December 2025

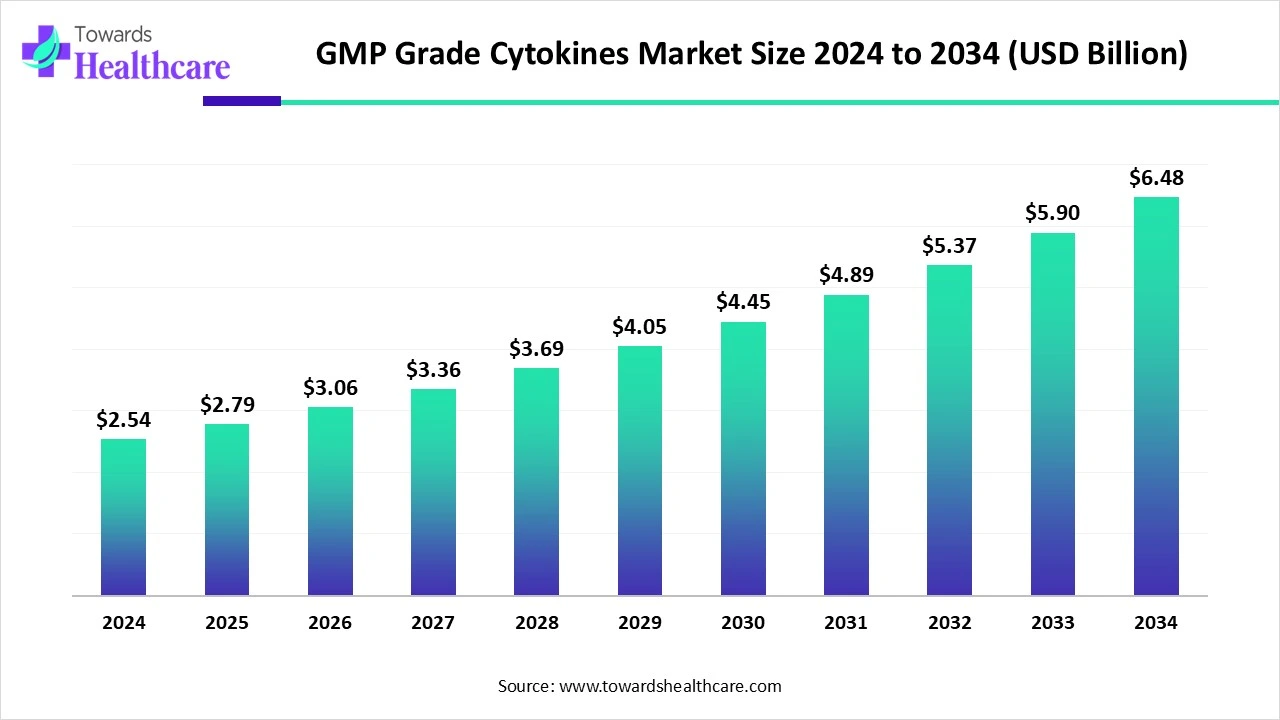

The global GMP grade cytokines market size is calculated at USD 2.54 billion in 2024, grew to USD 2.79 billion in 2025, and is projected to reach around USD 6.48 billion by 2034. The market is expanding at a CAGR of 9.84% between 2025 and 2034.

The GMP grade cytokines market is primarily driven by the rising prevalence of chronic disorders. The growing research and development activities and the need for personalized medicines boost the market. Prominent players collaborate to develop novel products and access advanced technologies. Stringent regulatory policies also favor market growth. The future looks promising, with the advancements in genomic technologies and the increasing number of clinical trials.

