January 2026

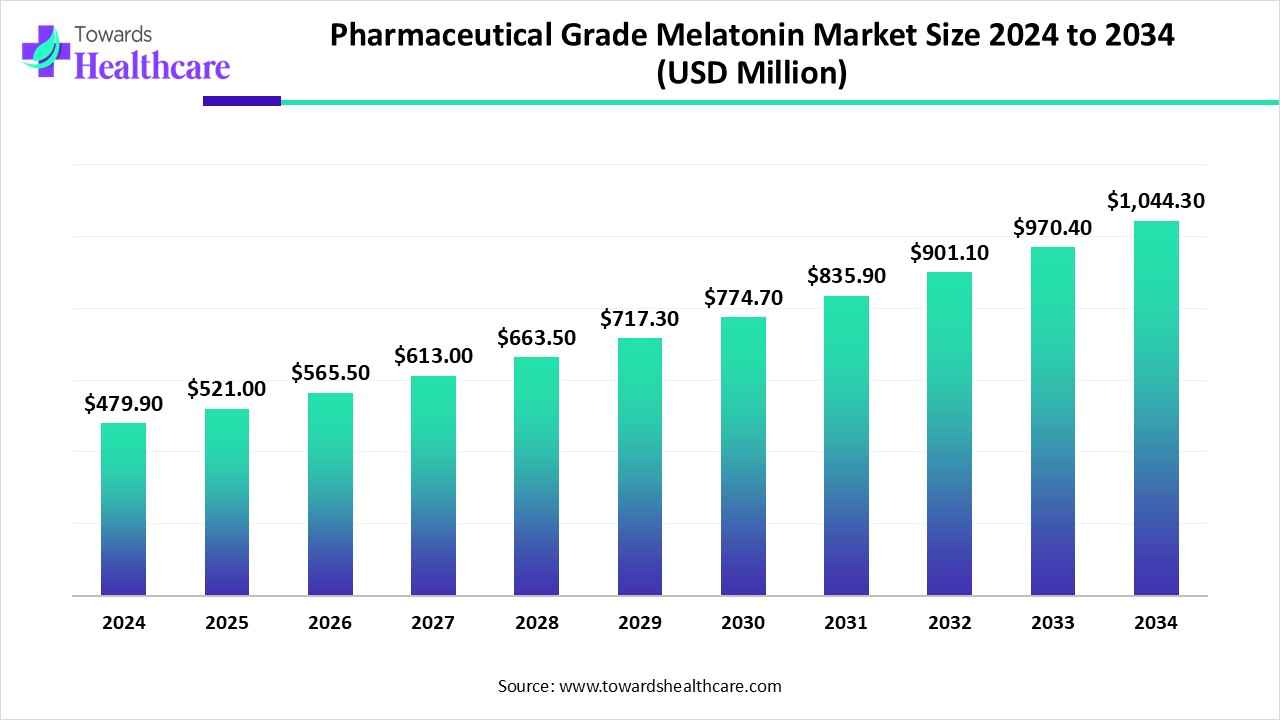

The global pharmaceutical grade melatonin market size is calculated at USD 479.9 million in 2024, grew to USD 521 million in 2025, and is projected to reach around USD 1044.3 million by 2034. The market is expanding at a CAGR of 8.56% between 2025 and 2034.

The pharmaceutical grade melatonin market is primarily driven by the increasing prevalence of sleep disorders and the growing demand for natural sleep aids. Ongoing efforts are made to identify the role of melatonin in neuroprotection and immune modulation. The increasing R&D investments, rising adoption of melatonin therapy, and favorable government support propel the market. Artificial intelligence (AI) revolutionizes the development of melatonin formulations, enhancing their efficacy.

