January 2026

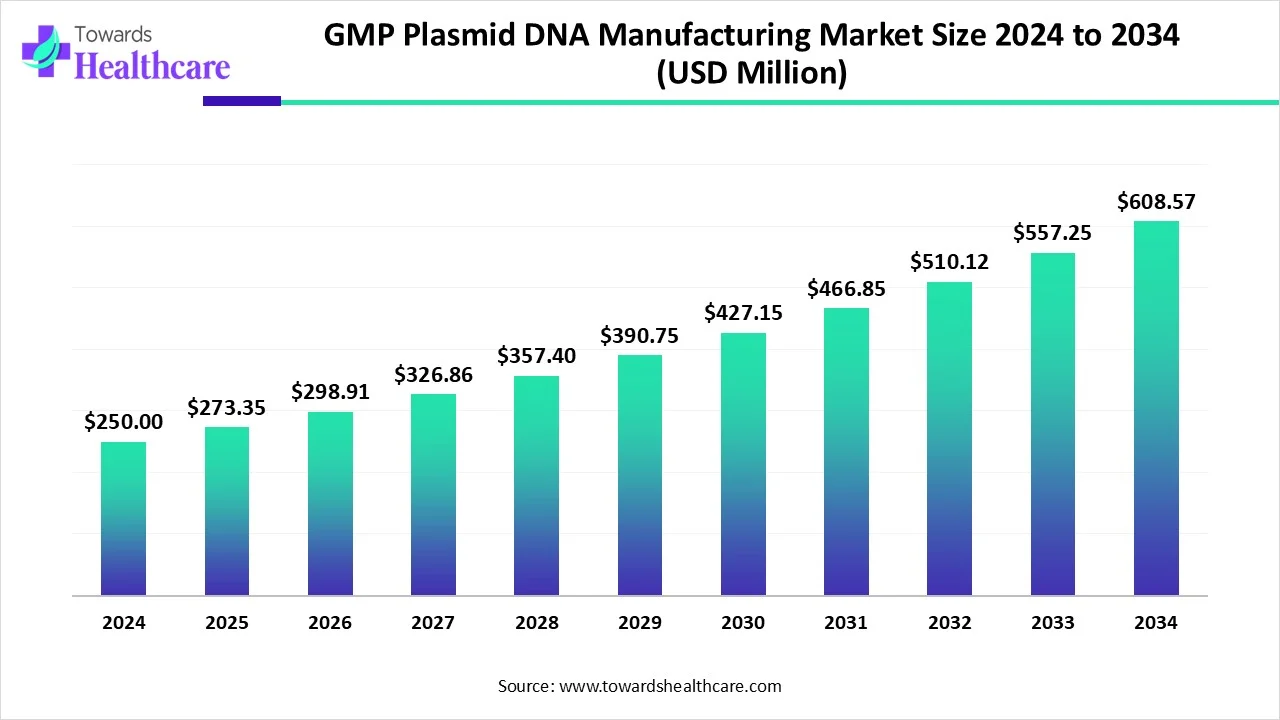

The global GMP plasmid DNA manufacturing market size is calculated at USD 250 in 2024, grew to USD 273.35 million in 2025, and is projected to reach around USD 608.57 million by 2034. The market is expanding at a CAGR of 9.34% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 273.35 Million |

| Projected Market Size in 2034 | USD 608.57 Million |

| CAGR (2025 - 2034) | 9.34% |

| Leading Region | North America |

| Market Segmentation | By Product, By Type, By Application, By Region |

| Top Key Players | Thermo Fisher Scientific, Cobra Bio, Rescript Probe, Wuxi Advanced Therapies, Charles River, Weisman Biomanufacturing, Bioscience, Lake Pharma, Alderton, Kaneka Neurogenetic S.A., Catalent Biologics, Neurogenetic, Nature Technology Corporation, Vector Builder, VGXI, Inc., Plasmid Factory, Delphi Genetics, Esko Aster, Bionian, Creative Biolabs, Vilene Biosciences, Patheon, Cognate Bio Services |

Health Canada and the FDA in the U.S. are two examples of regulators that guarantee the quality of pharmaceutical products. In the pharmaceutical sector, they impose stringent and detailed rules on medication producers. The term "GMP" (Good Manufacturing Practice) refers to the quality control methods established by organizations that oversee the approval of pharmaceutical and medical goods. Plasmid DNA is manufactured and quality tested as a raw material or ingredient for medicines or gene therapy products with the help of a GMP-grade plasmid production manufacturing service.

