January 2026

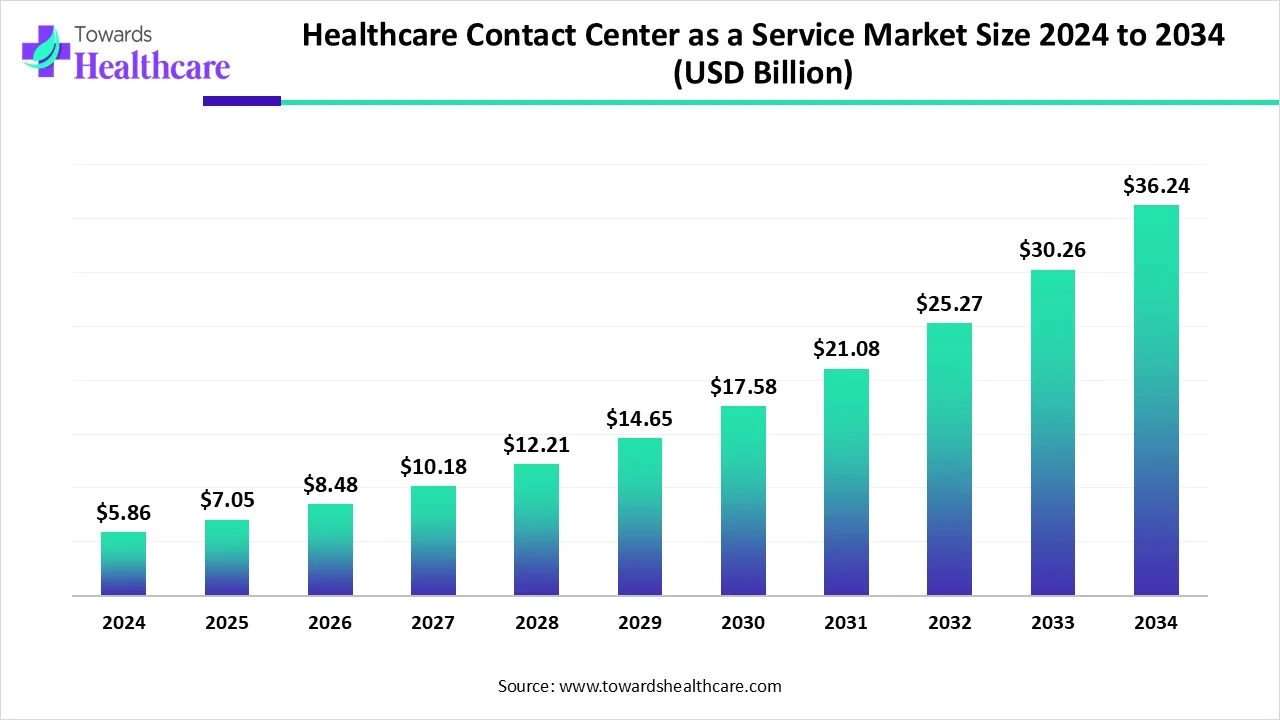

The global healthcare contact center as a service market size is calculated at USD 5.86 billion in 2024, grew to USD 7.05 billion in 2025, and is projected to reach around USD 36.24 billion by 2034. The market is expanding at a CAGR of 20.34% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 7.05 billion |

| Projected Market Size in 2034 | USD 36.24 billion |

| CAGR (2025 - 2034) | 20.34% |

| Leading Region | North America share by 36% |

| Market Segmentation | By Component, By Enterprise, By Application, By End-Use, By Region |

| Top Key Players | Authenticx, Epic, Fusion CX, Genesys, Microsoft, Ossisto Technologies Pvt. Ltd., Relatient, SAS Call Center, Sequence Health, Talkdesk, Webex Contact Center, Zoom |

Contact center as a service is a solution that provides the capabilities to route inbound customer interactions to call center agents. In the healthcare sector, it provides timely access to care, improves patient communication, and enhances overall healthcare experiences. It can manage incoming and outgoing calls, SMS, email, live chat, and social media messaging. The various tasks performed by the healthcare contact center as a service include appointment scheduling, prescription refills, insurance inquiries, and medical advice. The solution streamlines workflows, reduces wait times, and optimizes resource allocation. Additionally, it can empower healthcare providers to deliver personalized care.

