RNA molecules (mRNA, miRNA, lncRNA, circRNA, total RNA) across research, diagnostic, and industrial workflows. It includes technologies from RT-qPCR and digital PCR to bulk RNA-seq, single-cell RNA-seq, targeted RNA panels, microarrays, and emerging long-read / direct RNA sequencing.

Applications span gene expression profiling, biomarker discovery, drug development, clinical diagnostics, transcript isoform analysis, and regulatory/quality control in biomanufacturing. Demand is driven by precision medicine, single-cell biology, RNA therapeutics/vaccines, liquid biopsy development, and falling sequencing costs coupled with advanced bioinformatics.

AI is transforming corporate development in the generics pharmaceutical industry from an art based on knowledge to a science grounded in data. As AI-powered tools become more user-friendly, even mid-sized and smaller generics companies are adopting them. Machine learning (ML), a major subset of AI, is emerging as the most supportive force in the industry. AI-driven algorithms examine thousands of data points from existing medicines to patents to create accurate formulations quickly.

Additionally, AI and automation improve documentation, reporting, and audit trails that are essential for government approval. Integrating AI and automation into the manufacturing of generic medicines is not only a technological upgrade; it signifies a shift in how healthcare reaches people, boosting the branded generics market.

Which Product Type is Dominating the Market?

The tablets & capsules segment accounted for 45% of the branded generics market share in 2024, as this form is typically more stable, providing longer shelf life and confrontation to environmental factors like moisture and temperature. They are typically less luxurious to manufacture than other forms, making them more cost-effective for the end-user.

Injectables

The injectables segment is expected to grow at the fastest CAGR in the branded generics market during the 2025-2034 period, as branded generic injectable drugs provide many advantages over other administration routes, contributing precise and adjustable dosing, expected bioavailability, and onset of action.

Liquids & Suspensions

The liquids & suspensions segment is expected to grow at a significant CAGR during the forecast period, as it amplified viscosity of suspensions allows rapid swallowing, preventing the liquid from permeating all corners of the mouth and lowering the lingering aftertaste often associated with solution formulations. Formulating liquid suspensions contributes a slight interaction of science and creativity.

What made the Dosage Form Segment Dominant in the Market in 2024?

The oral solid dosage segment accounted for 50% of the branded generics market revenue in 2024, as oral solid dosage forms enable specific dosing and confirm the correct delivery of the prescribed amount of drugs. They offer uniform drug content, reducing variations in dosage and improving consistency in drug delivery.

Other Innovative/Advanced Delivery

The other innovative/advanced delivery segment is expected to grow at the fastest CAGR in the branded generics market during the 2025-2034 period, as these systems are intended to transport medications exactly to the target site, reducing adverse effects and enhancing patient compliance. The significance of these innovations lies in their capabilities to offer more efficient treatments for different medical conditions.

Liquid Oral

The liquid oral segment is expected to grow significantly during the forecast period as these dosage forms are better than tablets or other solid drugs for patients who have trouble swallowing. They are a standard choice for elderly and children patients. Liquids are absorbed rapidly than solids in the body fluids and provide more elasticity in attaining the correct dosage of medication.

Which Therapeutic Area Dominated the Market in 2024?

The anti-infectives segment dominated the Branded Generics Market, accounting for 22% of revenue in 2024, as anti-infective therapies are applied to a broad range of diseases, from minor infections to serious and life-threatening diseases like pneumonia, meningitis, and tuberculosis. By addressing the root cause of an infection, these drugs improve symptoms such as fever and pain, helping patients feel better and recover rapidly.

Oncology Supportive / Hematology

The oncology supportive/hematology segment is expected to grow at the fastest CAGR in the branded generics market during the 2025-2034 period, as generic drugs lower the cost of care predominantly, and their multi-source origin often provides a guarantee in supply. The applications of generic and biosimilar products are hinged on the supposition that they are of a certain quality and of similar pharmaceutical truthfulness as their modernizer counterparts.

Cardiovascular

The cardiovascular segment is expected to grow at a significant CAGR during the forecast period, as generic CVD drugs show the same medical output as brand-name medications. Generic medications provide considerably potential cost savings to health systems than the branded counterparts.

Which Distribution Channel Dominated the Market in 2024?

The retail pharmacies/drugstores segment dominated the branded generics market, accounting for 42% of share in 2024, as retail pharmacies play a significant role in medical care by offering convenient access to medications, a broad range of products, and significant additional solutions. Retail pharmacies have their wide range of services and products.