The creation of DNA plasmid vectors using artificial intelligence is a ground-breaking development in genetic engineering. It is possible for researchers to create vectors with enhanced safety profiles, performance, and specificity by utilizing AI's analytical capabilities and predictive modeling. AI is advancing the field in conjunction with gene-editing tools like CRISPR-Cas9, which enable precise genomic modifications for medicinal purposes. AI will surely provide new opportunities and transform the biotechnology environment as it advances, leading to previously unimaginable successes.

Growing Interest in Cell and Gene Therapy

Worldwide, almost 1,500 clinical studies are being carried out to assess gene and cell treatments. The design and kind of gene delivery vector utilized (in therapy development and/or administration) have been found to be critical to the clinical efficacy of these treatments over time. Currently, a number of innovative businesses are working hard to design and produce viral and/or non-viral vectors for gene and cell treatments.

Challenges in Designing Plasmid DNA

Since the inclusion of endotoxins, plasmid structural breakdown products, and host cell DNA may compromise the safety and effectiveness of gene therapy, purified plasmid DNA is a crucial manufacturing duty. Because even slight contamination can result in delays, batch failure, and decreased product quality, contamination during the plasmid DNA synthesis process is a serious problem.

How Expansion of Biopharmaceutical Facilities Promote the GMP Plasmid DNA Manufacturing Market?

The development of the infrastructure needed to produce biopharmaceuticals is another important industrial driver. To accommodate the increasing demand, manufacturers are investing in modern facilities with state-of-the-art equipment, including chromatography systems, scalable purification procedures, and single-use bioreactors. These advancements make it simpler to produce plasmid DNA effectively in accordance with Good Manufacturing Practices (GMP), which raises its acceptability for therapeutic usage. Additionally, the growing number of contract development and manufacturing organizations (CDMOs) that focus on plasmid DNA production has given smaller biotech companies a dependable outsourcing option.

By product, the plasmid DNA segment led the GMP plasmid DNA manufacturing market in 2024. Plasmids are used in genetic engineering to amplify, or produce many copies of, specific genes. They use a variety of techniques and are engaged in the research of genetic engineering and gene therapy. Scientists have discovered a number of uses for plasmids and have created instruments to extract plasmid DNA sequences for use in various ways. They are also used in large-scale protein replication, such as that of the protein that codes for insulin.

By product, the viral vectors segment is estimated to grow at a significant rate in the GMP plasmid DNA manufacturing market during the forecast period. Viral infections are ideal delivery systems because they are good at locating and entering target cells. In order to cure a number of diseases, such as cancer, metabolic disorders, heart defects, and neurological disorders, gene therapy can employ viral vectors. The evidence supporting the use of recombinant viral vectors for immunization is growing.

By type, the preclinical therapeutics segment held the major share of the GMP plasmid DNA manufacturing market in 2024. Any medicine that makes it to human trials must be thoroughly tested through high-quality preclinical research. Preclinical investigations are often rather small. These studies must, however, include comprehensive details regarding dosage and toxicity levels. Following preclinical testing, scientists evaluate their results and determine if human testing is necessary.

By type, the clinical therapeutics segment is expected to grow at the fastest CAGR in the GMP plasmid DNA manufacturing market during the predicted timeframe. The goal of clinical therapeutics is to identify and treat diseases by utilizing both traditional medicine and state-of-the-art research. The development of medicine and the improvement of global health depend on clinical research. Clinical research is the cornerstone of modern healthcare, driving medical advancements and breakthroughs that have the potential to transform people's lives. The significance of clinical research, from creating new treatments to enhancing existing ones, cannot be overstated.

By application, the DNA vaccines segment was dominant in the GMP plasmid DNA manufacturing market in 2024. The best way to apply immunological concepts to human health is through vaccination. A straightforward but efficient method of generating broad-based immunity is provided by DNA vaccines. DNA vaccines seem to have several advantages over traditional vaccinations, such as the capacity to elicit a greater variety of immune responses. Human studies are underway for a number of DNA vaccines, including those for herpesvirus, AIDS, influenza, Ebola, and malaria.

By application, the gene therapy segment is anticipated to be the fastest-growing in the GMP plasmid DNA manufacturing market during 2025-2034. The treatment of illnesses has changed significantly as a result of gene therapy. By changing a patient's gene expression or correcting defective genes, gene therapy commonly aims to address the root cause of diseases. Many new gene and cell therapies have been authorized by the U.S. Food and Drug Administration (FDA) in the last 20 years. Effective gene therapies might save years or even decades of morbidity with only one treatment.

