December 2025

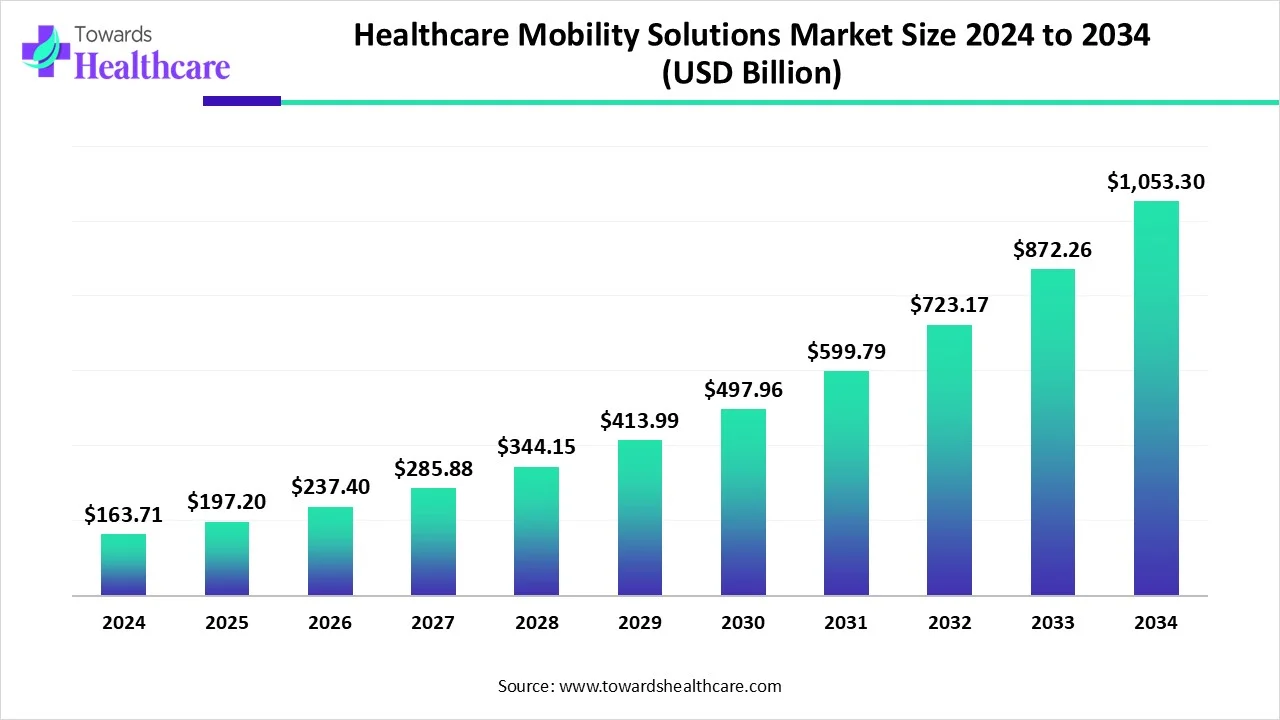

The global healthcare mobility solutions market size is calculated at USD 163.71 billion in 2024, grew to USD 197.2 billion in 2025, and is projected to reach around USD 1053.3 billion by 2034. The market is expanding at a CAGR of 20.44% between 2025 and 2034.

| Metric | Details |

| Market Size in 2024 | USD 163.71 Billoin |

| Projected Market Size in 2034 | USD 1053.3 Billion |

| CAGR (2025 - 2034) | 20.44% |

| Leading Region | North America |

| Market Segmentation | By Product & Services, By Application, By End-Use, By Region |

| Top Key Players | Airstrip Technologies, Inc., AMN Healthcare, Cerner Corporation, Cisco Systems, FuGenX Technologies, GE Healthcare, McKesson Corporation, MEDITECH, NetSfere, Omron Corporation, SoundHealth, Zebra Technologies |

Healthcare mobility solutions leverage cutting-edge technologies to provide personalized care to patients remotely. They include a variety of products from mobile health apps (mHealth) for remote monitoring of vital signs to electronic health records (EHRs) for instant access to patient information. These solutions streamline workflows, enhance patient-provider communication, and enhance quality care. The digital solutions also optimize nursing activity, leading to better medical decisions, especially during emergencies. Apart from patient care, mobility solutions can also boost return on investment (ROI).