| Table | Scope |

| Market Size in 2025 | USD 521 Million |

| Projected Market Size in 2034 | USD 1044.3 Million |

| CAGR (2025-2034) | 8.56% |

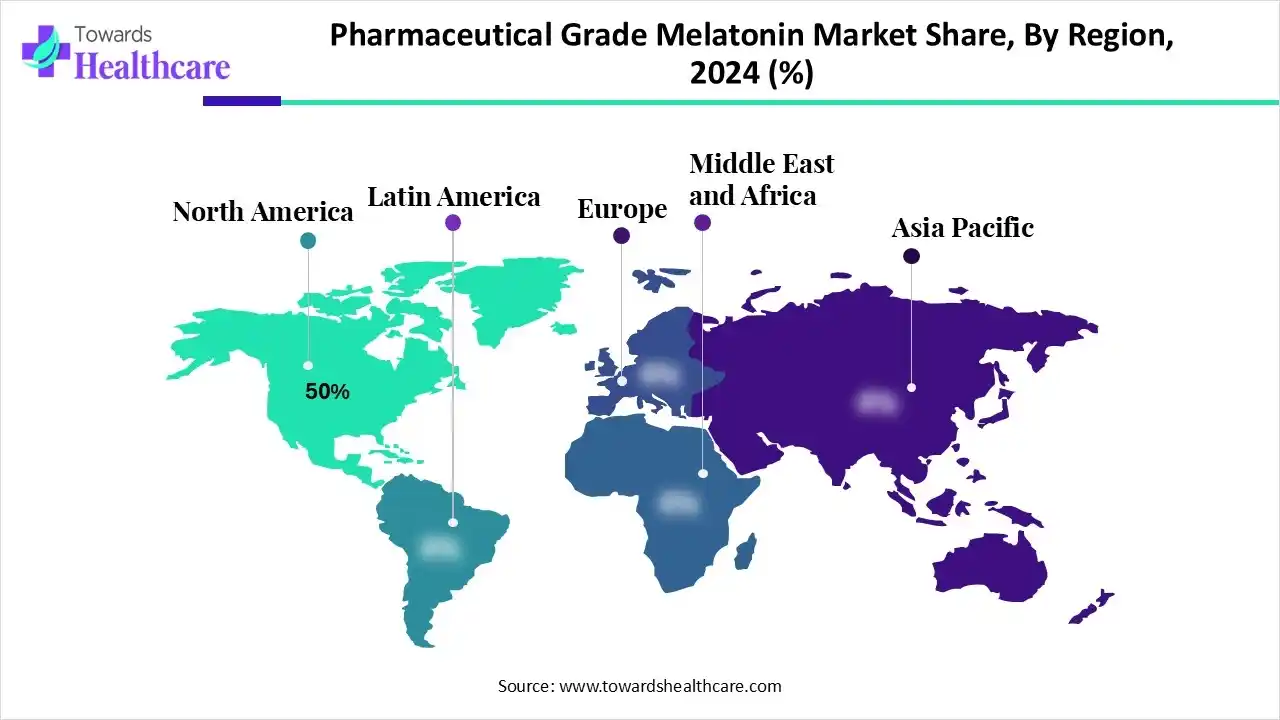

| Leading Region | North America by 50% |

| Market Segmentation | By Drug Type, By Synthesis Technology, By Application/Therapeutic Area, By Route of Administration, By Distribution Channel, By Type of Manufacturer, By Region |

| Top Key Players | Kemin Industries, Inc., Nutraceutical Corporation, Life Extension, Pharmaceutics International, Inc., TCI Chemicals, Pharmavite LLC, Evolva Holding SA, Sabinsa Corporation, Capsugel (Lonza Group AG), Himalaya Drug Company, Nutrivita GmbH |

The pharmaceutical grade melatonin market is experiencing robust growth, driven by the rising prevalence of sleep disorders, increasing adoption of melatonin therapy in clinical practice, demand for natural and safer sleep aids, and expanding research on melatonin’s role in neuroprotection, immune modulation, and chronobiology. It encompasses the production and distribution of high-purity melatonin formulations that meet stringent regulatory standards for use in clinical and prescription settings. Pharmaceutical-grade melatonin is widely used for treating sleep disorders such as insomnia, delayed sleep phase disorder, jet lag, and other circadian rhythm-related conditions.

AI can improve the market by assisting researchers in developing novel formulations and large-scale production. AI and machine learning (ML) algorithms can analyze vast amounts of data and can predict the compatibility of pharmaceutical excipients with melatonin. This helps researchers in developing more stable formulations. AI and ML can also predict the pharmacokinetic and pharmacodynamic properties of melatonin. Additionally, they can automate the large-scale production of melatonin.

