February 2026

The global cell and gene solutions market is on an upward trajectory, poised to generate substantial revenue growth, potentially climbing into the hundreds of millions over the forecast years from 2025 to 2034. This surge is attributed to evolving consumer preferences and technological advancements reshaping the industry.

The cell and gene solutions market is primarily driven by the growing demand for cell and gene therapy products. The increasing investments by government and private organizations facilitate the development of novel therapeutics. Prominent market players collaborate to access advanced technologies and expand their services and product portfolio across diverse geographical locations. The future looks promising, with advancements in genomic techniques and the integration of AI and ML.

The market comprises a broad ecosystem of technologies, products, and services enabling the development, manufacturing, delivery, and commercialization of cell and gene therapies (CGTs). These therapies range from CAR-T cells and iPSCs to viral/non-viral vectors, and CRISPR-edited products are revolutionizing the treatment of oncology, rare diseases, and genetic disorders. CGT solutions offer an integrated, flexible, and end-to-end solution for scale-up.

The different growth factors of the market include the growing demand for CGT products and personalized medicines. Favorable government support and increasing research activities contribute to market growth. The burgeoning pharma and biotech sectors are due to the rising number of startups and increasing venture capital investments. The rising investments and collaborations among experts, colleagues, and partners boost the market.

Artificial intelligence (AI) can transform cell and gene solutions by automating various tasks, facilitating the development of novel CGT products. AI and machine learning (ML) algorithms can analyze vast amounts of data and suggest personalized medicines for patients. They help companies and academic institutions to collaborate based on their research interests. Integrating AI and ML in research, manufacturing, and supply chain accelerates the time to market approval of CGT products. They also streamline the regulatory approval process, evolving with the changing regulatory landscape.

New Product Launches

The major growth factor for the cell and gene solutions market is the new product launch of CGT products. Several companies focus on developing personalized medicines for patients suffering from genetic, rare, and other chronic disorders. Regulatory agencies, like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), approve CGT products in their respective regions. The growing research and development activities and the increasing number of clinical trials favor the development of novel products. CGT solutions offer complete services from research to commercialization.

The table below demonstrates FDA-approved CGT products in 2024. The FDA approved a total of 7 CGT products in 2024 for different indications. New product launches potentiate the demand for CGT solutions, accelerating market growth.

| Products | Indication | Company Name |

| Amtagvi | Unresectable and metastatic melanoma | Iovance Biotherapeutics, Inc. |

| Aucatzyl | Relapsed or refractory B-cell precursor acute lymphoblastic leukemia | Autolus Therapeutics |

| Beqvez | Moderate-to-severe hemophilia B | Pfizer, Inc. |

| Kebilidi | Aromatic L-amino acid decarboxylase (AADC) deficiency | PTC Therapeutics |

| Ryoncil | Steroid-refractory acute graft versus host disease | Mesoblast Ltd. |

| Symvess | Vascular trauma | Humacyte Global, Inc. |

| Tecelra | Unresectable or metastatic synovial sarcoma | Adaptimmune Therapeutics, Inc. |

High Cost

The development of CGT products requires a high investment for various purposes, from research to manufacturing and commercialization. Some developing and underdeveloped countries lack funding programs, limiting the development of CGT products. They do not have sufficient funding to afford CGT solutions, thereby restricting market growth.

What is the Future of the Cell and Gene Solutions Market?

The market future is promising, driven by advances in genomic technologies. Novel and innovative genomic techniques, such as next-generation sequencing and CRISPR-Cas9 techniques. They expedite the speed of the research process and derive novel products. Researchers also prefer bioinformatics tools for numerous applications, from understanding diseases to designing drug candidates. Moreover, advancements in recombinant DNA technology and the PCR technique also offer significant strides in CGT product development. Recent advances focus on faster and more accurate sequencing, reduced costs, and improved data analysis.

By therapy type, the cell therapy solutions segment held a dominant presence in the market in 2024. This is due to the high success rates of cell therapy products and widespread applications. Cell therapy solutions are used for tissue regeneration, organ repair, and improved healing. Recent data indicate that stem cell therapies have higher success rates of 50% to 90% in clinical trials for regenerative medicine applications. They can be either autologous or allogeneic, offering a personalized approach.

By therapy type, the gene therapy solutions segment is expected to grow at the fastest CAGR in the market during the forecast period. Gene therapy solutions refer to developing novel products that can alter a patient’s genetic profile. They cure a disease from its root cause, which is otherwise difficult to treat through conventional therapy. They can even prevent a disease from occurring through early diagnosis and screening.