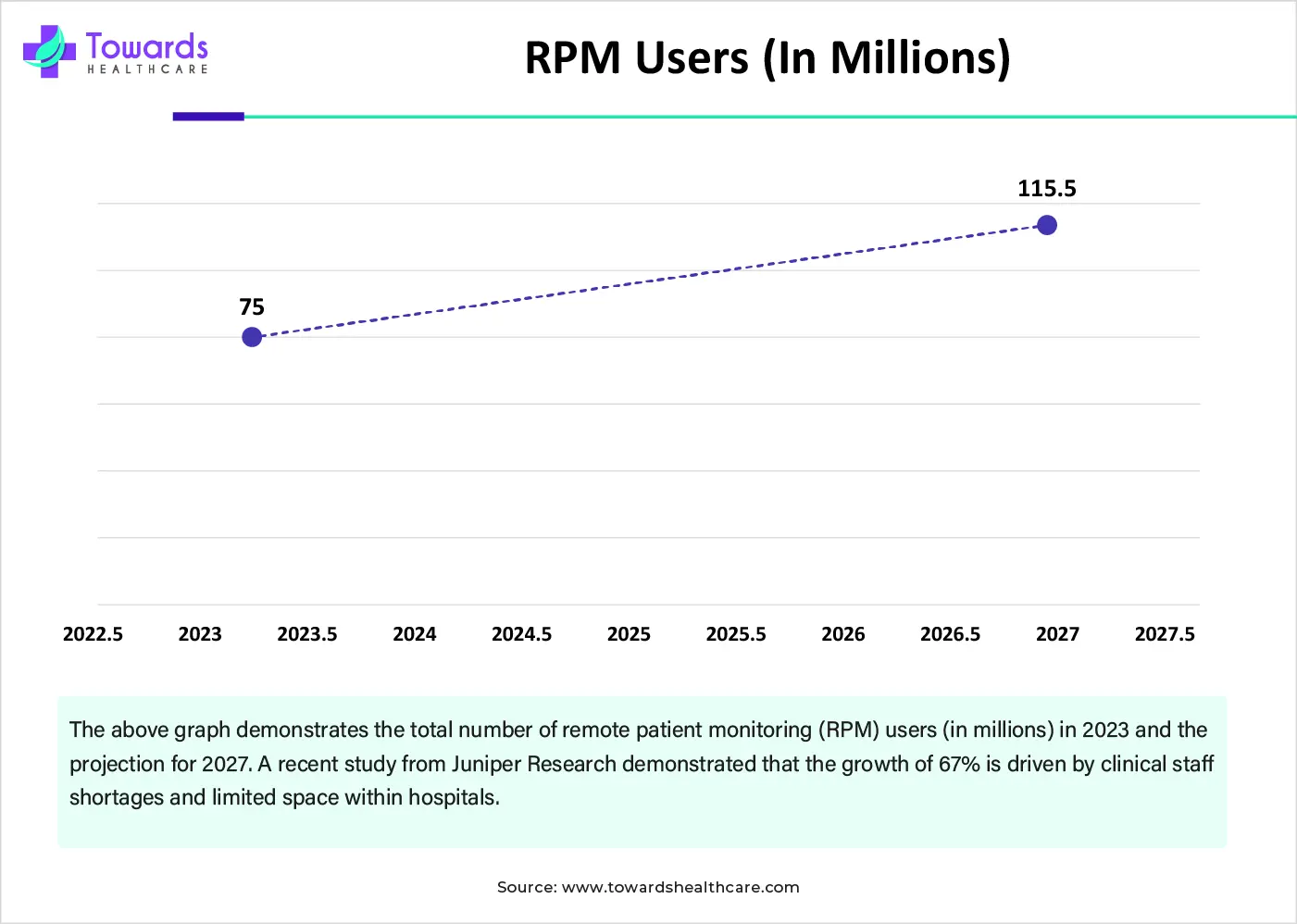

The rising prevalence of chronic disorders and the increasing geriatric population potentiate the demand for healthcare contact center as a service. This also increases the demand for remote patient monitoring and telecommunication. Several government organizations support the integration of IT solutions in healthcare organizations. The increasing investments by government and private organizations and the rising collaborations among healthcare professionals augment the market.

Integrating artificial intelligence (AI) into a healthcare contact center as a service revolutionizes contact center operations and streamlines workflows. AI enables predictive analytics, intelligent routing, and virtual assistants, enhancing efficiency and personalizing patient interactions. AI and machine learning (ML) analyze vast amounts of patient data and suggest solutions based on patient behavior or sentiment during an interaction.