The rising prevalence of chronic disorders increases the need for advanced patient care. The growing need for constant monitoring of patient vital signs also promotes the use of healthcare mobility solutions. The burgeoning healthcare sector and technological advancements boost the market. Several government organizations launch initiatives to adopt digitized solutions in healthcare organizations. The increasing investments and favorable reimbursement policies also contribute to market growth.

Artificial intelligence (AI) has proved to disrupt the healthcare sector by providing advanced solutions. AI-enabled mobility solutions provide real-time data to healthcare professionals, allowing them to make more informed decisions. AI can alert patients when there are fluctuations in normal levels of patients’ vital signs. This enables patients and providers to make instant decisions to improve their condition. AI can also predict patient outcomes and automate routine tasks, enabling healthcare professionals to focus more on patient care. The advent of the Internet of Things (IoT) also boosts the market by creating a more connected healthcare ecosystem between wearables, remote monitoring tools, and healthcare providers.

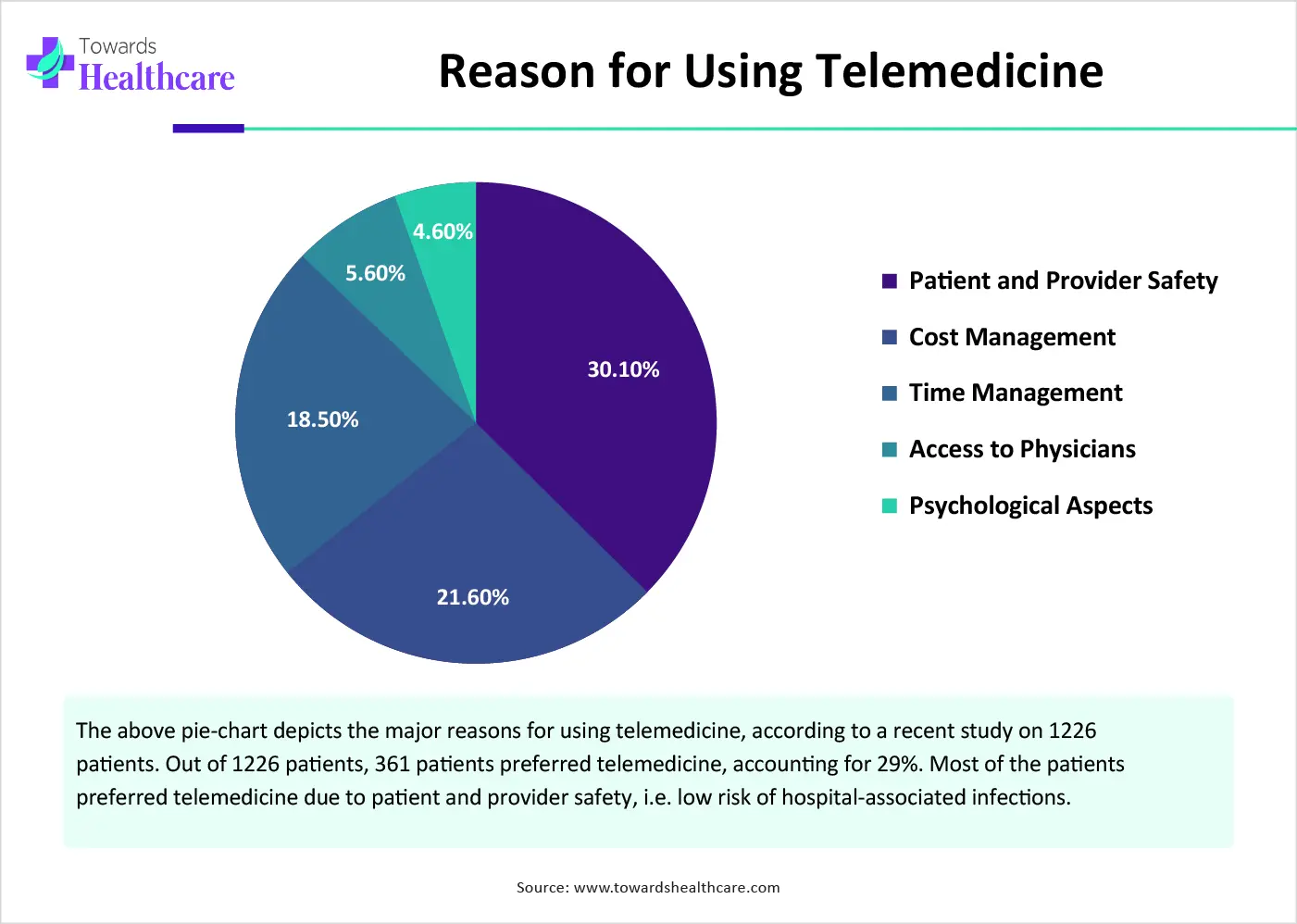

Need for Telemedicine

The major growth factor of the healthcare mobility solutions market is the rising need for telemedicine. The COVID-19 pandemic revolutionized patient visits to a physician through the use of digital solutions. Several factors govern the growing need for remote monitoring, including the growing geriatric population and access to better care. It is estimated that around 80% of people have used telemedicine at least once in their lifetime. Telemedicine benefits both physicians and patients by enabling remote monitoring of patients and increasing access to advanced treatment. Telemedicine eliminates the need for visiting the physician, saving traveling costs and waiting times. The growing need for personalized care also encourages the use of telemedicine.

High Cost

The major challenge of the healthcare mobility solutions market is the high cost of mobility solutions. This limits the affordability of numerous people from low- and middle-income groups to purchase these mobility solutions.

Augmented Reality

The future growth prospects of the healthcare mobility solutions market are promising, driven by the use of augmented reality (AR) in mobility solutions. Integrating AR in mobility solutions can make medical procedures more accurate and improve diagnostics. AR can help apps overlay graphical data and enhance diagnostic accuracy. It increases access to health information, such as data visualizations, charts, and other visual aids. AR also plays a vital role in educating healthcare professionals, preparing them for emergencies. It provides interactive and educational experiences to visualize complex medical concepts. Thus, incorporating AR could enhance medical learning and patient understanding, improving treatment outcomes.