By service/technology, the process development & manufacturing segment held the largest revenue share of the market in 2024. This segment dominated because process development is a vital step in CGT development, a complex step that requires a specialized infrastructure. The essential process development techniques include viral vector & plasmid production and cell engineering. Cell and gene solutions enable companies and academic institutes to collaborate with contract development and manufacturing organizations (CDMOs) and contract manufacturing organizations (CMOs).

By service/technology, the analytical testing & quality control segment is expected to grow with the highest CAGR in the market during the studied years. CGTs undergo frequent analytical testing at every stage of their development, i.e., before, during, and after manufacturing. Quality control tests are essential as per the stringent regulatory guidelines. They assess several parameters associated with the safety and efficacy of CGTs.

By application, the oncology segment contributed the biggest revenue share of the market in 2024. This segment dominated due to the rising prevalence of cancer and the growing need for personalized treatment. Various cancer types have a genetic origin and a complex pathophysiology, requiring targeted treatment. Currently, a total of 12 CGTs have been approved by the FDA for the treatment of cancer. Research efforts are made to develop novel cancer therapeutics to combat cancer prevalence.

By application, the rare genetic disorders segment is expected to expand rapidly in the market in the coming years. Conventional therapeutics fail to provide effective treatment and a cure for rare and genetic disorders. Hence, novel CGT products are developed for their treatment, as only 15% of rare disorders have at least one drug. Numerous government organizations launch initiatives to address the rising prevalence of rare disorders in their nations.

By end-user, the biotech startups & clinical stage developers segment led the global market in 2024. The segmental growth is attributed to the increasing number of startups and rising venture capital investments. Startups require specialized expertise and infrastructure to develop innovative CGTs. Therefore, cell and gene solutions enable the collaboration between suitable CDMOs/CMOs and startups. The increasing number of clinical trials also facilitates the segment’s growth.

By end-user, the large biopharma segment is expected to witness the fastest growth in the market over the forecast period. Large biopharma companies prefer to outsource their CGT development to CDMOs/CMOs as they have sufficient capital investment. This helps them to focus on product sales and marketing. The collaboration between large biopharma companies and CDMOs expedites the CGT development process, thereby reducing time to market approval. This is beneficial in the era of increasing competition among key players, helping them to strengthen their market position.