| Metric | Details |

| Market Size in 2025 | USD 2.79 Billion |

| Projected Market Size in 2034 | USD 6.48 Billion |

| CAGR (2025 - 2034) | 9.84% |

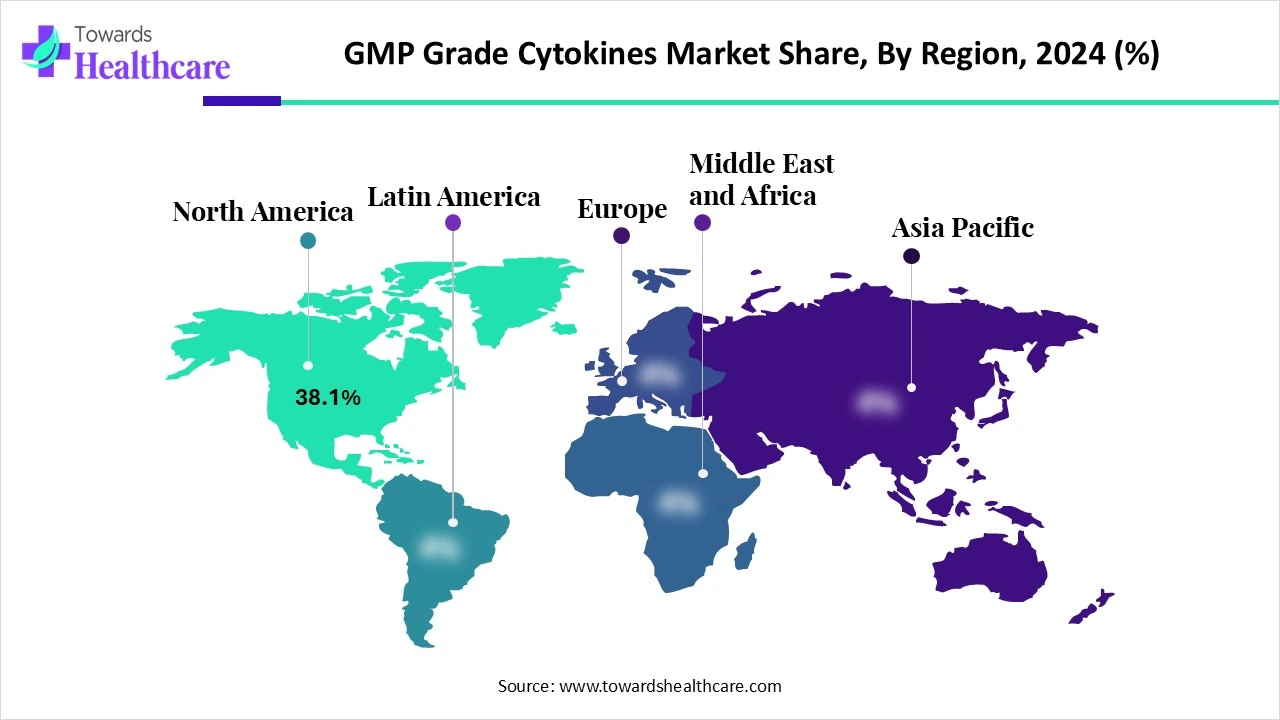

| Leading Region | North America Share 38.1% |

| Market Segmentation | By Cytokine Type, By Application, By Source, By Host Expression System, By End-User, By Formulation, By Packaging Size, By Region |

| Top Key Players | Miltenyi Biotec, PeproTech, CellGenix, Thermo Fisher Scientific, Bio-Techne (R&D Systems), Proteintech Group, ACROBiosystems, STEMCELL Technologies, ReproCELL, Creative Bioarray, GenScript Biotech, Abcam plc, BPS Bioscience, Bioventus, Enzo Life Sciences, ImmunoPrecise Antibodies Ltd., Lonza Group, Creative BioMart, Leinco Technologies, ProSpec Tany TechnoGene Ltd. |

The GMP grade cytokines market refers to recombinant cytokine proteins manufactured under Good Manufacturing Practice (GMP) standards for use in clinical and commercial applications, including cell and gene therapies, regenerative medicine, immunotherapy, and vaccine development. These cytokines are produced under stringent quality controls to ensure safety, consistency, and regulatory compliance. Unlike research-grade cytokines, GMP-grade products are suitable for clinical-grade human applications, often used as critical raw materials in the ex vivo expansion, activation, and differentiation of immune or stem cells.

The factors driving market growth include the increasing prevalence of chronic diseases and the rising demand for personalized medicines. The increasing research activities lead to the development of novel biologics. The rising investments and collaborations among key players contribute to market growth. Government organizations launch initiatives and provide funding for biologics manufacturing.

Integrating artificial intelligence (AI) in cytokine development and production enhances efficiency, precision, and accuracy. AI can increase the productivity of cytokines and improve yields, resulting in high-quality products. It can introduce automation in manufacturing, reducing manual errors. AI-enabled predictive analytics detect potential manufacturing errors, enabling manufacturers to make proactive decisions. AI and machine learning (ML) algorithms can analyze vast amounts of data and suggest desired modifications for developing recombinant proteins. Researchers can develop cytokines based on patients’ conditions. AI and ML can also enable researchers to study the role of cytokines in humans.