Online Pharmacies / E-pharmacy Platforms

The online pharmacies/e-pharmacy platforms segment is expected to grow at the fastest CAGR in the branded generics market during the 2025-2034 period, as these types of pharmacies often offer inexpensive pricing, discounts, and generic substitutes, leading to potential cost savings for people. This affordability is specifically relevant for those with chronic health conditions who need long-term drug treatment. Online pharmacies offer an extensive database of medication information, providing both healthcare professionals and patients with access.

Hospital Pharmacies / Institutional Tender

The hospital pharmacies/institutional tender segment is expected to grow at a significant CAGR during the forecast period, as hospital pharmacy is a dedicated field of pharmacy that is combined with the care of a medical center. These involve centers such as an outpatient clinic, hospital, drug-dependency facility, poison control center, drug information center, or residential care solutions.

Which End User / Customer Dominated the Market?

The outpatient/retail patients segment dominated the branded generics market, accounting for 55% of revenue in 2024, as outpatient care centers provide wellness and prevention solutions, diagnostic services, management, and rehabilitation to patients. Outpatient services are cost-effective, and major treatment centers offer limited-scale outpatient fees.

Others (Veterinary, Institutional)

The others segment is expected to grow at the fastest CAGR during the forecast period, as veterinary generic drugs provide advantages like guaranteed efficacy and quality through a rigorous approval procedure, constant production, and marketing support.

Long-term Care & Nursing Homes

The academic & research institutes segment is expected to grow at a significant CAGR in the branded generics market during the 2025-2034 period, as generic drugs in long-term care (LTC) offer major advantages such as cost savings, enhance patient adherence, and improve access to efficient treatment. Generic drugs also increased accessibility, healing equivalence, and trustworthy safety and quality.

Asia Pacific dominated the branded generics market in 2024 with approximately 38% share, driven by the growing burden of long-term diseases, rising medical care spending, and the need for affordable, high-quality medicines. Growing government support also drives market growth; for instance, in February 2025, China initiated a volume-based procurement (VBP) policy to award drug companies with large sales opportunities at significantly lower prices. Oftentimes, VBP winners have drug price discounts of 50% to 90%. There have been 10 rounds of VBP for drugs to date.

For Instance,

In India rising prevalence of lifestyle-related and long-term diseases is the major driver of the market growth. Rising public and private healthcare investment in India is creating a massive base of patients with access to healthcare treatment. This branding shapes trust with both physicians and patients, who often trust that these products are of higher quality than unbranded substitutes.

For Instance,

North America is estimated to host the fastest-growing branded generics market during the forecast period as a combination of massive healthcare expenditure, a strong government environment that supports generic use, and significant market consolidation. High medical care investment and the structure of insurance programs such as Medicare and Medicaid offer strong incentives for generic drug use.

For Instance,

In the U.S., the presence of a large and increasing aging patient population with chronic illnesses such as cardiovascular disease and diabetes creates sustained demand for cost-effective solutions. Increasing innovation in novel product launches by various healthcare companies. For Instance, in April 2025, Glenmark's US arm launched a generic Adderall for ADHD in May 2025 to address shortages, targeting a $421.7 million market.

Europe is expected to grow at a significant CAGR in the branded generics market during the forecast period, as European governments are under continuous pressure to manage rising healthcare expenses and are vigorously endorsing generics to attain this. Many countries are realizing guidelines that promote the use of generics, with prescribing mandates and substitution incentives, which contribute to the growth of the market.

In the UK, branded generics, which are off-patent drugs sold under a brand name, hold noteworthy value in the UK due to doctors' and patients' trust in their consistency and quality. For long-term therapies, particularly for chronic conditions such as cardiovascular and endocrine disorders, prescribing branded generics improves patient adherence.

For Instance,

In South America, branded generics thrive due to cost-sensitive markets and patent expirations. Governments in Argentina and Chile support local manufacturing, boosting competition and affordability while maintaining brand loyalty among prescribers.

Brazil’s branded generics market expands rapidly as ANVISA streamlines approvals. Strong domestic players like EMS and Eurofarma leverage marketing strength and biosimilar introductions, driving double-digit growth amid economic stabilization.

Across the Middle East and Africa, branded generics grow through enhanced healthcare access and local production incentives. Egypt, Nigeria, and Kenya witness rising demand as governments prioritize affordable chronic disease treatments.

In GCC countries, branded generics gain traction as physicians prefer trusted brands over unbranded versions. Saudi Arabia and UAE lead adoption, supported by localization policies and robust multinational–local manufacturer collaborations.

The R&D process for branded generics is a strategic, reverse-engineering strategy that develops a bioequivalent, cost-effective form of an innovator drug once its patent expires.