AI-based natural language processing (NLP) identifies and records patient conversations and enables healthcare professionals to address unmet patient needs. The advent of AI chatbots simplifies contact center agents’ tasks, including appointment scheduling, patient onboarding, and prescription refills. Hyro.ai demonstrated that 46% of call center leaders are planning to deploy or are already in the process of deploying LLM-based solutions to their call center in the next 12 months. (Source - hyro)

Remote Patient Monitoring

Remote patient monitoring (RPM) refers to a process of analyzing a patient’s condition from a remote location. This eliminates the need for the patient to visit the healthcare organization and saves time and cost. The increasing need for RPM is a result of the rising geriatric population and the demand for home healthcare services. The “World Population Prospects 2024” of the United Nations reported that by mid-2030, 265 million people will be aged 80 and older, and by late 2070, 2.2 billion people will be aged 65 years and above. (Source - United Nations) Thus, RPM results in improved patient outcomes and enhanced patient outcomes, thereby leading to better access to care.

Staffing Shortages

The major challenge of the healthcare contact center as a service market is staffing shortages in healthcare contact centers. Staff may resign from their positions due to low salaries, lack of appreciation, or burnout. This may lead to increasing wait times, decreasing patient satisfaction, and reducing the quality of service provided to patients.

Real-time Data Analytics

The future of the market is promising, driven by the growing need for real-time data analytics. Real-time data analytics provides real-time insights into patient preferences and behaviors. This enables contact center managers to gain information about patient satisfaction, call volume, and treatment outcomes. The increasing usage of wearable devices enables patients to send real-time data about their vital signs through a contact center as a service to their healthcare providers. This allows healthcare professionals to make informed and data-driven decisions on a patient’s health. Real-time data analytics can send automated alerts for long wait times, missed service levels, and negative patient sentiment.

By component, the solution segment held a dominant presence in the healthcare contact center as a service market in 2024. Solutions provide complete control over the healthcare operations and maintain privacy. They reduce the chance of confidential patient data breaches and provide personalized care. They can be used for a wide range of applications, including reporting & analytics, computer telephony integration, and automatic call distribution. The availability of cost-effective and user-friendly solutions boosts the segment’s growth. The advent of advanced technologies, such as AI and ML, has also revolutionized contact centers.

By component, the service segment is expected to grow at the fastest rate in the market during the forecast period. Services offer relevant expertise and customized solutions to healthcare organizations. It eliminates the need for annual subscriptions to solutions. Services are widely preferred by small- and medium-sized enterprises who cannot afford expensive solutions, and can access contact center as a service solutions. Services eliminate the need for favorable infrastructure to install solutions. The increasing collaborations among healthcare professionals also augment the segment’s growth.

By enterprise size, the large enterprises segment led the global healthcare contact center as a service market in 2024. The presence of a favorable infrastructure and suitable capital investments encourages large healthcare enterprises to adopt healthcare contact center as a service. These enterprises deal with large patient populations. Maintaining large patient data and providing personalized care to each patient is difficult through conventional methods. Hence, large enterprises adopt a contact center as a service. The integration of cloud computing solutions enables healthcare professionals to access patient data from anywhere and at any time.

By enterprise size, the small and medium enterprises segment is predicted to witness significant growth in the market over the forecast period. The increasing number of healthcare startups and the rising venture capital investments promote the segment’s growth. According to the Department for Promotion of Industry and Internal Trade (DPIIT), there were over 10,000 startups in the healthcare and life science sectors in 2023. In 2024, the healthtech sector raised a funding of $1.13 billion in the year 2024. (Source - ENTRACKER)

By application, the healthcare providers segment held the largest share of the healthcare contact center as a service market in 2024. Contact center as a service enhances the telemedicine experience and provides remote patient monitoring to patients. It performs a wide range of tasks in healthcare organizations, such as appointment scheduling, prescription refills, and follow-up care. It also conducts medical triage, assesses symptoms, and provides timely advice and guidance to patients. This enables healthcare providers to determine the appropriate level of care and avoid unnecessary emergency room visits.

By application, the healthcare payers segment is projected to expand rapidly in the market in the coming years. The increasing number of hospital admissions and the growing awareness of health insurance coverage govern the segment’s growth. Patients often face challenges in health insurance coverage and understanding medical bills. Hence, contact center as a service assists in insurance coverage, claims processing, and billing support, maximizing patients’ insurance benefits. Health insurance call centers provide services like premium payments and information distribution.

By end-use, the healthcare segment accounted for a considerable share of the healthcare contact center as a service market in 2024. The rising prevalence of chronic disorders, increasing population, and the growing healthcare expenditure contribute to the segment’s growth. The increasing number of hospitals and clinics and the demand for enhanced patient care encourage healthcare professionals to adopt healthcare contact center as a service. The burgeoning healthcare sector and rising investments also favor the segment’s growth.