Personalized Medicines

The major growth factor for the GMP grade cytokines market is the growing demand for personalized medicines. Personalized medicines, such as cell and gene therapies, monoclonal antibodies, and recombinant proteins, are developed based on a patient’s genetic profile. They offer targeted treatment and reduced systemic side effects. They can treat a wide range of chronic disorders that are not treatable by conventional medicines. Advancements in technology, enormous potential, and rapid pace of innovation promote the demand and development of personalized medicines.

High Manufacturing Cost

The manufacturing of GMP-grade cytokines is expensive and requires high capital investment. This limits the affordability of many companies in low- and middle-income countries, restricting market growth.

What is the Future of the GMP Grade Cytokines Market?

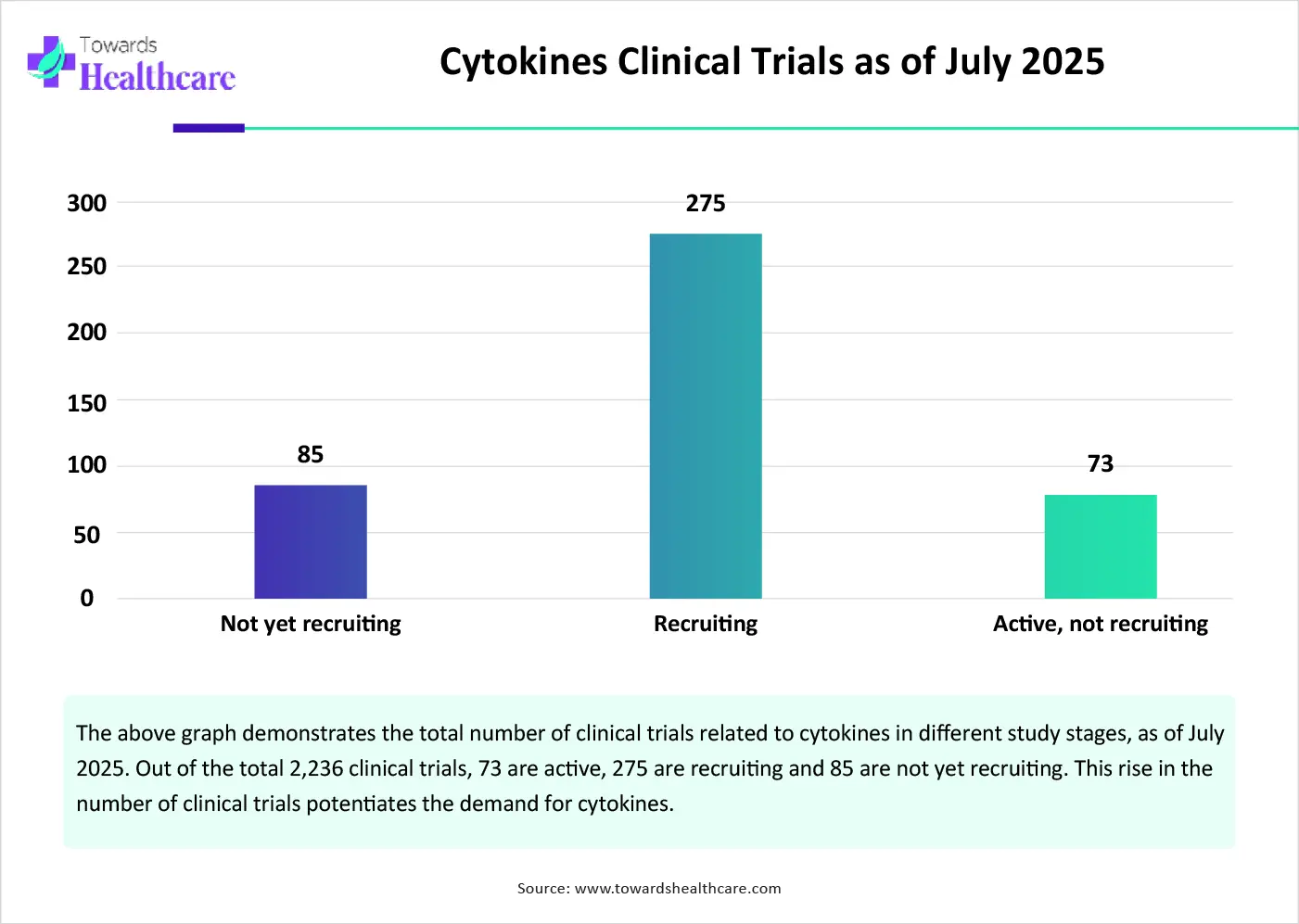

The market future is promising, driven by the advancements in genomic technologies and the increasing number of clinical trials. Advancements in cytokine manufacturing result in enhanced production yields and improved post-translational modifications. The integration of metabolic engineering and systems biology approaches leads to increased productivity and efficiency. Moreover, the increasing number of clinical trials due to growing research activities also presents future opportunities for market players. As of July 2025, there are 2,236 clinical studies related to cytokines on the clinicaltrials.gov website.