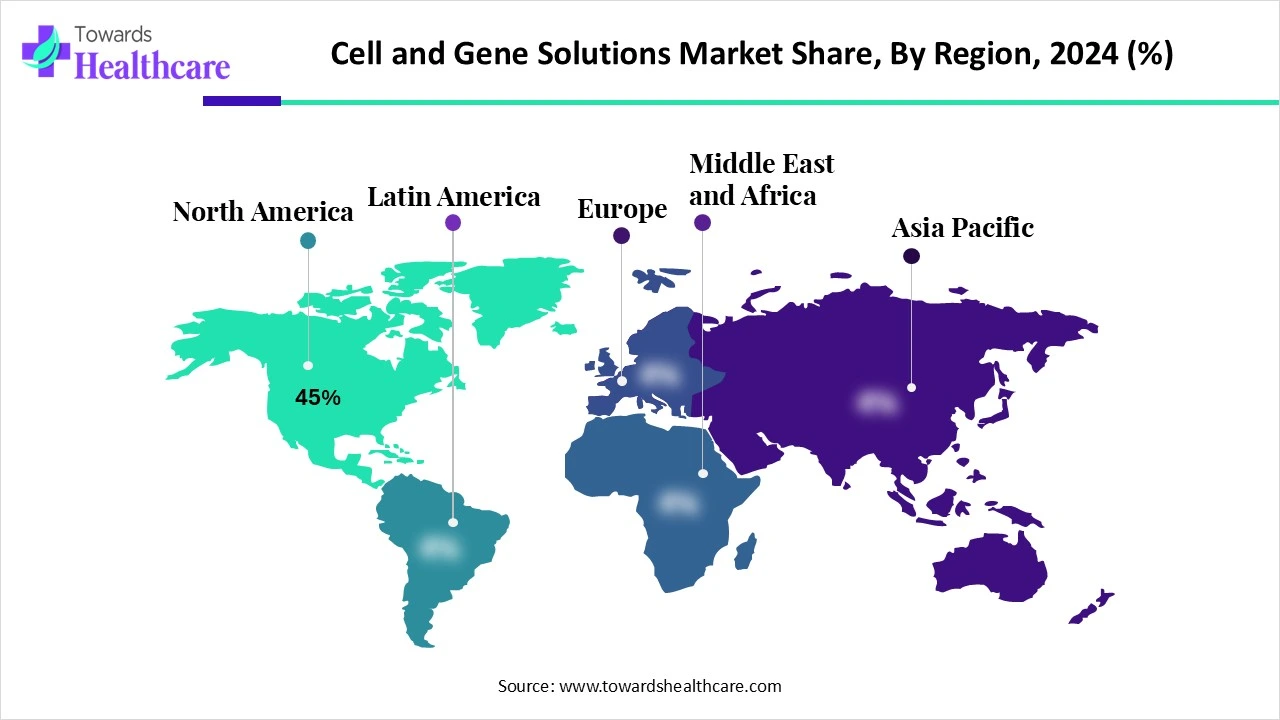

North America dominated the market share by 45% in 2024. The availability of state-of-the-art research and development facilities, the presence of key players, and the increasing number of clinical trials are factors that govern market growth in North America. Government organizations launch initiatives and programs to support the development of CGTs and personalized medicines. They also provide funding for research and manufacturing activities.

Key players, such as Thermo Fisher Scientific, Andelyn Biosciences, and Charles River Laboratories, are the major contributors to the market in the U.S. The FDA has approved a total of 43 CGTs as of January 2025. The U.S. conducts the highest number of clinical trials in the world. As of July 2025, 451 studies have been reported on the clinicaltrials.gov website related to CGT as an intervention. (Source - Clinical Trials)

The Human Health Therapeutics Research Center launched the “Disruptive Technology Solutions for Cell and Gene Therapy Challenge” program for the development of affordable and accessible CGTs to treat chronic and rare diseases in Canada. The program helps innovators navigate the complex development pathways of CGTs. (Source - Government of Canada)

Asia-Pacific is expected to grow at the fastest CAGR in the cell and gene solutions market during the forecast period. The presence of a suitable manufacturing infrastructure encourages foreign investors to set up their manufacturing facilities in Asia-Pacific countries like China, Japan, and South Korea. The biopharmaceutical and biotechnology sectors in this region are emerging, offering immense potential for market growth. The increasing number of startups and the rising venture capital investments boost the market.

The National Medical Products Administration (NMPA) regulates the approval of CGTs in China. Currently, there are 59 cell therapy startups and 34 gene therapy startups in China, totaling 93 startups. Of these, 72 startups are funded. Moreover, the Ministry of Commerce lifted the ban on foreign-invested enterprises engaging in CGT in some selected free-trade zones. (Source - China Briefing)

As of March 2024, Japan’s regulatory authority had approved 20 regenerative medicines, including CAR-T cells and in vivo gene therapies. The regenerative medicine field is expanding in Japan with the increasing number of foreign companies and their products. Japan is home to 12 gene therapy startups and 26 cell therapy startups.

Europe is expected to grow at a considerable CAGR in the cell and gene solutions market in the upcoming period. Favorable government support and suitable regulatory frameworks lead to the development of innovative CGTs. The growing demand for personalized medicines and increasing investments in research activities augment market growth. Countries like the UK, Germany, the Netherlands, and Belgium are at the forefront of driving innovation in CGTs.

The German government formed a “National Strategy for Gene and Cell Therapies” to serve as a basis for policymaking, positioning Germany as a leader in the CGT field in Europe. The government aims to make Germany more attractive as a location for pharmaceutical and healthcare innovation. The strategy encompasses every aspect involved in the development of CGTs.

The Association of the British Pharmaceutical Industry (ABPI) reported that, on average, only two advanced therapy medicinal products (ATMPs) have been approved annually over the past five years. The rate is projected to increase by 10-15 percent per year by 2030. The number of people who could be treated may increase by as many as 10,000 by 2028, compared to 2,500 in 2021. (Source - Association of the British Pharmaceutical Industry)

Joe DePinto, Head of Cell, Gene, and Advanced Therapies at McKesson Corporation, commented that the CGT market is one of the fastest-growing fields in medicine and is driven by unbelievable innovation. He also said that most of their clinicians believed in its significance to patients. The science is complex, but the outcomes are groundbreaking and have never been seen before. (Source - Pharma Life Sciences)

By Therapy Type

By Service/Technology

By Application

By End-User

By Region

February 2026

January 2026

January 2026

January 2026