By products & services, the mobile devices segment held a dominant presence in the market in 2024. The increasing need for wearable devices boosts the segment’s growth. These devices are widely used for tracking patients’ vital signs, such as heart rate, oxygen levels, and sleep patterns. The rising obesity prevalence necessitates that patients monitor their calories and steps daily. The World Obesity Atlas 2024 report stated that out of 41 million adult deaths annually, 5 million result from high BMI. Moreover, the rising demand for point-of-care diagnostics, such as glucose and blood pressure monitoring devices, propels the segment’s growth.

By products & services, the mobile applications segment is anticipated to grow with the highest CAGR in the market during the studied years. The rising adoption of smartphones and tablets augments the segment’s growth. Mobile applications improve communication between healthcare providers and patients. Technological advancements like AI and machine learning (ML) enhance the functionality and efficiency of mobile applications. They enable appointment scheduling, alert patients to take medications on time, and consult with the physician virtually.

By application, the enterprise solutions segment led the global market in 2024. This segment dominated because mobility solutions can simplify enterprise solutions, like patient monitoring, claims processing, and workforce management. They reduce the overall burden on administrative and nursing staff. According to a recent survey by Harris Poll and Google Cloud related to administrative burdens on U.S. healthcare workers, clinicians spend 28 hours weekly on administrative tasks. 80% of providers reported that the burden results in a loss of time, impacting the quality of care. The report also stated that genAI could reduce the time spent on administrative work by around 40%.

By application, the mHealth applications segment is projected to expand rapidly in the market in the coming years. mHealth refers to the use of mobile communication devices to gather clinical information and increase access to high-quality healthcare. These apps perform a wide range of functions, including self-monitoring, disease management, and teleconsultations. They enhance medication adherence, reduce cancellations, and decrease healthcare costs. The increasing affordability and advancements in connectivity technology foster the segment’s growth.

By end-use, the healthcare providers segment held the largest share of the market in 2024. Mobility solutions provide superior advantages to healthcare providers. The increasing need for physician consultations due to the rising prevalence of chronic disorders promotes the segment’s growth. Mobility solutions reduce the overall burden on providers and allow them to focus more on patient care. They simplify the storage and maintenance of patient data through EHRs. Providers can access patients’ data from anywhere and at any time.

By end-use, the healthcare payers segment is estimated to show the fastest growth over the forecast period. The increasing number of hospitalizations and favorable reimbursement policies govern the segment’s growth. Mobility solutions facilitate complex claims processing, reducing manual errors. They significantly enhance the speed of reimbursement and improve efficiency. They can also facilitate better communication between payers, providers, and patients.

