January 2026

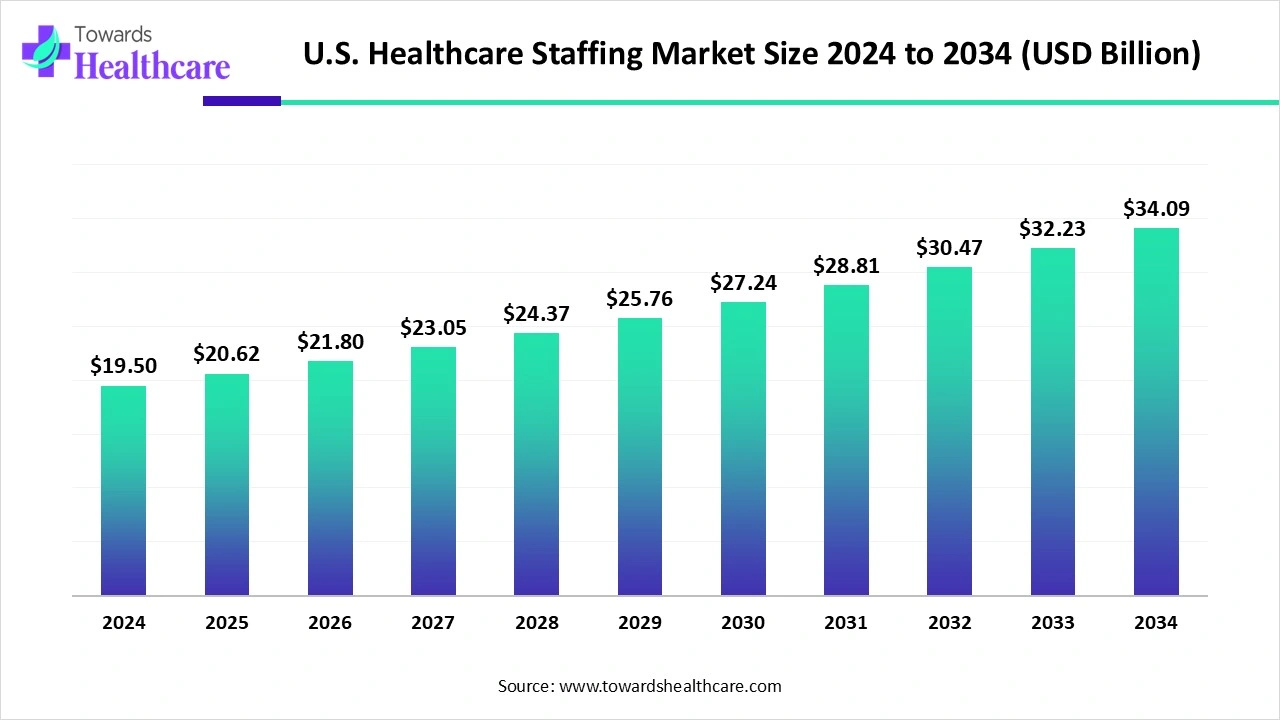

The U.S. healthcare staffing market size is estimated at US$ 19.5 billion in 2024, is projected to grow to US$ 20.62 billion in 2025, and is expected to reach around US$ 34.09 billion by 2034. The market is projected to expand at a CAGR of 5.74% between 2025 and 2034.

The U.S. healthcare staffing market is growing because of the rising demand for healthcare professionals due to the workforce shortage and the elderly population. Recent progress in technological advancement in online healthcare is reshaping the medical care staff. Strong presence of healthcare key players in the U.S., such as AMN Healthcare, Cross Country Healthcare, and CGH, is increasing demand for healthcare staffing.

| Table | Scope |

| Market Size in 2025 | USD 20.62 Billion |

| Projected Market Size in 2034 | USD 34.09 Billion |

| CAGR (2025 - 2034) | 5.74% |

| Market Segmentation | By Occupational Category, By Service Model, By End User / Buyer, By Employment Type / Contract Length |

| Top Key Players | AMN Healthcare, Aya Healthcare, Cross Country Healthcare, CHG Healthcare (CompHealth / Weatherby Healthcare), Jackson Healthcare, Medical Solutions, Supplemental HealthCare, Aureus Medical Group, Maxim Healthcare Services, Fastaff Travel Nursing, RNnetwork, Host Healthcare, Soliant Health, Health Carousel, LocumTenens.com, TeamHealth (physician staffing & services), Envision Healthcare (physician services / ED staffing), Interim HealthCare (home health & staffing), Favorite Healthcare Staffing, All Medical Personnel / Regional staffing groups |

The U.S. healthcare staffing market comprises agencies, platforms, and service providers that place clinical and non-clinical personnel across hospitals, clinics, long-term care, home health, and other care settings. Services include travel nursing, permanent placement, locum tenens, allied health staffing, per-diem and PRN staffing, home-care aides, and outsourced workforce management. The market is driven by clinician shortages, seasonal and regional demand volatility, rising use of contingent labor, value-based care pressures, and growing needs for home- and community-based care.