By drug type, the branded melatonin drugs segment held a dominant presence in the market with a share of 65% in 2024, due to the growing demand for innovative drugs for expanded applications. Companies experience the benefits of intellectual property (IP) rights for their branded melatonin drugs. Regulatory agencies approve melatonin based on its safety and efficacy profiles. This increases trust among patients, potentiating the demand for branded drugs.

By drug type, the generic melatonin drugs segment is expected to grow at the fastest CAGR in the market during the forecast period. Generic melatonin drugs are more cost-effective than branded drugs, as they are developed after patent expiration and do not require clinical trials. They enhance patient convenience, benefiting patients from low- and middle-income groups. The increasing healthcare expenditure encourages patients to purchase generic alternatives to medicines.

By synthesis technology, the chemical synthesis segment held the largest revenue share of 75% in the market in 2024, due to the ability to modify chemical structure based on the desired pharmacological effects. Chemical synthesis is the most widely preferred method for producing melatonin, as researchers can add or replace functional groups to modify biological activity and pharmacokinetic properties. It can also lead to drug candidates that can target multiple pathways simultaneously.

By synthesis technology, the fermentation/biotechnological production segment is expected to grow with the highest CAGR in the market during the studied years. The growing demand for natural supplements as therapeutics boosts the segment’s growth. Advances in fermentation technology and the increasing use of AI are revolutionizing the development of melatonin from natural sources. Several amino acids and enzymes are used to produce melatonin.

By application/therapeutic area, the sleep disorders segment contributed the biggest revenue share of 60% in the market in 2024, due to the rising prevalence of sleep disorders, such as insomnia, delayed sleep phase syndrome, and circadian rhythm disorders. It is estimated that about 50 to 70 million Americans suffer from sleep disorders. The chances of sleep disorders increase in patients with anxiety and depression. Additionally, the increasing international traveling across different geographical locations leads to jet lag, potentiating the demand for melatonin.

By application/therapeutic area, the neurological disorders segment is expected to expand rapidly in the market in the coming years. The growing research activities and the increasing prevalence of neurological disorders augment the segment’s growth. According to a recent survey published in The BMJ journal, the prevalence of people living with Parkinson’s disease will be approximately 25.2 million globally in 2050, representing a 112% increase from 2021. Researchers are evaluating the significance of melatonin for treating neurological disorders.

By route of administration, the oral segment accounted for the highest revenue share of 85% in the market in 2024, due to ease of administration and widespread availability. Oral formulations, such as tablets, capsules, and liquids, can be administered by patients of all age groups. They can provide sustained and immediate release of active ingredients, providing desired effects. They are cost-effective and more stable compared to other formulations, enhancing patient convenience.

By route of administration, the topical segment is expected to witness the fastest growth in the market over the forecast period. The demand for topical melatonin formulations is increasing due to the need for targeted delivery of melatonin and easy application. Topical melatonin formulations give localized effects at the site of their application by penetrating the drug into the underlying layers of the skin. They can be used as a photo-protective, anti-aging, and hair growth-promoting agent.

By distribution channel, the retail pharmacies segment led the market with a share of 45% in 2024, due to favorable infrastructure and the presence of skilled professionals. Skilled professionals guide patients about appropriate drug delivery and dosing. The increasing number of retail pharmacies increases patient accessibility. Retail pharmacies offer numerous advantages, such as free home delivery and 24x7 services.

By distribution channel, the online pharmacies segment is expected to show the fastest growth over the forecast period. Online pharmacies enable patients to purchase melatonin in the comfort of their homes. Patients can purchase melatonin formulations from a wide range of options and at affordable rates. They offer numerous benefits, such as same-day home delivery, specialized discounts, and virtual consultations.

By type of manufacturer, the in-house manufacturing segment held a major revenue share of 70% in the market in 2024, due to increasing investments from venture capitalists. This helps pharmaceutical and nutraceutical companies to leverage advanced technologies to develop and manufacture innovative melatonin. In-house manufacturing provides manufacturers the complete control over the entire manufacturing process, enabling them to make specific modifications.