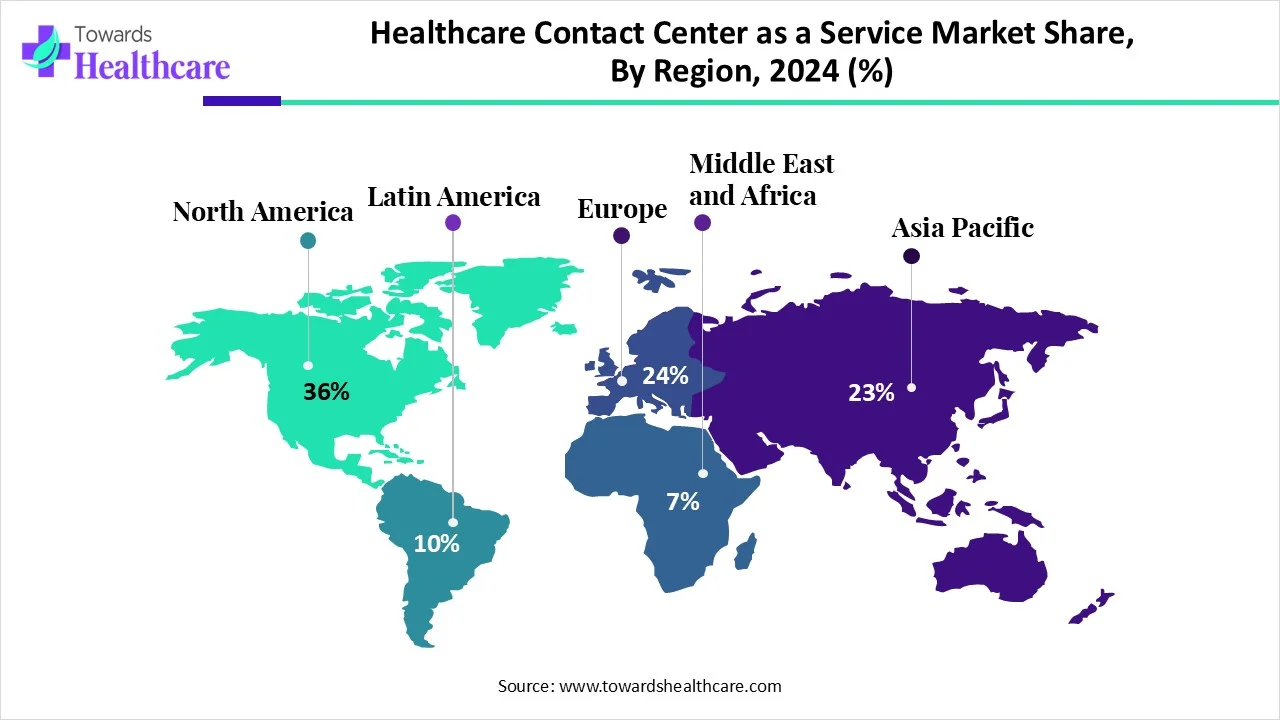

North America dominated the global market share by 36% in 2024. The availability of a robust healthcare infrastructure and the presence of key players drive the market. Several government organizations in North America support the development and deployment of advanced technologies in the healthcare sector. The growing need for personalized care and remote patient monitoring augments the market. The increasing adoption of electronic health records (EHRs) and telemedicine also contributes to market growth.

It is estimated that 51% of U.S. patients are satisfied with their healthcare providers’ call center service. There are over 51,000 healthcare companies in the U.S. The American Hospital Association reported around 6,093 hospitals in the U.S. as of 2023. (Source - American Hospital Association) The increasing number of healthcare providers necessitates the use of a contact center as a service. The Association of American Medical Colleges (AAMC) reported that there were more than 1 million active physicians in the U.S. as of 2023. (Source - AAMC)

According to the Canadian Institute for Health Information (CIHI), there were 97,384 physicians in Canada in 2023, an increase of 1.4% from 2022. The figures represent 243 physicians per 100,000 population, with 7% of physicians in rural areas and 93% in urban areas. This necessitates providers and patients to use a contact center as a service to increase treatment accessibility, especially for patients living in rural areas.

Asia-Pacific is projected to host the fastest-growing healthcare contact center as a service market in the coming years. The rising prevalence of chronic disorders and the rapidly expanding healthcare sector boost the market. The increasing healthcare expenditure facilitates healthcare professionals to adopt a contact center as a service. The rising geriatric population and the growing need for telemedicine propel the market.