Recent advancements in modern technology, such as AI, ML, and Virtual health, which drive the growth of the market.

For instance,

For Instance,

Integration of AI in the U.S. healthcare staffing drives the growth of the market, as AI-driven technology supports nurses in various facilities and units with unmatched accuracy. This technology analyzes vast datasets, and AI considers qualifications, past performance, patient requirements, and capability culture to make the best matches. This confirms that governments get professionals who meet the standards and align with their particular needs and values. AI-driven technology in the medical staffing process gathers data and makes recommendations in real time. This quick response is precious, particularly when facilities face sudden workforce shortages or must address rapid patient care demands. AI-based technology leads to momentous cost savings for healthcare organizations, which drives the growth of the healthcare staffing market.

For Instance,

Increasing Demand for Temporary Staffing

Temporary staffing is common in healthcare, where workforce needs often fluctuate. It helps sustain patient care quality by preventing understaffing and burnout. Although temporary staff bring valuable experience, overreliance can lead to consistency issues. Combining temporary workers with permanent staff ensures continuity, fills staffing gaps, and maintains care standards. These workers can be quickly deployed during emergencies or demand surges, such as flu outbreaks or staff shortages. Typically, temporary staff do not receive benefits like health insurance or paid time off, which reduces overall labor costs for healthcare facilities. This cost-saving aspect contributes to the expansion of the U.S. healthcare staffing market.

Major Limitations of Healthcare Staffing Services

The inconsistency in patient care happens because temporary staff work for short periods, disrupting continuous care. Patients and permanent staff often need to adapt to new professionals frequently, which limits the expansion of the U.S. healthcare staffing market.

Increasing Focus on Specialized Skilled Staff

With the increasing advancement of the healthcare industry, there's an increasing demand for specialized skills in temporary staffing. Many companies now prefer workers with specific expertise to manage complex projects or fill vital roles. This trend is especially noticeable in sectors like healthcare, where such knowledge greatly influences project outcomes. A healthcare expert might be hired to oversee a network upgrade, and a healthcare worker could be contracted short-term to address staffing shortages in crucial departments, contributing to the growth of the U.S. healthcare staffing market.

For Instance,

By occupational category, the nursing segment led the U.S. healthcare staffing market, as increasing demand for temporary nurses due to ongoing challenges in the nursing field. Clinics and hospitals require the right staff mix, and temporary nurses become an important part of the services. This trend supports meeting short-term healthcare requirements and provides nurses with flexible job choices. They support providing consistent care and maintaining proper nurse-to-patient ratios. Temporary nurses introduce fresh perspectives from different healthcare environments.

On the other hand, the home health aides and personal care attendants segment is projected to experience the fastest CAGR from 2025 to 2034, as an increasing aging population that is living longer with more chronic health requirements, growing recruitment, and successful retention of home care aides are important. Home health aides assist in the recovery of the chronically diseases, the elderly, and those who provide care and sometimes relief from the emotional and physical stress of caregiving.

By service model, the travel/contingent staffing segment is dominant in the U.S. Healthcare Staffing Market in 2024, as the growing demand translates into more job opportunities, modest pay, and a higher level of job security for travel medical care professionals. Travel professionals have a huge opportunity to work in non-traditional medical care settings, with clinics, mental health facilities, and rehabilitation centres, increasing their skill set and career adaptability.

The managed services/MSP and vendor management segment is projected to grow at the fastest CAGR from 2025 to 2034, as these services progressively support healthcare organizations in keeping up with, among other things, compliance and safety concerns. It improves operational effectiveness by rationalizing processes, reducing downtime, and securing sensitive patient data to comply with regulations. Managed services in medical care provide 24/7 support and zero downtime by active monitoring and rapid problem-solving.

By end user, the hospitals & health systems segment led the U.S. healthcare staffing market in 2024, as temporary staffing supports maintain patient care quality by avoiding understaffing and burnout. While temporary staff bring experience, consistency can be an issue if relied on too heavily. Balancing temporary workers with permanent staff ensures continuity while filling gaps and maintaining care standards.

The home health & hospice providers segment is projected to experience the fastest CAGR from 2025 to 2034, as home health services contribute to the recovery of the chronically ill, the elderly, and those who offer care and occasionally require relief from the emotional and physical stress of caregiving. Major home health aides work in assisted living services, which offer independent living in a group environment, with specialised care available as desired. Home health care is a service of care provided by expert practitioners to patients in their homes under the supervision of a physician.

By employment type/contract length, the temporary/contract segment led the U.S. Healthcare Staffing Market in 2024, as temporary staffing provides a broad range of benefits, with flexibility, affordability, and improved patient care. Temporary employment leads to enlarged job satisfaction by letting healthcare workforces select assignments that align with their career goals and interests.