By cytokine type, the interleukins segment held a dominant presence in the market in 2024. This is due to their involvement in the growth, differentiation, and activation of other immune cells. Interleukins play a vital role in immunomodulation and exert both inflammatory and anti-inflammatory actions. They are widely used for the treatment of cancer, autoimmune disorders, and other chronic disorders. They provide a deeper understanding of disease progression, enabling researchers to develop novel drugs.

The IL-2 sub-segment held the largest revenue share. The primary functions of IL-2 are the proliferation of effector T and B cells, the development of Treg cells, the differentiation and proliferation of natural killer (NK) cells, and a growth factor for B cells. IL-2 has been approved as an immunotherapy agent for cancer.

The IL-15 sub-segment is expected to grow rapidly. IL-15 also has diverse functions, including T-cell activation, proliferation, and activation of NK cells, and the development of inflammatory and protective immune responses. The demand has emerged due to the recent approval by the U.S. Food and Drug Administration (FDA) of IL-15 superagonist, N-803, for the treatment of bladder cancer.

By application, the cell therapy segment contributed the biggest revenue share of the market in 2024. This segment dominated because cytokines are vital for cell therapy manufacturing. Cytokines are essential for promoting the efficacy of cell therapies and in the development of the unique spectrum of associated toxicities. Ongoing research efforts are made to further understand the role of cytokines in generating a longer-lasting and more potent therapeutic effect and minimizing adverse effects.

The T-cell therapy sub-segment held the largest revenue share. This is due to the widespread applications of T-cell therapies, such as CAR-T cells, T-cell receptors, and tumor-infiltrating lymphocytes. Cytokines positively impact the functioning of these cells and aid in manufacturing high-quality products.

The NK cell therapy sub-segment is expected to grow rapidly. NK cells can rapidly kill multiple adjacent cancer cells and are highly safe. Cytokines play a crucial role in the maturation, activation, and survival of NK cells. This enables researchers to understand impaired function in tumors, enhancing the capability of NK cell therapy.

By source, the human recombinant segment held a major revenue share of the market in 2024. Cytokines are derived from human cells as they can be easily modified and delivered without a specific immune reaction. Human cells understand natural immune response, ensuring therapeutic molecules are recognized and processed correctly by the body’s cells. This results in the development of more effective and targeted treatments.

By source, the murine recombinant segment is expected to grow at the fastest CAGR in the market during the forecast period. Murine recombinant cytokines are preferred due to their resemblance to human cells. They are predominantly used to understand immune responses and disease mechanisms. By modifying murine cytokines, researchers can develop therapeutic products with desired effectiveness and toxicity profiles.

By host expression system, the E.coli segment accounted for the highest revenue share of the market in 2024. This is due to the easy growth of E.coli and a conventional host expression system for multiple experiments for many decades. E.coli has the ability to replicate rapidly and can be easily modified genetically. It is also preferred due to its high efficiency in DNA uptake, safety, and cost-effectiveness. Recombinant cytokines are produced in E.coli through genetic engineering.

By host expression system, the mammalian segment is expected to grow with the highest CAGR in the market during the studied years. Mammalian cells are specifically used as a host for the development of cytokines for human therapeutics. They can be used to produce cytokines with desired properties and with the correct glycosylation patterns. They also have high relevance to human physiology, eliminating the need for researchers to make further changes.

By end-user, the biopharma companies segment led the global market in 2024. The segmental growth is attributed to the need for developing novel products and suitable capital investments. The increasing competition among biopharma companies leads to the launch of novel therapeutics. Biopharma companies comply with stringent regulations while manufacturing biologics. The growing research and development activities in these companies facilitate the segment’s growth.

By end-user, the CDMOs segment is expected to expand rapidly in the market in the coming years. Contract development and manufacturing organizations (CDMOs) have suitable manufacturing facilities and research infrastructure. The increasing number of biopharmaceutical and biotechnology startups potentiates the need for CDMOs. Startups usually do not have specialized infrastructure and relevant expertise to develop and manufacture GMP-grade cytokines.