Key Players: Teva and Viatris

Clinical trials for branded generics mostly involve bioequivalence research, which is a type of clinical trial intended to prove that the generic drug is substitutable with the original branded drug.

Key Players: Sun Pharma and Dr. Reddy's Laboratories

Patient services for branded generics are intended to build brand recognition, improve patient confidence, and enhance treatment adherence, which is specifically important since branded generics carry a brand name but not the innovator's premium price.

Key players: Lupin Limited and Zydus Lifesciences

Company Overview

Corporate Information, Headquarters, Year Founded, Ownership Type:

History and Background:

Key Milestones/Timeline:

Business Overview

Business Segments/Divisions:

Geographic Presence:

Extensive global reach, with a strong presence in the United States and Europe, serving over 100 countries.

Key Offerings:

End-Use Industries Served:

Mergers & Acquisitions:

Focus on strategic acquisitions to strengthen the biosimilars portfolio and market reach.

Partnerships & Collaborations:

Product Launches/Innovations:

Capacity Expansions/Investments:

Investments in manufacturing and supply chain to improve efficiency and reliability post-spin-off.

Regulatory Approvals:

Secures multiple FDA and EMA approvals for generic and biosimilar products annually, a core part of its business.

Distribution channel strategy:

Core Technologies/Patents:

Expertise in complex generics (e.g., injectables, inhalation) and high-quality biosimilar development, manufacturing, and analytical techniques.

Research & Development Infrastructure:

Dedicated R&D infrastructure focused on difficult-to-make generics and biosimilars, distinct from the former Novartis innovative R&D.

Innovation Focus Areas:

Strengths & Differentiators:

Market presence & ecosystem role:

Major global supplier of affordable medicines, playing a critical role in increasing patient access, particularly in Europe and the U.S.

SWOT Analysis:

Recent News and Updates

Press Releases:

Industry Recognitions/Awards:

Recognized for contributions to healthcare affordability and for its biosimilar portfolio leadership.

Company Overview

Corporate Information, Headquarters, Year Founded, Ownership Type:

History and Background:

Key Milestones/Timeline:

Business Overview

Business Segments/Divisions:

Geographic Presence:

Operates in over 60 countries, with manufacturing facilities and commercial operations worldwide. Strong market penetration in the U.S. and Europe.

Key Offerings:

End-Use Industries Served:

Wholesalers, retail drugstores, hospitals, clinics, and government agencies.

Key Developments and Strategic Initiatives

Mergers & Acquisitions:

In the current phase, focus is on integrating past large acquisitions and smaller, strategic acquisitions to fill portfolio gaps.

Partnerships & Collaborations:

Product Launches/Innovations:

Capacity Expansions/Investments:

Ongoing optimization of its global manufacturing network to improve efficiency and reduce costs.

Regulatory Approvals:

Secures a high volume of generic drug approvals (Abbreviated New Drug Applications, ANDAs) from the FDA and equivalent bodies globally.

Distribution channel strategy:

Mix of direct distribution and partnerships with major drug wholesalers and pharmacy benefit managers (PBMs) to ensure broad market access and managed care coverage.

Technological Capabilities/R&D Focus

Core Technologies/Patents:

Research & Development Infrastructure:

Global R&D centers dedicated to generic drug formulation, biosimilar development, and specialty pipeline advancement.

Innovation Focus Areas:

Competitive Positioning

Strengths & Differentiators:

Market presence & ecosystem role:

A critical global player in supplying high volumes of essential, affordable generic medications, with a strong focus on maximizing generic market penetration.

SWOT Analysis:

Recent News and Updates

Press Releases:

Industry Recognitions/Awards:

Recognized for its volume contribution to affordable healthcare globally and for key product innovation in specialty areas.

| Company | Headquarters | Key Strengths | Latest Info (2025) |

| Sandoz (Novartis) | Basel, Switzerland | global leadership and scale, an extensive and diverse product portfolio | This company launched a comprehensive range of rivaroxaban film-coated tablets |

| Teva Pharmaceutical Industries Ltd. | Dvorah Haneviah 124 Tel Aviv, Israel | extensive portfolio of approximately 500 generic products in the US | Teva's recent generic drug activity includes the FDA approval and launch of the first generic liraglutide injection |

| Cipla Ltd. | Mumbai, India | focus on affordability and accessibility | Cipla Ltd. has recently focused on introducing specialty generics, including complex oncology and respiratory products |

Read further to see how top players are shaping the future of branded generic market at: https://www.towardshealthcare.com/companies/branded-generics-companies

By Product Type

By Dosage Form

By Therapeutic Area

By Distribution Channel

By End-User Industry / Customer

By Region

February 2026

February 2026

February 2026

February 2026