The per-diem/on-call segment is projected to experience the fastest CAGR from 2025 to 2034, as per diem services offer advantages such as encouraging training, growing staff motivation, and enhancing salary. Per diem medical care workers offer significant support in meeting changing patient volumes and addressing instant care requirements. Per diem staffing improves healthcare services by enhancing patient care, lowering expenses, and growing consumer satisfaction.

The South U.S. was dominant in the U.S. healthcare staffing market in 2024, as an increasing aging population and a shortage of healthcare professionals increased the demand in the market. Healthcare facilities are offering higher wages, bonuses, and better contracts, making healthcare staffing agencies more valuable in sourcing talent. It saves enterprises time and resources. More than 18,000 nurses, conducted by AMN Healthcare Services Inc, revealed that 30% of respondents are considering leaving their careers.

For Instance,

For Instance,

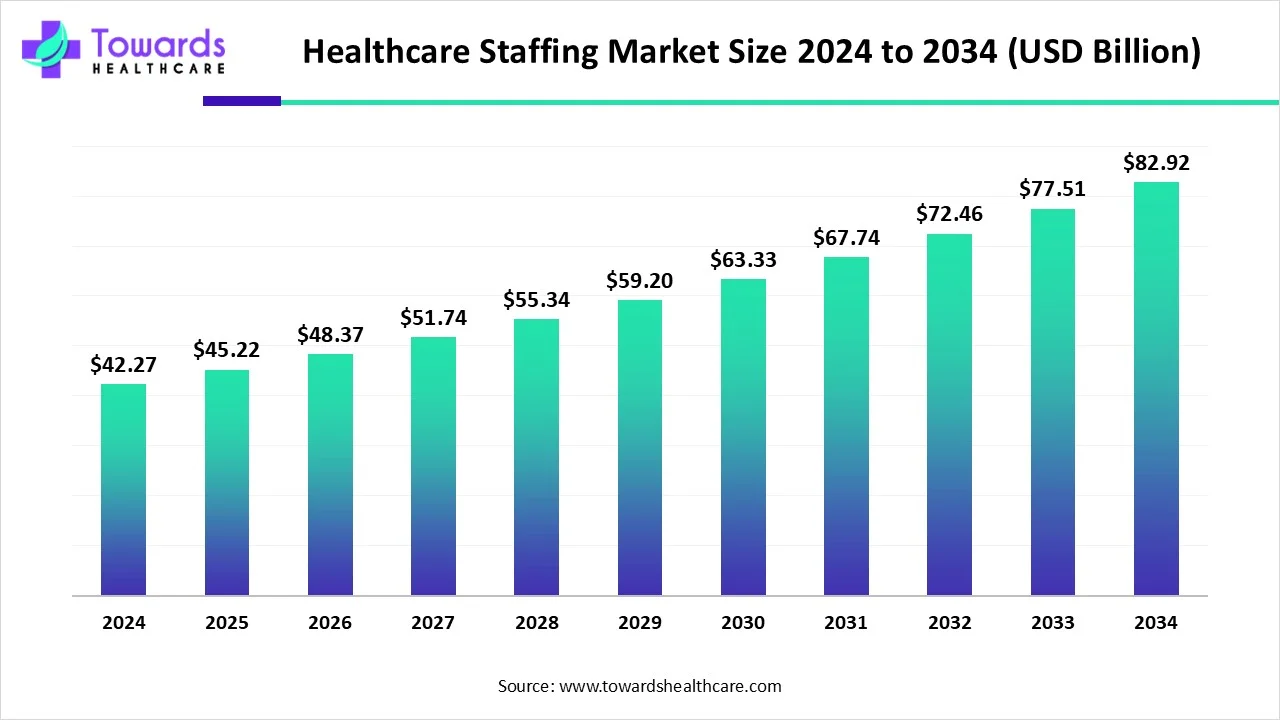

The global healthcare staffing market is valued at US$ 42.27 billion in 2024, expected to grow to US$ 45.22 billion in 2025, and projected to reach around US$ 82.92 billion by 2034. This reflects a steady growth rate, with the market expanding at a CAGR of 6.97% from 2025 to 2034.

In September 2025, Dr. Konstanze Diefenbach, Head of Research & Development, Radiology, Bayer, said, “Bayer is committed to innovative products and high-quality services in diagnostic imaging, and device innovation plays a critical role in delivering precision and safety in patient care. This new centre gives us direct access to specialised engineering capabilities through Tata Elxsi, enabling us to accelerate our pipeline of advanced radiology devices while maintaining the quality and reliability that healthcare providers expect from Bayer."

By Occupational Category

By Service Model

By End User / Buyer

By Employment Type / Contract Length

January 2026

January 2026

January 2026

January 2026