North America dominated the global healthcare mobility solutions market in 2024. The rising adoption of advanced technologies and favorable government support drive the market. Several government organizations invest in adopting advanced healthcare solutions. The presence of a favorable regulatory framework encourages developers to launch innovative solutions. Advanced healthcare infrastructure and the availability of cutting-edge technologies promote the market.

In 2023, around 40% of the U.S. adults used healthcare-related applications, and 35% used wearable devices. The Department of Health and Human Services operates several programs to improve access to healthcare services in underserved areas. The “Rural Health Care Program”, “Connected Care Pilot Program”, and Connect2Health Task Force are some of the programs.

Approximately 3 in 5 Canadians use virtual consultations with a family doctor, a nurse, or a specialist. The Canadian government invested around $200 billion over 10 years to improve healthcare services in Canada. In June 2024, the government launched the “Connected Care for Canadians Act” to access health information securely and digitally, enabling healthcare professionals to make effective clinical decisions.

Asia-Pacific is projected to host the fastest-growing healthcare mobility solutions market in the coming years. The increasing geriatric population and the rising prevalence of chronic disorders favor the market. The growing demand for remote monitoring and personalized patient care augments the market. The increasing investments, collaborations, and mergers & acquisitions potentiate market growth. People from rural and urban areas in Asia-Pacific countries are becoming aware of mobile solutions for advanced treatment and care.

The Indian government has launched a free National Telemedicine Service, eSanjeevani, to increase treatment access for rural populations. The app provided more than 276 million consultations, accounting for 300,000 consultations per day. Additionally, the launch of “The Advantage Health Care India - One Stop Digital Portal For Patient” and “Workforce Mobility” portals to create a patient-centric, value-based healthcare system.

It is estimated that older people aged 65 years and above will account for 21% to 23% of the total population by 2066. This favors the use of telemedicine and other mobility solutions to enhance healthcare access. The Australian government launched the “National Digital Health Strategy 2023-2028” to ensure all health consumers benefit from digital health.

Europe is expected to grow at a considerable rate in the healthcare mobility solutions market in the upcoming period. The growing need for patient-centric care and the rising adoption of digital healthcare solutions are the major growth factors of the market in Europe. The burgeoning healthcare sector and increasing investments drive the market. Favorable government support and the presence of key players lead to the development of novel mobility solutions. The increasing preference for telehealth services in Europe fosters market growth. Around 77% of European countries offer telemedicine or remote patient monitoring services.

The French government announced an investment of €650 million to bring digital transformation to the health sector. Out of these, €202 million contributes to accelerating research and innovation in digital health, in the areas of prevention, teleconsultation, surgical robotics, or AI medical devices. Additionally, the medtech startups raised €1.8 billion in 2023 for the development of innovative products, including screening & diagnostics, telemedicine, and new drug discovery.

Latin America is considered to be a significantly growing area in the healthcare mobility solutions market, due to the growing demand for remote monitoring and the rising adoption of advanced technologies. The burgeoning healthcare sector and the increasing use of smartphones boost the market. The growing demand for personalized care also enables healthcare professionals to adopt healthcare mobility solutions. Government organizations also support the use of mobility solutions and launch initiatives to govern advanced patient care at affordable rates.

In June 2025, Medsi AI announced the launch of a digital AI-powered health platform that transforms a 70-second video selfie from a smartphone into personalized health information reflecting more than 20 vital signs and biomarkers. The AI platform was approved by Mexico’s regulatory authority, COFEPRIS, as a Class II Software as a Medical Device (SaMD). (Source: MDDI)

The increasing demand for wearable devices contributes to market growth. Approximately 1.5 million units of wearable devices were sold in Brazil in the second quarter of 2023, an increase of 6.4% compared to Q2 2022. The demand was mostly due to the availability of cost-effective products. (Source: https://abes.com.br/en/estudo-da-idc-brasil-indica-retomada-do-mercado-de-wearables-com-aumento-de-64-nas-vendas-do-2o-trimestre)

Dr. Paramesh Gopi, Founder and CEO of SoundHealth, commented on raising $7 million that the investment will be used for product launch and advancing their pipeline of indications for the SONU device. SONU is the first FDA-approved, non-pharmaceutical, AI-enabled, wearable medical device for the treatment of nasal congestion. He also said that the company’s mission is to provide personalized, intelligent wearables to help people breathe and sleep better.

By Product & Services

By Application

By End-Use

By Region

December 2025

December 2025

December 2025

December 2025