In 2023, approximately 297 million people were aged 60 years and above in China, accounting for 21.2% of the total population. China boasted 7,881 integrated medical and elderly care institutions in 2023, an increase of 12.8% year-on-year. (Source - ENGLISH.GOV.CN) Over the past two decades, China has increased health insurance coverage to over 95% of the population.

The healthcare expenditure in India rose to 6.4 lakh crore in 2024-25, an increase from Rs 3.2 lakh crore in 2020-21. The Indian government allocated around Rs 1 lakh crore for the Ministry of Health and Family Welfare under the Union Budget 2025-26. The share of health in the FY26 budget increased marginally from 1.97% to 1.9% in FY25. The Indian government has also launched the National Tele Mental Health Programme (NTMHP) to expand mental healthcare services across India.

Europe is expected to grow at a notable rate in the healthcare contact center as a service market in the foreseeable future. Favorable government support to introduce digitalization and cloud computing in the healthcare sector is the major growth factor of the market in Europe. The rising adoption of advanced technologies and the increasing development of digital solutions potentiate market growth. In Europe, 40 countries either have a national telehealth strategy or include telehealth in a broader digital health strategy.

Germany secured 3rd rank in the 2024 World Index of Healthcare Innovation (WIHI) behind Switzerland and Ireland, an improvement from 4th position in 2022. (Source - FREOPP) It delivers the best healthcare services through scientific advancements and a commitment to fiscal sustainability. The German government also actively supports healthcare digitization through the “Digital Act” initiative.

Norway has made regulatory changes to support telemedicine, such as allowing e-consultations for issuing sick leave certificates, which was legalized in 2023. The digital platforms, like eMeistring, provide online therapy support and have become crucial for delivering mental health services. (Source - World Health Organization) Norway spends around 8.1% of its GDP on healthcare, making it one of the biggest healthcare spenders in the world.

The Middle East and Africa are expected to grow significantly in the healthcare contact center as a service market during the forecast period. The increasing digitalization in the Middle East and Africa is increasing the demand for healthcare contact center as a service. These services are enhancing the accessibility of hospital and clinical services to rural areas. At the same time, it is being used to monitor the health of the patient as well as to provide necessary support. Moreover, due to its multilingual nature, its use is increasing. This, in turn, is increasing the patient compliance as well as their outcomes. Moreover, their development is being supported by the government and private sector investments. This, in turn, is promoting the market growth.

With the growing urbanization and digitalization in South Africa, the use of healthcare contact centers as a service is increasing. They are offering the patients easy access and enhanced availability, which is increasing patient reliability.

The increasing medical tourism in the UAE is increasing the adoption of the healthcare contact center as a service. Its multilingual nature is promoting its use. Moreover, the government initiatives are supporting its development process.

In July 2025, the strong commitment to responsible innovation was presented by the launch of the Fiscal year 2025 sustainability report, which was released by Genesys, which is a leading cloud player in AI-Powered Experience Orchestration. Moreover, by designing and maintaining AI, sustainability and innovation can be scaled together, which can reduce the impact of energy-intensive processes, as was also demonstrated by the company.

Moreover, other achievements were also included in the report, which highlights the third consecutive EcoVadis Gold rating, which helped Genesys to achieve its position in the top 3% of companies. Additionally, compared to the fiscal year 2024, a 13% reduction in greenhouse gas emissions was reported. Moreover, the 99.998% uptime for the Genesys Cloud platform was observed, which was backed by reliability and security. Furthermore, for new buildings in the Philippines and Hungary, they also received LEED certifications.

In July 2025, Wall Street's estimates for quarterly revenue were exceeded by Microsoft. This was because of the steady growth of the Azure cloud-computing unit due to the growth in demand from businesses for artificial intelligence tools. Thisin turn, increased the total revenue in its fiscal fourth quarter, which is between the April-June period, from 18% to $76.4 billion. Moreover, as per the data compiled by LSEG, it was expected to be $73.81 billion by the analysts. Thus, by comparing to the Visible Alpha estimates, which showed 34.75% the revenue of Azure showed a growth of 39%.

In February 2025, Zoom secured its largest-ever contact center as a service deal with a Fortune 100 U.S. tech company, leading to more than 15,000 agents in the Zoom contact center. Eric Yuan, Founder & CEO of Zoom, commented that the growth was partially driven by its CCaaS packaging strategy, which allows customers to scale up their CCaaS operations. The company also aims to enhance Zoom Workplace for Clinicians with an upgraded AI Companion to enable clinical note-taking capabilities and specialized medical features for healthcare providers in March. (Source - CX TODAY)

By Component

By Enterprise

By Application

By End-Use

By Region

January 2026

January 2026

January 2026

January 2026