By formulation, the lyophilized segment accounted for a maximum revenue share of the market in 2024. Lyophilized cytokines are used due to their high stability and easy transport. They can be shipped at room temperature, eliminating the need for cold temperatures for storage and transportation. They are used by reconstituting the lyophilized cytokines in a solution. They can be stored for a longer period while freezing, for up to 2 years.

By formulation, the liquid segment is expected to witness the fastest growth in the market over the forecast period. Cytokines already in solution form eliminate the preparation step and save researchers’ time. They overcome several limitations caused by lyophilization, such as partial loss of activity and damage to protein structure.

By packaging size, the 100-500 µg segment registered its dominance over the global market in 2024. 100-500 µg of cytokines are required for small-scale research purposes, such as studies involving cell cultures and in vivo experiments. The increasing research activities to develop novel recombinant cytokines augment the segment’s growth. Cytokines of 100-500 µg quantity can be used to study the effects of cytokines in humans, modulate immune responses, and assess the impact of treatments on cytokine levels.

By packaging size, the >1 mg segment is expected to show the fastest growth over the forecast period. >1 mg is widely preferred by manufacturers for large-scale manufacturing of biologics. The increasing manufacturing of personalized medicines potentiates the demand for a high quantity of recombinant proteins.

North America dominated the market share by 38.1% in 2024. The presence of key players, increasing investments, and the growing demand for personalized medicines are the major growth factors for the market in North America. Government organizations provide funding for the research and manufacturing of recombinant cytokines. The increasing adoption of advanced technologies also propels market growth.

Key players, such as Thermo Fisher Scientific, Bio-Techne Corporation, and Lonza Group, are the major contributors to the market in the U.S. The demand for personalized medicines in the U.S. is increasing since the launch of the “Precision Medicine Initiative”. In 2023, the FDA approved a total of 16 personalized medicines for rare disease patients.

In July 2024, the Government of Canada announced the opening of STEMCELL Technologies’ state-of-the-art biomanufacturing facility, supported by an investment of $22.5 million. The GMP biomanufacturing facility was opened in British Columbia to support clinical trials for cell therapy, tissue engineering, immunotherapy, gene therapy, and regenerative medicine.

Asia-Pacific is expected to host the fastest-growing GMP grade cytokines market in the coming years. The increasing number of clinical trials and the presence of a suitable manufacturing infrastructure boost the market. Foreign investors are attracted to Asia-Pacific countries to set up their manufacturing facilities due to affordability and favorable infrastructure. Government and private institutions organize conferences, workshops, and seminars to train individuals and raise awareness of GMP-grade cytokines.

The growing demand for affordable and accessible biopharmaceutical products has potentiated the need for China to enhance its geopolitical influence in biomanufacturing. The government has also devised a national strategy to advance the innovativeness of its biotech sector. As of July 2025, 173 clinical studies have been reported in China related to cytokines as an intervention.

India is emerging as a global biomanufacturing hub with government support, increasing investments, and a growing population. The federal government recently launched the BioE3 policy (Biotechnology for Economy, Environment, and Employment) to foster sustainable and high-performance biomanufacturing.

Europe is expected to grow at a notable CAGR in the GMP grade cytokines market in the foreseeable future. The rising prevalence of chronic disorders and the growing research and development activities augment market growth. Key players collaborate to access advanced technologies and develop novel cytokines. Stringent regulatory policies and the expanding biotech sector contribute to market growth.

REPROCELL Europe Ltd. and Sartorius AG provide high-quality GMP-grade cytokines to the UK biopharma sector. The UK government’s Biomanufacturing Fund (BMF) allocated £520 million over five years (2025-2030) for life sciences manufacturing. It recently invested £38 million to incentivize investment in the manufacture of vaccines and biotherapeutics.

Dr. Agi Hamburger, Chief Operating Officer at A2 Biotherapeutics, Inc., commented that the company is impressed by the simplicity and scalability of the G-Rex platform and looks forward to exploring its applications in its clinical development programs. He also said that as an early-stage company, the G-Rex Grant provides valuable resources to support process development and comparability studies.

In January 2025, ScaleReady, Wilson Wolf Manufacturing, and Bio-Techne Corporation awarded a $125,000 G-Rex Grant to Seattle Children’s Therapeutics. The grant will integrate state-of-the-art advancements in the CAR-T cell platform. The company will also examine the full array of G-Rex bioreactors and the broad range of Bio-Techne’s GMP-grade cytokines to optimize the manufacturing of future CAR-T and other trials.

By Cytokine Type

By Application

By Source

By Host Expression System

By End-User

By Formulation

By Packaging Size

By Region

December 2025

December 2025

December 2025

October 2025