North America dominated the GMP plasmid DNA manufacturing market in 2024 due to its stronger biopharmaceutical industry, more advanced healthcare system, and large investments in vaccine and gene therapy research. Demand surged as a result of the ongoing requirement for plasmid DNA in gene therapy, vaccine production, and especially mRNA vaccines. It committed to investing USD 100 million to build a plasmid DNA synthesis plant in June 2024. It was unclear of its place in the new biotechnology industry, which was focused on gene engineering and molecular pharmaceuticals, just as in the U.S.

The market is majorly growing in the U.S. due to rising demand for gene and cell therapies. The country has various regulatory bodies to oversee the standards. Products involving human gene therapy, cellular therapy, and some cell and gene therapy-related devices are governed by the Center for Biologics Evaluation and Research (CBER). CBER conducts its oversight under the Federal Food, Drug, and Cosmetic Act and the Public Health Service Act.

The national organization that represents Canada's biotechnology industry is called BIOTECanada. The more than 230 businesses that are members of BIOTECanada are representative of the larger Canadian biotech ecosystem, which includes universities, incubators, accelerators, clinical-stage pre-commercial businesses, multinational pharmaceutical companies, early-stage/start-ups, venture capital, and hubs in every province. The life sciences industry has produced previously unheard-of value as a result of federal government initiatives and private sector investment. Important federal pledges such as the Strategic Innovation Fund (SIF), the Biomanufacturing Life Sciences Strategy (BMLSS), the resupply of the Venture Capital Catalyst Initiative (VCCI), and the newly formed Health Emergency Response Canada (HERC).

Asia Pacific is estimated to host the fastest-growing GMP plasmid DNA manufacturing market during the forecast period. The biotechnology sector in this area is still growing rapidly due to the substantial financial assistance given by both governmental and commercial organizations. China, India, and Japan are driving the development in plasmid DNA manufacturing because of their sizable populations, who require immunizations and gene-based therapies to enhance healthcare results. The need for healthcare solutions is rising as a result of China's quickly growing urbanization programs and rapidly growing elderly population, which is predicted to reach 400 million by 2030.

China's domestic biotech industry appears to be getting more inventive, according to a number of recent signs. These include an increase in the quantity and caliber of scientific publications pertaining to biotechnology, a rise in the number of new Chinese medications authorized by China's National Medical Products Administration (NMPA) and the U.S. Food and Drug Administration (FDA), a rise in out-licensing agreements from small Chinese biotech firms, especially in the field of oncology, and an increase in clinical trials taking place in China.

As seen by the large number of patents registered, Japan has one of the most advanced biotechnology industries globally. As seen by the large number of patents registered, Japan has one of the most advanced biotechnology industries globally. As seen by the large number of patents registered, Japan has one of the most advanced biotechnology industries globally.

Europe is expected to grow significantly in the GMP plasmid DNA manufacturing market during the forecast period. Both industry-based and institute-based research are growing throughout Europe. At the same time, treating rare illnesses is becoming increasingly important. Therefore, the government is providing aid in addition to these factors, which promotes market expansion.

In 2024, the UK biotech industry saw tremendous expansion, attracting £3.5 billion in investment, a startling 94% rise over the year before. In terms of biotech innovation, the UK leads the world and draws the most venture money in Europe. According to this year's data, biotech is a thriving, burgeoning industry in the UK with a remarkable capacity to draw in foreign investment. Some of the most pressing health issues in the world are being tackled by UK life science firms, from developing innovative medicines to leading early-stage research.

A noteworthy component of the European biotech scene, France's healthtech industry is distinguished by its wide range of expanding businesses. This industry, which encompasses biotech, medtech, and digital health, has over 2,600 businesses, including 820 biotechs. About 60,000 jobs are supported by it, demonstrating its significance for both innovation and the French economy overall. France has established itself as a pioneer in Europe's rare illness sector within this environment.

In July 2024, Kaneka Eurogentec, an FDA-inspected CDMO that specializes in injectable grade cGMP biopharmaceuticals, received an order for one kilogram of plasmid DNA from a major drug research company. The CEO of Kaneka Eurogentec, Lieven Janssens, stated that this successful production opens up commercial opportunities for plasmid DNA pharmaceutical research companies in the DNA vaccine and non-viral gene therapy sectors. The costs of launching a plasmid DNA-based medication depend on how well the production infrastructure works. (Source - Eurogentec)

By Product

By Type

By Application

By Region

January 2026

January 2026

December 2025

December 2025