By type of manufacturer, the outsourced manufacturing segment is expected to account for the fastest growth in the upcoming years. Several small- and mid-sized companies lack specialized facilities to manufacture melatonin. This necessitates them to outsource their development and manufacturing activities to CDMOs and CROs. CDMOs and CROs have skilled professionals who provide relevant expertise and customized solutions to complex problems.

North America dominated the global market share by 50% in 2024. The availability of state-of-the-art research and development facilities, the presence of key players, and a robust healthcare infrastructure are the major growth factors of the market in North America. The increasing travel across different geographical locations fosters the demand for melatonin. The rising prevalence of neurological disorders and the growing geriatric population augment the market.

In the U.S., melatonin is considered a dietary supplement and is not regulated by the FDA. Melatonin is used for various disorders, including sleep and neurological disorders. According to a new survey by the American Academy of Sleep Medicine, 12% of Americans were diagnosed with chronic insomnia. As of 2024, 6.9 million Americans aged 65 years and older were living with Alzheimer’s disease, and it is projected to further reach 13.8 million by 2060.

Health Canada recently added melatonin and its salts to the Prescription Drug List (PDL) for the treatment of insomnia in patients with Autism Spectrum Disorder and/or Smith-Magenis Syndrome. Recent data from Statistique Canada reported that around 575,100 overseas residents, especially from Europe and Asia, arrived in Canada in May 2025. Canadian residents returned from 3.4 million trips abroad in May. Additionally, Canadian-resident return trips by air from overseas countries increased by 9.3% in May 2025.

Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period. The increasing prevalence of sleep disorders, mainly due to sedentary lifestyles, potentiates the demand for pharmaceutical-grade melatonin. People are more aware of using natural products to maintain human health. Asia-Pacific countries like China, India, and Japan have suitable manufacturing infrastructure, encouraging foreign companies to set up their manufacturing facilities in these countries. Favorable trade policies also contribute to market growth.

China is the largest exporter of melatonin in the world, accounting for a total of 353 shipments from June 2024 to May 2025. These exports were made by 95 Chinese exporters to 115 buyers, representing a 79% growth rate from the previous year. The majority of the exports were made to the U.S., India, and Russia. Fengchen Group, VDK NaturaSyn, and Green Sky Bio are the major manufacturers of melatonin in China.

India is the second-largest global exporter of melatonin, accounting for 75 shipments from October 2023 to September 2024. 17 Indian exporters made exports to 28 global buyers, representing a 9% growth rate compared to the previous year. The U.S., Turkey, and Mexico were the major importers of melatonin from India. Velnex Medicare, Neuracle Lifesciences, and Abco India are renowned manufacturers in India.

Europe is considered to be a significantly growing area in the market. The burgeoning healthcare sector and the rapidly expanding clinical trial infrastructure bolster the market. Favorable regulatory support leads to the development of innovative melatonin formulations. The European Medicines Agency (EMA) regulates the approval of melatonin in European nations. Government organizations provide funding and launch initiatives to seek early diagnosis and screen for chronic disorders, enabling healthcare professionals to provide early intervention.

The Medicines and Healthcare products Regulatory Agency (MHRA) authorizes the use of melatonin as a prescription-only medicine for specific sleep disorders, including insomnia and jet lag, in both adults and children over the age of 6 years. A total of 117,093 patients aged 17 years or under were prescribed melatonin in the first quarter of 2024/25. This represents a 245% rise in melatonin prescription in children in 9 years, i.e., from 2015 to 2024.

Researchers are evaluating the role of melatonin in the treatment of various conditions, including cancer, metabolic disorders, gastrointestinal conditions, and reproductive dysfunctions.

Key Players: Sanofi, Roche International, Inc., and Mylan Laboratories.

Clinical trials are conducted to assess the safety and efficacy of melatonin formulations. Regulatory agencies like the FDA, EMA, and NMPA regulate the approval of melatonin.

Key Players: Neurim Pharmaceuticals Ltd., Kuhnil Pharmaceutical Co., Ltd., and Teva Pharmaceuticals.

Patient support & services involve medical supervision, guidance on side effects and dosing, and drug delivery.

By Drug Type

By Synthesis Technology

By Application/Therapeutic Area

By Route of Administration

By Distribution Channel

By Type of Manufacturer

By Region

January 2026

December 2025

December 2025

November 2025